Answers

Answer:

The Productisation produce is:

1. Ideation/Conceptualisation

This has to do with the generation of a product or service idea;

2. Research / Concept Testing Stage / Analysis

This stage has to do with the research around the idea to determine the availability of market for the product, size and target segment within the market, Growth Potential, competition analysis and current and potential issues that may arise due to the creation of the product;

As a substage of the research phase, a business analysis of the viability of the product is also carried out. this will entail

Cost-Benefit Analysis Resources Required Capital Expenses Profitability/Margin Anticipated Sales

3. Design/Creation of Prototype/Development

For physical products, this stage will look at on-paper design from which a prototype will be created.

After testing to ensure that the prototype works, it is then sent for development. This stage also involves market tests.

4. Launch

This is the final stage of the product development process.

It entails all the go-to-market activities such as market plan execution, sales/production training, execution of distribution plan.

It is possible at this stage to still collect product-related feedback from the market for consideration in the upgrade version of the product to be launched at a later date.

Cheers!

Related Questions

Select the sentence that best demonstrates business writing skills. -The question was answered by sixty-one percent of the respondents. -The question was answered by 61% of the respondents. -The question was answered by 61 percent of the respondents.

Answers

Out of the choices provided above, the sentence, ''The question was answered by 61 percent of the respondents.'', is the one that best demonstrates the business writing skills. Therefore, the option C holds true.

The writing skills can be referred to or considered among the most important aspects of business communication. If a letter or a piece of information is presented in a hasty manner, it leaves a bad impression of the business, and may also formation of a bad imagery of the organization from an ethical perspective.

Learn more about the writing skills here:

https://brainly.com/question/2136671

#SPJ4

Dale is a guitar teacher and Terrence is a tile layer. If Dale teaches Terrence's daughter to play the guitar in

exchange for Terrence tiling Dale's kitchen floor,

a. only Dale is made better off by trade.

O b. both Dale and Terrence are made better off by trade.

c. neither Dale nor Terrence are made better off by trade.

O d. only Terrence is made better off by trade.

Answers

If Dale teaches Terrence's daughter to play the guitar in exchange for Terrence tiling Dale's kitchen floor Option B. both Dale and Terrence are made better off by trade.

In this scenario, Dale is a guitar teacher and Terrence is a tile layer. Dale teaches Terrence's daughter how to play the guitar in return for Terrence tiling Dale's kitchen floor. It is a classic example of trade and bartering. Dale, the guitar teacher, would have had to pay for tile installation if he hadn't bartered with Terrence, the tile layer. Terrence, on the other hand, would have had to pay for guitar lessons if he hadn't traded with Dale.

Both Dale and Terrence, therefore, benefit from the trade, and they are both better off as a result. Because Dale receives tile installation in exchange for teaching guitar lessons, and Terrence receives guitar lessons in exchange for tile installation, both benefit.

In conclusion, the answer is (b) both Dale and Terrence are made better off by trade. When both parties are better off after a trade, it is known as a mutually beneficial trade. Trade, in general, promotes mutual gains by allowing people to concentrate on what they do best and exchange their output with others for goods and services that they desire. Therefore, the correct option is B.

Know more about Trade here:

https://brainly.com/question/24431310

#SPJ8

Reedy Company reports the following information for 2012:

Cost of goods manufactured $68,250

Direct materials used 27,000

Direct labor incurred 25,000

Work in process inventory, January 1, 2012 11,000

Factory overhead is 75% of the cost of direct labor. Work in process inventory on December 31, 2012, is:________

a. $16,250

b. $8,500

c. $18,750

d. $13,500

Answers

Answer:

Ending WIP= $13,500

Explanation:

First, we need to calculate the factory overhead:

Factory overhead= 25,000*0.75= $18,750

Now, the ending WIP inventory:

cost of goods manufactured= beginning WIP + direct materials + direct labor + allocated manufacturing overhead - Ending WIP

68,250 = 11,000 + 27,000 + 25,000 + 18,750 - Ending WIP

Ending WIP= $13,500

Choose all that apply.

Select the reliable sources of information.

an expert on television

loan information from your credit union

financial data from 1978

www.IRS.gov

a personal Web site

a presentation in a college finance class

Answers

Answer:

i believe it is a,d,e

Explanation:

which 2 statements are true about billable expenses

invoicing for a billable expense must always use an income account,

a default markup percentage can be added automatically on the invoice,

the purchase transaction

Answers

Explanation:

The two true statements about billable expenses are:

1. Invoicing for a billable expense must always use an income account: When invoicing a client for a billable expense, it is necessary to use an income account to record the revenue generated from that expense. This allows for proper tracking of the income related to the expense.

