brooke company borrows $7,600, signing a 90-day, 6%, $7,600 note. what is the journal entry made by brooke company to record the payment of the note on the maturity date?

Answers

To record the payment of the note on the maturity date, we need to consider the principal amount, interest, and the terms provided.

The question is: Brooke Company borrows $7,600, signing a 90-day, 6%, $7,600 note.

Step 1: Calculate the interest on the note.

Interest = Principal x Rate x Time

Interest = $7,600 x 6% x (90/360)

Interest = $7,600 x 0.06 x 0.25

Interest = $114

Step 2: Determine the total payment on the maturity date.

Total Payment = Principal + Interest

Total Payment = $7,600 + $114

Total Payment = $7,714

Step 3: Record the journal entry for the payment of the note.

To record the payment of the note on the maturity date, debit (decrease) Notes Payable for the principal amount of $7,600, debit (increase) Interest Expense for the interest amount of $114, and credit (decrease) Cash for the total payment of $7,714.

Journal Entry:

Notes Payable (Debit) - $7,600

Interest Expense (Debit) - $114

Cash (Credit) - $7,714

To know more about the principal amount, refer to:

https://brainly.com/question/17011251

#SPJ11

Related Questions

Cain Company reports net cash provided by operating activities of $35,000. It also reports the following information under “Adjustments to reconcile net income to net cash provided by operating activities” on its statement of cash flows (using the indirect method).

Answers

It can be seen from the solutions given that Cain's net income is $24,000.

Here is the solution:Net income = Net cash provided by operating activities - Adjustments

= $35,000 - $6,000 - $10,000 + $4,000 + $7,000 + $4,000

= $24,000

Therefore, Cain's net income is $24,000.

Here is a breakdown of the adjustments:

To determine cash flow from operations, it is necessary to include the gain on equipment sales in the net income as it is a non-cash entry.

A rise in accounts receivable implies that customers are prolonging payment of their invoices, resulting in decreased cash flow from the company's activities.

The depreciation expense is classified as a non-cash expense, hence it must be included in the calculation of cash from operations by adding it back to the net income.

A decrease in inventory indicates that the company is experiencing faster turnover of its inventory, leading to increased cash flow generated by its operations.

A rise in prepaid expenses denotes that the company is channeling more funds towards prepaid expenditures like insurance and rent, implying a reduced cash inflow from its operational activities.

A decline in the amount of wages that the company owes indicates that it is not promptly compensating its workforce. Consequently, this implies that the company's operational cash flow is reduced.

Read more about net income here:

https://brainly.com/question/28390284

#SPJ1

on january 1, 2022, woodstock, inc. purchased a machine costing $40,000. woodstock also paid $1,000 for transportation and installation. the expected useful life of the machine is 6 years and the residual value is $5,000. how much is the annual depreciation expense assuming use of the straight-line depreciation method?

a. $6,100.

b. $6,000.

c. $5,950.

d. $5,750.

Answers

The annual depreciation expense assuming the use of the straight-line depreciation method is $6,000. Option B.

Calculation:

Annual depreciation under SLM:

= (Asset cost-Salvage value) + Useful life of the asset

= ($40,000+$1,000 - $5,000)/6

= $36,000/6

= $6,000

Residual value, also called residual value, is the estimated value of an item of property, plant, and equipment at the end of the lease term or useful life. In a leasing situation, the lessor uses the residual value as one of the primary ways to determine how much the lessee will pay in regular lease payments. Residual value is one of the components of a lease calculation or transaction.

Learn more about The residual value here:- https://brainly.com/question/15072869

#SPJ4

The risk associated with the unlikelihood that one of the key members will be struck by lightning would most likely be handled by which of the following?

A) Mitigating

B) Retaining

C) Ignoring

D) Transferring

E) Avoiding

Answers

Answer:

B) Retaining

Explanation:

The risk retaining refers to the risk in which the company takes the decision that represents the responsibility for some specific risk i.e. opposed to the risk transfer over and above to the insurance company

Here the risk retain is adopted when the doing cost is less than the fully or partially cost

In the given situation, since it is mentioned that the risk is attached with the unlikelihood and struck from lighting so this is to be handled by retaining

hence, the correct option is B. Retaining

The break-even point is the quantity at which

total revenue is equal to total cost.

variable cost is equal to fixed cost.

total revenue is lower than total cost.

total revenue is lower than fixed cost.

total cost is lower than variable cost.

