Doug Casey is in charge of planning and coordinating next spring’s sales management training program for his company. Doug listed the following activity information for the project:

Time (weeks)

Activity

Description

Immediate Predecessor

Optimistic

Most Probable

Pessimistic

A

Plan topic

---

1.5

2

2.5

B

Obtain speakers

A

2

2.5

6

C

List meeting locations

---

1

2

3

D

Select location

C

1.5

2

2.5

E

Finalize speaker travel plans

B,D

0.5

1

1.5

F

Make final check with speakers

E

1

2

3

G

Prepare and mail brochure

B,D

3

3.5

7

H

Take reservations

G

3

4

5

I

Handle last minute details

F,H

1.5

2

2.5

a. Draw a project network

b. Prepare an activity schedule

c. What are the critical activities and what is the expected project completion time?

d. If Doug wants a 0.99 probability of completing the project on time, how far ahead of the scheduled meeting date should he begin working on the project?

NOTE; PLEASE SHOW ALL WORK.

Answers

If he should start working on the project, the average session date would be 2.39 weeks if there is a 0.99 likelihood that it will be finished on time.

How is probability determined?In mathematics, the probability can be calculated by first considering the sample space of experiment results, and then by dividing the entire number of possible outcomes, or sample space, by the number of possibilities of an event.

Briefing:

Given here is that Doug Casey will be in charge of organizing and arranging his company's sales training program for management for the next spring.

We also need to determine how far in advance of the specified meeting date Doug should start tackling the task if he expects a 0.99 possibility of finishing it on time.

Here, we learn that the critical path's time impacts whether the entire project is completed.

Therefore, the mean completion time of the project =μ=15

And the the variance of the critical path = sum of the variances of the activities A, B, G, H, and I =0.03+0.44+0.44+0.11+0.03=1.06

Therefore, the standard deviation of the critical path or that of the whole project =σ=√1.06=1.03

Here we know that, if a 0.99 probability of completion is required, then the corresponding Z-score =2.3263

Then the actual completion time corresponding to a Z-score of

=> 2.3263 = μ+(Z×σ) = 15+(2.3263×1.03) = 15+2.39 = 17.39 weeks

Which states that the extra time needed over and above the mean completion time of the project of 15 weeks to have a 0.99 probability of completion =17.39−15=2.39 weeks

Therefore, in order to have a 0.99 probability of completing the project on time, the project should be started 2.39 weeks ahead of the scheduled meeting date.

To know more about Probability visit:

https://brainly.com/question/29381779

#SPJ4

Related Questions

Gary and Lakesha were married on December 31 last year. They are now preparing their taxes for the April 15 deadline and are unsure of their filing status. Problem 4-46 Part-b (Static) b. Assume instead that Gary and Lakesha were married on January 1 of this year. What is their filing status for last year (neither has been married before and neither had any dependents last year)

Answers

a. Gary and Lakesha can either file as Married Filing Jointly or Married Filing Single.

b. Since Gary and Lakesha are married on January 1 of this year, they should file as Single.

What is a tax filing status?The tax filing status defines the taxpayer's status in a tax year. The tax filing status is used to determine the applicable rate of income tax.

The IRS rules recognize five filing statuses are: single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

Thus, for a) Gary and Lakesha can file Married Filing Jointly or Married Filing Single but for b) Gary and Lakesha should file Single.

Learn more about tax filing status at https://brainly.com/question/25456613

On December 31, Westworld Incorporated has the following equity accounts and balances. Preferred Stock $ 7,000 Retained Earnings $ 45,000 Common Stock 1,000 Paid-In Capital in Excess of Par Value, Common Stock 39,000 Treasury Stock 2,000 Paid-In Capital in Excess of Par Value, Preferred Stock 3,000 Prepare the stockholders’ equity section of Westworld’s balance sheet.

Answers

Stockholders equity sectionPaid in the capital Common stock$1,000Additional paid-in capital in excess of par value-Common

What is capital?The capital is a city where a region's system of rules is located. This is where government constructions are and where government leaders work. A region can be determined as a nation, state, province, or another political unit.

stock$39,000$40,000 Preferred Stock$7,000Additional paid in capital in excess of par value-Preferred Stock$3,000$10,000Total Paid-in capital$50,000Retained earnings$45,000Total Paid-in capital and Retained earnings$95,000Less:Treasury stock-$2,000Total Stockholder's equity$93,000

Therefore, the stockholders’ capital equity section of Westworld’s balance sheet. Stockholder's equity$93,000

Learn more about capital here:

https://brainly.com/question/679709

#SPJ1

Pamper Me Salon Inc.’s general ledger at April 30, 2017, included the following: Cash $5,000, Supplies $500, Equipment $24,000, Accounts Payable $2,100, Notes Payable $10,000, Unearned Service Revenue (from gift certif cates) $1,000, Common Stock $5,000, and Retained Earnings $11,400. The following events and transactions occurred during May

May 1 Paid rent for the month of May $1,000.

4 Paid $1,100 of the account payable at April 30.

7 Issued gift certif cates for future services for $1,500 cash.

8 Received $1,200 cash from customers for services performed.

14 Paid $1,200 in salaries to employees.

15 Received $800 in cash from customers for services performed.

15 Customers receiving services worth $700 used gift certif cates in payment.

21 Paid the remaining accounts payable from April 30.

22 Received $1,000 in cash from customers for services performed.

22 Purchased supplies of $700 on account. All of these were used during the

month.

25 Received a bill for advertising for $500. This bill is due on June 13.

25 Received and paid a utilities bill for $400.

29 Received $1,700 in cash from customers for services performed.

29 Customers receiving services worth $600 used gift certif cates in payment.

31 Interest of $50 was paid on the note payable.

31 Paid $1,200 in salaries to employees.

31 Paid income tax payment for the month $150.

Instructions

(a) Using T-accounts, enter the beginning balances in the general ledger as of April 30,

2017.

(b) Journalize the May transactions.

(c) Post the May journal entries to the general ledger.

(d) Prepare a trial balance on May 31, 2017.

Answers

The beginning balances should be entered in the general ledger as of April 30, 2017, as

follows:

A. Beg. Bal

Supplies

(Beg. Bal 500]

Equipment,

[Beg.Bal___ 24000]

‘Accounts Payable

72100 Beg. Bal

Notes Payable

110000 Beg. Bal

neared Service Revenue

1000 Beg. Bal

Common Stock

‘5000 Beg. Bal

Retained Earnings

11400 Beg. Bal

D.

Prepare the trial balance as follows:

PM Salonine.

Trial Balance

As on May 31, 2017

Account Titles Debit ($) Credit ($)

Cash 5100

Supplies 1200

Equipment 24000

‘Accounts Payable 1200

Unearned Service Revenue 1200

Notes Payable 10000

Common Stock 5000

Retained Earnings 11400

Service Revenue 6000

Salaries Expense 2400

Rent Expense 1000

Advertising Expense 500

Utilities Expense 400

Interest Expense 50

Income Tax Expense 150

Total 34800-34800

Learn more about balances here:- https://brainly.com/question/24914390

#SPJ9

State for each account whether it is likely to have debit entries only, credit entries only, or both debit and credit entries. also, indicate its normal balance.

Typical Entrees Normal Balance

1. Accounts Payable -

2. Cash -

3. Dividends -

4. Miscellaneous

5. Insurance Expense

6. Fees earned

Answers

Answer:

Explanation:?

QUESTION 11

Whether targeting consumers or resellers, marketers need to focus on:

O Buying center synergy.

O Corporate profit sharing

O Reducing derived demand

O Creating value for their customers

Answers

Marketers need to focus on creating value for their customers. The Option D.

Why is creating value for customers crucial for marketers?Creating value for customers is crucial for marketers as it directly impacts customer satisfaction and loyalty. When marketers prioritize creating value, they focus on understanding customer needs and preferences, developing products or services that meet those needs and delivering exceptional customer experiences.

By doing so, they differentiate themselves from competitors, build strong customer relationships and drive business growth. When customers perceive value in what a company offers, they are more likely to make repeat purchases.

Read more about marketers

brainly.com/question/25369230

#SPJ1

which of the following would be considered a want rather than a need for most people?

Answers

Complete the sentence about the most important parts of an email. Before sending an email, you must include the email addresses of one or more recipients in the address box and mention the topic of the mail in the box

Answers

Before sending an email, you must include the subject line of the email addresses of one or more recipients in the address box and mention the topic of the mail in the box.

Email, often known as electronic mail, is the process by which one user sends one or more recipients computer-stored communications through the internet. Emails are a convenient, quick, and affordable means of communication for both personal and professional purposes. If a user has an internet connection, which is normally provided by an internet service provider, they can send emails from any location.

Email can be sent and received between many computer networks, most notably the internet, but it can also be sent and received through both public and private networks, such as a local area network. Both lists of persons and single recipients can receive emails. Using an email reflector, one can control a common distribution list. In order to subscribe to some mailing lists, users must submit a request to the mailing list administrator.

Learn more about email here:

https://brainly.com/question/14666241

#SPJ1

Which type of tax is paid by businesses on their profits to federal or state governments?

Corporate income tax

Estate tax

Personal property tax

Sales tax

Answers

Answer:

Corporate income tax

Explanation:

A corporate income tax (CIT) is levied by federal and state governments on business profits, which are revenues (what a business makes in sales) minus costs (the cost of doing business).

Principal: $1500

Interest rate: 6%

Date borrowed: July 25

Date repaid: January 15

Exact Time ?

Interest ?

Maturity Value ?

Answers

Note that given the principal, date, and interest above:

What is the rationale for the above response?

To calculate the interest, maturity value, and exact time for this loan, we need to know the number of days between the borrowing date (July 25) and the repayment date (January 15).

Number of days between July 25 and January 15:

July: 6 days remainingAugust: 31 daysSeptember: 30 daysOctober: 31 daysNovember: 30 daysDecember: 31 daysJanuary: 15 daysTotal number of days: 6 + 31 + 30 + 31 + 30 + 31 + 15 = 174 days

Using the principal of $1500 and an interest rate of 6%, we can calculate the interest and maturity value:

Interest: $1500 x 6% x (174/365) = $43.15

Maturity value: $1500 + $43.15 = $1543.15 (

To determine the exact time of repayment, we need to know the time of day when the loan was borrowed and repaid. Assuming that both transactions occurred at 12:00 PM noon, the exact time between July 25 and January 15 is:

174 days x 24 hours/day = 4176 hours

So the loan was repaid 4176 hours after it was borrowed.

Learn more about Principal at:

https://brainly.com/question/30517341

#SPJ1

50 red and 50 black balls in a box when you randomly pick two balls without replacement

Answers

=1/50

.........

in the cash book, every cash receipt is______ and every cash payment is_______

Answers

What was Indiana's total government expenditures in fiscal year 2018-2019? (1 point)

O $15.9 billion

O $11.9 billion

O$34.89 billion

O $34.11 billion

Answers

Indiana's total government expenditures in the fiscal year 2018-2019 is $34.89 billion. The correct option is C.

Public consumption, public investment, and transfer payments made up of capital transfers and income transfers (pensions, social benefits), collectively referred to as government expenditures, are all included in the definition of goods and services.

Fiscal policy is characterized as the strategy used by the government to carry out various economic policy goals through the use of taxation, public expenditure, and public borrowing.

Thus, the ideal selection is option C.

Learn more about government expenditures here:

https://brainly.com/question/31649187

#SPJ1

How does a business survive and maintain a profit?

Answers

Answer:

Make sure you don't copy and paste. Have a good day!!!

Explanation:

1. Customers

Find and keep your own customers – you have to be able to solve their real problems & sell yourself effectively.

Too many businesses rely on ‘being in the supply chain’, have too few major customers and do not invest personal time and effort in developing and maintaining customer relations – remember, ‘people buy people’.

Check their credit rating and monitor their speed of payment.

You have not made a sale until they’ve paid the bill. Some customers have bad habits over slow payment; some are big enough to know better. Some will go under before they pay – avoid them.

2. Risks

Assess risks & their potential impact – e.g. customer or supplier closure

Develop contingency plans to mitigate risks

We live in a risky business environment. Don’t assume everything will be OK – look at the potential risks, pitfalls and liabilities for your business and at how you can reduce the biggest risks or anticipate how you will respond if the worst happens.

3. Opportunities

Look for ways to create new value – e.g. new pricing, products & offers to stimulate demand

It often takes longer and costs more than you think to innovate or do anything new.

Use the technology – social media, tablet computing and smartphones are constantly changing the ways we can do business

There are always new opportunities and growing confidence in the economy accelerates these. Many of the most attractive are not in the UK but are international.

Innovation and new approaches can open up promising opportunities but experience tells us that when doing anything new often costs more and takes longer to implement than you first expect, so be prepared to increase your investment of time and money for those new ideas. That means doing your research to find out just how attractive an opportunity it is in the first place.

4. Money in – manage cash and break even

Forecast and monitor your cash flow very closely

Aim to maintain/increase profit margins rather than just increasing sales turnover (bottom line not top line)

Monitor breakeven on the business, customers, products, staff.

Beware of ‘buying’ work at cut-throat margins. Profitable businesses can fail because they run out of money, often suffering from slow payment and lack of credit. Aim to be cash-positive and you will sleep better at night. Break-even is the point at which the business, a person or a contract starts making a profit and is always an important measure.

5. Money out – manage costs and debt

Keep your fixed costs down: avoid costs which are not essential.

Aim to grow sales on a variable cost basis – borrow, rent or lease assets but don’t buy things or hire people you don’t need.

Keep in contact with creditors & lenders to avoid nasty surprises.

Businesses can be wasteful; you don’t need to be. Invest your money only in assets and projects which will provide a strong return. The worst time to ask a lender for more money is when you really need it. Up to date management accounts are essential and you must read them to monitor the health of the business.

6. People

Optimism – positive, realistic leadership with open communications

Set & monitor clear & realistic targets – sales, costs, project completion, debt etc.

Move unproductive people & customers out of the business.

At the end of the day it’s all about how you manage relationships with people. You can tell a lot about a business from the quality of interactions between its managers, employees, customers and suppliers.

Answer:

Explanation:

No business can survive for a significant amount of time without making a profit, though measuring a company's profitability, both current and future. Without sufficient capital or the financial resources used to sustain and run a company, business failure is imminent.

4. During a slow business period, an associate sees a new hire having trouble answering a customer's questions. The customer is ready to leave. What should the

associate do?

O A. Step in and say, "Here, let me help," then ring the sale

OB. Approach them and ask, "Can I help answer any questions?

OC. Alert the manager that the new hire needs help

D. Watch without interrupting and advise the new hire after the customer leaves

Answers

In this situation, the most appropriate course of action for the associate would be to choose option B: Approach them and ask, "Can I help answer any questions?"

In this situation, the most appropriate course of action for the associate would be to choose option B: Approach them and ask, "Can I help answer any questions?" By approaching the new hire and offering assistance, the associate demonstrates teamwork and a willingness to support colleagues. This approach allows the new hire to handle the customer interaction directly, gain experience, and build confidence. However, the associate's presence and offer to help signal that they are available to step in if needed. Interrupting the interaction completely, as in option A, may undermine the new hire's ability to learn and handle customer inquiries independently. It is essential to strike a balance between providing support and allowing the new hire to develop their skills. Option C, alerting the manager, should be reserved for situations where the new hire is struggling consistently or if the customer's concerns are not being addressed. It is generally more effective to offer immediate assistance before involving higher-level management. Option D, watching without interrupting and advising the new hire afterward, misses the opportunity to salvage the customer's experience in real-time. Addressing the customer's concerns promptly and preventing them from leaving is crucial for maintaining customer satisfaction and loyalty. In summary, approaching the new hire and offering assistance while the customer is still present (option B) strikes a balance between supporting the new hire and ensuring a positive customer experience.

For more question on associate

https://brainly.com/question/27993489

#SPJ8

Which of the following is likely to increase the value of a country's currency?

Answers

Higher interest rates in a country can increase the value of that country's currency relative to nations offering lower interest rates. Political and economic stability and the demand for a country's goods and services are also prime factors in currency valuation.

The percentages in the table represent the performance change from the previous month. Consider the impact of each metric on customer questions.

Metric Month 1 Month 2 Month 3

% Customer Questions +8% +10% +12%

% Shipped On Time -10% -7% -5%

% Shipped Incorrectly +2% +4% +4%

% Discounted +18% +18% +14%

Units Shipped (Thousands) 80 85 100

Question 2 of 4

How impactful were shipping errors on customer questions?

Answers

Based on the metrics given, we can say that shipping errors were not very impactful on customer questions.

