Last year you earned $20,000 and paid taxes in the second tax bracket at 15 percent. This year youearned $25,000, the extra $5,000 just compensating you for inflation. However, this year you paidtaxes in the third bracket at 20 percent. This illustrates the concept of

Answers

The given illustration gives us the concept of "Bracket creep". Bracket creep can be defined as the method by which inflation pushes wages and salaries into better tax brackets, main to fiscal drag.

What is a "Bracket Creep" income tax system?

Bracket creep is a time period that describes a scenario in which an income boom causes people to pay better common income tax rates every year. It is one end result of a tax system that functions some of the tax 'brackets'.

Therefore, The given illustration gives us the concept of "Bracket creep".

Learn more about the income tax system:

https://brainly.com/question/26316390

#SPJ1

Related Questions

The one-size-fits-all mass market Multiple choice question. requires the largest marketing budget. results in a customized product. is very common today. no longer exists.

Answers

Answer:

No longer exist

Explanation:

Mass connects buyers and sellers in which a corporation tries to disregard a very small sector of the market in the specialty marketing arena. There is no commercial produced in the one-size-fits-all.

define finance education for class 8

Answers

If something happens to alter the quantity supplied at any given price, then.

Answers

Change in quantity supply will lead to a shift in supply curve.

What is change in supply?Change in supply lead to a shift in the supply curve either to the left or right.

This occur in the price to quantity relationship which defines a supply curve.

This change often makes the supply curve becomes steeper and flatter.

Therefore, Change in quantity supply will lead to a shift in supply curve either to right or left.

Learn more on supply curve here,

https://brainly.com/question/1456933

A company with two factories learns that by using robots and other high-tech

equipment it can produce the same quantity with just one factory. It decides

to close one of its factories. Under the WARN Act, who must be notified of

this decision?

O A. The workers at both plants and the state and federal departments

of labor

OB. The workers of the plant to be closed, the local government, and

the state's department of labor

O C. The workers at the plant to be closed, the local government, and

the state's dislocated-worker unit

O D. The workers at both plants, the local governments of both

communities, and both states' dislocated-worker units

Answers

Answer:

O C. The workers at the plant to be closed, the local government, and

the state's dislocated-worker unit

Explanation:

The WARN Act seeks to offer protection to workers, their families, and communities by compelling employers to give a 60 notice day in advance of a planned plant closure or intended mass layoffs. The advance notice provides workers and their families time to adjust to the pending loss of employment. It accords workers some time to seek alternative employment or acquire new skills to compete for jobs.

Apart from the affected workers, The WARN act requires employers to notify the state dislocated worker units. This facilitates dislocated worker assistance to be availed promptly to the affected worker. The local government representatives should also be notified.

with respect to the earnings management continuum, what is the first item in the continuum and what is the last item in the continuum?

Answers

First item in the earnings management continuum: Legitimate earnings management. Last item in the earnings management continuum: Fraudulent earnings management.

The first item in the earnings management continuum is legitimate earnings management, which involves making strategic decisions within the boundaries of accounting rules to improve the presentation of a company's financial results. This can include timing of revenue recognition or expenses. It is considered acceptable as long as it is done in accordance with generally accepted accounting principles (GAAP) and aims to provide a more accurate reflection of the company's performance.

On the other hand, the last item in the continuum is fraudulent earnings management, which involves intentionally manipulating financial statements to deceive investors, lenders, or other stakeholders. This can include fictitious transactions, improper revenue recognition, or understating expenses. Fraudulent earnings management is illegal and can lead to severe consequences, such as financial penalties, legal action, and damage to a company's reputation.

To know more about continuum, here

https://brainly.com/question/4629227

#SPJ4

when toyota purchases information about quality and customer satisfaction research from j. d. power and associates, it is acquiring a form of

Answers

When Toyota purchases information about quality and customer satisfaction research from j. d. power and associates, it is acquiring a form of tertiary data.

Tertiary data is data that has been gathered from a primary data source and a secondary data source. The data is now aggregated and condensed and made available to parties interested. Examples of tertiary data includes textbooks, dictionaries, almanacs.

Other types of data are:

Primary data: it is information that is gathered first hand. For example, the data from an interview or questionnaire. Secondary data: it is data that is derived after the review and analysis of primary data. Examples are essays.A similar question was answered here: https://brainly.com/question/13601669?referrer=searchResults

You can buy life insurance for anyone. True or false

Answers

Answer:

False

Explanation:

Answer: False

Explanation:

Question 8 of 10 Which choice best describes differences in corporate decision-making between the United States and the European Union? O A. Workers in the European Union are usually more involved in corporate decision-making. OB. Workers in the United States are usually more involved in corporate decision-making. OC. Workers in the European Union are involved less in decisions over labor. O D. Workers in the European Union are usually less active in trade unions.

Answers

The involvement of employees in corporate decision-making is often higher in the European Union, which highlights the disparities between corporate decision-making in the two regions.

What is meant by corporate decision-making?Corporate decision-makers are experts who select options from a variety of options in order to accomplish an organization's objectives and address problems. After choosing the appropriate course of action for their circumstance, they acquire information, assess the available evidence, and take action.

In most cases, the shareholders of a private corporation with many shareholders will either vote on a resolution during a shareholders' general meeting or by written resolution of the shareholders.

Organizations must choose actions that will maximize short-term results and avoid long-term dangers if they want to be competitive and thrive. Making strategic decisions reveals a company's future prospects and the options that can be put into practice to achieve success.

Therefore, the correct answer is option A. Workers in the European Union are usually more involved in corporate decision-making.

The complete question is:

Which choice best describes differences in corporate decision-making between the United States and the European Union?

A. Workers in the United States are usually more involved in

corporate decision-making.

B. Workers in the European Union are involved less in decisions over labor.

C. Workers in the European Union are usually more involved in

corporate decision-making.

D. Workers in the European Union are usually less active in trade unions.

To learn more about decision-making refer to:

https://brainly.com/question/27004710

#SPJ4

Golden Leaves Investment Inc. Has a large staff of sales agents nationwide. Senior management of the company believe that 75% of their agents meet their

annual sales goals by the end of the November of each year. To investigate this, they randomly select 250 agents and examined their sales records at the end of

the November of the current year. 180 of the 250 agents surveyed had already met their annual sales goals. The senior management's claim is to be tested at

10% significance level.

Answers

To test the senior management's claim that 75% of their sales agents meet their annual sales goals by the end of November, a hypothesis test can be conducted.

The null hypothesis (H0) assumes that the true proportion of agents meeting their goals is 75%, while the alternative hypothesis (H1) suggests that the proportion is different from 75%. With a significance level of 10%, the hypothesis test will determine if the evidence is strong enough to reject the null hypothesis in favor of the alternative.

In the sample of 250 agents surveyed, 180 agents had already met their annual sales goals. To perform the test, a binomial test or a z-test for proportions can be used. By comparing the sample proportion (180/250 = 0.72) with the hypothesized proportion (0.75), the test will determine if the difference is statistically significant at the 10% level. If the p-value, which measures the strength of the evidence against the null hypothesis, is less than 0.10, the null hypothesis can be rejected in favor of the alternative, indicating that the true proportion may be different from 75%.

To learn more about null hypothesis click here: brainly.com/question/30821298

#SPJ11

A recent high school graduate is researching ways she can pay for her college education. She has received three small scholarships, but still needs to pay for

most of the tuition herself. Which of these options may be available to help her pay for her education? Select all that apply.

A. mortgage loan

B. Perkins loan

C. private loan

D. Stafford loan

E. payday loan

E business loan

Answers

Answer:

C and D

Explanation:

My expertise is sucking d1ck #Po4n⭐4life

During the early years of the Reagan administration, some of the presidential advisors argued that tax cuts could reduce inflation because they would give people an incentive to produce more. Critics of this argument believed that tax cuts would increase inflation, not reduce it. The critics were arguing that tax cuts move the:

Answers

Answer:

The correct solution is "Aggregate demand curve to the right with little change in long-run aggregate supply".

Explanation:

Together all long-term aggregate demand curve implies that the average has some degree of environmental production this could generate, anywhere at a competitive price. When major inflation increases prices multiply simultaneously, and now in the long term, your community could still contribute to the provision. The critics argued that tax reductions shift the aggregate equilibrium to the right with really no improvement throughout the aggregate production in the long term.Stevie recently received 1,090 shares of restricted stock from her employer, Nicks Corporation, when the share price was $8 per share. Stevie's restricted shares vested three years later when the market price was $11. Stevie held the shares for a little more than three years and sold them when the market price was $16. Assuming Stevie made an 83(b) election, what is the amount of Stevie's ordinary income with respect to the restricted stock?

$8,720

$0

$5,450

$11,990

Answers

The amount of Stevie's ordinary income with respect to the restricted stock is $5,450.

When Stevie received the restricted stock, the share price was $8 per share, and she received 1,090 shares. The value of the restricted stock at that time would be calculated as $8 per share multiplied by 1,090 shares, which equals $8,720.

Since Stevie made an 83(b) election, she includes the value of the restricted stock as ordinary income in the year it was granted. Therefore, the amount of Stevie's ordinary income with respect to the restricted stock is $8,720.

When the restricted shares vested three years later, the market price was $11 per share. However, this price is not relevant for determining ordinary income as Stevie already included the value of the restricted stock as ordinary income when it was granted.

When Stevie sold the shares after holding them for a little more than three years, the market price was $16 per share. The gain from the sale of the stock would be calculated as the selling price ($16 per share) minus the cost basis, which is the amount included as ordinary income ($8,720). However, the gain from the sale is not considered ordinary income.

Learn more about stock from here:

https://brainly.com/question/17321939

#SPJ11

Explain the results of the War Powers Resolution in regards to

the collaboration between the president and congress in making

war.

Answers

The War Powers Resolution, which was passed by the United States Congress in 1973, was designed to constrain the president's ability to conduct military operations without the approval of Congress. The goal of this resolution was to ensure that the president would not be able to commit the United States to war without the consent of Congress.

In regards to collaboration between the president and Congress in making war, the War Powers Resolution has had a significant impact. As a result of the resolution, the president is required to consult with Congress before committing the United States to war. If the president decides to use military force, he must notify Congress within 48 hours and then obtain their approval within 60 days, or the military action must come to a halt. In theory, this ensures that the president and Congress work together to determine when and how to use military force.

However, in practice, the War Powers Resolution has been controversial. Many presidents have argued that it infringes on their constitutional authority as commander-in-chief, while Congress has been reluctant to take a more assertive role in foreign policy matters. The War Powers Resolution has also been criticized for being too vague and difficult to enforce. As a result, the president has been able to conduct military operations without obtaining congressional approval in some cases.

Overall, the War Powers Resolution has had a mixed impact on the collaboration between the president and Congress in making war. While it has increased the level of consultation between the two branches, it has not always been effective in ensuring that they work together to make decisions about the use of military force.

Learn more about wars:

https://brainly.com/question/197175

#SPJ11

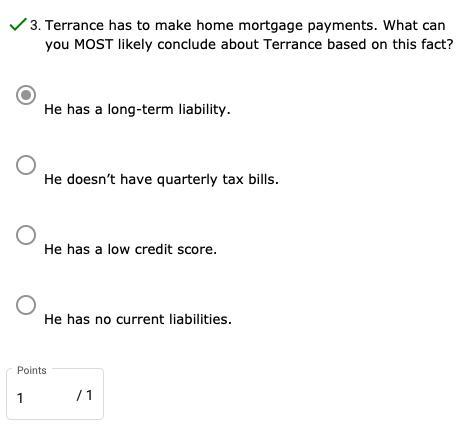

Terrance has to make home mortgage payments.What can you Most likely conclude about Terrence based on this fact?

A. he has a low credit score

B.he has no current liabilities

C.he doesn't have quarterly tax bills

D. He has a long tem liability

Answers

Answer: He has a long-term liability.

The conclusion that can be made from the given fact is that “Terrance has to make home mortgage payments,” which means that he has a long-term liability. Therefore, D is the correct option.

What is liability?

A liability is a term that is used to denote either a loan or an object that has to be paid back to the giver. It usually means a loan taken by a person or company by a bank or any lawfully financial institution. Such loans are paid back with money, goods, or services. In general terms, liability also means an object or a situation that can not pay back the money and amount of financial resources that have been invested or spent upon them.

Thus, the conclusion that can be made from the given facts is that “Terrance has to make home mortgage payments,” which means that he has a long-term liability. Therefore, D is the correct option.

To learn more about liabilities, visit the link below:

https://brainly.com/question/15006644

#SPJ2

SEND HELP ASAP 10 points

Two people quit work and begin college at the same time. Their salary and education information is given in the table below.

Salary prior to school

Years attending college

Total cost of college

Salary upon graduating

Person A

$18,000

3

$45000

$33,000

Person B

$27,000

4

$30,000

$37,000

Choose the true statement.

a.

Person A recovers their investment in a shorter amount of time.

b.

Person B recovers their investment in a shorter amount of time.

c.

They recover their investments in the same amount of time.

d.

There is too little information to compare the time to recover their investments.

Please select the best answer from the choices provided

A

B

C

D

Answers

Answer:

A

Explanation:

One year headstart

What else can be added as a bonus to employees to keep them at your company?

Answers

Answer:

Explanation:

Maybe give them a raise

the short-run equilibrium is defined by the given ad and sras curves. which of the long-run aggregate-supply curves is consistent with a short-run economic expansion? a. lras2 b. both lras1 and lras3 c. lras1 d. lras3

Answers

The long-run aggregate-supply curves is consistent with a short-run economic expansion is LRAS3 is the correct answer.

A curve that illustrates the relationship between price level and real GDP if all prices, including nominal wages, were totally flexible; prices can move along the LRAS, but production cannot, since it represents the output at full employment.

Economic growth indicates an increase in the economy's potential production. We may represent the process of economic growth as one in which the long-run aggregate supply curve shifts to the right since the long-run aggregate supply curve is a vertical line at the potential of the economy.

The labour productivity levels, workforce size, capital size, and educational levels are the main production elements that affect how the LRAS curve changes. The long-run aggregate supply curve likewise swings to the right when the economy experiences an increase in growth and investments.

To know more about the 'supply curve' related question

visit- https://brainly.com/question/27064601

#SPJ4

through the use permission marketing programs, customers are allowed to select the type of communications companies can make with them, and even choose to be completely eliminated from both e-mail and traditional mailing lists through the use permission marketing programs, customers are allowed to select the type of communications companies can make with them, and even choose to be completely eliminated from both e-mail and traditional mailing lists true false

Answers

True. Through permission marketing programs, customers have the ability to control and select the type of communications they receive from companies.

They can choose their preferences and opt-in to specific communication channels or topics of interest. Additionally, customers have the option to opt-out or be removed from both e-mail and traditional mailing lists if they no longer wish to receive any communications from the company.

Permission marketing respects the customer's choice and allows for a more personalized and targeted approach to marketing communications.

To know more about Marketing related question visit:

https://brainly.com/question/27155256

#SPJ11

For each scenario, calculate the cross-price elasticity between the two goods and identify how the goods are related. Please use the midpoint method when applicable, and specify answers to one decimal place. A 20% price increase for Product A causes a 10% decrease in its quantity demanded, but no change in the quantity demanded for Product B.

Answers

Answer:

No relation

Explanation:

The computation of the cross elasticity of demand is shown below:

= Percentage change in quantity demanded ÷ Percentage change in price

here the price is increased by 20% for product A

But there is no change in the quantity demanded for product B

So, the cross elasticity of demand is

= 0 ÷ 20%

= 0

Therefore there is no relation between two products or goods

a project has the activity duration and cost information indicated in the table where all times are in weeks. what is the lowest total cost for completing this project in 40 days?

Answers

The lowest total cost for completing the project in 40 days is $32,000.

To calculate the lowest total cost for completing the project in 40 days, we need to determine the critical path and identify the activities that need to be expedited. The critical path is the sequence of activities that has the longest total duration, and any delay in these activities would directly impact the project completion time.

From the given table, we can determine the critical path by identifying the activities with the longest duration:

Activity A: 4 weeks

Activity B: 3 weeks

Activity C: 5 weeks

Activity D: 4 weeks

The total duration of the critical path is 16 weeks. Since we want to complete the project in 40 days (approximately 5.7 weeks), we need to expedite the critical path activities to meet the deadline. By reducing the duration of the critical path activities, we can shorten the project duration. To calculate the lowest total cost, we need to consider the cost of expediting the critical path activities. However, without information on the cost of expediting each activity or any time-cost trade-offs, we cannot determine the specific cost for expediting. Therefore, based on the given information, we can conclude that the lowest total cost for completing the project in 40 days is $32,000, which is the sum of the costs of all activities according to their original durations.