Answers

The correct answer is (a) total revenue is equal to total cost. The break-even point is the quantity at which total revenue is equal to total cost.

The break-even point is the level of production or sales at which total revenue equals total cost. At this point, the company is neither making a profit nor incurring a loss. In other words, it is the point where the company has covered all its costs and has started to make a profit.

The break-even point is calculated by dividing the total fixed costs by the contribution margin per unit, which is the selling price per unit minus variable costs per unit. Once the break-even point is reached, any additional units sold will generate profits for the company.

Therefore, the correct answer is that the break-even point is the quantity at which total revenue is equal to total cost. It is a crucial metric for businesses as it helps them determine the minimum level of production or sales required to cover their costs and start making a profit.

for more such question on break-even point

https://brainly.com/question/9212451

#SPJ11

the redwood company determined that its balance in its accounts receivable account represented 23% of total assets and that cost of goods sold represented 38% of total revenue. these findings are the result of

Answers

Considering the situation described above, these findings are the result of "Vertical Analysis."

This is because Vertical Analysis is a form of analysis conducted in a business firm to express their financial statements.

It is written or described in percentages or proportional calculation.

In vertical analysis, the items on the documents are represented as a percentage of another item, such as accounts receivable account represented 23% of total assets and that cost of goods sold represented 38% of total revenue.

Hence, in this case, it is concluded that the correct answer is "Vertical Analysis."

Learn more here: https://brainly.com/question/16791825

An international business is a firm that

Part 2

A. hires non-U.S. citizens.

B. produces a wide range of products.

C. is not from the United States.

D. engages in international trade or investment.

Answers

Option D: An international business is a firm that engages in international trade or investment.

Therefore, the correct answer is option D. An international business is a company that conducts business across national borders. This can include importing and exporting goods, investing in foreign markets, and operating in multiple countries.

It is not necessarily defined by the nationality of its employees, the range of products it produces, or the country in which it is headquartered. International business refers to the trade of goods, services, technology, capital and/or knowledge across national borders and at a global or transnational scale. It involves cross-border transactions of goods and services between two or more countries.

For such more questions on international business:

brainly.com/question/14690606

#SPJ11

Which fund type cannot be financed solely by transfers from other funds

Answers

Revenue funds cannot be financed solely by transfers from other funds.

A revenue funds is essentially a sort of bond that is paid for by specific clearly defined types of public money, such as admission taxes, accommodation taxes, and various other types of public money.

A revenue funds is essentially a sort of form of municipal securities that is backed by the proceeds of a particular public financing source are all included in this source. Revenue bonds who finance income-generating businesses or enterprises are often backed by a specific revenue source.

Learn more about funds, here:

https://brainly.com/question/13318000

#SPJ4

Which one of these items is NOT a processed material?

O Paper

O Steel

O Sand

O Glass

Answers

Paper was originally tree, steel was metal, glass was heated to become glass

does 1 plus 1 = 65 yes or no

Answers

Answer:

No 1 + 1 = 2

Explanation:

Lol

A person has $120 to spend on two goods (x and y) whose respective prices are $3 and $5 per unit. (a) Draw the budget line showing all the different combinations of the two goods that can be bought with the given budget. (b) What happens to the budget line if the budget (money available to spend) falls by 25%. (c) What happens to the budget line if the price of good x doubles? (d) What happens to the budget line if the price of good y falls to $4?

Answers

Answer:

Price of good x is $3

Price of good y is $4

What is one benefit US workers who have a college degree rather than a high school diploma?

Answers

Answer:

Those with a college degree earn nearly twice as much as those without college.

Explanation:

A college degree increases the chances of securing a higher paying job than a high school diploma. Most employers insist on college degrees for managerial or executive positions. These are the positions with good pay packages. Currently, college graduates earn nearly twice their high school diploma holders.

Answer:

D.

Explanation:

the person above me is correct

is laws and regulations that govern business. is well-defined rules for appropriate business behavior. do not vary from one person to another. is most important for advertising agencies. is the application of moral standards to business situations.

