Trout farming is a perfectly competitive industry and all trout farms have the same cost curves.

When the market price is $25 a fish, farms maximize profit by producing 200 fish a week. At this output, average total cost is $20 a fish and average variable cost is $15 a fish. Minimum average variable cost is $12 a fish.

Required:

i) If the price falls to $20 a fish, will a trout farm produce 200 fish a week. Explain why or why not?

ii) If the price falls to $12 a fish, what will the trout farmer do?

iii) What are two points on a trout farm's supply curve?

Answers

Answer:

(i) The farm can cover its revenue using its total variable cost, therefore the farm will continue producing 200 units

(ii) The farm cannot cover its revenue using its total variable cost, therefore the farm will shut down

(iii) The two relevant points on supply curve will be: (Price = $12 & Quantity = 0) and (Price = $25 & Quantity = 200)

Explanation:

(i)According to given data, When output is 200 but price is $20, this price is equal to ATC, so the farm breaks even. But since this price is higher than AVC of $15, the farm can cover its revenue using its total variable cost, therefore the farm will continue producing 200 units.

(ii) When output is 200 but price is $12, this price is equal to ATC, so the farm makes economic loss. Also, this price is lower than AVC of $15, so the farm cannot cover its revenue using its total variable cost, therefore the farm will shut down.

(iii) The farm's supply curve is the portion of its Marginal cost (MC) curve above the minimum point of AVC. Since price equals MC, the two relevant points on supply curve will be: (Price = $12 & Quantity = 0) and (Price = $25 & Quantity = 200).

Related Questions

Jamie Kerr is an hourly employee of Noonan Company located in Los Angeles. This week, Kerr had to travel to the company's regional office in Santa Fe. He left Sunday at noon and arrived in Santa Fe at 3:30 P.M. During the week, he worked his normal 40 hours in the Santa Fe office (Monday through Friday-9 A.M. to 5 P.M.). In addition, he attended the company's 3½-hour work training session on Wednesday evening. Kerr's hourly rate of pay is $26.90 per hour.

Round the interim computations to two decimal places and use the rounded answers in subsequent computations. Round the final answers to the nearest cent.

a. Kerr's overtime earnings for the week are

b. Kerr's total earnings for the week are

Answers

a) Kerr received $164.78 in weekly overtime pay. Individuals who work for a company and receive compensation are called employees. Under the heading "Income from salaries," earned salaries are taxable.

How does income relate to salary?For the purposes of income tax, the amount that an employee receives from his employer in any of the following forms during a fiscal year will be considered "Salary": Wages: Wages are a set amount of money that an employer pays its employees in exchange for their work.

In the Netherlands, what is the "30 rule"?Employees recruited from outside the Netherlands to temporarily work here can take advantage of the 30% facility. They are exempt from paying tax on up to 30% of their salary provided they meet the conditions for the 30% facility.

To learn more about income tax here:

https://brainly.com/question/17075354

#SPJ1

VIII. Victoria Rivera owns and manages a consulting firm called Prisek, which began operations on July 1. On July 31, the company's records show the following selected accounts and amounts for the month of July. Equipment $12000 Salaries expense$9000 Consulting revenue$36000 Cash $24000 Utilities expense$600 Note payable$7200 Accounts receivable$10500 V. Rivera, WithdrawalsYI$6000 Office supplies$4500 Rental revenue$1500 Advertising expense$1200 Prepaid insurance$3000 Accounts payable$3900 Note receivable$7500 Rent expense$6000 Unearned revenue$900.

Required

1. Prepare a July income statement for the business.

2. Prepare a July statement of owner's equity. The owner's capital account balance at July 1 was $0, and the owner invested $34,800 cash in the company on July 2.

3. Prepare a July 31 balance sheet. Hint: Use the owner's capital account balance calculated in part 2.

Answers

1. Total Revenue is $20,700.

2. Owner's Capital as of July 31 was $49,000.

3. The July 31 balance sheet shows assets of $61,500, liabilities of $12,000, and owner's equity of $49,500.

1. Income Statement for July:

$35,000. Consulting revenue

rental income of $1,500

Revenues totaled $37,500.

Salaries cost $9,000, so expenses total.

Expenses for utilities: $600

Cost of advertising: $1,200

Cost of rent: $6,000

Costs in total: $16,800

Total Revenue - Total Expenses equals Net Income.

$37,500 minus $16,800 is the net income.

2. Owner's Equity Statement for July:

Capital owned by Owner as of July1: $0

On July 2, the owner had invested $34,800.

$20,700 in net income

$6000 in owner withdrawals

Owner's Capital at July 31 is calculated as Owner's Capital at July 1 plus Owner's Investment plus Net Income minus Owner's Withdrawals.

Owner's Capital as of July 31 equaled $0 plus $34,800 plus $20,700 minus $6,000

3. July 31 The balance sheet

Assets:

$24,000 in cash; $10,000 in receivables

Inventories: $12,000

$4,500 for office supplies

$3000 in prepaid insurance

Amount Owed: $7,500

Assets in total: $61,500

Liabilities:

a payable note: $7,200

Accounts Payable: $3,900

Unearned Revenue: $900

Total Liabilities: $12,000

Owner's Equity:

Owner's Capital at July 31: $49,500

Total Liabilities and Owner's Equity: Total Liabilities + Owner's Equity

Total Liabilities and Owner's Equity = $12,000 + $49,500

Total Liabilities and Owner's Equity = $61,500

Therefore, the July 31 balance sheet shows assets of $61,500, liabilities of $12,000, and owner's equity of $49,500.

For more such questions on balance sheet

https://brainly.com/question/1113933

#SPJ8

Topic. The desire for people to attend meeting in my

organisation has gone down. As a newly employed

Secretary, explain three reasons why people dislike

meetings and discuss five factors that can make

For effective meetings

Answers

*Will mark for Brainliest if given the correct answer!*

What is the correct ICD-10-CM code for Obstructive hydrocephalus ?

Answers

Answer:

G91.1

Explanation:

It is a billable code.Simply it's too specific as there are unique ICD codes.It can be used for reimbursement process at any cause.Shelton, Inc. has sales of $435,000, costs of $216,000, depreciation expense of $40,000, interest expense of $21,000, and a tax rate of 35 percent. What is the net income for the firm? Suppose the company paid out #30,000 in cash dividends. What is the addition to retained earnings?

Answers

Answer:

The Income Statement is-

Sales = $435,000

Costs = 216,000

Depreciation = 40,000

EBIT= $179,000

Interest = 21,000

EBT = $158,000

Taxes = 55,300

Net income = $102,700

I have done this question before in my "Money Management" Dual enrolled class.

:)

The corporation distributed cash dividends of $30,000. The resulting net income will be $102,700.

What is the calculation?This is the income statement:

Sales = $435,000

Costs = 216,000

Amount depreciated: 40,000

EBIT= $179,000

Interest equals 21,00

EBT = $158,000

Taxes = 55,300

Profit = $102,700

In finance and business, net income (also known as total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income less its costs of goods sold, depreciation expenses, and amortization, interest payments, and taxes for a given accounting period.

It is calculated as the sum of all revenues, profits, and losses during the period less all expenses, losses, and gains. It has also been described as the net growth in shareholders' equity as a result of a company's operations. It's not the same as gross income, which solely deducts the cost of the things sold from revenue.

Learn more about net income, from:

brainly.com/question/15570931

#SPJ2

(−2,6) and (−12,2)? Write your answer in simplest form.

Answers

The addition of the decimal number that's given will be -14.8

How to calculate the decimals?It should be noted that decimal numbers are the numbers that have a whole number and the fractional part is separated by a decimal.

In this case, the addition will be:

= -2.6 + (-12.2)

= -2.6 - 12.2

= -14.8

In conclusion, the correct option is -14.8.

Learn more about decimals on:

brainly.com/question/1827193

#SPJ1

Windborn Company has 15,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $30 par common stock.

The following amounts were distributed as dividends:

20Y1 $30,000

20Y2 12,000

20Y3 45,000

Common Stock

(dividends per share)

I cannot figure out Y1 or Y3

Answers

The dividends per share for the common stock in year 1 (Y1) is $0.60 per share, and in year 3 (Y3) is $0.90 per share.

To calculate the dividends per share for the common stock in year 1 (Y1) and year 3 (Y3), we need to determine the total dividends distributed and divide them by the number of common shares outstanding.

Given information:

Cumulative preferred stock: 15,000 shares, 1% dividend

Common stock: 50,000 shares, $30 par value

Dividends distributed:

Y1: $30,000

Y2: $12,000

Y3: $45,000

First, let's calculate the dividends per share for the cumulative preferred stock in each year.

Dividends per share for cumulative preferred stock = (Par value * Dividend rate) / Number of preferred shares

Dividends per share for cumulative preferred stock = ($100 * 1%) / 15,000 shares

Dividends per share for cumulative preferred stock = $1 / 15,000

Dividends per share for cumulative preferred stock = $0.000067 per share

Now, let's calculate the dividends per share for the common stock in year 1 (Y1) and year 3 (Y3).

For Y1:

Total dividends for common stock = Dividends distributed - (Dividends per share for cumulative preferred stock * Number of preferred shares)

Total dividends for common stock = $30,000 - ($0.000067 * 15,000)

Total dividends for common stock = $30,000 - $1.005

Total dividends for common stock = $29,998.995

Dividends per share for common stock in Y1 = Total dividends for common stock / Number of common shares

Dividends per share for common stock in Y1 = $29,998.995 / 50,000 shares

Dividends per share for common stock in Y1 = $0.5999799 per share (rounded to $0.60 per share)

For Y3:

Total dividends for common stock = Dividends distributed - (Dividends per share for cumulative preferred stock * Number of preferred shares)

Total dividends for common stock = $45,000 - ($0.000067 * 15,000)

Total dividends for common stock = $45,000 - $1.005

Total dividends for common stock = $44,998.995

Dividends per share for common stock in Y3 = Total dividends for common stock / Number of common shares

Dividends per share for common stock in Y3 = $44,998.995 / 50,000 shares

Dividends per share for common stock in Y3 = $0.8999799 per share (rounded to $0.90 per share)

For such more question on dividends:

https://brainly.com/question/30360786

#SPJ8

PLC Ltd. found the following debts to be bad on the dates shown

Answers

The acronym PLC, which stands for a public limited company, indicates that the firm's shares are publicly traded. It is the British equivalent of "Inc." in the United States.

What is PLC?In the United Kingdom, a public limited company (PLC) is a type of public business. PLC is the counterpart of a publicly listed firm in the United States that uses the Inc. or corporation classification. The inclusion of the PLC acronym following a business's name is required, and it informs investors and anybody interacting with the firm that it is a publicly listed corporation. PLC, which stands for a public limited company, is an acronym for public corporations in the United Kingdom.

PLCs make up the majority of the firms listed on the London Stock Exchange. A PLC shares can be purchased by any regular investor. Unlike privately held companies, public companies are required to publish financial data and disclosures to the public on a regular basis.

Learn more about PLC

https://brainly.com/question/16602847

#SPJ1

You, a Captain, are a section chief in Military Personnel and 2d Lt Smith’s supervisor. Lt Smith is a Force Support Officer. She has been on active duty for a year and in her present job for 10 months. She supervises 21 enlisted personnel who perform a variety of administrative tasks in support of a tactical fighter wing. She majored in business administration in college, served 3 years as an administrative specialist, and was an E-4 before being accepted for OTS. As an enlisted member, she graduated from technical school as an honor graduate and was cited on numerous occasions for outstanding performance. Her supervisors considered her a valuable asset to the unit and an expert in her area of responsibility. She’s very enthusiastic about her work and plans to make the Air Force a career.

Lieutenant Smith took over her job 2 months after the unit had received a rating of “marginal” by the numbered Air Force Inspector General’s evaluation team. At the end of her first week on the job, Lt Smith called her NCOIC and key supervisors together and told them that she wouldn’t tolerate marginal performance, that she had previous experience in this type of work, and would be looking at the quality of their work very closely. Since that time, Lt Smith has attempted to supervise every phase of work in her office and, at times, has involved herself in even the most routine decisions. Lt Smith assigns people to certain jobs within the office, plans the work schedule, leave schedule, and does most of the counseling in the office.

In the last 6 months, Lt Smith has ordered several people to work overtime to complete routine work ahead of schedule. Each time this has happened, the NCOIC has asked the lieutenant for permission to speak to her immediate supervisor. On each occasion, the lieutenant has told the senior master sergeant he must not take these internal problems to you, because she’ll take care of any problems in her section--and the NCOIC should remember who writes his EPR.

Most of the time, when Lt Smith approaches the work or break area where the workers are congregated, she notices all conversation stops and the personnel won’t talk to her unless she addresses them first. After reviewing a report yesterday, Lt Smith became very impatient. She bypassed his NCOIC and took the report directly to the Airman who had typed it. While Lt Smith was berating the Airman about the typing errors, the NCOIC walked into the office and asked the Airman what the problem was. The lieutenant became flustered, told the NCOIC she was tired of doing his job for him, and shoved the report into his hands. Lt Smith then went into her office and slammed the door.

The NCOIC relayed this situation to you and asked for your help. How will you help? BACKGROUND

*ENVIRONMENT: Airforce Base

*PEOPLE INVOLVE: The Captain, Lt Smith, Airman and NCOIC.

PROBLEM DEFINATION

*Lt Smith Unprofessional Behavior

DIAGNOSIS

*Marginal Performance

*Previous Experience

*Enthusiastic With her Job

*Academic Credibility

Answers

The lieutenant Smith has taken leave, and everything is running smoothly. People are, however, more attentive when she is present. Decisions are being delayed, and morale was low. The and other important supervisors are worried which some people may decide to due to her supervision, leave the service style.

Several issues must be addressed as a result of this case study. Lieutenant Smith's micromanagement technique is causing morale issues and may lead to retention issues, which is one of the main concerns. It's also troubling that she's requesting people to work extra hours without proper authorization or regard for the impact on their personal lives.

As her boss, you ought to tackle these concerns with Lt Smith and advise her on proper supervisory techniques. You could advise her to delegate more responsibilities to her NCOIC and other key supervisors, and to concentrate in strategic planning and decision-making instead of micromanaging every detail. We should also emphasise the significance of adhering to proper procedures for authorising overtime and taking into account the impact on personnel.

Learn more about lieutenant, here:

https://brainly.com/question/30148992

#SPJ1

Why would you need a larger reserve fund?

Answers

Answer:

Having a reserve fund allows the board to fund these expenses without having to raise association dues or resorting to special assessments.

Explanation:

Computer-assisted telephone interviewing has replaced online survey research as the most popular method of

collecting data.

a. True

b. False

Answers

The statement "Computer-assisted telephone interviewing has replaced online survey research as the most popular method of collecting data." is false. Option B

What is Computer-assisted telephone interviewing?Generally, The Computer-Assisted Personal Interviews (CAPI) technique is a face-to-face data-collecting approach in which the interviewer utilizes a tablet, mobile phone, or computer to record responses made during the interview. This technique is also known as a computer-assisted telephone interview (CATI).

Computer-assisted telephone interviewing (CATI) is a method of conducting telephone surveys in which the interviewer is guided through the questions by a script that is generated by a software program.

In conclusion, The claim that computer-assisted telephone interviewing has surpassed online survey research as the most common approach of data collection is untrue.

Read more about Computer-assisted telephone interviewing

https://brainly.com/question/28964934

#SPJ1

credit economical definition.

Answers

Answer:

The credit definition in economics is any agreement where one party borrows money from a second party with the promise to pay the amount back with interest. Credit ranges from consumer loans and credit cards to corporate bonds. I hope it helps. : )

Explanation:

The economical definition of credit is the allowance of one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately but promises either to repay or return those resources at a later date.

good luck ;)

brainliest?✨

TIME REMAINING

53:22

Which of these is a banking activity of the Fed?

printing money

regulating securities markets

storing money for banks

funding government programs

Answers

Answer:

C

Explanation:

Answer:

C

Explanation:

ình hình tài sản của Cty SAO KIM, số 7, Lê VănTám , phường 9, Quận 10 tính đến ngày 31/12/2020 như sau :

Đvt: triệu đồng.

Tiền mặt 1,000

Tiền gửi ngân hàng 79,000

Phải trả người bán 110,000

1399Nguyên vật liệu 225,000

Vay ngắn hạn ngân hàng 120,000

Công cụ dụng cụ 5,000

Nguồn vốn kinh doanh 965,000

Lãi chưa phân phối 203,500

Xe tải 100,000

Dây chuyền công nghệ 500,000

Máy móc thiết bị 389,000

Phải thu khách hàng 100,000

Phải trả người lao động X

Yêu cầu:

1. Tìm X.

Answers

Project: Business Ventures – Part 3

This project will focus on using the principles of financing and financial statements covered in Chapters 1 & 2, to develop financial statements—an income statement and a balance sheet—for a business you choose. If you have already completed Business Ventures Part 1 and Part 2, you may continue to base Part 3 on that business, or you can start with a new business. Your main goal for this project is to create a table like the one shown below to develop your financial statements: an income statement and a balance sheet. Next, you will analyze the charts relating to an income statement and a balance sheet. Finally, you will decide what financing source you will use to expand your business and explain why you chose this source.

During this project you'll accomplish the following:

Objectives

Create a table and develop an income statement and a balance sheet.

Analyze charts relating to an income statement and a balance sheet.

Decide what financing source you will use to expand your business and explain why you chose this source.

Business Ventures - Part 3

Directions

1. Using the information learned in Unit 3, create a table like the one shown below to develop your financial statements: an income statement and a balance sheet.

Click here for a printable income statement.

Click here for a printable balance sheet.

2. Next, using the information from the charts shown below, analyze the information and explain how it relates to an income statement or a balance sheet.

img/img_is_graph_business_ventures3.gif

img/img_bs_graph_business_ventures3.gif

Write a paragraph to explain if the business had a net income or net loss. Why?

Write a paragraph to explain what the chart shows about the business's financial condition?

3. Now, based on your financial statements, decide what financing source (self-financing, friends and family, investors, loans, grants, or credit cards) you will use to expand your business and explain why you chose this source.

Question # 1

Long Text (essay)

Type your answers to the questions here:

Write a paragraph to explain if the business had a net income or net loss. Why?

Write a paragraph to explain what the chart shows about the business's financial condition?

Based on your financial statements, decide what financing source (self-financing, friends and family, investors, loans, grants, or credit cards) you will use to expand your business and explain why you chose this source.

Answers

Answer: The business shown in the graph had a net income or gain. The reason being is one quick glance shows that the business shows its revenue and assets in a teal blue. That teal blue is well above owners equity, total liabilities, and total expenses.

The chart shows that the business is doing great and is pulling in massive profits. The chart also shows that whatever the business is doing they can continue to do so for a while until market or economic changes occur that would render their strategies ineffective.

Based on my financial statements I would likely use self financing. At the very least in the initial stages of the business. This is because I'd rather not owe anyone for a business that doesn't even generate revenue yet. However after the business is stable and more money is needed for growth then I would entertain the possibility of getting a grant or seeking an investor.

Explanation: I'm not sure this is the best answer but this question is more opinion than anything, try taking my answer as an example and work off of that in order to make yours more unique.

Answer:

Based on the charts the company is making a Net Income because almost all four quarters had a profit. In order to find out if they had a profit or not, I added up the Total Revenue and Total Expenses. Total revenue made around $100,000 and the total expenses were around $61,000. I calculated that the company roughly made $39,000 in profit for that year.

The chart shows that the business is doing well and is attracting huge profits. The chart also shows that whatever the business is doing they can continue to do so for a while until market or economic changes make their strategies ineffective.

Based on my financial statements I would try to get a loan to help finance the company because the company is making a profit of 15%. With a profitable business with proof, it can be used to show that the company is able to pay of the loan and fees. This financial source is the best for my situation because the business is too large for funding from self financing and family or friends, is too small for Angel Investors, and is too much for a credit card. The loans allow the company to pay off at a gradual rate for a fixed term.

Explanation:

These were answers for when I finished the project.

EDGE 2021

**Please do not copy word for word**

Only use as an example so you don't plagiarise

A parking lot charges $2 per hour for the first 4 hours, then $3 per hour after that. Which equation(s) describes the total cost y as a function of the hours x?

Answers

Answer:

there are no options but i would say it’s probably close to y= 8 + 3x

A senior executive employed by a major consultancy was recently quoted as saying the following: 'As a result of the speed of change in the development of web and mobile technology, traditional concepts of MIS are now completely irrelevant.' a. Discuss the degree to which you agree OR disagree with this statement, with at least THREE supporting examples.

Answers

I disagree with the statement that states that "As a result of the speed of change in the development of web and mobile technology, traditional concepts of MIS are now completely irrelevant.'" because these concepts are still very relevant in organization using its data to facilate decision making.

What is a Management Information system?Basically, a management Information system refers to an idea that is associated with man, machine, marketing and methods for collecting of information from the internal, external source and, then processing such information for the purpose of facilitating the process of decision-making of the business.

Read more about MIS

brainly.com/question/26477014

#SPJ1

Dawson Toys, Ltd., produces a toy called the Maze. The company has recently established a standard cost system to help control costs and has established the following standards for the Maze toy:Direct materials: 6 microns per toy at $1.50 per micron Direct labor: 1.3 hours per toy at $21 per hourDuring July, the company produced 3,000 Maze toys. Production data for the month on the toy follow:Direct materials: 25,000 microns were purchased at a cost of $1.48 per micron. 5,000 of these microns were still in inventory at the end of the month.Direct labor: 4,000 direct labor-hours were worked at a cost of $88,000.Required: 1. Compute the following variances for July:a. The materials price and quantity variances.b. The labor rate and efficiency variances.

Answers

Answer:

1. a. The materials price and quantity variances

Material price variance: Standard cost per micron is $1.50 and actual cost per micron is $1.48. So, price variance is 1.48 - 1.5 = $(0.02) per micron

Quantity variance: Based on standard bill of material, Dawson Toys need 3,000 x 6 = 18,000 microns to produce 3,000 Maze toys. Actual consumption volume is 25,000 - 5,000 = 20,000 microns. So, quantity variance is 20,000 - 18,000 = 2,000 microns.

1. b. The labor rate and efficiency variances

Actual labor rate = Actual labor cost / Actual hour = 88,000/4,000 = $22 per hour.

Efficiency variance = Actual labor rate - Standard labor rate = 22 - 21 = $1 per hour.

2. Prepare a brief explanation of the possible causes of each variance.

Direct material cost variance: Total actual material cost is 20,000 x 1.48 = $29,600, higher than standard material cost of 18,000 x 1.5 = $27,000. This is mainly due to higher production waste as compared to standards.

Direct labor cost variance: Total actual labor cost is $88,000, higher than standard labor cost of 4,000 x 21 = $84,000. This is mainly due to lower labor rate per hour than expected.

Explanation:

Using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C, determine the federal income tax withholding and calculate the net pay of the following employees. They are paid semimonthly.

C. Pare | Married, Filing Jointly, dependents < 12 = 2 | Pay $1,720

S. Lightfoot | Single, 1 Other dependents | Pay $3,265

Answers

The federal income tax withholding for C. Pare is $700.80, and the net pay is $159.20. Since the calculated federal income tax withholding exceeds the gross pay, the net pay for S. Lightfoot is negative. This is not possible, so there may be an error in the input data.

For C. Pare

Determine the gross pay for one pay period

$1,720 / 2 = $860

Calculate the annual salary

$860 x 24 = $20,640

Calculate the taxable income

$20,640 - (12,800 + 2,000) = $5,840

Find the appropriate tax bracket and calculate the federal income tax withholding

Taxable income falls in the 12% tax bracket for married filing jointly.

$5,840 x 0.12 = $700.80

Calculate the net pay

Gross pay - Federal income tax = Net pay

$860 - $700.80 = $159.20

Therefore, the federal income tax withholding for C. Pare is $700.80, and the net pay is $159.20.

For S. Lightfoot

Determine the gross pay for one pay period

$3,265 / 2 = $1,632.50

Calculate the annual salary

$1,632.50 x 24 = $39,180

Calculate the taxable income

$39,180 - (12,800 + 2,000 + 2,000) = $22,380

Find the appropriate tax bracket and calculate the federal income tax withholding

Taxable income falls in the 22% tax bracket for single filers.

($22,380 - $9,875) x 0.22 + $987.50 = $3,018.70

Calculate the net pay

Gross pay - Federal income tax = Net pay

$1,632.50 - $3,018.70 = -$1,386.20

Since the calculated federal income tax withholding exceeds the gross pay, the net pay for S. Lightfoot is negative. This is not possible, so there may be an error in the input data.

To know more about income tax here

https://brainly.com/question/30206522

#SPJ1

i'll give brainliest!!! Which descriptions offer examples of Governance workers? Check all that apply.

Tia writes and votes on federal legislation.

Herman prepares and oversees responses to earthquakes.

Isaiah performs basic office tasks for a court of law.

Willis makes sure that people and businesses pay their taxes.

Valerie analyzes public opinions and voting results.

Chong maintains weapons and armored vehicles for the US Army.

Answers

Answer:

A, B, and E

Explanation:

Answer:

A,B,E

Explanation:

on edg 2020 your welcome luv<3

What situation best illustrates the role of businesses in the circular flow of goods?

A. A taxi driver take a group of students to the airport.

B. A website sells the products made by many different companies.

C. A company makes a new line of kitchen appliances.

D. A factory produces steel used in cars and trucks.

Answers

A company makes a new line of kitchen appliances is the situation best illustrates the role of businesses in the circular flow of goods. Thus, option (c) is correct.

What is businesses?The term “business” refers to earning a benefit. The business is taking the risk and gaining the benefit. The business is in the main concentrated on the activities of the creative activity, organization, and merchandising of concepts.

A process of the businesses in the circular flow of goods. It was the market situation basis to create the new line of products on such as kitchen appliances. It was the different from their usual production line.

As a result, the significance of the company makes a new line of kitchen appliances are the role of the businesses are the aforementioned. Therefore, option (c) is correct.

Learn more about on businesses, here:

https://brainly.com/question/15826604

#SPJ1

a company bought a new machine for its warehouse on january 1. whats the book value of the new machine on december 31. paid $10,000 in cash. financed the rest of the purchase price

Answers

It can be noted that the book value of the machinery by December 31 is $36000.

How to calculate the book valueFrom the complete information, the purchase price of the machinery will be:

= $10000 + $2000 + $30000

= $42000

Annual depreciation will be;

= $500 × $12

= $6000

Therefore, the book value will be:

= $42000 - $6000

= $36000

Learn more about book value on:

https://brainly.com/question/23057744

The book value of the new machine on December 31 of the first year is $45,000.

What is book value?The book value of an asset is the purchase cost less the accumulated depreciation.

Assume that the asset was purchased for $50,000 on January 1, and depreciation is at 10% per year.

Data and Calculations:

Cost of asset = $50,000

Depreciation rate = 10%

Depreciation expense = $5,000 ($50,000 x 10%)

Book value on December 31 = $45,000 ($50,000 - $5,000)

Thus, the book value of the new machine on December 31 of the first year is $45,000.

Learn more about depreciation methods at https://brainly.com/question/25530648

The correlation between absenteeism and turnover is ______ the correlation between tardiness and turnover.

Answers

The correlation between absenteeism and turnover is stronger than the correlation between tardiness and turnover.

Absenteeism simply refers to a pattern where an employee misses work without giving a good reason. Turnover is the number of an employer's workforce that must be replaced as a result of the separation of employees from the workplace.

It should be noted that the correlation between absenteeism and turnover is stronger than the correlation between tardiness and turnover. When employees continually don't come to the office, this will lead to the employers looking for someone to fill in for them.

Read related link on:

https://brainly.com/question/25525397

Why is a bank more likely to offer you credit if you have a cosigner?

Answers

Answer:

Because a cosigner is another person who is also responsible for ensuring the loan is paid.

Explanation: A cosigner is a person who is signing on to the loan and by doing so, they are jointly taking on responsibility for repayment of the loan. So basically loan repayment is being guaranteed by the person taking out the loan and the cosigner.

Simba Company’s standard materials cost per unit of output is $9.68 (2.20 pounds x $4.40). During July, the company purchases and uses 2,970 pounds of materials costing $15,741 in making 1,500 units of finished product. Compute the total, price, and quantity materials variances

Answers

Unfavorable price variance = 2,673

Unfavorable quantity variance = 1,452

Favorable total materials variance = 2,673

What is the definition of gross income?

Answers

Gross income refers to the total income earned by an individual, business, or entity before any deductions or expenses are subtracted.

Gross income is typically calculated on an annual basis, representing the total income earned over a specific period, usually a fiscal year. It serves as a starting point for determining taxable income, which is the amount on which taxes are assessed.

It is important to note that gross income does not account for any deductions or expenses, such as taxes, operating costs, depreciation, or other business expenses. These deductions are subtracted from the gross income to arrive at the net income or taxable income, which is the actual amount on which taxes are levied.

For individuals, gross income includes wages or salaries earned from employment, income from self-employment or freelancing, rental income, investment income, and other sources. It is reported on the individual's tax return and is used to determine their tax liability.

For such more question on income:

https://brainly.com/question/14510611

#SPJ8

Sandler Industries manufactures plastic bottles for the food industry. On average, Sandler pays $70 per ton for its plastics. Sandler's waste-disposal company has increased its waste disposal-charge to $57 per ton for solid and inert waste. Sandler generates a total of 500 tons of waste per month. Sandler's managers have been evaluating the production processes for areas to cut waste. In the process of making plastic bottles, a certain amount of machine "drool" occurs. Machine drool is the excess plastic that drips off the machine between molds. In the past, Sandler has discarded the machine drool. In an average month, 190 tons of machine drool is generated. Management has arrived at three possible courses of action for the machine drool issue

Required:

What is the annual cost of the machine drool currently?

Answers

Based on the amount of drool generated, the cost of the plastics, and the disposal cost, the annual cost of the machine drool is $289,560.

What is the annual cost of the machine drool?This can be found as:

= Material cost of machine drool - Disposal cost

Material cost = (Machine drool generated per month x Number of months in year x Cost of each ton of drool)

Disposal cost = (Machine drool generated per month x Number of months x disposal charge)

Solving gives:

= (190 x 12 x 70) + (190 x 12 x 57)

= 159,600 + 129,960

= $289,560

Find out more on annual cost of waste at https://brainly.com/question/10910406.

Then create a newspaper article/blog post/video (information/explanatory writing) to explain the factors a

consumer should consider when buying an automobile.

Answers

A self-propelled passenger vehicle for land transport that typically has four to eight tyres and is powered by an internal combustion engine or an electric motor. Automobile engineering refers to the branches of engineering that deal with the design and manufacturing of automobiles.Automobiles now play a significant role in our lives, which cannot be imagined without the modern world's luxuries. Because the automobile is used for both passenger and cargo transportation, it is a human lifeline. An automobile is a human-controlled vehicle that is not driven by humans.The number of doors, the arrangement of seats, and the roof structure are frequently used to categorise automotive body designs. Roofs on automobiles are traditionally supported by pillars on each side of the body.

To know more about Automobile, click on the link :

https://brainly.com/question/14908350

#SPJ1

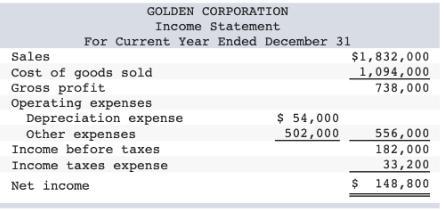

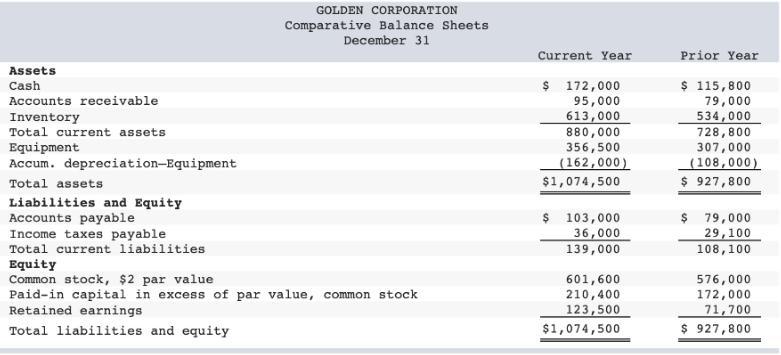

golden corporation's current year income statement, comparative balance sheets, and additional information follow. for the year, (1) all sales are credit sales, (2) all credits to accounts receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to accounts payable reflect cash payments for inventory, and (5) any change in income taxes payable reflects the accrual and cash payment of taxes.

Answers

At December 31, there was $1,72,000 in cash.

According to the information provided in the inquiry, the company's net income is $148,800.

The following adjustments are made to net income to net cash generated by operations:

the comparative balance sheet as follows

The accounts had a decrease of $16,000.

-$79,000 worth of inventory has increased.

An increase in accounts payable of $24,000

The increase in income taxes due is $6,900

The amount deducted for depreciation is $54,000.

There is $138,700 in net cash provided by operating activities.

money flows from investing activities: $49,000 in equipment purchases

Net cash used for investing was $49,000 less.

financial activity cash flows: money obtained from stock issuing Paid in cash: $64,000 for cash dividends $ -97,000

$33,000 less was used to finance activities on net.

Net cash growth (decline) $56,200

Cash on hand as of December 31 of the previous year: $157,800

cash on hand as of At December 31, there was $1,72,000 in cash.

To learn more about Comparative balance sheet:

https://brainly.com/question/20344808

#SPJ4

On the first day of the fiscal year, a company issues a $970,000, 9%, 5-year bond that pays semiannual interest of $43,650 ($970,000 x 9% × 1/2), receiving cash of $884,171. Journalize the entry for the issuance of the bonds.

Answers

Answer:

Dr Cash 884,171

Dr Discount on bonds payable 85,829

Cr Bonds payable 970,000

Explanation:

Since the bonds were sold at a lower price than par value, they were sold at a discount. That discount on bonds payable = total face value - cash received when issuing the bonds = $970,000 - $884,171 = $85,829