2. A default markup percentage can be added automatically on the invoice: Some businesses may choose to add a markup percentage to the original cost of a billable expense when invoicing the client. This markup percentage helps cover any additional costs or overhead associated with the expense. The use of a default markup percentage can automate this process, making it easier to calculate and include in the invoice.

Paladin Furnishings generated $4 million in sales during 2016, and its year-end total assets were $2.4 million. Also, at year-end 2016, current liabilities were $500,000, consisting of $200,000 of notes payable, $200,000 of accounts payable, and $100,000 of accrued liabilities. Looking ahead to 2017, the company estimates that its assets must increase by $0.60 for every $1.00 increase in sales. Paladin's profit margin is 3%, and its retention ratio is 55%. How large of a sales increase can the company achieve without having to raise funds externally

Answers

Answer:

$105,571.6

Explanation:

Calculation of how large of a sales increase can the company achieve without having to raise funds externally.

The first step is to calculate the self-supporting growth rate using this Formula:

Self-supporting growth rate =

M (1-POR) (S0)÷A0 – L0 – M (1-POR) (S0)

Where:

M = Net Income/Sales = 3%

POR = Payout ratio = 55%

S0 = Sales = $4,000,000

A0 = $2,400,000

L0 = Spontaneous liabilities = $200,000+$100,000 =$300,000

We are using only accounts payable and accruals for LO because they are been considered as spontaneous liabilities

Let plug in the formula

.03 (1 - .55) (4,000,000) ÷2,400,000-300,000 - .01(1-.55)(4,000,000)

=54,000÷2,100,000 – 54,000

=54,000÷2,046,000

=2.63929%

Therefore, the self-sustaining growth rate will be 2.63929%

Second step is to Calculate for how large a sales can increase

Using this formula

Sales amount * Self-sustaining growth rate

Let plug in the formula

$4,000,000×2.63929%

=$105,571.6

Therefore, the sales can increase by $105,571.6

In the event that Only1Corp. obtains control of all the natural gas producers in the US, it would most likely Group of answer choices

Answers

Group of Answers:

a. raise prices, cut production, and realize positive economic profits

b. have a patent giving it exclusive legal rights to make, use, and sell for a limited time.

c. have legal protection to prevent copying its methods of production for commercial use

d. acquire rights for its investors to produce and sell their product

Answer:

Only1Corp

a. raise prices, cut production, and realize positive economic profits

Explanation:

Only1Corp has by the above move become a monopoly by acquiring all the natural gas producers in the US and now has near or total control of the natural gas production. It will display the characteristics of a monopoly, especially that of a price maker. Its position in the marketplace will become unchallenged if there are no importers of natural gas to compete with it in the marketplace. However, it must be noted that monopolies are illegal in the US unless they are government-created monopolies.

Recently, "de-dollarization" has become a hot topic of global discussion. Recently, a Chinese think tank published an article saying that the trend of global de-dollarization has become very clear, and many countries in the world are working hard to reduce their dependence on the US dollar. The main driving force for this trend is my country's weaponization of its currency through excessive sanctions.

Answers

De-dollarization, or the reduction of dependence on the US dollar in global financial transactions, has indeed gained attention in recent years. While it is true that some countries are actively working to diversify their currency holdings and reduce reliance on the US dollar, it is essential to consider multiple factors that contribute to this trend.

One of the factors that have led to discussions about de-dollarization is the use of economic sanctions by the United States. Economic sanctions can be a powerful tool for a country to exert pressure on another nation, but they can also have unintended consequences. When the US imposes sanctions, it often restricts access to the US financial system, which is heavily reliant on the US dollar. This has prompted some countries to explore alternative methods of conducting international trade and finance to mitigate the impact of sanctions.

China, as a rising economic power, has been at the forefront of efforts to promote de-dollarization. It has taken steps to internationalize its currency, the yuan (also known as the renminbi), and has established currency swap agreements with various countries to facilitate trade settlements in yuan. Additionally, China has been promoting the use of its currency in international transactions through initiatives like the Belt and Road Initiative, which aims to enhance trade connectivity and financial integration among participating countries.

While weaponization of the US dollar through sanctions is indeed a contributing factor to the de-dollarization trend, it is not the sole driver. Other factors include concerns about the long-term stability of the US dollar, efforts by countries to reduce vulnerability to currency fluctuations, and geopolitical considerations. Some countries view de-dollarization as a way to enhance their economic and financial sovereignty, diversify risk, and reduce exposure to potential US policy changes.

It is important to note that the process of de-dollarization is gradual and complex. The US dollar still remains the dominant global reserve currency and the primary currency for international trade. The global financial system has deep-rooted structures and networks that make a rapid shift away from the US dollar challenging. However, as various countries seek to reduce their dependence on the US dollar, we can expect ongoing discussions and actions related to de-dollarization in the global economic landscape.