Answers

The Company pledges to conduct itself in a way that upholds all applicable laws, norms of conduct in the workplace, and business ethics, as well as to treat every employee equally and fairly.

Does a set of laws specify how a company ought to conduct itself?Every business has a code of conduct that is applicable to both the organization and its staff. The motivation behind the rule of conduct is business ethics. Corporate ethical guidelines are frequently adopted freely by businesses, but on occasion, these guidelines may also be mandated by law.

Business ethics: What Is It?The rules for ethically correct and wrong behavior in company are referred to as business ethics. Law defines behavior in part, but "legal" and "ethical" are not always synonymous. By defining permissible practices outside of the purview of the state, business ethics strengthen the law.

Learn more about business ethics here:

https://brainly.com/question/4048149

#SPJ4

according to the syndrome model of addictions, there are multiple and interacting antecedents of addiction that can be organized in at least three primary areas. which of the following is not a primary area?

Answers

According to the syndrome model of addictions, there are multiple and interacting antecedents of addiction that can be organized into at least three primary areas: psychological, biological, and social.

The Syndrome Model of Addiction provides a more complete view of addiction than the earlier, and still widespread, disease model. According to this model, addiction is the product of multiple interacting antecedents that can be grouped into three primary areas: psychological, biological, and social.

Psychological antecedents refer to mental health problems, personality features, and cognitive processes that are related to addiction. Biological antecedents include genetic factors, neurobiological mechanisms, and the effects of drugs on brain function. Social antecedents refer to family, peer, and cultural influences that affect drug use.

Addiction is a complex phenomenon that emerges as a consequence of the interplay between these antecedents over time. While the specific antecedents that contribute to addiction may vary from individual to individual, it is essential to identify and understand the underlying factors that contribute to the development and maintenance of addiction in each case.

For more such questions on Syndrome model of addictions.

https://brainly.com/question/13188973#

#SPJ11

anybody can help with this too ??

Answers

Answer:

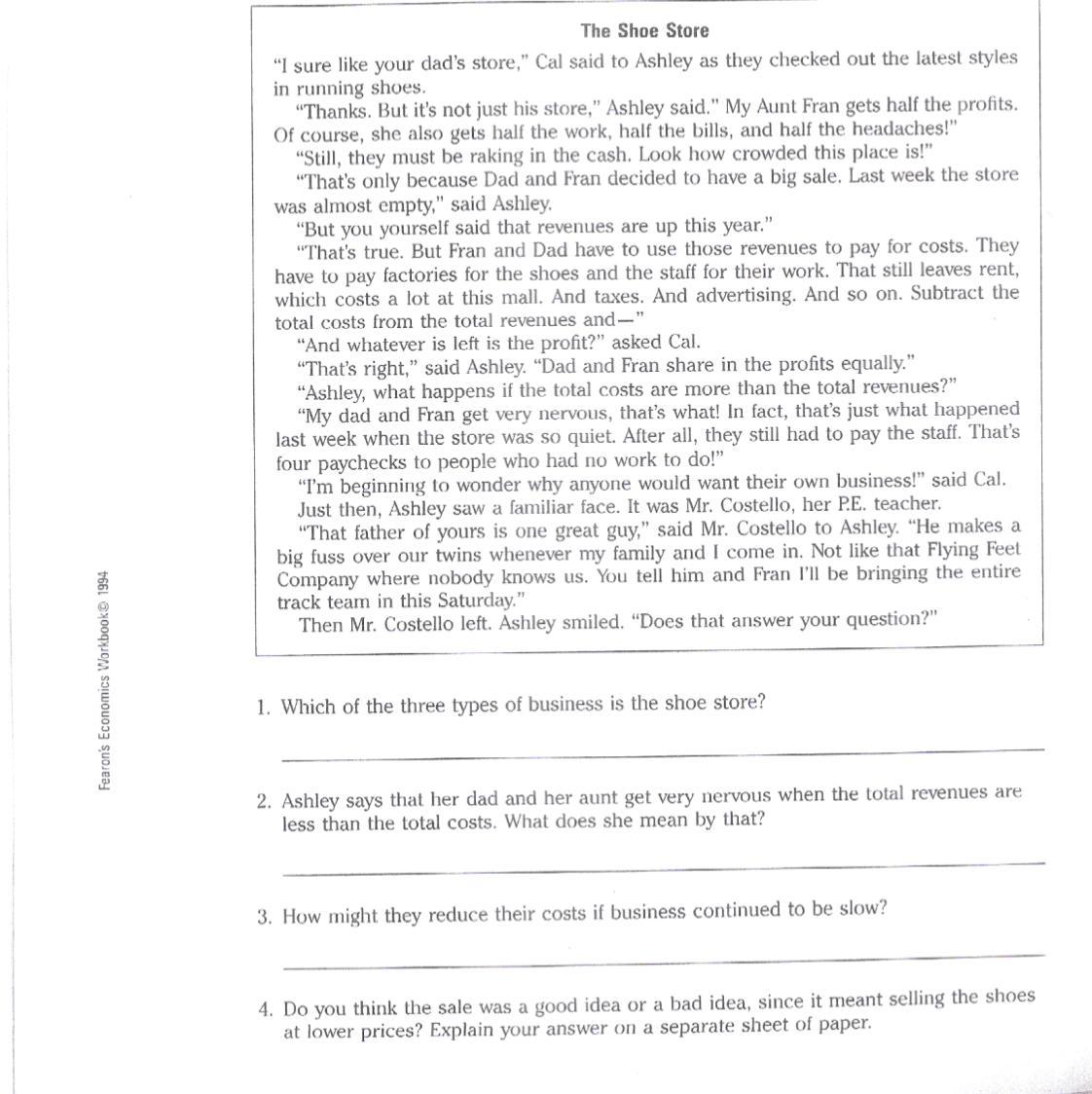

1. The three types of business mentioned are – Manufacturing, Retail store and School

2. She means that whenever there is loss both Ashley’s father and aunt get tensed.

3. They sell their product on sale to increase the revenue

4. Sale is better than having no sale at all as it caters the immediate financial requirement without ant further invetsment

Explanation:

1. The three types of business mentioned are – Manufacturing, Retail store and School

2. She means that whenever there is loss both Ashley’s father and aunt get tensed.

3. They sell their product on sale to increase the revenue

4. Sale is better than having no sale at all as it caters the immediate financial requirement without ant further invetsment

"What a given group of people appreciates" are their ___________. A. Cultural contexts b. Culture shock c. Cultural education d. Cultural values Please select the best answer from the choices provided A B C D

Answers

Answer:

d. Cultural values

Explanation:

Cultural values are the values and norms that are followed by a distinct society or a group of people. In other terms, values and norms developed within the society to form its basis are said to be the cultural values. The people believe, follow, and appreciate the values. They help in defining the ways of living and leading the life. The behavior, nature, and thinking of the society is influenced or structured as per the cultural values.

Answer:

D

Explanation:

I just took the assignment

write a story about what could happen if you purchase a home without a

financial plan in action. In other words, what could go wrong, what could

happen as a result, and how could it have been handled differently?

Answers

i'm not going to write the whole story but i'll give you a few details :)

- the person ends up buying a house that was falling apart, pipes breaking/leakage, roof falling apart, floorboards splitting.

- goes for a loan to fix the house but doesn't know the process of the loan and gets put into debt.

- tries to fix the house himself cheaply, it works for a week then it goes back to what it was. a lot more holes and breaks show up. hires someone to come fix the things that were breaking and gets put farther into debt and loses a lot of money.

- falls behind on his mortgage and eventually, the house gets repossessed (sorry if i spelt that wrong)

The higher the tax rate, the _________ larger smaller the multiplier effect.

Answers

The higher the tax rate, the smaller the multiplier effect. This is because when taxes are high, people have less disposable income to spend on goods and services. As a result, the money that would have been spent on consumption is instead diverted to paying taxes.

This decrease in consumer spending leads to a decrease in aggregate demand, which in turn reduces the multiplier effect. The multiplier effect refers to the phenomenon where a change in spending results in a larger change in overall economic activity. When people spend money, it goes to businesses, which then use that money to pay wages, purchase materials, and so on. These businesses then spend money, which goes to other businesses, and so on. This chain reaction of spending creates a larger economic impact than the initial amount spent.

