to initiate an arbitrage trade if a futures contract is overpriced, a trader should: group of answer choices go short the futures, borrow at the risk-free rate, and buy the underlying asset. go long the futures, short the underlying asset, and invest the proceeds at the risk-free rate. go short the futures, short the underlying asset, and invest the proceeds at the risk-free rate.

Answers

To initiate an arbitrage trade if the futures contract is overpriced, the trader should: A. borrow at the risk-free rate, short the asset, and sell the futures.

Trading called arbitrage takes advantage of the minute price discrepancies between identical or comparable assets in two or more marketplaces. In order to profit on the price discrepancy, the arbitrage trader purchases the item on one market and simultaneously sells it on another market. This situation has more intricate permutations, but they all on finding market inefficiencies.

Arbitrage traders, often known as arbitrageurs, typically work for major financial organizations. It often entails trading a substantial sum of money, and the split-second chances it presents may only be recognized and taken advantage of using extremely sophisticated algorithms.

To know more about arbitrage trade visit:

https://brainly.com/question/27994067

#SPJ4

Related Questions

income tax how will it affect a pharmacy business?

Answers

Answer:

the tax deduction will be used to reduce current year profits.

Toni Nicolet's

checking account balance on Monday, April 13, is $540; her savings balance is $980. On

Tuesday, April 14, she made an ATM withdrawal from checking of $86. On April 15, Toni plans to make

these online payments: income tax bill, $823, utility bill, $98, and charge account bill, $127. How much

money, if any, will Toni have to transfer into her checking account from savings to cover the online

payments and leave a balance of $50 in the checking account?

Answers

Answer:

$644

Explanation:

Toni has a balance of $540 on her checking account

She made an ATM withdrawal of $86

The balance on her checking account after withdrawal is

= $540 - $86

=$454

Toni intended to pay online payments on Arpril 15. The total of the payments

=$823 + $98 + $127

=$1048

It means Toni has a deficit of

=$454- $1048

=($594)

If Toni desires a balance of $50 after payments, she must withdraw 594+50 from the savings account.

=596 + 50

=$644

Which of the following are true?

I. Risk-averse individuals require compensation for taking risks

II. Risk neutral individuals ignore risk

III. Risk avoiders chose only riskless assets

A. I and II

B. I, II, and III

C. III only

D. II and III

E. Not enough information to tell

Answers

Risk-averse individuals require compensation for taking risks, and risk-neutral individuals ignore risk. The correct answer is A: I and II.

I. Risk-averse individuals require compensation for taking risks: This statement is true. Risk-averse individuals have a preference for lower levels of risk and seek to minimize their exposure to risk. They require compensation in the form of higher returns or rewards to engage in activities that involve risk.

II. Risk-neutral individuals ignore risk: This statement is true. Risk-neutral individuals do not consider the level of risk when making decisions. They are indifferent to risk and base their decisions solely on expected returns or outcomes.

III. Risk avoiders choose only riskless assets: This statement is not mentioned in the given information, so we cannot determine its validity. Therefore, the correct answer is A: I and II.

In summary, risk-averse individuals require compensation for taking risks, and risk-neutral individuals ignore risk. The information provided does not give any indication about whether risk avoiders choose only riskless assets, so it cannot be determined.

Learn more about assets here

https://brainly.com/question/30830369

#SPJ11

help!

A way to establish a good credit record is to:

A) Borrow to the maximum individual credit limit

B) Pay bills when they are due

C. Use credit as little as possible or not at all

D) Use credit when income is unreliable

Explain why?

Answers

Answer:

B) Pay bills when they are due.

Explanation:

A loan can be defined as an amount of money that is being borrowed from a lender and it is expected to be paid back at an agreed date with interest.

Generally, the financial institution such as a bank lending out the sum of money usually requires that borrower provides a collateral which would be taken over in the event that the borrower defaults (fails) in the repayment of the loan.

A credit score can be defined as a numerical expression between 300 - 850 that represents an individual's financial history and credit worthiness. Therefore, a credit score determines the ability of a borrower to obtain a loan from a lender.

This ultimately implies that, the higher your credit score, the higher and better it is to obtain a loan from a potential lender. A credit score ranging from 670 to 739 is considered to be a good credit score while a credit score of 740 to 799 is better and a credit score of 800 to 850 is considered to be excellent.

Generally, it's recommended that loans or bills are paid on a timely basis or as at when due in order to obtain a good credit score.

Hence, a way to establish a good credit record (score) is to pay bills when they are due.

mark is interested in becoming a bio

Answers

Answer:

ok

Explanation:

Blackmon Brothers law firm used 165 legal pads over the last three weeks (15 days). It takes them three days to get more, and they want to keep two day's worth as a safety stock. How low can their stock get before they need to order more?

Answers

Answer:

55 legal pads.

Explanation:

The level at which Blackmon Brothers should order more legal pads is the re-order point.

The calculate re-order point, we require

Average daily usage

Delivery lead time

Safety stock is needed.

For Blackmon, Average daily usage will be 165 divided by 15 days

=165/15

=11 legal pads per day.

Lead time is 3 days

Formula for getting the re-order point

= (average daily usage x delivery time) + requires safety stock

For Black man

= (11 x 3)+ (11 x 2)

=33 + 22

=55 legal pads.

They should re-order when they have a balance of 55 legal pads.

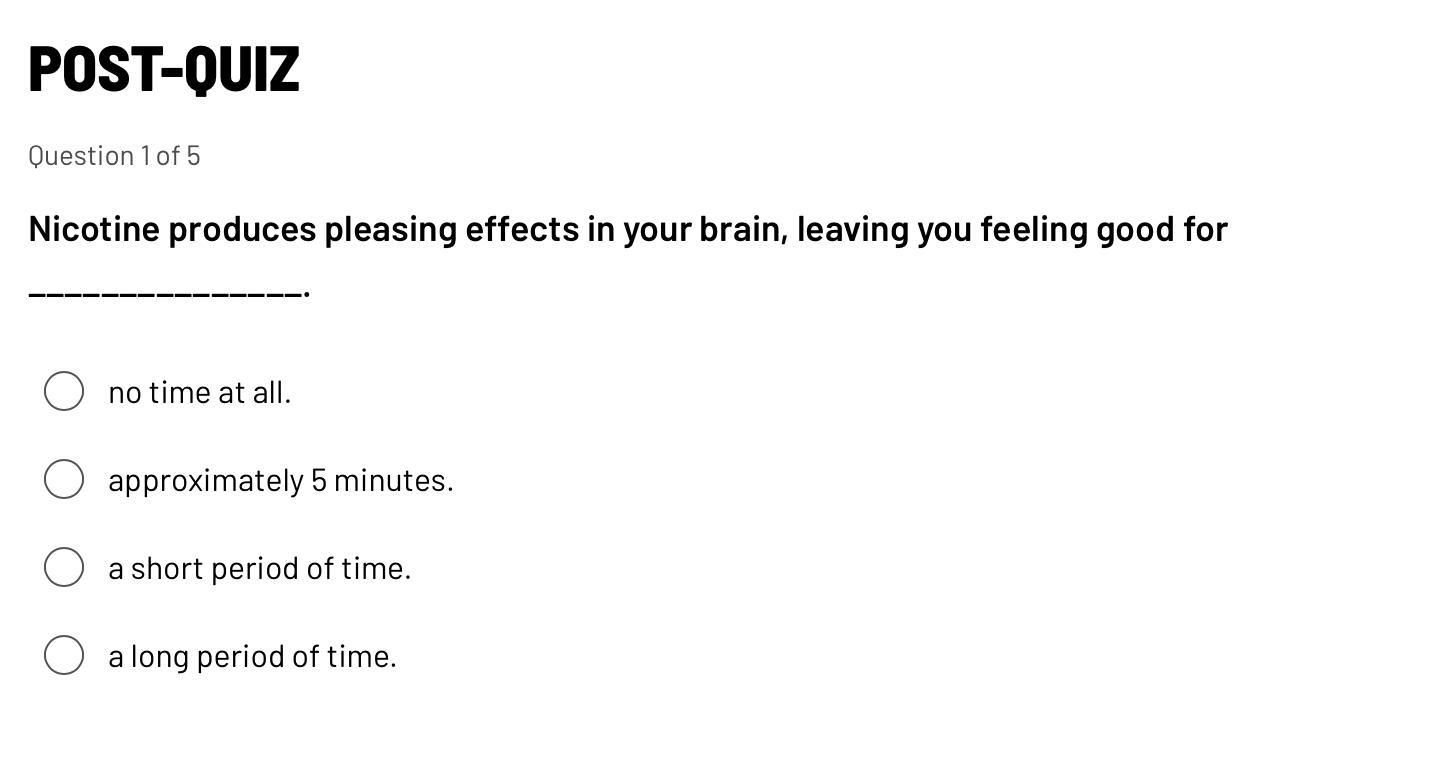

Help pls I need help

Answers

Answer:

The answer is "a short period of time".

Answer:

a short period of time

Explanation:

i dont know lol

during march, a firm expects its total sales to be $161,000, its total variable costs to be $95,100, and its total fixed costs to be $25,100. the contribution margin for march is:

Answers

The contribution margin is the amount left from sales revenue after variable costs have been subtracted. To calculate the contribution margin for March, we can subtract the total variable costs from the total sales.

Contribution Margin = Total Sales - Total Variable Costs

Contribution Margin = $161,000 - $95,100

Contribution Margin = $65,900

Therefore, the contribution margin for March is $65,900. This means that for every dollar of sales revenue generated, $0.41 (or 41%) is available to contribute towards covering fixed costs and generating profit. The contribution margin is a key metric for understanding a company's profitability and helps managers make decisions about pricing, cost control, and resource allocation.

Learn more about sales revenue

https://brainly.com/question/21290956

#SPJ4

The Trial Balance is an early indicator of the quality of accounting control systems as it highlights an equal level of Debit and Credit Accounts. Explain errors that might not be highlighted in the Trial Balance. (Note: need detailed and thorough explanation)

Answers

The Trial Balance is used to show the equality of Debit and Credit accounts. It is not a conclusive proof of the accuracy of accounts or errors.

Trial Balance is a statement of the equality between the Debit and Credit columns of an accounts ledger. It ensures the accuracy of accounting data and helps detect any errors in the ledger.

However, it is not a conclusive proof of the accuracy of accounts. There are errors that might not be highlighted in the Trial Balance. The following errors are likely to be omitted:

Error of omission: When an account is omitted entirely from the ledger, this is known as an error of omission. As a result, it will not be recorded on the Trial Balance, which implies that the Debit and Credit columns will be unequal.

Error of commission: When an entry is entered on the wrong side of the ledger, this is known as an error of commission. As a result, it will be recorded on the Trial Balance, however the Debit and Credit columns will not be equal.

Error of principle: When a transaction is entered into the ledger with an incorrect classification, this is known as an error of principle. As a result, it will be recorded on the Trial Balance, however, the Debit and Credit columns will not be equal.

Compensating errors: Two mistakes that offset each other, resulting in an equal amount of Debit and Credit columns, are known as compensating mistakes. As a result, the Trial Balance will indicate that there is no mistake in the accounts, despite the fact that there are two mistakes.

To learn more Error of omission about visit:

https://brainly.com/question/31185173

#SPJ11

What is a source of equity financing?

A. securing short-term loans from a family member

B. receiving trade credit from suppliers

C. selling personal assets to raise funds

D. securing government loans

E. borrowing money from friends

Answers

All taxpayers can make tax payments using a direct debit from their bank account.

True

False

Answers

Answer:

false

Explanation:

how much money does a therapyst make an hour/ and how much would they make in a year

Answers

a year = the median annual salary for clinical, counseling, and school psychologists was $85,340 per year, according to the Bureau of Labor Statistics. The lowest 10 percent of workers earned less than $44,040, and the highest 10 percent earned more than $129,310.

Answer:

Explanation:they make 1,000 dollars per hour. I don’t know how much in a year.

Arrange the following revenues in the federal government, from greatest to

least.

Drag each item to put them in the correct order.

(2 points)

= excise taxes

= Social Security and Medicare taxes

= corporate income taxes

= individual income taxes

= customs duties

= miscellaneous revenue

Answers

Social Security and Medicare taxes

Corporate income taxes

Excise taxes

Custom duties

miscellaneous revenue

How do depreciating assets hurt your financial health?

a. They decrease your net worth.

b. They increase your discretionary spending.

d. They lower your FICO score.

c. They increase your equity.

Answers

Answer:

A

Explanation:

net worth is based on assets and income so if assets decrease your net worth decreases

Design thinking is based on the needs of the designer.

True

False

Answers

Answer:

True

Explanation:

The founders of the U.S. wanted to avoid establishing a permanent aristocracy or group of wealthy families who could control a great deal of the nation’s wealth. How is this idea related to estate and gift taxes?

Answers

Answer:

There are two points that I would like to single out that are very similar. First by implementing tax and gift taxes, Founding Father wanted to weaken families and business of that time, since there was a threat that rich families could become permanent aristocracy which over time could lead to the point where that families will rule the US. Second, by implementing those two taxes, government is taking a share from receivers since the receivers are getting some good that they did not earn it, they have just received it as a gift or as an estate. This way inheritance or gift would be of a much lesser value then it was before someone’s death or before someone made a gift. This was important because wealth of powerful families would just accumulate and grow so government of that time, strictly out of political reasons, prescribed those two taxes, so that the wealth will be smaller of value after tax.

The idea of avoiding an aristocracy by the founders of USA is related to estate and gift taxes because:

There was a need to reduce the influence of the wealthyAccording to the given question, we are asked to show the link which the founders of America had to preventing aristocracy and imposing estate and gift taxes.

As a result of this, we need to remember than an aristocracy is a government based on the wealthy and influential members of the society and this was one of the things which the Founding Fathers of America sought to prevent.

With this in mind, we can see that they imposed gift and estate taxes which was specifically targeted at the extremely wealthy so that their influence would be reduced and the country would not become an aristocracy.

Read more here:

https://brainly.com/question/20830385

The extras people may ask for must be priced along with other items. You must decide ahead of time what those items will

be and how much you will charge for them. How will you do that?

Answers

In a restaurant, customers must be informed about the payment of extras, which must be communicated clearly and accurately in the company's media.

Why is customer communication essential?Clear and honest communication is able to attract consumers, as in marketing communication, as well as to explain a company's rules and procedures, generating reliability and value.

Therefore, payments for extras in a restaurant must be communicated in advance so that customers do not feel cheated and know exactly what they will pay for.

Find out more about communication here:

https://brainly.com/question/25645043

Taxes on cigarettes are designed to a. lower the price to reflect their true benefits b . encourage farmers to grow more tobacco . raise the price to reflect their true costs d. restrict sales to government-owned stores

Answers

Answer:

c

Explanation:

A tax is a compulsory sum levied by the government or an agency of the government on goods and services. Taxes increases the price of a good. the aim of tax on cigarettes is to increase the price of cigarettes. this should discourage consumption of cigarettes. taxes on cigarette reflect the true cost of consuming cigarettes

Which of the following is NOT a career and technical student organization mentioned in the presentation?

Answers

Answer:

FHA or Computers for Kids

purchased grooming equipment for $12,700

Answers

Answer:

who spends that much-

Explanation:

okay good job on the server Andrew and it they said

(2.04) Which type of market has the least competition?

a) Oligopoly

b) Monopoly

c) Pure competition

d) Monopolistic competition

Answers

The type of market that has the least competition is B. Monopoly.

What happens in a monopoly?A monopoly sets its own price rather than accepting the market price as given. In order to make the most profit feasible, it chooses from its demand curve the price that corresponds to the quantity the firm has decided to produce. the establishment of new businesses.

A single seller of commodities is created in a monopoly market by variables such as a government license, resource ownership, copyright, patent, and high entry costs. These characteristics collectively prevent other sellers from entering the market. Monopolies also have access to information that other merchants do not.

Monopolies are typically highly profitable when there is no significant competition. While businesses compete constantly to gain market share, obtaining actual monopoly status is difficult.

This shows that monopolies have the least amount of competition in them, with a single firm basically controlling the market.

Find out more on monopolies at https://brainly.com/question/7217942

#SPJ1

An oil company hires an engineering firm to help them comply with environmental laws. What is this an example of?

Answers

Answer:

Human Capital

Explanation:

The engineering firm has the experience and certain skills that are able to help defining a Human Capital.

Opportunity Cost

in order to

v something else.

Opportunity cost is what must be

Opportunity cost forces consume

lucers to make

received

given up

replaced

Answers

given the following scenario, select the best business organization.camille and john would like to start a business together. john would handle bookkeeping and customer service, and camille would make natural soaps and aromatherapy products. they plan to start a

Answers

John would manage bookkeeping and customer service while Camille made natural soaps and aromatherapy goods, thus a partnership would be best for them.

Two or more people own, manage, and profit from a partnership. Camille and John, who have complementary skills, are starting and running the business. Camille and John may collaborate, share resources, and divide up the work in a partnership. Camille's soap-making and aromatherapy skills would enhance the business's main offering, while John's bookkeeping and customer service skills would assure smooth operations. Partnerships simplify legal requirements and decision-making. Camille and John can create a partnership agreement that covers profit-sharing, obligations, and conflict resolution. Camille and John's best option for collaborating and using their expertise in the natural soaps and aromatherapy market is a partnership.

To know more about complementary skills

https://brainly.com/question/17185458

#SPJ11

how long does it take for tax refund to show in bank account after approved

Answers

Answer:

Assuming no issues, IRS issues tax refunds in less than 21 calendar days after IRS receives the tax return. IRS has an on-line tool, "Where's My Tax Refund", at www.irs.gov that will provide the status of a tax refund using the taxpayer's SSN, filing status, and refund amount.

Explanation:

influences of Business environment,

Answers

Factors that Influence the business environment are :

Economic environmentSocial environmentTechnological environmentPolitical environmentLegal environment

The business environment means the total of all the individuals, and institutions that could affect the working of the business firm.

Importance of business environment:

Business environments help the firm to prepare itself for every possible obstruction or hindrance that can affect the functioning of the firm.It also helps the firm to adjust to frequent changes.The economic environment is all the things that create an economic impact on the firm.

The social environment is all the traditions and customs of the society that creates an impact on the firm.

The technological environment is all the impact on the firm caused due to new technology and upgradations.

The political environment is the conditions and behavior that the elected representatives hold toward the business

The legal environment is entirely based on the rules and legislation of the authorities.

For more about Business Environment refer to the link : https://brainly.com/question/26589766

which situation is an example of skimming?

a) pop-up windows on a computer asking for you pin

b) a retailer scanning your credit card to steal its number

c) bank statements stolen from your garbage

d) a phone call from someone pretending to be a bank employee

Answers

Answer:

B.) a retailer scanning your credit card to steal its number

Explanation:

Which statement is true for a short-term goal?

A.

It is usually complex.

B.

It usually requires one to exert a lot of effort.

C.

It is usually related to the bigger things that you want to achieve.

D.

It usually takes less than a year to achieve.

Answers

Answer:

I would say D because it sounds more reasonable for me

budgeted performance considers all of the following in relation to a benchmark: (select all that apply). multiple select question. past performance factors economic factors industry factors company factors

Answers

The budgeted performance considers economic factors ,industry factors and company factors.

What is Performance Budgeting?A performance budget accounts for both the input of resources and the output of services for every organization. Performance Budgeting aims to identify and score relative performance for specified outcomes based on attainment of objectives.

The economic factors involve the efficient use of resources. The overall objective of an organization including both short-term and long-term objectives is included in the company factor. The industry factor is used to compare the performance of a industry with other similar industries.

The economic factors, industry factors and company factors act as benchmark for budgeted performance.

To know more about performance budgeting click here:

https://brainly.com/question/15465389

#SPJ1

Find a news headline that refers to the business cycle. What phase of the business cycle does your headline reference? Explain.

Answers

Answer:

The business cycle typically consists of four phases:

Expansion: This phase is characterized by increasing economic activity, rising GDP, low unemployment rates, high consumer confidence, and increased business investments.

Peak: The peak represents the highest point of economic expansion before the cycle starts to slow down.

Recession: This phase marks a slowdown in economic activity. It is characterized by declining GDP, rising unemployment, reduced consumer spending, and decreased business investments.

Trough: The trough represents the lowest point of the business cycle. It is the phase where the economy reaches its bottom before starting to recover.