Pearle Corporation makes automotive engines. For the most recent month, budgeted production was 3,300 engines. The standard power cost is $9.20 per machine-hour. The company's standards indicate that each engine requires 2.1 machine-hours. Actual production was 3,400 engines. Actual machine-hours were 7,160 machine-hours. Actual power cost totaled $61,815.

Required:

a) Determine the rate and efficiency variances for the variable overhead item power cost and indicate whether those variances are unfavorable or favorable. (Input all amounts as positive values.)

Answers

Answer:

Rate variance = $4057 Favorable

Efficiency variance = $184 unfavorable

Explanation:

Rate variance $

7,160 hours should have cost (7,160 × $9.20) 65872

bur did cost (actual cost) 61,815

Rate variance 4057 Favorable

Efficiency variance

3400 units should have taken (3,400 × 2.1 hours) 7140

but did take 7,160

Efiicienct=y varince (hours) 20 unfavorable

standard hour ×$9.20

Efficiency variance $184 unfavorable

Rate variance = $4057 Favorable

Efficiency variance = $184 unfavorable

Related Questions

would you like to go abroad for forieign employment ? why or why not? Give any two supportive reason

Answers

Answer:

yes (1) it would bring an opportunity to learn about foreign cultures, then helping in understanding clients and people in general. (2) if a new language is learned (or attempted) it can benefit other aspects, such as opening paths for trade or collaboration between two countries.

Lusk Company produces and sells 15,000 units of Product A each month. The selling price of Product A is $20 per unit, and variable expenses are $14 per unit. A study has been made concerning whether Product A should be discontinued. The study shows that $70,000 of the $100,000 in fixed expenses charged to Product A would continue even if the product was discontinued. These data indicate that if Product A is discontinued, the company's overall net operating income would:_______.

a. decrease by $60,000 per month

b. increase by $10,000 per month

c. increase by $20,000 per month

d. decrease by $20,000 per month

Answers

Answer:

tghh

Explanation:

nghrhbr

Using the post-enrollment method, when will a new member be disenrolled from their C-SNP if a qualifying condition cannot be verified?

Answers

A new member is disenrolled from their C-SNP if a qualifying state cannot be demonstrated by the end of the first month enrolled.

What is C-SNP?

Chronic Condition Special Needs (C-SNP) programs exist as a kind of Medicare Advantage (MA) plan created to satisfy the unique conditions of people with one or more additional chronic conditions, including diabetes, and end-stage renal disease (ESRD), lung disease, or heart disease.

With this information, we can deduce that C-SNPs are SNPs that limit enrollment to particular requirements for individuals with specific severe or injury chronic conditions.

These exist unique requirements plans which exist designed to bring care to people with one or more additional chronic conditions.

A new member will nevertheless be disenrolled if the qualifying condition for the schedule can't be confirmed in the first month.

To learn more about Special needs plans refer to:

brainly.com/question/2355947

#SPJ9

Whipple Corp. just issued 325,000 bonds with a coupon rate of 6.29 percent paid semiannually that mature in 30 years. The bonds have a YTM of 6.73 percent and have a par value of $2,000. How much money was raised from the sale of the bonds? (Round your intermediate calculations to two decimal places and final answer to the nearest whole dollar amount.)

Answers

Answer:

la bilirrubina me duve a 100

speedy motors LDT

identify the micro and the macro challenges of SM from the scenario

Answers

Based on the fact that Speedy Motors is in the automotive industry, some micro and macro challenges include:

Macro challenges - Government regulation and Economic growth. Micro challenges - Lack of liquidity and Retaining good labor. What are micro challenges?Micro challenges are those that affect a company alone and not the economy.

Companies in the automobile industry face the micro challenge of having poor liquidity because cars might not be sold fast enough. They also have issues with retaining good labor which can help them remain competitive.

What are macro challenges?These affect the economy and industry at large and so affect the company as well.

Some challenges here include government regulation that is aimed at reducing pollution. This will force an auto company to invest in more expensive equipment to comply.

If economic growth is poor, a car company will experience less sales as well.

In conclusion, there are several challenges affecting Speedy Motors.

Find out more on the macro perspective at https://brainly.com/question/3558688.

Which of the following is true of the master budget of a company?

a. It is a moving 12-month budget.

b. It corresponds to the calendar year of a company.

c. It is a comprehensive financial plan for an organization as a whole.

d. It is always prepared for a 5-year period.