However, when taxes are high, this chain reaction is disrupted. Less money is available for spending, which means less money goes to businesses, leading to a smaller multiplier effect. Additionally, high taxes can discourage investment, which can further reduce economic activity. In summary, the higher the tax rate, the smaller the multiplier effect. This is because high taxes reduce consumer spending and discourage investment, both of which can decrease economic activity.

To know more about the Multiplier Effect visit:

https://brainly.com/question/13994959

#SPJ11

angela has authority to punish her employees due to her position in the work hierarchy, controls valuable resources, and is respected and admired. however, she does not have any unique knowledge or skills. angela is low on which type of power? group of answer choices

Answers

Angela is low on the type of power known as expert power.In terms of power dynamics, there are different types of power that one can possess. According to French and Raven, there are five types of power, which are reward, coercive, legitimate, referent, and expert power.

Angela has authority to punish her employees due to her position in the work hierarchy, controls valuable resources, and is respected and admired. However, she does not have any unique knowledge or skills. Therefore, Angela does not possess expert power.Expert power is a type of power that is derived from having knowledge or skills that are in high demand. If Angela had unique knowledge or skills, then she would possess expert power.

Since she does not have any unique knowledge or skills, she is low on the type of power known as expert power.In addition to expert power, reward power, coercive power, legitimate power, and referent power are other types of power. Reward power is the power that comes from being able to provide rewards to others. Coercive power is the power that comes from being able to punish others. Legitimate power is the power that comes from having a position of authority. Referent power is the power that comes from being respected and admired by others.

To know more about legitimate visit:

brainly.com/question/30390478

#SPJ11

stephon's homeowner's association rejects the roofing material he planned to use when adding a large, covered deck to his home.

Answers

Stephon's homeowner's association denied his chosen roofing material for the addition of a large, covered deck to his home.

Homeowner's associations often have guidelines and regulations in place to maintain consistency and uphold the aesthetics of the community. The rejection could be due to various reasons, such as the material not meeting the association's standards, not being in line with the established architectural style, or conflicting with existing regulations. Associations typically aim to ensure harmony and conformity within the neighborhood. In such cases, Stephon may need to revisit his plans and select an alternative roofing material that complies with the association's requirements. This process helps maintain the overall appearance and value of the community while considering the collective interests and preferences of its residents.

To learn more about material

https://brainly.com/question/27993723

#SPJ11

27. Research suggests that serial interviews have higher predictive validity (i.e., more effective) than panel/board interviews when using unstructured forms of interviewing. a. true b. false

30. Using personality tests as part of the selection process has been increasingly popular because of the increased autonomy found in more recent organizational structures. Thus, people are more likely to be authentic in the expression of their personality. a. true b. false

Answers

27. The statement that research suggests serial interviews have higher predictive validity than panel/board interviews when using unstructured forms of interviewing is true 30 "personality tests as part of the selection process has been increasingly popular because of increased autonomy" is false

The statement that using personality tests as part of the selection process has been increasingly popular because of the increased autonomy found in more recent organizational structures is false. Personality tests as part of the selection process has been increasingly popular because of their increased validity in assessing job-related skills and aptitudes.

Total cost refers to the total expense incurred in the production of goods or services, such as labor and material costs and overhead. It can also refer to the total cost of ownership of a product or service, which includes all costs associated with the purchase, use, maintenance, and disposal of the product or service.

Know more about overhead here:

https://brainly.com/question/28528644

#SPJ11

Should a business email contain a salutation?

Answers

Answer:

A business email is meant in a professional way. It can be sought out as multiple different approaches, one of them, in this case, can include a friendly and welcoming business approach, including a salutation. All in all, it is up to the writer, there is no fully correct answer. Hope this helps :)

the equilibrium price of a cotton shirt is $15. assume that a change in customers’ tastes will increase the demand for such shirts by 10%

Answers

A change in customers' tastes decreases the demand for cotton shirts by 10% which leads to the shift of demand curve to the left. The correct option is (b).

A decrease in demand due to a change in customers' tastes implies that consumers are now less willing to purchase cotton shirts at any given price. This decrease in demand is represented by a leftward shift of the demand curve in the demand and supply model. The original equilibrium price of $15 will likely be impacted as a result. The supply curve, on the other hand, is not directly affected by the change in customers' tastes.

Thus, the ideal selection is option (b).

Learn more about demand curve here:

https://brainly.com/question/7451501

#SPJ4

The complete question might be:

The equilibrium price of a cotton shirt is $15. Assume that a change in customers' tastes will decrease the demand for such shirts by 10%.

How does this affect the demand and supply model?

a. The demand curve will shift to the right.

b. The demand curve will shift to the left.

c. The supply curve will shift to the left.

d. The supply curve will shift to the right.

Please! i need help :): will mark brainliest! describe sinek's golden circle. what does he use this for? sinek argues that "people don't buy 'what' you do; people buy 'why' you do it." what does he mean by this? do you agree or disagree with him? why? what are the advantages of hiring people who share the same beliefs and visions in terms of the company's 'why' or purpose? why wasn't tivo successful as a company? what is the difference between leaders and those who lead? how does safety contribute to trust and cooperation? what are some ways that leaders can make the company environment safe? what are the advantages of companies where employees feel safe and protected?

Answers

Sinek uses the Golden Circle to emphasize that people are more likely to be motivated by the Why rather than the What. He argues that when communicating, businesses should start with the Why, then move to the How and What. This is because people are more likely to be inspired and connect with the purpose behind a company, rather than just its products or services.

I agree with Sinek's statement because when people understand and resonate with a company's purpose, they are more likely to support and buy from that company. It creates a sense of loyalty and emotional connection.

Hiring people who share the same beliefs and visions as the company's Why or purpose has several advantages. Firstly, it creates a cohesive and unified team, as everyone is working towards the same goal. It also fosters a sense of shared values and commitment, which leads to better collaboration and teamwork. Additionally, employees who align with the company's purpose are more likely to be motivated and passionate about their work, leading to increased productivity and job satisfaction.

TiVo's lack of success as a company can be attributed to several factors. One reason is the fierce competition in the market. TiVo faced strong competition from cable and satellite providers who offered their own DVR services. Another factor was the high cost of TiVo's products and services, which made it less accessible to a broader consumer base. Additionally, TiVo's marketing and branding strategies were not as effective as its competitors, which affected its market share and overall success.

The difference between leaders and those who lead lies in their approach and impact. Leaders are often associated with a formal position of authority, while those who lead can come from any level of an organization. Leaders inspire and influence others through their actions and behaviors, rather than relying on their title or position.

Safety plays a crucial role in building trust and cooperation within a company. When employees feel safe, both physically and psychologically, they are more likely to trust their leaders and colleagues. This trust fosters open communication, collaboration, and teamwork, which are essential for a productive and successful work environment.

Leaders can create a safe company environment in several ways. They can establish clear and transparent communication channels, encourage and value employee feedback, promote a culture of respect and inclusivity, provide training and resources to address safety concerns, and ensure fair and consistent policies and procedures are in place.

Companies where employees feel safe and protected have several advantages. Firstly, employees are more likely to be engaged and motivated, leading to increased productivity and job satisfaction. It also helps attract and retain top talent, as employees are more likely to stay in an environment where they feel safe and valued. Additionally, a safe work environment promotes innovation, creativity, and collaboration, leading to better problem-solving and decision-making.

To learn more about "Marketing And Branding Strategies" visit: https://brainly.com/question/25492268

#SPJ11

You are the CEO for a small, single plant chemical company. Though you know you operate within the guidelines set by the Environmental Protection Agency, you have heard of complaints in the community about the particulates discharged from the plant and there are rumblings of people believing that their illnesses, including cancer, are related to the discharged particulates. You can greatly reduce the particulate discharge by installing a new filter system at a cost of $10 million dollars. Your company last year made $7.5 million in profits, which greatly pleased the shareholders and led to a nice bonus for you. If you were the CEO what would you do and why? Use the specific ethical concepts and at least one ethical decision making framework discussed as support for your decision.

Answers

As the CEO of a small chemical company, faced with complaints and concerns about particulate discharge and its potential impact on community health, I would prioritize installing a new filter system.

