Mr. Rational has $27 that he plans to spend purchasing 5 units of good X (priced at $3 per unit) and 6 units of good Y (priced at $2 per unit). The marginal utility of the fifth unit of X is 30, and the marginal utility of the sixth unit of Y is 18. If Mr. Rational is a utility maximizer, he should: a. buy less of X and more of Y. b. buy more of X and less of Y. c. buy X and Y in the quantities indicated. d. buy less of X and even lesser than that of Y. e. not buy anything.

Answers

Answer:

Option A, buy less of X and more of Y is correct.

Explanation:

The amount that Mr. Rational is going to spend = $27

Quantity of good X = 5 units

Price of good X (Px) = $3 per unit

Marginal utility of 5th unit of X (MUx) = 30

Quantity of good Y = 6 units

Price of good Y (Py) = $2 per unit

Marginal utility of 6th unit of Y (MUy) = 18

\(Now \ find \ \frac{MUx}{Px} = \frac{30}{3} = 10 \\\)

\(Now \ \frac{MUy}{Py} = \frac{18}{2} = 9\)

\(Since \ the \ \frac{MUx}{Px} is \ greater \ than \ \frac{MUy}{Py}.\)

So good x will be substituted for y in order to reach the consumer equilibrium.

\(\frac{MUx}{Px} = \frac{MUy}{Py}\)

Thus, Option a. buy less of X and more of Y is correct.

Related Questions

George Washington Carver developed new

A.military strategies

B. web 2.0 products

C. agricultural innovations

D. long-distance communication

Answers

George Washington Carver developed new agricultural innovations. Thus, the correct answer is option (C).

Who was George Washington Carver?George Washington Carver was an American agricultural scientist and inventor who advocated for non-cotton crops and ways to avoid soil depletion. He was a famous black scientist in the early twentieth century.

Carver created an agriculture extension in Alabama as well as an industrial research lab, where he worked tirelessly on the development of hundreds of novel plant applications. Carver created his crop rotation technique at Tuskegee, which alternated nitrate-producing legumes like peanuts and maize with cotton, which depletes the soil of nutrients. His innovations are attributed with ensuring the South's economic survival in the early twentieth century.

Therefore, George Washington Carver is considered to have made large contributions in agricultural innovations.

To learn more on George Washington Carver, click here:

https://brainly.com/question/30310601

#SPJ2

Magic Realm, Inc., has developed a new fantasy board game. The company sold 45,000 games last year at a selling price of $66 per game. Fixed expenses associated with the game total $810,000 per year, and variable expenses are $46 per game. Production of the game is entrusted to a printing contractor. Variable expenses consist mostly of payments to this contractor. Required: 1-a. Prepare a contribution format income statement for the game last year. 1-b. Compute the degree of operating leverage. 2. Management is confident that the company can sell 54,900 games next year (an increase of 9,900 games, or 22%, over last year). Given this assumption: a. What is the expected percentage increase in net operating income for next year? b. What is the expected amount of net operating income for next year? (Do not prepare an income statement; use the degree of operating leverage to compute your answer.)

Answers

Answer:

Please see below and attached.

Explanation:

1a. Prepare a contribution format income statement for the game last year. The Net operating income is $90,000.

1-b The degree of operating leverage

= $10.

2a. Net operating income increases by 220%

2b. Total expected net operating income is $288,000.

Please find attached detailed breakdown of the answers provided above

E4.11 (LO 2), AP Selected accounts for Tamora’s Salon are presented here. All June 30 postings are from closing entries.

Salaries and Wages Expense

6/10 3,200

6/28 5,600

Bal. 8,800 6/30 8,800

Supplies Expense

6/12 600

6/24 700

Bal. 1,300 6/30 1,300

Service Revenue

6/15 9,700

6/24 8,400

6/30 18,100 Bal. 18,100

Rent Expense

6/1 3,000

Bal. 3,000 6/30 3,000

Owner’s Capital

6/30 2,500 6/1 12,000

6/30 5,000

Bal. 14,500

Owner’s Drawings

6/13 1,000

6/25 1,500

Bal. 2,500 6/30 2,500

Instructions

Prepare the closing entries that were made.

Post the closing entries to Income Summary.

Prepare correcting entries.

Answers

1. The preparation of the the closing journal entries made is as follows:

Closing Journal Entries:Debit Income Summary $8,800

Credit Salaries and Wages Expense $8,800

Debit Income Summary $1,300

Credit Supplies Expense $1,300

Debit Income Summary $3,000

Credit Rent Expense $3,000

Debit Service Revenue $18,100

Credit Income Summary $18,100

2. The posting of the closing entries to the Income Summary is as follows:

Income Summary:Service Revenue $18,100

Salaries & Wages Expense $8,800

Supplies Expense 1,300

Rent Expense 3,000

Total Expenses $13,100

Operating income $5,000

3. The preparation of the the correcting entries is as follows:

Debit Owner’s Drawings $2,500

Credit Owner’s Capital $2,500

What are closing entries?Closing entries are the journal entries made at the end of a financial period to close the revenue and expenses (temporary accounts) to the income summary, income summary to the retained earnings account, and dividends to retained earnings.

Learn more about preparing closing entries at https://brainly.com/question/13408214

sample of how to figure the Gross profit Margin?

Answers

We know, Gross Profit Margin = (Gross Profit ÷ Revenue) x 100

Sure, here's a sample calculation of gross profit margin:

Gross Profit Margin = (Gross Profit ÷ Revenue) x 100

Where: Gross Profit is the total revenue minus the cost of goods sold (COGS). Revenue is the total amount of sales during a given period.

Let's assume that a retail store generated $500,000 in revenue for a quarter and incurred $300,000 in COGS for the same period. The gross profit would be:

Gross Profit = Revenue - COGS

Gross Profit = $500,000 - $300,000

Gross Profit = $200,000

Using the formula above, we can calculate the gross profit margin as follows:

Gross Profit Margin = ($200,000 ÷ $500,000) x 100

Gross Profit Margin = 0.4 x 100

Gross Profit Margin = 40%

This means that for every dollar in sales, the retail store is making 40 cents in gross profit. The higher the gross profit margin, the more efficient a company is at generating profits from their sales.

for more such questions on Gross

https://brainly.com/question/942181

#SPJ11

phân tích phạm trù hàng hoá sức loa động theo quan điểm cua chủ nghĩa mác.Thực trạng thị trường sức lao động ở nước ta hiện nay. Là sinh viên trường đại học anh chị nhận thấy mình có trách nhiệm gì trong việc nâng cao chất lượng nguồn nhân lực đáp ứng yêu cầu của sự nghiệp công nghiệp hoá đất nước

Answers

Paragraph on your bedroom

Answers

Answer:

My room is a place where I feel the most comfortable and openly show my personality to myself. This is the place where I do what I want to do and it is the place where I disembark myself when I come home and wake up every day. My room makes me feel very comfortable in my own space so my house is always crazy as my dog barking and siblings moving around making noise around the house. I care about everyone in my home.

Please mark as brainliest if answer is right

Have a great day, be safe and healthy

Thank u

XD

Asorting tool is most likely used to

find missing data

present ordered data

generate search results

find information sources

Answers

why do projects fail ?

Answers

Which of the following is not a source of funding

Answers

Answer:

Correct option is

C. Issue of bonus shares

By source of funds we mean that money is coming in the business. In the given question all of them are sources of funds except issue of bonus shares. The company issues bonus shares out of its own reserves and hence there is no money received by the company for such shares. Rest all being sale of fixed assets, issue of share capital and issue of shares for consideration other than cash are a part of sources of funds.

The purchase of machinery is not a source of funding. Hence, Option (A) is correct.

