Arizona Crystal is a distributor of feldspar, amethyst and other mystically powerful types of crystals. The owner of Arizona Crystal, Geri Moonbeam, is proud to be a part of the movement that is contributing to the higher spirituality of the world. Geri buys crystals from local collectors and then ships them out to wholesalers throughout the country. Geri pays cash for the crystals, but she extends credit to the wholesalers. As the business has grown, problems have arisen. When Geri buys more crystals than she can sell, inventory increases and cash flow problems arise. When Geri doesn’t buy enough crystals, then she can’t fill orders and that creates problems with her customers. She needs to base her buying decisions on accurate forecasts of the demand for crystals so she can avoid these problems. After consulting her tarot cards, Geri visits a friend from El Paso, Texas, who channels for a Wall Street tycoon who didn’t survive the crash of 1929. He recommends that, since she only has twelve months of data, she should try using a moving average or exponential smoothing forecasting model. So Geri contacts you. She provides you with data on the number of crystals (in thousands) ordered during each of the past twelve months and asks you to help her develop a forecasting model. 8. Use a five period moving average model to forecast the demand in January of 1993. Also calculate the RMSE for this model. Use the table below to carry out your calculations. How does this model compare with the three period model? Month Demand (A) Demand (F) (A-F)2 Jan-92 25.6 Feb-92 24.7 Mar-92 21.3 Apr-92 13.9 May-92 12.6 Jun-92 18.0 Jul-92 21.5 Aug-92 22.3 Sep-92 30.7 Oct-92 15.0 Nov-92 13.8 Dec-92 22.6

Answers

Answer:

Explanation:

Month Demand (A) Demand (F) (A-F)²

Jan-92 25.6 - 0

Feb-92 24.7 - 0

Mar-92 21.3 - 0

Apr-92 13.9 - 0

May-92 12.6 19.62 49.28

Jun-92 18.0 18.1 0.01

Jul-92 21.5 17.46 16.32

Aug-92 22.3 17.66 21.53

Sep-92 30.7 21.02 93.7

Oct-92 15.0 21.5 42.25

Nov-92 13.8 20.66 47.06

Dec-92 22.6 20.88 29.58

The demand for january of 1993 is 20.88

RMSE² = 49.28+0.01+16.32+21.53+93.7+42.25+47.06+29.58

=299.73

\(=\frac{299.73}{12} \\\\= 24.98\)

RMSE = √24.98

=4.99

The model has higher values of demand and RMSE than that of three month moving average model

Related Questions

what is computer ethics?

Answers

Answer:

Computer ethics is a part of practical philosophy concerned with how computing professionals should make decisions regarding professional and social conduct.

Hope you like the answer.

Answer:

Computer ethics is defined as the analysis of the nature and social impact of computer technology and the corresponding formulation and justification of policies for the ethical use of such technology. The typical problem with computer ethics is the policy vacuum that arises from the new capabilities of the technology.

Explanation:

Computer ethics essentially protect individuals online from predation: they prevent breach of privacy, identify theft, interference with work and unlawful use of proprietary software, among other events. Computer ethics govern the behavior of users online, and date back to 1992.

please mark me brainliest

Help Please with questions

Answers

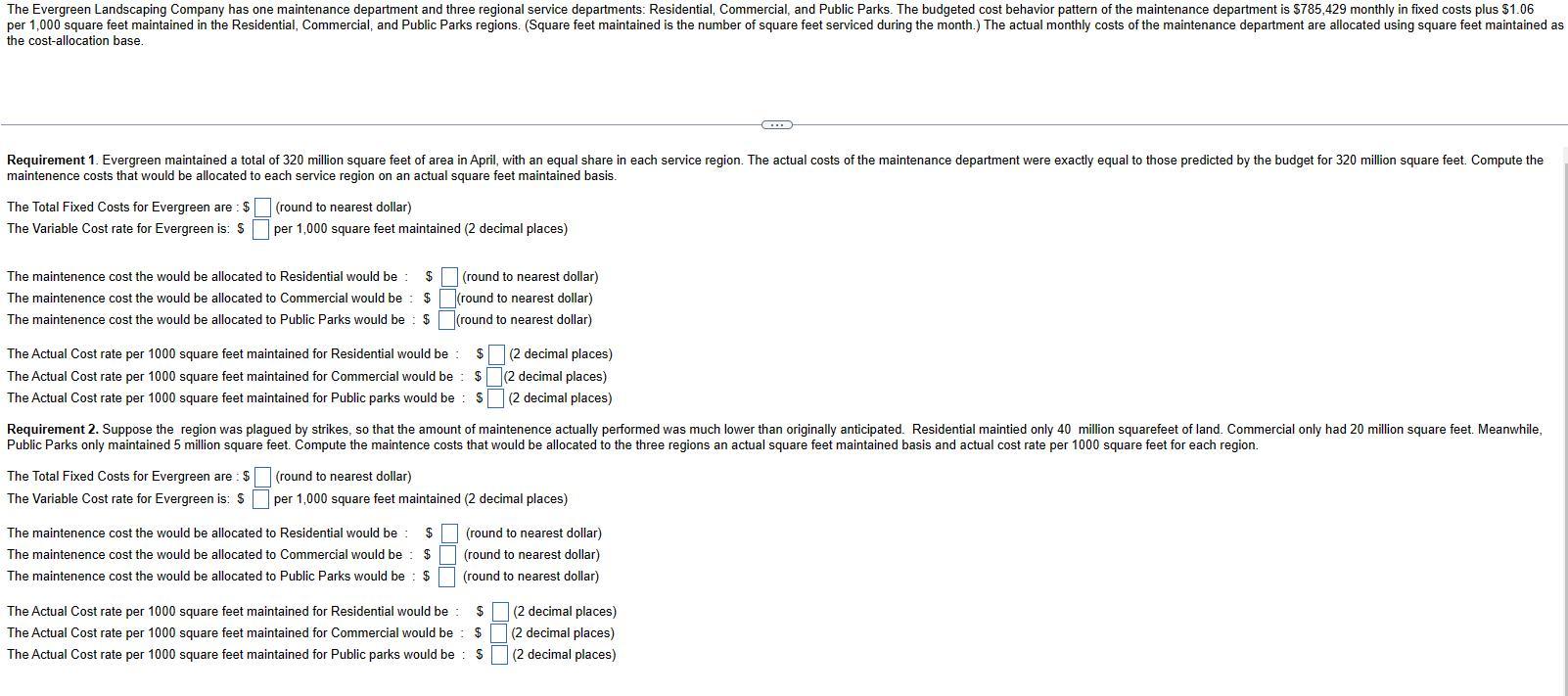

The actual cost rate per 1,000 square feet maintained for Residential region is $1.06, and for Commercial region is $1.06.

How to calculate the cost rateCalculation of total maintenance cost for Evergreen:

Total Fixed Costs (S) = $785,429

Variable Cost rate = $1.06 per 1,000 square feet maintained

Total square feet maintained in April = 320 million

Total variable cost = $1.06 per 1,000 square feet maintained * 320 million square feet / 1,000 = $339,200

Total maintenance cost for Evergreen = Total Fixed Costs + Total Variable Costs = $785,429 + $339,200 = $1,124,629

Allocation of maintenance cost to each service region:

Total maintenance cost to be allocated = $1,124,629

Since the total square feet maintained is divided equally among the three service regions, each region maintained 320 million / 3 = 106.67 million square feet.

Allocation of maintenance cost to Residential region:

Maintenance cost allocated to Residential region = (106.67 million square feet / 1,000) * $1.06 per 1,000 square feet maintained

= $113,067

Allocation of maintenance cost to Commercial region:

Maintenance cost allocated to Commercial region = (106.67 million square feet / 1,000) * $1.06 per 1,000 square feet maintained

= $113,067

Allocation of maintenance cost to Public Parks region:

Maintenance cost allocated to Public Parks region = (106.67 million square feet / 1,000) * $1.06 per 1,000 square feet maintained

= $113,067

Therefore, the maintenance cost that would be allocated to Residential region is $113,067, to Commercial region is $113,067, and to Public Parks region is $113,067.

Calculation of actual cost rate per 1,000 square feet maintained for each region:

Since the actual monthly costs of the maintenance department are equal to the budgeted costs for 320 million square feet, the actual cost rate per 1,000 square feet maintained would be the same as the budgeted variable cost rate, which is $1.06 per 1,000 square feet maintained for all three regions. Therefore, the actual cost rate per 1,000 square feet maintained for Residential region is $1.06, and for Commercial region is $1.06.

Learn more about rate on

https://brainly.com/question/119866

#SPJ1

Sam is working with his financial partner to figure out if and when the supply chain project investment will be positive. Which factor should they look for?

Answers

Sam and his financial partner should consider the net present value when making investment decisions in order to determine the profitability of the supplychain project investment.

