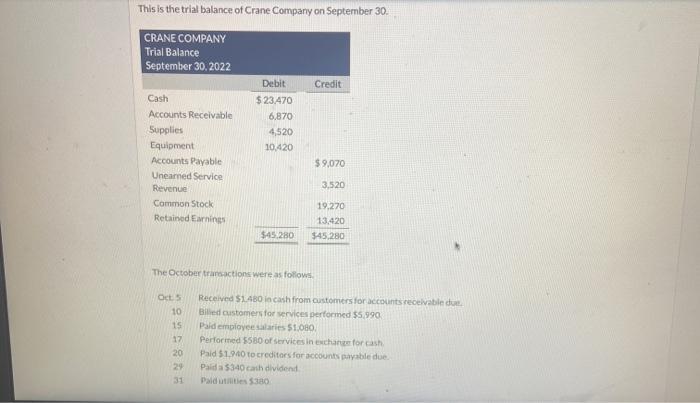

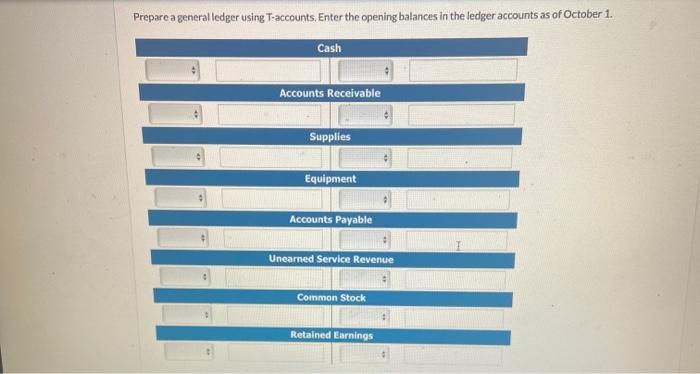

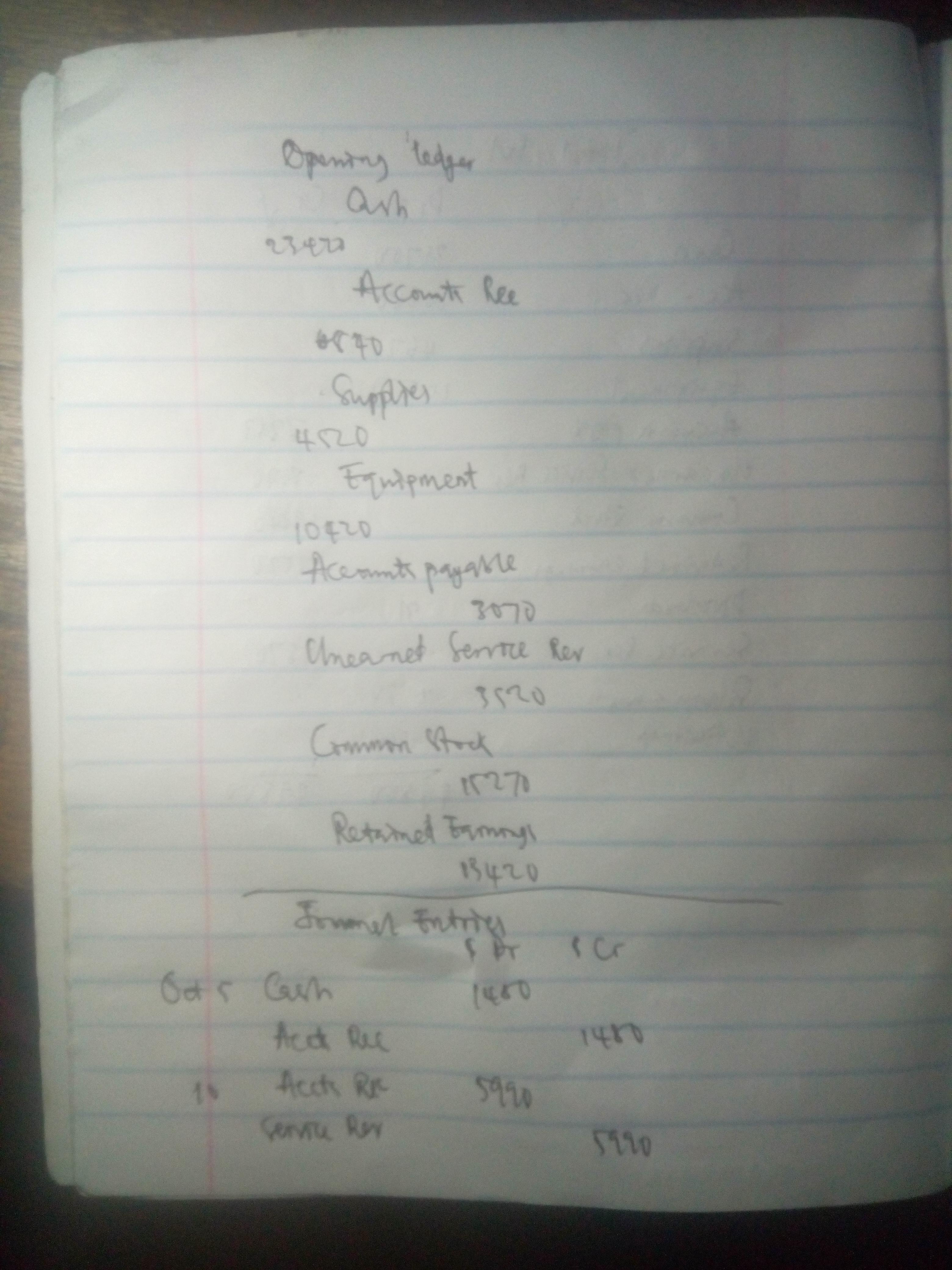

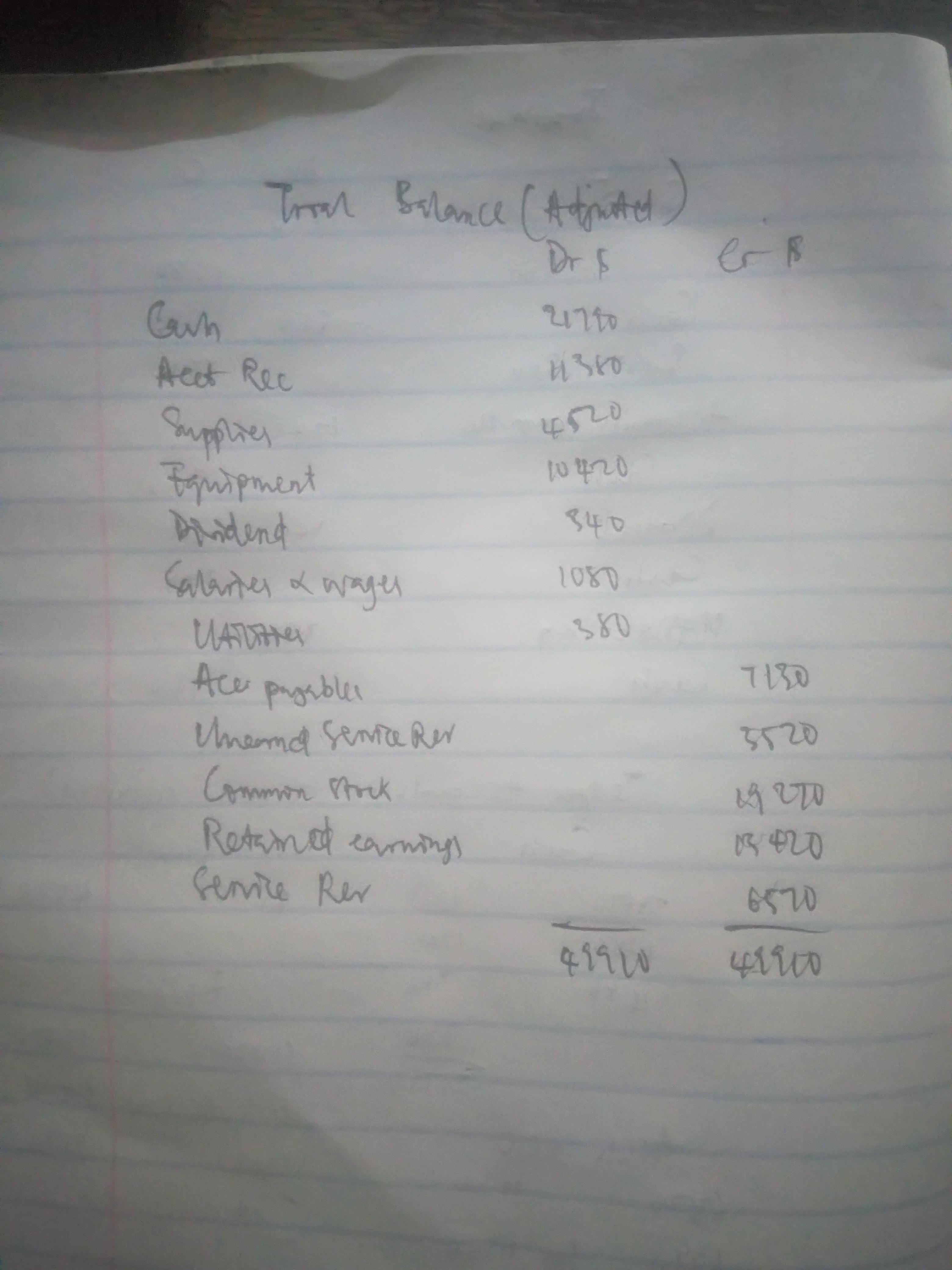

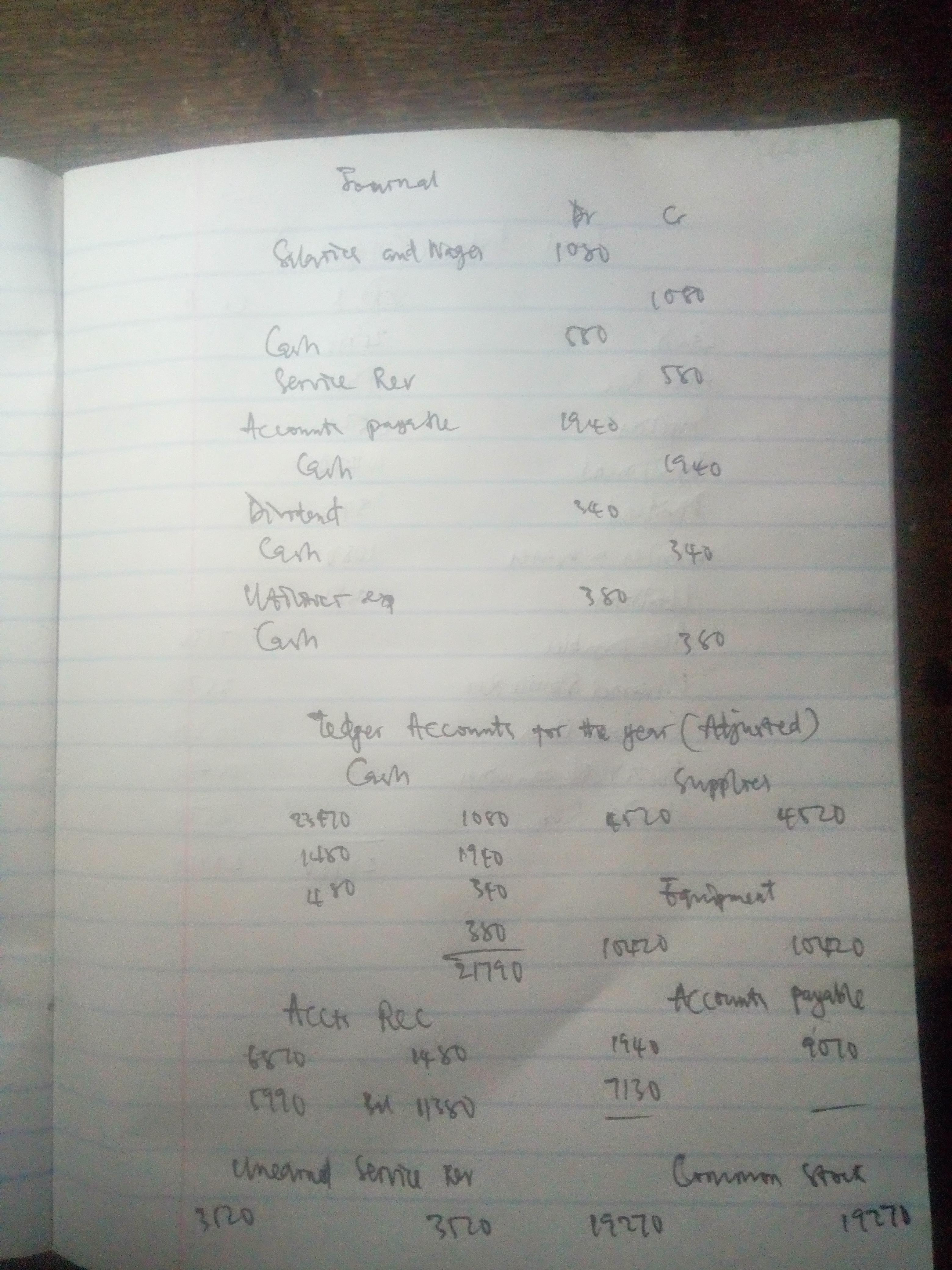

This is the trial balance of Crane Company on September 30. CRANE COMPANY Trial Balance September 30, 2017 Debit CreditCash $ 23,860 Accounts Receivable 7,260 Supplies 5,040 Equipment 10,940 Accounts Payable $ 9,460Unearned Service Revenue 4,040Common Stock 19,660Retained Earnings 13,940 $47,100 $47,100The October transactions were as follows.Oct. 5 Received $1,370 in cash from customers for accounts receivable due.10 Billed customers for services performed $5,850.15 Paid employee salaries $1,260.17 Performed $580 of services in exchange for cash.20 Paid $1,830 to creditors for accounts payable due.29 Paid a $340 cash dividend.31 Paid utilities $470.Prepare a general ledger using T-accounts. Enter the opening balances in the ledger accounts as of October 1. Journalize the transactions. Post to the ledger accounts. Prepare a trial balance on October 31, 2017.

Answers

Find full question attached

Answer and Explanation:

Answer and explanation attached

Related Questions

* Distinguish between Accounts Receivable and

Account Payable.

Answers

Explanation:

Accounts receivable is money owed to a company by its debtors.

Account payable amounts due to vendors or suppliers for goods or services received that have not been yet paid for.

Answer:

Accounts receivable are the amounts owed to a company by its customers. it is an asset to the company

accounts payable are the amounts that a company owes to its suppliers.it is a liability to the company

Explanation:

Read each statement about trademarks, trade secrets, copyrights, and patents, select the TWO True statements.

Select 2 correct answer(s)

Question 11 options:

Trade Secrets are confidential information which may be sold or licensed.

A Trademark protects a brand name.

A Patent is used to protect an original work, like music.

A Copyright is used to protect a company logo.

Answers

The two correct statements are

Trade Secrets are confidential information that may be sold or licensed.A Trademark protects a brand name.What is a trade secret?Any procedure or technique used by a firm that is often kept a secret from the public is considered a trade secret. The unlawful disclosure and use of sensitive information, often known as trade secret misappropriation, is subject to some legal protection.

The brand names and logos that are used on products and services are protected by trademarks. The purpose of a trademark is to safeguard items that help customers recognize a company in the marketplace, and logos are one of the most crucial identifying tools.

Learn more about Trademarks, here:

https://brainly.com/question/11668233

#SPJ1

explain the components of National income

Answers

National income is the total value of all goods and services produced within a country's borders, including both goods produced by domestic firms and foreign firms operating within the country. The components of national income include:

1. Wages and salaries: This includes the income earned by employees for their work, including both hourly wages and salaries.

2. Profits: Profits are the income earned by businesses after they have paid all their expenses, including salaries, rent, and other costs.

3. Rent: Rent is the income earned by landlords for the use of their property, such as land or buildings.

4. Interest: Interest is the income earned by lenders for lending money to borrowers, such as banks or other financial institutions.

5. Dividends: Dividends are the income earned by shareholders for their ownership of a company's stock.

6. Indirect taxes: Indirect taxes are taxes that are levied on goods and services, such as sales taxes or value-added taxes.

7. Subsidies: Subsidies are payments made by the government to businesses or individuals to encourage certain activities, such as the production of certain goods or services.

8. Depreciation: Depreciation is the decrease in value of an asset over time, such as a piece of machinery or a building.

Together, these components make up the total national income of a country, and they provide a measure of the overall health and productivity of the economy.

Letters with already formatted fonts and fields are called:

A. Files

B. Templates

C. Themes

D. Views

Answers

Answer: B. Templates

For an auditor of an issuer, critical audit matters should be communicated in the critical audit matters section, which:

Immediately follows the Basis for Opinion section

Answers

Yes, critical audit matters should be communicated in the critical audit matters section, which immediately follows the Basis for Opinion section.

In the given question for an auditor of an issuer, critical audit matters should be communicated in the critical audit matters section and we have to find which Immediately follows the Basis for Opinion section.

Yes, that is correct. The critical audit matters section of an auditor’s report typically immediately follows the Basis for Opinion section. The critical audit matters section contains the auditor’s communication of any matters that the auditor believes are of most significance to those who use the financial statements.

To learn more about auditors link is here:

brainly.com/question/28457117

#SPJ4

If you could vote today who would you vote for Trump/ Biden or someone else. I would vote for someone else.

Answers

Answer:

Lauren boebert

Explanation:

Tony’s business has been struggling for a while his marketing strategy has not worked with the consumers his business has reached the stage words market value is an all time low Tony plans to sell his business Gavin an entrepreneur has been interested in buying Tony’s business for a while currently Gavin is in an ideal position to buy Tony’s business because it is ___ (fill in the blank)

Answers

Answer:

selling

Explanation:

Approximately how many forms does the IRS currently have?

O 8

O 80

O 800

O 8000

Answers

Option (c) 800 is correct.

Approximately the IRS currently have 800 forms.

What is IRS?The Internal Revenue Service is the revenue service for the federal government of the United States and is in charge of collecting federal taxes as well as overseeing the Internal Revenue Code, which is the main section of federal statutory tax legislation.IRS Notice 2014-21 outlines the tax implications of transactions involving convertible virtual currencies for both individuals and companies. Virtual currency is regarded as property for federal tax purposes. Transactions using virtual currency are subject to the general tax principles that apply to real estate transactions.Learn more about IRS here:

https://brainly.com/question/8949559

#SPJ13

a benelovent social planner chooses to produce less than the equlibrium quantity of a good is?

Answers

A benevolent social planner chooses to produce less than the equilibrium quantity of a good making the price of that current good higher.

Who is a producer?A producer is a person who creates or manufactures a good or a commodity, whether it is a finished good or a semi-finished good. These are essentially commodity makers.

The benevolent social planner would make sure that the purchasers attach a greater value to that final unit of manufacturing than it cost to manufacture the said unit. As attaining an equilibrium will imply that there will not be any loss with the firm will have to bear.

Learn more about producer, here:

https://brainly.com/question/28714356

#SPJ1

Explain the types of FDI

Answers

Explanation:

Typically, there are two main types of FDI: horizontal and vertical FDI. Horizontal: a business expands its domestic operations to a foreign country. In this case, the business conducts the same activities but in a foreign country. For example, McDonald's opening restaurants in Japan would be considered horizontal FDI.

suppose gabriel and nia are playing a game that requires both to simultaneously choose an action: up or down. the payoff matrix that follows shows the earnings of each person as a function of both of their choices. for example, the upper-right cell shows that if gabriel chooses up and nia chooses down, gabriel will receive a payoff of 6 and nia will receive a payoff of 1.

Answers

The payoff matrix that Gabriel and Nia follows shows the earnings of each person as a function of both of their choices actually depicts the zero-sum between two players.

What is Payoff Matrix?A double entry table, similar to another Table, serves as the reward matrix or payoff matrix and contains all of the payments made by one player to the other for each chosen strategy. The game is known as zero-sum since one player's payment equals the other player's gain.

The calculation in above payoff matrix can be illustrated by the given case scenario;

The matrix must have n & m cells and include a total of 2 n m payoff values if the row player has n strategies and the column player has m strategies. In a payout matrix, the row player's name is listed to the left of the matrix, while the column player's name is listed above the matrix.

Thus the game of payoff matrix is known as zero-sum since one player's payment equals the other player's gain.

Learn more about Payoff Matrix refer:

https://brainly.com/question/7656949

#SPJ1

A project kick off meeting is usually conducted to:

Setup project team and announce the PM assignment

To draft project charter

Build up team spirit

Define project scope and develop WBS

Answers

A project kick-off meeting is usually conducted to set up the project team and announce the PM assignment. Thus, option A is correct.

What is the project?A project is a collection of activities that must be finished in order to achieve a goal. A project can be thought of as a set of results and effects required to achieve a particular goal.

In this meeting there are lots of details that are given, and a new announcement is also made about the same, sometimes a project manager is also introduced during which the PM mandate is also disclosed. Therefore, option A is the correct option.

Learn more about project, here:

https://brainly.com/question/15404120

#SPJ1

George was in an automobile accident. According to the police report, he was responsible for causing the wreck. The accident was large enough to close down the interstate for an hour. The three people in the other car were rushed to the hospital. The costs associated with the rescue and medical care were $18,000 for each person. Based on the facts of the case, which of the following statements is true?

I. George can expect his PAP premiums to increase in the future.

II. George will be personally liable for any excess damages not covered by insurance.

III. George’s future liability will be exempt if he can prove that he was covered at the state insurance minimum level.

a. I and III only.

b. I and II only.

c. III only.

d. I only.

Answers

Answer:

c. III only.

Explanation:

George is responsible for the damages caused but it is also out of control from the George since he does not willingly does the accident. His liability turn out to be $18,000 for the medical care that the victims of the accident incurred. He can exempt his future liability if he can prove that he was covered at state insurance.

At the end of 2011, the XYZ city deferred Br. 40,000 in property taxes, and that

amount is reflected in the beginning balance sheet is recognized as revenue for

2012.

Answers

At the end of 2011, the XYZ city deferred Br. 40,000 in property taxes, which means that the city did not recognize this amount as revenue in the 2011 financial statements. Instead, it carried it forward as a liability on the beginning balance sheet for 2012.

In 2012, the Br. 40,000 deferred property taxes are recognized as revenue, reflecting an increase in the city's financial resources. This recognition follows the accrual accounting principle, where revenue is recognized when it is earned, regardless of when the cash is received. By recognizing the deferred property taxes as revenue in 2012, the city accurately reflects its financial position and performance for that year.

The recognition of the deferred property taxes as revenue in 2012 will impact the city's income statement, increasing its revenue figure, and potentially affecting its net income or surplus. It also signifies the city's ability to generate resources from property taxes, which can contribute to funding public services and projects within the XYZ city.

For more such questions on taxes

https://brainly.com/question/28798067

#SPJ11

Which of the following is NOT one of the three main steps discussed in this course to ensure the safety and well-being of children in your care?

Answers

What is not the in the three main steps discussed in this course to ensure the safety and well-being of children in your care is to stay informally. This is further explained below.

What is safety?Generally, safety is simply defined as a state of safety, guaranteeing that one will not be put in harm's way.

In conclusion, Which of the following is NOT one of the three essential measures to ensure the safety and well-being of children in your care?

Read more about safety

https://brainly.com/question/2964363

#SPJ1

Résumés should include the following:

your contact information

education history

family history

work history

Answers

Answer:

Education history

Explanation:

When you are looking for a job more than liky the job wants to know what school you went to and what level of education you have. Most job said you can take it right after high school some other job tell you you have to go through college other what a whole different school or training you have to go through.

Isaiah is in his 50s and currently does not have a retirement fund. However, he recently read a few articles about the insufficient savings of people in retirement and, as a result, he decides he wants to start now. He saves $500 per month for 15 years and earns 7% by investing in the stock market* through an index fund.

1. How much of the total did Isaiah contribute himself?

2. How much money did Isaiah make through compounded returns in this investment account?

Answers

Answer:

1255

Explanation:

gh\\667

An effective contract writing will describe all _________________ to be conveyed or excluded in the sale in detail.

Answers

An effective contract writing will describe all terms and conditions to be conveyed or excluded in the sale in detail.

An effective contract writing will describe all the essential elements and provisions to be conveyed or excluded in the sale in detail. These elements encompass a wide range of aspects that need to be clearly defined to ensure the rights, obligations, and expectations of both parties are accurately outlined.

Firstly, the contract should outline the identification of the parties involved, including their legal names, addresses, and any other pertinent details that establish their identities. This ensures clarity and avoids any confusion regarding the individuals or entities responsible for fulfilling the contract's terms.

Next, the contract should explicitly define the subject matter of the sale. This includes a comprehensive description of the goods, services, or property being transferred, along with any specifications, quantities, quality standards, or other relevant details. Clearly stating what is included and what is excluded in the sale helps prevent misunderstandings and potential disputes in the future.

Furthermore, the contract should outline the purchase price or compensation, including any payment terms, installment schedules, or contingencies. It should specify the currency in which the payment will be made and any applicable taxes, fees, or additional costs that may be incurred during the transaction.

Additionally, the contract should cover the timeframe and conditions of the sale, including delivery or transfer dates, inspection and acceptance procedures, and any warranties or guarantees provided by either party. It should also address any contingencies or conditions that must be met before the sale can be completed.

Moreover, an effective contract writing should incorporate provisions related to the allocation of risks and liabilities. This includes clarifying who bears responsibility for loss or damage during transit or after delivery, as well as any limitations of liability or indemnification clauses that protect the parties involved.

Lastly, the contract should address dispute resolution mechanisms, such as arbitration or mediation, to provide a framework for resolving conflicts should they arise. It should also include provisions related to the termination or cancellation of the contract and any associated penalties or remedies.

In conclusion, an effective contract writing comprehensively describes all the terms and conditions to be conveyed or excluded in the sale. By addressing the aforementioned aspects in detail, the contract minimizes ambiguity, establishes clear expectations, and protects the interests of both parties involved in the transaction.

for more such questions on contract

https://brainly.com/question/27899951

#SPJ8

I need some help please and thank you

Answers

Answer:

Education..

Explanation:

Hope i helped u

Ship Co. produces storage crates that require 29.0 meters of material at $0.50 per meter and 0.35 direct labor hours at $13.00 per hour. Overhead is applied at the rate of $14 per direct labor hour. What is the total standard cost for one unit of product that would appear on a standard cost card

Answers

Answer:

Total standard cost per unit= $23.95

Explanation:

First, we need to allocate overhead:

Allocated MOH= Estimated manufacturing overhead rate* Actual amount of allocation base

Allocated MOH= 14*0.35= $4.9

Now, the total direct material and total direct labor:

Direct material= 29*0.5= $14.5

Direct labor= 0.35*13= $4.55

Finally, the total cost per unit:

Total standard cost per unit= 4.9 + 14.5 + 4.55

Total standard cost per unit= $23.95

Which of the following Lean principles reflects the ability of a customer to move through a process? a) Value b) Flow c) Pull d) Perfection

Answers

Answer:

The correct answer is A) Customer Value

Explanation:

Value is always defined by the paradigm of the Customer.

It starts with the end product in mind then works back to how the product can be achieved, each time modifying the process until all waste is eliminated.

Everything along the production or manufacturing chain that does not contribute to the end-value expected by the customer is eliminated.

Cheers!

These are sets of opinions, thoughts, and feelings an audience member might have on a topic that are not necessarily deeply held, and are therefore subject to change.

Answers

The definition corresponds to the concept of prejudice, because it involves a set of opinions, thoughts, and feelings.

A prejudice is a concept from the Latin praeiudicium that refers to an opinion, thought, or feeling (usually negative) that a person has formed about something or someone in advance and without prior knowledge.

Prejudice is the action and effect of establishing a definition or a meaning for something before the opportune time, that is, before knowing it in depth.

Note: This question is incomplete because the question is missing. Here is the complete question:

What concept does this definition correspond to?Learn more in: https://brainly.com/question/6997476

Cheyenne Corp., a private corporation, received its articles of incorporation on January 3, 2024. It is authorized to issue an unlimited

number of common shares and $1 preferred shares. It had the following share transactions during the year:

Jan. 12

24

July 11

Oct. 1

Issued 47,000 common shares for $5 per share.

Issued 890 common shares in payment of a $5,479 bill for legal services.

Issued 940 preferred shares for $25 per share.

Issued 9,400 common shares in exchange for land. The land's fair value was estimated to be $51,700. Cheyenne's

accountant estimated that the fair value of the shares issued might be as high as $6 per share.

What is the average per share amount for the common shares???

Answers

The average per share amount for the common shares of Cheyenne Corp. is approximately $4.9787.

To calculate the average per share amount for the common shares of Cheyenne Corp., we need to determine the total amount of money received from the issuance of common shares and divide it by the total number of common shares issued.

Let's calculate the total amount of money received from the issuance of common shares:

Jan. 12: 47,000 common shares issued for $5 per share

47,000 common shares × $5 per share = $235,000

Now, let's calculate the total number of common shares issued:

Jan. 12: 47,000 common shares issued

The total number of common shares issued is 47,000.

Next, we can calculate the average per share amount for the common shares:

Average per share amount = Total amount of money received / Total number of common shares issued

Average per share amount = $235,000 / 47,000

Average per share amount ≈ $4.9787

Therefore, the average per share amount for the common shares of Cheyenne Corp. is approximately $4.9787.

It's important to note that the calculation assumes that there were no other common share issuances or transactions throughout the year. If there were additional issuances or transactions, they would need to be considered to calculate an accurate average per share amount.

for more such question on shares visit

https://brainly.com/question/28452798

#SPJ8

PLEASE HELP!!!! WILL GIVE BRAINLIEST!!!

Is the second one correct (the answer I chose is in blue)

Answers

Hadley, a business researcher, believes that organizations will have to spend a lot of money on employee health care in the future. Her colleague Owen argues that organizations will not have to increase their spending on employee health care benefits. Which statement weakens Owen's argument

Answers

Answer: A. The fastest-growing share of the workforce is at least 55 years old.

Explanation:

The options to the question are:

A. The fastest-growing share of the workforce is at least 55 years old.

B. The fastest-growing age group is workers 16-25, who are prone to having accidents.

C. The largest proportion of the labor force is expected to be in the 16- to 25-year age group.

D. The total cost of labor in the United States will decrease considerably in the near future.

E. The labor force is expected to grow at a greater rate by 2026 than at any other time in U.S. history.

From the question, we are informed that Hadley, a business researcher, believes that organizations will have to spend a lot of money on employee health care in the future while Owen argues that organizations will not have to increase their spending on employee health care benefits.

The statement that weakens Owen's argument is that the fastest-growing share of the workforce is at least 55 years old. This simply means there are more old people incthe the workforce and that means there'll be more tendency for them to go to hospitals when ill compared to youths who'll be stronger.

SCC Co. reported the following for the current year:

Net sales $ 59,000

Cost of goods sold $ 48,800

Beginning balance in inventory $ 3,100

Ending balance in inventory $ 9,100

Compute (a) inventory turnover and (b) days’ sales in inventory.

Hint: Recall that inventory turnover uses average inventory, and days’ sales in inventory uses the ending balance in inventory."

Answers

Answer:

a. The inventory turnover is 8.00 times

b. The days’ sales in inventory is 68 days

Explanation:

a. In order to calculate the inventory turnover we would have to use the following formula:

inventory turnover=cost of goods sold/average inventory

inventory turnover=$ 48,800/($3,100+$ 9,100)/2

inventory turnover=8.00 times

b. In order to calculate thedays’ sales in inventory we would have to use the following formula:

days’ sales in inventory=(Ending invenory/cost of goods sold)*365

days’ sales in inventory=($9,100/$48,800)*365

days’ sales in inventory=68 days

answer with one of your favorite nicknames given to you, and one you've given to someone else

Answers

My favorite nickname I gave someone would be "shortstack", to my brother who is shorter than me. And my favorite nickname I am was given would be pippy, in refer to Pippi longstock.

You ordered a pizza from a store that does not have home delivery. Which of these was provided by this transaction?

a good

both goods and services

a service

Answers

Answer:

Explanation:

3

What will produce more accurate results when giving a survey?

A. Using the word "frequently" in a question

B. Creating face-to-face interviews

C. Adding boxes to check for answers

D. Creating an open questions

Answers

Answer:

Option B; Creating face-to-face interviews

Explanation:

Research has shown that face-to-face interviews tend to produce more accurate results when giving a survey. So the correct answer is option B.

00 For Market failures means that the market has not achieved its optimum production outcome. This means that it has not produced the correct quantity of goods and services. QUESTION 1 Conduct a research to any small business that is manufacturing goods in your community. Make an appointment to interview the owner for the purpose of collecting the information using the questionnaire below. 1.1 General information: ● Name of the firm / business Specify the type of goods or service ● ● Position of the person interviewed ● Date of the interview 1,2 Explain briefly the negative impact the following factors have in your business. (10) Lack of information: ● Price discrimination Immobility of factors of production with special reference to: Physical capital Structural changes ● ● (1) ● (1) (1) (1) [14] QUESTION 2: Interview 3-4 community members that reside near the business you have visited. 2.1 Ask them to name any TWO negative externalities and TWO positive externalities caused by the local business, (2 x 2) (4) 2.2 Request them to list any TWO characteristics of public goods. (2 x 1) (2) 2.3 Use the negative externality and positive externality graphs to explain the impact this business have to the society (10) [16]

Answers

The first step in researching a small business in your neighborhood is to find a suitable nearby manufacturing company.

Once you do, contact the manager or owner to arrange an interview. Gather general information during the interview, such as the name of the company or business, what types of products or services they provide, the interviewer's position, and the time and date of the interview.

Then, focus on the detrimental effects different situations can have on the company. Briefly describe the impact on business of informational gaps, price discrimination, immobility of production variables (with a focus on physical capital), and structural changes.

Interview three to four locals who live close to the establishment you just visited. Ask them to list two unfavorable and two beneficial externalities brought about by the neighborhood business. Ask them to add two properties of public goods to the list as well.

Finally, use the data from the interviews to create graphs showing the positive and negative externalities of business on society. These infographics will graphically describe the costs and benefits that the company's neighborhood has.

Learn more about business, here:

https://brainly.com/question/15826604

#SPJ1