Answers

As interest rates move up, the cost of borrowing becomes more expensive. This means that demand for lower-yield bonds will drop, causing their price to drop. As interest rates fall, it becomes easier to borrow money, and many companies will issue new bonds to finance expansion.

Finance is the study and discipline of money, foreign money and capital assets. it's far associated with, but no longer synonymous with economics, the take a look at of production, distribution, and intake of cash, belongings, goods and offerings (the field of monetary economics bridges the two). Finance sports take region in financial structures at numerous scopes, as a result the field may be more or less divided into private, corporate, and public finance. in a economic machine, belongings are offered, sold, or traded as economic units, consisting of currencies, loans, bonds, shares, shares, alternatives, futures, and so forth. assets also can be banked, invested, and insured to maximize fee and limit loss. In practice, dangers are always found in any financial action and entities.

Learn more about finance here

https://brainly.com/question/26240841

#SPJ4

Related Questions

2. Who pays the tariffs on imports on foreign steel into the United States? How does the payee deal with the additional costs that the tariffs represent

Answers

Answer: The importer of steel pays the tariffs on the steel then the importer then pays the additional costs of the tariffs to the payee.

You own a golf course in Florida and you need to determine how many golf carts you need to buy to maximize profits. Please answer the following questions given the information below.

A brand new golf cart costs 2000 rounds of golf and the rate of depreciation is 5%.

The real interest rate is 8%

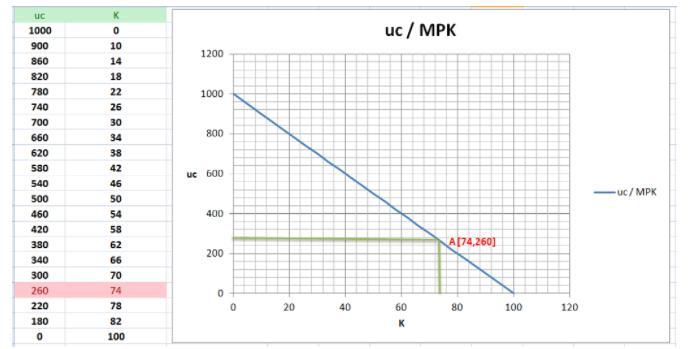

The expected marginal product of capital is given by MPKf = 1000 – 10K.

a) What is the user cost of capital and what is it expressed in?

b) How many golf carts should you buy to maximize profits (i.e., what is K*)?

c) Draw a graph (the uc / MPK graph) depicting the state of affairs and label this initial profit maximizing point as point A.

Now suppose the (local) government with all their financial shortfalls embarks on a campaign to raise revenue to fund the fire department by imposing a so-called "luxury tax" (we know it as τ) equal to 15% of gross revenue. What happens to the profit maximizing number of golf carts? Please show all work and round to two decimal places.

Answers

Answer:

a) 260 rounds of golf

b) 74

c) attached below

d) 70 golf carts

Explanation:

a) Calculate the user cost of capital and what is it expressed in

user cost of capital = total depreciation + total interest

= ( rate of depreciation * Golf cart cost ) + ( real interest rate * Golf cart cost )

= ( d + r ) Golf cart cost

= ( 0.05 + 0.08 ) 2000 = 260 rounds of golf

b) determine the number of carts that should be bought to maximize profits

Profits are maximized when User Cost of capital = MPKF

(d +r) Golf cart cost = MP Kf = 1000 – 10K

( 0.05 + 0.08 ) 2000 = 1000 – 10K

260 = 1000 – 10K ∴ K = ( 1000 - 260 ) / 10 = 74

c) attached below is the required graph

d) Determine what happens to the profit maximizing number of golf carts

User cost of capital ( 1 - t ) = MPK^f

∴ User cost of capital ( 1 - t ) = 1000 – 10K

260 ( 1 - 0.15 ) = 1000 – 10K

305.88 = 1000 – 10K

K=69.41

that is approximately 70 golf carts is been bought to maximize profit

can I have free account please

Answers

Answer:

what kind of account?

i will give you don't worry

Johnson corporation began the year with inventory of 14,000 units of its only product. units cost $8 each. The company uses a Perpetual inventory system and the fifo cost method. The following transactions occurred during the year: a. purchase 70,000 additional units at a cost of $10 per unit. Terms of the purchases were 2 /10 n/ 30, and 100% of the purchases were paid within the 10-day discount. The company uses the gross method to record purchase discounts. The merchandise was purchased f. O. B. Shipping point and Freight charges of $0.40 per unit were paid by Johnson. b. 1400 units purchased during the year will return to suppliers for credit. Johnson was also given credit for the freight charges of $0.40 per unit it had paid on the original purchase. The units were defective and were returned two days after they were received. c. sales for the year totaled 65,000 units at $18 per unit. d. on December 28th Johnson purchased 5400 additional units at $10 each. The goods were shipped f. O. B. Destination and arrived at Johnson's Warehouse on January 4th of the following year e. 17600 units were on hand at the end of the year. required: 1. for financial reporting purposes, the company uses lifo (amounts based on the Periodic inventory system). Record the year-end adjusting entry for the lifo reserve, assuming the balance in the lifo Reserve at the beginning of the year it's $15,800 2. determine the amount the company would report as income before taxes for the year under lifo. Operating expenses other than those indicated in the above transactions amounted to $158,000

Answers

manager is intrigued as to why some employees seem to derive joy from work and get energized by it, while others find it troublesome and frustrating. Indicate how the researcher should proceed in regard to the following:[6*2=12 marks] a. Type of research question (exploratory, descriptive, or causal). b. The extent of researcher interference. c. The study setting. d. The research strategy. e. The time horizon for the study. f. The unit of analysis

Answers

Scenario 1 A specific department within an organization has a high turnover rate; employees of this department have a shorter average tenure than those of other departments in the company.

Why Managers Ignore Employees’ Ideas?

Organizations innovate and perform better when employees share original ideas and raise issues or difficulties. Employee feedback can significantly aid managerial decision-making because they frequently are the first to notice problems on the front lines.

However, supervisors do not always support employees' suggestions. They may even purposefully ignore employee complaints and behave in a manner that deters employees from raising any issues in the first place.

According to a large body of recent study on the subject, managers are typically mired in their own ways of doing things and identify so deeply with the status quo that they are afraid to listen to feedback that is contradictory from below. They frequently work in settings where they lack the independence to make changes.

To learn more about Employees’ Ideas refer to:

https://brainly.com/question/13753685

#SPJ4

To help audiences understand large amounts of information, which visuals are the most suitable?

Answers

different between isoquant and isocost

a pension fund manager is considering three mutual funds. the first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a t-bill money market fund that yields a sure rate of 5.5%. the probability distributions of the risky funds are: expected return standard deviation stock fund (s) 17% 32% bond fund (b) 11% 23% the correlation between the fund returns is 0.25. problem 6-8 (algo) required: what is the expected return and standard deviation for the minimum-variance portfolio of the two risky funds? (do not round intermediate calculations. round your answers to 2 decimal places.)

Answers

The standard deviation would be 35%.

What is standard deviation?Standard deviation is a statistical measure that describes the amount of variability or dispersion in a set of data. It measures how much the data values differ from the average or mean value of the data set.

A smaller standard deviation indicates that the data points tend to be closer to the mean, while a larger standard deviation indicates that the data points are more spread out.

In the above case, the standard deviation would be 35%.

Learn more about standard deviation here:

https://brainly.com/question/13905583

#SPJ1

Values for the first year of a project are projected as: Sales = $1.800, Depreciation = $300, Fixed costs = $450, Variable costs = $620, Tax rate = 34 percent, What is the OCF?

Answers

Answer:

the operating cash flow or OCF is $583.80

Explanation:

The computation of the operating cash flow or OCF is given below:

= (Sales - variable cost - fixed cost - depreciation) × (1 - tax rate) + depreciation expense

= ($1,800 - $620 - $450 - $300) × (1 - 0.34) + $300

= $430 × 0.66 + $300

= $283.80 + $300

= $583.80

Hence, the operating cash flow or OCF is $583.80

Bank Sohar declares the profit for the year ended 2019-20. They makes profit:

a.

When bank Sohar asset is less than the liability

b.

When their rate of interest on loan is greater than the deposit rates

c.

When their bank liability is greater than their assets

d.

When their rate of interest on loan is less than the deposit rates

Answers

Answer:

Option B

Explanation:

A bank makes profit when it gets more returns on the loan given as compared to the interest given on the deposited money.

Hence, option B is correct. In case A and C liability is greater than asset and hence this situation does not signify a profitable situation.

Also, option D is just the opposite of option B (profitable situation).

Consider the following financial statements about DANIEL Co. for the current year 2015

I/S for the year ended Dec. 31, 2015

Sales $16,000

CGS 10,000

Operating expenses 4,000

Profit from operations (EBIT) 2,000

Interest expense 200

EBT 1,800

Tax expense 600

NI $ 1,200

Additional information:

Operating expenses include $150 of depreciation expense and a $200 impairment loss on equipment.

A/R increased by $380

Inventory decreased by $100

Prepaid expenses related to operating expense increased by $80

A/P decreased by $360

Accrued liabilities related to operating expenses decreased by $180

Interest payable decreased by $20

Unearned revenue received from customers decreased by $34

Income tax payable increased by $40

Required:

Prepare CFO section of the cash flow statement under the (a) DIRECT (12 marks);

and (b) INDIRECT methods (8 marks)

Answers

Answer:

a. For the Year Ended December 31, 2015

Cash flows from operating activities:

Cash received from customers 15586

Cash paid to suppliers -10260

Cash paid for operating expenses -3910

Cash paid for interest -220

Cash paid for income taxes -560

Net cash flow from operating activities 636

Working:

Sales 16000

Less: Increase in accounts receivable -380

Less: Decrease in unearned revenue -34

Cash received from customers 15586

Cost of goods sold 10000

Add: Decrease in accounts payable 360

Less: Decrease in inventory -100

Cash paid to suppliers 10260

Operating expenses 4000

Less: Noncash expenses

Depreciation expense -150

Impairment loss -200

Cash operating expenses 3650

Add: Increase in prepaid expenses 80

Add: Decrease in accrued liabilities 180

Cash paid for operating expenses 3910

Interest expense 200

Add: Decrease in interest payable 20

Cash paid for interest 220

Income tax expense 600

Less: Increase in income tax payable -40

Cash paid for income taxes 560

(b) Partial Cash Flow Statement (Indirect Method)

For the Year Ended December 31, 2015

Cash flows from operating activities

Net income 1200

Adjustments to reconcile net

income to operating cash flows:

Depreciation expense 150

Impairment loss 200

Increase in accounts receivable -380

Decrease in inventory 100

Increase in prepaid expenses -80

Decrease in accounts payable -360

Decrease in accrued liabilities -180

Decrease in interest payable -20

Decrease in unearned revenue -34

Increase in income tax payable 40 -564

Net cash flow from operating activities 636

How do you build and maintain a positive credit history that leads to a high credit score? What changes could you make to improve yours?

Answers

Building and maintaining a positive credit history requires responsible borrowing and timely payments. To improve your credit score, you should pay your bills on time, keep your credit utilization low, maintain your credit accounts, diversify your credit mix, and avoid applying for too many credit accounts.

A credit score is a three-digit number that reflects your creditworthiness. It indicates how well you manage your finances and repay your debts. A high credit score indicates that you are a responsible borrower and are less likely to default on your loans.

As a result, you are more likely to be approved for loans and credit cards, and you will receive lower interest rates. Here are some ways to build and maintain a positive credit history that leads to a high credit score:

Pay your bills on time: Late payments have a significant impact on your credit score. To avoid late payments, set up automatic payments or payment reminders.

Keep your credit utilization low: Credit utilization is the percentage of your available credit that you use. To maintain a good credit score, it is recommended that you keep your credit utilization under 30%.

Keep your credit accounts open: The length of your credit history is an essential factor in determining your credit score. Therefore, it is recommended that you keep your credit accounts open as long as possible and use them regularly. However, if you have too many credit accounts, consider closing the ones that you don't use.

Improve your credit mix: Having a mix of different types of credit, such as credit cards, auto loans, and mortgages, can help improve your credit score.

Therefore, if you only have one type of credit, consider adding another type to your credit mix. Avoid applying for too many credit accounts: Applying for too many credit accounts in a short period can negatively impact your credit score.

Therefore, it is recommended that you only apply for credit when you need it and space out your applications over time.

In conclusion, building and maintaining a positive credit history requires responsible borrowing and timely payments. To improve your credit score, you should pay your bills on time, keep your credit utilization low, maintain your credit accounts, diversify your credit mix, and avoid applying for too many credit accounts.

For more such questions on credit accounts

https://brainly.com/question/13964348

#SPJ8

Answer:The best way to build a credit history is to borrow responsibly and open lines of credit through credit cards, home and or car loans. Once these lines of credit are open you want to maintain timely payments monthly as well as maintaining your monthly bills, so they do not go into collections. These monthly bills are things such as utilities and medical bills. This will help establish credit history and the longer these lines are open and have on-time payments you will gain and build your credit score. You want your utilization of the credit lines to remain low, not max them out and avoid having too many open lines. Another way to protect and a healthy score to avoid too many credit inquiries especially hard inquiries.

Some changes I would make to mine would be to pay off the accounts I have in collections, open one or two secure cards while only using a small percentage of the available credit and make the minimum monthly payment. and start making early payments to my student loans. Once I have accomplished this, I would like to finance a new vehicle and maintain on time and or early monthly payments.

Explanation:

Changes in Market Indexes

The market index reached its lowest point in the year

Based on the market index, demand began to fall sharply in the year

Answers

The market index reached its lowest point in the year 2008 Based on the market index, demand began to fall sharply in the year 2008

What caused the market index to fall in the year 2008?The devaluation of mortgage-backed securities in the housing market was what precipitated the stock market meltdown of 2007–2008. The securities' value fluctuated when house values dropped due to frequent speculative trading.

On September 29, 2008, the stock market dropped 777.68 points. The largest point decrease in recorded history occurred at the time. Congress' initial failure to approve the bank bailout legislation, which would have stabilized the American financial system

Read more on the market index here:https://brainly.com/question/16969849

#SPJ1

robbery prevention at dollar general cbl test

Answers

Answer: i have no idea what to do here to help you but i'll try my best,

Explanation:

security cameras, security systems, security officers, and a policy against guns and other weapons.

Robbery is the act of stealing money or other items from a bank, store, or moving object while frequently utilizing force or threats. It's crucial to put in place efficient security measures and train staff members to be ready for such circumstances if you want to reduce the likelihood of robberies at Dollar General stores.

Keep the store's inside and exterior adequately lit, paying particular attention to the parking areas and entrances. By making people more visible and eliminating hiding places, well-lit spaces might dissuade potential robberies. To establish and close the firm, at least two people are required. Never give strangers your personal information.

Lock up bags and other personal items in desks or lockers. Activate a robbery alarm. A surveillance camera facing the front counter should be placed behind the cash register.

Learn more about Robbery here:

https://brainly.com/question/15526673

#SPJ6

If you are the Head of H.R Department in Ali Manufacture Company and you have hire the totally fresh candidates in your company so what kind of training you will suggested; on the job training or off the job training

Answers

Answer:

on the job training

Explanation:

On the job training focuses on a more practical training, i.e. training new employees through real life situations. While off the job training is theoretical training that can be carried out somewhere else. The advantage of on the job training is that new employees encounter the same type of situations that they will face on their jobs.

An investor receives $1,100 in one year in return for an investment of $1,000 now. Calculate the percentage return per annum with: (a) Annual compounding (b) Semiannual compounding (c) Daily compounding (d) Continuous compounding

Answers

7.) Geometry: Which set of ordered pairs can be connected in order to

form a right triangle?*

A. (-1,3), (-1,-1), (2, -1)

B. (-4, 0), (0, 1), (1,2)

O C. (2, 2), (2, -2), (-2,-2), (-2, 2)

D. (0,5), (-3, 3), (3,-3)

What’s the answer

Answers

Answer:

C. (2,2), (2,-2), (-2,-2), (-2,2)

sorry if it's wrong

brainiest please

The requirement that the party bringing a lawsuit must have an injury in fact, that is direct, concrete, and individualized, is referred to as?

Answers

Answer:

"standing" requirement

Explanation:

The requirement that the party bringing a lawsuit must have an injury in fact, that is direct, concrete, and individualized, is referred to as the "standing" requirement.

Standing is a legal principle that determines whether a party has the right to bring a lawsuit in court. To have standing, a party must have suffered an injury in fact that is actual or imminent, rather than hypothetical or speculative. The injury must be directly caused by the defendant's actions, and it must be redressable by a favorable decision in court.

The standing requirement is designed to ensure that courts only hear cases that involve real controversies between the parties, and to prevent parties from bringing frivolous or speculative lawsuits. It is an important part of the legal system in many countries, including the United States.

The following points are relevant to the preparation of the consolidated accounts:

(1)

Abba pc acquired 70% of the ordinary £1 shares of Saul plc on 1 Jan 2022 for

£ 420,000 in cash. The balance of the retained profit in Saul pl was £ 217,500

at acquisition. The fair value of Saul plc's non-current assets (PPE) at the date

of acquisition was £ 40,000 higher than their book value. Saul plc does not

account for this amount in its own accounts. Saul depreciates its PPE using the

straight-line, and at 1 January these assets had a useful remaining life of 10

years.

(2)

Abba plc sold goods to Saul ple for £ 50,000 during 2022. The original cost of

these goods was £ 30,000. Half of these goods were included in Saul plc's

closing inventory on 31 Dec 2022.

(3)

For the year ended 31 Dec 2022, goodwill impairment on the acquisition of Saul

pc was determined by the directors to be £ 15,000.

(4)

At 31 December 2022 Saul pc owed Abba pc £ 20,000.

(5)

Non-controlling interest (NCI) is determined using the partial goodwill method

Answers

To prepare the consolidated accounts, the following adjustments need to be made:

How to prepare thisAdjust for the fair value of non-current assets (PPE) acquired in the acquisition of Saul plc by Abba pc:

Increase the value of PPE by £40,000

Depreciate the increased value of PPE over its useful remaining life of 10 years

Record a corresponding increase in the accumulated depreciation balance

Eliminate intercompany sales between Abba pc and Saul plc:

Remove the sales revenue of £50,000 recorded by Abba pc

Remove the cost of goods sold of £30,000 recorded by Abba pc

Remove the corresponding inventory balance of £15,000 recorded by Saul plc

Recognize goodwill and goodwill impairment on the acquisition of Saul plc by Abba pc:

Recognize goodwill of £147,000 (£210,000 - £63,000 partial goodwill)

Recognize a goodwill impairment charge of £15,000 for the year ended 31 Dec 2022

Record a corresponding decrease in the carrying amount of goodwill

Eliminate intercompany balances between Abba pc and Saul plc:

Remove the accounts payable balance of £20,000 owed by Saul plc to Abba pc

After making the above adjustments, the consolidated accounts can be prepared.

The non-controlling interest (NCI) will be calculated using the partial goodwill method (Method 1), which involves valuing the NCI at its proportionate share of the fair value of the identifiable net assets of Saul plc.

The consolidated statement of profit or loss will show the profit from operations, interest income or expense, and profit before tax for the group, with tax expense deducted to arrive at the consolidated profit after tax.

Read more about consolidated accounts here:

https://brainly.com/question/30359866

#SPJ1

Write an elevator pitch for someone that will start their own beauty salon/barber shop

Answers

An effective technique to introduce your company's goals and pique interest in your goods or services is through an elevator pitch. A compelling pitch will draw in potential.

Product: What does that mean?The object being sold is referred to as a product. A service or even an object both qualify as products. It might take on a physical, virtual, or cyber form. Every product has a cost associated with it, and each one has a price.

Is a remedy a thing?The easiest way to distinguish between a product and a solution is to say that a product is what you have made and what it is capable of. A business outcome who offers your clients quantifiable value is a solution.

To know more about products visit:

https://brainly.com/question/29515100

#SPJ1

Havel and Petra are married and will file a joint tax return. Havel has W-2 income of $38,588, and Petra has W-2 income of $46,227.

Use the appropriate Tax Tables and Tax Rate Schedules.

Required:

a. What is their tax liability using the Tax Tables?

b. What is their tax liability using the Tax Rate Schedule?

Note: Round your intermediate computations and final answer to 2 decimal places.

a. Tax liability using Tax Tables

b. Tax liability using Tax Rate Schedule

Answers

1. The liability using Tax Tables will be $7186

2. The tax liability using Tax Rate Schedule is $7,185.28

How to calculate the tax liability?A tax is a mandatory fee or financial charge that a government imposes on a person or a business in order to raise money for public projects like building the greatest infrastructure and services. Different public expenditure programs are then funded with the funds that have been raised. Tax liability is the sum of money that a person, company, or other entity owes to a federal, state, or municipal taxing body.

Total Income ($38,588 + 49,381) $87,969

Less: Standard deduction 2020 for Married Filing Jointly -24,800

Taxable Income $63,169

Tax liability using the tax table $7,186

Tax liability using tax rate Schedule $7,185.28

Learn more about tax on:

https://brainly.com/question/25783927

#SPJ1

Which 3 of these can you do when you select the Pencil icon on the bank account tile in the Banking center?

Answers

The three (3) activities that can be done when one select the Pencil icon on the bank account tile in the Banking center are the following:

reorder the accountsDrag and drop the bank/credit card accounts to the right place, and then hit Save.What is the Pencil icon on the bank account tile in the Banking center?The pencil icon is a digital tool for editing. Perhaps, one may wish to have a different name or perceived a different name to be better fitting or need to correct a wrong name, one can easily rename or correct it by clicking the pencil icon to the right of the title and enter a new name.

Therefore, the correct answer is as given above.

learn more about bank account: https://brainly.com/question/26181559

#SPJ1

The complete question goes thus:

Which 3 of these can you do when you select the Pencil icon on the bank account tile in the Banking center?

reorder the accounts

Drag and drop the bank/credit card accounts to the right place, and

Save

setting

If you were Marshall’s manager how might you increase Marshall’s awareness of the negative impact he is having on his team?

Answers

As Marshall's manager, I would increase his awareness of the negative impact he is having on his team by providing specific and constructive feedback on his behavior and its consequences. This would involve having open and honest conversations with Marshall, highlighting examples of how his actions are affecting team morale, productivity, and collaboration.

In order to effectively address Marshall's negative impact on his team, it is important to approach the situation with clarity and professionalism. By providing specific examples of incidents where Marshall's behavior has caused harm, I can help him understand the direct consequences of his actions. This feedback should be delivered in a constructive manner, focusing on the behaviors rather than attacking his character.

By emphasizing the impact on team dynamics, performance, and overall work environment, Marshall can begin to see the need for change. Additionally, it would be beneficial to discuss alternative approaches and provide guidance on how he can improve his interactions with the team. Ongoing feedback and support from me as his manager can help Marshall recognize the negative impact he is having and encourage him to take steps towards positive change.

For more such answers on negative impact

https://brainly.com/question/32299187

#SPJ8

The Dubuque Cement Company packs 80-pound bags of concrete mix. Time-study data for the filling activity are shown in the following

table. Because of the high physical demands of the job, the company's policy is a 25% allowance for workers. (Round all intermediate

calculations to two decimal places before proceeding with further calculations.)

Element

Grasp and place bag

Fill bag

Seal bag

Place bag on conveyor

Performance

Rating

110%

80%

105%

85%

1

8

37

16

8

Observation (seconds)

2

8

42

17

6

3

9

38

12

9

Bag breaks open; included as delay in the allowance factor

A Conveyor jams; included as delay in the allowance factor

a) The standard time for this process = seconds (round your response to two decimal places).

4

12

34

20

30^

5

8

114

18

34

Answers

Answer:

g

Explanation:

d

Harper makes an annual salary of $60,000 a year. Apply the rule of housing to determine her monthly housing budget.

Answers

If Harper makes an annual salary of $60,000 a year. A her monthly housing budget is $1250.

How to find her monthly housing budget?The "rule of housing" suggests that a person's monthly housing budget should not exceed 25% of their gross monthly income. To apply this rule to Harper's annual salary of $60,000, we can divide her yearly salary by 12 months to get her gross monthly income:

$60,000 / 12 = $5,000 per month

To find Harper's monthly housing budget using the rule of housing, we multiply her gross monthly income by 285%:

$5,000 x 0.25 = $1,250 per month

According to the rule of housing, Harper's monthly housing budget should not exceed $1,250 per month.

Learn more about monthly budget here:https://brainly.com/question/19162407

#SPJ1

Economists claim that individuals buy less as the price of a good increases. However, even though housing prices have been rising, home sales have also been increasing, so economic theory must be wrong.

Which of the following best characterizes the statement?

O The statement violates the ceteris paribus condition.

O The statement ignores the secondary effects of government policies.

O The statement demonstrates that association proves causation.

O The statement contains the fallacy of composition.

Answers

Correct answer will be option A. Given statement violates the ceteris paribus condition.

Ceteris paribus, literally "keeping other parameters constant," is a Latin word that translates to "all else being equal." It is a dominant presumption in mainline economic thinking and serves as a short - hand sign of the impact of one economic indicator on another, assuming all other factors remain constant (constant). In a scientific sense, claiming that one factor impacts another, ceteris paribus, means that we are essentially trying to control for the effects of other variables. Ceteris paribus is a Latin expression that roughly translates to "all else being equal." In economics, it serves as a shorthand indicator of the impact of one economic variable on another, assuming all other factors remain constant.

To learn more about ceteris paribus refer here

brainly.com/question/15541077#

#SPJ4

The Reverend Petros receives an annual salary of 51,000 as full-time minister this includes 5000 designated as a rental allowance River and Pedro is not exempt from employment tax how much must he include figuring that income for self-employed tax

Answers

If the Reverend Petros receives an annual salary of 51,000 as full-time minister that includes 5000 designated as a rental allowance. The amount that must be include figuring that income for self-employed tax is : $51,000.

What is annual salary?Annual salary can be defined as the amount a person earn as salary per year.

On the other hand self employed tax can be defined as the tax a person that is solely working for his/her self without working for any other person remit to the government.

Therefore the amount that must be include figuring that income for self-employed tax is the amount of $51,000.

Learn more about annual salary here:https://brainly.com/question/29045555

#SPJ1

Stanley receives his degree from OCC. Stanley leaves his job at Trump Organization, paying him $100,000 a year. Stanley uses his life saving of $250,000 that he had deposited at Wells Fargo at an annual rate of 5% to start his own clean-energy company. Stanley’s first year revenue and expenses are as follow, Rent $23,000 Salary 57,000 Utility 22,000 Others 13,000 _________ Total 115,000 _________ Revenue for the year $180,000 11. Stanley’s explicit costs for the year is Group of answer choices $215,000 $112,500 $180,000 $216,250 $115,000

Answers

Stanley’s explicit costs for the year is $115,000.

Using this formula

Explicit costs=Rent+ Salary+ Utility+ Others

Where:

Rent=$23,000

Salary=$57,000

Utility=$22,000

Others=$13,000

Let plug in the formula

Explicit costs= $23,000+$57,000+$22,000+$13,000

Explicit costs=$115,000

Inconclusion Stanley’s explicit costs for the year is $115,000.

Learn more here:

https://brainly.com/question/13091750

Solutions Company - Unadjusted Trial Balance as of December 31.

Account Titles

Unadjusted Trial Balance Dr. Unadjusted Trial Balance Cr.

100: Cash 20,000

110: Accounts Receivable 0

120: Supplies 7,600

160: Machinery 50,000

161: Accumulated Depreciation 20,000

200: Accounts Payable 0

205: Interest Payable 0

210: Wages Payable 0

230: Unearned Rental Fees 7,200

240: Note Payable 30,000

300: Common Stock 10,000

310: Dividends 9,500

320: Retained Earnings 14,200

400: Rental Fees 32,450

600: Wage Expense 24,500

610: Interest Expense 2,250

620: Supplies Expense 0

630: Depreciation Expense 0

113,850 113,850

Totals

Requirement:

Prepare year-end adjusting journal entries for each of these separate situations.

As of December 31, employees had earned $400 of unpaid and unrecorded wages. The next payday is January 4 at which time $1,200 in wages will be paid.

The cost of supplies still available at December 31 is $3,450.

The notes payable requires an interest payment to be made every three months. The next payment occurs after the new year begins. The amount of unrecorded accrued interest at December 31 is $800.

Analysis of the unearned rental fees shows that $3,200 remains unearned at December 31.

In addition to the machinery rental fees included in the revenue account balance, the company has earned another $2,450 in unrecorded fee that will be collected on January 31 of next year.

Depreciation expense for the year is $3,800.

Answers

The Preparing Adjusted Trial Balance with the help of Worksheet: is given below:

The Adjusted Trial BalanceSolutions Company

Worksheet

December 31

Accounts Unadjusted Trial Balance Adjusting Entries Adjusted Trial Balance

Debit Credit Debit Credit Debit Credit

Cash $20,000 $20,000

Accounts Receivable 0 $2,450 2,450

Supplies 7,600 $4,150 3,450

Machinery 50,000 50,000

Accumulated Depreciation $20,000 3,800 $23,800

Accounts Payable 0 0

Interest Payable 0 800 800

Salaries Payable 0 400 400

Unearned Rental Fees 7,200 4,000 3,200

Note Payable 30,000 30,000

Common Stock 10,000 10,000

Dividends 9,500 9,500

Retained Earnings 14,200 14,200

Rental Fees 32,450 6,450 38,900

Salaries Expense 24,500 400 24,900

Interest Expense 2,250 800 3,050

Supplies Expense 0 4,150 4,150

Depreciation Expense 0 3,800 3,800

Totals $113,850 $113,850 $15,600 $15,600 $121,300 $121,300

Preparing Income Statement:-

Solutions Company

Income Statement

For the Year Ended December 31

Accounts Amount Amount

Revenue:-

Rental Fees $38,900

Total Revenue $38,900

Expenses:-

Salaries Expense $24,900

Interest Expense 3,050

Supplies Expense 4,150

Depreciation Expense 3,800

Total Expenses ($35,900)

Net Income $3,000

Preparing Statement of Retained Earnings:-

Solutions Company

Statement of Retained Earnings

For the Year Ended December 31

Accounts Amount

Retained Earnings 14,200

Net Income 3,000

$17,200

Dividends (9,500)

Retained Earnings, Ending $7,700

Preparing Balance Sheet:-

Solutions Company

Balance Sheet

December 31

Accounts Amount Amount

Assets:-

Cash $20,000

Accounts Receivable 2,450

Supplies 3,450

Machinery 50,000

Accumulated Depreciation (23,800)

Total Assets $52,100

Liabilities:-

Accounts Payable $0

Interest Payable 800

Salaries Payable 400

Unearned Rental Fees 3,200

Note Payable 30,000

Total Liabilities $34,400

Stockholders Equity:-

Common Stock $10,000

Retained Earnings, Ending 7,700

Total Stockholders Equity $17,700

Total Liabilities and Stockholders Equity $52,100

Preparing Closing Entries:-

Solutions Company

General Journal

December 31

Date Accounts Title and Explanation Debit Credit

December 31 Rental Fees $38,900

Income Summary $38,900

(To close Revenue Account)

December 31 Income Summary $35,900

Salaries Expense $24,900

Interest Expense $3,050

Supplies Expense $4,150

Depreciation Expense $3,800

(To close Expenses Accounts)

December 31 Income Summary $3,000

Retained Earnings $3,000

(To close Income Summary)

December 31 Retained Earnings $9,500

Dividends $9,500

(To close Dividends Account)

Read more about Adjusted Trial Balance here:

https://brainly.com/question/14476257

#SPJ1

Sual Company purchased a tractor at a cost of $180,000. The tractor has an estimated salvage value of $20,000 and an estimated life of 8 years, or 12,000 hours of operation. The tractor was purchased on January 1, 2019 and was used 2,400 hours in 2019 and 2,200 hours in 2020. What method of depreciation will produce the maximum depreciation expense in 2020

Answers

Answer:

Double-declining balance

Explanation:

Calculation to determine What method of depreciation will produce the maximum depreciation expense in 2020

Based on the information given we would be using the Straight-Line method, Double-declining balance and Units of production to determine the method of depreciation that will produce the maximum depreciation expense in 2020

Straight-Line method =($180,000 ‒ $20,000) / 8 Straight-Line method= $20,000 per year

Double-declining balance= $180,000 × (1/8 × 2)

Double-declining balance= $45,000 for 2019

Double-declining balance= ($180,000 ‒$45,000) × 1/4

Double-declining balance= $33,750 for 2020

Units of production=($180,000 - 20,000) × (2, 200 hours / 12,000 hours)

Units of production=$160,000*0.1833333

Units of production = $29,333 for 2020

Therefore the method of depreciation that will produce the maximum depreciation expense in 2020 is DOUBLE-DECLINING METHOD.

During a conversation with the credit manager, one of Tabor's sales representatives learns that a $1,342 receivable from a bankrupt customer has not been written off but was considered in the determination of the appropriate year-end balance of the Allowance for Bad Debts account balance. What is the effect of write-off on 2019 net incom

Answers

Answer:

Dr Allowance for bad debt $1,342

Cr Accounts receivable $1,342

Explanation:

Based on the information given there won't be NO effect of write-off on 2019 net income reason been that it has already been accounted for in the allowance for bad debt which was estimated for the year.

Therefore the Journal entry to record this transaction will be to Debit Allowance for bad debt with the amount of $1,342 and Credit Accounts receivable with the same amount which is $1,342.

Dr Allowance for bad debt $1,342

Cr Accounts receivable $1,342