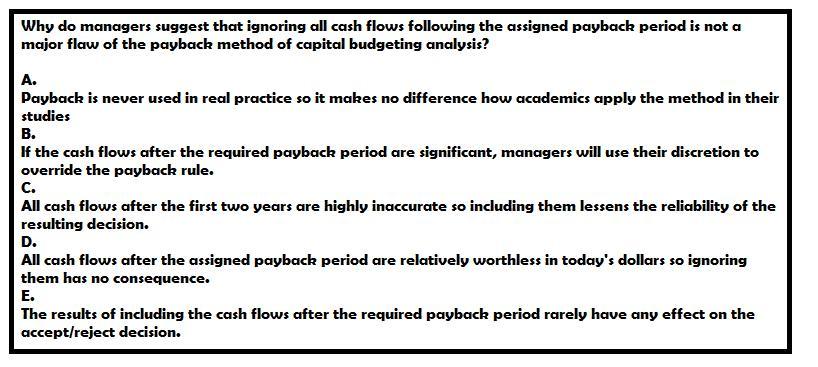

Why do managers suggest that ignoring all cash flows following the assigned payback period is not a major flaw of the payback method of capital budgeting analysis? Payback is never used in real practice so it makes no difference how academics apply the method in their studies If the cash flows after the required payback period are significant, managers will use their discretion to override the payback rule. All cash flows after the first two years are highly inaccurate so including them lessens the reliability of the resulting decision. All cash flows after the assigned payback period are relatively worthless in today’s dollars so ignoring them has no consequence. The results of including the cash flows after the required payback period rarely have any effect on the accept/reject decision.v

Answers

Answer:

The answer is "choice B".

Explanation:

Please find the numbering of the question in the attachment file.

Whenever the cash flows become substantial after the required period, managers would use their option to surpass the pay-back rule, as well as the managers, recommend that ignoring all investment returns after a period of pay-back would not be an important component in the capital-budget evaluation repayment process, that's why the choice "B" is correct.

Related Questions

Why do you think the Federal government taxes long-term capital gains and qualified dividends at a lower rate than earned

and other types of unearned income?

Answers

Answer:

The justification for a lower tax rate on capital gains relative to ordinary income is threefold: it is not indexed for inflation, it is a double tax, and it encourages present consumption over future consumption. ... Future personal consumption, in the form of savings, is taxed, while present consumption is not.

Explanation:

Negative criticism is generally

A.private

b. public

c. productive

d. practical

Please select the best answer from the choices provided

Answers

Answer:

The answer is A.

Hope I helped! If not I apologize.

Answer:

c is correct on edge

Explanation:

what does this fitted line mean? trace the circle joining its both hands?

Answers

Answer:

line fitting is the process of constructing a straight line that has the best fit to a series of data points. Several methods exist, considering: Vertical distance: Simple linear regression

Rickie loves to shop. lately, she's been thinking it might be wise to cut back on the time and money she spends shopping. Then again, it's something she really enjoys. based on your spending experience and personal knowledge, what would you recommend to Rickie?

Answers

It may be wise for Rickie to evaluate her spending habits and prioritize her financial goals while considering her enjoyment of shopping.

Should Rickie Cut Back on Shopping?Rickie should take a closer look at her spending habits and financial goals. She could start by creating a budget and tracking her expenses to gain a clear understanding of how much time and money she is spending on shopping.

By evaluating her spending patterns, Rickie can identify areas where she may be able to cut back or make adjustments, without completely giving up something she enjoys. For example, she could set a monthly shopping budget, limit impulsive purchases, or look for ways to save money while still enjoying the shopping experience, such as shopping during sales or using coupons.

Read more about Shopping habit

brainly.com/question/24345991

#SPJ1

I found this off the internet: Government security agencies like the NSA can also have access to your devices through built-in back doors. This means that these security agencies can tune in to your phone calls, read your messages, capture pictures of you, stream videos of you, read your emails, steal your files … whenever they please

Answers

Answer:

Well isn't that just great. Well my family is crazy and there is always something going on. I bet we must be pretty fun to watch. XD. I can't imagine what the government thinks about my fam. And we are always joking about murder and stuff. I am prolly on some watch list for the crazy people.

Explanation:

My fam is just a bunch of funny crazy people.

Credit is Costly Chapter 4 Lesson 4

Answers

The 4th chapter - Credit is Costly of Dave Ramseys' Workbook provides important terms relating to credit.

The key terms relating to Credit are given as follows:

• Annual Fee: A fee charged by a credit card company for the use of their credit card.

• Credit Limit: The maximum amount of money the lender is willing to loan to an applicant.

• Finance Charge: The total cost of using credit, including interest and fees.

• Origination Fee: A charge for setting up a loan, often associated with home loans.

• Loan Term: The length of time a borrower has to repay a loan. Remember, the longer the loan term, the lower the monthly payment, but the greater the interest paid over time.

• Grace Period: The length of time that the lender charges no interest on money borrowed when the borrower pays off their balance in full each month.

• Annual Percentage Rate (APR): The cost of the loan each year expressed as a percentage. All lenders are required by law to calculate APR the same way.

• Introductory Rate: A lower interest rate offered by credit card companies, usually for a short period of time, to entice customers to sign up for credit with them. Eventually, the introductory rate expires and a new, increased rate takes effect.

Learn more about Credit:

https://brainly.com/question/1475993

#SPJ1

Full Question:

Although part of your question is missing, you might be referring to this full question:

What are the key terms discussed in Credit is Costly Chapter 4 Lesson 4 of Dave Ramseys' Workbook?

Question 14(Multiple Choice Worth 5 points) (01.02 LC) The actual amount of income received after taxes and deductions is O net income gross income O earnings statement O year-to-date deductions

Answers

The actual amount of income received after taxes and deductions is net income.

Gross income refers to the total amount of income earned before any taxes or deductions are applied. Earnings statement refers to a document that outlines an employee's pay for a specific period, including gross income, taxes, and deductions. Year-to-date deductions refers to the total amount of deductions taken from an employee's pay since the beginning of the year.

Net income is the amount of income that an individual receives after all taxes and deductions have been subtracted from their gross income. It is the actual amount of income that is deposited into an individual's bank account or received as a paycheck.

To know more about Net Income, click here:

https://brainly.com/question/20938437

#SPJ1

PLs, HELP URGENT! Will give brainiest for a proper answer!

Answers

Answer:

D. Has more money for research and development

Explanation:

Answer:

d

Explanation:

which of the following words, if added to an offer, will cause the offer to fail for definiteness? (select two)

Answers

"Some" and "Most" are the words, if added to an offer, will cause offer to fail for definiteness.

What is an offer?An offer is a proposal or an invitation to enter into a contract or a transaction. It is a formal expression of willingness to buy or sell goods or services, to hire or be hired, to lease or rent property, or to undertake any other legal obligation. An offer must be clear, definite, and certain, and it must include all essential terms and conditions of the agreement. It may be made orally or in writing, and it may be open for a limited time or subject to certain conditions. Once an offer is made, the offeree has the right to accept, reject, or make a counteroffer. If accepted, an offer creates a binding agreement between the parties, and it becomes legally enforceable.

To learn more about offer, visit:

https://brainly.com/question/2667914

#SPJ4

How does Tony convince Joel to go swimming in the Vermillion River?

Answers

Answer: Could be from bribing, displaying all of the perks of swimming in the river or describing how much fun it could be

Explanation:

Who is authorized to inspect a scaffold?

Answers

Answer:

Competent person

Explanation:

OSHA requires the general contractor in section 1926.451(f)(3) to have scaffolds and scaffold components inspected for visible defects by a competent person prior to each work shift and after any occurrence which could affect a scaffold's structural integrity.

Answer:OSHA

According to 2 sources

Posted on June 29, 2017 by Trekker Group As you know, OSHA requires that a competent person inspect all scaffolds before each shift when it will be used and after any circumstances or events that could potentially affect their integrity.

Why do you need long-term coping skills?

Answers

Answer:

people who adjust to stressful or traumatic situations through coping mechanisms may be less likely to experience anxiety, depression, and other mental health concerns.

Anxiety, sadness, and other mental health issues may be less common in persons who use coping methods to deal with stressful or traumatic experiences.

Fear, dread, and unease are emotions associated with anxiety. Your heart rate may increase, you could start to perspire, and you might feel anxious and tight. Stress may be the cause of it.