Sam and his financial partner should look for the Net Present Value (NPV) factor when figuring out whether the supply chain project investment will be positive or not.What is Net Present Value (NPV)?Net Present Value (NPV) is a financial metric used to evaluate an investment's worth, taking into account the time value of money.

It's based on the idea that cash today is worth more than the same amount of cash in the future because it can be invested and earn a return. NPV is used to determine whether an investment is profitable or not, and it's a popular investment analysis tool.NPV is

calculated by determining the present value of the cash inflows and outflows associated with the investment, and then subtracting the initial investment outlay from the resulting figure. If the resulting number is positive, the investment is profitable; if it is negative, the investment is not profitable.

for more questions on supplychain

https://brainly.com/question/25160870

#SPJ8

following types of businesses are devoted to carrying out marketing activities

Answers

Answer:

i think lawyers

Explanation:

Why is ethics important in business give an example of how an unethical practice can affect a business

Answers

Answer:

being ethical ensures a trustworthy reputation in business, and will make sure your less likely to be sued for malpractice or involved in a major scandal. for an example, probably just make a unethical financial situation or involving social or environmental ethics

What is one of the most profitable bank services offered by a bank?

A)Debit Cards

B)Credit Cards

C)Savings Accounts

D)Electronic Fund Transfers

Answers

The McGee Corporation finds it is necessary to determine its marginal cost of capital. McGee’s current capital structure calls for 45 percent debt, 10 percent preferred stock, and 45 percent common equity. Initially, common equity will be in the form of retained earnings (Ke) and then new common stock (Kn). The costs of the various sources of financing are as follows: debt (after-tax), 5.0 percent; preferred stock, 6.0 percent; retained earnings, 11.0 percent; and new common stock, 12.4 percent.

Answers

The marginal cost of capital for McGee Corporation is 9.96%.

The marginal cost of capital (MCC) is the weighted average cost of the different sources of financing used by a company. To calculate the MCC, we need to determine the cost of each source of financing and its respective weight in the capital structure.

Given information:

Debt (after-tax) cost = 5.0%

Preferred stock cost = 6.0%

Retained earnings cost = 11.0%

New common stock cost = 12.4%

Capital structure weights:

Debt weight = 45%

Preferred stock weight = 10%

Common equity weight = 45%

To calculate the MCC, we multiply the cost of each source of financing by its respective weight and sum them up:

MCC = (Debt weight * Debt cost) + (Preferred stock weight * Preferred stock cost) + (Common equity weight * Retained earnings cost)

MCC = (0.45 * 0.05) + (0.10 * 0.06) + (0.45 * 0.11)

= 0.0225 + 0.006 + 0.0495

= 0.078

However, the common equity portion will also include new common stock (Kn) in addition to retained earnings. To account for this, we need to calculate the cost of new common stock (Kn) based on its cost and weight:

New common stock cost = 12.4%

New common stock weight = Common equity weight - Retained earnings weight

= 0.45 - Retained earnings weight

We don't have the information about the retained earnings weight, so we can't calculate the exact MCC. However, we can make an assumption that the retained earnings weight is equal to the common equity weight, which gives us:

New common stock weight = 0.45 - 0.45

= 0

In this case, the MCC would be:

MCC = (0.45 * 0.05) + (0.10 * 0.06) + (0.45 * 0.11) + (0 * 0.124)

= 0.0225 + 0.006 + 0.0495 + 0

= 0.078

Therefore, the marginal cost of capital for McGee Corporation is 9.96% (rounded to two decimal places).

For more question on marginal cost visit:

https://brainly.com/question/30165613

#SPJ8

WHich of the following is not a type of skill needed by effective leaders?

Answers

Answer:

WHich of the following is not a type of skill needed by effective leaders?

Answer. power hankering skil

b) Find the standard deviation and the coefficient of variation of the following data. 25 Marks Interval Frequency Interval Frequency 3.00-3.25 6 4.00-4.25 47 3.25-3.50 19 4.25-4.50 29 3.50-3.75 35 4.50-4.75 15 3.75-4.00 44 4.75-5.00 5

Answers

The standard deviation is 0.4182 and the coefficient of variation is 10.5%.

Given the following data Interval Frequency 3.00-3.25 64.00-4.25 473.25-3.50 194.25-4.50 293.50-3.75 354.50-4.75 153.75-4.00 445.00-4.75 5 The formula for finding the standard deviation is:\($$ \sigma =\sqrt{ \frac{\sum f(x-\overline{x})^2}{N}} $$\)

The table below shows the calculation; Interval \($X$ Midpoint ($X_i$)\) Frequency \(($f$) $x-\bar{x}$ $f(x-\bar{x})$ $(x-\bar{x})^2$ $f(x-\bar{x})^2\)

$3.00-3.25 3.125 6 -0.725 -4.35 0.525625 3.153.25-3.50 3.375 19 -0.475 -9.025 0.225625 4.279.50-3.75 3.625 35 -0.225 -7.875 0.050625 1.773.75-4.00 3.875 44 0.025 1.1 0.000625 0.274.00-4.25 4.125 47 0.275 12.925 0.075625 3.554.25-4.50 4.375 29 0.525 15.225 0.275625 7.994.50-4.75 4.625 15 0.775 11.625 0.600625 9.01.75-4.00 4.875 5 1.025 5.125 1.050625 5.25 \($\sum f=200$ $\sum f(x-\bar{x})= 3.15$ $\sum f(x-\bar{x})^2= 35.01$\)

The variance is: \($ \sigma^2 =\frac{\sum f(x-\overline{x})^2}{N} $$\sigma^2=\frac{35.01}{200}=0.1751$\)

Therefore, the standard deviation is: \($$ \sigma=\sqrt{ \sigma^2} $$$ \sigma=\sqrt{ 0.1751}=0.4182$\)

The formula for finding the coefficient of variation is:$$ C.V = \(\frac{\sigma}{\overline{x}} \times 100\% $$\)

The coefficient of variation is:$$ C.V = \(\frac{0.4182}{3.985} \times 100\% $$$C.V = 10.5\%$\)

Therefore, the standard deviation is 0.4182 and the coefficient of variation is 10.5%.

For more such questions on standard deviation

https://brainly.com/question/475676

#SPJ8

rent controls require that landlords set apartment prices below the equilibrium price level. an immediate effect is an apartment rental shortage (excess demand for apartments), because at the regulated price the quantity of apartments demanded is greater than the quantity supplied. when landlords are prevented by cities from charging market rents, which of the following listed outcomes are common in the long run? check all that apply. the quantity of available rental housing units falls. the future supply of rental housing units increases. black markets develop. nonprice methods of rationing emerge.

Answers

The quantity of available rental housing units falls and Nonprice methods of rationing emerge are the listed outcomes are common in the long run. Hence, option A and D are correct.

What is equilibrium price level?The only price at which consumer and producer plans coincide is the equilibrium price, which is reached when the quantity sought by consumers and the quantity supplied by producers, respectively, are equal.

The amount of the good supplied exceeds the quantity of the good desired if the price of the good is above equilibrium. The market is overstocked with the product.

Thus, option A and D are correct.

For more information about equilibrium price level, click here:

https://brainly.com/question/29992423

#SPJ1

if there are 25 number 05 buyers what will be market demand

Answers

Answer:

its demand increases and when the price of a commodity rises,

Explanation:

demand decreases other things remaining constant.

Prepare journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual inventory system and

the gross method.

August 1 Purchased merchandise from Aron Company for $8,000 under credit terms of 1/10, n/30, FOB destination, invoice dated

August 1.

August 5 Sold merchandise to Baird Corporation for $5,600 under credit terms of 2/10, n/60, FOB destination, invoice dated August

5. The merchandise had cost $4,000.

August 8 Purchased merchandise from Waters Corporation for $7,000 under credit terms of 1/10, n/45, FOB shipping point, invoice

dated August 8.

August 9 Paid $190 cash for shipping charges related to the August 5 sale to Baird Corporation.

August 10 Baird returned merchandise from the August 5 sale that had cost Lowe's $500 and was sold for $1,000. The merchandise was

restored to inventory.

August 12 After negotiations with Waters Corporation concerning problems with the purchases on August 8, Lowe's received a price

reduction from Waters of $700 off the $7,000 of goods purchased. Lowe's debited accounts payable for $700.

August 14

At Aron's request, Lowe's paid $160 cash for freight charges on the August 1 purchase, reducing the amount owed (accounts

payable) to Aron.

August 15 Received balance due from Baird Corporation for the August 5 sale less the return on August 10.

August 18 Paid the amount due Waters Corporation for the August 8 purchase less the price allowance from August 12.

August 19

Sold merchandise to Tux Company for $4,800 under credit terms of n/10, FOB shipping point, invoice dated August 19. The

merchandise had cost $2,400.

August 22

Tux requested a price reduction on the August 19 sale because the merchandise did not meet specifications. Lowe's gave a

price reduction (allowance) of $800 to Tux and credited Tux's accounts receivable for that amount.

August 29 Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22.

August 30 Paid Aron Company the amount due from the August 1 purchase.

Answers

Based on the given merchandising transactions, a journal entry has been prepared below:

Journal EntriesNo Date General Journal Debit Credit

1 Aug 01 Merchandise inventory $6,000

Accounts payable-Aron $6,000

2 Aug 05 Accounts receivable-Baird $4,200

Sales $4,200

3 Aug 05 Cost of goods sold $3,000

Merchandise inventory $3,000

4 Aug 08 Merchandise inventory $5,000

Accounts payable-Waters $5,000

5 Aug 09 Delivery expense $200

Cash $200

6 Aug 10 Sales return and allowances $1,000

Accounts receivable-Baird $1,000

7 Aug 10 Merchandise inventory $500

Cost of goods sold $500

8 Aug 12 Accounts payable-Waters $500

Merchandise inventory $500

9 Aug 14 Accounts payable-Aron $190

Cash $190

10 Aug 15 Cash ($3,200 - $3,136) $3,136

Sales discounts ($3,200 x 2%) $64

Accounts receivable-Baird ($4,200 - $1,000) $3,200

11 Aug 18 Accounts payable-Waters ($5,000 - $500) $4,500

Merchandise inventory ($4,500 x 1%) $45

Cash ($4,500 - $4,455) $4,455

12 Aug 19 Accounts receivable-Tux $3,600

Sales $3,600

13 Aug 19 Cost of goods sold $1,800

Merchandise inventory $1,800

14 Aug 22 Sales return and allowances $600

Accounts receivable-Tux $600

15 Aug 29 Cash ($3,600 - $600) $3,000

Accounts receivable-Tux $3,000

16 Aug 30 Accounts payable-Aron ($6,000 - $190) $5,810

Cash $5,810

Read more about journal entries here:

https://brainly.com/question/14279491

#SPJ1

10. The directors of KOKO Limited issued 100,000 ordinary shares of no-par value for GH¢10 each payable as follows: on application GH¢3 and on allotment GH¢7. All issued shares were fully subscribed and monies were paid. How much was paid on application? GH 1,000,000 B. GH 300,000 C. GH 400,000 D. GH 700,000

Answers

The correct answer is B. GH¢300,000 was paid on application for the 100,000 ordinary shares issued by KOKO Limited.

The total amount raised from the issuance of 100,000 ordinary shares is calculated by multiplying the number of shares by the issue price per share. In this case, the issue price per share is GH¢10. Therefore, the total amount raised would be 100,000 shares multiplied by GH¢10, which equals GH¢1,000,000. According to the information provided, the amount paid on application iGH¢3 per share. To determine the total amount paid on application, we multiply the amount paid per share by the total number of shares. Therefore, GH¢3 multiplied by 100,000 shares equals GH¢300,000. Therefore, the correct answer is B. GH¢300,000 was paid on application for the 100,000 ordinary shares issued by KOKO Limited.

For more question on shares

https://brainly.com/question/28452798

#SPJ8

Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut.

If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit:

Selling price ($2.40 per pound) $ 2.40

Less joint costs incurred up to the split-off point where

T-bone steak can be identified as a separate product 1.60

Profit per pound $ 0.80

If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut; the remaining ounces are waste. It costs $0.19 to further process one T-bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $3.60 per pound, and the New York cut can be sold for $3.30 per pound.

Required:

1. What is the financial advantage (disadvantage) of further processing one T-bone steak into filet mignon and New York cut steaks?

2. Would you recommend that the T-bone steaks be sold as initially cut or processed further?

Answers

1. The Lone Star Meat Packers' financial advantage of further processing one T-bone steak into Filet Mignon and New York cut steaks is $0.41 per pound.

Data and Calculations:

Selling price per pound of T-bone steaks = $2.40

Split-off costs = $1.60

Profit per pound =$0.80 ($2.40 - $1.60)

6-ounce filet mignon = 0.375 pounds (6/16)

8-ounce New York cut = 0.5 pounds (8/16)

Further processing costs = $0.19

New sales prices after further processing:

Filet Mignon = $1.35 ($3.60 x 0.375)

New York cuts = $1.65 ($3.30 x 0.5)

Total price per pound = $3.00

Total cost after further processing = $1.79 ($1.60 + $0.19)

Profit per pound after further processing = $1.21 ($3.00 - $1.79)

Financial advantage from further processing = $0.41 ($1.21 - $0.80)

Thus, the financial advantage of further processing one T-bone steak into Filet Mignon and New York cut steaks is $0.41 per pound.

Learn more: https://brainly.com/question/23032790

Material costs of $200,000 and conversion costs of $214,200 were charged to a processing department in the month of September. Materials are added to the beginning of the process while conversion costs are incurred uniformly throughout the process. There were no unit in the beginning working process, 100,000 units were started into production in September and there were 8,000 units in ending working process that were 40% complete at the end of September. What was the total amount of manufacturing costs assigned to the 8,000 units in the ending work in process?

Answers

Answer:

ending WIP : 320,000

transferred out : 1,500,000

Explanation:

California taxpayers are generally opposed to higher taxes. They tend to make exceptions and to support new taxes or higher tax rates when ______.

A. the economy is bad and there is a budget deficit that needs to be fixed

B. the taxes are dedicated for specific purposes C. there is a Democratic governor in charge

D. there is Republican governor in charge

Answers

California taxpayers are generally opposed to the higher taxes. They tend to make exceptions and to support the new taxes or higher tax rates when economy is bad and there is budget deficit that needs to be fixed.

Who is a taxpayer?A taxpayer is an organization that has tax obligations. Today's taxpayers may own an identification or reference number that a government has provided to people or organizations. Income taxes and/or property taxes assessed against real estate owners are just two examples of the many various types of taxes (such as homes and automobiles). The workforce of a country is frequently referred to as a "taxpayer," as they pay taxes that fund government services and activities. The money that the people pay forms a part of the public funds, which are all the resources that the government uses or puts to use in order to satisfy present or future demands. Businesses are taxed in the same way as people are, thus their earnings and outgoings are taxable.

To learn more about taxpayer, visit:

https://brainly.com/question/14190241

#SPJ4

define credit crunch.

Answers

Answer:

"a sudden sharp reduction in the availability of money or credit from banks and other lenders."

Answer: a sudden sharp reduction in availability of money or credit from Banks and other lenders

Explanation:

Cheyenne Corp., a private corporation, received its articles of incorporation on January 3, 2024. It is authorized to issue an unlimited

number of common shares and $1 preferred shares. It had the following share transactions during the year:

Jan. 12

24

July 11

Oct. 1

Issued 47,000 common shares for $5 per share.

Issued 890 common shares in payment of a $5,479 bill for legal services.

Issued 940 preferred shares for $25 per share.

Issued 9,400 common shares in exchange for land. The land's fair value was estimated to be $51,700. Cheyenne's

accountant estimated that the fair value of the shares issued might be as high as $6 per share.

What is the average per share amount for the common shares???

Answers

The average per share amount for the common shares of Cheyenne Corp. is approximately $4.9787.

To calculate the average per share amount for the common shares of Cheyenne Corp., we need to determine the total amount of money received from the issuance of common shares and divide it by the total number of common shares issued.

Let's calculate the total amount of money received from the issuance of common shares:

Jan. 12: 47,000 common shares issued for $5 per share

47,000 common shares × $5 per share = $235,000

Now, let's calculate the total number of common shares issued:

Jan. 12: 47,000 common shares issued

The total number of common shares issued is 47,000.

Next, we can calculate the average per share amount for the common shares:

Average per share amount = Total amount of money received / Total number of common shares issued

Average per share amount = $235,000 / 47,000

Average per share amount ≈ $4.9787

Therefore, the average per share amount for the common shares of Cheyenne Corp. is approximately $4.9787.

It's important to note that the calculation assumes that there were no other common share issuances or transactions throughout the year. If there were additional issuances or transactions, they would need to be considered to calculate an accurate average per share amount.

for more such question on shares visit

https://brainly.com/question/28452798

#SPJ8

How does the government pay for roads, schools, and

emergency services?

They are funded through non-profits.

They are funded through taxes.

They are funded through charitable donations.

None of the above

Answers

Roads, schools, and emergency services are primarily funded through a system of taxation. This varies depending on the type of tax and the service being funded. The taxes are then allocated to different government departments.

Explanation:Roads, schools, and emergency services are predominantly funded by the government through a system of taxation. When residents and businesses pay taxes, that money is pooled together and divided among various governmental departments. For instance, certain taxes, like property taxes, are often used to fund local services such as schools and emergency services, while gasoline taxes can contribute to the construction and maintenance of roads. Funding for these resources can also come federally or from the state.

Learn more about Government Funding here:https://brainly.com/question/34026406

five printing jobs are waiting to be assigned at boston printing. their work (processing) times and due date are given in the following table. the firm wants to determine the sequence of processing according to spt rules. jobs were assigned a letter in the order they arrived. today is day 1 and work begins today. determine the average completion time, ulitiization metric, average

Answers

Here the Boston printing firm wants to determine the sequence of processing according to spt rules. Jobs were said to be assigned a letter in the order they arrived.

The job is said to be with the shortest processing time which processed first. This rule is said to reduce work-in-process inventory, average job completion time, and also the average job lateness by this. However, this rule is useful when the goal is said to reduce job lateness.

Spt rules is said to be a rule which sequences jobs which are to be processed on a resource in the given ascending order of their given processing times.

Hence, this is said to determine the average completion time, and ulitization metric.

To learn more about the inventory here:

https://brainly.com/question/14184995

#SPJ4

Percentage of sales budgeting can also be called _____.

arbitrary budgeting

objective and task budgeting

rule of thumb budgeting

competitive budgeting

Answers

Answer:

promotional budget is set as a percentage of current or anticipated sales

Typical percent of sales is 2%-5%

Explanation:

so I would have to say arbitrary budgetingHow would implementing the cost-volume-profit analysis benefit a company? As a manager, which income statement format do you find more useful - the traditional financial accounting method or the contribution margin method? Why?

Answers

It provides insights into the relationship between sales volume, costs, and profitability, helping managers make informed decisions about pricing, production levels, and cost management.

CVP analysis allows managers to determine the breakeven point, the level of sales needed to cover all costs, and to assess the impact of changes in sales volume, costs, or prices on the company's profitability. This analysis can guide strategic planning, budgeting, and resource allocation.

As a manager, I find the contribution margin method of income statement format more useful than the traditional financial accounting method. The contribution margin method separates costs into fixed and variable components, allowing for a clearer understanding of how changes in sales volume affect profitability.

It highlights the contribution margin ratio, which indicates the proportion of each sales dollar available to cover fixed costs and contribute to profits.

This format enables managers to analyze cost behavior, identify cost-saving opportunities, and evaluate the financial impact of different sales scenarios. It provides a more focused view of the underlying profitability drivers and aids in decision-making related to pricing, product mix, and cost control.

For more such questions on profitability visit:

https://brainly.com/question/24553900

#SPJ8

is the sun considered a gas giant or a planet

Answers

Answer:

it's considered a gas giant

I need help with 1.5 ,1.6 and 1.7 please

Answers

Answer:

1.5.1 Business venture/Venture capital

1.5.2 a) Risk: High risk for the investor(s), if research is not properly done

b) period of investment: Inexperienced

business owners that make wrong

business decisions may experience

big losses/closing down of an existing

business.

1.6.1 unit trusts

1.6.2 - share price may fluctuate

- unit trusts are not allowed to borrow,

therefore reducing potential returns.

- not good for people who want to invest for

a short period

- not good for people who want to avoid

risks at all costs

1.5.1 Stocks, also known as shares or equities, is the best type of investment opportunity i would choose in future.

It is most well-known and simple type of investment. When you buy stock, you’re buying an ownership stake in a publicly traded company.

Benefit of investment in stocks:

A. Dividend it the profit that i will get on shares

B. When I will buy a stock, there will be a hope that the price will go up so I can then sell it for a profit.

1.5.2 (a) The risk is that the price of the stock could go down, in which case I’d lose money.

1.5.2 (b) Shares in a company can be kept as long as I wish.

1.6.1 The investment chosen by Pearl is the investment in shares (joint stock exchange)

1.6.2 Disadvantages are dividend uncertainty, high risk, fluctuation in market price, limited control, residual claim etc.

*I hope it is helpful

which of the following is a good habit to protect your checking account information

Answers

Answer:

Here's a few

Explanation:

Use unique passwords for every account. You probably know that having a strong password is important.

Leverage two-factor authentication.

Be cautious of public Wi-Fi.

Update and patch your software regularly.

Install ad blockers.

Utilize features and tools provided by your bank.

A MAIN reason cited by American businesses for outsourcing jobs to other countries is the high cost of

A. labor in the United States.

B. building factories.

С. training new workers.

D. shipping products around the world.

Answers

Answer:

The correct answer is A. A main reason cited by American businesses for outsourcing jobs to other countries is the high cost of labor in the United States.

Explanation:

Outsourcing means separating from the organizational structure of the enterprise some functions performed by them independently and transferring them to other entities for execution. This decentralization process is very evident in American companies that produce manufactured goods, which place the primary production processes in other countries such as China, Mexico or Vietnam, among others, to produce their products at a lower cost, given the lower costs. labor (lower wages, lower taxes, less expensive regulations, etc.).

Answer:

The answer is A for E2020

Explanation:

Just took the Exam

Anne Dietz at Changi #3 (Singapore). Anne Dietz lives in Singapore, but is making her first business trip to Sydney, Australia. Standing in Singapore's new terminal #3 at Changi Airport, she looks at the foreign exchange quotes posted over the FX trader's booth. She wishes to exchange 1,100 Singapore dollars (S$ or SGD) for Australian dollars (A$ or AUD). What Anne sees: Spot rate (SGD = 1.00 USD) 1.3443 Spot rate (USD = 1.00 AUD) 0.7646 a. What is the Singapore dollar to Australian dollar cross rate? b. How many Australian dollars will Anne get for her Singapore dollars? a. What is the Singapore dollar to Australian dollar cross rate? The cross rate is SGD 1.0279 1.0279/AUD. (Round to four decimal places.) b. How many Australian dollars will Anne get for her Singapore dollars? Anne will get AUD nothing . (Round to two decimal places.)

Answers

Answer:

a. The Singapore dollar to Australian dollar cross rate is (SGD = 1.00 AUD) 1.0278.

b. The number of Australian dollars Anne will get is 1,070.25 Australian dollars.

Explanation:

a. What is the Singapore dollar to Australian dollar cross rate?

Given:

Spot rate (SGD = 1.00 USD) 1.3443

Spot rate (USD = 1.00 AUD) 0.7646

These imply that:

1.3443 SGD = 1.00 USD ..................... (1)

0.7646 USD = 1.00 AUD ................... (2)

From equation (2), we divide through by 0.7646 to have:

0.7646 / 0.7646 USD = 1.00 / 0.7646 AUD

1.00 USD = 1.3079 AUD

Substituting this into equation (1) and solve as follows:

1.3443 SGD = 1.00 USD = 1.3079 AUD

Dropping 1.00 USD, we have:

1.3443 SGD = 1.3079 AUD

Dividing through by 1.3079, we have:

1.3443 / 1.3079 SGD = 1.3079 / 1.3079 AUD

1.0278 SGD = 1.00 AUD

Therefore, the Singapore dollar to Australian dollar cross rate is (SGD = 1.00 AUD) 1.0278.

b. How many Australian dollars will Anne get for her Singapore dollars?

This can be calculated as follows:

Number of Australian dollars Anne will get = Amount of Singapore dollars Anne wishes to exchange for Australian dollars / Singapore dollar to Australian dollar cross rate = 1,100 / 1.0278 = 1,070.24712979179 Australian dollars

Rounding to two decimal places as required, we have:

Number of Australian dollars Anne will get = 1,070.25 Australian dollars

Therefore, the number of Australian dollars Anne will get is 1,070.25 Australian dollars.

Based on the spot rates between the three nations, the following is true:

The Singapore dollar to Australia dollar is 1.02785178 Singapore Dollars. Anne Dietz will get AUD 1,070.19.To find the cross rate, you should multiply the Singapore dollar to USD rate with the USD to Australian dollar rate:

= 1.3443 x 0.7646

= 1.02785178 Singapore Dollars

The amount that Anne would get for 1,100 SGD is:

= 1,100 / 1.02785178

= AUD 1,070.19

In conclusion, Anne would get AUD 1,070.19.

Find out more about cross rates at https://brainly.com/question/10112843.

who is the beneficiary from the entrepreneurship wealth?

Answers

Answer:

u

Explanation:

edg2020

Answer:

Money is the money that don't kniloe that money

Which of the following could be an outcome of unexpected inflation?

Export goods decrease.

Foreign goods cost less.

Worker education increases.

Workers have more purchasing power.

Answers

Answer: A. Export goods decrease.

Explanation: There is a difference between anticipated and unanticipated inflation, which typical occurs because of an unexpected event such as a pandemic or natural disaster. Because of this unexpected event, there is an increase for the demand for goods and services locally beyond what the producers can make and export overseas.

For example, during the Covid-19 pandemic, there was an increased demand for toiletries such as tissues that would help with the symptoms of the virus and resulted in a cap of the amount of boxes a consumer could purchase. Companies not only had to increase production to meet the demands, but had to reduce their amount of product being exported.

How did they get they find $200,000 loss?

Answers

Hi the answer to that would be $26,000,000