The purchase of machinery involves using funds to acquire a capital asset rather than acquiring funds from an external source.

When a company purchases machinery, it typically uses its existing funds, such as cash on hand or retained earnings, to make the purchase.

This transaction does not introduce new funds into the company; rather, it represents a reallocation of existing resources toward capital investment.

Sources of funding, on the other hand, typically involve obtaining funds from external parties or generating funds through internal sources such as profits, issuance of share capital, or long-term loans.

Thus, the purchase of machinery isn't considered the source of funding.

Learn more about the source of funding here:

https://brainly.com/question/32124973

#SPJ6

Which of the following is not a Source of Funding?

A) Purchase of Machinery

B) Profit earned during the year

C) Issue of share capital

D) Long-term loan raised

Amazon is the dominant firm in the online shopping service industry, which has a total market demand given by Q = 100 – 2 P. Amazon has competition from a fringe of four small firms that produce where their individual marginal costs equal the market price. The fringe firms each have total costs given by TCi = 10 Qi + Q i 2. If Amazon’s total costs are given by TCA = 10 + 10 QA, , how much does the industry as a whole produce at this price?

Answers

The price that Amazon has to establish for their online shopping should be $20.

The Excel financial functions section includes the Price Function. It will determine the cost of a bond with a $100 face value that accrues interest on a recurring basis. The PRICE function in financial analysis can be helpful when we want to borrow money by selling bonds rather than stocks.

We have the price function as

P = 10 + 2Qi

Make Qi subject

= Qi = 0.5P - 5

4 firms with identical features

This would give us

Qs = 4Qi

Qs = 4(0.5P -5)

Qs = 2p - 20

Q = 100 - 2p

Qa = Q - Qs

(100 - 2P) - (2P -20)

Take like terms

100 - 2p - 2p + 20

100 - 4p + 20

Qa = 120 - 4p

Make p subject

p = 120 - Qa / 4

p = 30 - 0.25Qa

TRa = p*Qa

= (30 - 0.25Qa)Qa

= 30Qa - 0.25Qa²

MRa

= 30 - 0.5Qa

TCA = 10 + 10QA

= ΔTCA / ΔQA

= 10

30 - 0.5QA = 10

Take like terms

30 - 10 = 0.5Qa

divide through by 0.5

20/0.5 = Qa

40 = Qa

Output produced = 40.

We have P as

30 - 0.25QA

P = 30 - 0.25( *40)

= 20

Hence the price that Amazon has to establish for online shopping should be $20

Read more on price here:

https://brainly.com/question/25638609

#SPJ1

How much leverage (debt as a percentage of the total project cost) would you be able to arrange given what you know about underwriting metrics? Can express this as an LTV, LTC, DSCR, or DY. Is this a definite amount or is there room for negotiation?

Answers

Leverage, which refers to the amount of debt used to finance a project relative to the total project cost, is typically expressed as a percentage.

Underwriting metrics are used by lenders to assess the creditworthiness of a borrower and the risk of a project. These metrics typically include loan-to-value (LTV), loan-to-cost (LTC), debt service coverage ratio (DSCR), and debt yield (DY).

LTV is the ratio of the loan amount to the appraised value of the property or asset being financed. LTC is the ratio of the loan amount to the total cost of the project. DSCR is the ratio of the property's net operating income to its debt service. DY is the property's net operating income divided by the loan amount.

The maximum amount of leverage that can be arranged may depend on the lender's underwriting criteria and risk appetite. In general, a higher LTV or LTC ratio means a higher level of risk for the lender, and therefore, a higher interest rate may be charged to compensate for the increased risk. Similarly, a higher DSCR or DY indicates that the property is generating sufficient income to service its debt, which may increase the lender's confidence in the borrower's ability to repay the loan and result in more favorable lending terms.

There may be some room for negotiation in terms of leverage and underwriting metrics, depending on the lender's policies and the borrower's creditworthiness and negotiating power.

To know more about Leverage, visit:

https://brainly.com/question/30985112

#SPJ1

The United States is _____.

Answers

The United States is a federal republic and a democratic country situated in North America, bordered by Canada to the north, Mexico to the south, and the Pacific and Atlantic Oceans on the west and east respectively.

With a total area of 3.8 million square miles, the country is the third largest country in the world by area. It also has a diverse population, consisting of people of different ethnic, racial, and religious backgrounds. The United States has a long history of promoting democracy, human rights, and freedom around the world. Its constitution guarantees basic freedoms like the freedom of speech, religion, and the press, and the right to bear arms.

The country has a capitalist economy that is the largest in the world, and is driven by its vast natural resources, technological innovations, and a well-educated workforce. The United States is a member of several international organizations like the United Nations, the World Trade Organization, and NATO. It also has an important role in maintaining global peace and security, as well as tackling global challenges like climate change and terrorism.

For more such questions on democratic

https://brainly.com/question/32723008

#SPJ8

Suppose that a small town has seven burger shops whose respective shares of the local hamburger market are (as percentages of all hamburgers sold): 23 percent, 22 percent, 18 percent, 12 percent, 11 percent, 8 percent, and 6 percent. Instructions: Enter your answers as a whole number. a. What is the four-firm concentration ratio of the hamburger industry in this town? percent b. What is the Herfindahl index for the hamburger industry in this town? c. If the top three sellers combine to form a single firm, what would happen to the four-firm concentration ratio and to the Herfindahl index? Four-firm concentration ratio = percent Herfindahl index =

Answers

Answer:

a= 75%

b= 1702

c= 94% , 4334

What exactly allows individuals to consume more if they specialize and trade than if they don't

Answers

Answer:

They work within the company that allows them to do so. Vs. others that don't.

Explanation:

Hope this helps! plz mark as brainliest!

During its first year of operation Mazer Manufacturing Company produced 9,500 units of inventory and sold 2,550 units. Mazer incurred variable product cost of $2.50 per unit and $13,300 of fixed manufacturing overhead costs. The sales price of the products was $9.50 per unit. Determine the amount of net income Mazer would report if the company uses variable costing.

Answers

Answer:

Explanation:

To determine the amount of net income Mazer would report if the company uses variable costing, we need to calculate the variable cost per unit and the contribution margin per unit first:

Variable cost per unit = variable product cost per unit

= $2.50

Contribution margin per unit = sales price per unit - variable cost per unit

= $9.50 - $2.50

= $7.00

Using this information, we can calculate the total variable cost and total contribution margin for the units sold:

Total variable cost = variable cost per unit x units sold

= $2.50 x 2,550

= $6,375

Total contribution margin = contribution margin per unit x units sold

= $7.00 x 2,550

= $17,850

Next, we can calculate the total fixed manufacturing overhead cost incurred by Mazer during the first year of operation:

Total fixed manufacturing overhead cost = $13,300

Finally, we can calculate the net income using the variable costing method:

Net income = total contribution margin - total fixed manufacturing overhead cost

= $17,850 - $13,300

= $4,550

Should VALORANT give out free skins?

Answers

Explanation:

Take a meme.

Self-disclosure is considered a major theme of interpersonal relations because

Answers

The objectives of cybersecurity are to accomplish each of the following except:_______ a. Make data and documents available and accessible 24/7 while simultaneously restricting, access. b. Promote secure and legal sharing of information among authorized persons and partners. c. Ensure compliance with supply chain business partners. d. Detect, diagnose, and respond to incidents and attacks in real time.

Answers

Answer:

C

Explanation:

Cybersecurity is the protection of internet-connected systems such as hardware, software and data from cyber-threats. It is used to prevent unauthorized access to data.

Which of the following answer options are your employer's responsibility? (OSHA)

(A) Develop a written hazard communication program

(B) Implement a hazard communication program

(C) Maintain a written hazard communication program

Answers

Answer: A, B, and C. ALL OF THE ABOVE!

Explanation:

They're all the correct answer.

An employer's OSHA responsibility with regard to a hazard communication program is (C) Maintain a written hazard communication program.

OSHA's HCS, 29 CFR 1910.1200 (e) specifically requires the employer to maintain a written hazard communication.This written program includes maintenance of labels and other warning forms, safety data sheets.It is also required that the employer should provide safety information and training, especially for its employees.Thus, the responsibility of the employer is not to develop or implement a hazard communication program but to maintain a written hazard communication program.

Read more about employer's OSHA responsibilities at https://brainly.com/question/5337593

6) When you were leading your in-house team, you displayed optimism by your demeanor each day. How can you best instill a spirit of optimism with your new remote team?

A) Frame challenges as opportunities and provide the tools to meet those opportunities.

B) Frame challenges as a part of business life and encourage your team to find ways to overcome them.

C) Display your same optimistic attitude when you are on video calls with your remote team.

Answers

The best way to instill the spirit of optimism in the new remote team is to Display your same optimistic attitude when you are on video calls with your remote team. Thus, option D is correct.

Particularly when working remotely, your leadership style and attitude may have a significant influence on the morale and optimism of your team.

Building a positive and resilient mindset may also be aided by encouraging your team to overcome obstacles and highlighting the possibilities that problems present.

The leaders may assist to establish a positive mood among the team by consistently being cheery throughout video conferences and other interactions.

Learn more about optimism, here:

brainly.com/question/23313835

#SPJ1

Tyare Corporation had the following inventory balances at the beginning and end of May:

May 1 May 30

Raw materials $35,500 $50,000

Finished Goods $85,000 $86,000

Work in Process $23,500 $18,040

During May, $68,500 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 500 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $8,050 of direct materials cost. The Corporation incurred $45,000 of actual manufacturing overhead cost during the month and applied $45,600 in manufacturing overhead cost. The raw materials purchased during May totaled:__________

Answers

Answer:

purchases= $83,000

Explanation:

Giving the following information:

May 1 May 30

Raw materials $35,500 $50,000

During May, $68,500 in raw materials (all direct materials) were drawn from inventory and used in production.

To calculate the direct material purchase, we need to use the following formula:

Direct material used= beginning inventory + purchases - ending inventory

68,500= 35,500 + purchases - 50,000

$83,000= purchases

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 29,328 83,351 103,760 9,078 257,087 $ 482,604 $ 32,285 $ 34, 323 57,663 45,764 76,967 50, 226 8,737 3,775 240,386 216,112 $ 416,038 $ 350, 200 $ 120,168 $ 70,310 $ 44,840 88,915 162,500 111,021 $ 482,604 96,646 75,072 162,500 162,500 86,582 67, 788 $ 416,038 $ 350, 200 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period?

Answers

Answer:

1a. Current ratio = Current assets / Current Liabilities

Current year = $224,517 / $120168 = 1.88 : 1

1 years ago = $175,652 / $70,310 = 2.50 : 1

2 years ago =$134,088 / $44,840 = 2.99 : 1

1b. The Current ratio worse over three years period

2a. Acid test ratio = (Cash + Investment + Account Receivables) / Current liabilities

Current year = ($29,328 + $0 + $83,351) / $120,168 = 0.94 : 1

1 year ago = ($32,285 + $0 + $57,663) / $70,310 = 1.28 : 1

2 year ago = ($34,323 + $0 + $45,764) / $44,840 = 1.79 : 1

2b. The Acid test ratio are worse over three years period

Which best describes how consumers may benefit from specialization?

Consumers can only purchase high-quality goods.

Consumers have more price options.

O Consumers receive more sale offers.

O Consumers find products at lower prices.

Answers

In specialization a company have produced the product at different price levels. Consumers have more price options.

What is consumer?A consumer is a person who purchases the goods and or services from the business and is also the ultimate user of the products or services. In specialization the company produces a certain product at many different levels by which they have many price options available which vary according to their customization and quality that can be offered to the consumers and hence the customer can purchase different types of a single product from a single company or Brand.

Learn more about consumer at https://brainly.com/question/14579118

#SPJ1

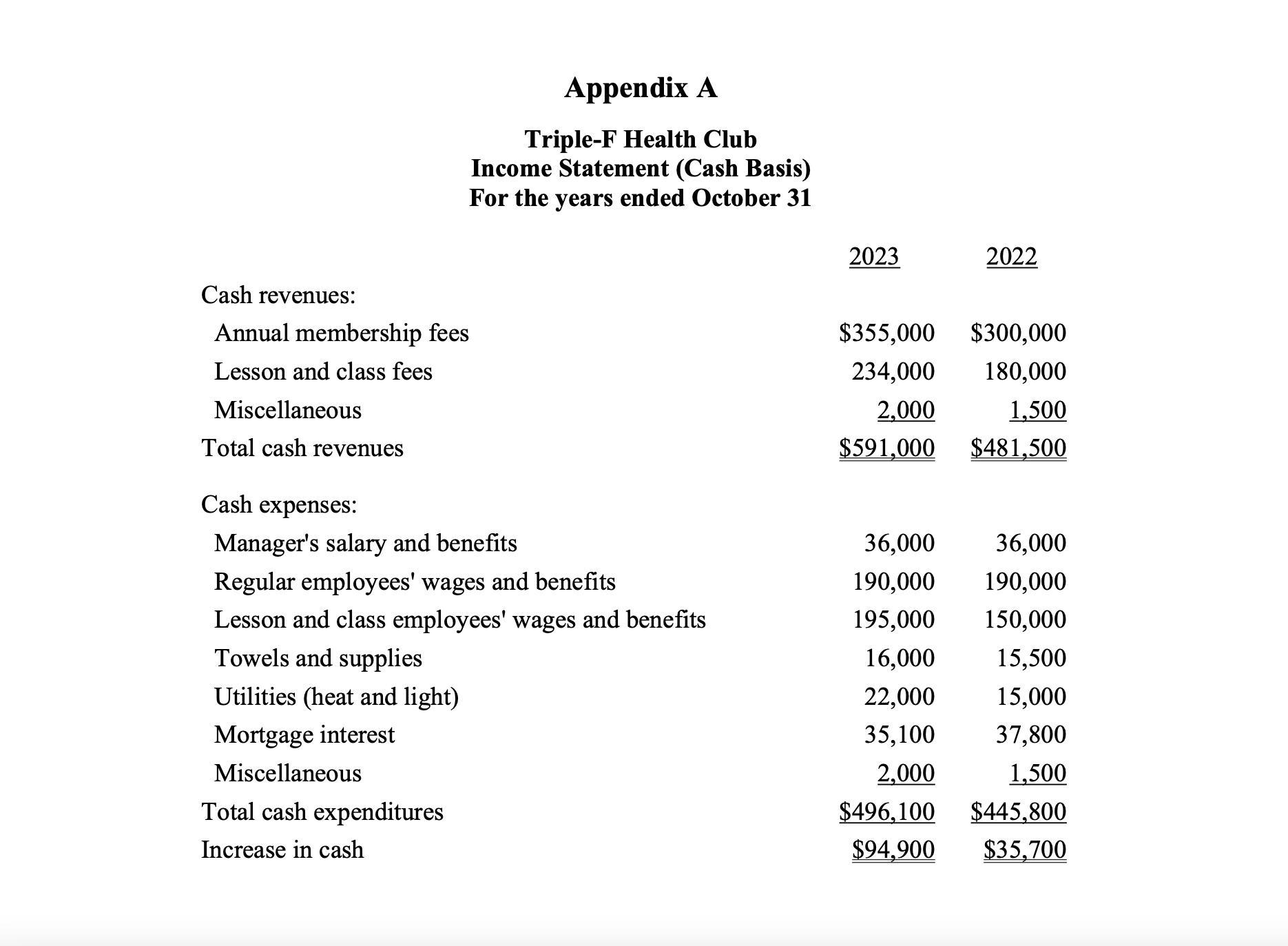

Triple-F Health Club (Family, Fitness, and Fun) is a not-for-profit family-oriented health club. The club's board of directors is developing plans to acquire more equipment and to expand club facilities. The board plans to purchase about $25,000 of new equipment each year and wants to establish a fund to purchase the adjoining property in four or five years. The adjoining property has a market value of about $300,000.

The club manager, Jane Crowe, is concerned that the board has unrealistic goals in light of the club's recent financial performance. She has sought the help of a club member with an accounting background to assist her in preparing a report to the board supporting her concerns.

Jane would like you to prepare a cash budget for 2024 for the Triple-H Health Club and explain any operating problems that this budget discloses for the Triple-H Health Club. Is Jane Crowe's concern that the board's goals are unrealistic justified?

Answers

The Triple-H Health Club may face operational issues in 2024, based on the cash budget. There is a $5,000 cash shortfall as a result of the anticipated cash outflows exceeding the anticipated cash inflows.

What is Cash Outflow?Any cash payments or expenditures made by a person or organization, such as purchasing inventory, paying salaries, or purchasing equipment, are referred to as cash outflow.

To prepare a cash budget for 2024, we need to estimate the club's cash inflows and outflows for that year. Here is a potential cash budget for Triple-H Health Club for 2024:

Cash Inflows:

Membership fees: $200,000

Donations: $20,000

Total Cash Inflows: $220,000

Cash Outflows:

Equipment purchases: $25,000

Rent: $60,000

Salaries and wages: $100,000

Utilities: $12,000

Insurance: $10,000

Maintenance and repairs: $8,000

Total Cash Outflows: $215,000

Net Cash Inflows: $5,000

This cash budget indicates that the club is expecting a net cash inflow of $5,000 in 2024, which is a positive sign. However, the budget also shows that the club has relatively high fixed costs in the form of rent, salaries, and wages, which could pose challenges if the club's revenue falls short of expectations.

To know more about Cash Outflow, visit:

brainly.com/question/23453537

#SPJ1

Olympus Climbers Company has the following inventory data:

July 1 Beginning Inventory 20 units at $19 $380

7 Purhcases 70 units at $20 1,400

22 Purchases 10 units at $22 220

$2,000

A physical count of merchandise inventory on July 30 reveals that there are 32 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for July is:

a. $1380

b. $1340

c. $620

d. $660

Answers

Option b is the correct one, the amount allocated to cost of goods sold for July is $1340.

What is FIFO?First In, First Out, also referred to as FIFO, is an asset management and valuation technique that gives priority to the sale, use, or disposal of assets that were created or acquired first. For taxes purposes, FIFO assumes that the assets with the oldest expenses are included in the cost of goods sold on the income statement (COGS).

What is LIFO?The Last-In, First-Out (LIFO) methodology is based on the notion that the newest or most recent unit to enter inventory is the first to be sold.

Using the first in first out (FIFO) method.

Total units available for sale = 20 units + 70 units + 10 units = 100 units

Units sold = Total units available for sale - ending units on hand

Units sold = 100 units - 32 units

Units sold = 68 units

1-Jul Beginning Inventory = 20 units at $19 = $380

7-Jul Purchases = 48 units at $20 = $960

Cost of goods sold for July = 68 units = $1,340

To know more about FIFO visit: brainly.com/question/29532136

#SPJ4

Solving for dominant strategies and the Nash equilibrium Suppose Gilberto and Juanita are playing a game in which both must simultaneously choose the action Left or Right. The payoff matrix that follows shows the payoff each person will earn as a function of both of their choices. For example, the lower-right cell shows that if Gilberto chooses Right and Juanita chooses Right, Gilberto will receive a payoff of 3, and Juanita will receive a payoff of 7.

Juanita

Left Right

Gilberto

Left 4, 6 6, 8

Right 7, 5 3, 7

The only dominant strategy in this game is for _____ to choose _____ . The outcome reflecting the unique Nash equilibrium in this game is as follows: Gilberto chooses _____ and Juanita chooses ____ .

Answers

Answer:

The only dominant strategy in this game is for Juanita to choose left since it is the best response of Juniata irrespective of what Gilberto does.

Gilberto chooses left and Juanita chooses left.

Explanation:

Gilberto appears to know Juniata's left to choose. So Gilberto opts for Left to maximize its return on investment. The technique is superior if the approach gives a participant a greater payout than just about any other player, no matter what any player does.

Therefore, the effect is.

When Juanita chooses his winning approach, it is the safest option for Gilberto to left.

Requirement 2. How much is the owner's equity of the property management company? Irene Chan has $ of equity in the property management company?

Answers

The information provided is incomplete as the amount of equity or any specific details about Irene Chan's investment in the property management company are not given. Therefore, without knowing the specific amount or percentage of equity Irene Chan holds in the company.

it is not possible to determine the exact value of the owner's equity or Irene Chan's equity in the property management company.Equity represents the ownership interest in a company and is calculated by subtracting the company's liabilities from its assets. However, since no information is provided regarding the company's liabilities, assets, or Irene Chan's investment.

We cannot calculate the owner's equity or determine Irene Chan's specific equity in the property management company.To accurately determine the owner's equity or Irene Chan's equity, it would be necessary to have additional information about the company's financial statements, investments, and any other relevant details regarding ownership stakes or capital contributions.

For more such questions on equity

https://brainly.com/question/11556132

#SPJ11

What are the dimensions of organizational climate in restaurant management?

Answers

For federal tax purposes, which of the following is true regarding lump-sum life insurance benefits?

Answers

Based on the information given, it should be noted that all proceeds are income tax free in the year that they're received.

What is tax?A tax simply means a compulsory levy that's paid by the people or companies to the government. It's important to achieve economic development.

For federal tax purposes regarding lump-sum life insurance benefits, it should be noted that all proceeds are income tax free in the year that they're received.

Learn more about tax on:

https://brainly.com/question/9437038

The Warren Watch Company sells watches for $26, fixed costs are $155,000, and variable costs are $13 per watch. What is the break-even point

Answers

Based on the information given the break-even point is 11,923 units.

Break Even Point:Using this formula

Break Even Point = Fixed Cost / (selling price per unit - Variable cost per unit)

Where:

Fixed Cost=$155,000

Selling price per unit=$26

Variable cost per unit=$13

Let plug in the formula

Break Even Point=155,000 / (26 - 13)

Break Even Point=155,000/13

Break Even Point= 11,923 units

Inconclusion the break-even point is 11,923 units.

Learn more about Break Even Point here:https://brainly.com/question/21137380

The break-even points for The Warren Watch Company can be computed as follows:

1. The break-even point in units = Fixed costs/Contribution margin per unit

= 11,923 units ($155,000/$13).

2. The break-even point in dollars = Fixed costs/Contribution margin ratio

= $310,000 ($155,000/50%).

Data and Calculatioins:

Fixed costs = $155,000

Selling price per unit = $26

Variable costs per unit = $13

Contribution margin per unit = $13 ($26 - $13)

Contribution margin ratio = 50% ($13/$26 x 100)

The break-even point in units = Fixed costs/Contribution margin per unit

= 11,923 units ($155,000/$13).

The break-even point in dollars = Fixed costs/Contribution margin ratio

= $310,000 ($155,000/50%).

Learn more about break-even point here: https://brainly.com/question/9212451