Answers

Answer:

C, it's a plan for the entire organization.

The second issue you chose to address with Kenisha is the complexity of the product. The marketing department conducted numerous focus groups to gauge their reaction to the prototype, and the feedback from these focus groups revealed that customers perceived the product to be too complicated and not sufficiently user-friendly. Which of the following statements would be the best explanation for the rejection based on the focus groups' feedback that the product was too complex?

a. The good news is that you've put a lot of great features in the Radio-DRM. The bad news is that focus group customers thought that it was about as complicated as programming the Starship Enterprise. They don't want to spend hours adjusting dials and knobs; all they want to do is plug it in and set a few controls.

b. The customers in the focus groups thought this product is just too complicated! You're building a cruise ship when a simple rowboat will do. You and your team need to stop over- engineering.

c. The marketing department conducted several focus groups for this prototype, and it looks like there are some problems with its complexity. You need to fix these problems as soon as possible.

d. As you know, the marketing department conducted several focus groups for the prototype. Although there were features customers liked, much of the feedback from customers was that the Radio-DRM needs to be made simpler and more user-friendly.

Answers

Answer:

ushdusbs

Explanation:

espero te si ha bro zorry

HURRRYYYY PLEASE HELP ME ASAP!!!!

1, Select a company with an international presence that you are familiar with or that you learn about by searching the internet

2.Identify the laws, treaties, acts, and governing bodies (e.g. U.N., WTO, and IMF) that impact their business.

3.Explain the impact these laws, treaties, acts, and governing bodies have on their business.

4.Differentiate the impact of those various laws etc. on their business abroad from the impact of similar things on their business in the United States.

Please provide citation and reference to sources. Quoted language must be put inside quotation marks

Answers

The WTO has a major impact on Toyota in a similar manner.The WTO's primary responsibility is to negotiate trade regulations among its members. As a result, the WTO regulations have a big impact on the Toyota industry.

The company is permitted to import and export the medicine in accordance with WTO regulations. The WTO may have both beneficial and bad effects on enterprises.

Toyota was able to enhance product exports with the help of the WTO. As the WTO upholds the organization's viewpoint to comply with WTO regulations and rules, the company's sales rate has increased.

However, the WTO also has a detrimental effect on Toyota's operations. Due to the substantial influence of its quantity of exports, the World Trade Organisation has continually raised the tariff ceiling. Therefore, it is conceivable to assert that the WTO has an impact on the Toyota company both advantageously and badly.

Learn more about WTO, here:

https://brainly.com/question/30199694

#SPJ1

If Mexico exports to Canada decline by $14 billion, by how much will Mexico's aggregate spending drop if their MPC is 0.8?

Answers

Answer:

\(14 \times 0.8 = (11.2\)

You are given the following particulars of a business having three departments: 963

Department

Purchases

Opening Stock

A

200 units

B

300 units

ISO units

71

1500 units

1000 units

2000 units

Additional Information:

1. Purchases were made at total cost of Rs.92,000.

2. The % of gross profit on turnover is the same in each case.

3. Purchases & Sales prices are constant for the last 2 years.

4. Selling price per unit:

A

Department

B

C

You are required to prepare Departmental Trading Account.

Closing Stock

100 units

160 units

200 units

Rs.

20

25

30

Answers

According to the Smith text, what must be maintained to ensure the success of a nonprofit organization's sponsorship program?

a. the development of relationships with vendors

b. a solid financial plan

c. a close alliance between the theme of the sponsorship program and the mission of the organization

d. location, location, location

Answers

Answer:

c

Explanation:

What was Indiana's total government expenditures in fiscal year 2018-2019? (1 point)

O $15.9 billion

O $11.9 billion

O$34.89 billion

O $34.11 billion

Answers

Indiana's total government expenditures in the fiscal year 2018-2019 is $34.89 billion. The correct option is C.

Public consumption, public investment, and transfer payments made up of capital transfers and income transfers (pensions, social benefits), collectively referred to as government expenditures, are all included in the definition of goods and services.

Fiscal policy is characterized as the strategy used by the government to carry out various economic policy goals through the use of taxation, public expenditure, and public borrowing.

Thus, the ideal selection is option C.

Learn more about government expenditures here:

https://brainly.com/question/31649187

#SPJ1

whats a good job for me A. nail artist B.GameDev C. Aesthetic photography D.Anime Actor idc They all sound good

Answers

Answer:

C. Aesthetic photography

Explanation:

Answer: it really depends on what you're good at !!

Explanation: seeing all the jobs you listed here, if you look more into the requirements and the education that is needed, see which one is either easier or what you're good in in that field, and go for that !!

i think that either a nail artist or an aesthetic photographer would be good for you :)

Musashi and Rina run a catering business in which they have two major tasks: getting new clients and preparing food for events and parties. It takes Musashi 10 hours to prepare the food for an event and 5 hours of effort to get each new client. For Rina, it takes 12 hours to prepare food for an event and 3 hours to get a new client. In this scenario,____has an absolute advantage in food preparation,and____has a comparative advantage in food preparation.

Answers

Answer:

Musashi

Musashi

Explanation:

A person has comparative advantage in production if it produces at a lower opportunity cost when compared to other people.

opportunity cost of preparing food

Musashi = 5 / 10 = 0.20

Rina = 3 / 12 = 0.25

Musashi has a lower opportunity cost in food preparation. She has a comparative advantage in food preparation

A person has absolute advantage in the production of a good or service if it produces more quantity of a good when compared to other people

Musashi prepares food in 10 hours while Rina does in 12 hours

Musashi prepares food faster, thus, she has an absolute advantage in good preparation

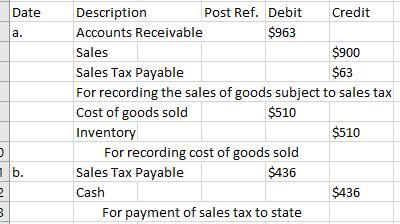

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

1. When distribution team members use replenishment reports to retrieve quantities of items to be sent to stores they are:

O A. Mixing

O B. Sending

O C.Packing

O D. Picking

Answers

Answer:

D. Picking.................

Distribution team members use replenishment reports to retrieve quantities of items to be sent to stores, this is called as Picking. Hence, Option D is the correct statement.

What is the picking system?Systems for picking orders from warehouses are created to improve picking operations' effectiveness, speed, and accuracy. A few of these systems can be used by businesses to improve order fulfillment processes in their distribution channels.

Hence, Distribution team members use replenishment reports to retrieve quantities of items to be sent to stores, this is called as Picking. Option D is the correct statement.

Learn more about distribution channels:

https://brainly.com/question/11379146

#SPJ5

Who is more likely to object to a proposed 1 percentage point increase in the city sales tax—the owner of a local liquor store or the owner of a local video rental store? Why?

Answers

Answer:

The owner of a local liquor store.

Explanation:

Rentals are not taxed in some places.

Consider the following data representing the price of laptop computers (in dollars).

1365, 1240, 1371, 1052, 1238, 1293, 1043, 1393, 1416, 1035, 1092, 1428, 1288, 1175, 1098, 1083, 1313, 1300, 1060, 1120, 1116

Determine the class width of the classes listed in the frequency table.

Answers

Answer:

The class width is calculated by subtracting the lowest value from the highest value in the given data set. In this case, the lowest value is 1035 and the highest value is 1428, so the class width is 1428 - 1035 = 393.

Explanation:

Gains on the sale of long-term assets are:

A. added to operating activities.

B. added to investing activities.

C. added to financing activities.

D. subtracted from operating activities.

Answers

Gains on the sale of long-term assets are added to investing activities. Therefore, option B is correct.

When a long-term asset is sold at a gain, the cash received from the sale is classified as a cash inflow in the investing activities section. This section of the statement of cash flows includes transactions related to the sale of long-term assets, such as property, plant, and equipment, and investments in other companies.

Gains on the sale of long-term assets are considered investment-related gains and are included in this section to provide a comprehensive view of the organization's investing activities.

Learn more about assets, here:

https://brainly.com/question/14826727

#SPJ1

Brainstorm the ways in which GARP can impact on the management and success of a sports organisation by explaining it first and then identifying the roles and functions which it should play within the sports organisation

Answers

Answer:

GARP, which stands for Governance, Accountability, Risk Management, and Performance, encompasses key principles and practices that can greatly impact the management and success of a sports organization. Here are the ways in which GARP can influence and the roles and functions it should play within a sports organization:

1. Governance:

- GARP emphasizes the importance of having effective governance structures and processes in place within the sports organization.

- It involves establishing clear lines of authority, decision-making frameworks, and transparent communication channels.

- GARP ensures that the organization has a well-defined governance structure, including a board of directors or management committee responsible for setting strategic direction, overseeing operations, and ensuring compliance with regulations.

- The role of GARP in governance is to provide guidance on ethical conduct, promote transparency, and ensure accountability at all levels of the organization.

2. Accountability:

- GARP emphasizes the need for accountability within a sports organization, holding individuals and teams responsible for their actions and decisions.

- It involves implementing systems and processes to track performance, measure results, and report on progress.

- GARP ensures that the organization sets clear goals and objectives, establishes key performance indicators (KPIs), and holds individuals accountable for achieving them.

- The role of GARP in accountability is to provide frameworks for performance measurement, establish reporting mechanisms, and foster a culture of responsibility and ownership within the organization.

3. Risk Management:

- GARP highlights the importance of identifying and managing risks that can impact the sports organization's operations, reputation, and financial stability.

- It involves assessing potential risks, developing mitigation strategies, and implementing controls to minimize the likelihood and impact of adverse events.

- GARP ensures that the organization has a robust risk management framework in place, including policies, procedures, and monitoring mechanisms.

- The role of GARP in risk management is to provide guidance on risk identification, analysis, and mitigation, as well as ensuring compliance with legal and regulatory requirements.

4. Performance:

- GARP emphasizes the need for measuring and improving performance within a sports organization to achieve strategic objectives.

- It involves setting performance targets, regularly evaluating progress, and implementing strategies to enhance performance.

- GARP ensures that the organization establishes performance metrics aligned with its mission and strategic goals.

- The role of GARP in performance management is to provide frameworks for performance evaluation, facilitate continuous improvement, and align individual and team efforts with organizational objectives.

Overall, GARP plays a crucial role in shaping the management and success of a sports organization by establishing effective governance structures, promoting accountability, managing risks, and driving performance. It provides guidance and frameworks to ensure that the organization operates ethically, transparently, and efficiently, ultimately contributing to its long-term sustainability and achievements.

Which of the following might cause the inflation rate to spike up sharply?

Plentiful rainfall and moderate temperatures result in good harvests of wheat and soybeans.

Prices on world oil markets rise steeply due to war in the Middle East. O

The purchasing power of the average consumer decreases due to a sluggish economy.

The items in the CPI market basket change to account for changing consumer buying habits.

Answers

Answer: Prices on world oil markets rise steeply due to war in the Middle East

Explanation:

The inflation rate spiked sharply because prices in world oil markets rise steeply due to the war in the Middle East. Option (b) is correct.

What do you mean by Inflation?The rate of increase in prices over a given period of time is known as inflation.

The cost of making items would rise as a result of an increase in crude oil prices. Inflation would eventually arise from this price increase being passed on to consumers.

Inflation in Oil prices are a result of the Russian Federation being cut off from global supply networks as a result of sanctions following Moscow's invasion of Ukraine. Nations now have to pay more for oil when seeking to obtain it from other sources.

Therefore, Option (b) is correct.

Learn more about Inflation, here;

https://brainly.com/question/30112292

#SPJ6

The reserve requirement is 15 percent. Lucy deposits $600 into a bank. By how much do excess reserves change

Answers

Answer:

$510

Explanation:

Calculation for By how much do excess reserves change

Using this formula

Change in excess reserve= Bank Deposits-(Reserve requirement*Deposit)

Let plug in the formula

Change in excess reserve=$600-($600*15%)

Change in excess reserve=$600-$90

Change in excess reserve=$510

Therefore By how much do excess reserves change is $510

1. I Co. recently began production of a new product, an electric clock, which required the investment of

$3,200,000 in assets. The costs of producing and selling 160,000 units of the clocks are estimated as

follows:

Variable costs:

Per unit

Direct labor

$

10

Direct materials

6

Factory overhead

$

4

Administrative and selling

$

5

EA

Fixed costs:

Manufacturing

Administrative and selling

$ 1,600,000

800,000

I Co. is considering establishing a price to sell it's electrical clock to the market. The CEO has

decided to use a cost plus approach to product pricing and that the clock must eam 10 percent on

it's invested assets.

Instructions: NOTE: SHOW ALL WORK

1. Determine the amount of desired profit from the production and sale of the

electric clock.

2. Assuming that the product cost concept is used, determine (a) total variable

cost per unit, the total fixed cost per unit, and the selling price per unit.

Answers

Answer:

I Co.