Relationships between metricsCustomer questions kept rising by 2% from the first month till the third month. Shipping errors (shipped incorrectly) rose by 2% from the first to the second month and then stayed constant.What we then realize is that even though questions kept rising, shipping errors only rose once which means that shipping errors did not account for much of customer questions. If it did, the customer questions would have stayed constant as well.

In conclusion, shipping errors were not very impactful.

Find out more on performance metrics at https://brainly.com/question/4295533.

The postal service of St. Vincent, an island in the West Indies, recently introduced a limited edition deluxe souvenir sheet priced at $15.00 each. The initial market response was quite positive, with an increase in unit sales compared to the regular souvenir sheets. The postal service sold a total of 50,000 units of the deluxe souvenir sheet.

Based on the given information, calculate the following:

What was the postal service's increase (decrease) in total contribution margin when it sold 50,000 deluxe souvenir sheets at $15.00 each, compared to selling 80,000 regular souvenir sheets at $8.00 each?

By what percentage did the St. Vincent post office increase the selling price for the deluxe souvenir sheet compared to the regular souvenir sheets? Additionally, calculate the percentage increase in unit sales for the deluxe souvenir sheet compared to the regular souvenir sheets. (Round your answers to one-tenth of a percent.)

If the postal service wants to maintain the same total contribution margin per unit for the deluxe souvenir sheets as it did for the regular souvenir sheets, what selling price should they set for the deluxe souvenir sheet? (Round your answer to the nearest whole dollar.)

Calculate the number of deluxe souvenir sheets the postal service would need to sell at the price determined in question 3 to equal the total contribution margin earned by selling 80,000 regular souvenir sheets at $8.00 each. (Round your answer to the nearest whole number.)

Please show your calculations and provide explanations for each answer.

Answers

1. the postal service experienced an increase in total contribution margin of $7.00

2. The unit sales for the deluxe souvenir sheets decreased by 37.5% compared to the regular souvenir sheets.

3. The postal service should set the selling price for the deluxe souvenir sheet at $15.00

4. The exact number of deluxe sheets is 45.

Calculation of the increase (decrease) in total contribution margin:

The contribution margin is calculated as the selling price minus the variable cost per unit. Given the information, we have:

Selling price of regular souvenir sheets: $8.00

Selling price of deluxe souvenir sheets: $15.00

Number of regular souvenir sheets sold: 80,000

Number of deluxe souvenir sheets sold: 50,000

To calculate the increase (decrease) in total contribution margin, we need to compare the contribution margin of the two scenarios:

Contribution margin regular souvenir sheets = Selling price - Variable cost

= $8.00 - Variable cost

Contribution margin deluxe souvenir sheets = Selling price - Variable cost

= $15.00 - Variable cost

To find the increase (decrease), we'll subtract the contribution margin of regular souvenir sheets from that of deluxe souvenir sheets:

Increase (decrease) in contribution margin = Contribution margin deluxe - Contribution margin regular

= ($15.00 - Variable cost) - ($8.00 - Variable cost)

= $15.00 - $8.00

= $7.00

So, the postal service experienced an increase in total contribution margin of $7.00 when selling 50,000 deluxe souvenir sheets compared to selling 80,000 regular souvenir sheets.

2. Calculation of the percentage increase in selling price and unit sales:

Percentage increase in selling price = [(Selling price deluxe - Selling price regular) / Selling price regular] * 100

= [(15.00 - 8.00) / 8.00] * 100

= 87.5%

Therefore, the St. Vincent post office increased the selling price for the deluxe souvenir sheet by 87.5% compared to the regular souvenir sheets.

Percentage increase in unit sales = [(Unit sales deluxe - Unit sales regular) / Unit sales regular] * 100

= [(50,000 - 80,000) / 80,000] * 100

= -37.5%

The unit sales for the deluxe souvenir sheets decreased by 37.5% compared to the regular souvenir sheets.

3. Calculation of the selling price for the deluxe souvenir sheet to maintain the same total contribution margin per unit:

To maintain the same total contribution margin per unit, the selling price for the deluxe souvenir sheet should be equal to the selling price for the regular souvenir sheet plus the increase in contribution margin per unit:

Selling price deluxe = Selling price regular + Increase in contribution margin

= $8.00 + $7.00

= $15.00

So, the postal service should set the selling price for the deluxe souvenir sheet at $15.00 to maintain the same total contribution margin per unit.

4. Calculation of the number of deluxe souvenir sheets to be sold to equal the total contribution margin earned from selling 80,000 regular souvenir sheets:

Total contribution margin from selling regular souvenir sheets = Contribution margin regular * Number of regular sheets sold

= ($8.00 - Variable cost) * 80,000

To calculate the number of deluxe souvenir sheets to be sold, we'll set the total contribution margin equal to that of regular sheets and solve for the number of deluxe sheets:

Contribution margin deluxe * Number of deluxe sheets = Contribution margin regular * Number of regular sheets

($15.00 - Variable cost) * Number of deluxe sheets = ($8.00 - Variable cost) * 80,000

Simplifying the equation:

Number of deluxe sheets = (Contribution margin regular * Number of regular sheets) / (Contribution margin deluxe)

= ($8.00 - Variable cost) * 80,000 / ($15.00 - Variable cost)

For such more question on margin:

https://brainly.com/question/9797559

#SPJ8

How would implementing the cost-volume-profit analysis benefit a company? As a manager, which income statement format do you find more useful - the traditional financial accounting method or the contribution margin method? Why?

Answers

It provides insights into the relationship between sales volume, costs, and profitability, helping managers make informed decisions about pricing, production levels, and cost management.

CVP analysis allows managers to determine the breakeven point, the level of sales needed to cover all costs, and to assess the impact of changes in sales volume, costs, or prices on the company's profitability. This analysis can guide strategic planning, budgeting, and resource allocation.

As a manager, I find the contribution margin method of income statement format more useful than the traditional financial accounting method. The contribution margin method separates costs into fixed and variable components, allowing for a clearer understanding of how changes in sales volume affect profitability.

It highlights the contribution margin ratio, which indicates the proportion of each sales dollar available to cover fixed costs and contribute to profits.

This format enables managers to analyze cost behavior, identify cost-saving opportunities, and evaluate the financial impact of different sales scenarios. It provides a more focused view of the underlying profitability drivers and aids in decision-making related to pricing, product mix, and cost control.

For more such questions on profitability visit:

https://brainly.com/question/24553900

#SPJ8

1. Why do we need emotions when we make decision?

2. Why do you think the reason and impartialty are minimum requirements in decision making?

Answers

To keep people trusting in the decision-making process, there must be the illusion of impartiality. When there is a conflict of interest, you shouldn't participate in the decision-making process.

Why are feelings necessary for moral decision-making?Emotional processes influence moral judgement by giving moral decision-making scenarios an affective value, which helps to define what behaviours are acceptable and unacceptable (Haidt, 2001).

What do reason and objectivity in morality mean? Why are impartiality and reason considered to be the bare minimum of morality?It is a basic justice principle. Giving equal and/or sufficient regard to the interests of all parties involved is necessary according to the impartiality moral theory. It is predicated on the idea that everyone is, usually speaking, equally significant and that no one is viewed as having more intrinsic value than another.

To know more about decision-making process visit :-

https://brainly.com/question/19901674

#SPJ1

Discuss why positive thinking is critical in starting the entrepreneurship journey

Answers

1. Motivation: Starting a business can be challenging, and there will be times when things don't go as planned. Positive thinking can help entrepreneurs stay motivated and focused on their goals, even when faced with obstacles.

2. Resilience: Entrepreneurship is a journey filled with ups and downs. Positive thinking helps entrepreneurs build resilience and bounce back from setbacks quickly. It enables them to focus on solutions rather than dwelling on the problems.

3. Creativity: Positive thinking encourages entrepreneurs to think creatively and come up with innovative solutions to problems. Positivity can help entrepreneurs see possibilities where others may only see challenges.

4. Confidence: A positive mindset can help entrepreneurs approach challenges with confidence, which can be critical when making important business decisions. It helps entrepreneurs believe in their abilities and their vision, which can be contagious and attract others to their business.

5. Networking: Positive thinking can also help entrepreneurs build strong relationships with others. People are naturally drawn to positive individuals, and this can help entrepreneurs build a strong network of supporters, mentors, and partners.

In summary, positive thinking is critical in the entrepreneurial journey because it helps entrepreneurs stay motivated, builds resilience, encourages creativity, boosts confidence, and enables entrepreneurs to build strong relationships with others.

Reggie, who is 55, had AGI of $35,200 in 2022. During the year, he paid the following medical expenses:

Drugs (prescribed by physicians)

Marijuana (prescribed by physicians)

Health insurance premiums-after taxes

Doctors' fees

Eyeglasses

Over-the-counter drugs

$ 570

1,470

1,280

1,320

445

270

Required:

Reggie received $570 in 2022 for a portion of the doctors' fees from his insurance. What is Reggie's medical expense deduction?

Answers

Reggie's medical expense deduction is $7,276.

AGI, or adjusted gross income, is a person's total income minus certain deductions and is used to calculate taxable income.

Reggie, who is 55 years old, had an AGI of $35,200 in 2022. During the year, he incurred the following medical expenses:

Drugs (prescribed by physicians): $5,701

Marijuana (prescribed by physicians): $1,470

Health insurance premiums-after taxes: $1,280

Doctors' fees: $1,320

Eyeglasses: $445

Over-the-counter drugs: $270

Reggie was reimbursed $570 by his insurance company for a portion of the doctors' fees. To calculate his medical expense deduction, we first need to subtract any reimbursements from his total medical expenses.

Total medical expenses: $5,701 + $1,470 + $1,280 + $1,320 + $445 + $270 = $10,486

Reimbursements: $570

Medical expenses after reimbursements: $10,486 - $570 = $9,916

To claim a medical expense deduction, the expenses must exceed a certain percentage of AGI, which varies depending on the taxpayer's age. For taxpayers who are 65 or younger, the threshold is 7.5% of AGI. For taxpayers who are over 65, the threshold is 7%.

Since Reggie is 55 years old, the threshold is 7.5% of his AGI or $35,200 x 0.075 = $2,640.

Therefore, Reggie can deduct the portion of his medical expenses that exceed $2,640.

Amount of medical expenses that exceed the threshold: $9,916 - $2,640 = $7,276

Therefore, Reggie's medical expense deduction is $7,276.

Know more about Adjusted gross income here:

https://brainly.com/question/31249839

#SPJ8

Suppose that the production function is y= 9k^0.5 N^0.5. With this production function, the marginal product of labor is MPN= 4.5K^0.5 N^-0.5. The capital stock is K= 25. The labor supply curve is NS= 100[(1-t)w]^2, where w is the real wage rate, t is the tax rate on labor income, and hence (1-t)w is the after-tax real wage rate.c.Suppose that a minimum wage of w=2 is imposed. If the tax rate on labor income, t, equals zero, what are the resulting values of employment and the real wage? Does the introduction of the minimum wage increase the total income of workers, taken as a group?

Answers

The resulting values for employment and the real wage are 70.3125 and $1.5811 per hour, respectively.

The introduction of the minimum wage does not increase the total income of workers taken as a group.

How to determine employment and real wageTo find the resulting values of employment and real wage, determine where the labor supply curve intersects the labor demand curve.

MPN =

\(4.5K^0.5 N^-0.5 = (9K N)^0.5 / (2KN)^0.5 = (9/2)^0.5 (K/N)^0.5 = w/P

\)

where P is the price of output, which we can assume is equal to 1.

This equation can be rearranged to solve for N:

N =

\((9/2) (K/w)^2\)

Plugging in K = 25 and w = 2, we get:

N =

\((9/2) (25/2^2) = 70.3125\)

To find the real wage, we can plug this value of N into the labor supply curve:

NS =

\(100[(1-t)w]^2 = 100(1-0)(2)^2\)

= 400

Since labor supply exceeds labor demand, the real wage will be bid down to the equilibrium level.

\((9/2)^0.5 (K/N)^0.5 = w/P

(9/2)^0.5 (25/N)^0.5 = 1/2

N = (9/2) (25/2^2) = 70.3125

w = 2(70.3125/100)^0.5 = 1.5811\)

The equilibrium real wage is $1.5811 per hour.

To determine whether the introduction of the minimum wage increases the total income of workers,

Total income before minimum wage = wN = 1.5811 x 70.3125 = $111.31

After the minimum wage of $2 is imposed, the real wage is fixed at $2, and the level of employment is determined by the intersection of the labor supply and demand curves at this wage:

N =

\((9/2) (25/2^2) / (2)^2 = 35.15625\)

Total income after minimum wage = wN = 2 x 35.15625 = $70.31

Since the total income of workers decreases from $111.31 to $70.31 after the minimum wage is imposed, the introduction of the minimum wage does not increase the total income of workers taken as a group.

Learn more on Real wage on https://brainly.com/question/1622389

#SPJ1

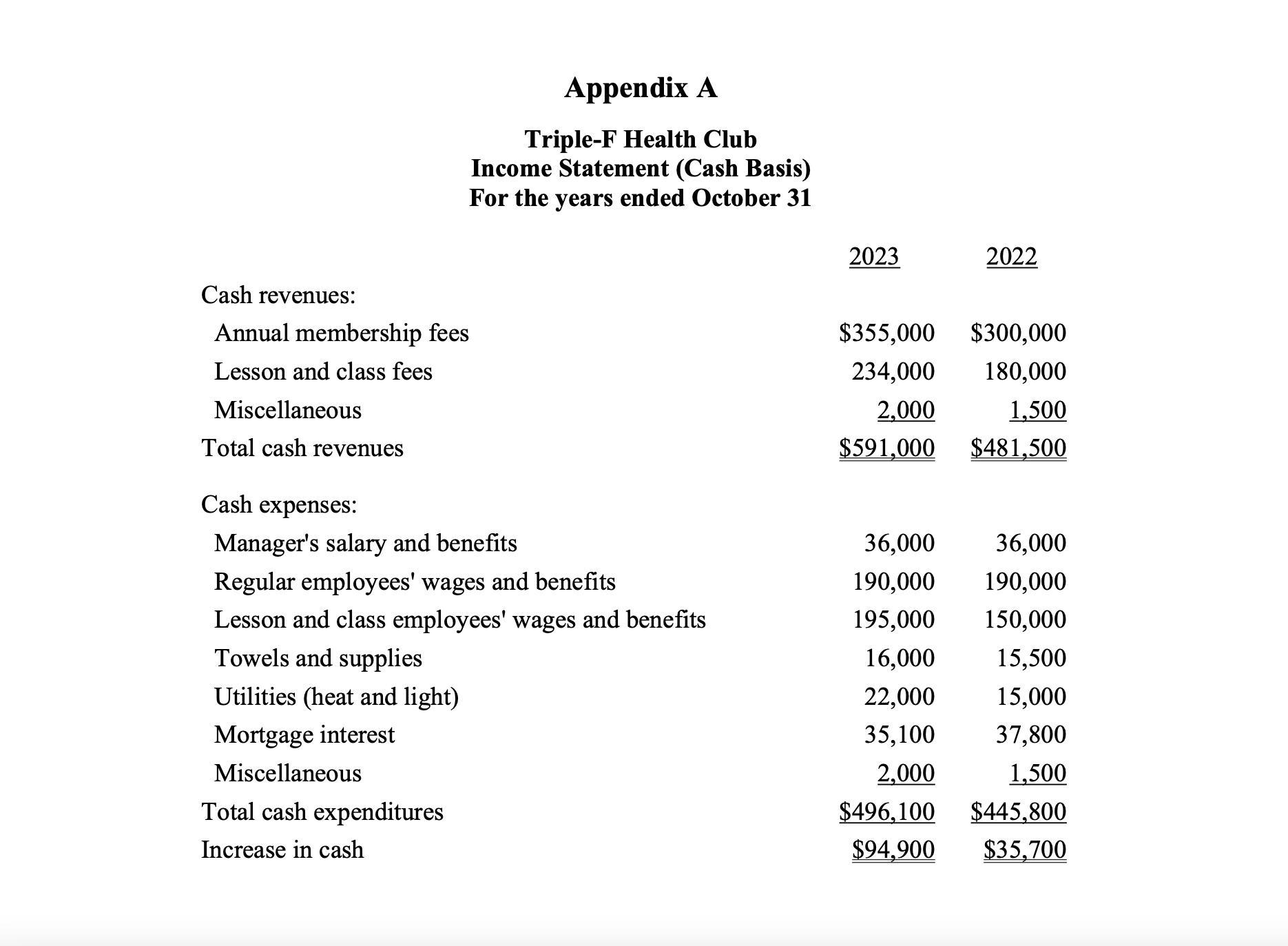

Triple-F Health Club (Family, Fitness, and Fun) is a not-for-profit family-oriented health club. The club's board of directors is developing plans to acquire more equipment and to expand club facilities. The board plans to purchase about $25,000 of new equipment each year and wants to establish a fund to purchase the adjoining property in four or five years. The adjoining property has a market value of about $300,000.

The club manager, Jane Crowe, is concerned that the board has unrealistic goals in light of the club's recent financial performance. She has sought the help of a club member with an accounting background to assist her in preparing a report to the board supporting her concerns.

Jane would like you to prepare a cash budget for 2024 for the Triple-H Health Club and explain any operating problems that this budget discloses for the Triple-H Health Club. Is Jane Crowe's concern that the board's goals are unrealistic justified?

Answers

The Triple-H Health Club may face operational issues in 2024, based on the cash budget. There is a $5,000 cash shortfall as a result of the anticipated cash outflows exceeding the anticipated cash inflows.

What is Cash Outflow?Any cash payments or expenditures made by a person or organization, such as purchasing inventory, paying salaries, or purchasing equipment, are referred to as cash outflow.

To prepare a cash budget for 2024, we need to estimate the club's cash inflows and outflows for that year. Here is a potential cash budget for Triple-H Health Club for 2024:

Cash Inflows:

Membership fees: $200,000

Donations: $20,000

Total Cash Inflows: $220,000

Cash Outflows:

Equipment purchases: $25,000

Rent: $60,000

Salaries and wages: $100,000

Utilities: $12,000

Insurance: $10,000

Maintenance and repairs: $8,000

Total Cash Outflows: $215,000

Net Cash Inflows: $5,000

This cash budget indicates that the club is expecting a net cash inflow of $5,000 in 2024, which is a positive sign. However, the budget also shows that the club has relatively high fixed costs in the form of rent, salaries, and wages, which could pose challenges if the club's revenue falls short of expectations.

To know more about Cash Outflow, visit:

brainly.com/question/23453537

#SPJ1

Considering current world economic climate, the future exchange rates are uncertain. How would you analyse/anticipate the change in exchange rates? Write a brief proposal to mitigate impact of possible exchange rate fluctuations

Answers

Answer:

In order to analyse and anticipate the change in exchange rates, I would use a combination of technical and fundamental analysis. Technical analysis involves studying charts and trends to identify patterns that can be used to predict future price movements. Fundamental analysis involves looking at economic indicators such as GDP growth, inflation, unemployment, and interest rates to gain an understanding of the underlying economic conditions that can affect exchange rates.

In order to mitigate the impact of possible exchange rate fluctuations, I would suggest implementing a strategy of hedging. Hedging involves taking out a position in a currency or financial instrument that is opposite to the current position in order to reduce the risk of losses due to exchange rate fluctuations. This can be done through the use of forward contracts, options, and futures. Additionally, I would suggest diversifying investments across multiple currencies to reduce the risk of losses due to exchange rate fluctuations.

Finally, I would suggest monitoring exchange rate movements closely and adjusting the hedging strategy accordingly in order to ensure that the hedging strategy is effective in mitigating the impact of exchange rate fluctuations.

Explanation:

it is a figure of speech in which ideas,action,or object are described in nonliteral terms

Answers

Answer:

parts of speech

Explanation:

In a personal budget, which of the following is considered to be a fixed expense? A. Dinner at a restaurant B. A movie Ticket C. A personal trainer D. Apartment rent

Answers

Answer: Personal Trainer

Explanation: It's a personal budget.

Case study analysPartnering - The Accounting software installation projects

Answers

1. The attempt at project partnering appears to be failing due to communication breakdowns, misalignment of expectations, inadequate project management, and potential performance issues with subcontractors.

2. As Karin, I would assess the project's current state, enhance communication and collaboration, review and update the partnering charter, strengthen project management practices, and address any subcontractor issues promptly.

3. To keep the project on track, I would establish a robust project governance structure, implement effective project controls, foster collaboration, provide adequate resources and support, conduct regular performance reviews, and maintain strong stakeholder engagement.

1. The attempt at project partnering appears to be failing due to several reasons. First, despite the effective planning and involvement of subcontractors in developing the project components such as the Work Breakdown Structure (WBS), costs, specifications, and time, there seems to be a breakdown in communication and collaboration. The signing of the partnering charter and the team-building workshop might have created initial alignment, but it appears that these efforts did not translate into sustained cooperation.

Second, there could be a lack of effective project management practices. The project management team may not have been able to provide adequate oversight, coordination, and issue resolution. This can result in misunderstandings, delays, and conflicts among the subcontractors and project personnel.

Third, there might be misalignment of expectations and unclear roles and responsibilities. The partnering charter may not have sufficiently defined the obligations and expectations of each party involved, leading to confusion, finger-pointing, and disputes regarding scope, deadlines, and quality standards.

2. As Karin, the project manager, there are several steps to take in order to get the project back on track. First, conduct a thorough assessment to identify the root causes of the issues. Engage in open and transparent communication with all stakeholders to understand their concerns, challenges, and perspectives. This will help in addressing specific problems effectively.

Next, prioritize clear and frequent communication. Foster an environment that encourages collaboration, sharing of information, and addressing conflicts constructively. Revise and reinforce the partnering charter to ensure all parties have a shared understanding of roles, responsibilities, and expectations.

Implement robust project management practices. Strengthen project tracking mechanisms, establish performance metrics, and develop change management processes. Provide necessary support and resources to subcontractors, and address any underperformance or resource constraints promptly.

3. To keep the project on track, continuous monitoring and adaptation are essential. Regularly review the project's progress, risks, and issues. Implement effective project controls to manage scope, schedule, budget, and quality. Maintain strong stakeholder engagement through proactive communication and involvement.

Promote a culture of collaboration and learning within the project team. Conduct regular performance reviews with subcontractors, recognizing and rewarding good performance. Continuously learn from project outcomes and implement corrective actions as needed.

By taking these actions, Karin can enhance communication, strengthen project management practices, and foster a collaborative environment. This will enable effective problem-solving, alignment of expectations, and proactive risk management, ultimately leading to a higher chance of project success.

Know more about WBS here:

https://brainly.com/question/31078257

#SPJ8

The Question was Incomplete, Find the full content below :

THE ACCOUNTING SOFTWARE INSTALLATION PROJECT

This Case Study is asking you assess how a project that seemed to have done effective planning, by including the subcontractors in developing the WBS, costs, specifications, and time, can go bad so quickly. Before the project started, there was a team-building workshop for all six subcontractors and project personnel that resulted with everyone signing the partnering charter. Yet two months into the project, trouble is brewing on the project. In six months the project seemed to be falling apart. There are three questions at the end of the Case Study you need to respond to:Please anwer to the following questions:

Why does this attempt at project partnering appear to be failing?

If you were Karin, what would you do to get this project back on track?

What action would you take to keep the project on track?

Your coin collection contains fifty 1952 silver dollars. If your grandparents purchased them for their face value when they were new, how much will your collection be worth when you retire in 2060, assuming they appreciate at a 5.7% annual rate

Answers

Answer:

$19,909.88

Explanation:

Calculation to determine how much will your collection be worth when you retire in 2060,

Future value = Present value x (1 + r )n

Present value = 50

r = 5.7% or 0.057

n = 2060- 1952= 108

Plugging these values in the above mentioned formula, we shall get:

Future value= $ 50 x ( 1 + 0.057 )^108

Future value= $ 50 x ( 1 +.057 )^108

Future value= $19,909.88 Approximately

Therefore how much will your collection be worth when you retire in 2060 is $19,909.88

Internal Analysis: Looking Inside the Firm of Honda Corp.

The strategic actions managers take link firm resources and capabilities. For example, investments in R&D labs (managerial actions) are one mechanism that links the resource (engineers) with the firm capability (product innovation). This activity is important because when multiple resources and capabilities are aligned on a single goal, the firm may have a core competency. For instance, Canon’s ability in optics originates not just in the capability of its design engineers, but also in its precision in manufacturing. When a firm’s core competency is at the heart of the product it sells, that product can be considered a core product. In the case of Canon, optics are at the heart of such products as cameras, camcorders, scanners, and projectors.

The goal of this activity is look closely at Honda, and differentiate the important relationships between its firm resources, managerial actions, firm capabilities, core competencies, and core products.

Read the case below and complete the activities that follow.

Since 1959 Honda has been the world’s largest motorcycle manufacturer. It is also the world’s largest manufacturer of internal combustion engines—the core of many of Honda’s products including sport boats, marine engines, off-road power sport vehicles (e.g., ATVs, snow mobiles), an extensive line of power equipment (e.g., lawn mowers, electric generators, snow blowers), and cars. Over time, Honda has maintained as its core ability a dedication to the engineering and ongoing innovation of these small, reliable, and powerful internal combustion engines.

While Honda invested much in developing and maintaining this competency, in 1960, its management made an important decision that later became central to the creativity and productivity of its engineers and designers. The research and development division separated from Honda Motor Company to form the independent company Honda R&D. This management decision helped facilitate a unique corporate culture built on excellence in innovation and engineering.

Honda R&D continues to build on this important tradition by focusing on the spread of new ideas through cultural and regional diversity; as such, the firm now has five R&D centers located outside of Japan in North America, South America, Europe, Asia, and China.

Resources fall broadly into two categories: tangible and intangible. Tangible resources have physical attributes and are visible. Intangible resources have no physical attributes and thus are invisible. Examples of intangible resources are a firm's culture, its knowledge, brand equity, and reputation. Which of the following is an example of an intangible resource?

Multiple Choice

equipment

copyright

cash

land

inventory

Answers

From the list given, one that is an example of an intangible resource is; "copyright" (Option B)

What is a Copyright?A copyright is a sort of intellectual property that grants the owner the exclusive right to copy, distribute, modify, exhibit, and perform creative work for a specific period of time. The creative effort might be literary, artistic, educational, or musical in nature.

Copyrights are a type of intangible property since they grant their owners certain rights that are not perceptible through the physical senses. Small business owners frequently must handle a range of intangible assets, including copyrights.

Learn more about intangible resources;

https://brainly.com/question/29916481?

#SPJ1

In an unrelated acquisition, if five firms are interested in acquiring a firm and each of the bidding firms had a current market value of $30,000 while the current market value of the target firm is $20,000, this acquisition is likely to generate economic profits of ________ for the acquiring firm.

Answers

Answer:

It is not possible to determine the economic profits that the acquiring firm will generate from the acquisition based on the information provided.

The economic profits of an acquisition depend on various factors such as the price paid for the target firm, the synergies and efficiencies that can be realized by combining the two firms, and the potential growth and profitability of the target firm in the future.

In this scenario, it is only stated that five firms are interested in acquiring a firm with a current market value of $20,000, and each bidding firm has a current market value of $30,000. This information alone does not provide enough detail to calculate the expected economic profits for the acquiring firm.

Therefore, additional information such as the final acquisition price and other factors that could impact the acquisition's profitability would be needed to determine the economic profits generated by the acquisition.

Explanation: