buy-sell agreements are typically funded by which two insurance products?

Answers

Buy-sell agreements are typically funded by two insurance products which are: life insurance and disability insurance.

Buy-sell agreements are legally binding contracts that specify how a business owner's share of a business can be sold or transferred if they become incapacitated, retired, or deceased. In such situations, a buy-sell agreement outlines the conditions for a business partner or shareholder to buy the shares of the business owner. Buy-sell agreements may be funded in a number of ways. However, two of the most common insurance products used to fund buy-sell agreements are life insurance and disability insurance. When a buy-sell agreement is funded with life insurance, the policyholder's life insurance policy pays out a death benefit to the beneficiary upon the policyholder's death. When a buy-sell agreement is funded with disability insurance, it typically pays out a percentage of the business owner's salary or income in the event that they become disabled and can no longer work.

Buy-sell agreements are legally binding contracts that specify how a business owner's share of a business can be sold or transferred if they become incapacitated, retired, or deceased. In such situations, a buy-sell agreement outlines the conditions for a business partner or shareholder to buy the shares of the business owner. Buy-sell agreements may be funded in a number of ways. However, two of the most common insurance products used to fund buy-sell agreements are life insurance and disability insurance. When a buy-sell agreement is funded with life insurance, the policyholder's life insurance policy pays out a death benefit to the beneficiary upon the policyholder's death. When a buy-sell agreement is funded with disability insurance, it typically pays out a percentage of the business owner's salary or income in the event that they become disabled and can no longer work. Using insurance to fund a buy-sell agreement provides business owners with a reliable and predictable way to transfer ownership of their business while protecting their interests and ensuring the continuity of their business.

To know more about Buy Sell Agreements visit:

https://brainly.com/question/29038387

#SPJ11

Buy-sell agreements are typically funded by life insurance and disability insurance policies. They act as a safeguard, providing financial security against the death or disability of a business owner, ensuring the continuity of the business.

Explanation:Buy-sell agreements are often funded by two major insurance products: life insurance and disability insurance. These insurance products act as collateral against unforeseen, detrimental events, ensuring the continuation of the company in event of the death or disability of one of the owners.

A premium payment is typically made to an insurance company, thereby placing the investors or owners into a risk group. This guarantees financial security in the event of a significant adverse event. The insurance payout is then used to buy-out the affected owner’s share, thereby providing a seamless transition while minimizing financial risk.

Learn more about Buy-sell agreements here:https://brainly.com/question/32764134

#SPJ6

Related Questions

By manipulating the money_____, the Federal reserve can change _____ rates, thus encouraging or dicouraging additional investment.

Answers

Answer:

Supply, interest

Explanation:

The money supply can be regarded as supply of all the currency as well as other liquid instruments in the economy of a particular country.

Money supply can be manipulated by central bank by influencing interest rates, as well as printing money. The federal reserve can also engage in open market operations which is the selling/buying security or bond of government. It should be noted that By manipulating the money supply the Federal reserve can change interest rates, thus encouraging or dicouraging additional investment.

What course of action does the instructor prescribe in order to define the critical issues facing an organisation?

Answers

The course of action does the instructor prescribe in order to define the critical issues facing an organisation is Use a 4 step model to diagnose the problems underlying the issue faced by your organisation.

What is 4 step model?The simulation process can be described as the four step process which serves as the process used in finding solutions to the critical issues in an organization and these are:

trip generation trip distributionmodal split traffic assignments.It should be noted that the Organizational problems which are the problems t that are affecting the departments as well as the units in an organization and this can also affect the entire organization can bee solved by using the steps listed above

We can conclude that course of action does the instructor prescribe in order to define the critical issues facing an organisation is Use a 4 step model to diagnose the problems underlying the issue faced by your organisation.

Find out more on organisation at

https://brainly.com/question/2636977

#SPJ1

COMPLETE QUESTION:

What course of action does the instructor prescribe in order to define the critical issues facing an organisation?

Assess whether there is a capability gap to address.

Evaluate the degree of alignment between the key capabilities and the four elements of the organization.

Cluster related problems together, so that you can reduce the main problem areas down to a maximum of about three.

Use a 4 step model to diagnose the problems underlying the issue faced by your organisation.

Now that you have selected the cultural environment, you must predict what the effects of these changes on gerlach's microenvironment might be. select the outcome you see as most likely. select an option from the choices below and click submit.

Answers

Answer: The suppliers might raise the costs of paper in the future.

Explanation:

When production is being seeing as being expensive is die to the fact that items which composites of them are expensively gotten from the suppliers. When there is an increase by the supplies on the individual items used, it rubs off on the production aspect and makes theirs also expensive to produce. Also, suppliers raise their cost too when they buy the materials at an expensive or high cost. Whatever they are being sold to affects the cost that they supply to the end user. Production cost affects supply cost.

what is the purpose of a ""second partner review""? what should be the extent of the second partner’s association with the engagement being reviewed?

Answers

The goal of a second partner review is to confirm that the engagement complied with all quality control policies of the CPA firm and that the audit was carried out in compliance with GAAP.

A second partner review, or "concurring review partner," is conducted primarily for the purpose of assessing the engagement team's key decisions and the related conclusions that were drawn in creating the overall conclusion.

This study looks at how concurring partners' propensity to accept an engagement team's findings is affected by their past involvement in audit planning. The survey included 36 audit partners from 8 CPA firms in the United States. These partners had varying degrees of involvement in the audit planning for the bad debt allowance.

Our findings showed that prior involvement in audit planning had no impact on the level of concurring partners' agreement with an engagement team's conclusion. Also, we gathered information about the overall traits of the tasks carried out throughout coinciding partner reviews.

To know more about partner:

https://brainly.com/question/30295652

#SPJ4

if the preferred stock is cumulative, how much of the $760,000 would be paid to common stockholders?

Answers

$200,000 would be paid to the preferred stockholders, and the remaining amount of $760,000 - $200,000 = $560,000 would be available to be paid to the common stockholders.

if the preferred stock is cumulative, it means that any missed dividend payments on the preferred stock must be paid to the preferred stockholders before any dividends can be paid to the common stockholders.

to determine how much of the $760,000 would be paid to common stockholders, we need to consider the cumulative dividend requirements of the preferred stock.

let's assume the preferred stock has an annual dividend rate of 5% and there are 10,000 shares of preferred stock outstanding. the cumulative dividend requirement for each year would be calculated as follows:

cumulative dividend requirement = preferred dividend rate x preferred stock outstanding

cumulative dividend requirement = 5% x 10,000 = 0.05 x 10,000 = $500

if there were any missed dividend payments in previous years, those payments would also need to be made to the preferred stockholders before any dividends can be paid to the common stockholders. let's assume there were missed dividend payments of $200,000 in previous years.

now, let's calculate how much of the $760,000 would be paid to the common stockholders:

amount paid to preferred stockholders = cumulative dividend requirement x number of years with missed dividend payments

amount paid to preferred stockholders = $500 x number of years with missed dividend payments

amount paid to preferred stockholders = $500 x (total missed dividend payments / cumulative dividend requirement)

amount paid to preferred stockholders = $500 x ($200,000 / $500) = $200,000

Learn more about stock here:

https://brainly.com/question/31940696

#SPJ11

Name the choreographic element that encourages dancers to rely on musical cues, visual connections, and emotional phrasing.

Answers

The choreographic element that encourages dancers to rely on musical cues, visual connections, and emotional phrasing includes the time, energy, and space

What is the meaning of Choreography?In art, a choreography means the way in which an idea is expressed physically through dance. When developing this concept, the users usually relies on important principles of organization to ensure that the idea takes a clear, appropriate, and aesthetically pleasing form.

These are principles that comprises the basic ingredients for the dancers' movements and patterns and help the choreographer utilize space, express intention and the music, and organize the dancers.

Read more about Choreography

brainly.com/question/1384028

#SPJ1

Analyze and explain the relationship that exists between government and business, exploring

the ways in which the two entities work together and interact

Answers

Answer:

b

Explanation:

Answer:

B

Explanation:

FOOK U

What is the primary purpose of ABC's T.R.A.C.E. program?

Answers

The primary purpose of ABC's TRACE program is to identify and investigate where persons under 21 years of age obtained alcohol and who was killed or obtained serious injury or accident.

What is the ABC's TRACE program?The program involves a protocol that allows first responders to respond immediately by notifying ABC when an incident involves a person under 21 and an alcoholic beverage that results in great bodily injury or death.

Hence, the primary purpose of ABC's TRACE program is to identify and investigate where persons under 21 years of age obtained alcohol and who was killed or obtained serious injury or accident.

Read more about ABC program

brainly.com/question/4316039

#SPJ1

Investments in debt securities acquired principally for the purpose of selling them in the near term are classified as ________ securities.

Answers

Investments in debt securities acquired principally for the purpose of selling them in the near term are classified as trading securities.

The definition of investment is an asset that is purchased or invested to build wealth and save money from hard-earned income or capital appreciation. The importance of investment is primarily to gain an additional source of income or to make a profit from the investment over a period of time.

Form of investment shares. Knead. Mutual funds and ETFs. bank product. option. Savings for pension, retirement, and education. Your investment allows you to be independent and not depend on other people's money when you need it financially. You can pay enough for your needs and desires in life.

Learn more about Investments here: https://brainly.com/question/24703884

#SPJ4

Question 41 Leonard Company purchased a machine that cost $57752, has an estimated residual value of $6601, and has an estimated useful life of 4 years Using the straight line method of depreciation,

Answers

The book value of the machine purchased by Leonard Company at the end of year 3 would be $ 19, 388. 75

How to find the book value ?The cost of the machine is given, as well as the residual value and the estimated useful life. We can use this to find the depreciation per year using the straight line method of depreciation:

= ( Cost of Machine - Estimated residual value ) / useful life

= ( 57, 752 - 6, 601 ) / 4

= $ 12, 787. 75

The net book value at the end of year 3 is :

= Cost - 3 year deprciation

= 57, 752 - ( 12, 787. 75 x 3 )

= $ 19, 388. 75

Find out more on book value at https://brainly.com/question/29847155

#SPJ4

Rest of question is:

Using the straight line method of depreciation, the book value at the end of year 3 is ?

Claire is opening her first savings account with a $200 deposit. Her account pays 0.5% interest compounded monthly. How much will this $200 earn in interest over the next 20 years?

Answers

48240

If subtracting

47760

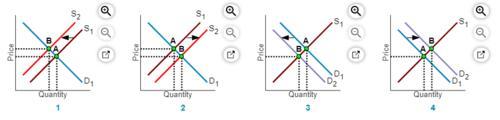

The following four graphs represent four market scenarios, each of which would cause either a movement along the supply curve for premium bottled water or a shift of the supply curve. Match each scenario with the appropriate graph.

a. A decrease in the supply of sports drinks

b. A drop in the average household income in the United States from $56,000 to $52,000

c. An improvement in the bottling technology for premium bottled water

d. An increase in the prices of electrolytes used in premium bottled water

Answers

Match each scenario with the appropriate graph attached below.

a. The decrease in the supply of sports drinks: 4

Define supply curve.The relationship between the price of a good or service and the volume supplied over a specific time period is represented graphically by the supply curve. The price will typically be shown on the left vertical axis of an illustration, and the quantity supplied will be shown on the horizontal axis. A supply curve's entire slope can be shifted right or left by changes in production costs and related variables. This results in the supply of a higher or lower quantity at a specific price.

b. The drop in the average household income in the United States from$56,000 to$52,000: 3

c. An improvement in the bottling technology for the premium bottled water: 2

d. An increase in the prices of electrolytes used in the premium bottled water: 1

To learn more about supply curve, visit:

https://brainly.com/question/14925184

#SPJ1

In 18th century, what was the main reason of slow down of Indian Foreign Trade

Answers

Answer:

Introduction to India’s Foreign Trade:

Even being a typical poor underdeveloped country, India’s foreign trade was in a prosperous state during the period under review. In terms of volume of trade and the range of commodities entering into trading list, India was better placed compared to other contemporary underdeveloped countries. But that must not be viewed as an indicator of prosperity. Above all, her pattern of trade was definitely different from those of other underdeveloped countries.

India’s composition of trade (i.e., pattern of imports and exports) before 1813 included manufactured goods as well as primary articles in export list and metals and luxury products in the import list. But such pattern of trade was supplanted by the import of manufactured goods and exports of agricultural raw materials and food grains during much of the nineteenth and twentieth century. This must not be the sign of prosperity or cause for jubilation.

Explanation:

Rather, this situation generated much heat and controversy because, instead of being an engine of growth, foreign trade, as engineered by the British Government, exacerbated economic exploitation. It hampered the process of industrialization. It brought untold misery to the masses. Most importantly, of course partly the backwardness of Indian industry and agriculture is ‘the effect of its external trade which moulded into shape the productive mechanism of the country.’

To understand the nature of the controversy it will be fruitful to tell something about the history of India’s foreign trade during 1757 and 1947. The growth of foreign trade during the two centuries can be divided into following unequal periods: 1757 to 1813, 1814 to 1857, 1858 to 1914, and from 1915 to 1947.

The first period—the early years of the British East India Company (EIC)—is known as the ‘age of mercantilism’. During the period under consideration trade statistics is not available. However, some sort of institutional changes in trade took place during this period.

In the mid-18th century, Indian foreign trade was mainly conducted by the English, Dutch, French, and Portuguese traders and merchants. But the revolution of 1757 strengthened the supremacy of the British EIC. In the process, the EIC monopolized trade and ousted the other merchants and traders.

Selma and Patty Bouvier are twins and both work at the Springfield DMV. Selma and Patty Bouvier decide to save for retirement, which is 35 years away. They'll both receive an annual return of 11 percent on their investment over the next 35 years. Selma invests $2,500 per year at the end of each year only for the first 10 years of the 35-year period—for a total of $25,000 saved. Patty doesn't start saving for 10 years and then saves $2,500 per year at the end of each year for the remaining 25 years—for a total of $62,500 saved.

a. How much will each of them have when they retire?

b. How much will Selma have when she retires?

Answers

Selma will have approximately $46,059.47 and Patty will have approximately $280,583.90 when they retire after saving for 35 years with an 11% annual return.

a. To calculate the retirement savings for Selma and Patty, we can use the future value formula for an ordinary annuity

Future Value = Payment × [(1 + interest rate\()^{number of periods}\) - 1] / interest rate

For Selma:

Payment = $2,500

Interest rate = 11%

Number of periods = 10 (since she saves for the first 10 years)

Future Value (Selma) = $2,500 × [(1 + 0.11)^10 - 1] / 0.11

Future Value (Selma) = $2,500 × (1.11^10 - 1) / 0.11

Future Value (Selma) ≈ $46,059.47

For Patty:

Payment = $2,500

Interest rate = 11%

Number of periods = 25 (since she saves for the remaining 25 years)

Future Value (Patty) = $2,500 × [(1 + 0.11)²⁵ - 1] / 0.11

Future Value (Patty) = $2,500 × (1.11²⁵ - 1) / 0.11

Future Value (Patty) ≈ $280,583.90

b. Selma will have approximately $46,059.47 when she retires.

To know more about Future Value:

https://brainly.com/question/30787954

#SPJ4

a real estate professional who has several years of experience in the industry decided to retire from actively marketing properties. now this person helps clients choose among the various alternatives involved in purchasing, using, or investing in property. what is this person's profession?

Answers

Real estate agents typically work with commercial property investors rather than residential property buyers and sellers. They are also called "real estate consultants"

What does a Real Estate Counselor do:

Real property specialists manual purchaser choices primarily based totally on big studies and enterprise expertise. The first step is to have an preliminary assembly with the purchaser to speak about number one and secondary targets. When the targets are defined, a actual property representative formulates a plan to reap them withinside the maximum cost-powerful way. A actual property representative's actual position relies upon at the kind of purchaser with whom they work. For example, specialists operating on a belongings improvement mission are regularly employed earlier than the land is even secured. The purchaser is based at the actual property representative to affirm the viability of the investment. The representative does this with the aid of using touring the proposed task site, assembly with nearby actual property professionals, and studying marketplace trends.

To learn more about Real Estate Counselor

https://brainly.com/question/2469840

#SPJ4

What is Bloom’s Taxonomy?

( no c0py from g00+gle)

Answers

Answer:

a set of three hierarchical models used to classify learning objectives into levels of complexity and specificity

Answer:

Bloom's Taxonomy is a Hierarchal Pyramid used to classify the objectives when learning something into: creating, evaluating, analyzing, applying, understanding, and remembering.

Explanation:

Miguel is a new salesperson for Imperial Realty. Dissatisfied with the lack of mentoring he has received, he decides to work for Millennium Real Estate instead, and has his license transferred. At the time of the switch, he had listed two properties. What happens to his listings

Answers

Answer:

Miguel cannot keep the listings; they belong to Imperial Realty.

Explanation:

Since Miguel decides to work for Millennium Real Estate instead and want to transferred his license but at the time of switching, he listed two properties.

So as a salesperson he cannot keep the listing as it belongs to a broker not a salesperson and the broker should also be reassigned to the new salesperson plus it also belongs to the imperial realty which he has not part anymore

Why might a manager for a non-profit organization seem as concerned with his or her organization's financial well-being as a for-profit manager?

a. Non-profit managers are evaluated on financial performance only.

b. Non-profit managers try to give the illusion that they care about the "bottom line."

c. Not-for-profit organizations need to make money to continue operating.

d. Non-profit organizations have an obligation to turn a profit.

Answers

Answer:

c. Not-for-profit organizations need to make money to continue operating.

Explanation:

Non-profit organisations mainly focus on meeting their set objectives for example ensuring education is provided to poor children, health services reach the less privileged in society, and so on.

On the other hand for profit organisations mainly focus on turning a profit for the benefit of the business owners.

The manager for a non-profit organization will be as concerned with his or her organization's financial well-being as the for profit manager.

This is because non- profit organisations tend to have a tight budget and they will need to effectively manage resources available to them to ensure they keep functioning.

Write a paragraph explaining what kind of assessment works best for you to really be able to show what you know. (Consider standardized tests, open ended responses, essays, projects, speeches, labs). Explain how your learning style may influence your success on each kind of assessment. 100 POINTS PLZ HELP TODAY

Answers

Answer:

In my experience, essays work best for me to be able to show what I know. I feel that they are more effective than taking, say, a standardized test for example. This is because they are often multiple choice, and I find myself sometimes guessing rather than doing the intended work. In an essay, I have no option other than to type/write out what I know with little-to-no guesswork, making writing out an essay a superior option when it comes to displaying my knowledge on a topic. My preferred learning style is of the visual sort, and that means I learn best by taking notes, seeing examples, using charts and diagrams, etcetera. These skills influence my success on many different types of assessments, including essay writing, test taking, and project making. I am able to visually take notes on the topic at hand, often with examples, which, in my experience, greatly influences my success on these different types of assessments.

Why are financial records important? How does keeping organized financial records contribute to successful money management?

Answers

Financial record bookkeeping is the way towards recording, compressing and revealing the horde of exchanges coming about because of business operations over some stretch of time.

And it is so important because such records includes money related articulations, including the accounting report, pay proclamation and income explanation, that optimize the organization’s working execution over a premeditated period.

how to calculate cost of sales and gross profit

Answers

Discuss case 13.2 Steve Jobs' Shared Vision Project Management Style.

1 1. Steve Jobs shows the importance of people skills. Explain Jobs’ way of motivating people. For example, did he try to get everyone to like him? Did he try to get everyone target along with each other?

2.Why did Jobs’ approach to project management work so well for him?

3.What lessons can project managers learn from Jobs?

4.Research Steve Jobs’ management style from reputable sources. What did you learnabout how people reacted to Jobs’ style?

5.Create a checklist of effective project management practices

Answers

Instead, he concentrated on forging a unifying vision .1. Steve Jobs did not aim to win over everyone's favour or create a sense of camaraderie among team members as a means of encouraging individuals.

3. There are several things that project managers may take away from Steve Jobs. First and foremost, a team has to be inspired and aligned by a clear and compelling vision. Jobs was able to establish a sense of purpose among his staff by clearly communicating his goal. Second, exceptional accomplishments can result from holding individuals to a high standard and pushing them outside their comfort zones. It's crucial to strike a balance between this strategy and support and appreciation for the team's work. Finally, encouraging a culture of creativity, embracing innovation.

