Flintlnc. provided the following information for the year 2017.

Retained earnings, January 1, 2017 $ 589,400

Administrative expenses 246,000

Selling expenses 307,200

Sales revenue 1,812,200

Cash dividends declared 83,000

Cost of goods sold 821,500

Loss on discontinued operations 78,200

Rent revenue 40,200

Unrealized holding gain on available-for-sale securities 16,900

Income tax applicable to continuing operations 192,700

Income tax benefit applicable to loss on discontinued operations 43,010

Income tax applicable to unrealized holding gain on available-for-sale securities

2,000

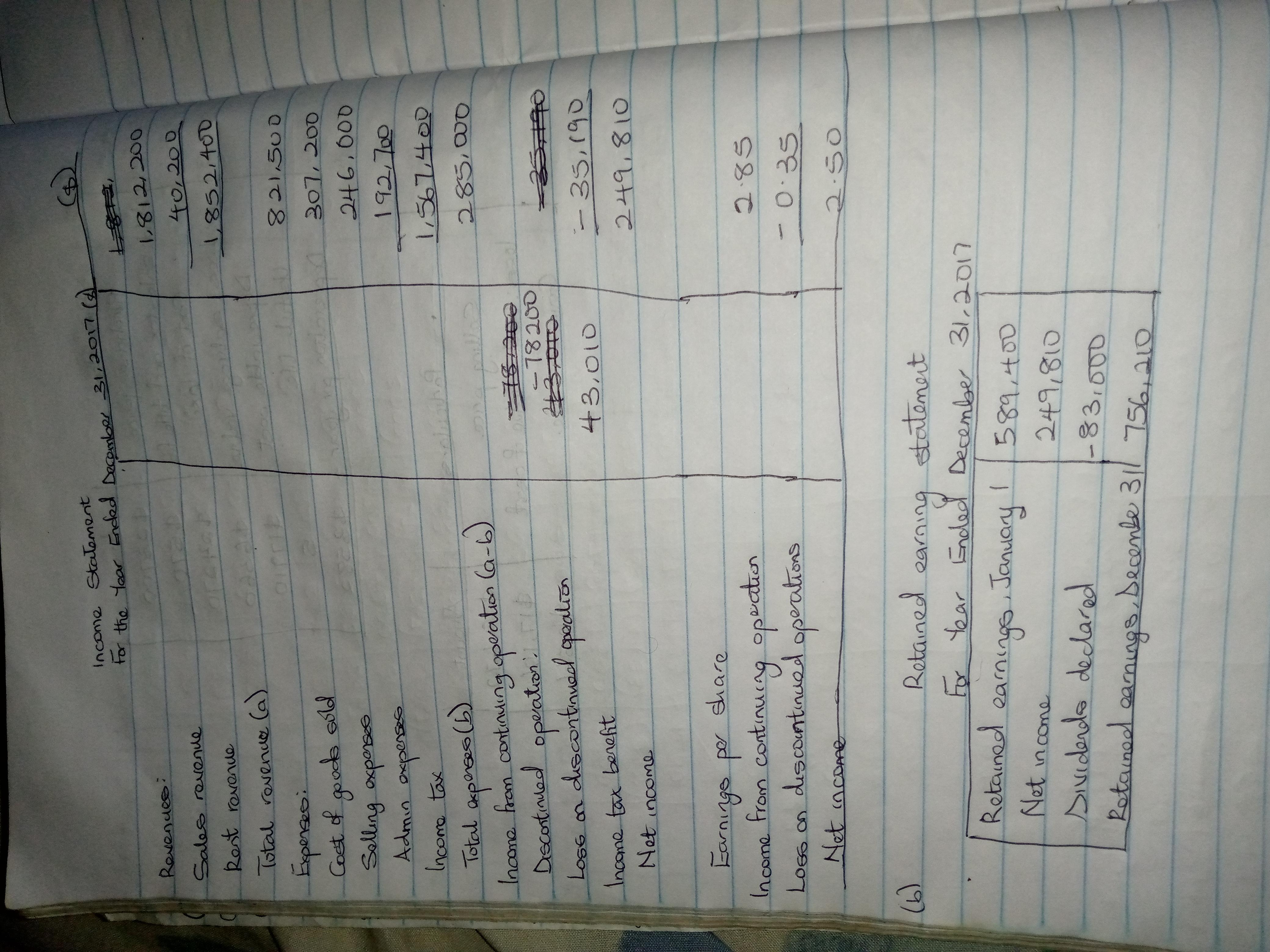

1. Prepare a single-step income statement for 2017. Shares outstanding during 2017 were 100,000. (Round earnings per share to 2 decimal places, e.g. $1.48.)

2. Prepare aretained earning statement for 2017. Shares outstanding for 2017 were 100000.

Answers

Answer: See explanation

Explanation:

1. Prepare a single-step income statement for 2017. Shares outstanding during 2017 were 100,000. (Round earnings per share to 2 decimal places, e.g. $1.48.)

The income from continuing operations for earnings per share was calculated as:

= 285000/100000

= $2.85

The loss on discontinued operations was calculated as:

= 35190/100000 shares

= 0.35

Check the attachment for the solution.

2. Prepare aretained earning statement for 2017. Shares outstanding for 2017 were 100000.

Check the attachment for the solution

Related Questions

1. The most common definition of appraisal is:

Answers

Answer:

development of an opinion of market value.

Explanation:

As defined in USPAP, an appraisal is the act or process of developing an opinion of value. The valuation process is a systematic procedure the appraiser follows to answer a client's question about real property value. The most common type of appraisal assignment is the development of an opinion of market value.

Answer:

An appraisal is a valuation of property, such as real estate, a business, collectible, or an antique, by the estimate of an authorized person. ... Appraisals are typically used for insurance and taxation purposes or to determine a possible selling price for an item or property.

Explanation:

Hope this helps,

Have a splendiferous day!

Compare the difference between the transfer of shares and transmission of shares with examples.

Answers

Answer:

The transfer of shares is a voluntary act by the holder of shares and takes place by way of contract. Whereas, the transmission of shares takes place due to the operation of law that is on the death of the holder of shares or in an event where the holder becomes insolvent/lunatic.

On average, a person with a bachelor's degree earns

than a person

with an associate degree and

than a person with a high school

diploma

O A. more; more

O B. less; more

O c. less; less

O D. more; less

SUBMIT

Answers

Answer:

B

Explanation:

the knowledge.. between a Bachelor degree and an associate degree. is leser

Which of the following might cause the inflation rate to spike up sharply?

Plentiful rainfall and moderate temperatures result in good harvests of wheat and soybeans.

Prices on world oil markets rise steeply due to war in the Middle East. O

The purchasing power of the average consumer decreases due to a sluggish economy.

The items in the CPI market basket change to account for changing consumer buying habits.

Answers

Answer: Prices on world oil markets rise steeply due to war in the Middle East

Explanation:

The inflation rate spiked sharply because prices in world oil markets rise steeply due to the war in the Middle East. Option (b) is correct.

What do you mean by Inflation?The rate of increase in prices over a given period of time is known as inflation.

The cost of making items would rise as a result of an increase in crude oil prices. Inflation would eventually arise from this price increase being passed on to consumers.

Inflation in Oil prices are a result of the Russian Federation being cut off from global supply networks as a result of sanctions following Moscow's invasion of Ukraine. Nations now have to pay more for oil when seeking to obtain it from other sources.

Therefore, Option (b) is correct.

Learn more about Inflation, here;

https://brainly.com/question/30112292

#SPJ6

If you are filing your tax return as an individual, you will need to itemize your taxes if

(1 point)

the sum of your deductible contributions is less than $300.

the sum of your deductible contributions exceeds $300.

you don't have any deductible contributions.

you donated to a religious institution.

Answers

If you are filing your tax return as an individual, you will need to itemize your taxes if the sum of your deductible contributions is less than $300.

What does it mean to file a tax return?To file a tax return means to fill in the documents that have to do with the taxes that a person owns to the government authorities responsible for taxes based on the income that they make in the economy and based on their expenditures also.

The person that is filing this has to do so with the authority that is closest to the areas that they are residing.

The tax that is paid to the government can be defined as the money that a person makes from the businesses and the salary that they are paid in the economy.

