Fortuna Company issued 70,000 shares of $1 par stock, with a fair value of $5 per share, for 80% of the outstanding shares of Acappella Company. The firms had the following separate balance sheets prior to the acquisition:

Assets Fortuna Acappella

Current assets $2,100,000 $ 960,000

Property, plant, and equipment (net) 4,600,000 1,300,000

Goodwill -- 240,000

Total assets $6,700,000 $2,500,000

Liabilities and Stockholders' Equity

Liabilities $3,000,000 $ 800,000

Common stock ($1 par) 800,000

Common stock ($5 par) 200,000

Paid-in capital in excess of par 2,200,000 300,000

Retained earnings 700,000 1,200,000

Total liabilities and equity $6,700,000 $2,500,000

Book values equal fair values for the assets and liabilities of Acappella Company, except for the property, plant, and equipment, which has a fair value of $1,400,000. Compute goodwill or gain recognized in the consolidated statements .

Book values equal fair values for the assets and liabilities of Acappella Company, except for the property, plant, and equipment, which have a fair value of $1,600,000.Required:

a. What is the Goodwill/Gain associated with the acquisition:

b. What is the Non-Controlling Interest recorded in the consolidated balance sheet

c. What is the balance of the assets and liabilities side of the consolidated balance sheet after the acquisition:

d.Record the two elimination entries associated with the acquisition of the company

Answers

Answer:

Part 1

$1,730,000 (Gain)

Part 2

a. $1,890,000 (Gain)

b. $560,000

c. Consolidated Assets = $9,850,000 and Consolidated Liabilities = $3,800,000

d. Journals

Journal 1

Property Plant and Equipment $300,000 (debit)

Revaluation Reserve $300,000 (credit)

Revaluation of Acappella`s Property Plant and Equipment item

Journal 2

Common Stock $1,300,000 (debit)

Retained Earnings $1,200,000 (debit)

Revaluation Reserve $100,000 (debit)

Investment in Subsidiary $350,000 (credit)

Non-Controlling Interest $560,000 (credit)

Gain on Bargain Purchase $1,890,000 (credit)

Main Elimination Journal

Explanation:

Goodwill is the excess of Purchase Consideration over the Net Assets Acquired.

Purchase Consideration (70,000 shares × $5) = $350,000

Part 1

Calculation of Net Assets Acquired

Retained Earnings $1,200,000

Common Stock $1,300,000

Revaluation $100,000

Total Net Assets Acquired $2,600,000

Therefore,

Net Assets Attributable to Fortuna Company = $2,600,000 × 80%

= $ 2,080,000

Purchase Consideration $350,000 < Net Assets Acquired ($ 2,080,000), therefore we have a gain situation of $1,730,000

Part 2

2a.

Calculation of Net Assets Acquired

Retained Earnings $1,200,000

Common Stock $1,300,000

Revaluation $300,000

Total Net Assets Acquired $2,800,000

Therefore,

Net Assets Attributable to Fortuna Company = $2,800,000 × 80%

= $ 2,240,000

Purchase Consideration $350,000 < Net Assets Acquired ($ 2,240,000), therefore we have a gain situation of $1,890,000

2b.

Calculation of Non - Controlling Interest

Note : I have elected to measure Non-Controlling Interest as proportionate to the fair value of Net Identified Assets Acquired !

Non - Controlling Interest = Non Controlled Interest % × Total Net Assets Acquired

= 20 % × $2,800,000

= $560,000

2c.

Consolidation is 100 % of Parent/ Acquirer and 100% of subsidiary (Acquired) combined.

Assets :

Fortuna Company = $6,700,000 + $350,000 = $7,050,000

Acappella Company = $2,500,000 + $300,000 = $2,800,000

Total Assets = $9,850,000

Liabilities :

Fortuna Company = $3,000,000

Acappella Company = $ 800,000

Total Liabilities = $3,800,000

2d.

Journal 1

Property Plant and Equipment $300,000 (debit)

Revaluation Reserve $300,000 (credit)

Revaluation of Acappella`s Property Plant and Equipment item

Journal 2

Common Stock $1,300,000 (debit)

Retained Earnings $1,200,000 (debit)

Revaluation Reserve $100,000 (debit)

Investment in Subsidiary $350,000 (credit)

Non-Controlling Interest $560,000 (credit)

Gain on Bargain Purchase $1,890,000 (credit)

Related Questions

On January 1, Year 1, Kennard Co. issued $2,000,000, 5%, 10-year bonds, with interest payable on June 30 and December 31 to yield 6%. The bonds were issued for $1,851,234. a. Prepare an amortization schedule for Year 1 and Year 2 using the effective interest rate method. Round answers to the nearest dollar. Enter all amounts as positive numbers.

Answers

The Amortization Schedule for Kennard Co. using the effective interest rate method is as follows:

Date Cash Interest Amortization Balance

Payment Expense

Jan. 1, Yr 1 $1,851,234

June 30 Yr 1 $50,000 $55,537 $5,537 $1,856,771

Dec. 31 Yr 1 $50,000 $55,703 $5,703 $1,862,474

June 30 Yr 2 $50,000 $55,874 $5,874 $1,868,348

Dec. 31, Yr 2 $50,000 $56,050 $6,050 $1,874,398

Data and Calculations:

Face value of bonds = $2,000,000

Bonds Proceeds = 1,851,234

Bonds Discounts = $148,766

Maturity period = 10 years

Coupon interest rate = 5%

Market interest rate = 6%

Payment of interest = June 30 and December 31 annually

June 30, Year 1:

Interest Expense = $55,537 ($1,851,234 x 6% x 1/2)

Cash payment = $50,000 ($2,000,000 x 5% x 1/2)

Amortization of discount = $5,537 ($55,537 - $50,000)

Bonds Payable value = $1,856,771 ($1,851,234 + $5,537)

December 31, Year 1:

Interest Expense = $55,703 ($1,856,771 x 6% x 1/2)

Cash payment = $50,000 ($2,000,000 x 5% x 1/2)

Amortization of discount = $5,703 ($55,703 - $50,000)

Bonds Payable value = $1,862,474 ($1,856,771 + $5,703)

June 30, Year 2:

Interest Expense = $55,874 ($1,862,474 x 6% x 1/2)

Cash payment = $50,000 ($2,000,000 x 5% x 1/2)

Amortization of discount = $5,874 ($55,874 - $50,000)

Bonds Payable value = $1,868,348 ($1,862,474 + $5,874)

December 31, Year 2:

Interest Expense = $56,050($1,868,348 x 6% x 1/2)

Cash payment = $50,000 ($2,000,000 x 5% x 1/2)

Amortization of discount = $6,050 ($56,050 - $50,000)

Bonds Payable value = $1,874,398 ($1,868,348 + $6,050)

Learn more: https://brainly.com/question/16088548

what is the effect on market when suppliers under invest in their businesses

Answers

Answer:

Low supplyScarcityLow economic growthExplanation:

When suppliers under invest in their business, they will end up having the capacity to only produce less than the market requires. Should this happen, supply will be reduced in the market which would lead to relative scarcity all else being equal.

For economic growth to happen, there must be increasing production in an economy so if suppliers are under investing and production is low, there might be low or no economic growth.

Itzair has completed the balance sheet for his business. What is one question the balance sheet answers about the business?

COA.

"How much debt does my business have?"

OB. "Who do I owe for my cost of goods sold?"

OC. "What percentage of sales tax is required?"

COD. "Did I meet my end-of-year profit goals?"

)

Answers

The question that balance sheet answers about the business is "How much of debt does my business have?".

What is a balance sheet?A balance sheet is financial statement that reports company's assets, liabilities, and equity at a specific point in time. It provides a snapshot of a company's financial position and helps investors and stakeholders understand the company's financial health. The assets section of the balance sheet includes items such as cash, investments, inventory, and property. The liabilities section includes items such as loans, accounts payable, and taxes owed. The equity section includes items such as retained earnings and stockholders' equity. The balance sheet is important because it provides insights into a company's financial stability, liquidity, and ability to meet its obligations. It is commonly used by investors, analysts, and creditors to evaluate a company's financial health and make informed decisions.

To learn more about balance sheet, visit:

https://brainly.com/question/30158228

#SPJ1

Africanisation (how will you incorporate the learners culture or heritage into the contemporary socio-economic issues lesson

Answers

By incorporating culturally relevant examples, guest speakers, local data, cross-cultural comparisons, a multilingual approach, and artistic expressions, we can incorporate learners' culture or heritage into the contemporary socio-economic issues lesson.

To incorporate the learners' culture or heritage into a contemporary socio-economic issues lesson, it is important to create a culturally responsive and inclusive learning environment that recognizes and values the African context. Here are some strategies to achieve this:

Culturally Relevant Examples: Use examples and case studies from African countries or communities that relate to the socio-economic issues being discussed. This helps students connect with the content on a personal and cultural level, fostering engagement and understanding.

Guest Speakers and Community Involvement: Invite guest speakers from diverse African backgrounds who can share their experiences and perspectives on the socio-economic issues being studied. This provides authentic and firsthand insights into how these issues manifest in different African contexts.

Local Data and Research: Incorporate local data and research from African sources to illustrate the impact of socio-economic issues. This helps students see the relevance of these issues within their own communities and promotes a sense of ownership and empowerment.

Cross-Cultural Comparisons: Encourage students to explore and compare socio-economic issues between African countries, as well as with other regions of the world. This broadens their perspective, promotes critical thinking, and encourages understanding of global interconnections.

Multilingual Approach: Recognize and embrace the diversity of languages spoken by students. Incorporate key terms, discussions, and resources in various African languages, ensuring that students can engage with the content in their native languages and feel valued.

Art, Music, and Literature: Incorporate African art, music, and literature that address socio-economic issues. This helps students explore these topics through creative expressions that resonate with their cultural heritage.

For more question on multilingual visit:

https://brainly.com/question/29634337

#SPJ8

17-1: Many multinational and global companies use ethnocentric staffing in their operations abroad. Why do you think a company might prefer to have someone from home country in top management positions? If you were hired as a consultant, would you recommend that a multinational or global business change its policy? Explain.

17-2: Culture shock is commonly experienced by people living in an unfamiliar culture. Yet not all people experience it, and not all people feel its effects in the same way nor to the same extent. Some experts advise psychological testing to determine one's likelihood of handling such an adjustment. What psychological attributes do you suppose are advantageous in this situation? What sort of training do you think could help someone adapt more easily to a new culture? Explain.

Answers

Many multinational and global companies use ethnocentric staffing in their operations abroad for reasons such as cultural familiarity, language similarity. psychological attributes that are beneficial in adapting are flexibility, desire to learn more and accept others openly.

In addition to encouraging consistency in management procedures, an ethnocentric staffing policy may also make communication and decision making easier. However, such a policy might also restrict diversity and make it more difficult for the business to respond to local market circumstances or capitalize on local talent. If appointed as a consultant I would suggest multinational companies to adopt a more geocentric staffing strategy that promotes diversity and inclusion while striking a balance between local and global perspectives.

The psychological qualities of openness to new experiences, flexibility, empathy, and resilience are helpful in adjusting to a new culture. These characteristics increase a person propensity to be receptive to new ideas, adaptable to novel circumstances and equipped to deal with the difficulties of integrating into a foreign culture. Intercultural communication classes and language and cultural immersion programs are all types of training that could make it easier for someone to adapt to a new culture.

Learn more about ethnocentric staffing at:

brainly.com/question/29763151

#SPJ1

Suppose that in Wageland, all workers sign annual wage contracts each year on January 1. No matter what happens to the prices of final goods and services during the year, all workers earn the wage specified in their annual contract. This year, prices of final goods and services fall unexpectedly after the contracts are signed.

a. In the short run, how will the quantity of aggregate output supplied respond to the fall in prices?

b. What will happen when firms and workers renegotiate their wages?

Answers

Answer: Aggregate output will decrease, and wages will be lower when renegotiated.

Explanation: Because lower prices means less supply, a fall in the prices of final goods and services means that it's less profitable for firms to produce the same amount of output as before, because the prices of the goods they're selling are smaller, and so they'll decrease the amount they produce. This also means a decline in the market value of wages, because as aggregate supply drops there'll be more unemployment, and so as workers become less in demand the value of their wages goes down. Thus, when it's time to renegotiate wages will also be lower.

under manufacturing what are the following national and international business opptunities

Answers

When nations cannot successfully produce a true or service, they can seek to acquire it through trade with every other country. These opportunities to specialize regularly lead to greater effectivity in production, greater levels of innovation, and extended satisfactory of development.

Which of the following is are kind kinds of global enterprise *?The fundamental sorts of International business include: Export Trade: Selling products and services to different nations. Import Trade: Buying items and offerings from different countries. Entrepot Trade: Importing items and offerings to re-export them to other nations.

Attract foreign demand: Some companies are unable to extend their market share due to fierce competition within the enterprise

Learn more about international business here:

https://brainly.com/question/14926566#SPJ1 In a survey of a group of people, it was found that 60 0f them have

business, 45 have government jobs, 125 have farming, 27 have business

only, 15 have government job only, 10 have business and government

job only, 5 have government job and farming only.

i) How many people have all the profession?

ii) How many people were there in a survey?

Answers

Answer:

i) 15 ii) 177

Explanation:

Number of people with business = 60

Number of people with farming = 125

Number of people with government jobs = 45

Number of people with business only = 27

Number of people with government jobs only = 15

10 have business and government job only, 5 have government job and farming only.

i) Let x represent the number of people with all three jobs. Hence:

Number of people with government jobs = number of people with all three jobs + number of people with government and farming job + number of people with government and business + number of people with government job only

45 = x + 10 + 5 + 15

45 = x + 30

x = 15

15 people have all three profession.

ii)

Number of people with business jobs = number of people with all three jobs + number of people with business and farming job + number of people with government and business + number of people with business job only

60 = 15 + number of people with business and farming job + 10 + 27

number of people with business and farming job = 60 - 52 = 8

Number of people with farming jobs = number of people with all three jobs + number of people with business and farming job + number of people with government and farming + number of people with farming job only

125 = 15 + 8 + 5 + number of people with farming job only

number of people with farming job only = 125 - 28 = 97

Number of people surveyed = number of people with all three jobs + number of people with business and farming job + number of people with government and farming + number of people with farming job only + number of people with government and business + number of people with business job only + number of people with government job only

Number of people surveyed = 15 + 8 + 5 + 97 + 10 + 27 + 15

Number of people surveyed = 177

a corporation has taken out a loan to finance a new operation. What is the name of that type of financing called? A .Collateral financing B. debt financing C. bank financing D. retained earnings financing?

Answers

Since the corporation took out a loan, the name of that type of financing is called debt financing.

What are the two major funding options for corporations?The two primary funding options for corporations are debt financing and equity financing.

Debt financing entails taking a loan from a bank or selling fixed-income securities like bonds.

Equity financing is the practice of raising funds through the selling of shares.

As the corporation took out a loan, the name of that type of financing is called debt financing.

Learn more about loans here: https://brainly.com/question/7299838.

#SPJ1

Consider an asset that costs $655,000 and is depreciated straight-line to zero over its seven-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $133,000. If the relevant tax rate is 24 percent, what is the aftertax cash flow from the sale of this asset?

Answers

The after tax cash flow from the sale of the asset at the end of its seven year life span is $145,994.29.

What is the after tax cash flow?The after tax cash flow is the cash flow calculated after taxes have been deducted. Tax is a form of transfer of wealth from the private sector to the government. Tax is the compulsory amount that is deducted from the income of an individual or company.

After tax cashflow = value after the sale - tax(salvage sale - Book value)

Book value = value of the asset - accumulated depreciation

Annual depreciation = ($655,000 - 0) / 7 = 93,571.43

Accumulated depreciation = 93,571.43 x 5 = $467,857.14

Book value = $655,000 - $467,857.14 = $187,142.86

After tax cashflow = $133,000 - 0.24($133,000 - $187,142.86)

$133,000 - (0.24 x -54,142.86)

$133,000 + 12,994.29 = $145,994.29

To learn more about after tax cash flow, please check: https://brainly.com/question/17166727

#SPJ1

The fact that human wants cannot be fully satisfied with available resources is called the problemof

A)normative economics.

B)who will consume.

C)scarcity.

D)opportunity costs.

E)what to produce

Answers

The fact that human wants cannot be fully satisfied with available resources is called the problem of C)scarcity.

What is scarcity in the economy?One of the fundamental ideas in economics is scarcity. It indicates that there is a gap between the supply and demand for an item or service. As a result, scarcity may restrict the options available to consumers, who in the end drive the economy.

Economics is primarily concerned with the issue of scarcity because, despite the fact that human needs and wants are limitless and growing, there are only so many resources that can be used to satisfy them. This prevents humans from completely meeting their wants.

Therefore, option C is correct.

Learn more about resources at:

https://brainly.com/question/24514288

#SPJ1

Why does the scientific method not follow an exact order?

Answers

Through testing and experimentation, the scientific method establishes facts in an unbiased manner.

What is an scientific method?Making an observation, formulating a hypothesis, making a prediction, carrying out an experiment, and then evaluating the findings are the fundamental steps. The scientific method's principles can be used in various contexts, including business, technology, and scientific study.

A set of steps are used in the scientific process to establish facts or generate knowledge. The general procedure is generally known, but depending on what is being examined and who is performing it, each step's specifics may alter. Only questions that can be tested and either proven true or false can be answered using the scientific method.

Therefore, Through testing and experimentation, the scientific method establishes facts in an unbiased manner.

To learn more about scientific method, refer to the link:

https://brainly.com/question/7508826

#SPJ1

Work with a partner. An art collector buys two paintings. The value of each painting after t years is y dollars. Complete each table. Compare the values of the two paintings. Which painting's value has a constant growth rate? Which painting's value has an increasing growth rate? Explain your reasoning.

Answers

In general, if a painting's value increases by the same amount each year, it may have a stable growth rate, or if it increases by a bigger amount each year, it may have an increasing growth rate.

How can you compare exponential and linear functions?Review: linear growth. For both linear and exponential relationships, the y-values change in several ways when the x-values increase by a specific amount: In a linear relationship, the difference between the y-values is equal. The y-values have equal ratios in an exponential relationship.

How are the pictures created?It can be done using nearly any medium, including painting, photography, sculpture, and others. In addition to making portraits for clients, some painters also do it merely for artistic purposes.

To know more about growth rate visit:-

https://brainly.com/question/13870574

#SPJ1

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock.The following amounts were distributed as dividends: Year 1: $10,000 Year 2: 45,000 Year 3: 90,000 Determine the dividends in arrears for preferred stock for the second year. a.$10,000 b.$25,000 c.$30,000 d.$0

Answers

Answer:

Option b is correct

Arrears preference dividends = $25,000

Explanation:

Preference shareholders are entitled to a fixed amount of dividends.

Cumulative preference shares: Cumulative simply implies that should the company misses the payment of dividend in a particular year such unpaid dividend would be carried carried forward and paid in arrears in the following year.

$

Preferred dividend in year = 2%× 100× 20,000= 40,000

Preferred dividend in year 2 = 2%× 100× 20,000= 40,000

Total dividend accrued to preference shares 80,000

Less total dividend paid in year 1 and 2 55,000

Arrears preference dividends 25,000

Arrears preference dividends = $25,000

You buy a share of The Ludwig Corporation stock for $19.20. You expect it to pay dividends of $1.11, $1.1833, and $1.2614 in Years 1, 2, and 3, respectively, and you expect to sell it at a price of $23.26 at the end of 3 years. Calculate the growth rate in dividends. Round your answer to two decimal places. % Calculate the expected dividend yield. Round your answer to two decimal places. % Assuming that the calculated growth rate is expected to continue, you can add the dividend yield to the expected growth rate to obtain the expected total rate of return. What is this stock's expected total rate of return (assume market is in equilibrium with the required rate of return equal to the expected return)

Answers

Answer:

P0 = $19.20

D1 = $1.11

D2 = $1.1833

D3 = $1.2614

P3 = $23.26

a. Dividend growth rate = (1.2614-1.1833)/1.1833 = 0.0781/1.1833 = 0.06600186 = 6.60%

b. Expected Dividend Yield=(Expected Dividend/Price)*100 = $1.11/$19.20 = 0.0578125 = 5.78%

c. Total Rate of Return = 6.60% + 5.78% = 12.38%

Team __________ occurs when individuals and departments rely on other individuals and departments for information or resources to accomplish their work.

Answers

Answer:

Team interdependence

Managers use all of the following types of resources to achieve organizational goals except

Answers

Managers use all of the following types of resources to achieve organizational goals except: A. International.

Who is a manager?A manager can be defined as the person that help to oversee a company or an organization day to day business operation and activities by ensuring that their is smooth business operation.

Managers tend to often make use of the below resources to achieve their organizational goals and objectives:

PhysicalHumanFinancialInformationTherefore we can conclude that the correct option is A.

Learn more about who is a manager here:https://brainly.com/question/24553900

#SPJ1

The complete question is:

Managers use all of the following types of resources to achieve organizational goals EXCEPT

A. International

B. Physical

C. Human

D. Financial

E. Information

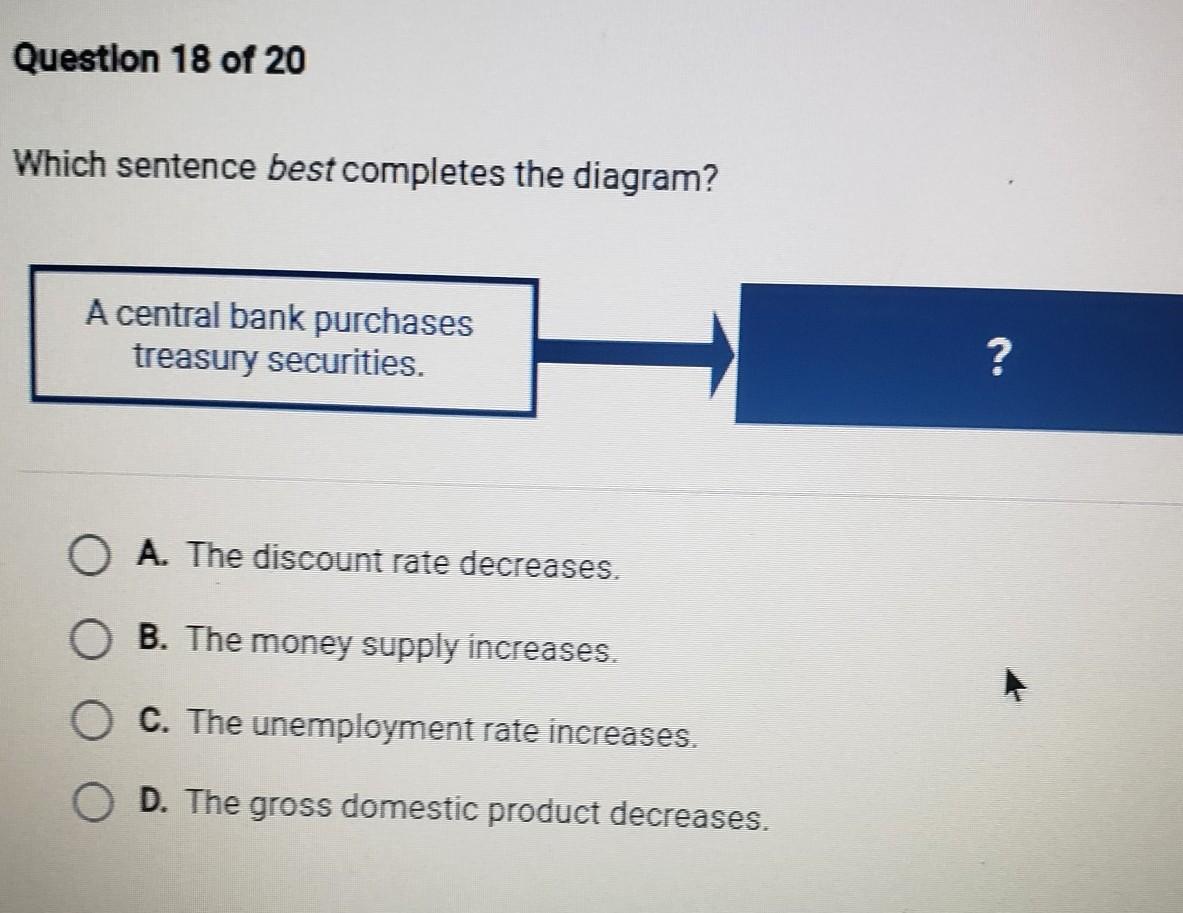

which sentence best completes the diagram

A. the discount rate decrease

B. the money supply increases

C. the unemployment rate increases

D. the gross domestic product decreases

Answers

Answer:

B

Explanation:

taking unit 3 test right now

The sentence best completes the diagram is the money supply increases. Thus the correct option is B.

What are Treasury securities?To five different term options, Treasury Bills are a type of short-term security that offers protection and tax advantages to investors who invest money in them. The US government's complete faith and reputation are guaranteed as security for the debt obligations.

While selling securities has the reverse impact and takes money from the system, adding securities lowers rates, makes loans simpler to get and boosts economic activity.

When the Fed purchases Treasury securities, it converts them into "reserve balances," or deposits made at the Federal Reserve by a depository institution. This creates additional wealth for the economy.

Therefore, option B is appropriate.

Learn more about Treasury securities, here:

https://brainly.com/question/15004124

#SPJ5

State management functions for enterprises

Answers

State management functions for enterprises include planning, organizing, leading and controlling.

What are the functions of state management ?Planning encompasses the delineation of goals, formulation of objectives, and crafting of strategies to accomplish them. Organizing entails the structuring of an enterprise's resources, encompassing human capital, financial assets, and material possessions, to optimize efficiency and productivity.

Leadership involves the guidance and influence exerted by enterprises to steer employees toward the attainment of organizational goals. Control pertains to the monitoring and evaluation of performance to ensure adherence to plans and the achievement of objectives.

Find out more on management functions at https://brainly.com/question/17083312

#SPJ1

Carey Company owns a plot of land on which burried toxic wastes have been discovered. Since it will require several years and a considerable sum of money before the property is fully detoxified and capable of generating revenues, Carey wishes to sell the land now. It has located two potenital buyers. Buyer A, who is willing to pay $480,000 for the land now, or Buyer B, who is willing to make 20 annual payments of $75,000 each, with the first payment to be made 5 years from today. Assuming that the appropraite rate of interest is 9%, wo whom should Carey sell the land. Show calculations.

Answers

Answer:

Carey should accept buyer A's offer

Explanation:

we need to compare the present values of both proposals:

Present value of proposal A = $480,000

Present value of proposal B:

present value of annuity in 5 years = $75,000 x 9.1285 (PVIFA, 9%, 20 periods) = $684,637.50

present value (today) = $684,637.50 / (1 + 9%)⁵ = $444,967.40

The fixed costs for Teddy bikes are $ 1000, the variable costs are $855, and the firm's revenues are $950.What should the firm do?

Answers

If the variable costs are $855, and the firm's revenues are $950, then the firm should cut down the variable cost in order to increase the profit or revenue as the fixed cost cannot be changed in short run.

What is fixed cost?A fixed cost is a cost that does not fluctuate with the production or sale of more or fewer goods or services.

Rent and leasing charges, salary, energy prices, insurance, and loan repayments are a few examples of fixed costs. There are some taxes that are fixed costs as well, such as company licenses.

Fixed costs are expenses that remain constant regardless of whether sales or production volumes rise or fall. This is so because they are not involved in the actual process of producing a good or providing a service. Fixed costs are therefore regarded as indirect costs.

The term "variable cost" refers to a sort of cost that will fluctuate in response to changes in production levels.

Learn more about fixed cost, here

https://brainly.com/question/29673154

#SPJ1

Which of the following is not an example of a multichannel retailer?

Answers

Answer:A

thats the one

Explanation:

McDonals is the example of multichannel retailer as the company is providing burgers and fries to its different outlets and in diffrent food ordering sites in many countries.

What is multichannel retailer?The technique of selling similar products over multiple channels and platforms is known as multichannel commerce.

The platforms can be both online and offline, with different channels such as brick and mortar stores, online stores, mobile stores, and mobile app stores.

Thus, McDonals is the example of multichannel retailer.

For more details about multichannel retailer, click here

https://brainly.com/question/13125283

#SPJ2

Max Weber believed the more an organization approaches the ideal type of bureaucracy, the more effective it will be in pursuing the objectives for which it was established. However, he also recognized that bureaucracies can create some negatives, such as a. organizational tension between authority figures and subordinates over dissolving the organization. b. numerous unofficial ways of doing things because of the lack of flexibility in completing tasks in a bureaucracy. c. increasing employee salary costs. d. inefficiency because of the strict adherence to rules and regulations that makes it difficult to respond to new issues.

Answers

Answer:

d. inefficiency because of the strict adherence to rules and regulations that makes it difficult to respond to new issues.

Explanation:

Yes! This sense of bureaucracy created within it another problem–inefficiency again due to strict adherence to rules and regulations.

According to Max Weber despite the advantages of having a bureaucratic structure in an organization, it also recognized created some negatives like inefficiencies because of the strict adherence to rules and regulations which makes it difficult to respond to new issues.

For example, an employee may have to pass through all the levels of authority in other to get a particular issue resolved. While doing so, he might yet encounter another new issue; with the first issue still pending review from top management, it makes it difficult to address the new issue.

Calculating taxes on security transactions. If Isabella Rodriguez is single and in the 24 percent tax bracket, calculate the tax associated with each of the following transactions. (Use the IRS regulations for capital gains in effect in 2018.) a. She sold stock for $1,200 that she purchased for $1,000 5 months earlier. b. She sold bonds for $4,000 that she purchased for $3,000 3 years earlier. She sold stock for $1,000 that she purchased for $1,500 15 months earlier.

Answers

a. Tax Amount = $ 48

b. Tax amount = $ 150

c. Loss on Sale of Stock = $ 500

As per given details please refer below answer :-

If Capital Assets are held for less than 12 months then it is short term capital gain and taxed as per ordinary income tax rates.

If Capital Assets are held for more than 12 months then it is long term capital gain and taxed as per long term capital gain tax rates.

In 2018 if single taxpayer income has less than $ 38,600 then long term capital gain applicable tax rate is 0%. If income between $ 38,601 and $ 425,800 then applicable tax rate is 15% and income above $ 426,801 then tax rate is 20%.

Isabell is in 24% tax bracket hence her ordinary income between $ 82,501 and $ 157,500 so applicable long term capital gain tax rate is 15%.

Part a :-

Gain on sale of Stock = Sale price - Purchase price

Gain on sale of Stock = 1,200 - 1,000

Gain on sale of Stock = $ 200

Stock has hold for 5 months hence it is short term capital gain and taxed with 24% (as given).

Tax Amount = Gain on Stock * 24%

Tax Amount = 200 * 24%

Tax Amount = $ 48

Part b :-

Gain on Sale of Bonds = Sale price - Purchase price

Gain on Sale of Bonds = 4,000 - 3,000

Gain on Sale of Bonds = $ 1,000

Bond hold for 3 years hence it is treated as long term capital gain and taxed at rate of 15%.

Tax amount = Gain on bonds * 15%

Tax amount = 1,000 * 15%

Tax amount = $ 150

Part C :-

Purchase price is greater than sale price hence there is loss.

Loss on Sale of Stock = Purchase price - Sales price

Loss on Sale of Stock = 1,500 - 1,000

Loss on Sale of Stock = $ 500

Stock hold for 15 months hence it is treated as long term capital loss and can be first set off against the long term capital gain.If there is no long term capital gain then it will set off against short term capital gain.Loss still remain after set off against long term and short term capital gain then remaining amount set off against ordinary income up to $ 3,000 and excess amount carry forward to next year.Tax saving if set off against Long term capital gain = Capital loss * 15%

Tax saving if set off against Long term capital gain = 500 * 15%

Tax saving if set off against Long term capital gain = $ 75

Tax saving if set off against short term capital gain or ordinary income = Capital loss × 24%

Tax saving if set off against short term capital gain or ordinary income = 500 × 24%

Tax saving if set off against short term capital gain or ordinary income = $ 120

Learn more about Taxes, here

https://brainly.com/question/16423331

#SPJ9

Marcie goes to the salon and has a pedicure and a manicure. What has Marcie purchased from the salon?

A.) A good

B.) A good and a service

C.) Neither

D.) A service

Answers

D.) A service

what is true about taxes ?

Answers

Answer:

1. TAXES DATE BACK TO AT LEAST ANCIENT EGYPT.

We can trace documented records of taxation all the way back to Ancient Egypt, sometime around 3000 to 2800 BCE. Apparently, there was a biennial event called the Following of Horus, when the Pharaoh went around collecting taxes in his dual roles as head of state and living incarnation of the god Horus. Taxation is even described in the Bible when Joseph tells the people of Egypt to give a fifth of their crops to Pharaoh.

2. THE FIRST TAXES IMPLEMENTED IN THE UNITED STATES CAUSED A REBELLION.

Fans of the Broadway musical Hamilton probably remember the lyric, “Imagine what gon’ happen when you try to tax our whiskey.” What happened was the Whiskey Rebellion, which was largely due to a tax that Alexander Hamilton imposed on—you guessed it—whiskey.

As you might imagine, people were extremely unhappy about it, especially small producers of whiskey, who, because of the way the tax was structured, had to pay nine cents per gallon in taxes, while larger producers were able to get as low as six cents. Violence quickly broke out. Tax officers were assaulted and tarred and feathered for trying to do their jobs, and several people were killed during riots. The Rebellion was eventually quashed in 1794, and the whiskey tax remained in effect until 1802, when Thomas Jefferson repealed it.

3. ABRAHAM LINCOLN GAVE US FEDERAL INCOME TAX.

Abraham Lincoln signed the Revenue Act in 1861, which imposed the first-ever federal income tax. To drum up funds for the Civil War, Lincoln and Congress enacted a modest 3 percent tax on income over $800, which would be roughly $23,000 today. The law was almost instantly replaced with a new revenue act and would be repealed a decade later, but the relief obviously didn’t last: In 1913, the 16th Amendment established the federal income tax system we all know today.

4. TAX DAY WASN'T ORIGINALLY ON APRIL 15.

When the modern federal income tax was established, lawmakers set March 1 as the looming deadline.

Although they gave no reason for this particular date, it was presumably to give people a couple of months to gather paperwork and crunch numbers after the end of the year. By 1919, the government tacked a couple of more weeks on to help panicked filers, making March 15 the date. That date stood until 1955, after Congress acknowledged that doing your taxes was getting more complicated by the year.

To help accommodate all of those changes and give people adequate time to file, the date was bumped by another month—but the change wasn’t entirely altruistic. The IRS acknowledged that the extra month would help their employees as well, spreading the workload out across another 30 days.

5. WE SPEND A LOT OF TIME DOING OUR TAXES.

The amount of time we spend doing our taxes every year suggests that the repeated date changes may have been justified. According to the IRS, the average taxpayer spends about 11 hours doing record-keeping, tax planning, form submission, and other super fun tax-related activities. Of course, if you break it down even further, the amount of time changes based on the type of form the filers use. Business filers spend about 20 hours, including 10 hours on record-keeping alone.

Explanation:

please mark me brainliest and theses are just facts about taxes

A country wants to promote economic growth by giving companies more

freedom. It cuts taxes on corporations, eliminates environmental regulations,

and makes it easier to start new businesses. The government tries to limit its

involvement in economic issues as much as possible.

This situation best reflects the influence of which economic thinker?

Answers

Answer:

Adam Smith

Explanation:

Adam Smith lived in the 18th century. He was Scottish, a decorated philosopher, economist, and author. Many view him as the father of modern economics.

Adam Smith was a principal advocate of the market economy. In his book, ''The Wealth of Nations," Adam emphasized that the individual's need to satisfy self-interest has more societal benefit. Adam Smith wrote this book at a time when markets were heavily regulated by the state, church, and trading societies . He argued that removing unnecessary interference would permit trade to flourish and prosper. Although Smith advocated for individual profits maximization and low trade barriers, he also saw to need for government to participate through regulation. Smith thought that the government had a big role in education and the country's defense.

Smith believed that competition in business ensures that private firms driven by profit motive will produce their goods at the lowest possible cost. This benefits society and ensures markets use resources efficiently.

Smith is also accredited with developing the gross domestic product (GDP) concept and the theory of compensating wage differentials.

Can u give me a list of ethical products that can start a business?

also give me list of creative inventions

Surely guys, if you answer this, you will get a noble prize and you are getting 50!!!!! POINTS, COME ON Answer this, please give good answers please!

Answers

[Total = 25marks]

QUESTION 2

a. Azon and Son Ltd acquired use of plant over three years by way of a lease. Installments of

GhC700,000, are paid six monthly in arrears on 30 June and 31 December. Delivery of the plant

was on 1 January 2010 so the first payments of GhC700,00 was on 30 June 2010. The present

value of minimum lease payments is GhC3,000,000, Interest implicit in the above is 10% per six

months. The plant would normally be expected to last three. Azon and Son is required to insure

the plant and cannot return it to the lessor without severe penalties.

Required

i. Describe whether the above lease should be classified as an operating or finance

1

Answers

A significant portion of the asset's economic life—three years—is covered by the lease period. The minimum lease payment present value is GhC3,000,000, which is essentially the entire leased asset's fair market value.

The equivalent of monthly rent, a lease payment is formally stipulated in a contract between two parties and gives one party the right to use the other party's real estate holdings, manufacturing equipment, computers, software, or other fixed assets for a predetermined period of time.

A lease payment will be shown as a right-of-use asset and lease liability on the balance sheet. The ROU asset is the ownership of the asset under the lease contract, whereas the lease liability period is the payment obligation during the course of the lease contract.

Learn more about lease payment, from :

brainly.com/question/17196771

#SPJ1

Philosopher T.M. Scanlon makes four points about why we should be concerned with economic inequality. What did you think of his arguments? Are there any you find convincing? Explain your position.

Answers

Answer : yes , i find the following scriptures by philosopher convincing:

T.M. Scanlon, a philosopher, has made several points about why we should be concerned with economic inequality.

Fairness and Desert: Scanlon argues that economic inequality is a concern because it can violate principles of fairness and desert. He suggests that individuals should be rewarded based on their contributions and efforts rather than arbitrary factors like birth circumstances. This perspective implies that extreme economic disparities can undermine fairness in society.

Democratic Equality: Scanlon contends that economic inequality can undermine democratic equality by allowing the wealthy to exert undue influence over political decisions, potentially distorting democratic processes. This argument highlights the potential threat to the principle of political equality when wealth disparities are significant.

Social and Economic Power: Scanlon argues that economic inequality can lead to the concentration of social and economic power in the hands of a few, creating disparities in opportunities and social mobility. This perspective suggests that unequal distribution of resources can limit equal access to education, healthcare, and other important social goods.

Social Cohesion and Shared Identity: Scanlon posits that extreme economic inequality can erode social cohesion and undermine the sense of shared identity within a society. When there is a significant gap between the rich and the poor, it can lead to social divisions, conflicts, and a sense of alienation among different groups.

The persuasiveness of these arguments may vary depending on an individual's beliefs, values, and political ideology. Some may find Scanlon's points compelling, as they highlight the potential negative consequences of economic inequality on fairness, democracy, social mobility, and societal cohesion. Others may have different perspectives, emphasizing the importance of individual freedom, market dynamics, and the potential benefits of incentives provided by economic inequality.

It's crucial to engage in thoughtful discussions and consider multiple viewpoints to foster a comprehensive understanding of the complex issue of economic inequality.