\(\huge{\mathfrak{\colorbox{black}{\textcolor{lime}{I\:hope\:this\:helps\:!\:\:}}}}\)

♥️ \(\large{\textcolor{red}{\underline{\mathcal{SUMIT\:\:ROY\:\:(:\:\:}}}}\)

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 8,988. The FICA tax for social security is 6.2% of the first $128,400 of employee earnings each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,491.37. Her net pay for the month is: (Round your intermediate calculations to two decimal places.) Multiple Choice $6,566.00 $6,809.04 $5,074.63 $7,366.30 $6,375.04

Answers

Answer:

$6,809.04

Explanation:

Calculation to determine what her net pay for the month is

Gross Pay (a) $8,988

Less: Deductions

Social Security Tax $557.26

($8,988 * 6.2%)

Medicare Tax $130.33

($8,988 * 1.45%)

Federal income Tax $1,491.37

Total Deductions (b) $2,178.96

Net Pay (a-b) $6,809.04

($8,988-$2,178.96)

Therefore her net pay for the month is $6,809.04

ima start selling many things on ebay,so I'm setting up a PayPal account, what's the df between these 2 tho? which one should I choose?

Answers

Can explain to me what are the financial sector of Japan?

Answers

Answer:

1.1 Core Functions of the Financial Sector

Although they are often thought of as recent phenomena, financial and payment systems have evolved over several thousand years. The manner in which transactions occur has changed remarkably over that time, but the underlying objectives have not. The economic functions performed by the first modern banks of Renaissance Italy, for instance, still apply today (Freixas and Rochet 2008).

At least four core functions can be identified.[1] The financial sector should provide the following services:

Value exchange: a way of making payments.

Intermediation: a way of transferring resources between savers and borrowers.

Risk transfer: a means for pricing and allocating certain risks.

Liquidity: a means of converting assets into cash without undue loss of value.

These are all valuable tools for a community to have. The modern economy could not have developed without the financial sector also developing these capabilities. Moreover, these core functions require the financial sector to have certain supporting capabilities, such as the ability to screen and monitor borrowers. In principle, each of these functions could be performed by individuals. But there are efficiency benefits from having institutions perform them, particularly in addressing some of the informational asymmetries that arise in financial transactions.

The provision of these core functions can overlap and interact in important ways. For example, some financial products, such as deposits, combine value exchange, intermediation, risk transfer and liquidity services. With these interactions in mind, each core function is considered in more detail below.

"I haven't missed a day of work in the past year, and I'm committed to this company, so I determined that a 20 percent salary increase is warranted for reasons of fairness," said Ted to his supervisor. In reply, Liz asked, "How did you determine that a 20 percent salary increase is fair?" If Ted had used equity theory as a basis for his request, he would have replied, "To determine a proper salary increase:______

a. I made comparisons with others' salaries."

b. I demonstrated a positive attitude as expected of me."

c. I evaluated how much I am respected."

d. I sought intrinsic rewards for myself."

e. I sought job enlargement in my position."

Answers

Answer: a. I made comparisons with others' salaries."

Explanation:

Equity theory simply refers to the principle that the actions of individuals are based on fairness and in a situation whereby there's no fairness or equity, the workers will seek to address such differences.

According to the equity theory, workers believe that everyone who puts in a similar input should get a similar reward. Therefore, in this case since Ted used the equity theory, he'll make a comparison with the salary of others.

Fill out the tax forms for:Ivy Perry, age 40, is single and has no dependents. She is employed as a legal secretary by Legal Eagle Beagle, Inc. She owns and operates Type It located near the campus of Florida Community College at 200 College Road. Ivy is a material participant in the business. She is a cash basis taxpayer. Ivy lives at 6020 College Road, Pensacola, Fla. 33210. Ivy's Social Security number is 123-44-5678. Ivy indicates that she wishes to designate $3 to the Presidential Election Campaign Fund. During 2021, Ivy had the following income and expense items: a. $50,000 salary from Legal Eagle Beagle, Inc. b. $20,000 gross receipts from her typing business c. $700 interest income from Florida Community Bank. d. $1,000 Christmas bonus from Legal Eagle Beagle, Inc. e. $60,000 life insurance proceeds on the death of her brother. f. $5,000 check given by her wealthy uncle g. $100 won in a bingo game. h. Expenses connected with the typing business: Office Rent Supplies Utilities and telephone Wages paid to part-time typists Payroll Taxes Equipment Rentals $7,000 4,400 4,680 5,000 500 3,000 i. $8,346 interest expense on a home mortgage (paid to Florida Community Savings& Loan) j. $5,000 fair market value of silverware stolen from her home by a burglar on October 12 2021; Ivy had paid $4,000 for the silverware on July 1, 2008. She was reimbursed $1,500 by her insurance company k. Ivy had loaned $2,100 to a friend, Deb Dobson, on June 3, 2018. Deb declared bankruptcy on August 14, 2021 , and was unable to repay the loan. Legal Eagle Beagle, Inc. withheld Federal income tax of $7,500 and FICA tax of $3,551 (which was adequate for 2021). Assume the loan is a bona fide debt. 1. m. Alimony of $10,000 received from her former husband, Tony Springfield. n. Interest income of $800 on City of Pensacola bonds. o. Ivy made estimated Federal tax payments of $1,000. p. Sales tax from the sales tax table of $654. q. Charitable Contributions of $2,500. What is the Total income, Adjusted gross income, Taxable income, Tax liability, and amount of federal tax due or refunded.