Hence we can conclude by saying that If you are filing your tax return as an individual, you will need to itemize your taxes if the sum of your deductible contributions is less than $300.

Read more on tax return here: https://brainly.com/question/27300507

#SPJ1

Answer:

the sum of your deductible contributions exceeds $300.

Explanation:

connexus

How to get a series 7 license

Answers

Take and Pass SIE exam

Secure a Sponsorship

Study for series 7 exam

Pass it :)

Presente perOW IS INTormation rerarea Orrounder company.

Retail

Cost

$148,740

1,359,000

Beginning inventory

Purchases

Markups

Markup cancellations

Markdowns

Markdown cancellations

Sales revenue

$285,000

2,148.000

96.200

16,300

31,800

4,700

2,209,000

Compute the inventory by the conventional retail inventory method. (Round ratios for computational purposes to 0 decimal places, eg.

78% and final answer to O decimal places, eg. 28,987.)

Ending inventory using conventional retail inventory method

$

Answers

Answer:

Note: "The complete and organized question is attached below as picture"

Conventional Inventory Method

Particulars Cost Retail

Beginning inventory A $148,740 $285,000

Purchases $1,359,000 $2,148,000

Markups-net $79,900

Current year's addition B $1,359,000 $2,227,900

Goods available for sale C=A+B) $1,507,740 $2,512,900

Markdown-net ($27,100)

Sales ($2,209,000)

Ending inventory at retail $276,800

Cost-to-retail percentage = $1,507,740 / $2,512,900*100

Cost-to-retail percentage = 0.6 * 100

Cost-to-retail percentage = 60%

Ending inventory at cost = Ending inventory at retail * Cost-to-retail percentage

Ending inventory at cost = $276,800 * 60%

Ending inventory at cost = $166,080

On July 23 of the current year, Dakota Mining Co. pays $7,147,920 for land estimated to contain 9,048,000 tons of recoverable ore. It installs machinery costing $1,900,080 that has a 10-year life and no salvage value and is capable of mining the ore deposit in eight years. The machinery is paid for on July 25, seven days before mining operations begin. The company removes and sells 466,500 tons of ore during its first five months of operations ending on December 31. Depreciation of the machinery is in proportion to the mine's depletion as the machinery will be abandoned after the ore is mined.

Required:

Prepare entries to record the following. (Do not round your intermediate calculations.):

a. to record the purchase of the land

b. to record the cost and installation of machinery

c. to record the first five months depletion assuming the land has a net salvage value of zero after the one is mined

Answers

Depreciation of the machinery is in proportion to the mine's depletion as the machinery will be abandoned after the ore is mined. Debit for mineral deposit = $6,346,080.

Cost and installation of machinery:Depletion expense = $368,535

Depreciation expense = $97,965

Ore deposit = $368,535

Equipment accumulated depreciation = $97.965

Calculation of depreciation and depletion:The machine will be depreciated at the same phase as the ore deposit As the asset is related to it and will have no value after the minimizing project ends. Therefore, depreciation for the year:

466,500 / 9,048,000 x 7,147,920 = 368.535 ore deposit amortization

466,500 / 9,048,000 x 1,900,080 = 97.965 equipment depreciation

To learn more about depreciation visit:

brainly.com/question/15085226

#SPJ4

The brand changes form part of a strategic plan the group conceived in September last year called Ekuseni (the Zulu word for “dawn”)”

“Pick n Pay and its new CEO are taking the fight to competitors in a strategy..”

“Pick n Pay yesterday launched a new strategic plan…”

Evaluate the proposed strategy that Pick n Pay is planning to implement, including in your evaluation, the potential risks attached to the proposed new strategy

Answers

Pick n Pay's proposed strategy, known as Ekuseni, aims to implement changes in their brand and take the fight to competitors. The strategy, conceived in September last year, focuses on strategic planning and was launched recently. While the strategy holds potential for success, there are risks associated with its implementation.

1. Pick n Pay's proposed strategy, called Ekuseni, includes changes to their brand and a competitive approach to rivals. This strategic plan was conceived in September last year, with the term Ekuseni referring to "dawn" in Zulu.