For instance, before taking a test, making a big choice, or dealing with a challenging topic at work, you could have anxiety. You might cope better with it. Your anxiousness could make you more alert or help you concentrate. In contrast, the traumatic experiences can be paralyzing for those who suffer from anxiety disorders.

Learn more about Anxiety, from:

brainly.com/question/3253078

#SPJ6

Callas Corporation paid $380,000 to acquire 40 percent ownership of Thinbill Company on January 1, 20X9. The amount paid was equal to Thinbill’s underlying book value. During 20X9, Thinbill reported operating income of $45,000 and income of $20,000 from gains on derivative contracts that were designated as cash flow hedges, so these gains were reported in Other Comprehensive Income (OCI). Thinbill paid dividends of $9,000 on December 10, 20X9.

Required:

a. Give all journal entries that Callas Corporation recorded in 20X9, associated with its investment in Thinbill Company.

b. Give all closing entries at December 31, 20X9, associated with its investment in Thinbill Company.

Answers

Answer: Please refer to Explanation

Explanation:

A.

January 1 20X9

DR Investment in Thinbill Company $380,000

CR Cash $380,000

(To record Investment in Thinbill Company)

DR Investment in Thinbill Company $18,000

CR Income from Thinbill Company $18,000

(To record income from Thinbill company)

DR Investment in Thinbill Company $8,000

CR Unrealised gain on Investment $8,000

(To record share of OCI reported by Thinbill Company)

DR Cash $3,600

CR Dividend $3,600

(To record dividend received from Thinbill Company)

Workings

Income from Thinbill Comapny

Callas owns 40% of Thinbill company and so is entitled to 40% of income which is,

= 40% x 45,000

= $18,000

Dividends

= 9,000 x 40%

= $3,600

Unrealised Gain on Income

= 20,000 x 40%

= $8,000

b. The closing entries are as follows,

DR Income from Thinbill Company $18,000

CR Retained Earnings $18,000

(To recognise income from Thinbill Company)

DR Unrealised Gain on Investment $8,000

CR Accumulated OCI Income from Investee (Thinbill Company) $8,000

(To record accumulated OCI income)

List a minimum of sources of information in Australia that you could access to help you facilitate compliance with relevant international finance regulations.

Answers

Answer:

The answer is below

Explanation:

Some of the sources of information in Australia that you could access to help you facilitate compliance with relevant international finance regulations are:

1. Reserve Bank of Australia - RBA

2. Australian Prudential Regulation Authority - APRA

3. Australian Securities and Investments Commission - ASIC

4. Australian Competition and Consumer Commission - ACCC

5. Australian Communications and Media Authority - ACMA

6. Superannuation and Financial Services Industry - Royal Commission

7. Australian Financial Services Licence - AFSL

8. Australian Market Licence - AML

9. Clearing and Settlement - CS

10. Australian Consumer Law - ACL

Helen spent $7. 75 to purchase 23 snacks for the club meeting. Chips are $. 25 and pretzels are $. 50. How many of each type of snack did helen buy?.

Answers

Helen bought 15 bags of chips and 8 bags of pretzels.

Let's assume that Helen bought x bags of chips and y bags of pretzels. We can set up a system of equations grounded on the given information

x +y = 23( the total number of snacks bought was 23)

x0.5 +y = 7.75( the total cost of the snacks was$7.75)

To break for x and y, we can use the first equation to break for one of the variables in terms of the other

x+ y = 23

y = 23- x

We can also substitute this expression for y into the alternate equation and break for x

x0.5+ y = 7.75

x0.5( 23- x) = 7.75

x11.5-0.5 x = 7.75 -0.25 x = -3.75

x = 15

So, Helen bought 15 bags of chips.

We can also use the first equation to break for y

x+ y = 23 - 15

y = 8 thus, Helen bought 15 bags of chips and 8 bags of pretzels.

Learn more about problems of chips and pretzels at

https://brainly.com/question/891951

#SPJ4

The Kids Toy Company received an order for manufacturing and supply of 500toys from a retailer. The company spent the following costs for execution of the said order:-Material used Rs. 20,000Labour cost Rs. 15,000

FOH Applied 60% of labor cost On final inspection, it was found that 20 toys were spoiled which could be sold as ‘seconds’ at a price of Rs. 50 each.

Required: Record necessary accounting entries under the following cases:-

a)When the loss on spoiled toys is charged to the relevant job.

b)When the loss on spoiled toys is charged to the overall production

Answers

Additional computations: Equivalent production:

Materials = 7,000 + (5,000 × 100%) = 12000 units

Labor and factory overhead = 7,000 + (5,000 × 25%) = 8,250 units.

What is production?The process of mixing several inputs, both material and immaterial, to produce output is known as production. In a perfect world, this output would be a product or service that is useful to people and has value.

Production theory is the branch of economics that concentrates on production; it is closely tied to the consumption theory of the economy. Utilizing the initial inputs productively leads to the production process and output.

Land, labor, and capital are regarded as the three major production components and are referred to as primary producer commodities or services.

Both the output process and the final product do not considerably change these essential inputs or turn them into integral parts of the final product.

Learn more about production, here

https://brainly.com/question/22852400

#SPJ1

Hoag Corporation applies manufacturing overhead to products on the basis of standard machine-hours. Budgeted and actual fixed manufacturing overhead costs for the most recent month appear below: Original Budget Actual Costs Fixed overhead costs: Supervision $ 9,880 $ 9,970 Utilities 4,160 4,440 Factory depreciation 21,320 21,190 Total fixed manufacturing overhead cost $ 35,360 $ 35,600 The company based its original budget on 2,600 machine-hours. The company actually worked 2,280 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 2,080 machine-hours. What was the overall fixed manufacturing overhead volume variance for the month

Answers

Answer: $7,072 Unfavorable

Explanation:

Find fixed manufacturing overhead rate:

= Total budgeted fixed manufacturing overhead cost / Budgeted machine hours

= 35,360 / 2,600

= $13.60

Variance Favorable (Unfavorable) = (Standard hours allowed - Budgeted machine hours) * fixed manufacturing overhead rate

= (2,080 - 2,600) * 13.60

= -$7,072

LEONE COMPANY Income Statement For Year Ended December 31 Sales Cost of goods sold Finished goods inventory, beginning Cost of goods manufactured Goods available for sale Less: Finished goods inventory, ending Cost of goods sold Gross profit General and administrative expenses Selling expenses Net income $ 84,000 84,000 92.000 $ 3,251,000 $ (8,000) 3,259,000 127.000 603,000 2,529,000

How do you find the cost of goods manufactured?

Answers

The cost of goods manufactured (COGM) is the cost of all the products that a company has manufactured during a period.

How to calculateIt is calculated by adding the beginning finished goods inventory to the total manufacturing costs, and then subtracting the ending finished goods inventory.

In the income statement you provided, the cost of goods manufactured is calculated as follows:

COGM = $92,000 + $3,251,000 - $127,000 = $3,224,000

Therefore, the cost of goods manufactured for Leone Company is $3,224,000.

Here is the formula for calculating COGM:

COGM = Beginning finished goods inventory + Total manufacturing costs - Ending finished goods inventory

The total manufacturing costs include direct materials, direct labor, and manufacturing overhead.

Read more about income statement here:

https://brainly.com/question/28936505

#SPJ1

Suppose that the production function is y= 9k^0.5 N^0.5. With this production function, the marginal product of labor is MPN= 4.5K^0.5 N^-0.5. The capital stock is K= 25. The labor supply curve is NS= 100[(1-t)w]^2, where w is the real wage rate, t is the tax rate on labor income, and hence (1-t)w is the after-tax real wage rate.c.Suppose that a minimum wage of w=2 is imposed. If the tax rate on labor income, t, equals zero, what are the resulting values of employment and the real wage? Does the introduction of the minimum wage increase the total income of workers, taken as a group?

Answers

The resulting values for employment and the real wage are 70.3125 and $1.5811 per hour, respectively.

The introduction of the minimum wage does not increase the total income of workers taken as a group.

How to determine employment and real wageTo find the resulting values of employment and real wage, determine where the labor supply curve intersects the labor demand curve.

MPN =

\(4.5K^0.5 N^-0.5 = (9K N)^0.5 / (2KN)^0.5 = (9/2)^0.5 (K/N)^0.5 = w/P

\)

where P is the price of output, which we can assume is equal to 1.

This equation can be rearranged to solve for N:

N =

\((9/2) (K/w)^2\)

Plugging in K = 25 and w = 2, we get:

N =

\((9/2) (25/2^2) = 70.3125\)

To find the real wage, we can plug this value of N into the labor supply curve:

NS =

\(100[(1-t)w]^2 = 100(1-0)(2)^2\)

= 400

Since labor supply exceeds labor demand, the real wage will be bid down to the equilibrium level.

\((9/2)^0.5 (K/N)^0.5 = w/P

(9/2)^0.5 (25/N)^0.5 = 1/2

N = (9/2) (25/2^2) = 70.3125

w = 2(70.3125/100)^0.5 = 1.5811\)

The equilibrium real wage is $1.5811 per hour.

To determine whether the introduction of the minimum wage increases the total income of workers,

Total income before minimum wage = wN = 1.5811 x 70.3125 = $111.31

After the minimum wage of $2 is imposed, the real wage is fixed at $2, and the level of employment is determined by the intersection of the labor supply and demand curves at this wage:

N =

\((9/2) (25/2^2) / (2)^2 = 35.15625\)

Total income after minimum wage = wN = 2 x 35.15625 = $70.31

Since the total income of workers decreases from $111.31 to $70.31 after the minimum wage is imposed, the introduction of the minimum wage does not increase the total income of workers taken as a group.

Learn more on Real wage on https://brainly.com/question/1622389

#SPJ1

Demo Consulting End-of-Period Spreadsheet For the Year Ended August 31, 20Y9 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 11,050 11,050 Accounts Receivable 26,300 26,300 Supplies 2,790 2,340 450 Land 22,880 22,880 Office Equipment 21,570 21,570 Accumulated Depreciation 2,920 1,390 4,310 Accounts Payable 7,100 7,100 Salaries Payable 340 340 Common Stock 8,900 8,900 Retained Earnings 17,930 17,930 Dividends 3,420 3,420 Fees Earned 72,460 72,460 Salary Expense 19,200 340 19,540 Supplies Expense 2,340 2,340 Depreciation Expense 1,390 1,390 Miscellaneous Expense 2,100 2,100 109,310 109,310 4,070 4,070 111,040 111,040 Based on the preceding spreadsheet, prepare an income statement for Demo

Answers

Answer:

Demo Consulting

DEMO CONSULTING

Income Statement for the year ended August 31, 20Y9"

Fees Earned $72,460

Salary Expense $19,540

Supplies Expense 2,340

Depreciation Expense 1,390

Miscellaneous Expense 2,100

Total Expenses $25,370

Net income $47,090

Explanation:

a) Data and Calculations:

DEMO CONSULTING

End-of-Period Spreadsheet

For the Year Ended August 31, 20Y9

Unadjusted Adjustments Adjusted

Trial Balance Trial Balance

Account Title Dr. Cr. Dr. Cr. Dr. Cr.

Cash 11,050 11,050

Accounts Receivable 26,300 26,300

Supplies 2,790 2,340 450

Land 22,880 22,880

Office Equipment 21,570 21,570

Accumulated Depreciation 2,920 1,390 4,310

Accounts Payable 7,100 7,100

Salaries Payable 340 340

Common Stock 8,900 8,900

Retained Earnings 17,930 17,930

Dividends 3,420 3,420

Fees Earned 72,460 72,460

Salary Expense 19,200 340 19,540

Supplies Expense 2,340 2,340

Depreciation Expense 1,390 1,390

Miscellaneous Expen. 2,100 2,100

109,310 109,310 4,070 4,070 111,040 111,040

which of the four main business functions is responsible for production?

Answers

The main business function responsible for production is operations. Operations management encompasses the processes and activities involved in producing goods or delivering services within an organization. It focuses on the efficient and effective conversion of resources (such as labor, materials, and equipment) into finished products or services. This function includes tasks such as planning, scheduling, procurement, quality control, inventory management, and process improvement to ensure smooth and cost-effective production operations.

\(\huge{\mathfrak{\colorbox{black}{\textcolor{lime}{I\:hope\:this\:helps\:!\:\:}}}}\)

♥️ \(\large{\textcolor{red}{\underline{\mathcal{SUMIT\:\:ROY\:\:(:\:\:}}}}\)

Answer:

The four main business functions are

1. Operations This function is responsible for product and the conversion of inputs into goods or services.

2. Marketing This function is concentrated on understanding client requirements and wants, promoting products or services, and generating demand.

3. Finance This function manages the fiscal coffers of the business, including budgeting, fiscal planning, and investment opinions.

4. Human coffers This function is responsible for managing the association's mortal capital, including reclamation, training, performance operation, and hand relations.

Explanation:

The following amounts were reported by Howe Company before adjusting its immaterial overapplied manufacturing overhead of $16,000. Raw Materials Inventory $80,000 Finished Goods Inventory $120,000 Work in Process Inventory $200,000 Cost of Goods Sold $1,460,000. What is the amount Howe will report as cost of goods sold after it disposes of its overapplied overhead

Answers

Answer:

$1,444,000

Explanation:

Given the data as seen below,

Over applied manufacturing overhead = $16,000

Raw materials inventory= $80,000

Finished goods inventory = $120,000

Work in process inventory = $200,000

Cost of goods sold = $1,460,000

Therefore, the amount Howe will report as cost of goods sold after it disposes off its overhead applied will be;

= Cost of goods sold - over applied manufacturing overhead

= $1,460,000 - $16,000

= $1,444,000

Which of the following is true if you find a better rate on an external 3rd party channel within 24 hours of making a reservation through one of Marriott's direct channels?

Answers

If you find a better rate on an external 3rd party channel within 24 hours of making a reservation through one of Marriott's direct channels, the Marriott’s Best Rate Guarantee policy comes into effect.

Marriott’s Best Rate Guarantee policy is a commitment to providing the lowest rate possible. If you find a lower rate within 24 hours of booking through one of Marriott’s direct channels, Marriott will match that rate and offer an additional discount of 25%.

This policy applies to any Marriott brand including Ritz-Carlton, St. Regis, Westin, Sheraton, Aloft, and othersYou need to first book your reservation through Marriott’s direct channels like Marriott.com, the Marriott Mobile app, Marriott Bonvoy app, the Marriott Reservation Center, or directly with the hotel.

After that, you should look for lower rates on other third-party websites. If you find a lower rate within 24 hours, contact Marriott’s Customer Care team, and they will match that rate plus an additional discount of 25%.The policy does come with some terms and conditions.

The lower rate you find on the third-party website must be for the same hotel, same room type, same dates, same number of guests, same currency, and with the same booking conditions. It also excludes rates that are only available to members of certain groups or organizations, package rates that include flights, car rentals, and other amenities, and rates that are not available to the general public

For more such question on policy visit:

https://brainly.com/question/6583917

#SPJ8

ELIMINATE UNNECESSARY COSTS

Answers

You can eliminate unnecessary costs in business by some ways such as :

Identify and prioritize expensesReview vendor contractsStreamline processesHow to eliminate unnecessary costs ?Begin by scrutinizing your expenses to distinguish the essential ones for running your business from those that are not. Make sure to prioritize necessary expenditures and explore means of reducing outlays on pointless items.

Evaluate your legal agreements with merchants and providers, maximizing efforts to secure optimal deals. You could either examine more agreeable terminologies or opt for more economical suppliers.

Request ways of simplifying your company procedures in order to diminish expenditure on hours spent and resources utilized. Ponder using efficient automated systems or arranging outsourcing activities whilst cross-training team members across different positions.

Find out more on unnecessary costs at https://brainly.com/question/14815155

#SPJ1

(Chapter 3: Process Analysis) Consider a process consisting of three resources. Assume there exists unlimited demand for the product, and that all activities are always performed in the following sequence. Resource 1 has a processing time of 7 minutes per unit. Resource 2 has a processing time of 4 minutes per unit. Resource 3 has a processing time of 6 minutes per unit. All three resources are staffed by one worker and each worker gets paid $13 per hour. If the process starts empty, how long will it take to process 20 units

Answers

It will take 36 minutes to process 20 units.

How to calculate the time it takes to have 20 units?The first step is to consider the time each resource requires:

1 = 7 minutes per unit.2 = 4 minutes per unit.3 = 6 minutes per unit.Now, using this time, let's calculate the number of units every 15 minutes.

15 minutes:

Resource 1: 2 units.Resource 2: 3 units.Resource 3: 2 units.This implies that every 15 minutes 7 units are produced, based on this it will take about 36 minutes to complete the 20 units.

Resource 1: 5 units.Resource 2: 9 units.Resource 3: 6 units.Learn more about production in: https://brainly.com/question/1969315

Describe the battle between the retail supermarket and the e-commerce platform in the world

HELP ME !!!

Answers

There is an endless battle between the retail supermarket and e-commerce. Both sectors want their revenue and profits high so they use their own techniques.

What is E-Commerce?E-Commerce is the online shopping platform that has provided a cutting edge technology and ease to the buyers. This platform enables the buyer to make purchases without visiting the store.

Retail supermarkets claim that they have a large variety of products that are displayed on the store which can be seen easily by the buyer and their complete details are available including the manufacturing and expiry date. E-Commerce provide the comfort purchasing but is a little costly as the shipping is not always free. However when visiting a retail supermarket it seems difficult to walk around and find the wanted products which in e-commerce is just a search bar away.

Learn more about E-Commerce at https://brainly.com/question/26630192

#SPJ1

Mars celestial fire surround

Answers

Answer:

Mars Celestial Fire Surround is a two-tier offensive attack performed by Sailor Mars. Mars Celestial Fire Surround is Sailor Mars's third attack.

Please mark me brainlyest

Consider total cost and total revenue, given in the following table:

In the final column, enter profit for each quantity. (Note: If the firm suffers a loss, enter a negative number in the appropriate cell.)

Total Cost Marginal Cost

(Dollars)

Quantity (Dollars)

0

1

2

3

4

5

6

7

5

6

8

11

15

20

26

35

05

06

07

Total Revenue Marginal Revenue

(Dollars)

(Dollars)

0

6

12

18

24

30

36

42

AAAAAAA

Profit

(Dollars)

In order to maximize profit, how many units should the firm produce? Check all that apply.

04

Answers

The solution to the given question when we consider total cost and total revenue, given in the following table:

The Financial TableQuantity | Total Cost | Marginal Cost | Total Revenue | Marginal Revenue | Profit

------- | -------- | -------- | -------- | -------- | --------

0 | 5 | 5 | 0 | 0 | -5

1 | 11 | 6 | 6 | 6 | 1

2 | 17 | 6 | 12 | 6 | 5

3 | 24 | 7 | 18 | 6 | 4

4 | 31 | 8 | 24 | 6 | -7

5 | 39 | 8 | 30 | 6 | -9

6 | 47 | 8 | 36 | 6 | -11

7 | 55 | 8 | 42 | 6 | -13

As you can see, the firm's profit is maximized at quantity 3. This is because the marginal revenue is equal to zero at this point, which means that the firm is not making any additional profit by producing more units. In fact, if the firm produces more units, it will actually start to lose money.

Therefore, the answer to the question is 3.

In summary:

The firm's profit is maximized at quantity 3.This is because the marginal revenue is equal to zero at this point.If the firm produces more units, it will start to lose money.Therefore, the answer to the question is 3.Read more about marginal revenue here:

https://brainly.com/question/13444663

#SPJ1

A bond with a face value of $340,000 and a quoted price of 90 has a selling price of A. $377,778 B. $340,090 C. $306,000 D. $340,000

Answers

Answer:

Try C.

Explanation:

(I'm so sorry if it's wrong)

Jim is looking to purchase Vinney's property. The two parties agree on the terms of the deal and are ready to sign the purchase agreement. When will Jim and Vinney have an executed contract?

Answers

Jim is looking to purchase Vinney's property. The two parties agree on the terms of the deal and are ready to sign the purchase agreement. Jim and Vinney have an executed contract when they both are signed.

What is contract execution?A systematic event known as contract execution occurs when all necessary parties sign the agreement, making it a binding legal document.

Further the contract law provide the two broad categories of the contract which is considered to have been executed a) whenever all parties have fulfilled their responsibilities in full and b) A contract that has been signed by all parties required to make it legally enforceable is also referred to as being "executed."

Therefore Jim and Vinney when sign the agreement can make the purchase agreement into a real estate executed contract.

To know more about contract execution refer:

https://brainly.com/question/27516414

#SPJ1