Learn more about Vision here:

https://brainly.com/question/17063668

#SPJ11

"What a given group of people appreciates" are their ___________. A. Cultural contexts b. Culture shock c. Cultural education d. Cultural values Please select the best answer from the choices provided A B C D

Answers

Answer:

d. Cultural values

Explanation:

Cultural values are the values and norms that are followed by a distinct society or a group of people. In other terms, values and norms developed within the society to form its basis are said to be the cultural values. The people believe, follow, and appreciate the values. They help in defining the ways of living and leading the life. The behavior, nature, and thinking of the society is influenced or structured as per the cultural values.

Answer:

D

Explanation:

I just took the assignment

1. The City of Jefferson engaged in the following transactions in its fiscal year ending August 31, 2020. By law, the county is required to establish a capital projects fund to account for school construction projects and a debt service fund to account for resources legally restricted to the payment of long-term principal and related interest. Record the transactions below noting the appropriate fund. If a transaction impacts two funds, it should be recorded in both.

a) On March 1, 2020, it issued $40 million in general obligation bonds to finance the construction of a new high school. The bonds were sold for $40,500,000 (a premium of $500,000). After issuance, the premium plus an additional $300,000 was transferred to the Debt Service Fund to be held for eventual payment of interest.

b) On August 31, 2020, the city made its first interest payment on the bonds of $800,000.

c) On June 1, 2020, the county issued $2 million in tax anticipation notes (TAN). It repaid these notes on September 30 2020, which is 1 month after year end (8/31). Interest applicable to the notes for the fiscal year ending August 31, 2020, was $25,000, all of which was paid on September 30, 2020 when the notes matured. This $25,000 was transferred from the general fund to the debt service fund on August 31, 2020 and the county elected to accrue interest as of August 31, 2020 in accordance with GASB standards. (Note: only record the entries applicable to fiscal year ending 8/31/20).

Answers

The transactions can be recorded as follows: a) Capital Projects Fund: - Debit: Cash $40,000,000 - Credit: Bonds Payable $40,000,000 b) Debt Service Fund: - Debit: Cash $500,00 - Debit: Premium on Bonds $300,000 - Credit: Cash $800,000c) General Fund:- Debit: Expenditures-Transfers Out $25,000 - Credit: Cash $25,000 Debt Service Fund: - Debit: Accrued Interest Payable $25,000 - Credit: Revenues-Transfers In $25,000

1. On March 1, 2020, the City of Jefferson issued $40 million in general obligation bonds to finance the construction of a new high school. These bonds were sold for $40,500,000, which includes a premium of $500,000. The premium, along with an additional $300,000, should be transferred to the Debt Service Fund, as it will be used to eventually pay the interest. So, in the Capital Projects Fund, we record the issuance of the bonds at their face value of $40 million. In the Debt Service Fund, we record the receipt of the premium of $500,000 and the transfer of the premium and an additional $300,000 to be held for interest payment.

2. On August 31, 2020, the city made its first interest payment on the bonds, amounting to $800,000. This interest payment should be recorded in the Debt Service Fund as an expenditure, reducing the fund balance.

3. On June 1, 2020, the county issued $2 million in tax anticipation notes (TAN). These notes were repaid on September 30, 2020, one month after the fiscal year-end (August 31, 2020). The interest applicable to the notes for the fiscal year ending August 31, 2020, was $25,000. This $25,000 should be transferred from the General Fund to the Debt Service Fund on August 31, 2020. Additionally, the county elected to accrue interest as of August 31, 2020, in accordance with GASB standards.

Remember to consult the relevant accounting standards and guidelines for your specific jurisdiction to ensure accuracy and compliance.

Learn more about transactions

https://brainly.com/question/24730931

#SPJ11

Which types of postsecondary education are examples of traditional academic education? Check all that apply.

associate degree

apprenticeship

bachelor’s degree

technical school degree

Answer: 1,3

Answers

An apprenticeship studies under a master of a trade.

A technical school degree is training in a field specific to what you want to get a job in, like air conditioning repair.

Answer:

associate degree and bachelor’s degree is the answer

Explanation:

just did it trust me :)

i need help please..

Answers

Answer:

Changes in technology can affect the demand for different products or the demand for related products. It can increase the market for a product by increasing the demand for a new product and making an older product obsolete

Explanation:

When a firm discovers a new technology that allows it to produce at a lower cost, the supply curve will shift to the right as well. ... A technological improvement that reduces costs of production will shift supply to the right, causing a greater quantity to be produced at any given price.

two years ago, you created goforless, a new app that shows people the cheapest way to travel by bus, train, or air between two cities. turns out that your app was a big success, and now you’ve made enough money to hire some additional employees. you’re trying to figure out what your new employees should do. what kinds of jobs should they have? how should they work together? how should they work with you? how can you give your employees enough freedom to be innovative, while maintaining enough control over their work to be sure that goforless will stay true to its overall goals?

Answers

For Goforless, it would be interesting to adopt a decentralized organizational structure, where the hiring of new employees was focused on the development of innovative and creative work.

As Goforless is a technology company, the work environment should be more:

dynamic and flexibleWhere each work team was included in the decision-making process, generating greater agility and valorization of the work.

In an application development company, it is essential that your employees have experience and skills with:

programmingdata securitymarketingdesignTherefore, a work team managed by a participative leader, would be more motivated, trained and integrated, would generate greater productivity and innovation to Goforless processes, to:

inclusion of continuous improvement in the appadapting to news and trends in the digital marketThus fulfilling the company's general objectives.

Learn more here:

https://brainly.com/question/1288780

With regard to the passive loss rules involving rental real estate activities, which one of the following statements is true?A.The term "passive activity" loss limitations does not apply to a rental real estate activity when the individual performs more than 50% of his or her personal services during the year in real property trades or businesses in which (s)he materially participates and at least 750 hours of service are performed in those real property trades or businesses in which (s)he materially participates.B.Gross investment income from interest and dividends not derived in the ordinary course of a trade or business is treated as passive activity income that can be offset by passive rental activity losses when the "active participation" requirement is not met.C.Passive rental activity losses may be deducted only against passive income, but passive rental activity credits may be used against taxes attributable to nonpassive activities.D.The passive activity rules do not apply to taxpayers whose adjusted gross income

Answers

Statement A is incorrect because it does not accurately reflect the criteria for exemption from passive loss limitations. Statement B is incorrect because it misrepresents the treatment of gross investment income. Statement D is incomplete and lacks information for a conclusive determination.

The correct statement regarding the passive loss rules involving rental real estate activities is:

C. Passive rental activity losses may be deducted only against passive income, but passive rental activity credits may be used against taxes attributable to nonpassive activities.

According to the passive loss rules, passive rental activity losses can only be offset against passive income. This means that losses from rental real estate activities can only be used to reduce income generated from other passive activities. However, passive rental activity credits, if any, can be used to offset taxes owed on nonpassive activities. This allows for some flexibility in utilizing credits from passive rental activities to offset taxes from other sources.

Statement A is incorrect because it does not accurately reflect the criteria for exemption from passive loss limitations. Statement B is incorrect because it misrepresents the treatment of gross investment income. Statement D is incomplete and lacks information for a conclusive determination.

learn more about "taxes":- https://brainly.com/question/27978084

#SPJ11

name two of accounts used in commercial banks

Answers

Saving account

Click this link to view O*NET’s Work Context section for Chefs and Head Cooks.

Note that common contexts are listed toward the top, and less common contexts are listed toward the bottom.

According to O*NET, what are common work contexts for Chefs and Head Cooks? Check all that apply.

A. spend time keeping or regaining balance

B. importance of being exact or accurate

C. exposed to high places

D. spend time standing

E. responsibility for outcomes and results

F. responsible for others’ health and safety

Answers

Answer:

✅importance of being exact or accurate,✅spend time standing,✅responsibility for outcomes and results,✅responsible for others’ health and safety

I hope this helps!

Answer:

2. importance of being exact or accurate

4. spend time standing

5. responsibility for outcomes and results

6. responsible for others’ health and safety

Explanation: