Which of the following events (in the marketplace or within the company itself) will decrease the market price of Marvelous Manufacturing's common stock? Future dividend growth for Marvelous is forecast to increase from 6% to 9%. Marvelous has increased its estimate of next year's dividend from $1.60 to $1.75. The market's expectation of future inflation decreases from 7% to 5% The beta on Marvelous’ common stock decreases from 1.4 to 1.2. The risk-free rate of return required of investors increases from 8% to 10%.

Answers

Answer:

The beta on Marvelous’ common stock decreases from 1.4 to 1.2

Explanation:

According to the scenario, computation of the given data are as follow:-

As we know that

Expected Return = Market Risk Premium × Beta + Risk Free Rate

If the Beta is decreased, this means that expected return is decreased too, and if the expected return decreases the market value is decreases too.

According to the analysis, The Beta on marvelous’ common stock decreases from 1.4 to 1.2 is correct option.

Related Questions

In January 2010, the U.S. Treasury issued a $1000 par, ten-year, inflation-indexed note with a coupon of 4%. On the date of issue, the consumer price index (CPI) was 200. By January 2020, the CPI had increased to 300. The principal payment that was made in January 2020 is closest to: Group of answer choices A) $1000 B) $1020 C) $1030 D) $1500

Answers

If In January 2010, the U.S. Treasury issued a $1000 par, ten-year, inflation-indexed note with a coupon of 4%. The principal payment that was made in January 2020 is closest to:D. $1500.

How to find the principal payment?Firsts step is to find the CPI appreciated

CPI appreciated = 300/200

CPI appreciated = 1.50

Now let find the principal payment

Principal payment = $1000 × 1.50

Principal payment = $1500

Therefore the correct option is D.

Learn more about principal payment here:https://brainly.com/question/29489526

#SPJ1

Cryptocurrency is a form of payment that:

A. can be exchanged online for goods and services.

B. can only be exchanged for specific things.

C. can be used for digital or face-to-face transactions.

D. exists online and in local banks.

Answers

Answer:

The answer is A. can be exchanged online for goods and services.

Explanation:

Cryptocurrencies are used primarily outside existing banking and governmental institutions and are exchanged over the Internet.Explain why income statement can also be called a profit and loss statement. What exactly does the word balance mean in the title of the balance sheet? Why do we balance the 2 halves?

Answers

25 points and brianly

Which sentence demonstrates the use of secondary market research technique?

Answers

Answer:

Sentence 3

Explanation:

Answer:sentence three

Explanation:

Holloway Company earned $6,800 of service revenue on account during Year 1. The company collected $5,780 cash from accounts receivable during Year 1. Required Based on this information alone, determine the following for Holloway Company. (Hint: Record the events in general ledger accounts under an accounting equation before satisfying the requirements.) (Enter any decreases to account balances with a minus sign.) a. The balance of the accounts receivable that would be reported on the December 31, Year 1, balance sheet. b. The amount of net income that would be reported on the Year 1 income statement. c. The amount of net cash flow from operating activities that would be reported on the Year 1 statement of cash flows. d. The amount of retained earnings that would be reported on the Year 1 balance sheet.

Answers

The further discussion can be defined as follows:

For point A:Calculated to use this formulation is the account receivable

reported on the balance sheets

Using formula:

Admissible Accounts

For point B:The reported net income is revenue from services of \(\$18,000\)

For point C:The reported net cash flow from operations is \(\$14,000\) in

cash from accounts receivables in 1 year.

For point D:Reclaimed revenues are \(\$18,000\) representing the amount of net

income transferred to the retained income account.

So, the final answer is "$4,000, $18,000, $14,000, and $18,000".

Learn more:

brainly.com/question/24561227

According to the extract, entrepreneurial activity includes developing and launching new businesses and marketing them, often with the end goal of selling the business to turn a profit. Based on this, indicate a product or service you plan to start a business with. Explain how you generated the business idea and determined the feasibility of the idea.

Answers

Developing a profitable company idea involves imagination, investigation, and cautious preparation.

How business idea is generated and its feasibilityTo generate a business idea, consider your interests, skills, and knowledge. Think about problems that you or others face in your daily life and whether there are potential solutions that could be turned into a business. Research the market to see if there is demand for the product or service you are considering and whether there are existing competitors.

To determine the feasibility of your business idea, conduct a thorough analysis of the potential costs and revenue streams. Create a business plan that outlines your goals, marketing strategy, and financial projections. Consider seeking advice from experts in your industry or consulting with a business mentor. It is also important to assess any legal or regulatory requirements that may apply to your business.