2. The strategy aims to revamp the brand image and position Pick n Pay as a strong competitor in the market. By taking the fight to competitors, the company intends to gain a competitive edge and attract more customers.

3. The launch of the new strategic plan indicates that Pick n Pay is committed to implementing this strategy and achieving its goals. It demonstrates the company's intention to adapt and stay relevant in the evolving market.

4. However, like any strategic plan, there are potential risks associated with its implementation. These risks include customer resistance to changes in the brand, increased competition from rivals, and potential financial strains due to the cost of rebranding and marketing efforts.

5. Customer resistance is a common risk when brands undergo significant changes. If the proposed strategy doesn't resonate with Pick n Pay's target market, it could lead to a decline in customer loyalty and affect sales.

6. Additionally, taking the fight to competitors may trigger retaliatory actions from rival companies. This could result in intensified competition, price wars, and potential market share loss for Pick n Pay.

7. Finally, implementing a new strategic plan involves financial investments. The cost of rebranding, marketing campaigns, and operational changes may strain the company's resources, potentially impacting its financial stability.

In conclusion, while Pick n Pay's proposed strategy holds promise for the company's growth and competitiveness, there are risks involved. Proper planning, market research, and effective execution will be crucial to mitigating these risks and ensuring the success of the strategy.

For more such questions on strategy, click on:

https://brainly.com/question/28561700

#SPJ8

The shoe company TOMS gives a pair of shoes to a needy child for every pair that it sells. This is an example of a company which has integrated ________ into its business model. correction marketing environmental marketing corporate social responsibility ethical marketing requirements

Answers

State and EXPLAIN three methods of paying workers

Answers

Answer:

three methods employers use to pay the employees are salary, commission, and hourly wage.

Explanation:

salary is a fixed amount that you get for working per month

commmission is getting a percentage of the total that you sell

hourly wage is getting paid for each hour that you work

hope this helps! i would appriciate brainliest too!!

Juggernaut Satellite Corporation earned $19.6 million for the fiscal year ending yesterday. The firm also paid out 30 percent of its earnings as dividends yesterday. The firm will continue to pay out 30 percent of its earnings as annual, end-of-year dividends. The remaining 70 percent of earnings is retained by the company for use in projects. The company has 2.8 million shares of common stock outstanding. The current stock price is $84. The historical return on equity (ROE) of 14 percent is expected to continue in the future.

What is the required rate of return on the stock?

Answers

Answer:

The required rate of return on the stock is 12.55%

Explanation:

According to the given data we have the following:

The Company is distributing 30% of its earnings as dividends

Therefore, company is retaining = 100-30 = 70% of its earnings

Growth = Retention ratio * ROE = 0.7*0.14 = 9.8%

Earning = 19.6 million

hence, Paid as dividends = 19.6*0.3 = $5.88 million

The Number of shares outstanding = 2.8 million

hence, Dividend per share = Total dividends / number of shares outstanding = 5.88/2.8 = $2.1

Current stock price = $84

Therefore, to calculate the required rate of return on the stock we would have to use the following formula:

Price of stock = Current dividend*(1+growth)/(r-growth), where r is required rate of return

84 = 2.1*(1.098)/(r-0.098)

40 = 1.098/(r-0.098)

r - 0.098 = 0.02745

r = 0.02745+0.098 = 0.12545

The required rate of return on the stock is 12.55%

What is the total amount of Five Below's Liabilities plus Stockholders' Equity in the 2021 fiscal year?

What is the total amount of Five Below's Liabilities plus Stockholders' Equity in the 2021 fiscal year?

$2,880,460,000

$1,120,284,000

$2,880,460

$2,314,770,000

$1,760,176,000

Answers

$2,880,460,000 is the total amount of Five Below's Liabilities plus Stockholders' Equity in the 2021 fiscal year .

What is Current liabilities ?A company's obligations or debts that are due within a year or the normal operating cycle are referred to as current liabilities. In addition, a current asset—either cash or a new current liability—is used to settle current liabilities.

On a company's Balance Sheet, current liabilities include accounts payable, accrued liabilities, short-term debt, and other similar debts.

Notes Payable, Accounts Payable, Short-Term Loans, Accrued Expenses, Unearned Revenue, Current Portion of Long-Term Debts, and Other Short-Term Debt are all considered current liabilities.

As current liabilities provides us with a general picture of your company's short-term financial standing and is useful for working capital expenditure planning. A healthy business is typically one with fewer current liabilities than current assets.

To learn more about Current Liabilities visit :

https://brainly.com/question/29341666

#SPJ1

Think of a time when you were leading a group project. What kinds of problems emerged? How did you hanlde them? How might those skills tranfer to managing a restaurant?

Answers

When leading a group project the most rising problem is deadlines and team coordination this can be handled by effective communication.

What is a group?

A group is referred to as a collection of people who come together to form a relationship or connection with each other. These groups mainly form to perform collaborative activities to achive something.

Working in a group was quite difficult as every individual have own perspective which causes differences of opinion and disagreement within the group.

This agreement can be solved by building effective communication and better relationships with group members in order to achieve the goal.

This will be helpful in the Restaurant business by dealing with customers and timely delivery of the demanded dish or service to them.

Learn more about communication, here:

https://brainly.com/question/22558440

#SPJ1

An employee from another department will join your team next week. She requested the transfer because she felt her work was becoming predictable and monotonous. Her performance reports show she has made good contributions to programming projects but needs to improve her presentation skills.

Answers

It appears that next week, an employee from another department will be joining your team.

She requested the transfer due to feeling that her previous work was becoming predictable and monotonous. According to her performance reports, she has made valuable contributions to programming projects, demonstrating her strong technical abilities.

However, an area where she could improve is her presentation skills. As she transitions to your team, it would be beneficial to provide her with opportunities to engage in diverse tasks and challenges, ensuring she stays motivated and experiences professional growth.

Additionally, offering resources and training in presentation skills can help her strengthen this aspect of her work. By doing so, she will not only become a more well-rounded team member but will also contribute effectively to the overall success of your team. Remember to welcome her warmly and provide any necessary support during this transition period.

For more such questions on, employee :

https://brainly.com/question/30355015

#SPJ11

2. Adama Garment which is operating in Adama currently has opened four new stores in Ethiopia. Data on monthly sales volume and labor hours are given below for each town. Which store location has the highest labor productivity?

Store

Bale-robe

Hawassa

Nekemt

Dahirdar

Sales volume

12000birr

60000birr

40000birr

25000birr

Labor hours

60

500

250

200

3. Adama Garment accountant (from Problem 2) suggests that monthly rent and hourly wage rate also be factored into the productivity calculations.

Hawassa pays the highest average wage at birr 6.75 an hour. Bale-Robe pays birr

6.50 an hour, Nekemte birr 6, and Bahirdar birr 5.50. The cost to rent store space

is birr 2000 a month in Hawassa, birr 800 a month in Nekemte, birr 1200 a month

in Bale-Robe, and birr 1500 a month in Bahirdar.

Which store is most productive?

Adama garment general manager is not sure it can keep all four stores open. Based on multifactor productivity, which store would you close? What other factors should be considered?

Answers

Adama Garment's Bale-robe store has the highest labor productivity. It generates 200 birr per labor hour, followed by Hawassa (40 birr/hour), Nekemt (16 birr/hour), and Dahirdar (12.5 birr/hour).

How to solveTo calculate labor productivity, we divide the monthly sales volume by the labor hours. Bale-robe has the highest labor productivity because it generates the most sales per labor hour.

Here is the table showing the labor productivity of each store:

Store Sales volume (birr) Labor hours Labor productivity (birr/hour)

Bale-robe 12,000 60 200

Hawassa 60,000 500 40

Nekemt 40,000 250 16

Dahirdar 25,000 200 12.5

Read more about labor productivity here:

https://brainly.com/question/6430277

#SPJ1

The McGee Corporation finds it is necessary to determine its marginal cost of capital. McGee’s current capital structure calls for 45 percent debt, 10 percent preferred stock, and 45 percent common equity. Initially, common equity will be in the form of retained earnings (Ke) and then new common stock (Kn). The costs of the various sources of financing are as follows: debt (after-tax), 5.0 percent; preferred stock, 6.0 percent; retained earnings, 11.0 percent; and new common stock, 12.4 percent.

Answers

The marginal cost of capital for McGee Corporation is 9.96%.

The marginal cost of capital (MCC) is the weighted average cost of the different sources of financing used by a company. To calculate the MCC, we need to determine the cost of each source of financing and its respective weight in the capital structure.

Given information:

Debt (after-tax) cost = 5.0%

Preferred stock cost = 6.0%

Retained earnings cost = 11.0%

New common stock cost = 12.4%

Capital structure weights:

Debt weight = 45%

Preferred stock weight = 10%

Common equity weight = 45%

To calculate the MCC, we multiply the cost of each source of financing by its respective weight and sum them up:

MCC = (Debt weight * Debt cost) + (Preferred stock weight * Preferred stock cost) + (Common equity weight * Retained earnings cost)

MCC = (0.45 * 0.05) + (0.10 * 0.06) + (0.45 * 0.11)

= 0.0225 + 0.006 + 0.0495

= 0.078

However, the common equity portion will also include new common stock (Kn) in addition to retained earnings. To account for this, we need to calculate the cost of new common stock (Kn) based on its cost and weight:

New common stock cost = 12.4%

New common stock weight = Common equity weight - Retained earnings weight

= 0.45 - Retained earnings weight

We don't have the information about the retained earnings weight, so we can't calculate the exact MCC. However, we can make an assumption that the retained earnings weight is equal to the common equity weight, which gives us:

New common stock weight = 0.45 - 0.45

= 0

In this case, the MCC would be:

MCC = (0.45 * 0.05) + (0.10 * 0.06) + (0.45 * 0.11) + (0 * 0.124)

= 0.0225 + 0.006 + 0.0495 + 0

= 0.078

Therefore, the marginal cost of capital for McGee Corporation is 9.96% (rounded to two decimal places).

For more question on marginal cost visit:

https://brainly.com/question/30165613

#SPJ8

Which situation would be appropriate for an investment bank?

Answers

Example of the situation that would be appropriate for an investment bank is Debt and Equity Financing.

What is Investment banking?Investment banking can be described as the special segment of banking operation which can be utilized by the people as well as the organisations so that theycan be able to raise capital and provide financial consultancy services to them.

It should be noted that this banking do serves as the intermediaries between security issuers as well as the investors however Investment bank clients can encompass the corporations, pension funds as well as financial institutions.

Learn more about Investment at:

https://brainly.com/question/29547577

#SPJ1

Name any three (3) tests that Hornbill Holdings can use to assess the graduates

Answers

Three tests that can be used to assess graduates include:

Skills and knowledge psychometric tests. Ability and aptitude psychometric tests. Personality tests. What are some tests that can be used to test graduates?A skills and knowledge psychometric test will allow Hornbill Holdings to find out how knowledgeable a graduate is in their industry and its processes.

They can also use an ability and aptitude test to find out how adaptive the graduate is to new situations.

Personality tests can then find out if the graduate has the right type of personality for the culture at Hornbill Holdings.

Find out more on graduate testing at https://brainly.com/question/16321787.

how to get a ps5 fast!!!!!!!?!?!?!!??!!?

Answers

Answer:

work for it and save money, other then that I have no idea

Question 7 of 10

Your company emphasizes the important of conserving (not wasting)

resources. How can you support that value when you print an 8-page report

you were asked to bring to your department's monthly meeting?

A. Use the Print option for two-sided printing.

B. Post the report online before printing it.

C. Use the Print option to create extra copies.

D. Use the Save option to choose a format readers can open.

SUBMIT

Answers

Answer:

A. Use the Print option for two-sided printing.

I'd choose A, although I don't really understand what option D means..

how will you react to the following destroying or removing information that could hurt your company if it fell into the wrong hands.

Answers

I will say it is crucial to prioritize ethical behavior and transparency. Instead of destroying or removing information, we should focus on implementing robust security measures to safeguard sensitive data.

How can we protect sensitive information from unauthorized access?Protecting sensitive information from unauthorized access is essential for companies to maintain trust with their stakeholders. Instead of resorting to destroying or removing information, it is more beneficial to invest in robust security measures.