1. Desired profit = 10% of invested assets

= $3,200,000 x 10%

= $320,000

2a. Total Variable cost per unit

Variable costs Per unit :

Direct labor $ 10

Direct materials 6

Factory overhead $ 4

Variable Product Cost ($20)

Administrative and selling $ 5

Total Variable cost per unit $25

b. Total fixed cost per unit

Total fixed cost per unit = $2,400,000/160,000 = $15

c. The selling price per unit

Sales / quantity = $7,520,000/160,000 = $47

Explanation:

Data:

Variable costs Per unit :

Direct labor $ 10

Direct materials 6

Factory overhead $ 4

Variable Product Cost $20

Administrative and selling $ 5

Total Variable cost per unit $25

EA

Fixed costs:

Manufacturing $ 1,600,000

Administrative and selling 800,000

Total fixed costs $2,400,000

b) Cost-plus approach to product pricing: This approach requires the addition of the direct materials, direct labor, and overhead costs

c) Required profit = 10% of invested assets

= $3,200,000 x 10%

= $320,000

d) Product cost:

Variable cost = $20 x 160,000 = $3,200,000

Fixed manufacturing costs $1,600,000

Total production cost $4,800,000

Product cost per unit $4,800,000/160,000 = $30

e) Income Statement to determine Sales Revenue

Sales $7,520,000

Cost of goods sold

($30 x 160,000) 4,800,000

Gross profit $2,720,000

Fixed Costs:

Manufacturing $ 1,600,000

Administrative & selling 800,000

Profit $320,000

Assume that the hypothetical economy of Econoland has 10 workers in year 1, each working 2,000 hours per year (50 weeks at 40

hours per week). The total input of labor is 20,000 hours. Productivity (average real output per hour of work) is $10 per worker.

Instructions: In parts a and b, enter your answers as a whole number. In part c, round your answer to 2 decimal places.

a. What is real GDP in Econoland?

$

b. Suppose work hours rise by 1 percent to 20,200 hours per year and labor productivity rises by 4 percent to $10.40. In year 2, what

will be Econoland's real GDP?

$

c. Between year 1 and year 2, what will be Econoland's rate of economic growth?

percent

Answers

In year one, the Econoland economy has 10 workers, each working 2,000 hours per year (50 weeks at 40 hours per week).

a. $200,000

b. $210,080

c. 5.04 percent

What is GDP?Gross domestic product (GDP) is a monetary measure of the market value of all final goods and services produced and sold by countries during a specific time period. Because of its complex and subjective nature, this measure is frequently revised before being considered a reliable indicator. The gross domestic product (GDP) is the monetary value of all finished goods and services produced within a country during a given time period.GDP provides an economic snapshot of a country and is used to estimate the size of an economy and its growth rate. GDP can be calculated in three ways: through expenditures, production, or income. Gross domestic product, or GDP, is a metric used to assess the health of a country's economy.To learn more about GDP, refer to:

https://brainly.com/question/1383956

#SPJ9

Basics Ltd reported current liabilities of R3 000 and a quick ratio of 1,2. The company has current assets of R6 000. If the company reports the cost of goods sold at R4 000 for the given year, what is the inventory turnover?

Answers

The inventory turnover for the given year is 3.33, calculated by dividing the cost of goods sold by the average inventory of R1200.

To calculate the inventory turnover, we first need to determine the inventory value. We can use the quick ratio formula to find the inventory amount.Quick ratio = (Current assets - Inventory) / Current liabilitiesRearranging the formula, we have: Inventory = Current assets - Quick ratio * Current liabilitiesSubstituting the given values, we have:Inventory = R6000 - 1.2 * R3000Inventory = R6000 - R3600Inventory = R2400The inventory value is R2400. To calculate the inventory turnover, we divide the cost of goods sold by the average inventory. In this case, the cost of goods sold is given as R4000. The average inventory is the sum of the beginning and ending inventory divided by 2. Since we don't have information about the beginning and ending inventory, we can assume they are equal, resulting in an average inventory of R2400/2 = R1200.Inventory turnover = Cost of goods sold / Average inventoryInventory turnover = R4000 / R1200Inventory turnover = 3.33Therefore, the inventory turnover for the given year is 3.33.For more questions on inventory

https://brainly.com/question/25947903

#SPJ8

5.8 Kate's base pay rate is R12.50 per hour, with overtime paid at time-and-a-half. Find her gross pay if she worked 45.5 hours Monday through Saturday. (Round your answer to the nearest cent) a. R603.13 b. R568.75 c. R613.03 d. R630.13

Answers

Kate's gross pay for working 45.5 hours Monday through Saturday is A. R 603.13.

