Gerald received a one-third capital and profit (loss) interest in XYZ Limited Partnership (LP). In exchange for this interest, Gerald contributed a building with an FMV of $31,000. His adjusted basis in the building was $15,500. In addition, the building was encumbered with a $9,300 nonrecourse mortgage that XYZ LP assumed at the time the property was contributed. What is Gerald's outside basis immediately after his contribution

Answers

Answer:

The appropriate answer is "$9,300".

Explanation:

The given values are:

FMV,

= $31,000

Adjusted basis,

= $15,500

Encumbered mortgage,

= $9,300

Now,

The Gerald's outside basis will be:

= \(Adjusted \ basis-Encumbered \ mortgage+Share \ of \ mortgage\)

On substituting the given values, we get

= \(15,500 - 9,300+(\frac{9,300}{3})\)

= \(15,500 - 9,300 + 3,100\)

= \(18,600-9,300\)

= \(9,300\) ($)

Related Questions

HELP PLS

Which of the following is a explain a job responsibility for an engineer in a manufacturing plant.

A: Creating product designs

B: inspecting products

C: repairing machinery

D: supervising mechanics

Answers

Answer:

The answer is AExplanation:

I know my answer is very late but imp leaving this here for whoever needs it. Engineers make the actual machinery designs and test them. Therefore the answer is A. If my answer is incorrect I am sorry.

738x150 divided by 6 x 1 0

Answers

design an approach that your team would recommend for Joseph and Nicholas to cover one area each that you deem necessary to aid in the planning and controlling functions

Answers

The combines strategic planning, performance measurement, effective communication, and continuous improvement to support Joseph and Nicholas in their planning and controlling functions. It ensures a well-defined direction, data-driven decision-making, collaboration, and a focus on growth and adaptability.

In order to aid in the planning and controlling functions, the following approach can be recommended to Joseph and Nicholas:

1. Establish Clear Objectives and Goals: The first step in planning is to establish clear objectives and goals for the team. It is important to have a clear understanding of what needs to be accomplished and what the team's priorities are.

2. Assign Responsibilities: Assigning specific responsibilities to team members helps to ensure that everyone is working towards a common goal. Joseph and Nicholas should each be assigned to cover one area that is necessary for planning and controlling functions. This will help to ensure that all aspects of the project are covered and that there is no overlap or duplication of efforts.

3. Develop a Schedule: Developing a schedule that outlines the key milestones and deadlines for the project is essential to effective planning and control. This will help to ensure that the project stays on track and that deadlines are met.

4. Monitor Progress: Regularly monitoring progress against the schedule and objectives is necessary to ensure that the project is progressing as planned. This will help to identify any issues or problems that arise and allow for corrective action to be taken.

5. Communicate: Effective communication is critical to the success of any project. Joseph and Nicholas should establish a regular communication schedule to ensure that everyone is up-to-date on the project's progress, any issues or problems that arise, and any changes to the schedule or objectives.

6. Make Adjustments: Finally, it is important to be flexible and make adjustments as needed. If the project is not progressing as planned, adjustments may be necessary to the schedule or objectives to ensure that the project stays on track and that goals are met.

for more question on adaptability

https://brainly.com/question/26810727

#SPJ8

You are considering switching your Internet and cable providers and DIRECTV is advertising an introductory rate of $30 a month for a two-year contract the introductory rate goes away after six months and the rate will raise to $75 a month after that in aaddition to switch now you will be entered into a drawing for a chance to be an extra in the companies next hilarious commercial you pay $50 a month with your current provider and there's no contract should you switch?

Answers

Answer:

DIRECTV:

($30)(6) + ($75)(18) = $1530

Current:

($50)(24) + $1200

Do not switch providers.

Explanation:

You should not switch providers because, in the long run, you will be paying less money with your current provider than with DIRECTV. Emotionally, you may want to purchase DIRECTV's contract because of the drawing; however, there is a low probability that you would actually be chosen, so it is not worth the increase in payments.

Discuss the functions of government necessary for a country

Answers

The functions of government are crucial for the proper functioning and development of a country. These functions can vary depending on the type of government system in place, but there are several key functions that are commonly considered necessary for a country's stability and progress.

1. Legislation and Governance: One of the primary functions of government is to create and enforce laws that maintain order, protect individual rights, and promote the welfare of the citizens. Governments establish institutions and frameworks for governance, ensuring the rule of law and providing a system of justice.

2. Defense and Security: Governments are responsible for safeguarding the country and its citizens from external threats. This involves maintaining armed forces, intelligence agencies, and diplomatic relations to protect national security interests.

3. Economic Management: Governments play a crucial role in managing and regulating the economy. They establish fiscal and monetary policies, oversee financial institutions, promote trade, and create an environment that supports economic growth and stability. Government intervention is often necessary to address market failures, promote fair competition, and protect consumers.

4. Social Welfare: Governments have a responsibility to ensure the well-being and social welfare of their citizens. This includes providing basic services such as healthcare, education, social security, and infrastructure development. Governments also implement social policies to address poverty, inequality, and promote equal opportunities.

5. Public Services: Governments are responsible for delivering essential public services, such as transportation, utilities, public safety, and environmental protection. These services are necessary for the functioning of society and improving the quality of life for citizens.

6. Diplomacy and International Relations: Governments engage in diplomatic activities and maintain relationships with other nations. They negotiate treaties, participate in international organizations, and represent the country's interests abroad. Governments also address global challenges, such as climate change and human rights, through international cooperation.

7. Public Communication and Information: Governments have a role in providing transparent and accurate information to the public. They engage in public communication, disseminate information, and promote citizen engagement and participation in the decision-making process.

These functions of government are essential for maintaining social order, promoting economic growth, protecting citizens' rights, and ensuring the overall well-being of a country. Effective governance requires a balance between these functions, adaptability to changing circumstances, and responsiveness to the needs and aspirations of the citizens.

For more such answers on development

https://brainly.com/question/28156728

#SPJ8

A bank offers 10.00% on savings accounts. What is the effective annual rate if interest is compounded continuously?

Answers

The effective annual rate if interest is compounded continuously equals to 10.52%.

What is an effective annual rate?This interest rate refers to the return on an investment or the rate owed in interest on a loan when the compounding periods is taken into account. The effective annual rate is equal to the nominal rate only if the compounding is done annually. So, when the number of compounding periods increase, the effective annual rate increases.

As we are looking for continuous compounding formula, the effective annual rate is as follows:

EAR = e^i – 1

Given data

A bank offers 10.00% on savings accounts.

EAR = e^(0.10) - 1

EAR = 1.10517091808 - 1

EAR = 0.10517091808

EAR = 10.52%

Therefore, the effective annual rate if interest is compounded continuously equals to 10.52%.

Read more about effective annual rate

brainly.com/question/17157418

#SPJ1

why is it important to have a good besiness background?

Answers

On June 15, 2021, Allen sold land held for investment to Stan for $65,000 and an installment note of $300,000 payable in five equal annual installments beginning on June 15, 2022, plus interest at 10%. Allen’s basis in the land is $255,500. What amount of gain is recognized in 2021 under the installment method?

Answers

The amount of gain that will be recognized in 2021 under the installment method, is $27, 857 . 14

How to find the gain recognized?First, find the profit margin on the land sold by Allen to Stan:

= ( Selling price of land - Allen's basis in the land) / Allen's basis in the land

= ( ( 300, 000 + 65, 000) - 255, 500) ) / 255, 500

= 109, 500 / 255, 500

= 42. 857 %

The gain to be recognized, using the installment method is:

= Profit margin x Amount paid by Allen in 2021

= 42. 857 % x $ 65, 000

= $27, 857 . 14

Find out more on gain recognized at https://brainly.com/question/17926235

#SPJ1

A database program would probably be used to

Answers

Answer:

The application scope of the database is very wide, such as the student information management system, course selection system, as well as the telecommunications department payment system, statistical system, and online game account management, etc., can be said that the current software, especially the network application software, is to use the database

Answer:

A database program would probably be used to track purchases on a commercial website.

Explanation:

A database is the heart of a business information system and provides file creation, data entry, query and reporting functions.

Which of the following is a reason that businesses invest in capital, such as technology and new equipment? Decrease production possibilities Increase production possibilities Maintain production possibilities An outcome cannot be determined

Answers

A reason that businesses invest in capital is to increase the production possibilities.

Why do businesses invest in capital?

Capital include all the man-made resources that are used in the production process. Capital is one of the factors of production. Examples of a capital include technology and new equipment.

Capital increases the production possibilities of a firm and it is also increase the efficiency and quality of output. For example, imagine that a company stores records in files in a cabinet. Now, imagine that the firm buys a computer and uses the computer to store information instead. The amount of data that can be stored now has increased. Also, the data stored are better preserved.

Some of the disadvantages of capital is that it can be expensive to acquire and sometime it can render the job functions rendered by humans obsolete.

To learn more about production possibilties, please check: https://brainly.com/question/28476383

#SPJ1

Answer:

Increase production possibilities

Explanation:

just took the quiz

If any financial institution, such as a brokerage house, handles a check for payment or collection, the check is covered by UCC Article 4.a. Trueb. False

Answers

FALSE. If any financial institution, such as a brokerage house, handles a check for payment or collection, the check is NOT covered by Uniform Commercial Code Article 4.

Funds transfers are governed by UCC Article 4A, starting with the payment order issued by the originator with the intention of paying the order's beneficiary. The item also applies to any payment instruction provided by the bank of the originator or by a bank acting as an intermediary to execute the originator's payment instruction. The liability of a bank for action or inaction with regard to an item it handled for presentment, payment, or collection is covered by Article 4 of the UCC. When it comes to bank deposits, the law of the location where the bank is located is typically more relevant.

To know more about Uniform Commercial Code:

https://brainly.com/question/13487732

#SPJ4

i'll give brainliest!!! Which descriptions offer examples of Governance workers? Check all that apply.

Tia writes and votes on federal legislation.

Herman prepares and oversees responses to earthquakes.

Isaiah performs basic office tasks for a court of law.

Willis makes sure that people and businesses pay their taxes.

Valerie analyzes public opinions and voting results.

Chong maintains weapons and armored vehicles for the US Army.

Answers

Answer:

A, B, and E

Explanation:

Answer:

A,B,E

Explanation:

on edg 2020 your welcome luv<3

Marco, Jaclyn, and Carrie formed Daxing Partnership (a calendar-year-end entity) by contributing cash 10 years ago. Each partner owns an equal interest in the partnership and has an outside basis in his/her partnership interest of $104,000. On January 1 of the current year, Marco sells his partnership interest to Ryan for a cash payment of $137,000. The partnership has the following assets and no liabilities as of the sale date:

Tax Basis FMV

Cash $ 18,000 $ 18,000

Accounts receivable 0 12,000

Inventory 69,000 81,000

Equipment 180,000 225,000

Stock investment 45,000 75,000

Totals $ 312,000 $ 411,000

The equipment was purchased for $240,000, and the partnership has taken $60,000 of depreciation. The stock was purchased seven years ago.

4.

value:

1.00 points

Required information

a. What are the hot assets [§751(a)] for this sale? (Select all that apply.)

Accounts receivable

Inventory

Stock investment

Potential depreciation recapture in the equipment

References

eBook & Resources

Difficulty: 2 MediumLearning Objective: 21-01 Determine the tax consequences to the buyer and seller of the disposition of a partnership interest, including the amount and character of gain or loss recognized.

5.

value:

1.00 points

Required information

b. What is Marco’s gain or loss on the sale of his partnership interest?

References

eBook & Resources

ProblemDifficulty: 2 MediumLearning Objective: 21-01 Determine the tax consequences to the buyer and seller of the disposition of a partnership interest, including the amount and character of gain or loss recognized.

Check my work

6.

value:

1.00 points

Required information

c. What is the character of Marco’s gain or loss?

$23,000 ordinary income and $10,000 capital gain

$10,000 ordinary income and $23,000 capital gain

$33,000 ordinary income

$33,000 capital gain

None of these

References

eBook & Resources

Difficulty: 2 MediumLearning Objective: 21-01 Determine the tax consequences to the buyer and seller of the disposition of a partnership interest, including the amount and character of gain or loss recognized.

Check my work

7.

value:

1.00 points

Required information

d. What are Ryan’s inside and outside bases in the partnership on the date of the sale?

Answers

Answer:

I have no idea

Explanation:

I apologize

a) The hot assets according to [§751(a)] for this sale are:

a. Accounts receivableb. Inventoryd. Potential depreciation recapture in the equipment.b) Marco’s gain or loss on the sale of his partnership interest is $33,000 ($137,000 - $104,000).

c) The character of Marco’s gain or loss is d. $33,000 capital gain.

d) Ryan’s inside and outside bases in the partnership on the date of the sale are $137,000 ($411,000/3).

What are hot assets in a partnership?Hot assets refer to these assets: "unrealized receivables" and "inventory items," which generate ordinary business income when sold.

The hot assets also include, in this instance, the "unrealized depreciation recapture" in the equipment of the partnership.

Data and Calculations:Tax Basis FMV

Cash $ 18,000 $ 18,000

Accounts receivable 0 12,000

Inventory 69,000 81,000

Equipment 180,000 225,000

Stock investment 45,000 75,000

Totals $ 312,000 $ 411,000

Question Completion:The equipment was purchased for $240,000, and the partnership has taken $60,000 of depreciation. The stock was purchased seven years ago.

a. What are the hot assets [§751(a)] for this sale? (Select all that apply.)

a. Accounts receivable

b. Inventory

c. Stock investment

d. Potential depreciation recapture in the equipment

b. What is Marco’s gain or loss on the sale of his partnership interest?

c. What is the character of Marco’s gain or loss?

a. $23,000 ordinary income and $10,000 capital gain

b. $10,000 ordinary income and $23,000 capital gain

c. $33,000 ordinary income

d. $33,000 capital gain

e. None of these

d. What are Ryan’s inside and outside bases in the partnership on the date of the sale?

The hot assets according to [§751(a)] for this sale are Accounts receivable, Inventory, and the potential depreciation recapture in the equipment because they generate ordinary business income when sold.

Learn more about partnership interest at https://brainly.com/question/23287300

A division can sell externally for $40 per unit. Its variable manufacturing costs are $15 per unit, and its variable marketing costs are $6 per unit. The variable marketing costs can be avoided if the units are transferred internally. What is the opportunity cost of transferring internally, assuming the division is operating at capacity

Answers

Answer:

$19

Explanation:

The opportunity cost of transferring internally is the lost contribution of selling the units externally.

Contribution = Sales - Variable Costs

where,

Sales = $40

Variable Costs = $15 + $6 = $21

therefore,

Lost Contribution = $40 - $21 = $19

Conclusion

the opportunity cost of transferring internally is $19.

11. a. Suppose David spends his income M on goods x1 and x2, which are priced p1 and p2, respectively. David’s preference is given by the utility function

(1, 2) = √1 + √2.

(i) Derive the Marshallian (ordinary) demand functions for x1 and x2. (25 marks)

(ii) Show that the sum of all income and (own and cross) price elasticity of demand

for x1 is equal to zero. (25 marks) b. For Jimmy both current and future consumption are normal goods. He has strictly convex and strictly monotonic preferences. The initial real interest rate is positive. If the real interest rate falls, in each of the following cases, argue what will happen to his period 2 consumption level? Clearly illustrate your argument on a graph.

(i) He is initially a borrower. (25 marks)

(ii) He is initially a lender. (25 marks)

Answers

Answer:

Explanation:

D

July 25, Andrews Promoters received $4,500 in revenue from cash ticket sales.

ce

What accounts are affected ?

Answers

Answer:

Cash accountRevenue AccountExplanation:

The tickets are sold on a cash basis. The transaction resulted in an increase in cash to the business. Therefore, the cash account will be affected. An increase in cash is debited to the cash account. $4500 will be debited

The transaction involved the selling of tickets, which is a business activity that generated revenue. The sales or revenue account will be affected. The revenue will increase by $4500. An increase in revenue is credited.

