Answers

An open-end mutual fund owns 1500 share of Krispy Kreme priced at $12. The fund also owns 1,000 shares of Ben & Jerry's priced at $43, and 2,000 shares of Pepsi priced at $50. The fund itself has 3,500 of its own shares outstanding. The NAV of a fund's share is $46.

[(1,500 × 12) + (1,000 × 43) + (2,000 × 50)] / 3,500 = $46

Open-End Fund: What Is It?A diversified portfolio of investor funds that are pooled together makes up an open-end fund, which has an unlimited share issuance capacity. The sponsor of the fund both sells and buys back shares from investors. Using their current net asset value as a basis, these shares are priced each day (NAV).

What distinguishes closed ended mutual funds from open ended ones?The units are regularly bought and sold in open-ended mutual fund schemes, and investors are free to join and leave the plan whenever it suits them. A predetermined number of units are issued by closed-end mutual fund schemes, which are then traded on stock exchanges.

To know more about open-end mutual fund visit:

https://brainly.com/question/28348572

#SPJ4

Related Questions

Princeton Avionics makes aircraft instrumentation. Its basic navigation radio requires $60 in variable costs and $4,000 per month in fixed costs. Princeton sells 20 radios per month. If the company further processes the radio, to enhance its functionality, it will require an additional $40 per unit of variable costs, plus an increase in fixed costs of $500 per month. The current sales price of the radio is $280. The CEO wishes to improve operating income by $1,200 per month by selling the enhanced version of the radio. In order to meet this target, the sales price to be charged for the enhanced product is

Answers

Answer:

Sales price =$405

Explanation:

A company should process further a product if the additional revenue from the split-off point is greater than than the further processing cost.

Also note that all cost incurred up to the split-off point are irrelevant to the decision to process further .

$

Sales revenue after the split-off point y

Sales revenue at the split-off point (280×20) (5,600)

Further processing cost (40× 20)+ 500 (1,300)

Net advantage from further processing 1,200

y-5600-1300=1200

y= 8,100

Sales price= Sales revenue after the split-off point/Number of units

Sales price = 8,100/20 =$405

Sales price =$405

Ayo has a day rate of N20 per week of 48hours plus a cost of living bonus of N20 per hour worked under the Halsey method of remuneration. He is given an Shours task to perform which he completed in hrs, he is allowed 30% of the time saved as bonus. What will be his gross wages under:

(i)

Rowan's plan; and

(ii)

Halsey plan

Answers

Ayo's gross wages under the two plans are as follows:

i) Rowan's plan = $270ii) Halsey plan = $252.What is Halsey's remuneration method?Halsey's remuneration method pays the worker at the time rate for hours worked plus the bonus at a specified percentage of the saved time.

One feature is that the worker is induced to save time for an increased bonus while the output quality may suffer.

What is Rowan's remuneration method?On the other hand, a worker is paid based on the hours worked, not saved hours, under Rowan's remuneration method.

The formula for computing the gross wages under Rowan's plan is:

Hours worked × Rate per hour + (Time taken / Time allowed × time saved × rate per hrs)

Day rate per week of 48 hours = $20

Cost of living bonus = $20 per hour worked

The total hours given to perform a task = 8 hours

The hours Ayo used to complete the task = 6 hours

Savings of time = 2 hours (8 - 6)

Allowance for time saved = 30%

Gross wages under:i) Rowan's plan = Hours worked × Rate per hour + (Time taken / Time allowed × time saved × rate per hr) + Cost of Living Bonus

= $270 [($20 x 6) + (6/8 x 2 x $20) + ($20 x 6)]

ii) Halsey plan = Hours worked × Rate per hour + (Time saved × rate per hr) + Cost of Living Bonus

= $252 [($20 x 6) + (30% of 2 x $20) + ($20 x 6)]

Learn more about hourly pay rates at https://brainly.com/question/21949345

#SPJ1

Question Completion:He is given an 8 hours task to perform which he completed in 6 hrs, he is allowed 30% of the time saved as a bonus.