By applying ethical decision-making frameworks, such as consequentialism or utilitarianism, the choice to reduce particulate discharge aligns with the principles of maximizing overall welfare

. Consequentialism focuses on the outcomes of actions, and in this case, installing the filter system would lead to improved air quality and reduced health risks, benefiting the community as a whole.

Moreover, utilitarianism considers the greatest happiness for the greatest number of people. By addressing the concerns and complaints of the community, the installation of the filter system demonstrates a commitment to public welfare, thereby promoting trust, goodwill, and a positive impact on stakeholders.

Therefore, as the CEO, my decision would be to prioritize installing the new filter system, despite the significant cost. This choice upholds ethical principles, protects public health

minimizes harm, ensures long-term sustainability, and utilizes ethical decision-making frameworks to support the decision-making process.

To learn more about CEO -

brainly.com/question/5045885

#SPJ11

When people purchase groceries or household goods in most states, they pay an additional percent of the subtotal. What kind of tax are they paying?

Answers

When people purchase groceries or household goods in most states, the additional percent of the subtotal they are paying is called sales tax.

The government levies a consumption duty known as a sales duty on the purchase of goods and services. At the point of trade, a standard deals duty is assessed, collected by the shop, and paid to the government. A company is liable for sales levies in a particular governance if it has a nexus there, which, depending on the regulations in that governance, may be a physical position, an hand, an chapter, or some other presence. Only the final consumer of a good or service is needed to pay conventional or retail sales taxes.

To know more about sales tax :

https://brainly.com/question/1811849

#SPJ4

which step of the accounting cycle involves checking to see if total debits equal total credits?

Answers

The step of the accounting cycle that involves checking to see if total debits equal total credits is known as the trial balance.

The trial balance is prepared as part of the accounting cycle to ensure the accuracy of the recorded transactions. It involves listing all the accounts from the general ledger and their respective debit and credit balances. The purpose of the trial balance is to verify that the total debits equal the total credits.

During this step, each account balance is transferred from the general ledger to the trial balance. Debits and credits are added separately, and their totals are compared. If the debits equal the credits, the trial balance is said to be balanced, indicating that the fundamental accounting equation (Assets = Liabilities + Equity) is in balance.However, if the debits and credits do not match, it indicates an error or omission in the accounting records. The trial balance helps in identifying such errors, which can then be investigated and rectified before preparing financial statements.Therefore, the trial balance serves as an important tool in the process of ensuring the accuracy and integrity of financial information.

For more questions on accounting

https://brainly.com/question/13310721

#SPJ8

Emil Corp. produces and sells wind-energy-driven engines. To finance its operations, Emil Corp. issued $15,000,000 of 20-year, 9% callable bonds on May 1, 20Y1, at their face amount, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year.

Answers

Answer and Explanation:

The Journal entry is shown below:-

1. Cash Dr, $15,000,000

To Bonds payable $15,000,000

(Being issue of bonds is recorded)

2. Interest expense on bonds Dr, $675,000

To cash $675,000 ($15,000,000 × 9% × 6 ÷ 12)

(Being payment of interest is recorded)

3. Bonds payable Dr, $15,000,000

To Gain on redemption of bonds $600,000

To Cash ($15,000,000 × 0.96) $14,400,000

(Being redemption on bonds is recorded)

In an economic slowdown,Keynesian economic policy would advocate increasing __________.

A)taxes

B)government spending

C)the unemployment rate

D)interest rates-

Answers

In an economic slowdown, Keynesian economic policy would advocate increasing government spending.

Keynesian economics is an economic theory developed by economist John Maynard Keynes, which suggests that during periods of economic downturn or recession, government intervention through fiscal policies can help stimulate economic growth and stabilize the economy. According to Keynesian theory, increasing government spending is one of the key policy measures that can be implemented to counteract the negative effects of an economic slowdown.

By increasing government spending, the theory posits that the aggregate demand in the economy will rise. This increased demand can lead to increased production, job creation, and overall economic activity. The idea is that government spending can fill the gap left by reduced private sector spending and investment during an economic slowdown, providing a boost to the economy.

To learn more about economic policy follow:

https://brainly.com/question/30104789

#SPJ11

In a venture capital firm, what does the word "capital" refer to? Question 5 options: a. the capital of the state where it's located

b. the capital, or money, they invest in businesses c. the way they use capital letters for all their communications

d. where their offices are housed in the state capitol building

Answers

In a venture capital firm, the word "capital" refers to B. the capital, or money, they invest in businesses.

Venture capital firms are financial institutions that specialize in providing funding to start-ups and emerging businesses, often in exchange for equity or ownership stakes in these companies. They play a critical role in the growth and development of innovative businesses by providing the financial resources and guidance necessary to scale and succeed.

The term "capital" in this context refers to the financial resources the firm allocates for investments in these companies. This capital can come from various sources, including private investors, institutional funds, or the firm's own resources. Venture capital firms use their expertise and networks to identify promising companies, evaluate their potential, and support their growth through strategic capital deployment.

In summary, the word "capital" in a venture capital firm is related to the money they invest in businesses, supporting their growth and development by providing the necessary financial resources. This usage of the term is not related to the location of the firm or the way they use capital letters in their communications. Therefore, the correct option is B.

Know more about Venture capital firms here:

https://brainly.com/question/31218982

#SPJ11

Answer:

ITS B

Explanation:

I JUST GOT A 100%

YEAHHHHH

1. Non-home-mortgage interest prepaid in cash can only be deducted:

A) When paid

B) When the loan is liquidated

C) In the year of loan origination

D) Over the period of the loan

2. Unnecessary cosmetic surgery costs directed solely at improving the patient's physical appearance:

A) Qualify as a medical expense deduction

B) Are listed as itemized deductions

C) Will not qualify for a medical expense deduction

D) Are limited to a maximum deduction of $10,000

3. Yearly ad valorem personal property taxes are allowed as an itemized deduction. True or false

4. An individual is allowed a medical deduction set at a standard rate of 18 cents per mile for the use of a car for medical purposes in lieu of a deduction based on the actual operating expenses for gas, oil, etc. True or false

5. In the current year, John Barraclough has $50,000 of adjusted gross income, a $10,000 casualty loss and a $2,000 casualty gain. How much is John’s net deductible casualty loss after making all appropriate reductions?

A) $0 B) $2,900 C) $3,000 D) $7,900 E) $8,000

I need help, urgently, please!!!

Answers

1. The correct answer is A) When paid. Non-home-mortgage interest prepaid in cash can only be deducted in the year when the payment is made.

This means that if you pay interest in advance, you can only claim the deduction for that interest in the year it is actually paid.

2. The correct answer is C) Will not qualify for a medical expense deduction. Cosmetic surgery costs that are solely for improving the patient's physical appearance are generally not considered eligible for a medical expense deduction.

In order for a medical expense to be deductible, it must be considered necessary for the treatment or prevention of a specific medical condition.

3. False. Yearly ad valorem personal property taxes are not allowed as an itemized deduction. Prior to the tax law changes in 2018, these taxes were deductible as part of the state and local tax (SALT) deduction. However, under the current tax law, starting in 2018, the SALT deduction is limited to a maximum of $10,000, and personal property taxes are no longer separately deductible.

4. True. An individual is allowed a medical deduction set at a standard rate of 18 cents per mile for the use of a car for medical purposes in lieu of a deduction based on the actual operating expenses for gas, oil, etc. This deduction is intended to cover the costs associated with using a car for medical-related travel, such as going to doctor's appointments or receiving medical treatment.

It simplifies the process by providing a standard rate per mile instead of requiring individuals to track and calculate their actual operating expenses.

5. The correct answer is C) $3,000. To calculate the net deductible casualty loss, you subtract any casualty gains from the casualty losses. In this case, John Barraclough has a casualty loss of $10,000 and a casualty gain of $2,000.

Subtracting the casualty gain from the casualty loss gives us $10,000 - $2,000 = $8,000. However, casualty losses are subject to a $100 floor per event, meaning that the first $100 of each casualty loss is not deductible.

Therefore, the net deductible casualty loss would be $8,000 - $100 = $7,900.

For more such questions payment,click on

https://brainly.com/question/26049409

#SPJ8