By implementing strong encryption, access controls, and regular security audits, we will significantly reduce the risk of sensitive data falling into the wrong hands. Also, fostering a culture of responsible data handling and training employees on best security practices can further enhance the overall protection of company information.

Read more about Confidentiality

brainly.com/question/29417102

#SPJ1

eastevan company calculated its return on investment as 10 percent. sales are now $300,000, and the amount of total operating assets is $320,000.

Answers

If both sales and expenses cannot be changed, a)18.75% b) $ 149333.33 change in the amount of operating assets is required to achieve the same result.

What is operating assets?Operational assets less operating liabilities equals net operating assets (NOA) for a company.

In order to distinguish between operating and financing activities on the balance sheet, NOA is determined.

This is done so that the operating performance of the company can be separated from the financial performance and valued separately.

Reformatting the balance sheet enables investors to value solely the operating activities and thereby obtain a more realistic valuation of the company.

Return on investment = 10% = 0.1

Total sales = $ 300000

Total operating assets = $ 320000

Reduction in expenses = $ 28000

a) The return on investment is calculated as:

Return on investment = Net income/ operating assets

on substituting the values, we get

0.1 = Net income/ $ 320000

Net income = 0.1 × $ 320000

Net income = $ 32000

The reduction in expenses is the amount that has been gained i.e. the net income will increase

thus, the net income = $ 32000 + $ 28000 = $ 60000

the return on investment for the latest net income will be

Return = $ 60000/$320,000

Return = 18.75%

b) for the condition given in the second case

we have

Return = 18.75%

Net income = $ 32000

Return = Net income/ operating asset

18.75% = $32000/ operating asset

Operating asset = $32000/0.1875

Operating assets = $ 170666.67

Now, the decrease of the operating asset from the actual asset = $ 320000 - $ 170666.67 = $ 149333.33

Thus, the operating cost must decrease by $ 149333.33

Learn more about operating assets, here

https://brainly.com/question/29908098

#SPJ4

Kate was turned down for a job because of a bad credit report. The creditor is required to give her the name of the credit bureau that supplied the report, according to

the:

Fair Credit Reporting Act.

Fair Credit Billing Act.

Truth in Lending Law.

Equal Credit Opportunity Act

Answers

The creditor is required to give Kate the name of the credit bureau that supplied the report under the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates the collection, use, and disclosure of consumer credit information. Under the FCRA, creditors are required to provide consumers with a copy of their credit report upon request. They are also required to provide consumers with the name and address of each credit bureau that has provided them with a report within the past two years.

The other laws you mentioned are also important, but they do not specifically address the issue of providing consumers with the name of the credit bureau that supplied their report. The Fair Credit Billing Act (FCBA) regulates the billing practices of creditors and credit card companies. The Truth in Lending Law (TILA) requires lenders to disclose certain information to borrowers, such as the annual percentage rate (APR) and the total amount of interest that will be charged on a loan. The Equal Credit Opportunity Act (ECOA) prohibits creditors from discriminating against borrowers on the basis of race, color, religion, national origin, sex, marital status, age, or because they receive income from a public assistance program.

Which investment option is eligible for tax deductions for calculating the net taxable income?

A. Lottery winnings

B. Alimony received

C. Mortgage interest payments

D. Interest on retirement plans

E. Income from dividends

Answers

Answer:

c

Explanation:

Answer:

c

Explanation:

According to Dr. Ridel's Levels of Critical Thinking in Chapter 1, what level of critical thinking applies to your current status? Discuss how you will use the "8-Step process to critical thinking" in your personal and professional life. Provide examples to support your answers.

Answers

Answer:

how to write it inthe morning and evening so much more than happy

(214) 1. Distinguish between technical efficiency and allocative efficiency. Use the two concepts of efficiency to compare a perfect market structure with a monopoly.

Answers

Technical efficiency refers to the ability to produce the maximum output from a given set of inputs or resources. It focuses on the production process and achieving the highest output level with the least amount of resources wasted. Technical efficiency emphasizes optimizing the production process to minimize costs and maximize productivity.

Allocative efficiency, on the other hand, relates to the allocation of resources in a way that maximizes overall social welfare. It refers to the ideal allocation of resources that matches consumers' preferences and demands. Allocative efficiency ensures that resources are allocated so that goods and services align with consumer preferences. This results in the best outcome for society.

When comparing an ideal market structure with a monopoly in terms of efficiency, there are significant differences. In an ideal market structure, characterized by complete competition, both technical and allocative efficiency is typically achieved. Many buyers and sellers exist, information is freely available, and no single entity controls the market. Competition drives firms to produce at the lowest cost and offer goods and services that match consumer preferences, leading to technical and economic efficiency.

In contrast, a monopoly represents a market structure where a single firm dominates the industry and has substantial market power. In terms of technical efficiency, a monopoly may not necessarily achieve the same level as a perfectly competitive market. Due to the lack of competition, a monopoly may not have the same incentive to minimize costs or innovate as efficiently as possible. This can result in higher production costs and lower technical efficiency.

Regarding allocation efficiency, monopolies often fail. Without competition, a monopolistic firm can set prices higher than the marginal cost of production, resulting in a suboptimal allocation of resources. The monopolist may prioritize maximizing profits rather than satisfying consumer preferences. This leads to a less efficient allocation of resources than in a perfectly competitive market.

Overall, an ideal market structure exhibits higher levels of technical and allocative efficiency than a monopoly. When true competition promotes resource optimization and consumer satisfaction, resulting in more efficient resource allocation.

Gibson Guitar Corporation has chosen to build instruments one at a time, by hand. Gibson's century-old tradition of creating investment-quality instruments represents the highest standards of imaginative design and masterful craftsmanship. Gibson's CEO has found an inverse price-demand relationship exists. He states, "the more we charged, the more guitars we sold." Thus, consumers think that higher prices mean more quality in the case of _____.

Answers

Answer:

product

Explanation:

1. Discuss how MINI has endured for 60 years as a brand despite being owned by various companies. 2. Does MINI have high brand equity

Answers

1. MINI's enduring success is due to its iconic design, adaptive evolution under various owners, and clever marketing that leverages heritage.

2. Yes, MINI has high brand equity evident in its recognition, perceived quality, emotional connection, heritage, community, and consistency.

Endurance of MINI Brand:

1. Iconic Design: MINI's enduring success is rooted in its original design, featuring a compact size and distinctive styling. This design has remained recognizable and appealing over generations, helping the brand maintain its identity despite ownership changes.

2. Adaptive Evolution: MINI has succeeded by evolving while retaining its core essence. Each owner, from BMC to BMW, has modernized the brand without losing its timeless appeal. This balance between continuity and adaptation has ensured MINI's relevance.

3. Clever Marketing: MINI's marketing strategy effectively combines heritage with contemporary trends. By celebrating its history while embracing the present, the brand creates an emotional connection with consumers who value both nostalgia and innovation.

MINI's Brand Equity:

1. Recognition: Distinct design ensures instant recognition, fostering trust and loyalty.

2. Perceived Quality: Consistent reputation for quality enhances equity.

3. Emotional Connection: Promoting individuality and adventure drives loyalty.

4. Heritage: Rich history creates a foundation of trust and authenticity.

5. Community: Enthusiastic followers enhance loyalty and support.

6. Consistency: Delivering a unique experience strengthens trust and perception.

Learn more about Community here:

https://brainly.com/question/33654337

#SPJ12

Which action would a government most likely take to reduce its

unemployment rate?

A. Increase spending to create government jobs

B. Cut off loans to businesses in order to reduce the money supply

C. Increase taxes on businesses that operate outside the country

D. Cut taxes on businesses that operate with very few workers

Answers

Option (a), The action that a government would most likely take to lower its unemployment rate is to increase expenditure to generate government jobs.

What would happen to the unemployment rate if government spending increased?Fiscal policy may lower unemployment by accelerating economic growth and total demand. The government will need to implement a broad budgetary policy, which calls for decreasing taxes and increasing general government spending.

Which government initiative has the most chance of reducing cyclical unemployment?To lower cyclical unemployment, policymakers should focus on raising output, which is best achieved by increasing demand. A fiscal strategy that is more expansive aims to increase government spending and decrease taxes in order to increase aggregate demand and economic growth.

Learn more about Fiscal policy: https://brainly.com/question/27506430

#SPJ1