It is December 31, the end of the year, and the controller of Saxton Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, the company reports the following data: LOADING...(Click the icon to view the data.) Saxton determines that the net realizable value of ending inventory is $48,000. Show what Saxton should report for ending inventory and for cost of goods sold. Identify the financial statement where each item appears. Financial statement where item is reported Balance to be reported Inventory Balance Sheet Cost of goods sold Income Statement 393000

Answers

The inventory that will be reported on the balance sheets is $43000 while the cost of goods sold is $455000

Your question is incomplete. A similar question will be used on guiding you. Let's assume the following figures:

The net realizable value of ending inventory = $43000Historical cost of ending inventory = $58000Cost of goods sold = $440000To know the inventory amount that will be reported on the balance sheets, you've to select the lowest between the net realizable value of the ending inventory and the historical cost of ending inventory. The lowest is $43000.

The cost of goods sold that'll be reported will be:

= $440,000 + $15,000

= $455,000

Read related link on:

https://brainly.com/question/24952762

A customer purchased some goods on credit from Stears Corp. The customer then returned $750 worth of goods to the company because he found them to be defective. What will the contra revenue journal entry by the accountant be? A. Customer Account (debit) 750; Sales Return Account (credit) 750 B. Sales Return Account (debit) 750; Customer Account (credit) 750 C. Sales Return Account (debit) 750; Sales Account (credit) 750 D. Sales Account (debit) 750; Sales Return Account (credit) 750 E. Sales Return Account (debit) 750; Cash Account (credit) 750

Answers

Answer: I went with A I'm not confident in it thou

Explanation:

The following data relate to direct labor costs for the current period:

Standard costs

9,000 hours at $5.50

Actual costs

8,500 hours at $5.75

What is the direct labor rate variance?

Answers

Answer:$2,125 unfavorable

Explanation:

Given

Standard costs 9,000 hours at $5.50

Actual costs 8,500 hours at $5.75

we have two formulas to calculate for direct labor rate variance is:

1ST ----Direct Labor rate variance = (Actual Rate- Standard Rate ) x Actual hour

=( $5.75 -$5.50) x 8,500 = $2,125 unfavorable

2ND----Direct Labor Rate Variance=Actual Direct Labor Cost Incurred - Standard Direct Labor Cost Based on Actual Hours

=Actual Hours x Actual Rate -Actual Hours x Standard Rate

= ($5.75 x 8,500 hours)-($5.50 x 8,500 hours)

$48,875 - $46,750 = $2,125 unfavorable

when the actual rate is higher than the standard rate, the Direct Labor Rate Variance is unfavorable and if the actual rate is lower than standard rate, the variance is favorable.

Aldo Redondo drives his own car on company business. His employer reimburses him for such travel at the rate of 42 cents per mile. Aldo estimates that his fixed costs per year—such as taxes, insurance, and depreciation—are $2,200. The direct or variable costs—such as gas, oil, and maintenance—average about 17.0 cents per mile. How many miles must he drive to break even? (Do not round intermediate calculations. Roundup your answer to the next whole number.)

Answers

Answer:

Break even in miles = 8800 miles per year

Explanation:

The break even in units is the number of units that must be sold in order for the total revenue to be enough to cover total costs or in order for the total revenue to be equal to the total costs.

In the given scenario, the units are miles driven and the break even in units will be the number of miles to be driven to cover total costs.

The formula for break even in units is as follows,

Break even in units = Fixed costs / Contribution margin per units

Where,

Contribution margin per units = Revenue per unit - Variable cost per unit

Contribution margin per units = 0.42 - 0.17

Contribution margin per units = $0.25 per mile

Break even in miles = 2200 / 0.25

Break even in miles = 8800 miles per year

Which part of the citation below refers to the publisher?

“Projections Overview.” Occupational Outlook Handbook. Bureau of Labor Statistics, 29 March 2012. Web. 1 May 2013.

a)Bureau of Labor Statistics

b)Occupational Outlook Handbook

c)Projections Overview

d)Web

Answers

Answer:

A

Explanation:

the bureau of labor statistics is the company publishing the book, the occupational outlook handbook is what they published, projection overview is the specific chapter or part of the handbook. and web is just stating what form the citation is in

Bureau of Labor Statistics of the citation below refers to the publisher. “Projections Overview.” Occupational Outlook Handbook. Bureau of Labor Statistics, 29 March 2012. Web. 1 May 2013. The correct option is a.

What is the Bureau of Labor Statistics?The U.S. Bureau of Labor Statistics gathers, examines, and disseminates trustworthy data on a variety of aspects of our economy and society. We track changes in employment, pay, worker security, output, and prices.

The Bureau of Labor Statistics (BLS) is a United States government agency that collects, analyzes, and disseminates statistical data on the American labor market and economy. The BLS is responsible for producing a wide range of economic and employment data, including the monthly Employment Situation Report, which provides the latest information on employment, unemployment, and wages in the United States.

Other key data produced by the BLS include the Consumer Price Index (CPI), which tracks changes in the prices of goods and services over time, and the Producer Price Index (PPI), which measures changes in the prices of goods and services purchased by businesses.

Thus, the ideal selection is option a.

Learn more about the Bureau of Labor Statistics here:

https://brainly.com/question/25414516

#SPJ7

1. Complete a SWOT Analysis for the company of Target from information provided by sources on the internet (Please provide the sources you used to obtain the information!!!)

2. What is the company’s (Target) perspective on diversification (Single-Product, Related, or Unrelated) of their business? If applicable, complete a BCG Matrix for the company.

3. What are some examples of programmed decisions the company (Target) makes? What are some examples of non-programmed decisions the company makes?

4. What is the organization’s structure (basic form of an organization)? Do they utilize job specialization, enlargement, or enrichment? If so, how?

5. How do they (Target) handle HR issues, such as employee compensation, hiring, etc.?

PLS ANSWER FULLY AND PROVIDE THE SOURCES WHERE YOU FOUND THE INFORMATION! PLS HELP

Answers

SWOT Analysis for Target are Strong brand recognition and reputation and Dependence on the US market. Programmed decisions that Target makes include routine decisions such as restocking inventory, pricing products, and processing transactions.

SWOT Analysis for Target:

Strengths:

Strong brand recognition and reputation

Large and diverse product offerings

Wide geographic presence with over 1,900 stores in the US

Weaknesses:

Dependence on the US market

Intense competition from online retailers like Amazon and Walmart

Limited international presence

Opportunities:

Expanding into new international markets

Growing e-commerce and online sales

Offering more sustainable and eco-friendly products

Threats:

Economic instability and uncertainty

Political and regulatory risks

Rapidly changing consumer preferences and trends

Programmed decisions that Target makes include routine decisions such as restocking inventory, pricing products, and processing transactions. Non-programmed decisions may include strategic decisions such as entering new markets, expanding product lines, or responding to unexpected events such as natural disasters.

learn more about swot analysis here

https://brainly.com/question/29889062

#SPJ1

Ginger, Inc., has declared a $6.40 per share dividend. Suppose capital gains are not taxed, but dividends are taxed at 10 percent. New IRS regulations require that taxes be withheld at the time the dividend is paid. The company's stock sells for $94.50 per share, and the stock is about to go ex dividend. What do you think the ex-dividend price will be?

Answers

Answer:

$88.74

Explanation:

Ginger incorporation has declared a dividend of $6.40 per share

The dividends are taxed at 10%

= 10/100

= 0.1

The company's stock is sold at $94.50 per share

Therefore, the ex-dividend price can be calculated as follows

Ex-dividend price= Current selling price-dividend(1- tax rate)

= $94.50-$6.40(1-0.10)

= $94.50-$6.40(0.9)

= $94.50-$5.76

= $88.74

Hence the ex-dividend price is $88.74

what the role of marketing

Answers

Answer:

The Marketing Department plays a vital role in promoting the business and mission of an organization. It serves as the face of your company, coordinating and producing all materials representing the business.

Explanation:

hope this helps and I want brainless

Bren Company sold a car for $17,100. The cost of the car was $37,000 and the depreciation expense was recorded at 10% for five and a half years. What was the gain or loss on disposal?

Answers

The loss on the disposal of the car is $-16,200.

The first step is to determine the total depreciation on the car.

Depreciation expense = percentage depreciation x cost of the asset

$37,000 x 0.1 = $3700

The second step is to determine the book value of the car = cost of the car - depreciation

$37,000 - $3700 = $33,300.

The book value is greater than the selling price of the car, so there was a loss on the sale. The third step is to determine the gain on the sale.

Loss = $17,100 - $33,300 = $-16,200

A similar question was answered here: https://brainly.com/question/24357323

FILL IN THE BLANK. when a country's currency appreciates, its exports will ___ and its imports will .___

Answers

A nation whose imports exceed its exports will have lower currency demand. Trade balances can fluctuate, which causes currencies to do the same.

What does the word "demand" actually mean?

to make a firm request and convey that you don't anticipate being refused: I sought a response. This year, the union is calling for a 7% salary increase. He has always expected his kids to act in accordance with the greatest moral standards. Demand describes the consumer's desire and willingness to purchase a good or service at a specific time or over an extended period of time. Additionally, consumers must be able to afford the items they want or need based on their budgeted disposable income.

Know more about fluctuate Visit:

https://brainly.com/question/27419417

#SPJ4

The Worker Adjustment and Retraining Notification (WARN) Act requires that

companies meet notice requirements of how many days before reducing a

workforce?

OA. 60 days

B. 30 days

C. 90 days

OD. 14 days

Answer: A. 60 days

Answers

The Worker Adjustment and Retraining Notification (WARN) Act requires that companies meet notice requirements of 60 days. Option A

What is meant by the (WARN) Act ?Mass layoffs and qualified plant closings are now more likely to be announced in advance according to the Worker Adjustment and Retraining Notification (WARN) Act. To help employees and employers understand their rights and obligations under the terms of WARN, the U.S. Department of Labor has compliance support materials available.

Provides protection for workers, their families, and communities by mandating the majority of firms with 100 or more employees to notify affected parties about plant closures and mass layoffs 60 days in advance.

Read more on the WARN act here:https://brainly.com/question/29527320

#SPJ1

Can someone help me with this ?

Answers

Answer:

come over

Explanation:

girls only and ima need hella yay

A loss is when:

A. Revenue is greater than expenses.

C. Revenue is equal to expenses.

B. Revenue is less than expenses.

D. None of the above.

Answers

Answer: B. Revenue is less than expenses.

Explanation:

Gains on the sale of long-term assets are:

A. added to operating activities.

B. added to investing activities.

C. added to financing activities.

D. subtracted from operating activities.

Answers

Gains on the sale of long-term assets are added to investing activities. Therefore, option B is correct.

When a long-term asset is sold at a gain, the cash received from the sale is classified as a cash inflow in the investing activities section. This section of the statement of cash flows includes transactions related to the sale of long-term assets, such as property, plant, and equipment, and investments in other companies.

Gains on the sale of long-term assets are considered investment-related gains and are included in this section to provide a comprehensive view of the organization's investing activities.

Learn more about assets, here:

https://brainly.com/question/14826727

#SPJ1

Based on the reading of the following, and given that a company is using a product structure, which of the following outcomes would you predict?

Company A produces televisions, stereos, radios, and security systems. They use a product structure that creates separate divisions for each product line. Each product has a team, and each team is responsible for production, production planning, and quality control. The radio team has an inventory of assembled components that are identical to those used by the television team.

A. The radio team will outperform the television team.

B. The television division will spend time doing unnecessary work.

C. Shared services will spot the duplicated effort.

D. Division teams will compete for resources.

Answers

Given that a company is using a product structure then the outcome which can be predicted is C. Shared services will spot the duplicated effort.

Product structure is a hierarchical corruption of a product, generally known as the bill of accouterments. As business becomes more responsive to unique consumer tastes and secondary products grow to meet the unique configurations, BOM operation can come ungovernable.

Product structure is an illustration of how the corridor of a product fit together and interrelate with one another; generally arranged in situations of detail according to the structure. It delivers a hierarchical sorting of the particulars forming a product. For illustration, if a company has a bakery division and apparel division, each of those product-grounded divisions will have its own deals department, marketing department, manufacturing department and other functional groups.

Learn more about Product structure here: https://brainly.com/question/25769390

#SPJ1

What are two factors used to determine a credit score? Explain how they indicate good or poor credit. Write in complete

sentences

Answers

Answer:

Payment history: Lenders are most concerned about whether or not you pay your bills on time.

Amounts owed: The amount of debt you have in comparison to your credit limits affects your credit. the higher the debt the riskier you seem to a potential creditor.

Length of credit history: Having a longer credit history is favorable because it gives them a more favorable picture that you have built credit over the years with other creditors.

New credit: In general, people who open many new credit accounts in a short amount of are considered a high risk. Too many new accounts can negatively impact your credit score.

Explanation:

Step 2. Search to find any summary about the company that mentions funds for starting the business. Try to find any information containing employee data in this section.

Step 3. Find the section where the product or service is detailed. Look to see what kinds of products or services will be involved with the business. Compare this with what other similar business plans are offering.

Record the information you found for steps 2 and 3. Make sure you discuss how the company got money to start the business, employee data, and what products or services the company provides in comparison with what other similar business plans are offering.

Answers

We can see here that such company gotten after searching for company that mentions funds for starting the business is Go-o-gle.

Funds for starting the business: $1 million in funding from Andy Bechtolsheim.

Employee data: over 160,000 employees worldwide.

What is a company?A company is a legal and organizational entity formed by individuals or a group of individuals with the purpose of conducting business activities. It is an association of individuals who come together to engage in commercial, industrial, or professional activities in order to generate revenue and make a profit.

Their products are digital and online services.

Comparing this company, we see Microsoft.

Learn more about business on https://brainly.com/question/26106218

#SPJ1

You decide to go on a shopping spree. You make a purchase at Sears, and the cashiers says "Can I put your purchase on your Sears Card?" You reply "I don't have a Sears Card." The cashier asks you if you would like to apply for one. You say "Sure!" Throughout your shopping spree you purchase items at many different stores. At each of the stores this same scenario happens, the cashier asks you to apply for credit and you say yes. What will happen to your credit score?

A. It will decrease because of the number of times you have applied for credit.

B. It won't change at all because you were denied the credit card.

C. It will increase because of the number of times you have applied for credit.

Answers

Answer:

A and it can raise red flags for future creditors

At the beginning of its first year of operations, Bumper Corp. purchased $4,000 of supplies, which were debited to the Supplies account. They did not purchase any other supplies during the year. At the end of the year, it has $800 of supplies left. The appropriate adjusting journal entry is:_________.

a. Debit Supplies Esxpense s$3,200 and credt Supplies $3.200.

b. Debit Supplies $3,200 and credit Supplies Expense $3200.

c. Debit Supplies $800 and credit Supplies Expense $800.

d. Debit Supplies Expense $800 and credit Supplies $800.

Answers

Supplies expense Dr ($4,000 - $800) $3,200

To Supplies $3,200

(Being supplies expense is recorded)

Here supplies expense should be debited as it increased the expenses and credited the supplies as it decreased the assets.

Therefore we can conclude that option a is correct.

Learn more about the supplies here: brainly.com/question/13296654

Which of the outcomes in are most appealing to you? Are you more attracted to extrinsic outcomes or intrinsic outcomes?

Answers

Extrinsic outcomes are external rewards such as money, status, or recognition that come from achieving a goal. These outcomes are appealing to some individuals because they provide tangible benefits and can be easily measured by others.

On the other hand, intrinsic outcomes are internal rewards such as personal satisfaction, a sense of accomplishment, or personal growth that come from achieving a goal. These outcomes are appealing to some individuals because they provide a deeper sense of fulfillment and can be more meaningful in the long-term.

Ultimately, whether someone is more attracted to extrinsic or intrinsic outcomes depends on their personal values and goals. Some people may prioritize external rewards and seek to maximize their income or social status, while others may prioritize personal growth and seek to achieve goals that align with their passions and values.

It is important to strike a balance between both types of outcomes and to find a sense of purpose and satisfaction in the goals that we pursue.

For more such questions on goal visit:

https://brainly.com/question/25534066

#SPJ11

SEE

What characters can be included in a macro name? Check all that apply.

letters

numbers

spaces

underscores

BO

symbols

Answers

Answer:

Letter

Number

Underscores

Explanation:

A Macro names should mainly comprise of alphanumeric characters which is made up of mainly letters and numbers. Underscores as well as the first key being in capital is also important.

Space isn’t necessary as it has no clearly defined function .

Answer:

1) Letters

2) Numbers

3) Underscores

Explanation:

got it right on edge

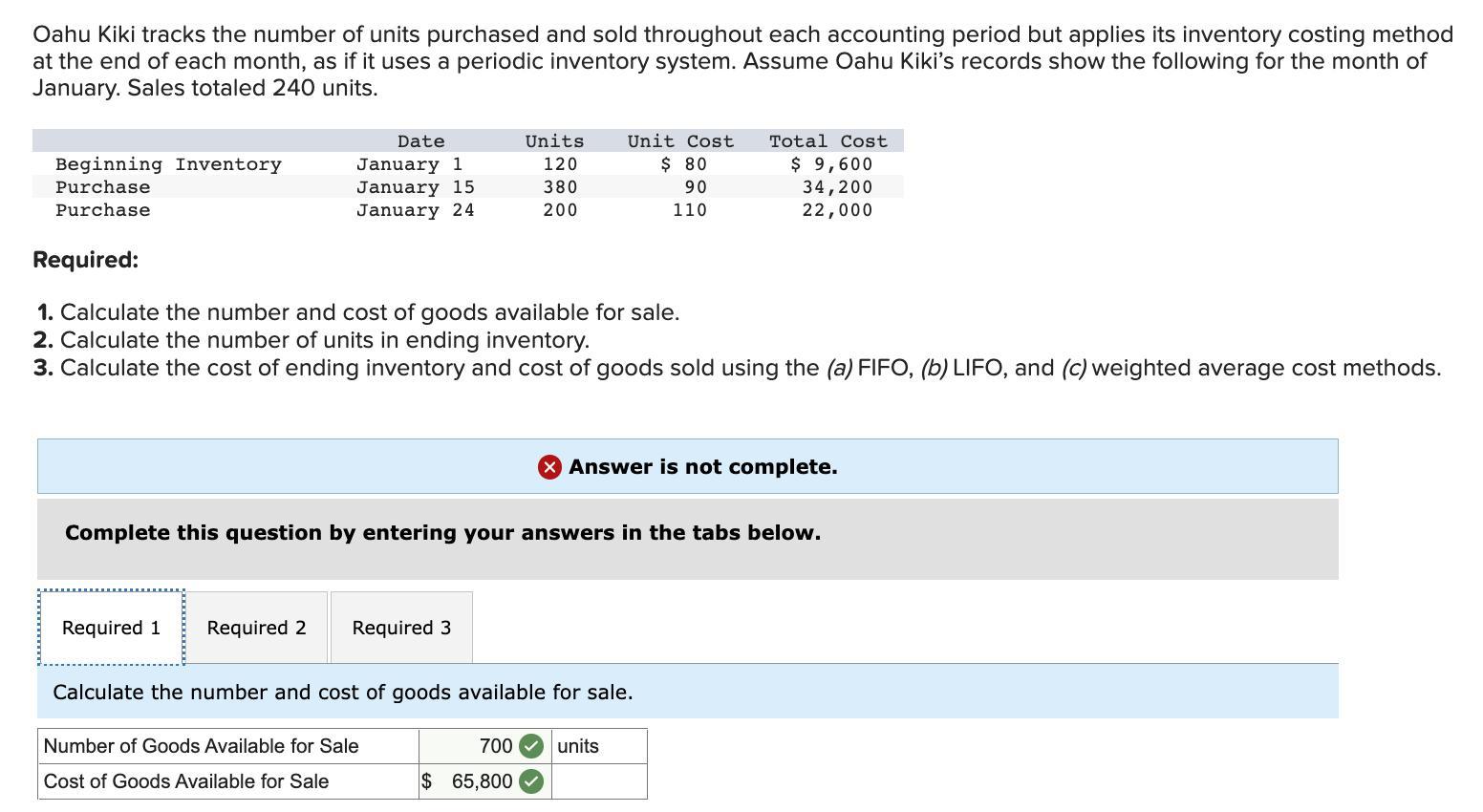

Oahu Kiki tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki’s records show the following for the month of January. Sales totaled 240 units.

Date Units Unit Cost Total Cost

Beginning Inventory January 1 120 $ 80 $ 9,600

Purchase January 15 380 90 34,200

Purchase January 24 200 110 22,000

Required:

Calculate the number and cost of goods available for sale.

Calculate the number of units in ending inventory.

Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO, (b) LIFO, and (c) weighted average cost methods.

Answers

A) The number and cost of goods available for sale are 700 units and $65,800, respectively.

B) The number of units in the ending inventory is 460 units.

C) The cost of ending inventory and cost of goods sold using the following cost methods are:

Ending Inventory Cost of Goods Sold

a) FIFO $45,400 $20,400

b) LIFO $40,200 $25,600

c) weighted average $43,240 $22,560

What is the difference between these inventory costing methods?The FIFO assumes that goods sold first are the first to be in, that is, First-in, First-out.

The LIFO method assumes the opposite of FIFO, that is Last-in, First-out.

The weighted average uses the average cost to determine the cost of goods sold and the cost of ending inventory.

Date Description Units Unit Cost Total Cost

January 1 Beginning Inventory 120 $ 80 $ 9,600

January 15 Purchase 380 90 34,200

January 24 Purchase 200 110 22,000

Total inventory 700 $65,800

Sales of units 240

Ending inventory 460

Average cost per unit = $94 ($65,800/700)

FIFO:Ending inventory = $45,400 (260 x $90 + 200 x $110)

Cost of goods sold = $20,400 ($65,800 - $45,400)

LIFO:Ending inventory = $40,200 (120 x $80 + 340 x $90)

Cost of goods sold = $25,600 ($65,800 - $40,200)

Weighted average:Ending inventory = $43,240 ($94 x 460)

Cost of goods sold = $22,560 ($94 x 240)

Learn more about inventory costing methods at https://brainly.com/question/27788988

#SPJ1

Describe the demographic segmentation that a company would use to

categorize you as a potential customer. Do you think you are representative of

that segmentation? Explain why or why not.

Answers

Seach engines are tracking all sorts of other things. Such as the most recent searches. What you've been reading so far. What you've been looking for but haven't purchased- your clothing measurements, your moral principles, the information in your emails. Psychographic profiling is all about understanding who your customers are, what really matters to them, what their values are, and how that intersects with their purchasing decisions, preferred information sources, and so on.

Demographic segmentation of customer bases is now extremely complex, allowing for micro-targeting on previously unimaginable scales. So, do I represent a segmentation? I am, indeed.

For more information on Demographic segmentation visit:

https://brainly.com/question/25198831

#SPJ1

Virginia has business property that is stolen and partially destroyed by the time it was recovered. She receives an insurance reimbursement of $6,000 on property that had a $14,000 basis and a decrease in market value of $10,000 due to damage caused by the theft. What is the amount of Virginia's casualty loss?

Answers

Answer:

$4,000

Explanation:

The computation of amount of Virginia's casualty loss is shown below:-

If property is personal property or is not absolutely destroyed, then the amount of loss of casualty is the lower of:

1. The adjusted asset base, or

2. Reducing the fair market value of the property as a result of the incident

But loss of casualty, should be decreased by any salvage value by any insurance or even other reimbursement that you obtain or consider.

Basis = $14,000

Decrease in fair market value = $10,000

Lower of above = $10,000

From insurance company the Reimbursement is = 6000

So, the Loss of Casualty = $10,000 - $6,000

= $4,000

You want to earn a return of 10% on each of two stocks, A and B. Each of the stocks is expected to pay a dividend of $4 in the upcoming year. The expected growth rate of dividends is 6% for stock A and 5% for stock B. Using the constant-growth DDM, the intrinsic value of stock A? A.. Will be higher than the intrinsic value of stock B B. Will be the same as the intrinsic value of stock B C. Will be less than the intrinsic value of stock B D. None of the above

Answers

If we want to earn a return of 10% on each of the two stocks, A and B then A.. Will be higher than the intrinsic value of stock B B. Will be the same as the intrinsic value of stock B.

What are shares in the company?Shares are units of equity ownership in a corporation.companies, shares exist as a financial asset providing for an equal distribution of any residual profits, if any are declared, in the form of dividends. Shareholders of a stock that pays no dividends do not participate in the distribution of profits. Instead, they anticipate participating in the growth of the stock price as company profits increase.Shares represent equity stock in a firm, with the two main types of shares being common shares and preferred shares. As a result, "shares" and "stock" are commonly used interchangeably.Shares represent equity interests in companies or financial assets owned by investors exchanging capital for those shares. Theshares of common stock allow for voting rights and potential earnings through price appreciation and dividends. Thepreferred stock never appreciates, but is redeemable at an attractive price and provides regular dividends.Most companies own shares, but only shares of listed companies can be found on the stock exchange.learn more about shares here

https://brainly.com/question/25818989

#SPJ1

How would a mixed economic system influence the operations of an organisation such as Bos Iced Tea?

Answers

A mixed economic system combines elements of both capitalism and socialism, allowing for a balance between private enterprise and government intervention. In such a system, the government may regulate certain industries or provide social programs, while businesses are free to operate in a competitive market.

For an organization like Bos Iced Tea, a mixed economic system would mean that they could operate as a private enterprise, competing in the market to sell their products. However, they may face government regulations regarding labeling and advertising of their products. Additionally, if the government were to implement social programs that aim to improve public health, such as promoting healthier food choices, this could impact the demand for their products.

On the other hand, a mixed economic system may also provide opportunities for Bos Iced Tea. For example, the government could offer tax incentives or subsidies for companies that produce environmentally-friendly products or use sustainable business practices. This could be an advantage for Bos Iced Tea, as they are known for their use of organic and fair-trade ingredients.

Overall, a mixed economic system would impact Bos Iced Tea by providing a mix of opportunities and challenges, as they navigate the market and government regulations.

for more such questions on system

https://brainly.com/question/31807690

#SPJ11

Nathen’s home office

Answers

Answer:

Today, the Chinese own Armour and the famous Smithfield hams, together with the most quintessential American brand of all: Nathan's Famous hot dogs, with its iconic annual eating contest. ... It remains the largest total acquisition of a U.S. company by the Chinese.

Explanation:

Which financial statement would include a listing of a companies assets

Answers

Answer:

Balance Sheet

Explanation:

In accounting, Balance sheet will show a complete listing of assets, liabilities and Equity of a company within a specific time period. (For most companies, the balance sheet will be made at each end of the year)

under the Assets segment, Balance sheet will specify several accounts arranged based on their liquidity. Cash usually put at the top of the list since it's considered as the most liquid assets.

People use balance sheet to give a general measurement on Company's financial health. If for example, they noticed that the liability is significantly larger than their assets, investors might feel discourage to invest in the company.