Overall, generating a successful business idea requires creativity, research, and careful planning. By considering your interests, skills, and market demand, you can identify a potential product or service that meets a need and has the potential to be profitable. With thorough analysis and planning, you can determine the feasibility of your idea and take steps towards launching a successful business.

Learn more on idea generation in business here: https://brainly.com/question/25462225

#SPJ1

Indicate whether these receivables are reported as accounts receivable, notes receivable, or other receivables on a balance sheet. (a) Advanced $10,000 to an employee. select an account title (b) Received a promissory note of $34,000 for services performed. select an account title (c) Sold merchandise on account for $60,000 to a customer. select an account title

Answers

Answer:

Indicating how each receivable is reported on the balance sheet:

(a) Advanced $10,000 to an employee = Other Receivable

(b) Received a promissory note of $34,000 for services performed = Notes Receivable

(c) Sold merchandise on account for $60,000 to a customer = Accounts Receivable

Explanation:

The advance to an employee is reported as Other Receivable, while the credit sale to a customer is reported as an Accounts Receivable. Finally, the promissory note received from a client for services rendered on credit is reported as Notes Receivable. This classification of receivables shows the true nature of the underlying transactions.

8. Refer to the Prescription Drug table on page 4 in the sample Health Benefits Form. John is

covered under the Standard Plan and plans to purchase his prescription drugs from an

in-network pharmacy. All of the following are true, EXCEPT...

a. For a 30-day supply purchased at retail, the generic version of the prescription drug

is $40 cheaper than the preferred brand.

b.

If John is looking for the lowest cost for his prescription drugs, he should purchase

from mail order.

c. The cost of a three month supply of generic prescription drugs purchased at retail

would be $50.

di John chose

and be no difference in the price of the

generic version of prescription drugs

Answers

The patient's name, the name of the medication, the dosage, and the dosage schedule are all listed on the label of each prescription medicine container. When a prescription is filled, the pharmacy typically provides more in-depth printed information about the medicine.

Which section of the prescription contains medicine-related information?Inscription (Medication Prescribed) The most crucial section of the prescription is the inscription, which details the drug's composition and dosage. It's possible that the medication is some kind of official or non-official formulation.

What are the 4 primary pieces of a solution?A prescription traditionally consists of four parts, predating modern legal definitions of the term: a signature, inscription, subscription, and superscription. The patient's information, such as name, address, and age, can be found in the superscription section.

Learn more about prescription here:

https://brainly.com/question/1392739

#SPJ1

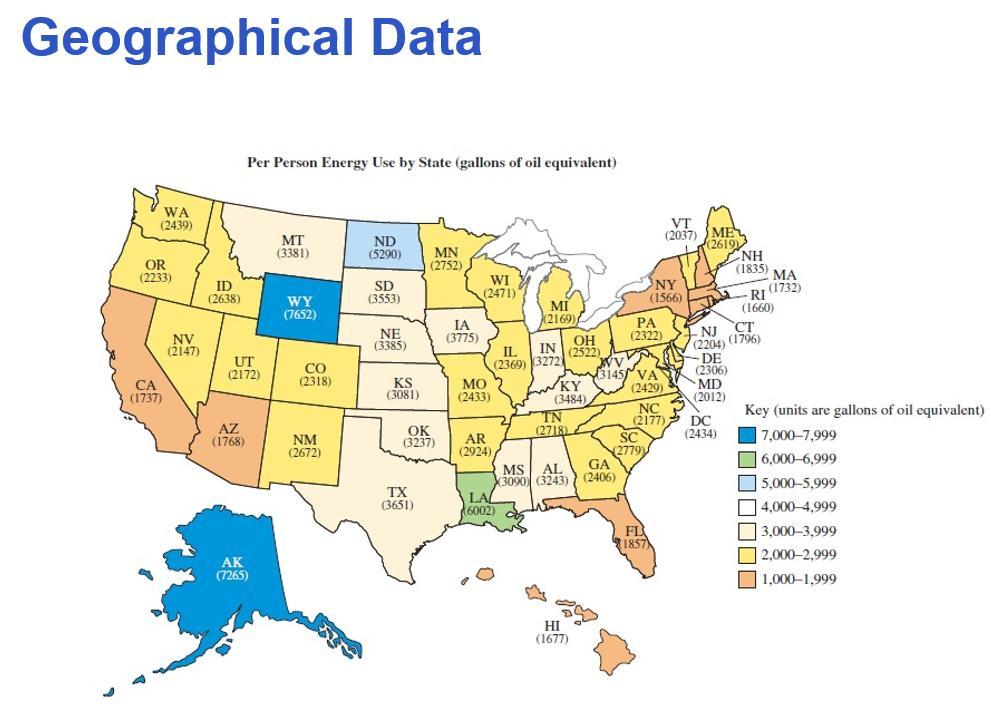

Given the figures below...

a. What geographical characteristics are common to states with the lowest energy usage per person?

b. Were there any temperatures above 80°F in the United States on the date shown in the contour map? If so, where?

Answers

a. States with the lowest energy usage per person in the United States often have mild climates and/or access to renewable energy sources. Specifically, they may have:

Lower average temperatures, reducing the need for heating and coolingAccess to renewable energy sources, such as hydroelectric or wind powerA smaller population density, leading to less energy consumption for transportation and infrastructureb. There was no state with temperatures above 80°F in the United States on the date shown in the contour map.

What is the energy usage about?States with low energy usage per person in the United States often have specific geographical characteristics and access to renewable energy sources. Here are some examples:

New York: New York has the fourth-lowest energy usage per person in the United States. The state has implemented energy efficiency policies, such as building codes and incentives for energy-efficient appliances. It also has access to hydroelectric power from the Niagara Falls.

Lastly, Vermont: Vermont has the second-lowest energy usage per person in the United States. Like Maine, Vermont's colder climate reduces the need for air conditioning. The state also has a high percentage of renewable energy sources, including hydroelectric power and solar energy.

Learn more about energy usage from

https://brainly.com/question/27438014

#SPJ1

The operating budget provides a roadmap for financial plans for a short-term, future period. What is a typical “future period” for an operating budget?

Answers

An operating budget is a financial statement that outlines the organization's expenditures and revenues for a specific period.

The operating budget is typically for a fiscal year, which is usually twelve months. The future period for an operating budget is usually a fiscal year or less than a year. The operating budget is critical because it establishes guidelines for financial activities and operations in an organization. It provides a roadmap for financial plans for a short-term, future period, which typically begins on January 1st and ends on December 31st.

An organization creates an operating budget to aid in the allocation of resources and expenditures to achieve its objectives for a given period. A typical operating budget is for a fiscal year. A fiscal year is the period when an organization prepares its financial statements. It is usually 12 months, but it may be shorter or longer depending on the organization. An operating budget typically covers one fiscal year; however, it may be longer or shorter based on the organization's preferences.

The future period for an operating budget is frequently updated to reflect the company's current situation and financial standing. It takes into account the actual results of the previous period and the estimated expenditures and revenues for the upcoming year to develop the operating budget for a future period.

Know more about Operating budget here:

https://brainly.com/question/30766715

#SPJ8

A major concern with Social Security is the possibility that funds will not be available when today’s tax-payers retire to become beneficiaries. According to the Social Security Trustee’s report, an increase of 1.89% in the Social Security payroll tax would keep the account full for the next 75 years. To achieve similar results, benefits would have to be decreased from the current 42% of the ending salary to 29% of the salary. Cindy is relatively new to the workforce. She has 32 years until she can retire. Her current annual salary is $45,000. 1a) Calculate how much Cindy will have to pay in Social Security tax (6.2%) based on this salary. 1b) Calculate how much Cindy will have to pay in Social Security tax if the tax was increased by 1.89%. 2a) Calculate Cindy’s annual Social Security benefit (about 42%) if her salary remains unchanged until she retires (annual average is $45,000). 2b) Calculate Cindy’s annual Social Security benefit if her salary remains unchanged but benefits (based on her annual salary of $45,000) were cut from 42% to 29%. 3) If Cindy were given a choice between the increase in Social Security tax now or the decrease in Social Security benefits when she retires, which would you recommend she choose? Explain your answer thoroughly.

Answers

If the tax was raised by 1.89%, Cindy will be responsible for paying Social Security tax 3,640.50.

Equation :1a) 45,000 * 6.2% = 2,790

1b) 45,000 * (6.2% + 1.89%) = 45,000 * 8.09% = 3,640.50

2a) 45,000 * 42% = 18,900

2b) 45,000 * 29% = 13,050

Briefing :Instead of a reduction in Social Security benefits when she retires, I believe it would be preferable to have an increase in Social Security taxes now and earn an annual pension of $18,900.

