During its first month of operations, Neptune Company (1) borrowed $200,000 from a bank, and then (2) purchased an equipment costing $80,000 by paying cash of $40,000 and signing a long term note for the remaining amount. During the month, the company also (3) purchased inventory for $60,000 on credit, (4) performed services for clients for $120,000 on account, (5) paid $30,000 cash for accounts payable, and (6) paid $60,000 cash for utilities. What is the amount of total assets at the end of the month?

Answers

Answer:

$330,000

Explanation:

the journal entries would be:

Dr Cash 200,000

Cr Notes payable - bank 200,000

Dr Equipment 80,000

Cr Cash 40,000

Cr Notes payable 40,000

Dr Merchandie inventory 60,000

Cr Accounts payable 60,000

Dr Accounts receivable 120,000

Cr Service revenue 120,000

Dr Accounts payable 30,000

Cr Cash 30,000

Dr Utilities expense 60,000

Cr Cash 60,000

Assets:

Cash = 200,000 - 40,000 - 60,000 - 30,000 = $70,000Equipment = $80,000Merchandise inventory = $60,000Accounts receivable =$120,000total = $330,000Answer: $330,000

Explanation:

(1) borrowed $200,000 from a bank, and then

(2) purchased an equipment costing $80,000 by paying cash of $40,000 and signing a long term note for the remaining amount.

(3) purchased inventory for $60,000 on credit, (4) performed services for clients for $120,000 on account,

(5) paid $30,000 cash for accounts payable, and (6) paid $60,000 cash for utilities. What is the amount of total assets at the end of the month?

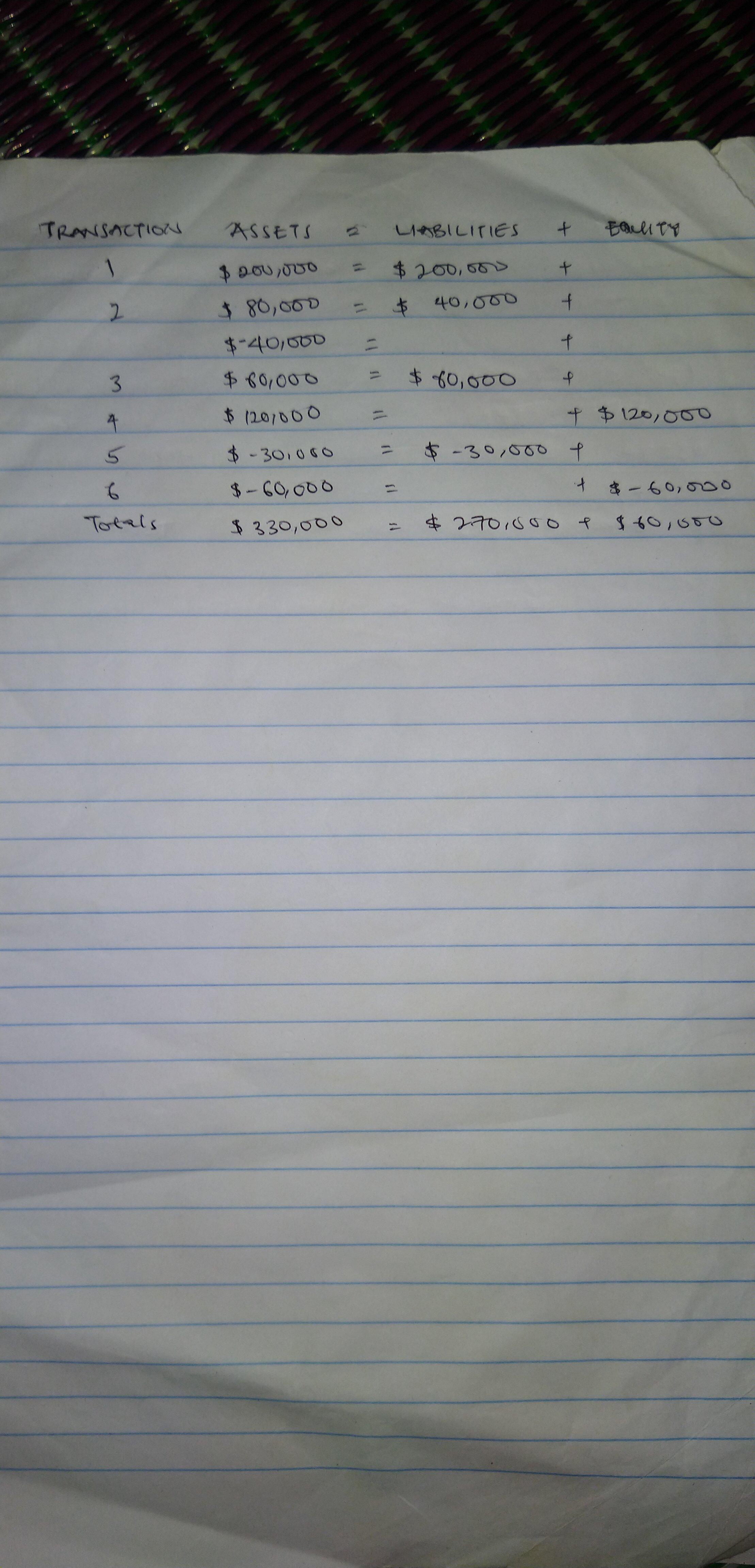

Kindly check attached picture for detailed explanation

Related Questions

Assessment

Which of the following is an example of investing in yourself?

A. Taking the time to learn how to create a budget.

B. Investing your money in the stock market.

C. Planning out your financial goals.

D. Signing up for an online class.

10/10

Answers

Answer:

A

Explanation:

The reason is because you can learn new techniques on money saving and budgeting.

If you could vote today who would you vote for Trump/ Biden or someone else. I would vote for someone else.

Answers

Answer:

Lauren boebert

Explanation:

Do you have, or have you ever had test-taking anxiety? What strategies will you use to manage test anxiety?

Answers

Explanation:

My test anxiety generally comes from a desire to do well. It usually accompanies the situation where I am not as prepared for the test as I would like to be, or where I have no idea what subject matter the test may cover.

__

My anxiety management strategy is to prepare for a test as well as I can in the time allotted, and detach from the outcome. In the case of specific subject matter tests (as opposed to "achievement" tests), a well-made test will be educational, so later questions help answer earlier ones. Paying attention to that possibility also manages test anxiety by letting me go back and correctly answer questions I might have missed.

__

One of the most effective techniques for managing test anxiety (beyond a decent level of preparation), is the use of Emotional Freedom Techniques (EFT), also known as "tapping." A few rounds of tapping on specific points on bodily energy meridians can greatly relieve stress and improve test performance. The process takes only minutes to learn and execute, and can be very effective. (Look up articles or videos on EFT Tapping.)

Describe the steps that you can take in the next 6 years to prepare for retirement. Please include how this investment will be nice

when you retire.

Answers

Answer: Planning for a happy retirement involves planning, the sooner the better.

Explanation: Planning for retirement is one of the important aspects of a working professional. People can have numerous reasons to plan for retirement, hence retirement needs may vary. Before planning for retirement it is important to have an idea of how much money needs to be saved at the time of retirement.

One can start planning for retirement by reducing dependencies, and cutting down unnecessary spending. A few of the important points which must be contemplated are;

1. Medical Needs.

2. Lifestyle goals post-retirement.

3. Changing Market returns.

Planning for investment also helps build a better investment discipline.

1) Define the external business environment of Jessops Group Limited.

Answers

Answer:

The external business environment of Jess-op Group Limited are factors such as economic, technological, regulatory, social etc. factors which the company does not have control over but affect the operation of the company.

Explanation:

The company has to adapt to its external business environment in order to continue to be successful.

Note: See the attached Microsoft word file for the full explanation. There is a difficulty in submitting everything here.

The Uniform Commercial Code (UCC) applies to Internet contracts.

True

False

Answers

Answer:

True, article 2 of the UCC applies to the sales of goods through internet channels.

Explanation:

The UCC governs transactions involving the sale of goods (not services) and the requirement of a written agreement is generally satisfied when parties exchange electronic messages, e.g. emails that confirm the transaction.

In relation to other types of internet transactions, the Uniform Computer Information Transactions Act (UCITA) was created in order to govern software licenses and other types of electronic contracts.

Answer:

true

Explanation:

Which scenario describes the highest level of productivity?

A. Producing 50 chairs using resources that cost $400

B. Producing 15 chairs using resources that cost $150

C. Producing 5 chairs using resources that cost $100

D. Producing 100 chairs using resources that cost $200

Answers

The scenario that describes the highest level of productivity is option D. Producing 5 chairs using resources that cost $100. Calculating the highest productivity:

For A. The cost should be $400 for 50 chairs so per chair should be = $400 ÷ 50 = 8. For B. The cost should be $150 for 15 chairs so per chair should be = $150 ÷ 15 = 10. For C. The cost should be $100 for 5 chairs so per chair should be = $100 ÷ 5 = 20. and For D. The cost should be $200 for 100 chairs so per chair should be = $200 ÷ 100 = 2

What is productivity?Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production process, i.e. output per unit of input, typically over a specific period of time.

Therefore, the correct answer is option D.

learn more about productivity: https://brainly.com/question/2992817

#SPJ1

Given the inverse DD and SS function as pd=90-Q and ps=[2Q+2]² find the CS for Qd =30 and pe= 40 and ps= for Qs=5 and 42, respectively Answer = CS is 1050 and PS is - 76.7

Answers

CS is 1050, representing the area between the demand curve and the price line. PS is -508322, indicating the producer's inability to cover costs.

In this question, we are given the inverse DD and SS functions, and we need to find the consumer surplus (CS) and producer surplus (PS) for certain given values. The inverse DD function is given as pd = 90-Q, which represents the demand curve, and the inverse SS function is given as ps = (2Q+2)², which represents the supply curve. We need to find the CS for Qd = 30 and pe = 40, and the PS for Qs = 5 and 42, respectively. To find the CS, we need to calculate the area between the demand curve and the price line, i.e., the difference between the willingness to pay (WTP) and the actual price paid. Here, the WTP is given by the demand function, which is pd = 90-Q. At Qd = 30, the WTP is pd = 90-30 = 60. The actual price paid is pe = 40. Therefore, the CS = WTP - price paid = 60 - 40 = 20. However, this is the value of the individual CS. To find the total CS, we need to integrate the CS over the entire demand curve, which gives us CS = ∫(90-Q-40)dQ = ∫50-QdQ = 50Q - (Q²/2) |\(_0^{30}\) = 1050.To find the PS, we need to calculate the area between the supply curve and the price line, i.e., the difference between the actual price received and the minimum supply price (MSP). The MSP is given by the supply function, which is ps = (2Q+2)². For Qs = 5, the MSP is ps = (2(5)+2)² = 98. For Qs = 42, the MSP is ps = (2(42)+2)² = 7396. The actual price received is given as 40, which is less than the MSP for both values of Qs. Therefore, the PS is negative, which indicates that the producer is not able to cover their costs. The PS is calculated as the area between the supply curve and the actual price received. Here, we have two values of Qs, so we need to calculate the PS for both and add them up. For Qs = 5, the PS = (40-98)(5) = -290. For Qs = 42, the PS = (40-7396)(42-5) = -508032. Therefore, the total PS = -290 - 508032 = -508322. Thus, the CS is 1050 and the PS is - 508322.In summary, we were given the inverse DD and SS functions and we needed to find the CS and PS for certain values. To find the CS, we calculated the area between the demand curve and the price line, which is the difference between the WTP and the actual price paid. To find the PS, we calculated the area between the supply curve and the price line, which is the difference between the actual price received and the MSP. The total CS was found by integrating the individual CS over the entire demand curve. The total PS was found by adding the PS for both values of Qs. The CS was found to be 1050 and the PS was found to be -508322.For more questions on demand curve

https://brainly.com/question/1139186

#SPJ8

A misconception is a misunderstanding.

O True

False

Answers

The statement ''A misconception is a misunderstanding.'' is True. A misconception refers to a misunderstanding or a mistaken belief about something.

It is a cognitive error where an individual holds an incorrect understanding of a particular concept, idea, or situation. Misconceptions can arise due to various factors such as incomplete information, misinterpretation of information, cultural influences, biases, or a lack of critical thinking. Misconceptions can be found in various domains, including science, history, language, and everyday life. They can persist even in the presence of contradictory evidence or when confronted with accurate information. Correcting misconceptions is important as they can lead to flawed decision-making, misinformation spreading, and hinder personal and intellectual growth.

Addressing misconceptions requires effective communication, education, and the promotion of critical thinking skills. By challenging and correcting misconceptions, individuals can develop a more accurate understanding of the world around them, make informed judgments, and engage in meaningful discussions based on reliable information.

For more questions on misconception

https://brainly.com/question/17220434

#SPJ8

Which of the following statements is false?

a. it is possible to compare one firm's accounting data with another firm's accounting data as long as both firms used generally accepted accounting procedures

b. many managers compare the financial results from one accounting period with the results from previous accounting periods

c. most corporations include in their annual reports comparisons of important elements of their financial statements for recent years

d. the format and information contained in one firm's financial statements are most likely to differ drastically from the format and information contained in another firm's financial statements

e. many firms compare their financial results with industry averages

Answers

Answer: D

Explanation:

Not necessarily. As long as the company follows GAAP (IFRS or ASPE), the format and information should be the same. This is because the accounting standards requires firm to report financial information in a specific way.

If government regulations are enforced to reduce corruption, then: the demand for investment will fall. businesses would lower their investment . the demand for loanable funds will shift left. the demand for loanable funds will shift right.

Answers

If government regulations are enforced to reduce corruption, then: c. the demand for loanable funds will shift left.

What is government regulations?Government laws that are successfully put into practise to combat corruption enhance the business climate and boost economic confidence.

As a result, companies are likely to become more dependable and trustworthy, which will reduce the demand for loanable cash. Businesses might not need as much outside funding if there is less corruption to decrease the risks brought on by corrupt practises or to get around obstacles to doing business.

Therefore the correct option is C.

Learn more about government regulations here:https://brainly.com/question/17084491

#SPJ1

A POS merchant system is __

Answers

Answer:

POS means point of sale

Explanation:

The point of sale or point of purchase is the time and place where a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer, and indicates the options for the customer to make payment.

3. Kelly executed a mortgage to Union Bank to secure an initial loan of $25,000. The mortgage contained a clause that provided: "This loan shall be for the purpose of construction of a dwelling house on the above- described property and shall cover and secure additional advances to be made by mortgagee to mortgagors in total amount not to exceed $145,000." Kelly later received other loans from Union totally $145,000. However, before the additional bank advances were made, several contractors furnished Kelly with materials and labor in building his home and complied with the state’s mechanics lien statute even though Kelly had failed to post a proper notice of commencement as required by the statute. Kelly did not pay the contractors and he defaulted on his bank loan. Union Bank foreclosed on its mortgage and argued that its mortgage, recorded before the contractors furnished their materials and labor, gave it priority. The contractors claimed that Union Bank only had a superior lien for $25,000 and that the remainders of its advances were subject to their mechanics’ liens. Who is correct? Why?

Answers

In the scenario provided, the statement that Union Bank can only claim $25,000 and the remainder advances must be paid to the contractors is factually true.

As per the case fought in the court of Lyman Lamb Company vs Union Bank of Benton, the decision was made in the favor of the contractors. It was stated by the court that a valid mortgage may be executed to secure debt which is to be contracted in the future but in doing so, an unequivocal agreement in the instrument itself must be mentioned for the debts incurred in future.

The Union Bank was liable to claim of $25,000 but no such clause/agreement was made that constituted prior or first lien for subsequent advances because was the bank was not in any obligation to do so.

The conclusion made by the court was that the mechanics lien had priority, as they furnished the required materials before Union Bank made the advances.

Learn more on: https://brainly.com/question/13447700

In order to keep the audiences attention, students were advised to avoid ______ discussion, and to speak only about subjects ______ to their report.

irrelevant...germane

brusque...mandatory

digressive...tangential

disinterested...impartial

melancholy...jovial

Answers

Answer:

In order to keep the audiences attention, students were advised to avoid digressive discussion, and to speak only about subjects tangential to their report.

908 25. द्वितीय लेखाविधि तथा विश्लेषण Nuwakot Consultancy was organized on June 2, 2019, by a group of accountants to provide accounting and tax services to small businesses in Kathmandu. The following transactions occurred during the first month of business. June 2 June 5 June 8 June 15 June 17 June 23 June 28 June 29 Received contributions of Rs. 10,000 from each of the three owners of the business is exchange for shares of stock. Purchased a computer system for Rs. 12,000. The agreement with the vendor requires a down payment of Rs. 2,500 with the balance in 60 days. Signed a two-year promissory note at the bank and received cash of Rs. 20,000. Billed Rs. 12,350 to clients for the first-half of June. Paid a Rs. 900 bill from the local newspaper for advertising for the month of June. Received the amounts billed to clients for services performed during the first half of the month. Received and paid gas, electric, and water bills. The amount is Rs. 2,700. Received the landlord's bill for Rs. 2,200 for rent on the office space that Nano Consultancy leases. The bill is payable by the 10th of the following month. Paid salaries and wages for June. The total amount is Rs. 5,670. Billed Rs. 18,400 to clients for the second half. Declared and paid dividends in the amount of Rs. 6,000. June 30 June 30 June 30 Required: (a) Journal entries on the books of Nuwakot Consultancy. (For the transactions entered into during the month. Ignore depreciation and interest expenses). (b) Post the transactions into T-accounts. (c) A trial balance at June 30, 2019.

Answers

1. The Journal Entries on the books of Nuwakot Consultancy for the June Transactions are as follows:

Journal Entries:Date Transactions Debit Credit

June 2 Cash Rs. 30,000

Common Stock Rs. 30,000

June 5 Computer Rs. 12,000

Cash Rs. 2,500

Accounts Payable Rs. 9,500

June 8 Cash Rs. 20,000

Notes Payable Rs. 20,000

June 15 Accounts Receivable Rs. 12,350

Service Revenue Rs. 12,350

June 17 Advertising Expense Rs. 900

Cash Rs. 900

June 23 Cash Rs. 12,350

Accounts Receivable Rs. 12,350

June 28 Utility Expense Rs. 2,700

Cash Rs. 2,700

June 29 Rent Expense Rs. 2,200

Rent Payable Rs. 2,200

June 30 Salaries &

Wages Expense Rs. 5,670

Cash Rs. 5,670

June 30 Accounts Receivable Rs. 18,400

Service Revenue Rs. 18,400

June 30 Dividends Rs. 6,000

Cash Rs. 6,000

2. The Posting of the transactions into T-accounts is as follows:

Cash AccountDate Transactions Debit Credit

June 2 Common Stock Rs. 30,000

June 5 Computer Rs. 2,500

June 8 Notes Payable Rs. 20,000

June 17 Advertising Expense Rs. 900

June 23 Accounts Receivable Rs. 12,350

June 28 Utility Expense Rs. 2,700

June 30 Salaries and Wages Expense Rs. 5,670

June 30 Dividends Rs. 6,000

June 30 Balance Rs. 44,580

Rs. 62,350 Rs. 62,350

Common StockDate Transactions Debit Credit

June 2 Cash Rs. 30,000

ComputerDate Transactions Debit Credit

June 5 Cash Rs. 2,500

June 5 Accounts Payable Rs. 9,500

June 30 Balance Rs. 12,000

Accounts PayableDate Transactions Debit Credit

June 5 Computer Rs. 9,500

Notes PayableDate Transactions Debit Credit

June 8 Cash Rs. 20,000

Rent PayableDate Transactions Debit Credit

June 29 Rent Expense Rs. 2,200

Accounts ReceivableDate Transactions Debit Credit

June 15 Service Revenue Rs. 12,350

June 23 Cash Rs. 12,350

June 30 Service Revenue Rs. 18,400

Service RevenueDate Transactions Debit Credit

June 15 Accounts Receivable Rs. 12,350

June 30 Accounts Receivable Rs. 18,400

June 30 Balance Rs. 30,750

Advertising ExpenseDate Transactions Debit Credit

June 17 Cash Rs. 900

Utility ExpenseDate Transactions Debit Credit

June 28 Cash Rs. 2,700

Rent ExpenseDate Transactions Debit Credit

June 29 Rent Payable Rs. 2,200

Salaries and Wages ExpenseDate Transactions Debit Credit

June 30 Cash Rs. 5,670

DividendsDate Transactions Debit Credit

June 30 Cash Rs. 6,000

3. The preparation of the trial balance at June 30, 2019, is as follows:

Date Transactions Debit Credit

Cash Rs. 44,580

Common Stock Rs. 30,000

Computer Rs. 12,000

Accounts Payable Rs. 9,500

Notes Payable Rs. 20,000

Rent Payable Rs. 2,200

Accounts Receivable Rs. 18,400

Service Revenue Rs. 30,750

Advertising Expense Rs. 900

Utility Expense Rs. 2,700

Rent Expense Rs. 2,200

Salaries and Wages Expense Rs. 5,670

Dividends Rs. 6,000

Totals Rs. 92,450 Rs. 92,450

What are the journal entries?Journal entries are made to record the transactions of a business as they occur daily.

Journal entries help post transactions to the general ledger (T-accounts).

With a trial balance, the balances in the general ledger are summarized to prepare financial statements.

Transaction Analysis:June 2 Cash Rs. 30,000 Common Stock Rs. 30,000

June 5 Computer Rs. 12,000 Cash Rs. 2,500 Accounts Payable Rs. 9,500

June 8 Cash Rs. 20,000 Notes Payable Rs. 20,000

June 15 Accounts Receivable Rs. 12,350 Service Revenue Rs. 12,350

June 17 Advertising Expense Rs. 900 Cash Rs. 900

June 23 Cash Rs. 12,350 Accounts Receivable Rs. 12,350

June 28 Utilities Expense Rs. 2,700 Cash Rs. 2,700

June 29 Rent Expense Rs. 2,200 Rent Payable Rs. 2,200

June 30 Salaries and Wages Expense Rs. 5,670 Cash Rs. 5,670

June 30 Accounts Receivable Rs. 18,400 Service Revenue Rs. 18,400

June 30 Dividends Rs. 6,000 Cash Rs. 6,000

Learn more about journal entries at https://brainly.com/question/28390337

#SPJ1

The Omega Corporation has some excess cash it would like to invest in marketable securities for a long-term hold. Its Vice-President of Finance is considering three investments: (a) Treasury bonds at a 11 percent yield; (b) corporate bonds at a 14 percent yield; or (c) preferred stock at an 12 percent yield. Omega Corporation is in a 40 percent tax bracket and the tax rate on dividends is 10 percent.

Required:

a. Compute the after-tax yields for the three investment options. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.)

b. Which one of the three investments should she select based on the after-tax yields?

Answers

Answer:1

Explanation:

why language is an important of communication tools?

Answers

Answer:

Because Language is a communication tool used by everyone in their daily life as a means to convey information and arguments to others. Explanation:

Makes Sense.

Answer:

The effective communication is made possible with the help of language. Language employs a combination of words to communicate ideas in a meaningful way. By changing the word order in a sentence, you can change its meaning, and even make it meaningless.

What can HR professionals do to mitigate concerns about pregnancy discrimination in the workplace? What does the law say companies need to do to avoid violating the rights of pregnant employees?

Answers

With our combined efforts as one HR, there is no cause we cannot influence. Knowing the law and interacting with expectant women are the greatest ways to stop pregnancy prejudice.

Employers place a high premium on discouraging pregnancy prejudice. The Pregnancy Discrimination Act of 1978's new EEOC rules have made it a particularly controversial topic in today's society. The best thing you can do to defend yourself in court is to train all managers or supervisors, but especially those who are directly in charge of supervising workers.

When you learn that a coworker is pregnant, you must show her respect and use caution. You should merely express gratitude to the worker for informing you. Offer pregnancy prejudice your support and assure her that, if necessary, you would make accommodation's that are reasonable in nature for her.

Never indicate that an employee's pregnancy is a burden on the company, and neither should your supervisors. Before approaching a pregnant employee, ask a member pregnancy prejudice of your human resources team any questions you may have about what to ask or not ask.

Learn more about pregnancy prejudice here

https://brainly.com/question/17164279

#SPJ9

A company uses the periodic inventory method and the beginning inventory is overstated by $9,000 because the ending inventory in the previous period was overstated by $9,000. The amounts reflected in the current end of the period balance sheet are

Answers

Answer:

"Correct Correct" is the right answer.

Explanation:

Overall inventory will be calculated by means including its physical computing mechanism at either the conclusion of each accountability conscious cognitive mostly on periodical inventory or purchasing department.Excessive conclusion or termination creates excessive starting inventory thresholds or their levels.Stealth bank has deposits of $600 million. It holds reserves of $30 million and has purchased government bonds worth $320 million. The bank's loans, if sold at current market value, would be worth $500 million. What does Stealth bank’s net worth equal?

Answers

Based on the value of the deposits at Stealth bank, the reserves, the loans, and the government bonds, the net worth of Stealth Bank is $810 million.

How to find the net worth?To find the Net Worth of Stealth Bank, the formula would include subtracting the assets from the liabilities.

The formula for the net worth of Stealth Bank is:

Net Worth = Assets - Liabilities

The Assets of Stealth bank are:

= Reserves + Deposits + Value of bank loans

= 30 million + 600 million + 500 million

= $1,130 million

The liabilities of Stealth Bank are the government bonds of $320 million.

The Net Worth of Stealth Bank is:

= Assets - Liabilities

= 1, 130 million - 320 million

= $810 million

In conclusion, the net worth that Stealth Bank has can be found to be $810 million.

Find out more on net worth at https://brainly.com/question/12371230

#SPJ1

At the end of 2021, Larkspur Co. has accounts receivable of $653,700 and an allowance for doubtful accounts of $24,200. On January 24, 2022, it is learned that the company’s receivable from Madonna Inc. is not collectible and therefore management authorizes a write-off of $4,245.

A) Prepare the journal entry to record the write-off.

Credit

Enter an account title Enter a debit amount Enter a credit amount

What is the cash realizable value of the accounts receivable before the write-off and after the write-off?

Before Write-Off After Write-Off

Cash realizable value $ $

Answers

Answer:

January 24, 2022, Madonna Inc.'c account is written off

Dr Allowance for doubtful accounts 4,245

Cr Accounts receivable 4,245

the cash realizable value of the accounts receivable account:

before the write off = $653,700 - $24,200 = $629,500after the write off = ($653,700 - $4,245) - ($24,300 - $4,245) = $629,500The net balance of the account does not change because the allowance for doubtful accounts is a contra asset account that already decreased the accounts receivable balance.

If Avon and Merck joined together to produce a cream that slows down the aging process, this would be called a(an)

Answers

I think you are asking what type of business this is. This is referred to as a "partnership". This is an ownership structure in which a single business is owned by two or more people. All individuals involved in a partnership are expected to contribute money, property, labor, or skill and share risks associated with operating a business. I hope this answers what you are looking for. :)

“Controlling includes defining goals, establishing strategy, and developing plans to coordinate activities”, this statement is:

Answers

“Controlling includes defining goals, establishing strategy, and developing plans to coordinate activities”, this statement is false.

What is Controlling?Control is a managerial activity that aids in error detection and the execution of remedial measures. These are done to reduce departure from norms while guaranteeing that the organization's overall objectives have been achieved in this preferred manner.

The leaders of a company develop their vision and determine the goals and targets of their organization through to the planning stage. Identifying the order in which these objectives should be accomplished can help the organization attain its important part.

Learn more about Controlling, here:

https://brainly.com/question/30551667

#SPJ1

Accounting is used to communicate financial information to both internal audiences and external audiences. Internal users are:

a. Only people within a business's accounting and finance departments

b. People within the business like production managers

c. Suppliers that provide goods

d. Contractors that perform work for the business.

Answers

Accounting can be regarded as a term used in communicating financial information across to internal audiences as well as external audiences.

These Internal users are been regarded as people within the business, such as production manager.

These information help in making the financial aspect of the company to succeed.

Therefore, option B is correct.

Learn more at:

https://brainly.com/question/1033546

Neap, spring, high, and low are all types of ____________________.

Answers

Imagine you are the CEO of Disney. You are defending profit maximization and copyright law.

Write some key points you would speak on during a press conference that don't make you come

across as qreedy.

Answers

Answer: we ignore any distinction between costs incurred, component of the cost of producing a work increases with the number of copyright produced, for it is the cost of creating, binding, and distributing individual copies. The cost of expression does not enter into the making of copies because, once the work is created, the team efforts can be incorporated into another copy virtually without cost.

Explanation:

If a tenant becomes 90 days late in rent payments, what can the landlord do?

(A) All of the choices are correct.

B Sue the tenant in civil court for rent and legal expenses, while starting the eviction process

C) Take possession of a renter's property as payment for unpaid rent.

D Lock a tenant out of their apartment.

Answers

The correct answer is (A) All of the choices are correct.

When a tenant becomes 90 days late in rent payments, the landlord typically has several options available to them.

These options may vary depending on local laws and regulations, but generally, the landlord can: A) All of the choices are correct:

Sue the tenant in civil court for unpaid rent and legal expenses, seeking a judgment for the outstanding amount.

Initiate the eviction process by serving the tenant with a notice to pay rent or vacate the premises. If the tenant fails to comply, the landlord can proceed with the eviction.

Take possession of the renter's property as payment for unpaid rent, typically through a process known as a "landlord's lien" or "distraint."

Locking a tenant out of their apartment without following the proper legal procedures is generally illegal and can result in legal consequences for the landlord.

It's important for landlords to understand and follow the specific laws and regulations governing landlord-tenant relationships in their jurisdiction to ensure they take appropriate and lawful actions.

for more such questions on tenant

https://brainly.com/question/30897115

#SPJ11

Why do managers ask employees to check inventory lists?

A.

to keep employees busy when there is little work to do

B.

to discover which items employees like the best

C.

to find out which items are most and least expensive

D.

to find out if any items that should be for sale are stolen or lost

Answers

the answer is the last answer D

Visit any nearby business of your locality and collect the information to prepare a project work report by taking the following information. 1)name and address of the firm. 2)find out whether the journal is maintained or not. 3) following the values of debit and credit. 4)the recording of business transactions in the journal

Answers

It is impossible to visit any nearby business of your locality and collect the information to prepare a project work report based on the factors given

What is a firmA common term for a company or business organization is "firm". A business is an organization involved in diverse economic endeavors, ranging from the production of goods, provision of services to trading of products.

A company usually has defined legal framework, ownership, and administration, with the main aim of earning profits or attaining specific goals. Companies can vary in their scale, spanning from petite regional enterprises to enormous global conglomerates.

Learn more about firm from

https://brainly.com/question/28234604

#SPJ1

Park Corporation is planning to issue bonds with a face value of $2,100,000 and a coupon rate of 9 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Park uses the effective-interest amortization method and also uses a premium account. Assume an annual market rate of interest of 7.5 percent. Required:

a. Prepare the journal entry to record the issuance of the bonds.

b. Prepare the journal entry to record the interest payment on June 30 of this year.

c. How will Park present its bonds on its June 30 balance sheet?

Answers

a.The journal entry to record the issuance of the bonds. Debit : Cash $677,135 and Credit : Bond Payable $677,135

b.The journal entry to record the interest payment on June 30 of this year. Debit : Bond Payable $43,715 ; Debit : Interest Charge $50,785 ; Credit : Cash $94,500

c.Presentation of bonds on June 30 balance sheet . Non - Current Liabilities : Bond Payable $633,420

Issuance of the bonds

Since Park Corporation is paying 7.5 percent ( Market Rate) compared to the coupon 9 percent, the Bonds will be issued at a discount. The amount recognized at issuance will be the Present Value of $677,135.

Determined as follows :

FV = $2,100,000

Pmt = ($2,100,000 x 9 %) / 2 = $94,500

N = 10 x 2 = 20

i = 7.5 %

PV = $677,135

Interest Payment

Since the effective-interest amortization method is used, the interest is calculated as follows :

Interest Charge = Present Value x Interest rate

= $677,135 x 7.5 %

= $50,785

Bonds Payable Presented on Financial Satement

Bond Payable = Present Value - ( Cash Payment - Interest charge)

= $677,135 - (94,500 - 50,785)

= $633,420

In conclusion, Since Park Corporation is paying 7.5 percent ( Market Rate) compared to the coupon 9 percent, the Bonds will be issued at a discount of $677,135

Learn more about Bonds and effective-interest amortization method here : https://brainly.com/question/23265123