Marwick's Pianos Inc. purchases pianos from a large manufacturer and sells them at the retail level.The pianos cost, on average, $1,488 each from the manufacturer.Marwick's Pianos Inc. sells the pianos to its customers at an average price of $2,900 each.The selling and administrative costs that the company incurs in a typical month are presented below:Costs Cost FormulaSelling:Advertising $942 per monthSales salaries and commissions $4,799 per month, plus 3% of salesDelivery of pianos to customers $60 per piano soldUtilities $650 per monthDepreciation of sales facilities $4,945 per monthAdministrative:Executive salaries $13,566 per monthInsurance $685 per monthClerical $2,480 per month, plus $36 per piano soldDepreciation of office equipment $900 per monthDuring August, Marwick's Pianos Inc. sold and delivered 63 pianos.Required:1. Prepare an income statement for Marwick's Pianos Inc. for August. Use the traditional format, with costs organized by function.2. Prepare an income statement for Marwick's Pianos Inc. for August, this time using the contribution format, with costs organized by behavior. Show costs and revenues on both a total and a per unit basis down through contribution margin.

Answers

Answer:

1) Marwick's Pianos Inc.

Income Statement

For the month ended August 202x

Total sales revenue $182,700

Cost of goods sold ($93,744)

Gross profit $88,956

Administrative expenses:Executive salaries ($13,566)Clerical salaries ($4,748)Depreciation office equipment ($900)Utilities ($650) ($19,864)Sales expenses:

Sales salaries and commissions ($10,280)Delivery expense ($3,780)Advertising ($942)Depreciation of sales facilities ($4,945) ($19,947)Operating income $49,145

2) Marwick's Pianos Inc.

Income Statement

For the month ended August 202x

Total sales revenue $182,700

Variable costs:

Pianos ($93,744)Sales commissions ($5,481)Clerical commissions ($2,268)Delivery expense ($3,780) ($105,273)Contribution margin $77,427

Period costs:

Executive salaries ($13,566)Clerical salaries ($2,480) Sales and commissions ($4,799)Advertising ($942)Depreciation expense ($5,845)Utilities expense ($650) ($28,282)Operating income $49,145

Explanation:

cost of a piano = $1,488

selling price per piano = $2,900

advertising $942 per month

sales and commissions $4,799 + 3% commissions on sales

delivery of pianos = $60 per piano

utilities expense = $650

depreciation expense = $4,945

executive salaries = $13,566

clerical salaries = $2,480 + $36 per piano

depreciation = $900

63 pianos sold during August

cost of goods sold = $1,488 x 63 = $93,744

total sales revenue = $2,900 x 63 = $182,700

sales commissions = $5,481

clerical commissions = $2,268

Do any of the actions Day took to change the culture align with Lewin & Schein's Model of Change? How? Help me quick!!

Answers

Lewin's change model is a framework for humanizing the change management process that is simple and easy to understand. You are able to plan and carry out the necessary change thanks to these three distinct stages of change—unfreeze, change, and refreeze.

How can Lewin's model of change be put to use?Lewin's model of change management can be used in a lot of different situations. It teaches you, for instance, how to engage employees in significant organizational changes and why some people and organizations are more motivated by the need for social approval than by financial incentives.

What is the model of Schein?The idea behind the Schein's Model of Organizational Culture is to explain the idea of culture and how it affects businesses. It is a dynamic model of group dynamics and learning.

Learn more about Lewin's model here:

https://brainly.com/question/28234679

#SPJ13

Question 1 (1 point)

Which examples are of financial goals? (Select three answers.)

Lanelle wants to become her school's class president.

Martina wants a part-time job that will earn enough money for the maintenance

on her car.

Caleb wants to get good enough at playing the piano to win the talent show

competition.

Dante wants to save up for a new stereo.

Tyrell wants his photos to be displayed at an art gallery.

Chelsea wants to be able to afford her own apartment.

Answers

The three examples that are of financial goals include the following:

B. Martina wants a part-time job that will earn enough money for the maintenance on her car.

D. Dante wants to save up for a new stereo.

F. Chelsea wants to be able to afford her own apartment.

What is a goal?In Business management, a goal can be defined as an outcome statement and strategic objectives that defines what an individual or a group of people (team members) hope to successfully achieve (accomplish) in the future i.e over a specific period of time.

This ultimately implies that, a goal is simply a futuristic idea, an objective, or desired result that an individual envision, plan, and commit to achieve over a specific period of time.

In this context, we can reasonably infer and logically deduce that a financial goal is mainly or primarily tied to money, especially earnings and savings.

Read more on goal here: brainly.com/question/18118821

#SPJ1

The comparative balance sheets for Riverbed Company show these changes in noncash current asset accounts: accounts receivable decreased $81,100, prepaid expenses increased $24,700, and inventories increased $43,400.

Answers

Decreases in accounts receivables are added back because these represent collections from customers. Increases, however, are deducted because no actual cash was received when sales were recorded.

A balance sheet contains what?An organization's assets, liabilities, and owner equity are listed on a balance sheet as of any given date. A balance sheet is usually created at the conclusion of predetermined periods (e.g., every quarter; annually). Two columns make up a balance sheet. The company's assets are listed in the left-hand column.

What is a balance sheet's primary function?A balance sheet provides you with a momentary glimpse of your company's financial situation. A balance sheet can assist business owners in assessing the financial health of their organization along with an income statement and a cash flow statement.

To know more about Balance Sheet visit:

https://brainly.com/question/26323001

#SPJ1

There are four hallmarks of an effective marketing mix: it matches customer needs, matches corporate resources, creates a competitive advantage and is well

Answers

Product, pricing, place, and promotion are the four basic pillars of a marketing strategy, often known as the marketing mix corporate or the four P's of marketing. The four Ps are product, pricing, place, and promotion.

They serve as an example of a "marketing mix," which is the set of tools and strategies used by marketers to achieve their marketing objectives. The 4 Ps were first formally proposed by E in 1960. corporate alter their marketing mix in an effort to convince management that their product is better than that of their competitors. The purpose of these changes is to gain a competitive advantage.

To learn more about marketing, click here.

https://brainly.com/question/13414268

#SPJ1

The ledger of Sunland Rental Agency on March 31 of the current year includes the following selected accounts, before adjusting entries have been prepared.

Prepaid Insurance

Supplies

Equipment

Accumulated Depreciation-Equipment

Notes Payable

Unearned Rent Revenue

Rent Revenue

Interest Expense

Salaries and Wages Expense

Debit

$ 1,200

3,500

18,750

Credit

$ 8,370

25,000

9,000

62,000

17,000

An analysis of the accounts shows the following.

The equipment depreciates $465 per month.

One-third of the unearned rent revenue was earned during the quarter.

Interest of $625 should be accrued on the notes payable.

Answers

yes it should 625% of interest

Based on this home-buying situation: (a) What questions might Zoe and Luis be asked about their home-buying experience? (b) What lessons did you learn from their experience?

Answers

(a) The Zoe and Luis share the home-buying experience are:

Firstly, difficult to as preference home to purchase. Secondly to difficult, the transaction of the money as the medium of the online cash transaction.(b) Someone learns to the experience as the online transaction is too difficult as the purchase of the home as cash transaction are easier.

What is home?

The term "home" refer to the resident, the family are they stay with in the permanently. The home, another name, is the house. There are the two types of the home, permanent homes and rental homes.

(a) The Zoe and Luis share the home-buying experience are more difficult to search the home and the registry time as the transaction of the online are more difficult.

(b) Someone as to learn to the cash transaction are the more easily as compare to the online transaction. The fraud case chances are the more.

As a result, the home-buying experience as the aforementioned.

Learn more about on home, here:

https://brainly.com/question/28174743

#SPJ1

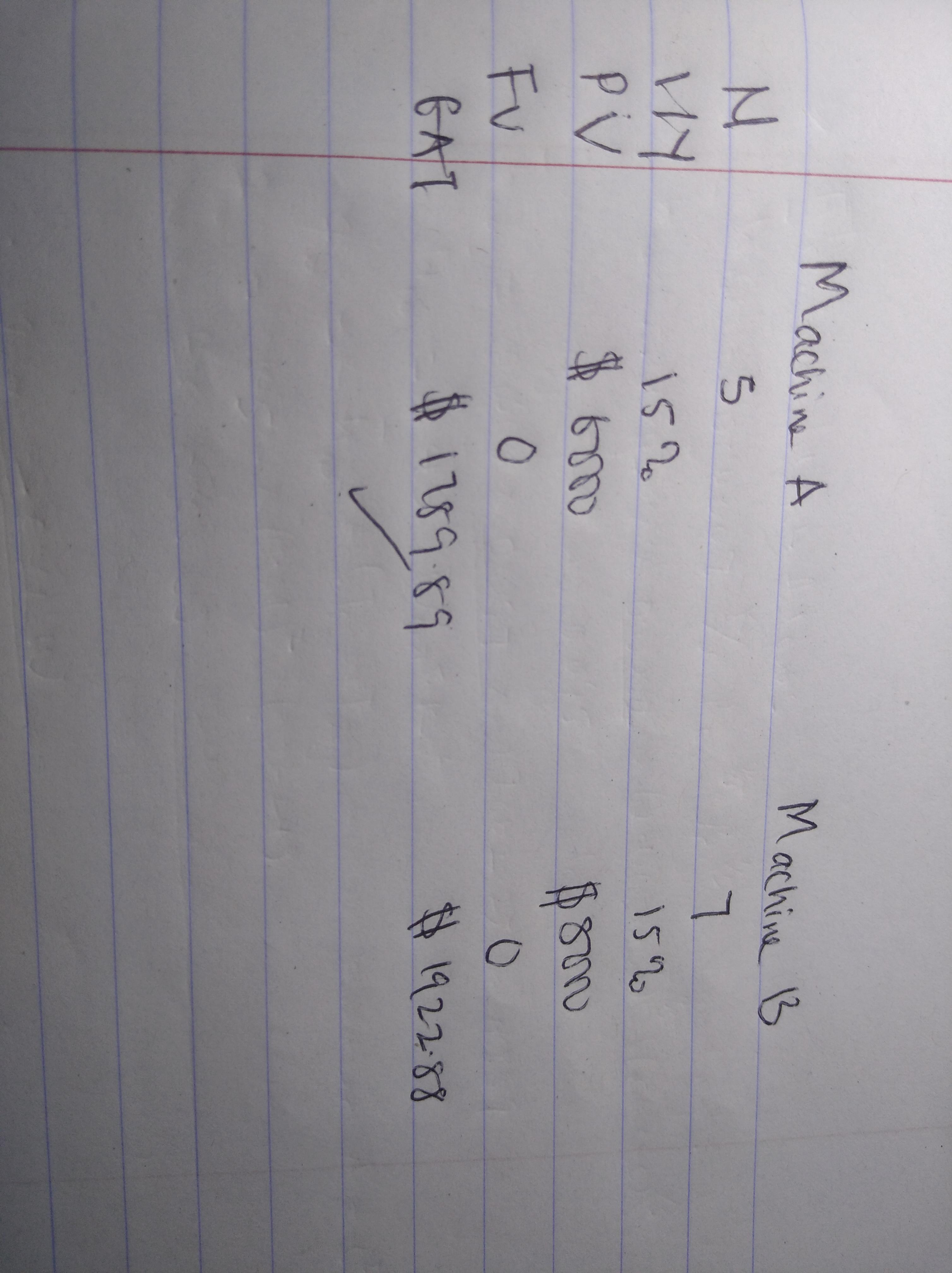

Two machines, A and B, which perform the same functions, have the following costs and lives. Type PV Costs Life Machine A $6,000 5 yr Machine B $8,000 7 yr Which machine would you choose

Answers

Answer:

Machine A

Explanation:

See attachment for tabulation

On September 30, 2021, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2022, and the program was available for release on April 30, 2022. Development costs were incurred as follows:

September 30 through December 31, 2021 $3,600,000

January 1 through February 28, 2022 1,500,000

March 1 through April 30, 2022 594,000

Athens expects a useful life of four years for the software and total revenues of $7,800,000 during that time. During 2022, revenue of $1,560,000 was recognized.