Answers

Based on the provided information, Ivy Perry's tax situation for 2021 is as follows:

Total Income: $71,800

Adjusted Gross Income (AGI): $47,220

Taxable Income: $34,670

Tax Liability: $3,961.40

Federal Tax Refund: $4,538.60

What is taxation?Taxation is the imposition of compulsory levies on individuals or entities by governments.

It should be noted that Taxes are levied in almost every country of the world, primarily to raise revenue for government expenditures, although they serve other purposes.

Learn more about taxation on

https://brainly.com/question/25783927

#SPJ1

Answer the following questions:

1. What is the lift when 20% of the customers are targeted by the company?

2. What is the lift when 60% of the customers are targeted by the company?

3. What is the overall accuracy of the Naïve Bayes model?

4. How many false positives does the model generate? What does that mean?

5. How many false negatives does the model generate? What does that mean?

6. What is the recall of the model?

7. What is the precision of the model?

8. What is the F-measure of the model?

9. Based on your answers to questions 3-8, comment on the overall performance of the model.

Answers

1 and 2- Without additional information about the data and the model used, it is impossible to answer questions 1 and 2 with certainty.

3- The overall accuracy of the Naïve Bayes model can be calculated by dividing the number of correct predictions by the total number of predictions.

4 and 5- Refer to false positives and false negatives.

6,7 and 8- Refer to different measures of the model's performance.

9- If the overall accuracy is high and the false positive and false negative rates are low, that suggests that the model is performing well.

To answer the first two questions, we need to know what is meant by "lift." Lift refers to the increase in response rate compared to a baseline response rate. In this case, it likely refers to the increase in the likelihood of a customer responding to the company's targeted marketing efforts compared to if they were not targeted at all. Without additional information about the data and the model used, it is impossible to answer questions 1 and 2 with certainty. However, we can say that the lift will likely be higher when more customers are targeted, as there will be more opportunities for the marketing efforts to be effective.

Moving on to question 3, the overall accuracy of the Naïve Bayes model can be calculated by dividing the number of correct predictions by the total number of predictions. Questions 4 and 5 refer to false positives and false negatives. A false positive occurs when the model predicts a positive outcome (such as a customer responding to the marketing efforts) but the actual outcome is negative. A false negative occurs when the model predicts a negative outcome (such as a customer not responding to the marketing efforts) but the actual outcome is positive.

Questions 6-8 refer to different measures of the model's performance. Recall measures the proportion of actual positives that were correctly identified by the model. Precision measures the proportion of predicted positives that were actually positive. F-measure is a weighted average of recall and precision, giving equal importance to both measures.

Based on the answers to questions 3-8, we can assess the overall performance of the model. If the overall accuracy is high and the false positive and false negative rates are low, that suggests that the model is performing well. High recall and precision scores also indicate good performance. The F-measure takes both recall and precision into account, so a high F-measure is a good sign.

For more such questions on model

https://brainly.com/question/28445323

#SPJ11

The federal government is considering providing a per-student subsidy to private schools in the country. What is the anticipated

effect of the subsidy on the supply of private education? (1 point)

At any given price, the quantity supplied of private education will increase

The demand for private education will increase

The supply of private education will decrease

At any given price the quantity supplied of private education will decrease

Answers

Answer:

At any given price, the quantity supplied of private education will incease

Explanation:

Answer:

for the quick check in connexus

Explanation:

1. the price of a substitute in production

2. Local government increases the taxes that are levied on firms.

3. a shift of the supply curve for apple juice to the left

4. At any given price, the quantity supplied of private education will increase.

5. It is impossible to tell.

All leaders tend to share several common characteristics.

O True

O False

Answers

Answer:

O True

Explanation:

Question Content Area

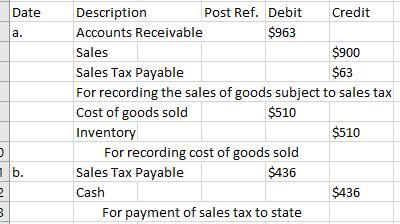

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

Write a 1-page memo to the CEO. Include each chart (3) and a paragraph per chart. Each paragraph should explain the story of each visualization and explain why visualizations are important.