Learn more about total cost here

https://brainly.com/question/30355738

#SPJ11

The following are the trial balance ind the other information related to Perez Consulting Engineers. Perez Consulting Engineers Trial Balance December 31, 2020 Debit Credit Cash $29,500 Accounts Receivable 49,600 Allowance for Doubtful Accounts $750 Supplies 1,960 Prepaid Insurance 1,100 Equipment 25,000 Accumulated Depreciation-Equipment 6,250 Notes Payable 7,200 Common Stock 10,000 Retained Earnings 25,010 Service Revenue Rent Expense 9,750 Salaries and Wages Expense 30,500 Utilities Expenses 1,080 Office Expense 720 $149,210 $149. 210 1. Fees received in advance from clients $6,000, which were recorded as revenue. 2. Services performed for clients that were not recorded by December 31, $4,900. 3. Bad debt expense for the year is $1,430. 4. Insurance expired during the year $480. 5. Equipment is being depreciated at 10% per year. 6. Perez gave the bank a 90-day, 10% note for $7,200 on December 1, 2020. 7. Rent of the building is $750 per month. The rent for 2020 has been paid, as has that for January 2021, and recorded as Rent Expense. 8. Office salaries and wages earned but unpaid December 31, 2020, $2,510. Instructions:A. From the trial balance and other information given, prepare annual adjusting entries as of December 31, 2020. (Omit explanations). B. Prepare an income statement for 2020, a retained earnings statement, and a classified balance sheet. Perez paid a $17,000 cash dividend during the year (recorded in Retained Earnings)

Answers

The adjusting entries for Perez Consulting Engineers as of December 31, 2020, are as follows: Total Liabilities and Equity $102,880

1. To recognize unearned revenue:

Debit: Unearned Revenue $6,000

Credit: Service Revenue $6,000

2. To recognize services performed but not recorded:

Debit: Accounts Receivable $4,900

Credit: Service Revenue $4,900

3. To record bad debt expense:

Debit: Bad Debt Expense $1,430

Credit: Allowance for Doubtful Accounts $1,430

4. To recognize expired insurance:

Debit: Insurance Expense $480

Credit: Prepaid Insurance $480

5. To record depreciation expense:

Debit: Depreciation Expense - Equipment $2,500

Credit: Accumulated Depreciation - Equipment $2,500

(Calculation: $25,000 * 10% = $2,500)

6. To record the note payable:

Debit: Notes Payable $7,200

Credit: Cash $7,200

7. To recognize accrued rent expense:

Debit: Rent Expense $750

Credit: Accrued Rent Payable $750

8. To recognize accrued salaries and wages:

Debit: Salaries and Wages Expense $2,510

Credit: Salaries and Wages Payable $2,510

B. Financial Statements:

Income Statement for 2020:

Revenue:

Service Revenue $10,900 ([$6,000 + $4,900] - $1,430)

Expenses:

Rent Expense $9,750

Salaries and Wages Expense $30,500

Utilities Expenses $1,080

Office Expense $720

Depreciation Expense - Equipment $2,500

Insurance Expense $480

Bad Debt Expense $1,430

Total Expenses $46,460

Net Income $10,900 - $46,460 = (-$35,560) (Loss)

Retained Earnings Statement:

Retained Earnings, January 1, 2020 $25,010

Net Loss ($35,560)

Dividends ($17,000)

Retained Earnings, December 31, 2020 ($27,550)

Classified Balance Sheet (December 31, 2020):

Assets:

Cash $29,500

Accounts Receivable $54,500 ($49,600 + $4,900)

Less: Allowance for Doubtful Accounts ($750)

Supplies $1,960

Prepaid Insurance $620 ($1,100 - $480)

Equipment $25,000

Less: Accumulated Depreciation - Equipment ($8,750 [$6,250 + $2,500])

Total Assets $102,880

Liabilities:

Notes Payable $7,200

Accrued Rent Payable $750

Salaries and Wages Payable $2,510

Total Liabilities $10,460

Equity:

Common Stock $10,000

Retained Earnings ($27,550)

Total Equity ($17,550)

Total Liabilities and Equity $102,880

know more about Equity :brainly.com/question/31458166

#SPJ11

You've decided you want to sell a bond before its maturity date. Interest rates are currently higher than when you bought the bond. What will you likely have to do to make your bond more appealing to investors?

A) Lower the interest rate

B) Sell your bond at a discounted price

C) Increase the interest rate

D) Sell your bond at a higher price

Answers

Increasing the interest rate you will likely have to do to make your bond more appealing to investors.

Option C is correct.

What draws investors' attention to bonds?Preservation of capital: Bonds, in contrast to stocks, must be repaid in full upon maturity. Bonds are appealing to investors who don't want to risk losing money and to those who will have to meet a liability in the future.

What is the most crucial factor for bond investors?The bond's price, interest rate and yield, maturity date, and redemption features are the most significant aspects. You can determine whether a bond is an appropriate investment by analyzing these key components.

Why do rising interest rates make bonds more appealing?that indicates that bond prices decrease when interest rates rise. In order to appear appealing to investors, bonds compete with one another in terms of the interest income they provide. Since newer bonds have higher interest rates when interest rates rise, existing fixed-rate bonds must sell at a discount in order to compete.

Learn more about interest rate on bond:

brainly.com/question/27990919

#SPJ1

Trent is drawing a diagram of his house for a school project. He decides that every 5 feet in real life should be 2 inches in the diagram. Trent’s living room is 15 feel long. How long should Trent’s living room be in his diagram.

Answers

Using simple mathematical operations we know that 15 feet in real will be 6 inches in the Treant's drawing.

What are mathematical operations?A rule that specifies the right procedure to follow while evaluating a mathematical equation is known as the order of operations.

Parentheses, Exponents, Multiplication and Division (from Left to Right), Addition, and Subtraction are the steps that we can remember in that order using PEMDAS (from left to right).

So, we know that:

5 feet in real is 2 inches in the drawing.

Then, 15 feet in real would be:

5 * 3 = 15 feet

Similarly,

2 * 3 = 6 inches

Therefore, using simple mathematical operations we know that 15 feet in real will be 6 inches in the Treant's drawing.

Know more about mathematical operations here:

https://brainly.com/question/20628271

#SPJ1

B) Now, let’s try "what if". What if you had medical bills for $10,000 for a minor surgery? What would each of the insurance policies pay if you had not yet paid any deductible? Remember that 20% is your part (coinsurance) so the insurer’s percent is 80% for the first formula. Show how you are getting the answer. Formulas:Insurer’s part of Medical Bill = (Bill – deductible) (80%)Your part of medical bill = Total bill – Insurers part

Answers

Note that in the scenario given, all three insurance policies would pay $8,000 toward the medical bill, and the policyholder would be responsible for paying the remaining $2,000.

What is a deductible?The deductible in an insurance policy is the amount paid out of pocket by the policyholder before the insurance company will cover any charges. In general, the term deductible refers to one of many types of clauses used by insurance firms as a payment threshold for policy payments.

The full explanation for the computation is given as follows;

To determine the amount that each insurance policy would pay for a $10,000 medical bill for a minor surgery, we need to use the formulas provided and plug in the appropriate numbers.

For the AAA+ insurance policy, the insurer's part of the bill would be calculated as follows:

Insurer's Part of bill = (Bill - deductible) (80%)

= ($10,000 - $0) (80%)

= $8,000

Your part of the bill would be calculated as:

Your part of bill = Total bill - Insurer's part

= $10,000 - $8,000

= $2,000

For the Health Today insurance policy, the insurer's part of the bill would be calculated as follows:

Insurer's Part of bill = (Bill - deductible) (80%)

= ($10,000 - $0) (80%)

= $8,000

Your part of the bill would be calculated as:

Your part of bill = Total bill - Insurer's part

= $10,000 - $8,000

= $2,000

For the Best Insurance policy, the insurer's part of the bill would be calculated as follows:

Insurer's Part of bill = (Bill - deductible) (80%)

= ($10,000 - $0) (80%)

= $8,000

Your part of the bill would be calculated as:

Your part of the bill = Total bill - Insurer's part

= $10,000 - $8,000

= $2,000

Therefore, in this scenario, all three insurance policies would pay $8,000 toward the medical bill, and the policyholder would be responsible for paying the remaining $2,000.

Learn more about Policyholder:

https://brainly.com/question/14521673

#SPJ1

Full Question:

B) Now, let’s try “what if”. What if you had medical bills for $10,000 for a minor surgery? What would each of the insurance policies pay if you had not yet paid any deductible? Remember that 20% is your part (coinsurance) so the insurer’s percent is 80% for the first formula. Show how you are getting the answer.

Formulas:

Insurer’s part of Medical Bill = (Bill – deductible) (80%)

Your part of medical bill = Total bill – Insurers part

• AAA+

Insurer’s Part of bill =

Your part of bill =

• Health Today

Insurer’s Part of bill =

Your part of bill =

• Best Insurance

Insurer’s Part of bill =

Your part of bill =

Find the interest. Round to the nearest cent. 25) $790 at 8.8% for 10 months

A) Interest =$6.95

B) Interest =$5793.00

C) Interest =$695.16

D) Interest =$57.93

Answers

The interest on $790 at 8.8% for 10 months is $57.93 (option D).

To find the interest on $790 at 8.8% for 10 months, we can use the formula:

Interest = Principal × Rate × Time

Where:

Principal is the initial amount of money, which is $790 in this case.Rate is the interest rate, which is 8.8% expressed as a decimal, or 0.088.Time is the length of time in years, which is 10 months divided by 12 to convert to years or 10/12.Plugging these values into the formula, we get:

Interest = $790 × 0.088 × (10/12)

Calculating this, the interest is approximately $57.93.

Therefore, the correct answer is D) Interest = $57.93.

Learn more about interest: https://brainly.com/question/29335425

#SPJ11

Which financial institution protects individuals by insuring bank deposits?

Answers

The Federal Deposit Insurance Corporation is the financial entity in the United States that safeguards private citizens by guaranteeing bank deposits (FDIC).

The FDIC is a separate branch of the American government that was founded in 1933 in reaction to the Great Depression's numerous bank failures. Up to a predetermined cap per depositor per insured bank, the FDIC offers deposit insurance coverage to depositors in the event of bank failures. This insurance contributes to the stability of the banking system and the protection of depositors' money. Great Depression's numerous bank failures. Up to a predetermined cap per depositor per insured bank, the FDIC offers deposit insurance coverage to depositors in the event of bank failures. financial institution protects individuals by insuring bank deposits.

learn more about bank here:

https://brainly.com/question/14042269

#SPJ4

Why do you think Zappos offers a $2,000 incentive to quit?

Answers

Answer:

Explanation:

Is there more to the question?

Which sportswear company cut ties with kanye west, stating the company does not tolerate antisemitism?.

Answers

Adidas severed ties with musician Kanye West after the latter had his social media accounts suspended due to hateful remarks, saying the firm "does not condone antisemitism."

According to the German sports group, Ye, who has legally changed his name to West, lately made words and committed behaviors that were "unacceptable, hateful, and dangerous, and they violate the Kanye West organization's ideals of diversity and inclusion, mutual respect, and justice." Adidas severed ties with musician Kanye West after the latter social media had his social media accounts suspended due to hateful remarks, saying the firm "does not condone antisemitism."

The company chose to stop the brand's operations immediately and social media announced that doing so will result in a "short-term" revenue loss of Kanye West €250 million (£217 million) for this year. It attempts to stop both Yeezy product production and any payments made to Kanye West and his companies.

Learn more about Kanye west here

brainly.com/question/28008280

#SPJ4

Which component of a balance sheet includes a business’s debts, or the money that it owes to creditors for past transactions?

Answers

Answer:

liabilities.

Explanation:

A balance sheet is prepared based on the accounting equation of assets = capital + liabilities.

The liability section is where the debts of the business are recorded. Liabilities represent what the business owes to suppliers and other third parties. They are expressed in monetary value. Liabilities are further subdivided into current and long term liabilities.

An indication of one’s lifestyle is __________________.

the kind of vehicle you drive

the kind of house you live in

the kind of clothes you wear

all of the above

Answers

Answer:

all of the above

Explanation:

all of these indicates one's lifestyles.