Required:

a. Prepare a journal entry to record the development costs in each year of 2021 and 2022.

b. Calculate the required amortization for 2022.

Answers

Answer:

2021

Dr Research and development expense $3,600,000

Cr Cash $3,600,000

2022

Dr Research and development expense 1,500,000

Dr Software and development costs 594, 000

Cr Cash 2,094,000

B. $148,500

Explanation:

1. Preparation of the journals entry

2021

Dr Research and development expense $3,600,000

Cr Cash $3,600,000

(To record the expenses incurred on research and development)

2022

Dr Research and development expense 1,500,000

Dr Software and development costs 594, 000

Cr Cash 2,094,000

(1,500,000+594,000)

(To record the software development costs incurred)

2.Calculatation for the amortization for 2022

Using percentage of revenues method

Amortization= Current revenue/Total revenue* Software development costs

Amortization=$1,560,000/$7, 800,000*$594,000

Amortization=0.2*$594,000

Amortization=$118,800

Using straight line method

Amortization =1/Useful life* Software devel opment costs

Amortization=1/4*$594,000

Amortization=$148,500

Based on the above calculation Tmte expense amounts under straight-line method is higher . Which means that , the amortization is $148,500.

What is market environment

Answers

Answer:

The market environment is the combination of external and internal factors that affect a company's ability to establish a relationship with and serve its consumers.

Explanation:

The internal factors relate to the company itself, such as owners, workers, materials, components, etc.

The external factors are divided into macro and micro components. The macro component is the broad environment which includes societal forces that affect society as a whole. The micro component is task-related, which includes factors that influence the production, manufacturing and distribution of a product or service.

You have a gross lease. Your rent is $1,000 per month. Taxes and maintenance total $500 per month. What is your total

monthly payment?

A) 500

B) 1,000

Answers

Answer:

Your total monthly payment would be 1,500 dollars.

Explanation:

A contingent liability is:

Answers

Answer:

In accounting, contingent liabilities are liabilities that may be incurred by an entity depending on the outcome of an uncertain future event such as the outcome of a pending lawsuit.

Explanation:

These liabilities are not recorded in a company's accounts and shown in a type of balance sheet when both probable and reasonably estimable as 'contingency' or 'worst case' financial outcome. The likelihood of loss is described as probable, reasonably possible, or remote. The ability to estimate a loss is described as known, reasonably estimable, or not reasonably estimable. It may or may not occur.

Hope this helps!!!

FILL IN THE BLANK the general electric model can be compared to swot analysis. market attractiveness corresponds to the_____element is swot analysis, whereas business strength corresponds to the_______ element.

Answers

Swot analysis and the general electric model are comparable. In a swot analysis, company strength refers to the internal aspect, while market attractiveness corresponds to the external element.

Which of the following actions could a marketer do while conducting a situational analysis?A situational analysis determines possible clients, examines predicted growth, evaluates competitors, and creates a realistic assessment of your company using market research. It entails focusing on the specific goals of the company and determining the elements that help or hinder those goals.

When a company launches a new product or service, which growth approach is employed?Market development plan is a growth strategy used by businesses or organizations to reach target consumers they haven't yet attained or aren't already serving with their offerings.

To Know more about Market development

https://brainly.com/question/28497768

#SPJ4

Critique the concept of Socialism using appropriate examples

Answers

The concept of socialism can be critiqued using examples of countries in which socialist economic systems have been enforced similar as the former Soviet Union, Venezuela, Cuba.

Critics argue that these countries have experienced economic recession, low norms of living, and a lack of individual freedoms due to the absence of free request competition and government control over resources and product. Socialism's critics argue that the absence of incentives for individual initiative, innovation, and profit has led to low situations of effectiveness, productivity and quality in these countries.

sympathizers of socialism argue that there are also examples of socialist systems that have achieved high living norms and greater economic equality similar as in Scandinavia.

To learn more about Socialism:

https://brainly.com/question/839803

#SPJ1