Answers

Answer:

The correct answer is: order-creaters.

Explanation:

To begin with, the area of personal selling there are three types of different approaches regarding the sales person and his proper way of selling. According to this theory, one of those types is the one named "order-creaters" and that concept comprehends the type of sellers that primarily focos on not to close the sale, but to persuade the regular customer to promote the product to other clients from the same audience. Therefore that Jake, when goes to have launch in the same place as the doctors, even though he does not want to make a sale, he is looking forward to establish a relationship that later favoured him in promoting the product.

Related Questions

Could This firm produce an output of 200 at an average total cost of $20?

Answers

Answer:

yes

Explanation:

Explanation: Hope you get it right

The units of an item available for sale during the year were as follows: Jan. 1 Inventory 50 units at $100 Mar. 10 Purchase 70 units at $110 Aug. 30 Purchase 30 units at $118 Dec. 12 Purchase 50 units at $120 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost and the cost of goods sold by three methods. Round interim calculations to one decimal and final answers to the nearest whole dollar.

Answers

The ending inventory cost and the cost of goods sold using FIFO, LIFO, and Weighted-Average Cost methods are as follows:

FIFO LIFO Weighted-Average

Ending inventory $9,540 $8,300 $8,896

Cost of goods sold $12,700 $13,940 $13,344

Data and Calculations:

Date Description Units Unit Cost Total Cost

Jan. 1 Inventory 50 $100 $5,000

Mar. 10 Purchase 70 $110 7,700

Aug. 30 Purchase 30 $118 3,540

Dec. 12 Purchase 50 $120 6,000

Total 200 $22,240

Dec. 31 Ending inventory 80

Number of units sold 120 (200 - 80)

Average cost per unit = $111.20 ($22,240/200) under the periodic system

FIFO:

Ending inventory = $9,540 (30 x $118 + 50 x $120)

Cost of goods sold = $12,700 ($22,240 - $9,540)

LIFO:

Ending inventory = $8,300 (50 x $100 + 30 x $110)

Cost of goods sold = $13,940 ($22,240 - $8,300)

Weighted-Average Cost:

Ending inventory = $8,896 (80 x $111.20)

Cost of goods sold = $13,344 (120 x $111.20)

Learn more: https://brainly.com/question/14586660

Fill in the blanks to complete the passage about why firms do not always increase their

production.

Drag word(s) below to fill in the blank(s) in the passage.

Firms use cost data to make decisions about how many units to produce based on their costs.

Increasing production may not always lead to an increase in profit. Increasing production will cause a

firm's costs to increase, which could outweigh any benefits that were previously gained by

lowering their overhead-which is determined by their costs in the short run.

fixed and variable

variable

fixed

average fixed

Answers

The reason firms do not always increase their production is based on the following factors:

1. Fixed and Variable costs: The fixed and variable costs are used to decide the number of goods to produce.

2. Average Fixed costs: When a firm increases its production, the average fixed costs may increase.

3. Fixed costs: The overhead cost is the fixed costs in the short-run.

Thus, each of the three blanks is filled with correct answer. Note that the every business entity incurs both fixed and variable costs.

Learn more: https://brainly.com/question/14872023

Answer:

fixed and variable, variable, average fixed

Explanation:

6) If the owner contributes $44,900 and the owner withdraws $4,200, how much is net income (loss)?

Answers

Based on the amount the owner contributed and then withdrew, the net income (loss) is -$12,300.

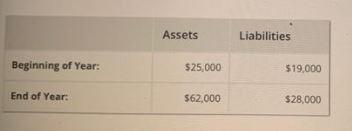

What is the net income (loss)?First, find the value of ending equity:

= Ending assets - liabilities

= 62,000 - 28,000

= $34,000

Then find beginning equity:

= 25,000 - 19,000

= $6,000

The net income(loss) is:

= Equity - Owner's contribution + Withdrawals - Beginning equity

= 34,000 - 44,500 + 4,200 - 6,000

= -$12,300

Find out more on calculating equity at https://brainly.com/question/11110287.

#SPJ1

Olivia and Yixing are volunteering at a cat rescue shelter. The shelter supervisor asks them to clean out kennels and haul bags of cat food from the donation area into storage. It takes Olivia 6 minutes to clean out a kennel and 6 minutes to move a bag of food. It takes Yixing 10 minutes to clean out a kennel and 12 minutes to move a bag of food.

A. ____has an absolute advantage in completing both tasks.

B. Olivia's opportunity cost of cleaning a kennel:___bags of food moved.

C. Olivia's opportunity cost of moving one bag of food:_____kennels cleaned.

D. Yixing's opportunity cost of cleaning a kennel:____bags of food moved.

E. Yixing's opportunity cost of moving one bag of food:____kennels cleaned.

F. Yixing says it does not matter which task each of them performs, because Olivia is faster at both tasks. Is she correct?

A) No, Yixing should clean out the kennels, and Olivia should move the food bags.

B) No, Olivia should clean out the kennels, and Yixing should move the food bags.

C) Yes, Olivia should do both tasks because she is faster at both.

D) No, Yixing should do both tasks so that she can practice and become more efficient.

Answers

Answer and Explanation:

The explanation is given below:

a. Olivia has an absolute advantage as she takes less time for completing both the tasks

b. Olivia's opportunity cost of cleaning a kennel is

= 6 ÷ 6

= 1 bags of food moved.

c.

Olivia's opportunity cost of moving one bag of food is

= 6 ÷ 6

= 1 kennel cleaned

d.

Yixing's opportunity cost of cleaning a kennel is

= 10 ÷ 12

= 0.83 bags of food moved.

e.

Yixing's opportunity cost of moving one bag of food is

= 12 ÷ 10

= 1.2 kennel cleaned

f.

As from the above calculations we can see that the opportunity cost of kennel cleaning would be les sin Yixing so here Yixing should have a comparative advantage and Olivia should hhave move the food bags

Therefore the correct option is a

If the economy is falling below potential real GDP, which of the following would be an appropriate fiscal policy to bring the economy back to long-run aggregate supply? An increase in

government purchases

Answers

Which of the following would be a suitable fiscal strategy to restore the economy to long-run aggregate supply if the economy is slipping below potential real GDP An increase in government purchases

Federal, state, and municipal governments spend money on products and services through government purchases. One of the most important factors in calculating a country's gross domestic product is the sum of all of this spending, minus transfer payments and interest on the debt (GDP). Spending that doesn't include purchases includes things like agriculture subsidies and Social Security payments.

Government investment is defined as the purchase of goods and services by the government with the intention of generating future benefits, such as infrastructure investment or research spending (government gross capital formation). Together, these two categories of government spending—on final consumption and gross capital formation make up one of the primary parts of the GDP.

To learn more about government purchases refer here:

https://brainly.com/question/13302294

#SPJ4

Who is more likely to object to a proposed 1 percentage point increase in the city sales tax—the owner of a local liquor store or the owner of a local video rental store? Why?

Answers

Answer:

The owner of a local liquor store.

Explanation:

Rentals are not taxed in some places.

Mrs. Harriett age 62, has the following receipts, accruals and expenses for the 2023

year of assessment:

Income R

Salary per month R18 000

Bonus for the year R22 000

Interest per annum from a local bank R23 000

Foreign interest R56 000

Dividends per annum from a South African Company R120 000

Foreign dividends per annum R45 000

Rental income per month R12 000

Gifts from friends on his 62nd birthday R3 700

Trade income from a part time business R180 000

Uniform allowance per annum R9 000

Annuity from a trust per annum R26 000

Commission per annum from a part time job R80 000

Inheritance of a building (market value) (Note 1) R550 000

Royalty from a book per annum R60 000

Foreign pension R120 000

Proceeds from the sale of a farm (Note 2) R600 000

War and disability pension (Note 3) R150 000

Restraint of trade receipt R350 000

Know-how receipt for her employer R120 000

Expenses:

Trade expense R22 000

Rental expense R19 000

Fees expenses for her children R19 000

Food and electricity expense for her household R4 500

Salaries/wages for her employee at the part-time business R60 000

Notes:

2

1) During the year, she inherited a building from her late Uncle. His Uncle started

in the Will that this building should never be sold by any member of the family.

2) Mrs. Harriett acquired this farm in 2008 at a cost of R200 000. She then sold

this farm during the 2019 year of assessment for the amount mentioned above.

3) Mrs. Harriett had been a member of the SANDF, she left the organization due

to an injury she sustained during war confrontation with Namibian Air Force.

Required:

You are required; to calculate the tax payable by Mrs. Harriett Norway for the

2023 year of assessment.

2023 tax year (1 March 2022 – 28 February 2023)

Answers

Tax payable by Mrs. Hariett for the given years are -

0% on the first R100,000

10% on the portion between R100,001 and R500,000

20% on the portion between R500,001 and R1,000,000

To calculate the tax payable by Mrs. Harriett for the 2023 year of assessment, we need to consider her various sources of income, expenses, and deductions. Please note that I will provide an estimation of the tax payable based on general tax rules. Actual tax calculations may vary depending on the specific tax laws and regulations of the country in question.

Here's a breakdown of Mrs. Harriett's income, expenses, and deductions:

Income:

Salary per month: R18,000 x 12 = R216,000

Bonus for the year: R22,000

Interest per annum from a local bank: R23,000

Foreign interest: R56,000

Dividends per annum from a South African Company: R120,000

Foreign dividends per annum: R45,000

Rental income per month: R12,000 x 12 = R144,000

Gifts from friends on her 62nd birthday: R3,700

Trade income from a part-time business: R180,000

Uniform allowance per annum: R9,000

Annuity from a trust per annum: R26,000

Commission per annum from a part-time job: R80,000

Inheritance of a building (market value): R550,000

Royalty from a book per annum: R60,000

Foreign pension: R120,000

Proceeds from the sale of a farm: R600,000

War and disability pension: R150,000

Restraint of trade receipt: R350,000

Know-how receipt for her employer: R120,000

Expenses:

Trade expense: R22,000

Rental expense: R19,000

Fees expenses for her children: R19,000

Food and electricity expense for her household: R4,500

Salaries/wages for her employee at the part-time business: R60,000

Deductions:

Medical expenses (if applicable)

Retirement annuity contributions (if applicable)

Now, let's calculate the taxable income and the tax payable based on the tax rates applicable for the 2023 tax year in Norway. Please note that I will assume the tax rates based on general knowledge and not specific to Norway's tax rates.

Calculate the taxable income:

Total Income: R216,000 + R22,000 + R23,000 + R56,000 + R120,000 + R45,000 + R144,000 + R3,700 + R180,000 + R9,000 + R26,000 + R80,000 + R550,000 + R60,000 + R120,000 + R600,000 + R150,000 + R350,000 + R120,000 = R3,260,700

Total Expenses: R22,000 + R19,000 + R19,000 + R4,500 + R60,000 = R124,500

Taxable Income: R3,260,700 - R124,500 = R3,136,200

Apply the applicable tax rates to the taxable income:

Based on the assumed tax rates, let's assume a progressive tax structure with the following tax brackets and rates:

0% on the first R100,000

10% on the portion between R100,001 and R500,000

20% on the portion between R500,001 and R1,000,000

For more such questions on Tax payable

https://brainly.com/question/29456954

#SPJ11

What role do governments play in the free enterprise system?

A. Providing jobs to all unemployed citizens

B. Deciding which products will be produced in factories

C. Controlling vital industries such as health care

D. Enforcing legal regulations to keep employees safe

Answers

Answer:

D. Enforcing legal regulations to keep employees safe

Explanation:

Enforcing legal regulations to keep employees safe.

In its function as a rule-maker, the government makes and enforces laws governing the conditions beneath which voluntary transactions are made. those laws are designed to protect the rights to non-public assets and character freedom and to keep and promote competition.

What is the position of government in a free employer device?In essence, the government gives the umbrella under which the unfastened organization system operates. Governments also provide goods, together with national defense, that the non-public market on its own might have a tough time generating. The charging machine is the link that connects customers, manufacturers, and markets.

Learn more about enterprise here https://brainly.com/question/13628349

#SPJ2

You are headed off to college. Some close family members decide it would be a good idea to buy a house in the college town and then rent it out to students, with you also living there and actively managing it. Assuming you and your family buy it, what form of business would you select? and why?

Answers

The ideal type of business would be the sole proprietorship, as it is a structure that is easy to start and manage.

What is the sole proprietorship?It is a simpler business structure, which is managed by an individual, who has the responsibilities for the business, that is, in this configuration there is no legal distinction between the company and the owner.

Therefore, the sole proprietorship is less bureaucratic, being able to close the business at any time, or change type as the business grows and requires greater responsibility.

Find out more about sole proprietorship here:

https://brainly.com/question/4442710

sales to customers in which the customers pay within 30 to 60 days are referred to as a. sales on account b. non accrued sales c. deferred sales d. credit sales

Answers

Sales to customers in which the customers pay within 30 to 60 days are referred to as - sales on account and credit sales i.e. Options A and D are true.

Credit sales allude to a deal where the sum owed will be paid sometime in the future. All in all, credit deals are buys made by clients who don't deliver instalments in full, in real money, at the hour of procurement

It is normal for credit deals to incorporate credit terms. Credit terms will be terms that show when an instalment is expected for deals that are made using a loan, potential limits, and any relevant interest or late instalment charges.

For instance, the credit terms for credit deals might be 2/10, net 30. This implies that the sum is expected in 30 days (net 30). Nonetheless, in the event that the client pays in no less than 10 days, a 2% markdown will be applied.

Expect Organization A to sell $10,000 worth of merchandise to Michael. Organization An offers credit terms 5/10, net 30. On the off chance that Michael pays the sum owed ($10,000) in no less than 10 days, he would have the option to partake in a 5% rebate. Thusly, the sum that Michael would have to pay for his buys assuming he paid in somewhere around 10 days would be $9,500.

Know more about credit sales - https://brainly.com/question/12269231

#SPJ4

Hay, Bee and Cee are partnership sharing profits in the ratio of 5:3:2.

Before Bee's salary of $17,000, the firm's profit is $97,000. How much in

total will Bee receive from the firm as his share of profit?

Answers

Ratio of profit sharing:

Hay: Bee: Cee=5:3:2

5/10 is Hay's Share.

Bee's Share equals 3/10.

2/10 is Cee's Share.

Salary plus Share of Profit is the total amount Bee will receive from the company as his Share of Profit.

Bee's salary is $17,000.

Before Bee's compensation, the company's profit was $97,000.

• Profit after salary:

= 97,000 - 17,000

= 80,000

Profit after salaries: 80,00

• Bee's Share:

= 80,000 × (3/10)

= 24,000

The sum Bee got was calculated as follows: Salary + Profit Share.

= 17,000 + 24,000

= 41,000

Bee has received $41,000 in total.

Therefore Bee will be paid $41,000 by the company

What is profit sharing ratio?

The new profit sharing ratio is the ratio in which the old and new partners concur to split the profit and loss proportion in the future following the addition of the new partner. A new partner only gets a few things when joining an established partnership company.

To know more about profit sharing ratio, refer:

https://brainly.com/question/15682978

#SPJ9

Which of these is an advantage of checking accounts?

Checking accounts prevent the customer from having overdraft fees.

Checking accounts allow convenient ways to deposit or withdraw funds.

Checking accounts are processed immediately so customer and bank records always match.

Checking accounts offer limited checks but offer higher rates of interest.

Answers

Answer:

Checking accounts allow convenient ways to deposit or withdraw funds.

Explanation:

Checking accounts do not have restrictions on the number of withdrawals and deposits that a customer can make. It means one can withdraw and deposit as many times as they want.

The money saves in a savings accounts is considered risk free. The probability of losing the money is negligible. For this reason, a checking account offers a safe and convenient way of depositing and withdrawing.

Learn more about:

https://brainly.com/question/11512915

The implementation plan should come before the action plan.

False

True

Answers

It is False that the implementation plan should come before the action plan.

What is implementation plan?An implementation plan can as well be regarded as strategic plan which provide the outlines of the steps that the team should take when accomplishing a shared goal or objective.

It should be noted that this plan combines strategy as well as process, and action that will be used in the parts of the project .

The major components of an implementation plan are:

planning the work planning the tasks and subtasks planning the time planning the people and resources.Read more about implementation plan here:

https://brainly.com/question/24864915

#SPJ1

Consumers spend the least amount of time-consuming news delivered in which format?

A.television

B.print

C.digital

D.radio

Answers

Answer: A. television. and D. Radio.

similarities between absolute advantage and comparative advantage

Answers

While absolute advantage refers to capacity of entity to generate bigger amount of thing or service, comparative advantage is ability to provide goods ,services at lowest possible cost compared to competition.

What is an example of an absolute advantage?Consider California and Mexico as two nations that produce tequila and wine, respectively. Off to the right, a list of the goods that each country can create is presented. As you can see, California has a clear edge in creating both items because it can produce more of everything.

How is absolute advantage determined?Low-cost production enables the achievement of an absolute advantage. In other senses, it describes a person, business, or nation that has cheaper production costs. When (in comparison to rivals): Fewer materials are required to make a product, such an advantage is developed.

To know more about absolute advantage visit :

https://brainly.com/question/13221821

#SPJ4

2. Joy Co. purchases 6 months of insurance in advance for $1,500.

Account Title and Description

Insurance expense (A)

Debit

paid 5.000 a month.

Credit

1-1500

Answers

"Sorry to put you through that test. We're more like a team of investors than operational partners even Seth and Jia, who started the restaurant 30 years ago. So we need to be sure you'll run the restaurant ethically. Everybody did love Julio, but he was a mess. We'd never hire him back. We'd like to hire you, but on a probationary basis for three months. What do you need to get started

Answers

Explanation:

Analyzing all the information related to the question above, a good strategy for an effective start would be to adopt good work practices such as organization and ethics, which were information provided by investors about what they expect from the new manager. That is why it is necessary to establish an effective and positive communication with employees and customers of the restaurant, be an ethical professional who meets the requirements and policies proposed by the company, etc.

A good strategy also to start in the internship regime and make a good impression for investors would be to talk with the establishment's prominent employees about the best practices to be adopted in the restaurant to be successful.

what is the explanation of how 3D printing gives SpaceX a competitive advantage

and

Exploration of how AI could be used to enhance SpaceX's 3D printing capabilities

Answers

3D printing offers your organization a genuinely necessary upper hand. It permits you to create models quicker, decreases the expense of creation, requires less info (HR and gear), and diminishes above.

SpaceX involves 3D printing in their designing and assembling processes, including printing parts for rocket motors, spouts, and primary parts for the Bird of Prey 9 and Hawk Weighty rockets and Mythical serpent shuttle.

The improvement of an ML framework that utilizes PC vision to screen the creation cycle and fix material dealing with shortcomings continuously. The fundamental benefits of 3D printing are diminishing expenses, less waste, decreased time, getting an upper hand, lessening mistakes, classification, and creation on request.

Learn more about printing:

https://brainly.com/question/13246781

#SPJ1

Businesses collect

information on where people live, what they buy, and how they spend their time.

Answers

Hannah had to pay an additional $2.80 on her $40.00 order of supplies for her business. The additional $2.80 that Hannah paid on her purchase is MOST likely a _____ tax.

A. point of purchase

B. sales

C. excise

D. distribution

Answers

Answer: B. sales

Explanation: The additional $2.80 that Hannah paid on her purchase is MOST

SALES

Which of the following best explains what a futures contract is?

a. a contract preventing the future sale or exchange of a particular good

b. a contract limiting the future liability of one set of partners if a business fails

c. a contract setting the price for the exchange of two foreign currencies

d. a contract setting the price and date for a commodity purchase

Answers

Answer:

d. a contract setting the price and date for a commodity purchase

DESCRIBE THE FUNCTIONS OF

PRELIMINARY DATA GATHERING?

Answers

Preliminary data gathering involves collecting and analyzing relevant information to establish a foundation for research or decision-making, including identifying objectives, assessing data availability, etc.

What are the Functions of Preliminary Data Gathering?Preliminary data gathering encompasses the initial acquisition and evaluation of pertinent information, serving as a basis for research or decision-making. It aids in defining project scope, goals, and needs, while also assessing data availability and quality.

This stage assists researchers and decision-makers in gaining insights, assessing project feasibility, recognizing potential obstacles, and formulating a strategic plan for subsequent data collection and analysis.

Learn more about Preliminary data gathering on:

https://brainly.com/question/14293427

#SPJ1

Required information

Skip to question

[The following information applies to the questions displayed below.]

Assume that Sivart Corporation has 2021 taxable income of $1,750,000 for purposes of computing the §179 expense and acquired several assets during the year. Assume the delivery truck does not qualify for bonus depreciation. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.)

Asset Placed in Service Basis

Machinery June 12 $ 1,440,000

Computer equipment February 10 70,000

Delivery Truck—used August 21 93,000

Furniture April 2 310,000

Total $ 1,913,000

b. What is the maximum total depreciation (§179, bonus, MACRS) that Sivart may deduct in 2021 on the assets it placed in service in 2021?

Answers

The maximum total depreciation deduction[ including 179 expense is $1,913,000.

How to calculate the amounta) Total of qualified assets $19,13,000

b) Threshold for section 179 in 2021 $26,20,000

c) Maximum Section 179 expense phase out [a-b][Only if value of qualified asset is more than threshold limit

d) Section 179 Maximum 2021 limit

$10,50,000

e) Section 179 deduction for 2021 is [d-c]

$10,50,000

Bonus depreciation= 863,000

Section 179 deduction= 1,050,000

maximum total depreciation deduction[ including 179 expense]= 863,000+1,050 000

=> $1,913,000.

Learn more about deprecation on

https://brainly.com/question/1203926

#SPJ1

A home furniture store, David's Furnishings, lowers its prices below those of

their competitors, Ada's Home Store. A price war then ensues. What must the

response of Ada's Home Store have been in order for the price war to begin?

A. Ada's Home Store started a marketing campaign against David's

Furnishings and their lower quality.

B. Ada's Home Store took David's Furnishings to court in an attempt

to make them raise their prices back up.

C. Ada's Home Store raised prices to show consumers that their

products are better.

O D. Ada's Home Store lowered prices even lower than David's

Furnishings did.

Answers

Answer:

d.

Explanation:

The response of Ada's Home Store has been in order for the price war to begin as Ada's Home Store lowered prices even lower than David's Furnishings did. Thus option D is correct.

What is the Price?A price refers to the amount which takes place between two individuals when performing the exchange of goods and services. This price is determined by the willingness of both parties involved in the exchange.

A price war took place when the competitors lower their prices in order to retain more customers will create conflicts in the market.

In the given case when an organization named David's Furnishings lower its prices with its competitors to begin a price war the competitors also lower their prices in order to capture the market gain effectively.

Therefore, option D is appropriate.

learn more about the price, here:

https://brainly.com/question/18117910

#SPJ5

PROBLEM 8–31 Completing a Master Budget Hillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter:

Required:

Using the data above, complete the following statements and schedules for the first quarter:

Schedule of expected cash collections:

Answers

The main purpose of the sales budget is to achieve the financials objectives of the sales department.

What is a sales budget?This refers to a financial plan that estimates a company's total revenue in a specific time period.

What is the Schedule of expected cash collections? Hillyard Company Sales Budget For the Quarter ended march 31 Jan Feb Mar QuarterBudgeted Sales $400,000 $600,000 $300,000 $1,300,000

Total Budgeted Sales $400,000 $600,000 $300,000 $1,300,000

Read more about sales budget

brainly.com/question/27207594

#SPJ1

Sally goes out to lunch with Mike and Fred. Each person orders the

$9 lunch special. Sally agrees to pay the bill. How much will she have to pay ?

Answers

Answer: 27

Explanation: if there are 3 people ordering the same lunch and the lunch is 9 dollars. That’s 9x3 which is $27 and the amount of money sally will have to pay.

The possibility that consumer spending may change before an anticipated change in income actually occurs reflects the importance of consumer

O irrationality.

O prophesy.

O expectations.

O imprudence.

Answers

The possibility that consumer spending may change before an anticipated change in income actually occurs reflects the importance of consumer D) expectations.

D)Consumer expectations play a vital role in shaping economic behavior and decision-making.

They are influenced by a variety of factors such as economic conditions, personal financial situations, and future prospects.

Consumer expectations refer to individuals' beliefs about the future state of the economy, including their own income levels and employment prospects.

These expectations can significantly impact consumer spending patterns and overall economic activity.

If consumers anticipate an increase in their income in the near future, they may choose to increase their spending even before the actual income change takes place.

This phenomenon is known as the "anticipatory effect" or "income effect" on consumption.

It suggests that consumers do not always wait for their income to change before adjusting their spending habits.

Instead, they act based on their expectations of future income changes.

For example, if consumers anticipate a pay raise or a promotion, they may start spending more in anticipation of the increased income, even if it has not materialized yet.

Consumer expectations can also work in the opposite direction. If consumers anticipate a future decline in income, such as a job loss or an economic downturn, they may reduce their spending in advance to prepare for the anticipated income decrease.

This behavior can have significant implications for economic stability and growth, as it can amplify the impact of economic shocks or changes in income on overall consumer spending and aggregate demand.

Therefore, understanding consumer expectations is crucial for policymakers, businesses, and economists.

It helps them gauge consumer sentiment, predict future spending patterns, and make informed decisions regarding fiscal and monetary policies.

Additionally, accurate assessments of consumer expectations can contribute to a more stable and resilient economy by allowing policymakers to respond effectively to changes in consumer behavior and manage economic fluctuations.

For more questions on consumer

https://brainly.com/question/380037

#SPJ8

Choose the cultures that display the Latin American enthusiasm for dance. Brazil Mexico Scotland Wales

Answers

Answer:

Mexico and Brazil

Explanation:

They are both countries known for Latin America

Troy Juth wants to purchase new dive equipment for Underwater Connection, his retail store in Colorado Springs. He was offered a $63,000 loan at 8.5% for 24 months. What is his monthly payment by table lookup? (Use Table 14.2)

Note: Round your answer to the nearest cent.

Answers

If he was offered a $63,000 loan at 8.5% for 24 months. His monthly payment by table lookup is : $3071.

What is monthly payment?Monthly payment can be defined as the amount a person received on a monthly basis.

First step is to convert the month to year

Month to year = 24 / 12

Month to year = 2 years

Second step is to find the interest using this formula

I = P × R×T

Where:

I = Interest

P = Principal

R = rate

T = time

Hence

I = 63,000 × 2 × 8.5%

I = 10,710

So,

P+ I = 63,000 + 10,710

P+I = 73,710

Now let find the monthly payment:

Monthly payment = 73,710 / 24 months

Monthly payment = $3,071.25.

Monthly payment = $3,071 (Approximately)

Therefore the monthly payment is the amount of $3071

Learn more about monthly payment here: https://brainly.com/question/25599836

#SPJ1