Does everyone contribute to Social Security?Regardless of whether they are employed by an employer or work for themselves, the majority of taxpayers are required to pay Social Security taxes on their income. A few categories of American taxpayers are exempt from the Social Security tax, nevertheless.

By choosing not to participate in Social Security, you can invest more of your salary in your own retirement plan. Additionally, it offers you the option to manage that portion of your income on your own terms based on biblical principles rather than letting Uncle Sam make that decision for you.

To know more about Social Security taxes visit:-

https://brainly.com/question/18268724

#SPJ1

What is the correct order of the loss-limitation rules?

Answers

Tax base, at-risk amount, and passive loss limits are the right order in which to apply the loss-limitation rules. So, option A is the best choice.

Loss-limitation is an optional component of a retrospective rating scheme that restricts or "caps" the amount of loss that would otherwise be used to determine premium (often at the $100,000 level or higher). The outcome of the loss-limiting formula, "proceeds less post-valuation date expenditure," is always a situation where there is neither a gain nor a loss. It is required to start with the core base cost formula in order to comprehend this formula: Base cost is the product of post-valuation date spending and valuation date value (VDV). Deduction The following restriction on a benefit that may be distributed in accordance with the Plan is referred to as a limitation. So option A. defines loss-limitation rules in the correct order.

The question is incomplete, complete question is:

What is the correct order of the loss limitation rules?

A) Tax basis, at-risk amount, passive loss limits.

B) At-risk amount, tax basis, passive loss limits.

C) Passive loss limits, at-risk amount, tax basis.

D) Tax basis, passive loss limits, at-risk amount.

E) Passive loss limits, tax basis, at-risk amount.

To learn more about losses here

https://brainly.com/question/23414491

#SPJ1

True or False: If the actual rate of inflation is 10%, the prices of goods and services increase relative to resource prices. In the short run, profit margins will increase and firms will cut back on output, which will cause layoffs, and increase unemployment.

Answers

Answer:

True

Explanation:

Brad owns a small townhouse complex that generates a loss during the year.

Complete each item below regarding (a) the circumstances where Brad can deduct a loss from the rental activity and (b) any limitations that would apply.

a. Brad might be allowed to deduct up to $ ...............of the passive activity losses from the townhouse complex against ................. income. To qualify for the deduction under the real estate rental exception, Brad must actively participate in the activity and own ................... or more of all interests in the activity for the entire taxable year.

Or, Brad may be allowed to deduct the loss if he works more than .............. hours as a material participant in connection with the townhouse complex and more than ................. of the personal services that he renders are performed in real property businesses where he materially participates. If Brad does not satisfy the the requirements for these two exceptions, he must continue to treat income and losses from real estate rental activities as .............. activity income and losses.

b. If Brad, who files single, qualifies for the real estate rental exception, the maximum deduction is reduced if his AGI exceeds the threshold. The reduction is equal to ............ of AGI in excess of $............... The deduction will be phased out completely if AGI reaches $...................

Answers

Answer:

a. Brad might be allowed to deduct up to $25,000

or Brad may be allowed to deduct the loss if he works more than 750 hours as a material participant in connection with the townhouse complex and more than half of personal service.

b. The reduction is equal to 50% of AGI in excess of $100,000. The deduction will be phased out completely if AGI reaches $25,000

Explanation:

Adjusted Gross Income is the final taxable income after all the allowable deductions are adjusted in the income. A tax payer can deduct up to $25,000 for the passive losses. This is standard deduction which Brad can deduct from the income.

Consider total cost and total revenue, given in the following table:

In the final column, enter profit for each quantity. (Note: If the firm suffers a loss, enter a negative number in the appropriate cell.)

Total Cost Marginal Cost

(Dollars)

Quantity (Dollars)

0

1

2

3

4

5

6

7

5

6

8

11

15

20

26

35

05

06

07

Total Revenue Marginal Revenue

(Dollars)

(Dollars)

0

6

12

18

24

30

36

42

AAAAAAA

Profit

(Dollars)

In order to maximize profit, how many units should the firm produce? Check all that apply.

04

Answers

The solution to the given question when we consider total cost and total revenue, given in the following table:

The Financial TableQuantity | Total Cost | Marginal Cost | Total Revenue | Marginal Revenue | Profit

------- | -------- | -------- | -------- | -------- | --------

0 | 5 | 5 | 0 | 0 | -5

1 | 11 | 6 | 6 | 6 | 1

2 | 17 | 6 | 12 | 6 | 5

3 | 24 | 7 | 18 | 6 | 4

4 | 31 | 8 | 24 | 6 | -7

5 | 39 | 8 | 30 | 6 | -9

6 | 47 | 8 | 36 | 6 | -11

7 | 55 | 8 | 42 | 6 | -13

As you can see, the firm's profit is maximized at quantity 3. This is because the marginal revenue is equal to zero at this point, which means that the firm is not making any additional profit by producing more units. In fact, if the firm produces more units, it will actually start to lose money.

Therefore, the answer to the question is 3.

In summary:

The firm's profit is maximized at quantity 3.This is because the marginal revenue is equal to zero at this point.If the firm produces more units, it will start to lose money.Therefore, the answer to the question is 3.Read more about marginal revenue here:

https://brainly.com/question/13444663

#SPJ1

The slope of a vertical line is what

Answers

Answer:

y-axis or x-axis?

Explanation:

Aubrey Daniel's savings account has a principal of $5,725. It earns 4% interest compounded quarterly for three quarters

Answers

Based on the period of compounding, the amount it comes to after 3 quarters is $5,327.75 and the interest earned is $52.75.

Find periodic rateThe 4% is an annual figure. Find the quarterly figure:

= 4%/4

= 1% per quarter

Amount after 3 quarters= Amount x ( 1 + rate) ^ number of periods

= 5,725 x ( 1 + 1%)³

= $5,327.75

Interest earned= Amount after 3 quarters - Invested amount

= 5,327.75 - 5,275

= $52.75

In conclusion, an interest of $52.75 was earned.

Find out more on compounding at https://brainly.com/question/25300240.

Answer: 4% divided by 4= 1% per quarter

after 3 quarters

Amount x ( 1 + rate(1%)) ^ number of periods (3)= 5,725 x ( 1 + 1%)³

= $5,327.75

Amount after 3 quarters - Invested amount

= 5,327.75 - 5,275

= $52.75 -interest earned

use a separate sheet)

SECTION A (2 Marks each)

1.

C'

The type of securities market that has relatively stringent listing conditions

companies

only

accommodate

strong

that

called

is

Answers

The type of securities market that has relatively stringent listing conditions companies only accommodate strong that is called Capital markets.

What is meant by Capital markets?In contrast to a money market, where short-term debt is purchased and sold, a capital market is a financial market where long-term debt or equity-backed securities are bought and sold. The New York Stock Exchange, American Stock Exchange, London Stock Exchange, and NASDAQ are examples of highly organized financial markets. Stock, bond, currency, and other financial assets are traded in capital markets, which are financial marketplaces that connect buyers and sellers. The stock market and the bond market are examples of capital markets.In the capital market, bonds, stocks, and other financial instruments are bought and sold by buyers and sellers. Participants in the trade include both individuals and institutions. Most securities traded on the capital market are long-term ones.To learn more about Capital markets refer to:

https://brainly.com/question/1159116

#SPJ9

Do the benefits of making the minimum payment outweighs the cost

Answers

Making the minimum payment can offer benefits such as avoiding late fees, maintaining a good credit score, and preventing legal action from creditors.

Additionally, it allows the borrower to have some cash available for other expenses. However, the cost of making only the minimum payment can be significant in the long run. It increases the interest accrued on the amount owed, leading to higher overall debt and longer repayment periods.

Moreover, it can hinder the borrower's ability to attain financial stability and independence in the future. Thus, while making the minimum payment can provide advantages, it is essential to ensure that it is not a long-term strategy for managing debt.

Learn more about minimum payment here:

https://brainly.com/question/1891029

#SPJ1

On November 19, Nicholson Company receives a $18,600, 60-day, 10% note from a customer as payment on account. What adjusting entry should be made on the December 31 year-end

Answers

Answer and Explanation:

The adjusting entry is as follows

Interest receivable Dr ($18,600 × 10% × 42 days ÷ 360 days) $217

To Interest revenue $217

(being the interest revenue is recorded)

Here the interest receivable is debited as it increased the assets and credited the interest revenue as it also increased the revenue

The 42 days are calculated from Nov 19 to Dec 31

1. What are 2-3 reasons why the product (saving or investing) might be a good option for someone to use for growing their money?

2. What are 2-3 reasons why the product (saving or investing) might NOT be a good idea for someone to use for growing their money?

Answers

1. Some reasons why a savings account or investment can be a good option for someone to use to increase their money is that it generates long-term compound interest in addition to generating a security reserve.

2. And some reasons why a savings or investment might not be a good option for someone to increase their money is lack of information about both and high risk.

How to make good investments?It is essential that investors seek information about investments and their profile, in order to identify the best options in line with their desires and needs, in addition to diversifying their investment portfolio to reduce risks.

Therefore, saving and investing are positive methods to increase money, generate greater control over your financial resources and greater long-term security.

Find more about investments at:

https://brainly.com/question/27717275

#SPJ1

If the price of an item decreases, producers will create fewer of the item. This is due to the

A.

Law of Demand

B.

Law of Supply

C.

Law of Price

D.

Consumer Choice

Answers

Answer:

the answer is B,law of supply

What are The two segments of the organization's environment

Answers

What is a personal documentation?

What is the use?

Why is it important?

Thank you :)

Answers

Answer:

Personal documents are first-hand accounts of social events and personal experiences, and they generally include the writer's feelings and attitudes. They include such things as letters, diaries, photo albums, and autobiographies. Personal Documents may sometimes be referred to as Life Documents

Explanation:

Many other aspects of your life will run more smoothly with your documents in order. With well-organized health and prescription records, it is easier to stay on top of any health conditions you may have. The ability to lay hands on your insurance policies in the event of an issue arising will minimize stress too!

Can anyone please write a summery of everything that happened in the Great depression?

Answers

14. Sabino Inc. manufactures widgets at a variable

cost of $1.05 per unit and has a fixed cost of

$404,000. If the sales price is $2.50, how many must

be made and sold to break even?

A. 156,992

B. 278,621

C. 287, 301

D. Impossible to break even

Answers

Answer:

B. 278,621

Explanation:

The break-even point is equal to fixed cost divided by contribution margin per unit from the contribution margin concept.

Break-even point = Fixed costs/ contribution margin per unit

contribution margin per unit = selling price- variable cost

In this case,

fixed costs are $404,000.

selling price $2.50,

variable cost $1.05

Contribution margin per unit : $2.50-$1.05= $1.45

Break-even point = $404,000/ $1.45

=278,620.689

=278,621 units

evaluate the effects of many sources of power in the economy

Answers

The four production factors—natural resources, labor, capital equipment, and entrepreneurship—are what largely determine a country's economic power if GDP per capita growth is the primary metric.

A variety of electricity sources can have distinct consequences on an economy. These power sources can include, among others, the government, businesses, labor unions, financial institutions, and consumer advocacy organizations.

Governments have the authority to influence economic policy through laws, regulations, and fiscal and monetary policies. Taxation, government spending, interest rates, and other elements that affect the broader economy can be impacted by these policies.

Investing in infrastructure, generating jobs, and promoting economic growth are all things that entrepreneurship can do. On the national economy and local communities, their decisions about employment, pay, investment, and production may have a big impact.

Learn more about the Economy here:

https://brainly.com/question/30131108

#SPJ1

In a personal budget, which of the following is considered to be a fixed expense? A. Dinner at a restaurant B. A movie Ticket C. A personal trainer D. Apartment rent

Answers

Answer: Personal Trainer

Explanation: It's a personal budget.

Which educational institutions typically cost the most to attend?

vocational schools

community colleges

public universities

private colleges

Answers

Answer:

Private colleges

The educational institutions that typically cost the most to attend is the private school.

What is private school?Private school is defined as an independent school that is self-contained. They are not managed by state, local, or national governments and are also known as private schools, non-governmental, privately funded, or non-state schools. Private schools are often the most expensive educational institutions to attend.

Therefore, option D is correct.

Learn more about the private school, refer to:

https://brainly.com/question/14140754

#SPJ2

Why might a person choose to open a certificate of deposit (CD)?

Answer: B. to earn interest over time without risk.

Answers

Answer:

thanks!

Explanation:

cool

A person chooses to open a certificate of deposit to earn interest over time without risk on the investment.

What is a certificate of deposit?A type of financial instrument named a certificate of deposit (CD) given by banks and other financial institutions consider as a savings account with a higher interest rate than a standard savings account.

When you buy a CD, you deposit a specific amount of money with the financial institution for a set period of time, which might range from a few months to several years.

One of the primary advantages of CDs is that they provide higher interest rates than typical savings accounts. This makes them an appealing alternative for those who wish to conserve money while still earning a larger return on their investment.

Learn more about the certificate of deposit, here:

https://brainly.com/question/29620076

#SPJ2