STEP 2

Income CATEGORIES PERCENTAGE NUMBER

$100,000 to $124,999 8% 2

$125,000 to $149,999 4% 1

$20,000 to $24,999 4% 1

$25,000 to $34,999 29% 7

$35,000 to $49,999 13% 3

$50,000 to $74,999 17% 4

$75,000 to $99,999 21% 5

Decline to answer 4% 1

24

STEP 3

GENDER PERCENTAGE NUMBER

Female 54% 13

Male 46% 11

24

STEP 4

QUESTION RESPONSES PERCENTAGE NUMBER

0 6% 1

2 11% 2

5 28% 5

6 11% 2

7 17% 3

8 11% 2

9 6% 1

10 11% 2

18

Answers

Answer:

[Your Name]

[Your Position]

[Date]

Subject: Insights from our Survey - A Window into the Lives of our Valued Customers

Dear [CEO's Name],

I hope this message finds you well. I wanted to take a moment to share some fascinating insights from the recent survey we conducted among our cherished customer base. To make the data more relatable and easier to grasp, I have transformed the findings into a series of engaging visualizations. These visuals not only bring the data to life but also allow us to truly connect with our customers on a human level. Let's dive into the story behind each visualization and explore why these visual representations are crucial in understanding our customers.

Chart 1: Income Categories - Reflecting the Lives of our Customers

This insightful chart provides a glimpse into the diverse income categories of our survey respondents. As you observe the bars rise and fall, you can visualize the financial landscapes our customers navigate. From the bustling middle-income group, representing 29% of respondents, to the resilient individuals in the $75,000 to $99,999 range, accounting for 21% of participants, we gain an intimate understanding of the financial tapestry that influences their decisions.

By presenting this information in such a humanized manner, we can empathize with the varying needs and aspirations of our customers. This visualization guides us in tailoring our products and services to better address the unique challenges and aspirations of each income segment.

Chart 2: Gender Distribution - Celebrating Diversity and Inclusion

This delightful pie chart celebrates the diversity among our survey participants by highlighting their gender identities. As you glance at the vibrant slices, you witness the vibrant mosaic of our customer base. With 54% of respondents identifying as female and 46% as male, we recognize the importance of inclusivity and strive to ensure our products and services cater to the needs and desires of all genders.

Visualizations like this one allow us to see the human faces behind the data. It reminds us to embrace diversity and equality in our business operations, ensuring that every customer feels heard and valued.

Chart 3: Question Responses - Unveiling Our Customers' Voices

Within this insightful bar chart, we uncover the authentic voices of our customers through their responses to a specific question. The bars rise and fall, revealing the choices they made and their preferences. The most popular response, "5," chosen by 28% of participants, demonstrates the collective sentiment that echoes among our customers. As we observe the varying heights of each bar, we gain a deeper understanding of their thoughts and desires.

Visualizations like this empower us to hear our customers' voices loud and clear. By listening attentively to their responses, we can make informed decisions that resonate with their needs, aspirations, and desires.

In summary, these captivating visualizations humanize our survey data, enabling us to truly connect with our customers and gain invaluable insights. By considering the stories behind each chart, we ensure that our strategies, products, and services align with their lived experiences. Together, we can build lasting relationships, foster inclusivity, and deliver the exceptional experiences our customers deserve.

Thank you for your time and attention. Should you have any questions or require further information, please don't hesitate to reach out.

Warm regards,

[Your Name]

[Your Position]

Explanation:

To maintain financial stability in the country with reduction in deficit, Govt gets help from different international financial institutions. Discuss the different pragmas introduced by IMF, World bank, Asian development bank and Islamic development bank for Pakistan.

Answers

Answer:

Pakistan is an under developed country. The resources here are sufficient but the main constraint which hinders the country progress is heavy debt burden on it. The country is struggling to become developed as other nations in the world. Pakistan is insufficient in financial resources and all the money which country generates is offset by the interest on the debt.

Explanation:

There are times when the country has to approach different financial aid institutions in the world for the money. IMF is one of the major financial aid institution which provides finance for developing country. Pakistan has approached IMF many times and it has imposed certain covenants on the country to provide financial aid. The tax imposition, restrictions on usage of fund, military and defense restrictions are imposed on Pakistan.

Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting entries on December 31.

Answers

In accounting, adjusting entry is one that is made to properly allocate revenue and expenses to each accounting period. It corrects previously recorded journal entries, ensuring that the financial statements at the end of the fiscal year are correct and up to date.

What are the adjusting entry for these previous entries?

