_____ refers to the ability to change supply chain configurations in response to longer-term changes in the environment and technology. a.alignment b.agility c.adaptability d.authority brindly

Answers

Adaptability refers to the ability to change supply chain configurations in response to longer-term changes in the environment and technology. The correct option is C. adaptability.

The correct answer to the question is "adaptability." Adaptability in supply chain management refers to the capability to make adjustments in the supply chain configuration in response to changes in the environment and technology in the long term. It involves the capacity to anticipate changes and prepare for them accordingly to maintain a competitive edge in the market. An adaptable supply chain is one that can quickly respond to unforeseen circumstances such as natural disasters, economic disruptions, and customer demands.

In essence, adaptability helps businesses remain relevant and responsive in a constantly evolving marketplace. Supply chain managers must develop an adaptable supply chain by leveraging emerging technologies, implementing efficient processes, building strong supplier relationships, and prioritizing flexibility and agility. With a highly adaptable supply chain, businesses can keep up with changing market demands and stay ahead of the competition.

To know more about the supply chain click here:

https://brainly.com/question/28165491

#SPJ11

Related Questions

10)

How might a mission statement help Donna with her new

business?

Answers

A mission statement can help Donna with her new business by providing clarity and direction for her venture. It serves as a guiding statement that outlines the purpose, values, and goals of the business.

It helps Donna align her decisions, actions, and strategies with the overall mission, facilitating focus and consistency in her business operations. A mission statement is a concise statement that articulates the purpose and core values of a business. It outlines what the business aims to achieve and how it intends to operate. For Donna, having a mission statement for her new business can provide several benefits.

Firstly, it helps Donna define the purpose and direction of her business. It clarifies the reason for starting the business and what it aims to accomplish, providing a sense of focus and clarity.

Secondly, a mission statement helps Donna communicate her business's values and principles to stakeholders, including employees, customers, and investors. It sets the foundation for building a strong company culture and aligning everyone's efforts toward a common goal.

Lastly, a mission statement can serve as a guide for decision-making and strategy development. When faced with choices or challenges, Donna can refer to her mission statement to ensure that her actions align with the overall purpose and values of her business.

A mission statement plays a crucial role in helping Donna with her new business by providing clarity, guiding decision-making, and aligning stakeholders toward a common vision.

In conclusion, a mission statement can significantly benefit Donna in her new business. It provides clarity and direction, communicates values to stakeholders, and guides decision-making and strategy development. By establishing a mission statement, Donna can effectively define her business's purpose and goals, foster a strong company culture, and make informed decisions that align with her business's overall mission. This helps create a solid foundation for success and growth in her new venture.

To know more about goals, visit:

https://brainly.com/question/25534066

#SPJ11

Which of the following best defines goal?

a. aim or purpose

b. disregard or disrespect

c. freedom from doubt

d. influence

Answers

Because a goal is a target that your trying to accomplish

After settling a legal dispute, Frank must chose one of two settlement

payment options. He can either receive an immediate lump sum payment of

$250,000, or he can receive an installment payment package with annual

payments of $25,500 spread out over a span of 10 years. Which would likely

be more beneficial to him, and why?

A. The installment package would be better because it would prevent

him from spending all of his money immediately.

B. The immediate payment would be better because it is more

money overall.

C. The immediate payment would be better because he could use the

money immediately to invest it in a safe, low return account.

D. The installment package would be better because he'll have more

money in 10 years than with the lump sum.

Answers

After settling a legal dispute, Frank must choose The immediate payment of $250,000, because it would be better as he could use the money immediately to invest it in a safe, low-return account. Therefore, option C is the correct option.

What is investing?

Investing or investment is a financial term. It is both a tool and a source to generate wealth and income. Investment means putting the money in respect of an object, as the value of the objects differs with time so the value of the money will also differ accordingly. This fact about investment makes it both, risky and profit-making at the same time.

Thus, after a legal dispute is resolved, Frank must select the $250,000 immediate payment because it would be preferable because he could use the money right away to invest it in a secure, low-return account. As a result, choice C is the best one.

Learn more about investment here:

https://brainly.com/question/15105766

#SPJ2

Police are investigating the site of a convenience store robbery. The glass door was

broken, and it looks as if several packages of cigarettes are missing from behind the

counter. One police officer notices a man walking past the store and gets an odd

feeling about him. He stops the man and insists on searching his pockets. Inside the

man's pockets, police find several packs of cigarettes. They arrest the man and

charge him with the crime. Unfortunately, the judge throws out the charges. What is

MOST likely the judge's reason for dismissal?

A-The man is under 18 years old.

B-The man did not have money to post bail.

C-The policeman did not have probable cause to search the man.

D-The policeman did not have enough evidence that the man was the robber.

Answers

The MOST likely judge's reason for dismissal is the policeman did not have enough evidence that the man was the robber. Thus the correct option is D.

What is Robbery?Theft or robbery is defined as the stealing of someone else's property without their permission and using force or a threat of force that exhibits fear in them to perform any action against them.

To prove a crime against someone requires one to submit enough evidence which helps to establish the claim as the justice system is based on evidence not on arguments.

In the given case, police found the activity of the men suspicious as they found cigarette packets from him. There is no evidence that he has stolen the cigarette packets might be possible he has purchased them.

So due to a lack of evidence against the person the Judge dismissal the case. Therefore, option D is appropriate.

Learn more about Robbery, here:

https://brainly.com/question/19151712

#SPJ2

4. Determine the importance of environment conservation from the business viewpoint

Answers

Answer:

Economic expansion is not what is causing the climate crisis; rather, the lack of effective public policy meant to lower greenhouse gas emissions is to blame. As long as regulations are in place to limit the environmental effects of the goods and services we produce and use, there is no conflict between capitalism and environmental protection. With those regulations in place, consideration for environmental sustainability can and will be factored into every decision made by the private, nonprofit, and governmental organizations from which we all benefit.

The sustainability of the environment is not affected in the same way by all consumption patterns. The emergence of more sustainable lifestyles can be seen in consumption trends. Young Americans, for instance, don't seem as interested in buying cars as their parents and older siblings did. The advancement of the mobile phone has made ride-sharing, bike-sharing, and other transit options possible.

However, taking an Uber or driving your own car are both considered economic activities for the purposes of calculating GDP. These consumption patterns are typically not the subject of policymaking because they are quite influenced by shifting social norms than by governmental action. The only exceptions might be behavior that directly harms other people, like drinking and driving or smoking in public. New technologies can also lessen the impact of consumption on the environment.

Ironically, some environmentalists and some deniers of global warming share the view that environmental protection and economic growth must be compromised. Both can and must be done. Because most people in the developed world enjoy their way of life and won't give it up, we cannot stop investing in economic development. Environmental advocates will fail politically if they make such a request.

Explanation:

Political and business leaders may not care if economic growth harms the environment, and environmentalists may disagree, contending that neither economic growth nor environmental harm can coexist.

Even by itself, environmental protection promotes economic expansion. The air pollution control technologies we install on power plants and automobiles are made and sold by a third party. Additionally, environmental amenities are valuable.

The following table shows the demand, supply, and price of tulips in the Netherlands. If the world price of tulips is $4 and there are no trade restrictions, the Netherlands will:

Domestic Supply and Demand for Tulips in the Netherlands Demand Demand Supply Supply

Q P($) Q P($)

12,000 0 6,000 0

10,000 1 7,000 1

8,000 2 8,000 2

6,000 3 9,000 3

4,000 4 10,000 4

a. produce 10,000, consume 4,000, and import 6,000 tulips.

b. produce 10,000, consume 4,000, and export 6,000 tulips.

c. produce 4,000, consume 10,000, and import 6,000 tulips.

d. produce 9,000, consume 6,000, and export 6,000 tulips.

e. import all of the tulips that it consumes.

Answers

The option B: the Netherlands will produce 10,000, consume 4,000, and export 6,000 tulips.

According to the table, when the price of tulips is $4, the domestic supply in the Netherlands is 10,000 and the domestic demand is 4,000. This means that the Netherlands will produce 10,000 tulips to meet its domestic demand and have an excess of 6,000 tulips.

Since there are no trade restrictions and the world price of tulips is also $4, the Netherlands will export its excess supply of 6,000 tulips to other countries. This will increase the Netherlands' overall economic welfare as it can sell its tulips at the world price and earn more revenue.

Step 1: Find the domestic equilibrium point. In this case, the equilibrium point is at a price of $2, with a quantity of 8,000 tulips (where demand and supply meet).

Step 2: Compare the world price ($4) to the domestic equilibrium price ($2). The world price is higher, meaning there is an opportunity for the Netherlands to sell tulips internationally at a better price.

Step 3: Find the domestic quantity supplied and demanded at the world price. At the world price of $4, the domestic demand is for 4,000 tulips, and the domestic supply is 10,000 tulips.

Step 4: Calculate the difference between the quantity supplied and demanded at the world price. The difference is 10,000 - 4,000 = 6,000 tulips, which will be exported.

To Know more about Netherlands

https://brainly.com/question/12731390

#SPJ11

You have won a labor contract negotiation with 7.6% pay increase retroactive for six months. Write a program in C# that gets the employee's previous annual salary as initial pay (20points) and outputs the amount of retroactive pay due to the employee (20 points), the new annual salary (20 points), and the new monthly salary (20 points). Use variables (20 points) to store previous annual salary, retroactive pay, new annual salary, and new monthly salary. Sample Screen Display: Congratulations! You won an annual increase in pay as much as 7.6%. There is more! This pay raise is RETROACTIVE! (This increase will be applied to your past six pay.) Now please tell me your last year's annual salary: 54900 Based on your last year's annual salary of $54,900 Your six months' retroactive pay is: $2,086.20 Your new annual salary will be: $59,072.40 And your new monthly salary will be: $4,022.70

Answers

Here is the solution to the given problem:Solution:using System; class Program { static void Main(string[] args) { Console.WriteLine("Congratulations! You won an annual increase in pay as much as 7.6%. There is more! This pay raise is RETROACTIVE!"); Console.Write("Now please tell me your last year's annual salary: $"); double initialSalary = Convert.ToDouble(Console.ReadLine()); double retroPay = initialSalary * 0.076 / 2; double newAnnualSalary = initialSalary + initialSalary * 0.076; double newMonthlySalary = newAnnualSalary / 12; Console.WriteLine("\nBased on your last year's annual salary of ${0:0.00}", initialSalary); Console.WriteLine("Your six months' retroactive pay is: ${0:0.00}", retroPay); Console.WriteLine("Your new annual salary will be: ${0:0.00}", newAnnualSalary); Console.WriteLine("And your new monthly salary will be: ${0:0.00}", newMonthlySalary); Console.ReadLine(); } }Explanation:The given program is written in C# language that is used to calculate the retroactive pay, new annual salary, and new monthly salary of an employee.

The program first reads the initial annual salary of an employee using Console.ReadLine() method and stores it in a variable called initialSalary.The retroactive pay is calculated by multiplying the initialSalary with 0.076 and then divided by 2. The result is stored in a variable called retroPay.The new annual salary is calculated by adding initialSalary with the multiplication of initialSalary with 0.076. The result is stored in a variable called newAnnualSalary.The new monthly salary is calculated by dividing newAnnualSalary with 12. The result is stored in a variable called newMonthlySalary.Finally, the results are displayed using Console.WriteLine() method along with string literals and variables.

To know more about C program, visit:

https://brainly.com/question/33334224

#SPJ11

explain why installing an enterprise system often requires the redesign of existing business processes. discuss the impact that installing an enterprise system has on the organization.

Answers

Because the process will be handled entirely differently, it will be necessary to revamp current .The business now has a variety of options for achieving the success they believe an enterprise system would bring them.

What is the role of enterprise system?Enterprise Systems (ES) are comprehensive, bundled software systems that may be used to connect and simplify all business activities inside a company. They also help to raise knowledge and data levels among employees, supply chain partners, and other stakeholders.

What advantages does an enterprise system offer?An enterprise system's key advantage is the way it makes the duties of managers and staff simpler. For your workforce to be more productive, these tools automate tedious business operations. These systems may, for instance, conduct payroll, send emails to salespeople, or even buy merchandise automatically.

To know more about Enterprise system visit:

https://brainly.com/question/30338990

#SPJ1

Which statement about the cost of loans is correct?

A. A short-term loan charges more interest than a long-term loan.

B. The lower the interest rate, the more the loan will cost.

C. A short-term loan accrues less total interest than a long-term loan.

D. The less often interest is compounded, the more the loan will cost.

Answers

The true statement about the cost of loans is option A. A short-term loan charges more interest than a long-term loan.

Short term loans are those loans that are taken in order to meet up with expenses that may just be urgent.

Such loans are usually known to have a bigger interest rate than the standard loans. Apart from the interest that they attract, such loans are known to also have other charges and fees attached to them.

Read more on https://brainly.com/question/19530929?referrer=searchResults

The correct answer to your question is C. A short term loan accrues less total interest than a long term loan

A business analyzes what competitors are charging for products.

Answers

When a business analyzes what the competitors are charging for their products, it is known as the process of marketing info management.

What is the significance of business competitors?A business competitor can be referred to or considered as an organization that deals in the same product that is offered for sale by other enterprises in the same market.

It is important for a business to keep an eye on the acts of its competitors, as it helps them in keeping themselves updated with marketing info management.

Therefore, the significance regarding the business competitors has been aforementioned.

Learn more about business competitors here:

https://brainly.com/question/13948372

#SPJ1

What is the main task of a general-purpose computing system? The main task is to execute programs. There is no main task. It can perform any task prescribed by a program. The main task depends on the system. Different systems may perform a different main task. The main task depends on the user. Different users may need the system to perform a different main task. ↔ plsś answer

Answers

The main task of a general-purpose computing system is to execute programs, providing users with the flexibility to perform a wide range of tasks. While there is no specific main task assigned to these systems, their versatility makes them valuable tools for various applications. Different systems may perform different main tasks, and the user's needs and preferences may also influence the main task performed by the system.

The main task of a general-purpose computing system is to execute programs. This means that the system is designed to carry out instructions provided by software applications. Whether it's a word processor, spreadsheet, or internet browser, the system is built to handle a wide range of tasks. There is no specific main task assigned to a general-purpose computing system because it is designed to perform any task prescribed by a program. This flexibility allows the system to adapt to various requirements and demands, making it useful for a variety of applications. The main task of a general-purpose computing system can vary depending on the specific system being used. Different systems may have different capabilities or limitations, and the main task may be influenced by factors such as hardware specifications and software compatibility. Additionally, the main task of a general-purpose computing system can also depend on the user's needs and preferences. Different users may have different goals and requirements, and the system may need to be customized to meet their specific needs.

for more questions on computing

https://brainly.com/question/30501826

#SPJ11

How often are financial statements

released?

Answers

Answer:

Once per year

Explanation:

The law requires businesses to prepare their financial statements and reports every year or twelve months. A business's financial period should not exceed 12 months. All firms must prepare their financial reports to the relevant stakeholders at the end of every financial period.

Shareholders, investors, business partners, and the government are some of the users of the company's financial reports. The law expects the business to present their financial statements at the end of every period. However, companies may prepare reports in between the financial period for their internal use.

Dividends are paid out of profits, and:

(A) dividends are paid before a firm's taxes are paid.

(B) dividend payments must be approved by the firm's board of directors.

(C) dividends are guaranteed.

(D) dividends are usually paid twice a year.

(personal finance question)

Answers

Dividends are given out of profits, and it is commonly pay off twice a year. Option D is correct.

What are dividends?A dividend is defined as the amount of profit that is available for the distribution by a corporation to its shareholders, this amount of profit is given only when an enterprise earns a profit.

The majority of dividends are paid four times a year, on a quarterly basis, but some companies pay dividends twice a year.

Therefore, option D is correct.

Learn more about the Dividend, refer to:

https://brainly.com/question/13535979

#SPJ1

Kaye Blanchard is 50 years old. She has $66000 of adjusted gross income and 15,200 of qualified medical expenses. She will be itemized her tax deductions this year. How much of a tax deduction will Kaye be able to deduct (assume 7.5 percent floor for deduction)?

Answers

Deductible amount is $10,250

A deductible is an expense that an individual taxpayer or a business can deduct from adjusted gross income when filling out a tax form. Deductible expenses lower taxable income and, as a result, the amount of income taxes owed.

Most wage earners take the standard deduction; however, those with extremely high deductible expenses can itemize to reduce their tax bill.

Individual tax deductions for individuals include student loan interest, self-employment expenses, charitable donation deductions, and mortgage interest deductions.

Payroll, utilities, rent, leases, and other operational costs are examples of business deductibles.

The amount of tax levied on the taxpayer is referred to as his or her income tax liability. It represents the total amount of tax owed to the government. Once paid, it will contribute to the total amount required by the government to fund its projects.

Threshold amount

=Adjusted gross income × Threshold rate

=$66,000 × 0.75

=$4950

Deductible amount

=Qualified medical expenses - Threshold amount

=$15,200 - $4950

=$10,250

Deductible amount is $10,250

To learn more about Deductible amount, refer:

https://brainly.com/question/4289977

#SPJ1

"The forty-fourth hole is the hardest to dig

from holes who said it

Answers

The quote "The forty-fourth hole is the hardest to dig" is often attributed to legendary golfer and course designer Arnold Palmer.

The phrase refers metaphorically to the clubhouse or bar at a golf course, which is sometimes referred to as the "nineteenth hole."

In this context, the forty-fourth hole is an exaggerated reference to a place where golfers gather after completing a round of golf. The quote humorously suggests that the challenge of digging the "forty-fourth hole" is related to the difficulty of enjoying a refreshing beverage and relaxing after a long day on the golf course.

Know more about Arnold Palmer here:

brainly.com/question/29584630

#SPJ11

What are my goals tool about saving for

retirement

Answers

Saving for retirement on a budget Many experts advise allocating 15% of your yearly gross income to retirement savings.

What does allocation mean solely?When implementing a fulfilment plan, choose Allocation Only if you only want to allocate inventory—not yet pick, pack, and ship—and you want to allocate it. Select "Allocation Only" when filling orders if you wish to allocate inventory to one or more orders but aren't yet prepared to finish the pick, pack, and ship processes.

How does allocation rate work?The allocation rate, which determines how much of the money that is being paid into a fund—like a pension fund—can be invested, is the portion of the money that is still available after all fees have been deducted. The allocation rate would be 98%, for instance, if the charges were 2%.

To know more about allocating visit:

https://brainly.com/question/16666093

#SPJ1

Consider you are writing an email to your employee, guiding them in creating commercials for a new brand of "diet" food. What would you stress to the employee that they should include in the commercial to be most convincing to high self-monitors? What would you stress in the commercial to be most convincing to low self-monitors?

Answers

Subject: Creating Effective Commercials for our New Brand of "Diet" Food

Dear [Employee's Name],

I hope this email finds you well. I wanted to provide you with guidance on creating commercials for our new brand of "diet" food. To effectively convince high self-monitors, who are typically more concerned about their appearance and how others perceive them, we should emphasize the following elements in the commercial:

1. Visual Appeal: Highlight the visual aspects of the "diet" food, showcasing its attractive presentation, vibrant colors, and appetizing appearance. Use close-up shots to capture the details and freshness of the ingredients. This will appeal to high self-monitors who are conscious of their body image and strive for a visually appealing diet.

2. Social Validation: Incorporate testimonials or endorsements from individuals who have successfully achieved their desired weight or improved their health by consuming our "diet" food. High self-monitors are more likely to be influenced by social proof, so featuring relatable success stories will boost their confidence in the effectiveness of our product.

3. Lifestyle Enhancement: Illustrate how our "diet" food can seamlessly fit into a busy, health-conscious lifestyle. Emphasize convenience, time-saving aspects, and the ability to maintain a balanced diet without sacrificing taste or enjoyment. High self-monitors value products that align with their desire for efficiency and healthy living.

On the other hand, to convince low self-monitors who may be less focused on external appearances and more concerned with personal satisfaction and convenience, we should stress the following elements in the commercial:

1. Taste and Pleasure: Highlight the delicious flavors and enjoyable eating experience of our "diet" food. Show individuals savoring each bite with expressions of satisfaction and pleasure. This will resonate with low self-monitors who prioritize their personal enjoyment and seek gratifying food options.

2. Health Benefits: Clearly communicate the health benefits of our "diet" food, such as improved energy levels, enhanced well-being, and better digestion. Low self-monitors are more likely to be motivated by internal factors related to their own health and vitality, so emphasizing these benefits will be persuasive.

3. Simplicity and Convenience: Showcase how easy it is to incorporate our "diet" food into their daily routine. Highlight features such as pre-portioned meals, quick preparation methods, and hassle-free packaging. By emphasizing the simplicity and convenience of our product, we can appeal to low self-monitors seeking effortless ways to maintain a healthy lifestyle.

Remember, it is important to create commercials that resonate with both high self-monitors and low self-monitors, catering to their unique motivations and desires. By incorporating these suggested elements, we can effectively capture the attention and interest of our target audience.

Please feel free to reach out if you have any further questions or need additional guidance. I appreciate your dedication to creating compelling commercials for our new brand of "diet" food.

Best regards,

[Your Name]

learn more about "Commercials ":- https://brainly.com/question/3837126

#SPJ11

9. F Co has recorded the following vehicle maintenance costs over the last three periods

Miles travelled Maintenance cost

$

1,800 2,900

2,400 3,170

2,600 3,300

Using the high/low method, the variable maintenance cost per mile and fixed maintenance cost are

Variable cost per mile Fixed cost

$ $

A 0.65 1,610

B 0.45 2,090

C 0.50 1,970

D 0.50 2,000

Answers

Option D (0.50 and 2,000) is the correct answer.

Variable cost per mile Fixed cost A 0.65 1,610B 0.45 2,090C 0.50 1,970D 0.50 2,000The high/low method is a technique used to separate the fixed and variable elements of mixed costs by comparing the cost data from the highest and lowest volume of activity. The following are the steps to use the high/low method: Step 1: Pick the highest and lowest levels of activity in which the company incurs maintenance expenses. Step 2: Using the formula, determine the variable cost per mile for maintenance: Variable cost per mile = Change in cost / Change in miles Step 3: Using the formula, determine the total fixed cost for maintenance: Total fixed cost = Total cost − Total variable cost Step 4: Input the variable cost per mile and the total fixed cost into the equation for maintenance cost. The following is the solution: Step 1The highest and lowest levels of activity in which the company incurs maintenance expenses are as follows: Miles traveled Maintenance cost1,800 $2,9002,600 $3,300The total change in cost is $3,300 - $2,900 = $400. The total change in miles is 2,600 - 1,800 = 800.Step 2Using the formula, determine the variable cost per mile for maintenance: Variable cost per mile = Change in cost / Change in miles Variable cost per mile = $400 ÷ 800 miles Variable cost per mile = $0.50Step 3Using the formula, determine the total fixed cost for maintenance: Total fixed cost = Total cost − Total variable cost At the highest level of activity, the total maintenance cost is $3,300, and the variable cost per mile is $0.50. Therefore, the total fixed cost for maintenance is: Total fixed cost = Total cost − Total variable cost Total fixed cost = $3,300 − ($0.50 × 2,600 miles) Total fixed cost = $3,300 − $1,300Total fixed cost = $2,000Step 4Input the variable cost per mile and the total fixed cost into the equation for maintenance cost. Maintenance cost = Fixed cost + (Variable cost per mile × Miles traveled) Using option D: Variable cost per mile = $0.50Fixed cost = $2,000The following is the calculation: Maintenance cost = Fixed cost + (Variable cost per mile × Miles traveled) Maintenance cost = $2,000 + ($0.50 × 2,400) Maintenance cost = $2,000 + $1,200Maintenance cost = $3,200Therefore, option D (0.50 and 2,000) is the correct answer.

To know more about Maintenance Cost, click on link below: -

brainly.com/question/20388858

#SPJ11

Creative Chronometer, Inc. is planning to launch a new brand of watches for kids. Similar watches are available in the market for $56. In order to penetrate the market, the company plans to use target pricing and desires a 28% net profit markup on total cost. Calculate the target cost. (Round your answer to the nearest cent.) $71.68 $43.75 $40.32 $15.68

Answers

Answer: $43.75

Explanation:

Given the following :

Markup on total cost = 28%

Projected selling price (price of similar products) = $56

Target cost = projected selling price - desired profit

Desired profit = 28% of target cost

Assume target cost = a

a = 56 - 28%a

a = 56 - 0.28a

a + 0.28a = 56

1.28a = 56

a = 56 / 1.28

a = 43.75

Therefore, target cost 'a' equals $43.75

which of the following is not a common investment mistake made by individuals? (select the best answer below.)

Answers

Of the options provided, option B ("Filing for bankruptcy to salvage certain investments") is not a common investment mistake made by individuals.

Common investment mistakes made by individuals include:

A. Taking excessive risks to recover their losses: This mistake occurs when individuals try to make up for their investment losses by taking on higher levels of risk. They may engage in speculative or high-risk investments in an attempt to recoup their losses quickly, which can further exacerbate their financial situation.

C. Investing money that could have been used to pay an existing loan: This mistake involves investing funds that could have been used to pay off existing debts or loans. Instead of prioritizing debt repayment, individuals allocate money towards investments, potentially neglecting their financial obligations and increasing their overall debt burden.

D. Taking more risk when losses are not substantial: This mistake refers to the tendency of individuals to increase their risk tolerance when they have not experienced significant losses. They may become overconfident in their investment decisions and take on greater risks without fully assessing the potential consequences.

In summary, option B ("Filing for bankruptcy to salvage certain investments") is not a common investment mistake made by individuals.

Learn more about investment

brainly.com/question/15105766

#SPJ4

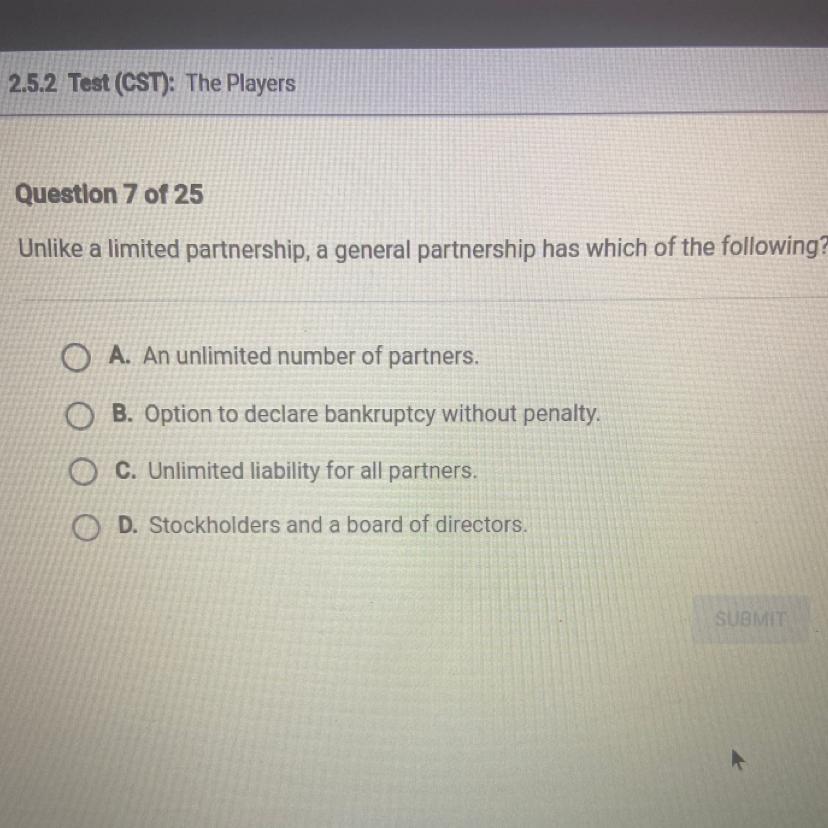

Unlike a limited partnership, a general partnership has which of the following?

O A. An unlimited number of partners.

B. Option to declare bankruptcy without penalty.

C. Unlimited liability for all partners.

D. Stockholders and a board of directors.

Answers

Answer:

C. Unlimited liability for all partners.

Explanation:

A general partner has unlimited liability to the debts of the business. It follows that in a general partnership business, all partners will have unlimited liability to business debts.

A general partnership is not a separate entity from its owners. Assets and liabilities of the business will be treated as those of the partners. Should the business fail in paying its debts, the partners' personal properties may be sold to clear the debts.

To examine

the weekly payroll of all employees, one would look at the:

Answers

To examine the weekly payroll of all employees, one would look at the: d. payroll register.

What is the payroll register?The payroll register is a book or record that is used to fill in the details of all the employees and their payment logs. A record of this register is often kept in good condition in case of any future discrepancies that will have to be resolved.

A person who wants to examine the weekly payroll of all employees in an organization must be able to look at the payroll register to know what is obtainable. There, he would find the names of the employees, their job roles and payment record.

Options:

a. W-4

b. employee earnings record

c. W-2

d. payroll register.

Learn more about the payroll register here:

https://brainly.com/question/24265652

#SPJ1

In 2016, Armenia had a real GDP of approximately $4.21 billion and a population of 2.98 million. In 2017, real GDP was $4. 59 billion and population was 2.97 million. From 2016 to 2017, Armenia's standard of living

A) decreased.

B) increased.

C) did not change.

D) might have increased, decreased, or remained unchanged but more information is needed to determine which.

Answers

From the year 2016 to 2017, Armenia's standard of living increased. This is because the GDP increased. The correct option is B.

What is GDP?GDP refers to Gross Domestic Product, which is the value of all goods and services generated within a country's borders during a specified period.

The following formula is used to determine GDP:

GDP = C + I + G + (X-M)

where, C stands for Consumption,

I stands for Investment,

G stands for Government spending,

X stands for exports, and

M stands for imports.

In this problem, we are given that the real GDP of Armenia was approximately $4.21 billion in 2016 and $4.59 billion in 2017, which indicates an increase in GDP. GDP is used to measure a country's economic growth or how well off the country is, therefore, it is an essential indicator of the standard of living.

Therefore, we can conclude that from 2016 to 2017, Armenia's standard of living increased.

Therefore, the correct option is B.

Learn more about GDP here:

https://brainly.com/question/15682765

#SPJ11

Superannuation concessional contributions are an effective way to minimise the tax payable by high income earners that earn between $180,000 and $250,000

T/F

Answers

True. Superannuation concessional contributions refer to contributions made to a superannuation fund on a pre-tax basis. These contributions are generally taxed at a lower rate compared to regular income tax rates.

High-income earners who fall within the income range of $180,000 to $250,000 can benefit from making concessional contributions to their superannuation fund. By making concessional contributions, high-income earners can reduce their taxable income, which in turn minimizes the amount of tax payable. These contributions are subject to a concessional tax rate of 15% within the superannuation fund, which is often lower than their marginal tax rate.It is important to note that there are annual contribution caps and limits on amount of concessional contributions that can be made. Additionally, the effectiveness of using concessional contributions to minimize tax depends on individual circumstances and should be considered in consultation with a financial advisor or tax professional.

Learn more about marginal tax rate here:

brainly.com/question/30404864

#SPJ11

Ralph buys new furniture for his living room from Good Times Furniture. It is agreed that the goods will be placed with a common carrier for delivery. The contract between Ralph and Good Times is ambiguous regarding whether the seller had the duty to deliver the goods only to the common carrier's hands or whether the seller had the duty to deliver the goods to Ralph's home. Unfortunately, on the way to Ralph's home, through no fault of the delivery driver, the delivery truck was wrecked and the furniture was significantly damaged.

Required:

What is true regarding the risk of loss at the time the goods were damaged?

Answers

True statement regarding the risk of loss is that Ralph bears the risk of loss when the goods are damaged since the seller fulfilled their obligation by transferring them to the common carrier.

In the case where Ralph bought new furniture from Good Times Furniture, and the goods were placed with a common carrier for delivery. The contract between Ralph and Good Times is ambiguous regarding whether the seller had the duty to deliver the goods only to the common carrier's hands or whether the seller had the duty to deliver the goods to Ralph's home.

Unfortunately, on the way to Ralph's home, through no fault of the delivery driver, the delivery truck was wrecked and the furniture was significantly damaged.In this case, the Uniform Commercial Code (UCC) guidelines govern. The UCC's guidelines include provisions regarding the risk of loss in the event of loss, damage, or destruction of goods sold.

The UCC requires that the transfer of goods occur once they have been given to the carrier, and therefore, Ralph has incurred the loss.The goods were transferred to the common carrier for delivery, indicating that the seller fulfilled their obligation when the goods were delivered to the carrier.

According to the UCC, after the goods are shipped, the buyer assumes the risk of loss, which means that the buyer has to bear the consequences of the loss. In this case, Ralph has incurred the loss because the goods were shipped, and the carrier assumed responsibility for delivering them to Ralph's house.

Know more about Furniture here:

https://brainly.com/question/31441302

#SPJ11

One of the following is against the business ethics. Find it.

a) Charging fair price for the product.

b) Giving wages to employees if by not considering their work load. c) Using correct measurement for products

d) Giving chances to hear the problems of employees.

Answers

define ecommerce in business with example

Answers

Answer:

See below

Explanation:

eCommerce refers to business transactions conducted via internment. eCommerce is the short form of electronic commerce. It is the selling and buying of products and services through the internet platform. eCommerce includes other commercial transactions conducted online such as online/internet banking, online money transfers, online auctions, ticketing, and payments.

An example of eCommerce is the online retail stores where shoppers pick and select merchandise on the retail store's website and pay online. The retail store then organizes for the items to be delivered to the customer's premises.

Question 2 (1 point)

Kelsi works in a toy manufacturing company assembling small dolls. Her job falls into

the Maintenance, Installation & Repair pathway of the Manufacturing career cluster.

1:) True

2:) False

Answers

I guess don’t be mad if I’m wrong

What is the purpose of the federal budget? A. It serves as a plan for government spending each year. B. It ensures that the government will always have a surplus C. It allows the government to default on its debts O D. It prevents the government from creating a budget deficit .

Answers

Answer:

It serves as a plan for government spending each year

The major purpose of the federal government is to serve as a plan for government spending each year.

What do you mean by a federal budget?A federal budget refers to a plan for how the government will take in money.

It is revised every year and the purpose is to outline the budget for the nation's priorities for years.

It serves as a plan for government spending. Therefore, A is the correct option.

Learn more about the federal budget here:

https://brainly.com/question/15374043

#SPJ2

Select the steps in the marketing research approach. (Select all that apply) Multiple select question. define the problem obtain resources select target group develop findings take marketing actions

Answers

It should be noted that marketing research approach:

obtain resources target marketing actionsWhat is marketing research approach?marketing research approach can be regarded as an approach that uses surveys, focus groups, personal interviews, observation, and field trials to get data about the market.

The The type of data needed and how much money you're willing to spend can be gotten.

Learn more about marketing research approach at;

https://brainly.com/question/14457086