Friends International is an NGO that fosters greater cultural awareness and understanding by arranging for people of different backgrounds to spend time in other countries and cultures. On January 1, 2014 they purchased $80,000 of open airline tickets in advance that can be used for a variety of destinations. Using the accrual method, build the entry to record the use of $40,000 of these tickets on March 15, 2014 for multiple passengers on a flight from New York to Kigali, Rwanda.

Answers

Answer:

Dr Travel Expenses 40,000

Cr Prepaid Expenses 40,000

Explanation:

Friends International

Dr Travel Expenses 40,000

Cr Prepaid Expenses 40,000

Travel Expense for $40,000 was been DEBITED in order to recognize the expense associated with the use of the tickets and cPrepaid Expense for $40,000 was been CREDITED because the company no longer has the right to receive benefits from the prepaid tickets.

Related Questions

If the price of tutoring increases from $5 to $15, producer surplus increases, in numerals, by $_____.

Answers

With the price increase in tutoring from $5 to $15, producer surplus increases by $10.

What is producer surplus?Producer surplus is the additional benefit that the tutors receive. It can be computed by determining the difference between old tutoring price, $5, and the new market price of $15. The implication is that while tutors are willing to accept $5, the new marketing price has made it possible for them to increase their surplus by $10 ($15 - $5).

Thus, the producer surplus increases by $10 to show the increased benefit that suppliers receive for selling their services in the marketplace.

Learn more about producer surplus at https://brainly.com/question/7622454

help with the blank lol

Answers

Compare and contrast an operating budget with cash flow budget.

Answers

Answer:

hope this helps

Explanation:

An operating budget tends to have a longer time frame than a cash budget, although the period covered by an operating budget can be covered by a series of cash budgets. Operating budgets are tied to strategic, long-term plans, expressing a company's priorities based on its overall mission and direction

What happens when demand decreases while supply increases

Answers

Explanation: When demand decreases while supply increases, it creates a situation of surplus, also known as oversupply. This is because there is now more supply available in the market than there is demand for it, leading to a surplus of goods or services.

As a result, businesses may have to lower their prices to incentivize consumers to purchase their products or services. This can lead to a decrease in revenue for the businesses and potentially even lower profits. In some cases, businesses may also need to reduce their supply in response to the decrease in demand.

If the surplus persists over a longer period, businesses may also need to cut costs, such as reducing staff or production capacity, in order to remain profitable. This can have broader economic implications, such as rising unemployment rates and a decrease in overall economic activity.

Overall, a decrease in demand while supply increases can have negative consequences for businesses and the economy as a whole.

Answer: When demand increases and supply increases it leads to reduction in the equilibrium price.

Explanation:

The market price will fall as a result of a decline in demand and an increase in supply because, for any quantity, consumers now place a lower value on the item and producers are ready to accept a lower price.

For information on equilibrium price refer,

https://brainly.com/question/13846894

A businessman wants to buy a truck. The dealer offers to sell the truck for either $120,000 now, or six yearly payments of $25,000.What is the interest rate being offered by the dealer in percentage (rounded to the closest integer number)

Answers

Answer: 6.77%

Explanation:

Based on the information given in the question, the following can be deduced:

Initial amount (PV) = $120000

Annual payment (PMT) = $25000

Number of payment period (NPER) = 6

Annual rate = Rate(nper, pmt, -pv)

= Rate(6, 25000, -120000)

= 6.77%

Case: Making Difficult Decisions in Hard Times

Read and discuss the following scenario:

You are on the top management team of a medium-size company that manufactures cardboard boxes,

containers, and other cardboard packaging materials. Your company is facing increasing levels of

competition for major corporate customer accounts, and profits have declined significantly. You have tried

everything you can to cut costs and remain competitive, with the exception of laying off employees. Your

company has had a no-layoff policy for the past 20 years, and you believe it is an important part of the

organization’s culture. However, you are experiencing mounting pressure to increase your firm’s

performance, and your no-layoff policy has been questioned by shareholders.

Even though you haven’t decided whether to lay off employees and thus break with a 20-year tradition for

your company, rumors are rampant in your organization that something is afoot, and employees are worried.

You are meeting today to address this problem.

Tasks to perform:

1. Develop a list of options and potential courses of action to address the heightened competition and decline

in profitability that your company has been experiencing.

2. Choose your preferred course of action, and justify why you will take this route.

3. Describe how you will communicate your decision to employees.

4. If your preferred option involves a layoff, justify why. If it doesn’t involve a layoff, explain why.

Organizational culture comprises the shared set of beliefs, expectations, values, norms, and work routines

that influence how members of an organization relate to one another and work together to achieve

organizational goals.

In essence, organizational culture reflects the distinctive ways in which organizational members perform

their jobs and relate to others inside and outside the organization. It may, for example, be how customers in a

particular hotel chain are treated from the time they are greeted at check-in until they leave; or it may be the

shared work routines that research teams use to guide new product development. When organizational

members share an intense commitment to cultural values, beliefs, and routines and use them to achieve their

goals, a strong organizational culture exists. When organizational members are not strongly committed to a

shared system of values, beliefs, and routines, organizational culture is weak.

/

/

/

Tasks to perform:

1. Develop a list of options and potential courses of action to address the heightened competition and decline

in profitability that your company has been experiencing.

2. Choose your preferred course of action, and justify why you will take this route.

3. Describe how you will communicate your decision to employees.

4. If your preferred option involves a layoff, justify why. If it doesn’t involve a layoff, explain why.

Answers

Answer:

c because I did this one an I chose a but it was c

The company is dedicated to developing high-quality housing projects that meet the needs of families and individuals, with a focus on affordability, sustainability, and innovation.

Answers

The focus of the company's housing projects is to provide affordable and sustainable housing solutions.

The focus of the company's housing projects is to address the global issue of housing affordability and sustainability. The company aims to provide cost-effective and eco-friendly housing solutions that cater to the needs of different income groups. They use sustainable building materials and technologies that reduce energy consumption, minimize waste, and lower carbon emissions.

In addition, the company works with local communities to understand their housing requirements and preferences, and designs housing projects that align with their needs. Overall, the company's focus on affordable and sustainable housing solutions contributes to the social, economic, and environmental well-being of the communities they serve.

To know more about housing projects, here

https://brainly.com/question/2620058

#SPJ1

--The complete question is, What is the focus of the company's housing projects?--

Neubart Company owns 100% of the outstanding shares of two European subsidiaries, which operate largely independently and operate in a different industry than Neubart. The subsidiaries' earnings typically are reinvested in their home country. In consolidating the subsidiaries financial statements with those of the U.S. parent, the subsidiaries' financial statement numbers should be:________ a) remeasured using the current rate method. b) remeasured using the temporal method. c) translated using the current rate method. d) translated using the temporal method.

Answers

Answer: c) translated using the current rate method.

Explanation:

It should be noted that the translation method is utilized when the financial statements of a subsidiary unit are being expressed in the functional currency of the parent company.

Following the question given above, in consolidating the subsidiaries financial statements with those of the U.S. parent, the subsidiaries' financial statement numbers should be translated using the current rate method.

Therefore, the correct option is C.

Which of the following is a duty of a personal finance manager?

A. Selling property insurance

B. filing tax returns

C. tracking clients' investments

D. selling houses

Answers

Answer:

Filling rax return is a duty of a personal finance manager

Which statement shows that money is a "store of value?" (5 points)

Answers

The statement that shows the money is a store of value is I just used the ten dollars given to me last year.

What does store of value mean?

Money is anything that is accepted generally as a means to pay for goods and services and a method to repay debt.

The functions of money include:

Store of value: any currency used as money must be able to retain its value over the long term. Thus, it can be stored and be used at a future date. Medium of exchange : money should be accepted as a means to exchange for goods and services. Unit of account : money can be used to value goods and services.To learn more about money, please check: https://brainly.com/question/940436

#SPJ1

Here is the complete question:

Which statement shows that money is a "store of value?"

I exchanged my dollar for ten dimes.

You can only use currency at that store.

I just used the ten dollars given to me last year.

I carried the money to the store.

Which factor would influence the premiums of health insurance?

Building size

Deductible

Elimination period

Profession

Answers

Answer:

Deductible

Explanation

The correct option is B. Plan category, the plan covers dependents, and deductibility is the factor that influences the premiums of health insurance.

What is Health Insurance?Medical and health-related costs are covered by a specific type of insurance called health insurance. Routine care, emergency care, and treatment for long-term illnesses are all partially or fully covered by health insurance.

Thus, there are many other factors that influence the health insurance premiums such as age, smoking status, region, type of plan, and if dependents are covered by the policy.

Learn more about Health Insurance here:

https://brainly.com/question/27356829

#SPJ2

Luther Industries has no debt, a total equity capitalization of $20 billion, and a beta of 1.8. Included in Luther's assets are $4 billion in cash and risk-free securities. What is Luther's enterprise value?

Answers

Answer:

2400000000

Explanation:

Luther's enterprise value will be $16 billion.

The following information can be depicted from the question given:

Total equity capitalization = $20 billionBeta = 1.8It should be noted that an enterprise value is the difference between the market value and cash. Therefore, the enterprise value will be:

= $20 billion - $4 billion

= $16 billion.

In conclusion, Luther's enterprise value will be $16 billion.

Read related link on:

https://brainly.com/question/19204736

Select all that apply

Which of the following appear on the statement of stockholders' equity? (Select all that apply.)

Dividends

Property, plant, and equipment

Net income

Cash received during the accounting period

Beginning balance of retained earnings

Answers

The items that would appear on the statement of stockholders' equity are dividends, net income and beginning balance of retained earnings

What is statement of stockholders' equity?

The statement of stockholders' equity is one of the final accounts or financial statements of the company which shows the transactions between the company and its stockholders for the current period as well as the balances of prior periods.

The statement of stockholders' equity would contain dividends, which are paid to shareholders as the returns on their investment for the current period, net income, which is the profits of the business after paying taxes to relevant tax authority and the opening of retained earnings.

Note that property, plant and equipment would be shown on the balance sheet and the cash received in cash flow statement

Find out more about statement of stockholders' equity on:https://brainly.com/question/2681718

#SPJ1

In the context of factors of production, which of the following an example of a natural resource?

a. An equipment

b. Land

c.An investment

d.Information

Answers

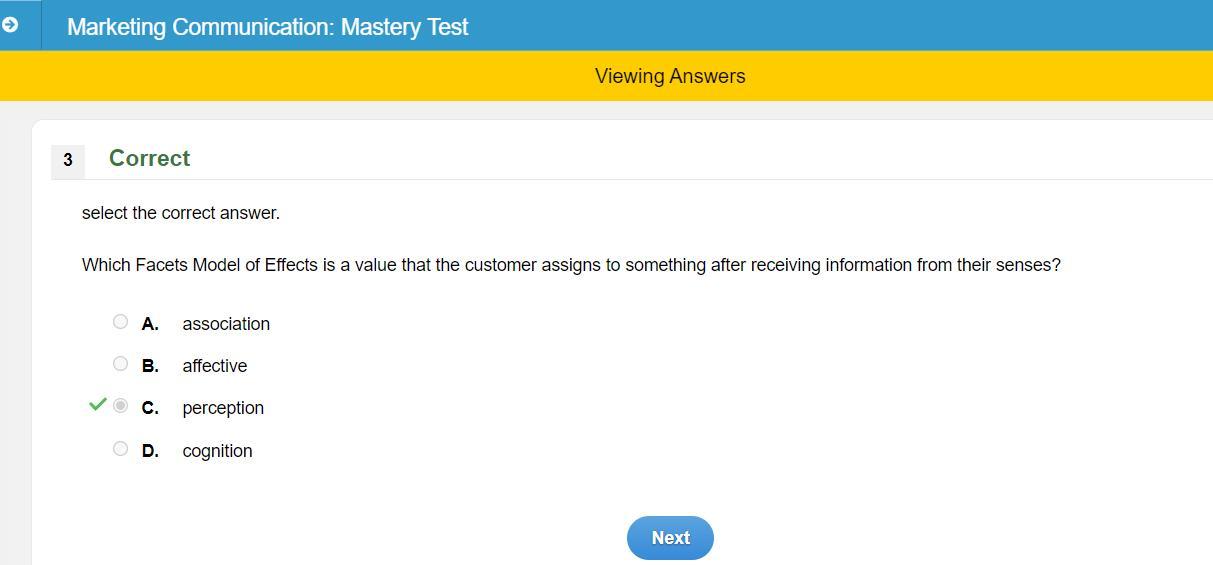

select the correct answer.

Which Facets Model of Effects is a value that the customer assigns to something after receiving Information from their senses?

OA association

OB. affective

OC. perception

OD. cognition

Answers

Answer:

The answer is C. Perception!

Explanation:

Perception is when you receive information through your senses and assign it meaning. (There's a quizlet made by slmoon9852 that can teach you more about it!)

The variable costs of labor and material are $8 per unit. The company has an offer from a major subcontractor to produce the part for $12 per unit. However, the subcontractor wants the company to share in the costs of the equipment. The electronics company estimates that the total cost would be $3.1 million, which also includes management oversight for the new supply contact. The company must consume more than ______ diaphragms to make the manufacturing the part in-house option least costly. (Enter your response rounded up to the nearest whole number.)

Answers

Zoe was comparing the variability of three of her stocks. Over the last month ACE stock had a mean price of $37.03 per share with a standard deviation of $1.5, while FHJ stock had a mean price of $60.55 per share with a standard deviation of $2.62, and LMP stock had a mean price of $124.9 per share with a standard deviation of $3.06. Out of these three stocks, what was the greatest coefficient of variation?

Round your answer to a hundredth of a percent. Input just the number. Do not input the percent sign. Do not use a comma. Example 4.35

Answers

According to the question the greatest coefficient of variation is 0.043 for FHJ stock.

What is stock?Stock, also known as equity, is a type of security that entitles the owner to a portion of the company’s assets and profits. When a company issues stock, it is offering a piece of itself to buyers. When someone purchases a company’s stock, they are essentially buying a small piece of ownership in the company. This form of investment provides the opportunity to benefit from the company’s growth, as the value of stocks typically increases over time. Generally, stocks can be divided into two categories: common stock and preferred stock. Common stock gives the investor voting rights, while preferred stock typically does not.

The coefficient of variation is a measure of relative variability and is calculated by dividing the standard deviation by the mean.

For ACE stock, the coefficient of variation is (1.5/37.03) = 0.040.

For FHJ stock, the coefficient of variation is (2.62/60.55) = 0.043.

For LMP stock, the coefficient of variation is (3.06/124.9) = 0.024.

Therefore, the greatest coefficient of variation is 0.043 for FHJ stock.

To learn more about stock

https://brainly.com/question/1193187

#SPJ1

Please help!

Note that common contexts are listed toward the top, and less common contexts are listed toward the bottom. According to O*NET, what are common work contexts for Film and Video Editors? Check all that apply.

(1) extremely bright or inadequate lighting

(2) spend time sitting

(3) exposed to disease or infections

(4) indoors, environmentally controlled

(5) face-to-face discussions

(6) deal with physically aggressive people

Answers

Answer:

BCD is wrong on Edge 2021.| The real Answer is BDE... (Edit)

Explanation:

Using resources from comments on the anwser above (or below) and the bad rating meant that is was wrong. And was also wrong for me.

The REAL ANWSER IS BDE..

Your welcome, have a nice day!

5/28/2021

How does a mechanic's lien assist creditors?

Answers

the impact of monitoring and evaluating quality process on the motor industry

Answers

Impact of monitoring and evaluating quality process on the motor industry is improved product quality and customer satisfaction.

How does monitoring and evaluating quality processes helps?Monitoring and evaluating quality processes in the motor industry can have a significant impact on product quality and customer satisfaction. By closely monitoring the production process, manufacturers can identify any issues or defects early on and take corrective actions to ensure that the final product meets the desired quality standards.

This can help to reduce the number of defective products and improve customer satisfaction by delivering high-quality products that meet their expectations. So. it also help to identify areas where production can be made more efficient which leads to cost savings and increased profitability.

Read more about quality process

brainly.com/question/13381607

#SPJ1

You can hire 0, 1, 2, or 3 workers. If you hire 0, you produce $0 of output. If you hire 1 worker, your revenue (total value product) is $30. If you hire 2 workers, your revenue (total value product) is $50. If you hire 3 workers, your revenue (total value product) is $60.

What is the marginal value product of the 3rd worker?

What is the profit-maximizing number of workers to hire when the wage is $15?

Given your answer to the last question, what is the most profits you can make from hiring?

Answers

When marginal revenue equals marginal cost, or when MR = MC, a fully competitive firm will make the decision that will maximize its profits.

How do you determine how many employees you need to hire?

You should be able to create statistical data related to your industry that enables you to quantitatively determine when hiring new employees is necessary. To make this computation simple, divide your annual revenue by your average annual employee count, then multiply the result by 12 months.

How do you figure out how many workers to hire in order to maximize profit?

The change in your company's total cost (TC) caused by hiring an additional employee is known as the marginal resource cost (MRC): MRC = TC/L. Since you can hire as many employees as you like at the going rate, MRC = Wage. An employer should hire the number of employees at which MRP = MRC in order to maximize profits.

To learn more about marginal revenue from the given link.

https://brainly.com/question/13444663

#SPJ9

Which of the examples provides the best evidence that inflation has occurred?

a. A person whose salary has decreased is able to purchase more goods and services.

b. A person whose salary has increased is able to purchase fewer goods and services.

c. A person whose salary has increased is able to purchase more goods and services.

d. A person whose salary has remained the same

Answers

Option b; A person whose salary has increased is able to purchase fewer goods and services is best evidence that inflation has occurred.

A sustained increase in the general price level of goods and services is referred to as deflation, which is the opposite of inflation in economics. When the general price index level increases, each unit of currency buys fewer goods and services; as a result, inflation corresponds to a decrease in the purchasing power of money. The annualized percentage change in a general price index, or inflation rate, is a commonly used indicator of inflation. Because not all prices rise at the same rate, the consumer price index (CPI) is frequently employed. In the US, wages are also calculated using the employment cost index.

Learn more about Inflation here:

https://brainly.com/question/29347039

#SPJ4

Which is the BEST example of marketing within sports?

Answers

While super bowl ads and athlete endorsements are well-known examples of sports marketing in action, sports marketing also includes marketing that builds a brand around healthy or aspirationally athletic lifestyles. Using sports marketing strategies can add serious appeal for many consumers.

ERISA mandates that all employees must have the opportunity to be vested in their pension so that

A: the plan will continue to earn money regardless of the state of the stock market

B: companies can offer pension plans to domestic partners as well as married couples

C: the plan will stay with the emplyoyee regardless of whether the employee stays with the company

D: the plan will be guaranteed by the Pension Benefit Guaranty Corporation

Answers

ERISA mandates that all employees must have the opportunity to be vested in their pension plans so that the plan will stay with the employee regardless of whether the employee stays with the company. The Option C is correct.

What was vesting mean in Pension?To an employee, a vesting in a retirement plan means having an ownership; this means that each employee will vest or own a certain percentage of their account in the plan each year.

An employee that is 100% vested in his or her account balance owns 100% of it and he/she employer cannot forfeit or take it back for any reason. The amounts that are not vested may be forfeited by employees when they are paid their account balance. For example, if the employee terminates employment.

In conclusion, in addition, an employee's own contributions to the plan are also always 100% vested or owned by the employee.

Read more about pension plans

brainly.com/question/1420072

#SPJ1

Question 1 Calculate the selling price that Valmont Company will establish for the XP–200 using absorption cost-plus pricing, considering the absorption unit product cost of $8,400 and a markup percentage of 85%.

Question 2 Determine the economic value to the customer (EVC) over the XP–200's 20,000-hour life. Consider the advantages it offers compared to the competitor's piece of equipment, such as longer usage time, lower preventive maintenance costs, and lower electricity consumption.

Question 3 If Valmont Company decides to use value-based pricing, what range of possible prices should they consider when setting a price for the XP–200? Take into account the economic value provided to the customer and the pricing of the competitor's equipment.

Question 4 Provide advice to Valmont's managers on choosing between absorption cost-plus pricing and value-based pricing. Consider the concerns expressed by the marketing managers and the potential impact on market competitiveness, customer perception, and profitability.

For each question, ask your students to show their calculations, provide explanations, and justify their answers based on the given information and pricing concepts. Encourage them to think critically and consider the implications of different pricing strategies on the company's goals and market position.

Answers

1. Valmont Company should establish a selling price of $15,540 for the XP–200 using absorption cost-plus pricing.

2. The advantages mentioned are longer usage time, lower preventive maintenance costs, and lower electricity consumption.

3. If Valmont Company decides to use value-based pricing, they should consider the economic value provided to the customer and the pricing of the competitor's equipment.

4. Choosing between absorption cost-plus pricing and value-based pricing depends on various factors such as market competitiveness, customer perception, and profitability.

1. To calculate the selling price using absorption cost-plus pricing, we need to add a markup percentage to the absorption unit product cost. In this case, the absorption unit product cost is given as $8,400, and the markup percentage is 85%.

Markup = Markup percentage * Absorption unit product cost

Markup = 85% * $8,400

Markup = $7,140

Selling price = Absorption unit product cost + Markup

Selling price = $8,400 + $7,140

Selling price = $15,540

Therefore, Valmont Company should establish a selling price of $15,540 for the XP–200 using absorption cost-plus pricing.

2. To determine the economic value to the customer (EVC) over the XP–200's 20,000-hour life, we need to consider the advantages it offers compared to the competitor's equipment. The advantages mentioned are longer usage time, lower preventive maintenance costs, and lower electricity consumption.

EVC can be calculated by quantifying the monetary value of these advantages over the product's lifespan. Let's assume the following values:

Longer usage time: 5,000 additional hours compared to the competitor's equipment.

Lower preventive maintenance costs: $500 saved annually compared to the competitor's equipment.

Lower electricity consumption: $200 saved annually compared to the competitor's equipment.

EVC = (Additional usage time * Value per hour) + (Annual cost savings * Present value factor)

Using a discount rate of 10% and assuming the annual cost savings remain constant over the 20,000-hour life:

EVC = (5,000 hours * Value per hour) + ($500 * Present value factor) + ($200 * Present value factor) + ... (repeated for all 20 years)

3. If Valmont Company decides to use value-based pricing, they should consider the economic value provided to the customer and the pricing of the competitor's equipment. This involves determining a range of possible prices based on the additional value delivered by the XP–200 compared to the competitor's equipment.

To calculate the range of possible prices, you would need to assess the economic value of the XP–200 as determined in Question 2 and consider the pricing of the competitor's equipment. Without specific values and competitor pricing information, it's not possible to provide a precise range of prices.

However, Valmont Company should set the price within a range that captures a significant portion of the economic value delivered to the customer while remaining competitive in the market.

4. Choosing between absorption cost-plus pricing and value-based pricing depends on various factors such as market competitiveness, customer perception, and profitability. Here are some considerations for Valmont's managers:

Absorption cost-plus pricing:

Pros: This approach ensures that all costs, including fixed and variable costs, are covered. It provides a straightforward calculation for determining the selling price and ensures profitability.

Cons: It does not directly consider the economic value delivered to the customer or the pricing of the competitor's equipment. This approach may not reflect the true value of the XP–200 to customers, potentially leading to pricing that is not aligned with customer expectations or market conditions.

Value-based pricing:

Pros: This approach considers the economic value provided to the customer, allowing the price to be based on the perceived value rather than just the cost. It aligns the price with the customer's willingness to pay and can capture the full value delivered by the XP–200.

Cons: It may be more challenging to quantify and communicate the economic value to customers. Determining the optimal price range requires a thorough understanding of customer preferences, competitor pricing, and market dynamics.

For such more question on selling price:

https://brainly.com/question/28189871

#SPJ8

when management's primary objective is the economic interests of shareholders, this is known as : A.philanthropy B.responsibility C. the strategic approach D.the pluralistic.

Answers

g TB MC Qu. 01-88 The area of accounting aimed... The area of accounting aimed at serving the decision making needs of internal users is:

Answers

Answer:

The correct option is (A) Managerial Accounting

Explanation:

Managerial accounting is the accounting that identifies, measures, analyze the financial information in order to accomplish the company goals and objectives. Its decisions such as identification cost per unit, fixation of the sales price etc. These decisions should be taken by the internal users

Therefore as per the given scenario, The correct option is (A) Managerial Accounting

The word “economy” comes from the Greek word oikonomos, which means

Answers

Answer:

Oikonomos, latinized oeconomus or œconomus, was an Ancient Greek word meaning 'household manager. Hope this helps :)

Explanation:

it means household manager

Conduct Internet research and find whether your state levies inheritance tax. and how is it different from the federal inheritance tax.

Answers

Answer:

My state is Wisconsin, and Wisconsin does not levy a state inheritance tax, nor a estate tax, being one of the 34 states that do not levy any of these two taxes.

This is in contrast with the federal leve, because there is a federal inheritance tax, although with a quite high exemption of around 11 million for individuals, and of 22 million for married couples.

Answer:Inheritance tax is a tax that a person has to pay on money or property inherited after the death of a family member, loved one, and so on. This tax is sometimes referred to as a death tax. It is fundamentally a state tax.

In the federal inheritance or estate tax, the tax value depends on the fair market value of the inheritance. The amount is then levied on the representative of the estate. The taxable amount comes from the value of the estate. Then, the balance goes to the beneficiary of the estate.

As per the state inheritance tax, the beneficiary of the estate must pay the taxable amount. For example, if five family members inherit a property from a deceased relative, each member will individually pay tax on their share of the inheritance

Only eight states have inheritance taxes, these include Indiana, Iowa, Kentucky, Maryland, Nebraska, New Jersey, Pennsylvania, and Tennessee. My state, the state of Texas, does not levy an inheritance tax. Even for states that do levy such taxes, many beneficiaries are exempt from the tax under various circumstances.

Explanation: plutos example after answering question so change it up a little dont use word for word.

Berman & Jaccor Corporation's current sales and partial balance sheet are shown below.

This year

Sales $ 1,000

Balance Sheet: Assets

Cash $ 150

Short-term investments $ 125

Accounts receivable $ 150

Inventories $ 100

Total current assets $ 525

Net fixed assets $ 400

Total assets $ 925

Sales are expected to grow by 14% next year. Assuming no change in operations from this year to next year, what are the projected total operating assets?

Answers

Sorry but this is kind of confusing but can you plz help me with this math problem

Santa is trying to buy socks for all his elf helping the year. He went on Amazon and found a pack of 8 socks for $24. He wants to know what each socks cost to be able to write an equation, and later he wants to know how much 12 socks with cost him.

I need the Ratio, Unit Rate, C.O.P. And an equation

Answer:

Explanation:

Total Operating costs for this year = Cash + Acct. Receivable + inventories + net fixed assets

Total Operating costs = 150+150+100+400 = 800

(Short term investments are not included in operating costs)

Projected growth in costs (Assuming same as sales) = 12% *800 = 96

Projected total operating costs = $800+$96 = $896