How to find the gross pay ?First, find the regular pay to Kate assuming she worked 40 hours in the week :

Regular pay: 40 hours * R 12 . 50/ hour

= R500

The overtime pay is calculated for the hours worked in excess of 40 hours. In this case, Kate worked 5.5 hours overtime.

Then the overtime for Saturday would be:

= 5. 5 * R12.50/hour * 1.5

= R 103. 13

The total gross pay is therefore :

Total gross pay: R500 + R103.13

= R603.13

Find out more on gross pay at https://brainly.com/question/30000784

#SPJ1

If Amelia would like to double her money in twelve years, how much interest does she need to earn O 12 percent O 16.6 percent O 6 percent 10 percent

Answers

Out of the given answer choices, the interest rate that Amelia needs to earn to double her money in twelve years is 16.6 percent.

To find out how much interest Amelia needs to earn to double her money in twelve years, we need to use the compound interest formula.

This formula is used to determine the future value of an investment based on the principal, the interest rate, the number of compounding periods, and the time involved.

The formula is as follows: FV = PV x (1 + r/n)^(n*t)where FV = future value, PV = present value (the amount of money Amelia currently has), r = annual interest rate, n = number of times the interest is compounded per year, and t = time in years.

To double her money, Amelia needs to have a future value that is twice her present value. Therefore, we can set FV = 2PV and solve for r.

2PV = PV x (1 + r/n)^(n*t)Dividing both sides by PV, we get:2 = (1 + r/n)^(n*t)

Taking the natural logarithm of both sides, we get: ln(2) = ln[(1 + r/n)^(n*t)]

Using the power rule of logarithms, we can simplify the right side of the equation to ln(2) = (n*t) ln(1 + r/n)

Dividing both sides by (n*t), we get:ln(2) / (n*t) = ln(1 + r/n)

Finally, we can solve for r by raising both sides as the power of e: e^(ln(2) / (n*t)) = 1 + r/n

Subtracting 1 from both sides and multiplying by n, we get:r = n x (e^(ln(2) / (n*t)) - 1)

Plugging in the values given, we get:r = n x (e^(ln(2) / (n*12)) - 1)

We don't know the value of n, so we can try each of the answer choices to see which one gives us a value of r that works.

Using a financial calculator or a spreadsheet program like Excel, we can calculate the values of r for each interest rate.

Using 12 percent: r = 1 x (e^(ln(2) / (1*12)) - 1) = 0.0956 or 9.56 percent

Using 16.6 percent: r = 1 x (e^(ln(2) / (1*12)) - 1) = 0.1407 or 14.07 percent

Using 6 percent: r = 1 x (e^(ln(2) / (1*12)) - 1) = 0.0488 or 4.88 percent

Using 10 percent: r = 1 x (e^(ln(2) / (1*12)) - 1) = 0.0794 or 7.94 percent

For more such questions on interest rate

https://brainly.com/question/29451175

#SPJ8

Which type of risk is most likely to be insurable?

Answers

Answer:

Pure risk is the only type of risk that is insurable because there is only the chance of loss. The Law of Large Numbers allows the probability of loss to become more predictable.

Explanation:

Calculate your month 1 expenses by adding the contents of column 8, your month 1 expenses. What is the total amount?

Answers

The total amount after adding month 1st expenses in the 8th column is 53,900$.

How to find?Lets add all the values in column 8-

= 2000+3000+3500+3250+4700+5575+6500+7500+8375+9500

= 53,900$

Hence, the total amount is 53,900$.

What are those expenses, exactly?Wages, salaries, repairs, rent, and depreciation are all examples of expenses. Profits are calculated by subtracting expenses from revenue. To lessen the tax burden and increase profits, businesses are permitted to deduct certain costs from taxes.

What are costs and expenses?Expenses are ongoing payments, whereas costs are one-time payments. Cost typically appears on the balance sheet, whereas expense appears on the profit and loss statement.

To know more on Expenses visit:

https://brainly.com/question/30659071

#SPJ1

A specific dollar amount a plan will pay toward the cost of dental care over a speck period of time is a;

A- Deductible

B- Maximum

C- scheduled of benefits

D- pretermination

Answers

Answer: c

Explanation: