question content area if fixed costs are $450,000, the unit selling price is $75, and the unit variable costs are $50, the old and new break-even sales in units (rounded to the nearest whole unit), respectively, if the unit selling price increases by $10 are a. 9,000 units and 15,000 units b. 18,000 units and 6,000 units c. 6,000 units and 5,294 units d. 18,000 units and 12,857 units

Answers

Option d: The correct option is d. 18,000 units and 12,857 units. A break-even point is a situation in which the cost of an operation or product is equal to the revenue generated by it.

In other words, the break-even point is the point at which there is no profit or loss from an activity. It is critical to understand the break-even point for every company since it aids in evaluating the financial feasibility of the business.A company's break-even point is determined by the following formula:

Break-even point (units) = fixed costs / (unit selling price - unit variable costs)

Given data:

Fixed cost = $450,000Unit

selling price = $75Unit

variable cost = $50O

Calculation:

Old break-even sales in units = fixed costs / (unit selling price - unit variable costs)

= $450,000 / ($75 - $50) = $450,000 / $25

= 18,000 units

New unit selling price = $75 + $10 = $85

New break-even sales in units = Fixed cost / (New unit selling price - Unit variable costs)

= $450,000 / ($85 - $50)

= $450,000 / $35

= 12,857 units

Therefore, the old break-even sales in units and the new break-even sales in units (rounded to the nearest whole unit), respectively, if the unit selling price increases by $10 are 18,000 units and 12,857 units.

To learn more about break-even point, here:

https://brainly.com/question/32507413

#SPJ11

Related Questions

Some banks offer interest on the money that is in the checking account.

~True

or

~False

Answers

Answer:

no

Explanation:

You can think of a checking account as the workhorse of financial accounts. ... But many checking accounts don't earn interest.

Sunland Company owns equipment that cost $73,000 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on an estimated salvage value of $13,000 and an estimated useful life of 5 years. Prepare Sunland Company's journal entries to record the sale of the equipment in these four independent situations. (a) Sold for $39,000 on January 1, 2022. (b) Sold for $39,000 on May 1, 2022. (c) Sold for $22,000 on January 1, 2022. (d) Sold for $22,000 on October 1, 2022.

Answers

Answer and Explanation:

The journal entries are shown below;

(a)

Cash $39,000

Accumulated Depreciation $36,000 [($73,000 - $13,000) × 3 ÷ 5]

To Equipment $73,000

To Gain on Sale of Equipment $2,000

(being the sale of equipment is recorded)

(b)

Depreciation $4,000 [($73,000 - $13,000) ÷ 5 × 4 ÷12]

To Accumulated Depreciation $4,000

(being depreciation expense is recorded)

Cash $39,000

Accumulated Depreciation $40,000 ($36,000 + $4,000)

To Equipment $73,000

To Gain on Sale of Equipment $6,000

(being the sale of equipment is recorded)

(c)

Cash $22,000

Accumulated Depreciation $36,000

Loss on Sale of Equipment $15,000

To Equipment $73,000

(being the sale of equipment is recorded)

(d)

Depreciation $9,000 [($73,000 - $13,000) ÷ 5 × 9 ÷ 12]

To Accumulated Depreciation $9,000

(Being depreciation expense is recorded)

Cash $22,000

Accumulated Depreciation $45,000 ($36,000 + $9,000)

Loss on Sale of Equipment $6,000

To Equipment $73,000

(being sale of equipment is recorded)

evan accidentally quoted a customer a price for new flooring that was more than $1,000 less than the actual price. his manager had a choice of punishing evan or providing him coaching and retraining on how to calculate the cost of flooring correctly. his manager chose to retrain evan, using the ________ control.

Answers

Answer: Feedforward control

can someone recommend me some research topics for economics.would really appreciate if it is in a list

Answers

Explanation:

here are some research topics for economics::

1. The effect of income changes on consumer choices

2. The effect of labor force participation on the economy and budget – A comparison

3. The impact of marital status on the labor force composition: A case of [your country] economy

4. The difference in the consumption attitude in [your country] over the last decade – Critical analysis of consumer behavior trends

5. The relationship between salary levels and ‘economic convergence’ in [your country]?

6. Analyzing salary inequalities in [your country] and the forces behind such inequalities.

7. The evolution of consumption in [your country] over the last 10 years: Trends and consumer behavior.

8. Dynamics of the Gini index as a reflection of the problem of inequality in income

9. Cashless economy: The impact of demonetization on small and medium businesses

10 Privatization of Public Enterprises and its implications on economic policy and development

Which is an example of an effective study skill?

Answers

Answer:

Teaching or asking a study partner the questions.

Explanation:

When you teach someone you take in the knowledge better and get to help someone else out.

.A manufacturing business has purchases of raw materials of $4,500, closing inventory of $1,400 and opening inventory of $800. What is the cost of raw materials used in production?

Answers

Answer:

Cost of raw materials used = $5,100

Explanation:

Given:

Purchases of raw materials = $4,500

Closing inventory = $1,400

Opening inventory = $800

Find:

Cost of raw materials used

Computation:

Cost of raw materials used = Opening inventory + Purchases of raw materials - Closing inventory

Cost of raw materials used = 1,400 + 4,500 - 800

Cost of raw materials used = $5,100

The difference between small business and entrepreneurship has nearly nothing to do with size and nearly everything to do with

O Capital

O competition

O number of employees

O characteristics

→

Answers

Answer: (1) Entrepreneurs are always looking for ways to make money while small business have the same goal but company owners also focus on maintaining their business income to pay for operating expenses.

(2) Entrepreneurs are more likely to take on debt than small business owners and typically have much higher risk tolerance. They are comfortable assuming larger uncertainties to pursue new ideas and opportunities

(3) Entrepreneurs are risk-takers while store owners are more conservative

(4) Entrepreneurs are future-oriented, while small business owners typically focus on the present.

Explanation:

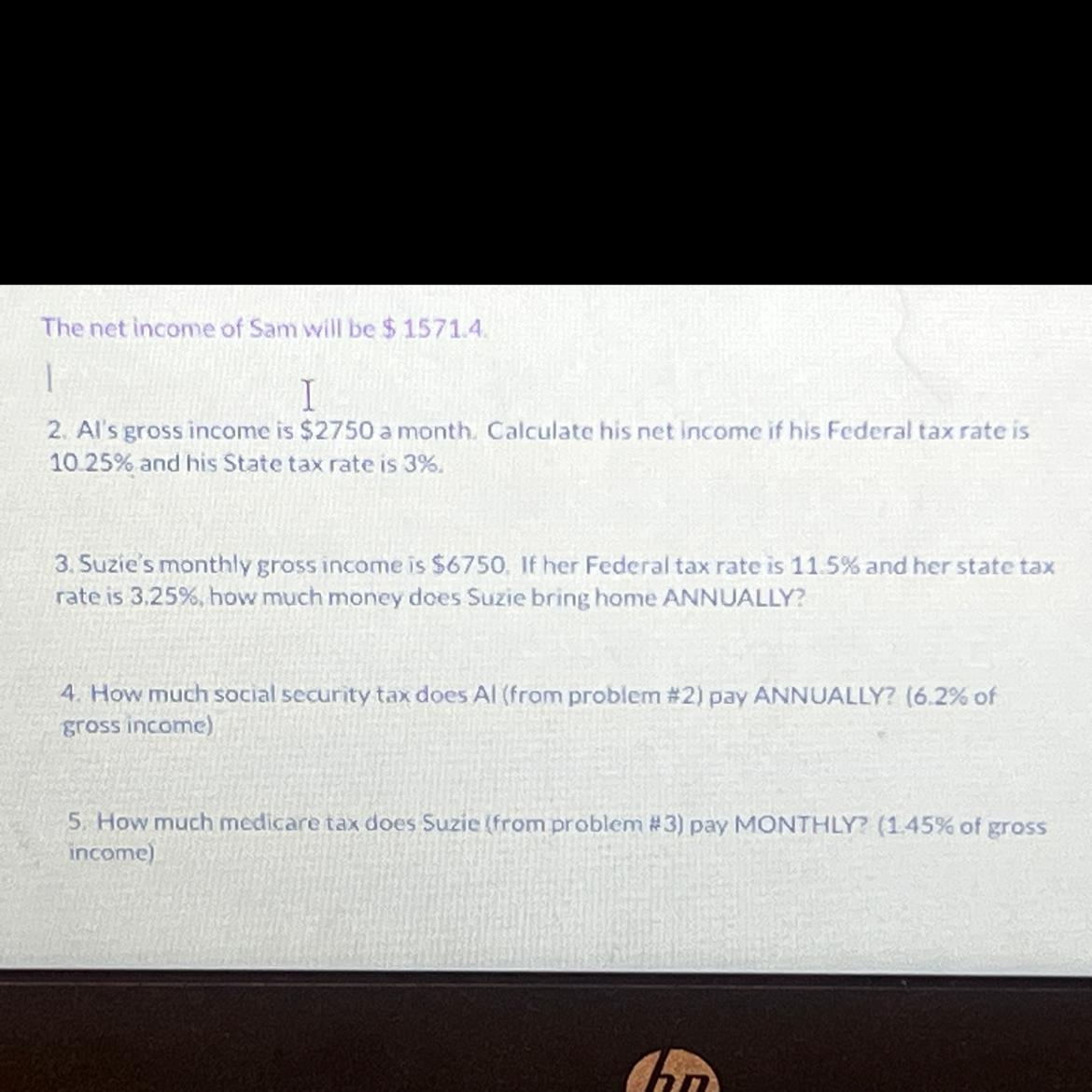

what are the the paycheck calculations for the questions?

Answers

Al's net income is $2385.62 per month.

Suzie brings home $69,052.44 annually.

How to calculate the IncomeTo calculate Al's net income, we first need to determine how much he pays in taxes.

His Federal tax rate is 10.25%, which means he pays 10.25% of his gross income in Federal taxes.

10.25% of $2750 = 0.1025 x $2750 = $281.88

His State tax rate is 3%, which means he pays 3% of his gross income in State taxes.

3% of $2750 = 0.03 x $2750 = $82.50

To calculate his net income, we need to subtract his total taxes from his gross income.

Net income = Gross income - (Federal taxes + State taxes)

Net income = $2750 - ($281.88 + $82.50)

Net income = $2385.62

Therefore, Al's net income is $2385.62 per month.

To calculate Suzie's annual net income, we first need to determine how much she pays in taxes.

Her Federal tax rate is 11.5%, which means she pays 11.5% of her gross income in Federal taxes.

11.5% of $6750 = 0.115 x $6750 = $776.25

Her State tax rate is 3.25%, which means she pays 3.25% of her gross income in State taxes.

3.25% of $6750 = 0.0325 x $6750 = $219.38

To calculate her net income, we need to subtract her total taxes from her gross income.

Net income = Gross income - (Federal taxes + State taxes)

Net income = $6750 - ($776.25 + $219.38)

Net income = $5754.37

Since we have calculated Suzie's net income for one month, to determine her annual net income, we can simply multiply this by 12.

Annual net income = $5754.37 x 12

Annual net income = $69,052.44

Therefore, Suzie brings home $69,052.44 annually.

Learn more about income on;

https://brainly.com/question/25745683

#SPJ1

historically, why didn't the court decision to require real estate licensees to be honest change the buyer beware approach to home purchases?

Answers

Historically, the court's decision to require real estate licensees, to be honest change the buyer beware approach to home purchases C) Unless asked, disclosure was not required

The court's requirement that real estate licensees be truthful historically changed the buyer-beware philosophy of house transactions. The disclosure was not needed until requested. Before, unless specifically requested by the buyer, real estate brokers were not legally compelled to divulge certain information. As a result, purchasers have to be attentive in making the correct inquiries and performing independent research.

Due to a combination of business and legal practises that favoured sellers and agents over purchasers and a lack of regulatory obligations for brokers to provide critical information to customers, the "buyer beware" attitude to house transactions has prevailed. Buyer representation did not become more widespread and disclosure requirements did not become more stringent until subsequent revisions in laws and regulations.

Complete Question:

Historically, why didn't the court decision to require real estate licensees to be honest change the buyer beware approach to home purchases?

A) Only sellers were represented in transactions

B) The laws did not favor consumers

C) Unless asked, disclosure was not required

D) Licensees made a point to be ignorant

Read more about disclosure on:

https://brainly.com/question/1838589

#SPJ4

4. What competitive structure features pricing that is determined entirely through the laws of supply and demand and requires t

Moderate competition

Perfect competition

Monopolistic competition

Direct competition

Answers

Pricing is not determined by supply and demand forces in monopolistic competition. Companies set the prices for their distinctly different yet similarly priced items. The answer is option (c).

What is monopolistic competition?When a large number of businesses provide rival goods or services that are comparable but imperfect alternatives, monopolistic competition develops. A monopolistic competitive economy has minimal entry requirements, and actions made by any one business do not immediately impact those of its rivals.

Consider a market system where there are many businesses and free enterprise entrance and exit, but the goods these businesses produce are not uniform. A market structure like this is referred to as monopolistic competition.

To know more about monopolistic competition, visit:

https://brainly.com/question/30062639

#SPJ1

23.'Behavioural finance' argues that:

Select one:

a.

fundamental analysis is nearly certain to lead to above average risk-adjusted returns

b.

psychological factors can influence investors' actions in ways which lead to inefficient markets

c.

behavioural factors lead to clear and obvious price trends based on available historical prices

d.

markets are too efficient to allow above average profits to be made unless excess risk is accepted.

Answers

b. Behavioral finance argues that psychological factors can influence investors' actions in ways that lead to inefficient markets.

Behavioral finance argues that psychological factors can influence investors' actions in ways that lead to inefficient markets. It recognizes that investors are not always rational and can be prone to biases, emotions, and cognitive errors when making financial decisions. These behavioral factors can result in market anomalies, mispricings, and deviations from fundamental values.

For example, investors may exhibit herd mentality, following the crowd without considering the underlying fundamentals. They may also be influenced by emotions such as fear or greed, leading to overreaction or underreaction to market events. Cognitive biases, such as anchoring or confirmation bias, can distort their perception and judgment.

These behavioral factors can create market inefficiencies, as prices may not accurately reflect the true value of assets. Consequently, opportunities for above-average risk-adjusted returns may arise for investors who are aware of and exploit these behavioral biases.

Overall, behavioral finance highlights the importance of understanding and accounting for the impact of human behavior on financial markets. It challenges the notion of market efficiency and emphasizes the need to incorporate psychological factors into financial analysis and decision-making processes.

learn more about investors here:

https://brainly.com/question/28538187

#SPJ11

Melvin Crane is 66 years old, and his wife, Matilda, is 65. They filed a joint income tax return for 2019, reporting an adjusted gross income of $22,200, on which they owed a tax of $61. They received $3,000 from Social Security benefits in 2019. How much can they claim on Form 1040 in 2019, as a credit for the elderly?

Answers

Answer:

$0

Explanation:

the credit for the elderly is the lesser of the following:

1) taxes owed = $61

2) you calculate the credit for the elderly by subtracting $7,500 - $3,000 (social security benefits) = $4,500

then you subtract half of your AGI over $10,000 = ($22,000 - $10,000) x 50% = $5,500

the credit = $4,500 - $5,000 = $0 (there are no negative tax credits)

the lesser between $61 and $0 is $0.

A Bank with the following capital levels: common equity of 47,000, Tier 1 of 38,000, Tier 2 of 17,000. If total assets are 850,000 and risk adjusted assets are 650,000, the capital classification of the bank is

Answers

The capital classification of the bank would be "Adequately Capitalized" as its Tier 1 capital ratio.

To determine the capital classification of the bank, we need to compare its capital levels to the risk-adjusted assets. The capital classification is typically based on regulatory requirements and ratios set by the relevant financial authorities.

One common capital adequacy ratio used for classification is the Tier 1 capital ratio.

The Tier 1 capital ratio is calculated by dividing Tier 1 capital (including common equity) by risk-adjusted assets. Let's calculate the Tier 1 capital ratio:

Tier 1 capital ratio = (Tier 1 capital / Risk-adjusted assets) * 100

In this case:

Tier 1 capital = 38,000

Risk-adjusted assets = 650,000

Tier 1 capital ratio = (38,000 / 650,000) * 100

= 5.846%

Now, let's determine the capital classification based on the Tier 1 capital ratio:

Well-Capitalized: Tier 1 capital ratio ≥ 6%

Since the calculated Tier 1 capital ratio is 5.846%, it does not meet the well-capitalized threshold.

Adequately Capitalized: Tier 1 capital ratio ≥ 4%

The calculated Tier 1 capital ratio is above the adequately capitalized threshold, which is 4%.

Undercapitalized: Tier 1 capital ratio < 4%

Since the calculated Tier 1 capital ratio is above 4%, the bank is not classified as undercapitalized.

Therefore, based on the given information, the capital classification of the bank would be "Adequately Capitalized" as its Tier 1 capital ratio exceeds the minimum regulatory requirement of 4%.

To learn more about capital, refer below:

https://brainly.com/question/32408251

#SPJ11

How do plants obtain the water required for photosynthesis?

Answers

Answer:

from their roots

Explanation:

the roots dig into the ground and absorb water for the plant

Answer:

they obtain their water from the roots of the plant and roots take the water from the soil.

HELP ASAP

Collaborating normally takes longer than ______ when engaging in conflict resolution

A. Denying the issue

B. Fighting

C. Compromising

D. Smoothing over the problem

Answers

Answer:

A. Denying the issue

Explanation:

Explanation:

Open market operations are _________?

Answers

Answer:

activity

Explanation:

by a central bank to give liquidity in its currency to a bank or a group of banks

Which of these is not a benefit of working as a team? a. Improved morale b. Increased productivity c. Improved communication d. Increased personal workload Please select the best answer from the choices provided A B C D.

Answers

The option that is correct about not the benefit of team working is to increased personal workload.

What are the benefits of teamwork?Teamwork is the process of doing the work with more than one person or employee in the organization. It is mainly used in large organizations to reduce the workload of the employees.

The benefits of teamwork are as follows:

Teamwork increases the productivity of the management.It makes the work on time.It improves the morale of all the employees in the organization.It improved communication power.It reduced the group workload among the employees.

Therefore, the correct option is D.

Learn more about teamwork, refer to:

https://brainly.com/question/18869410

Answer:

D

Explanation:

Reserves are funds set aside for emergencies, such as a rush of withdrawals. true or false

Answers

Answer:

true and False. not only that.

Explanation:

please do your research, also used for economic dis stress and so on. Hope I gave you a helping hand!

For most people, almost two-thirds of each work day is taken up by work and sleep. Please select the best answer from the choices provided T F

Answers

Answer:

True

Explanation:

For most people, almost two-thirds of each workday is taken up by work, and sleep is a true statement.

What is the statement?Statements are sentences that express a fact, idea, or opinion. Statements do not ask questions, make requests or give commands. They are also not utterances. Statements are sentences that express a fact, idea, or opinion. Statements do not ask questions, make requests or give speech acts. They are also not exclamations.

The term working day refers to the days in the working week, the span of (often five) days that are not the weekend, and when many people work. The word workday means the same thing as a working day

Therefore, By the above statement, for the t two-thirds of each work day is taken up by work and sleep is correct.

Learn more about the statement here:

https://brainly.com/question/2285414

#SPJ2

what is 4/8 = ??????????????????????

Answers

Answer:

4/8 is equivalent to 1/2

Explanation:

Hope it helps a lot :]

Answer:

4 divided by eight? if this is the question then the answer is 1/2

Explanation:

let me know if that was what you were asking

Alfred has plotted revenue and cost graphs for his pastry business. He’s testing a number of cost assumptions against his business’s revenue.

Answers

Cost decreases and revenue increases to about $6 per pastry. Cost and revenue both decrease after about $6.

What is Cost and Revenue in economics?

In business economics, the two key concepts are cost and income. Every firm strives to reduce expenses and increase revenue in order to generate the most profit.

Cost is the amount of money that each business has invested to produce a certain good or service.

The cost of a product is the monetary value assigned to the raw materials, labour, and other resources utilised to produce it in any firm.

Money serves as the production system's input in this instance so that the desired good or service can be obtained. Estimating costs during business planning for a firm, project, or product is crucial for ensuring profitability.

To learn more about Cost and Revenue refer to:

https://brainly.com/question/29786149

#SPJ1

Who gets a FICO score and how is it generated?

Answers

A FICO score is a credit score generated by the Fair Isaac Corporation, which is widely used by lenders to evaluate a borrower's creditworthiness.

Anyone who has credit history can have a FICO score, including individuals, businesses, and even non-profit organizations. The score is generated based on several factors, including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. These factors are weighted differently based on their level of impact on credit risk. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Generally, a score above 700 is considered good, while a score below 600 is considered poor.

Therefore, it is important to regularly check your FICO score and credit report for accuracy and take steps to improve your credit health if necessary.

Know more about "credit score".

https://brainly.com/question/14955701

#SPJ11

Four people are applying for a job. This chart shows the company’s favorite characteristic of each of these job applicants:

Answers

A competitive market achieves economic efficiency by maximizing the sum of consumer surplus and producer surplus." This statement:

a. is true only if there are no negative externalities in the market.

b. is true only if there are positive externalities in production in the market.

c. is true only if there are no positive or negative externalities in the market.

d. is true in theory, but economic efficiency cannot be achieved in a real market.

Answers

A market is competitive when neither a single consumer nor a manufacturer has sufficient power to sway the market. The supply curve, which depicts a product's quantity, changes in response to grant and demand.

What do you call a competitive market?Monopolistic competition, also known as an aggressive market, is characterized by an enormous variety of businesses, each with a little part of the market and barely distinguishable goods. Oligopoly is a market structure in which a small number of firms jointly hold the majority of the market share.

What sort of market is competitive?Agriculture is a prime example of a competitive market. There are many farmers, but none of them can currently influence the market or the rate solely based on the amount of produce they produce. The farmer's only option is to cultivate the crop and collect the current price for the finished good.

To know more about competitive market, visit:

brainly.com/question/1748396

#SPJ4

On March 15, Summit Hawk declares a quarterly cash dividend of $0.085 per share payable on April 13 to all stockholders of record on March 30. Required: Record Summit Hawk's declaration and payment of cash dividends for its 218 million shares.

Answers

The journal entries to Summit Hawk's declaration and payment of cash dividends is: Debit Dividend $18,530,000; Credit Dividend payable $18,530,000

Journal entriesMarch 15

Debit Dividend $18,530,000

(218,000,000 shares × $0.085)

Credit Dividend payable $18,530,000

(To record cash dividend declaration)

March 30

No entry

April 13

Debit Dividend payable $18,530,000

(218,000,000 shares × $0.085)

Credit Cash $18,530,000

(To record payment of cash dividend)

Therefore the journal entries to Summit Hawk's declaration and payment of cash dividends is: Debit Dividend $18,530,000; Credit Dividend payable $18,530,000.

Learn more about journal entries here:https://brainly.com/question/14017973

#SPJ1

if a company has 5 employees with annual salaries of $90,000, $60,000 ,$70,000 ,$90,000 and $20,000 respectively, what is the mean annual salary at the company?

Answers

Answer:

Mean annual salary = $66,000

Explanation:

Given the following data;

Number of employees = 5Employee's salaries = $90,000, $60,000 ,$70,000 ,$90,000 and $20,000.To find the mean annual salary at the company;

First of all, we would find the total amount of salaries.

Total amount = 90,000 + 60,000 + 70,000 + 90,000 + 20,000

Total amount = $330,000

Next, we would calculate the mean annual salary at the company;

\( Mean \; annual\; salary = \frac {Total \; salary}{Number \; of \; employees} \)

Substituting into the above formula, we have;

\( Mean \; annual\; salary = \frac {330,000}{5} \)

Mean annual salary = $66,000

Answer:

66,000

Explanation:

the volcker rule addresses the off-balance-sheet problem involving

Answers

The Volcker Rule addresses the off-balance-sheet problem involving proprietary trading and investment securities that are held in trading accounts by banks.What is the Volcker Rule .

The Volcker Rule is a piece of legislation that restricts banks from performing proprietary trading and investing in or sponsoring hedge funds or private equity funds in order to reduce systemic risks posed by these activities. The Volcker Rule is designed to limit the possibilities of banks undertaking risky activities and to prevent any future bailouts by taxpayers.

The Volcker Rule, which is named after former Federal Reserve Chairman Paul Volcker, was passed as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010.The rule is intended to prohibit banking organizations from engaging in proprietary trading (the act of buying and selling securities for the bank's account), with certain exceptions. It also limits ownership, sponsorship, and relationships with hedge funds and private equity funds in order to prevent banks from taking on too much risk.

To know more about balance-sheet visit :

https://brainly.com/question/28446946

#SPJ11

can someone tell me what car u like bc i need inspo, like a V6 or something

Answers

Answer:

My personal favs are the Ford GT 2017, the Lamborghini Veneno, the Aston Martin Vulcan, and the Koenigsegg Jesko.

What is the liability in sole proprietorships and partnerships??

Answers

Answer:

Sole proprietors and partners have unlimited liability. The unlimited liability means that if you're unable to repay the debts of the business, your creditors can go after whatever you own.

wants to invest but is worried about risk. in particular, she is worried that bad management and increased competition in the wireless phone market will make these companies less profitable than expected. what type of risk is genevieve most concerned with?

Answers

The type of risk that Genevieve is most concerned with is called business failure.

What is business failure?When a business fails, it means that it stops operating as a result of its inability to turn a profit or generate enough money to pay its bills. If a prosperous company does not produce enough cash flow to cover expenses, it may fail.

Failure can have a variety of reasons, but common ones include inadequate research, a lack of an all-encompassing business plan, a lack of sufficient funding for the company, improper money management, poor marketing, a failure to keep up with the demands of the market or the competition, and an inability to evolve.

Read more on business failure here:https://brainly.com/question/29620396

#SPJ1