Cash

Unadjusted Balance - D - $26793Adjusted Balance - D - $26793Accounts Receivable

Unadjusted Balance - D - $0f - Debit - $9600Adjusted Balance - D - $9600Teaching Supplies

Unadjusted Balance - D- $10304b - Credit - $7642Adjusted Balance - D - $2662d. Prepaid Insurance

Unadjusted Balance - D - $15458a - Credit - $3071Adjusted Balance - D - $12,387e. Prepaid Rent

Unadjusted Balance - D - $2062h - Credit - $2062Adjusted Balance - D - $0f. Professional Library

Unadjusted Balance - D - $30913Adjusted Balance - D - $30913g. Accumulated Depreciation - Professional Libary

Unadjusted Balance - C - $9275d - Credit - $6142Adjusted Balance - C - $15,417Tuitiion Fees Earned

Unadjusted Balance - C - $105108f - Credit - $9600Adjusted Balance - C - $114,708Training Fees Earned

Unadjusted Balance - C - $39,158e - Credit - $4,400Adjusted Balance - C- $43,558Depreciation Expense - Professional Library

Unadjusted Balance - D - $0d - Debit - $6142Adjusted Balance - D - $6142Depreciation Expense - Equipment

Unadjusted Balance - D - $0c - Debit - $12,285Adjusted Balance - D - $12,285Salaries Expense

Unadjusted Balance - D - $49464g - Debit - $400Adjusted Balance - D - $49,864Insurance Expense

Unadjusted Balance - D - $0a - Debit - $3071Adjusted Balance - $3071Equipment

Unadjusted Balance - D - $72,119Adjusted Balance - D - $72119Accumulated Depreciation - Equipment

Unadjusted Balance - C - $16,489c - Credit - $12,285Adjusted Balance - C - $28,774Accounts Payable

Unadjusted Balance - C - $37431Adjusted Balance - C - $37431Salaries Payable

Unadjusted Balance - C- $0g - Credit - $400Adjusted Balance - C - $400Unearned Training Fees

Unadjusted Balance - C - $11,000e - Debit - $4400Adjusted Balance - C - $6600Common Stock

Unadjusted Balance - C - $11000Adjusted Balance - C - $11000Retained Earnings

Unadjusted Balance -C - $54539Adjusted Balance - C- $54,539Dividends

Unadjusted Balance - D- $41,220Adjusted Balance - D - $41,220Rent Expense

Unadjusted Balance - D - $22,682h - Debit - $2062Adjusted Balance - D - $24,744Teaching Supplies Expense

Unadjusted Balance - D - $0b - Debit - $7642Adjusted Balance - D - $7642Advertising Expense

Unadjusted Balance - D - $7214Adjusted Balance - D - $7214Utilities Expense

Unadjusted Balance - D - $5771Adjusted Balance - D - $5771Missing words "Descriptions of items a through h that require adjusting entries on December 31, 2018, follow.

a) An analysis of WTI's insurance policies shows that $3,071 of coverage has expired.

b) An inventory count shows that teaching supplies costing $2,662 are available at year-end 2018.

c) Annual depreciation on the equipment is $12,285.

d) Annual depreciation on the professional library is $6,142.

e) On November 1, WTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a monthly fee of $2,200, and the client paid the first five months' fees in advance. When the cash was received, the Unearned Training Fees account was credited. The fee for the sixth month will be recorded when it is collected in 2019.

f) On October 15, WTI agreed to teach a four-month class (beginning immediately) for an individual for $3,840 tuition per month payable at the end of the class. The class started on October 15, but no payment has yet been received. (WTI's accruals are applied to the nearest half-month; for example, October recognizes one-half month accrual.)

g) WTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per day for each employee.

h) The balance in the Prepaid Rent account represents rent for December.".

Read more about adjusting entry

brainly.com/question/13035559

#SPJ1

13. Beth is working at solo. In the past few months, Beth has noticed that her managers don't like the idea of change very much. Whenever she proposes a new idea, they are quick to shoot it down. This indicates that solo is operating at a ______level of _____________.

Answers

Answer:

b. High; Uncertainty Avoidance

Explanation:

Options are "a. High; Power Distance b. High; Uncertainty Avoidance c. High; Collectivism d. Low; Uncertainty Avoidance"

Beth is working at solo. In the past few months, Beth has noticed that her managers don't like the idea of change very much. Whenever she proposes a new idea, they are quick to shoot it down. This indicates that solo is operating at a High level of Uncertainty Avoidance. The reason for this is because manager doesn't like the ideas of change, most especially the Uncertainty that comes with new idea. The manager is practically avoiding uncertainty at high level and prefer to continue using the pre-existing operating measures and method in the organization.

In 2020, a company receives advance payments from its customers. The company will deliver the products in 2021. At the end of 2020, the company will __________ related to this transaction (enter 1, 2, 3, or 4 that represents the correct answer).

1. record a deferred tax asset

2. record a deferred tax liability

3. have a permanent difference

4. report no difference between financial income and taxable income for 2020.

Answers

Answer:

In 2020, a company receives advance payments from its customers. The company will deliver the products in 2021. At the end of 2020, the company will ____1______ related to this transaction (enter 1, 2, 3, or 4 that represents the correct answer).

1. record a deferred tax asset

Explanation:

For having paid income tax in 2020 on the cash received for deferred revenue, the company will record a deferred tax asset. This deferred tax asset will then be offset in 2021 when the sales revenue will be recorded according to the financial income accounting. Deferred tax asset arises from the overpayment or advance payment of taxes. The opposite of a deferred tax asset is called a deferred tax liability, representing income tax owed, which will be settled in the coming years.

Shiigi Urban Diner is a charity supported by donations that provides free meals to the homeless. The diner's budget for May is to

be based on 3,320 meals. The diner's director has provided the following cost data to use in the budget: groceries, $4.00 per

meal; kitchen operations, $4,620 per month plus $1.75 per meal; administrative expenses, $3,820 per month plus $0.60 per

meal; and fundraising expenses. $1,720 per month

Required:

Prepare the diner's budget for the month of May. The budget will only contain the costs listed above; no revenues will be on the

budget.

Shiigi Urban Diner

Planning Budget

For the Month Ended May 31

Budgeted meals

3,320

Groceries

Kitchen operations

Administrative expenses

Fundraising expenses

Total expense

Answers

Answer:

Shiigi Urban Diner

Diner's Cost Budget for the month of May:

Fixed Variable Total

Budgeted meals = 3,320 units

Groceries $0 $13,280 $13,280

Kitchen Operations 4,620 5,810 10,430

Administrative Expenses 3,820 1,992 5,812

Fundraising Expenses 1,720 0 1,720

Total $10,160 $21,082 $31,242

Explanation:

Cost Data and Calculations:

Budgeted number of meals to serve = 3,320

Groceries = $4.00 per meal = $13,280 ($4 * 3,320)

Kitchen operations, $4,620 per month plus $1.75 per meal =

$4,620 + ($1.75 * 3,320) = 10,430

Administrative expenses, $3,820 per month plus $0.60 per meal =

$3,820 + ($0.60 * 3,320) = $5,812

Fundraising expenses, $1,720 per month

ABC Limited entered into a contract with XYZ (Pty) Ltd for the supply of electricity to the plant of XYZ situated in Walvis Bay Namibia. The contract will come into effect on the 01 June 2020 for a period of 3 years. ABC Limited is expected per the contract to provide the electrical transformer to XYZ, as well as two electrical engineers will be sourced out to XYZ for the maintenance of the electricity supply to XYZ’s plant. ABC Limited usually sells transformers at the price of NAD 1,500,000.00; however, they will be providing the transformer to XYZ Limited free as part of the contract. ABC Limited only source out their engineers to their clients that have entered into the electricity supply contract with them. The contract stipulated the prices to XYZ as below: Monthly electricity cost NAD 175,000.00 Engineers support monthly cost NAD 120,000 XYZ may use electricity to no limit. The monthly electricity cost is at a fixed monthly rate. The appropriate nominal interest rate applicable to the internet service provision contracts is 10% per annum, compounded monthly. It remains fixed for the full period of the contract.

REQUIRED

a) Provide the journal entries to account for the contract with XYZ (Pty) Ltd in the records of ABC Limited for the year ended 31 December 2020. Journal entries are to be provided on each relevant date (do not accumulate amounts for the year).

Answers

Answer:

HOPE IT'S HELP YOU

Explanation:

I'M SORRY IF THE PICTURE IS SO BLURRY.

What is the meaning of ECONOMICS?

Answers

Answer:

Hello and welcome to Brainly! I'm Gabriella and I'm a part of the Engagement team on Brainly. Thank you for posting your first question! I hope you enjoy your time here on Brainly! If you have any questions about navigating and understanding the Brainly website, don't hesitate to reach out to me or anyone else on the Engagement team!

Explanation:

When and under what conditions might managers change from a functional to a (a) product, (b) geographic, or (c) market structure?

Answers

The managers might consider changing from a functional structure to a product, geographic or market structure under various circumstances.

Product Structure: If the organization's products or services become more diverse and complex, a product-based structure may be adopted.

This structure allows dedicated teams for each product line that improving specialization and focus on specific customer needs and markets.

Geographic Structure: When the organization expands into different regions or countries, a geographic structure becomes more suitable.

Market Structure: If the company serves diverse customer segments with unique needs, a market-based structure can be more effective.

This structure involves creating separate divisions or teams for each market segment which allowing targeted strategies and focused marketing efforts.

To know more about market structure here,

https://brainly.com/question/30280211

#SPJ2

The annual maintenance cost of a monument in the state capital is estimated to be $4850. A perpetual i fund of $100,000 is set up to pay for this maintenance expenditure. Determine the interest rate this fund earns if the interest is compounded quarterly

Answers

Answer:

4.76%

Explanation:

P[(1+i/4)^4 - 1] = A

$100,000*P[(1+i/4)^4 - 1] = $4,850

[(1+i/4)^4 - 1] = $4,850/$100,000

[(1+i/4)^4 - 1] = 0.0485

(1+i/4)^4 = 0.0485 + 1

(1+i/4)^4 = 1.0485

(1+i/4) = 1.0485^(1/4)

(1+i/4) = 1.01191

i/4 = 1.01191 - 1

i/4 = 0.01191

i = 0.01191*4

i = 0.04764

i = 4.76%

. Discuss and Implement the Price Adjustment Strategies in current market. Apply each strategy with 3 examples along with picture. (10 Marks) (200 Words)

Answers

Answer:

There are many different price adjustment strategies which can be implemented in the current market.

Explanation:

Psychological pricing:

Psychological pricing is a strategy in which the price of a product is displayed with mostly one cent difference so the whole number shown is less by $1 and this difference can get higher if the price of the product is more.

Example 1: The price for a toy in a toy shop is $4.99, if rounded this will be $5 but the whole number visible is $4.

Example 2: The price of a laptop is $193, this again is nearly $200 but the price is reduced by $7 in order to influence their customers into buying the product.

Example 3: The price of a car is $35,995, this again is about $36,000 but the buyer may be influenced by this technique and result in purchasing the product with such price.

Geographical Pricing:

Geographical pricing is a strategy where different prices are charged in different outlets, this strategy is made keeping in mind the purchasing power of the locality, if the local people can pay higher price for a product then the price is high there but same product may have a lower price in an area where people can not pay high price.

Example 1: Price of a T-shirt is $15 in a posh area while the price of the same T-shirt is $5 in an area with poor locality.

Example 2: Price of a hair brush is $10 in a poor area while the same brush is available in a posh area at a rate of $35.

Example 3: Price for a food item is $6 in a restaurant in posh area while the same burger is available for $3 in a restaurant in a poor area.

6) When you were leading your in-house team, you displayed optimism by your demeanor each day. How can you best instill a spirit of optimism with your new remote team?

A) Frame challenges as opportunities and provide the tools to meet those opportunities.

B) Frame challenges as a part of business life and encourage your team to find ways to overcome them.

C) Display your same optimistic attitude when you are on video calls with your remote team.

Answers

One can best instill a spirit of optimism in your new remote team by displaying the same optimistic attitude when you are on video calls with your remote team. Thus the correct option is D.

As a leader, your approach and attitude can have a huge impact on the well-being and drive of your team, especially while working remotely.

Encouraging your team to solve difficulties and emphasizing the opportunities that challenges bring can also assist to build an optimistic and resilient attitude.

By regularly demonstrating an upbeat attitude during video calls and other contacts with your team, you can help to establish a sense of optimism and enthusiasm among your team members.

Therefore, option D is appropriate.

Learn more about optimism, here:

https://brainly.com/question/23313835

#SPJ1

1. Some businesspeople believe that elimination agents and wholesalers reduce their operating expenses. Discuss the opportunity costs associated with eliminating intermediaries.

Answers

1. While eliminating intermediaries may result in reduced operating expenses, businesses need to weigh these savings against the associated opportunity costs. These costs may include the loss of expertise and value-added services, additional responsibilities and expenses, and reduced customer access to products.

Eliminating intermediaries such as elimination agents and wholesalers reduce operating expenses, but it also has associated opportunity costs that businesses need to consider. One of the primary costs is the loss of the expertise and value-added services that intermediaries offer to businesses and customers. Eliminating intermediaries may result in businesses taking on additional responsibilities and expenses such as marketing, distribution, and logistics.

This may result in the need for additional staff and resources to ensure that products reach customers on time. Furthermore, eliminating intermediaries may also result in reduced customer access to products, as intermediaries are often responsible for finding new markets and customer segments. In this case, businesses may need to invest additional resources to market and promote their products to reach new customers.

In conclusion, while eliminating intermediaries may result in reduced operating expenses, businesses need to weigh these savings against the associated opportunity costs. These costs may include the loss of expertise and value-added services, additional responsibilities and expenses, and reduced customer access to products.

For more such questions on opportunity costs

https://brainly.com/question/30191275

#SPJ8