An increase in flotation costs will most likely result in which of the following?

a. smaller dividend payments so that external equity financing is needed

b. larger dividend payments so shareholders are able to earn their requested returns

c. no charge in dividend policies because flotation costs are paid by purchases of common stock

d. larger dividend payments to offset higher taxes paid by investors

Answers

In response to the question Smaller dividend payments necessitate the use of external equity financing.

What exactly do users mean by costs?

Costs are the monetary value of spendings for goods, services, labor, products, equipment, and other pay for the goods for use by a company or other accounting entity in accounting. It is the quantity denoted as the price on invoices and recorded as an expenditure or resource cost basis in bookkeeping records.

What are some cost examples?

Cost Varieties:

Some intangibles (i.e. patents)Tools used to build (i.e. equipment, vehicles)Insurance.Fixed interest rates are included in loan agreements.Rent.Salaries are fixed amounts of money paid to employees.Utility companies (i.e. electricity, phones)To know more about Costs visit:

https://brainly.com/question/15135554

#SPJ4

Related Questions

Which of the following would not be considered as an example of industrialization

a. Replacement of human with mechanical skills

b . Improved economic organization

c . Improved extraction and working of raw materials

d. Increase in literacy

Answers

What is industrialization?

Industrialization is the local or global development of industrial activity. Replacement of human with mechanical skills would be an example of industrialization because in an industry, most of the labor is performed by automated machines rather than enforcing physicality. Think of it this way: during times where involuntary servitude was permitted, the North was industrial while the South required slaves. Improved economic organization would be an example of industrialization because through industry, economies are more efficient, accurate, and high-quality, while with physical labor, things are produced with less quality and efficiency. Improved extraction and working of raw materials is an example of industrialization because with industry, things like mass production and interchangeable parts can be used to increase how the economy thrives and survives.

Your final answer: An increase in literacy would not be an example of industrialization. If you need any extra help, let me know and I will gladly assist you.

Which one of the following research is mainly concerned with generalization and with the formulation of a theory?

Analytical research.

Fundamental research.

Applied research.

Quantitative research.

Answers

Answer:

b fundamental research

Explanation:

Fundamental research is mainly concerned with generalizations and with the formulation of a theory. It is undertaken for the sole purpose of adding to our knowledge that is fundamental and generalizable. It is called pure or basic research.

What is a survey?

A. It is when only a portion of a population is researched.

B. It is a research method where the researcher assembles small

groups of people.

C. It involves recording actions or events related to buying behavior.

D. It is a set of questions used for gathering data.

Answers

Ex: let's say it's like school they gym survey they would ask you questions about your health or your activity and things like that so they can know if your health is good or not

It is a set of questions used for gathering data is a survey. Hence, option D is correct.

What is gathering data?Data collection is the process of gathering and measuring information on variables of interest in a systematic and prescribed manner in order to respond to specific research questions, test hypotheses, and evaluate findings.

The methods usually utilized in TNA to collect data include surveys and interviews. Because each TNA has characteristics that make it more or less effective according on the situation and the parties involved, it is necessary to select which one to utilize.

Data enables businesses to evaluate the efficacy of a certain strategy: Gathering data after implementing solutions to a problem will allow you to determine how well your strategy is functioning and whether it needs to be modified over time.

Thus, option D is correct.

For more details about gathering data, click here:

https://brainly.com/question/17538970

#SPJ5

The following data are taken from the income statement columns of the worksheet of a merchandising business for the year ended December 31.2002. Net income.........12,500

Sales .....................45,000

Income Summary....10,000 dr and 6000 cr

Gross Purchase......19,750

Purchase Ret. And Allowances....200

Required

prepare a correct trail balance for the company as june 30,2001 assuming every account in the ledger has a normal balance

Answers

To prepare a correct trial balance, we need to list all the accounts and their balances (debit or credit) as of December 31, 2002. Here's the trial balance:

What is in the trial balance?Account Debit Credit

Cash

Accounts Receivable

Inventory

Supplies

Prepaid Insurance

Equipment

Accum. Depreciation - Equipment

Accounts Payable

Salaries Payable

Interest Payable

Income Taxes Payable

Common Stock

Retained Earnings

Sales |45,000

Sales Returns and Allowances |200

Cost of Goods Sold 19,750|

Gross Profit 25,250|

Operating Expenses

Interest Expense

Insurance Expense

Rent Expense

Salaries Expense

Utilities Expense

Income Summary 10,000 | 6,000

Net Income 12,500 |

Total 67,000 | 67,000

Note that the total debits equal the total credits, which confirms that the trial balance is in balance. Also, the Income Summary account has been closed to Retained Earnings, and the final net income amount has been included in Retained Earnings.

learn more about trial balance: https://brainly.com/question/24914390

#SPJ1

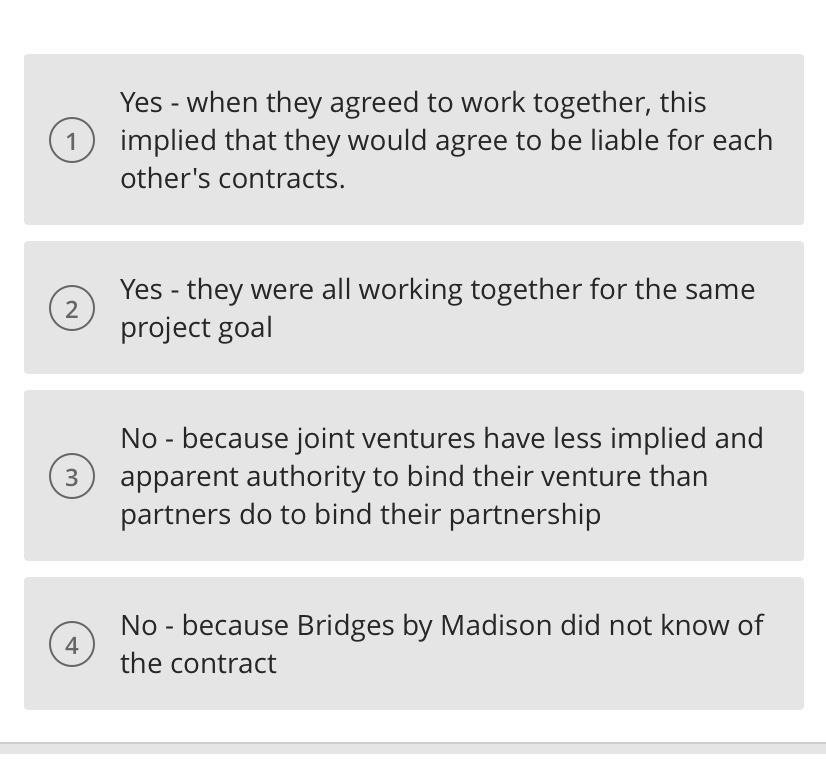

A bridge on a prominent public roadway in the city of Springfield, Ohio, was deteriorating and in need of repair. The city posted notices seeking proposals for an artistic bridge design and reconstruction. Bridges by Madison LLC, owned and managed by Madison Mason and his wife, May Mason, decided to submit a bid for a decorative concrete project that incorporated artistic metalwork. They contacted Pablo Hand, a local sculptor who specialized in large-scale metal designs, to help them design the bridge. The city selected their bridge design and awarded them the contract for a commission of $184,000. Bridges by Madison and Hand then entered into an agreement to work together on the bridge project. Bridges by Madison agreed to install and pay for concrete and structural work, and Hand agreed to install the metalwork at his expense. They agreed that overall profits would be split, with 25 percent to Hand and 75 percent going to Bridges by Madison. Hand designed numerous metal pig sculptures that were incorporated into colorful decorative concrete forms designed by May Mason, while Madison Mason performed the structural engineering. The group worked together successfully until the completion of the project. Suppose Hand had entered into an agreement to rent space in a warehouse that was close to the bridge so that he could work on his sculptures near the location at which they would eventually be installed. He entered into the contract without the knowledge or consent of Bridges by Madison. In this situation, would a court be likely to hold that Bridges by Madison was bound by the contract that Hand entered? Help please here is the multiple choices

Answers

Answer:

Bridges by Madison and Hand

Agreement by Hand for a Warehouse:

1. Yes - when they agreed to work together, this implied that they would agree to be liable for each other's contracts.

Explanation:

This is especially as far as this joint project is concerned. Since the purpose of the warehouse was to further and fulfill the project, the agreement entered into by hand for a warehouse affects Bridges by Madison.

In a joint venture, every aspect of the project's lifetime is shared: shared profits, shared losses, shared rewards, shared risks, shared obligations and responsibilities, shared rights and privileges until the end of the project, which also ends the joint venture, unless there is a binding agreement to the contrary. In such a case, Hand would not have been a joint-venturer but a sub-contractor.

In what way, if any, does click-jacking differ from cross-site scripting?

Answers

The click-jacking differ from cross-site scripting in the presence of an injected third-party JavaScript or malicious script in XSS.

Clickjacking is an interface-based attack in which a user is tricked into clicking on actionable content on hidden website by clicking on another content in a decoy website.

The click-jacking is an attack that tricks a user into clicking a webpage element which is invisible or disguised as another element. On the other hand, cross-site scripting is an attack in which an attacker injects malicious executable scripts into the code of a trusted application or website.

To know more about click-jacking here,

https://brainly.com/question/10742940

#SPJ1

Bonita Company has the following inventory information. July 1 Beginning Inventory 30 units at $90 5 Purchases 70 units at $90 14 Sale 45 units 21 Purchases 40 units at $90 30 Sale 28 units Assuming that a perpetual inventory system is used, what is the ending inventory (round all unit costs to three decimal places and all cost of goods sold and balance calculations to nearest dollar) under the moving-average cost method? Select answer from the options below $6030 $6035 $6010 $6016

Answers

The ending inventory under the moving-average cost method is $6,030. Option A

How to calculate the ending inventory under the moving-average cost methodUnder the moving-average cost method, the cost of goods available for sale is divided by the total number of units available for sale to obtain an average cost per unit, which is then used to calculate the cost of goods sold and ending inventory.

Here are the calculations:

Calculate the cost of goods available for sale:

Beginning inventory: 30 units × $90 per unit = $2,700

Purchases on July 5: 70 units × $90 per unit = $6,300

Purchases on July 21: 40 units × $90 per unit = $3,600

Total cost of goods available for sale = $2,700 + $6,300 + $3,600 = $12,600

Calculate the total number of units available for sale:

Beginning inventory: 30 units

Purchases on July 5: 70 units

Purchases on July 21: 40 units

Total units available for sale = 30 + 70 + 40 = 140 units

Calculate the average cost per unit:

Total cost of goods available for sale / Total units available for sale = $12,600 / 140 = $90 per unit

Calculate the cost of goods sold:

Cost of goods sold = 45 units × $90 per unit = $4,050

Calculate the ending inventory:

Units available for sale - Units sold = 140 units - 45 units - 28 units = 67 units

Ending inventory = 67 units × $90 per unit = $6,030

Therefore, the ending inventory under the moving-average cost method is $6,030.

Learn more about ending inventory at https://brainly.com/question/24868116

#SPJ1

The debt-to-equity ratio:

Multiple Choice

Is a measure used to assess the risk of a company's financing structure.

Must be calculated from the market values of assets and liabilities.

Can always be calculated from information provided in a company's income statement.

Is calculated by dividing book value of secured liabilities by book value of pledged assets.

Is not relevant to secured creditors.

Answers

Answer: A

Explanation:

Reggie, who is 55, had AGI of $35,200 in 2022. During the year, he paid the following medical expenses:

Drugs (prescribed by physicians)

Marijuana (prescribed by physicians)

Health insurance premiums-after taxes

Doctors' fees

Eyeglasses

Over-the-counter drugs

$ 570

1,470

1,280

1,320

445

270

Required:

Reggie received $570 in 2022 for a portion of the doctors' fees from his insurance. What is Reggie's medical expense deduction?

Answers

Reggie's medical expense deduction is $7,276.

AGI, or adjusted gross income, is a person's total income minus certain deductions and is used to calculate taxable income.

Reggie, who is 55 years old, had an AGI of $35,200 in 2022. During the year, he incurred the following medical expenses:

Drugs (prescribed by physicians): $5,701

Marijuana (prescribed by physicians): $1,470

Health insurance premiums-after taxes: $1,280

Doctors' fees: $1,320

Eyeglasses: $445

Over-the-counter drugs: $270

Reggie was reimbursed $570 by his insurance company for a portion of the doctors' fees. To calculate his medical expense deduction, we first need to subtract any reimbursements from his total medical expenses.

Total medical expenses: $5,701 + $1,470 + $1,280 + $1,320 + $445 + $270 = $10,486

Reimbursements: $570

Medical expenses after reimbursements: $10,486 - $570 = $9,916

To claim a medical expense deduction, the expenses must exceed a certain percentage of AGI, which varies depending on the taxpayer's age. For taxpayers who are 65 or younger, the threshold is 7.5% of AGI. For taxpayers who are over 65, the threshold is 7%.

Since Reggie is 55 years old, the threshold is 7.5% of his AGI or $35,200 x 0.075 = $2,640.

Therefore, Reggie can deduct the portion of his medical expenses that exceed $2,640.

Amount of medical expenses that exceed the threshold: $9,916 - $2,640 = $7,276

Therefore, Reggie's medical expense deduction is $7,276.

Know more about Adjusted gross income here:

https://brainly.com/question/31249839

#SPJ8

Explain how each of the following events would affect the equilibrium price and quantity of new textbooks. (Explain which curve(s) would shift and in which direction(s).)

Answers

The events that would affect the equilibrium price and quantity of new textbooks include changes in production costs, shifts in student enrollment, changes in government policies etc.

How do these events impact the equilibrium price and quantity?The changes in production costs will shift the supply curve of new textbooks. If production costs increase, the supply curve would shift to the left resulting in decrease in the equilibrium quantity and an increase in the equilibrium price.

But if production costs decrease, the supply curve would shift to the right leading to an increase in the equilibrium quantity and a decrease in the equilibrium price of new textbooks.

Read more about equilibrium

brainly.com/question/517289

#SPJ1

Certified management accounts vs certified public accountants

Answers

Explanation:

Difference Between CPA and CMA. ... read more (CMA). Both function as accountants but with a difference in approach. A CPA certified person generally works in tax and auditing, while a CMA certified person works as a management accountant responsible for the cost and financial analysis.

What is the six steps in the IHOP to go order correct order list

Answers

Answer:

HIOP is the correct answer for this question

Suppose that you are working as a financial analyst in Bank of America Merrill Lynch. Your boss have just asked to analyze three different money market instrument yields and to suggest investment advice to its rich clients. Which of following instruments is the most desirable to invest in ? A six month T-bill rate of 1.9 % A six moth Eurodollar deposit of 1.9% A six month CD rate of 1.9 %

Answers

Answer: A six month T-bill rate of 1.9 %

Explanation:

As all the instruments are similar in terms of maturity period and return rate, the most desirable will be in terms of the one with the lowest risk.

The United States T-bill is one of the safest instruments in the world as it is backed by the full faith of the United States Government which has technically never defaulted on debt. This is therefore the lowest instrument listed and is therefore the most desirable.

Today is also the day on which your manager’s boss is collecting information about your manager’s leadership style so that they can give him a 360-degree appraisal. They assure you that your comments about your manager will remain confidential, but the nature of your thoughts is such that he probably would guess you are the person who made those comments. Specifically, you think that your manager takes offense easily, has a bad temper, and could be more effective in time management. Would you share your thoughts with your manager’s manager?

Answers

The decision to share feedback about a manager should be based on a careful evaluation of the potential impact and one's own personal values and goals.

Sharing negative feedback about a manager can be a delicate situation, especially when it may affect the manager's performance review and future career opportunities. Before deciding whether to share the thoughts with the manager's manager, it is important to consider the potential consequences and benefits of doing so.

If the feedback is constructive and could help the manager improve their leadership skills, it may be worth sharing with the manager's manager in a tactful and respectful manner. However, if the feedback is solely based on personal opinions and could harm the manager's reputation or career prospects, it may be best to keep those thoughts to oneself.

for more questions on decision

https://brainly.com/question/30452878

#SPJ11

As an aid to a congressman, provide an essay that addresses the following: Identify and summarize three fiscal policy tools that the federal government may use to combat a inflation. Explain how each tool may reduce the recession and how it impacts employment and growth.

Answers

Fiscal policy refers to the government's decisions on taxes, public spending, and borrowing that impact the economy. The government uses fiscal policy to combat inflation. To do this, the government uses a variety of tools to stimulate economic growth.

Below are the three fiscal policy tools that the federal government may use to combat inflation:

Taxation: Taxation is a fiscal policy tool that the government may use to reduce inflation. The government can increase taxes to reduce the disposable income of individuals and businesses, thereby reducing their spending. In turn, this decreases the demand for goods and services, which reduces the prices and prevents inflation.

Also, an increase in taxes can help the government raise funds, which can be used to finance government spending. Government spending: The government can use government spending as a tool to control inflation. The government can increase its spending on public goods and services.

This increases the demand for goods and services, which stimulates economic activity and helps to reduce unemployment. Additionally, it increases disposable income, thereby increasing consumption. The increased demand may lead to inflation, so the government may use other policies to control inflation, such as taxation or monetary policy.

Borrowing: The government can use borrowing to control inflation. The government borrows money from banks and other financial institutions to finance public projects. The borrowing increases the money supply in the economy, which stimulates economic activity and reduces unemployment.

Additionally, it increases disposable income, which increases consumption. However, excessive borrowing may lead to inflation, so the government must ensure that the amount of borrowing is reasonable.

In conclusion, fiscal policy tools such as taxation, government spending, and borrowing can be used to control inflation. The government can use these tools to reduce the demand for goods and services, stimulate economic activity, increase disposable income, and reduce unemployment.

However, the government must use these tools carefully and effectively to achieve the desired results and avoid any negative impact on the economy.

For more questions on: Fiscal policy

https://brainly.com/question/29392243

#SPJ8

Howarth Manufacturing Company purchased equipment on June 30, 2017, at a cost of $800,000. The residual value of the equipment was estimated to be $50,000 at the end of a five year life. The equipment was sold on March 31, 2021, for $170,000. Howarth uses the straight- line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service

Required:

1. Prepare the journal entry to record the sale.

2. Assuming that Howarth had instead used the double-declining balance method, prepare the journal entry to record the sale.

Answers

The journal entry that can be used to record the sale will be:

March 31, 2021.

Debit Cash $170000

Debit Accumulated Depreciation $562500

Debit Less on sales $67500

Credit Equipment $800000

When Howarth used the double-declining balance method, the journal entry to record the sale will be:

Debit Cash $170000

Debit Accumulated Depreciation $675584

Credit Gain on sales $45584

Credit Equipment $800000

Learn more about journals on:

https://brainly.com/question/7019628

Make an estimate -- what is the average fee to take money out of a

non-network ATM?

Answers

Answer:

Your bank's non-network fee: Your own bank may also charge you a "non-network" ATM fee for using an ATM operated by another bank or institution. These charges will typically cost between $2.00 and $3.50, depending on your bank and the tier of service you're enrolled

Rachael Hair Products shows the following budgeted and actual data for the first quarter of the current fiscal year:

Actual (9,000 units) Flexible Budget (9,000 units) Master Budget (10,000 units)

Sales $ 139,500 $ 135,000 $ 150,000

Variable costs 64,000 63,000 70,000

Fixed costs 53,000 50,000 50,000

Operating income $ 22,500 $ 22,000 $ 30,000

Required:

What type of financial control system might the company use to determine whether the company met its short-term financial objectives?

For the first quarter of the year, what was the total master budget variance?

In general, into what two component variances can the master budget variance be decomposed? What is the meaning of each of these two variances?

Comment specifically on the financial performance of this company during the 1st quarter.

What are the primary limitations of traditional financial-control models?

Answers

Rachael Hair Products may use variance analysis to assess short-term financial objectives. The total master budget variance was -$7,500, divided into sales volume and flexible budget variances. Actual operating income of $22,500 was better than the flexible budget of $22,000 but below the master budget of $30,000, showing unfavorable variances, particularly in sales volume.

The company might use a variance analysis system to determine whether it met its short-term financial objectives. This involves comparing actual results to budgeted results and analyzing the variances to identify areas where performance was better or worse than expected.

The total master budget variance for the first quarter can be calculated as follows:

Actual Operating Income - Master Budget Operating Income

= $22,500 - $30,000

= -$7,500

Therefore, the total master budget variance for the first quarter is -$7,500.

The master budget variance can be decomposed into two component variances: the sales volume variance and the flexible budget variance. The sales volume variance measures the impact of the difference between the actual sales volume and the budgeted sales volume on operating income, while the flexible budget variance measures the impact of the difference between actual variable costs and budgeted variable costs on operating income.

During the first quarter, the company's actual operating income of $22,500 was slightly better than the flexible budget operating income of $22,000, but fell short of the master budget operating income of $30,000. This suggests that the company experienced some unfavorable variances, particularly in the area of sales volume.

The primary limitations of traditional financial-control models include their focus on historical financial data, their reliance on quantitative measures of performance, and their failure to account for non-financial factors that may influence performance. Additionally, traditional financial-control models may not be flexible enough to adapt to changing business environments or to capture the full range of factors that impact organizational performance.

To know more about income, here

brainly.com/question/14732695

#SPJ1

which of the following is not a possible complication that prevents a firm from ordering at the economic order quantity level? A. A supplier offers a quantity discount.

B. A supplier places order quantity restrictions.

C. A supplier charges a fixed cost to place an order.

D. An area offers limited space to hold the inventory received from a supplier.

Answers

A supplier charges a fixed cost to place an order is the correct answer.

The economic order quantity (EOQ) is the amount of inventory that a business should order in response to changing market conditions while reducing overall ordering, receiving, and holding expenses.

The optimal circumstances for using the EOQ formula are those in which demand, ordering, and holding costs are stable across time.

The assumption that the demand for the company's products will remain constant over time is one of the key limits of the economic order quantity.

The EOQ formula's objective is to determine the ideal quantity of product units to order. If accomplished, a business can reduce the cost of purchasing, distributing, and storing units.

To know more about EOQ, visit:

https://brainly.com/question/16024963

#SPJ4

Can a business have too many channel mem

Answers

Answer:

oo many sales channels become difficult to manage and fewer committed resellers means you can foster stronger sales relationships.

Explanation:

hope it helps <3

design an approach that your team would recommend for Joseph and Nicholas to cover one area each that you deem necessary to aid in the planning and controlling functions

Answers

The combines strategic planning, performance measurement, effective communication, and continuous improvement to support Joseph and Nicholas in their planning and controlling functions. It ensures a well-defined direction, data-driven decision-making, collaboration, and a focus on growth and adaptability.

In order to aid in the planning and controlling functions, the following approach can be recommended to Joseph and Nicholas:

1. Establish Clear Objectives and Goals: The first step in planning is to establish clear objectives and goals for the team. It is important to have a clear understanding of what needs to be accomplished and what the team's priorities are.

2. Assign Responsibilities: Assigning specific responsibilities to team members helps to ensure that everyone is working towards a common goal. Joseph and Nicholas should each be assigned to cover one area that is necessary for planning and controlling functions. This will help to ensure that all aspects of the project are covered and that there is no overlap or duplication of efforts.

3. Develop a Schedule: Developing a schedule that outlines the key milestones and deadlines for the project is essential to effective planning and control. This will help to ensure that the project stays on track and that deadlines are met.

4. Monitor Progress: Regularly monitoring progress against the schedule and objectives is necessary to ensure that the project is progressing as planned. This will help to identify any issues or problems that arise and allow for corrective action to be taken.

5. Communicate: Effective communication is critical to the success of any project. Joseph and Nicholas should establish a regular communication schedule to ensure that everyone is up-to-date on the project's progress, any issues or problems that arise, and any changes to the schedule or objectives.

6. Make Adjustments: Finally, it is important to be flexible and make adjustments as needed. If the project is not progressing as planned, adjustments may be necessary to the schedule or objectives to ensure that the project stays on track and that goals are met.

for more question on adaptability

https://brainly.com/question/26810727

#SPJ8

Who will be the first Trillonare in this world ?

Answers

The person who is expected to become the first Trillionaire is Jeff Bezos, founder, and CEO of Amazon.

According to a study conducted by Comparison, Jeff Bezos could become the world’s first Trillionaire by the year 2026. This prediction was made on the basis of the average percentage of growth of Bezos’ net worth over the last five years. The study also highlighted that Bezos’ wealth has grown by an average of 34% over the last five years. At this rate of growth, his net worth could reach $1 trillion by the year 2026.

However, the current COVID-19 pandemic has had a negative impact on the economy, and Bezos’ net worth has already decreased by over $20 billion since the start of the pandemic. Despite this, it is still possible that Bezos may become the world’s first Trillionaire in the future, but there are also other contenders who could reach this milestone, such as Elon Musk, CEO of Tesla and SpaceX. However, as of now, there is no confirmed Trillionaire in the world.

Know more about Jeff Bezos here:

https://brainly.com/question/33123119

#SPJ8

5.6 Last month Quick Industries produced 900 units. This month they produced 1,264 units. What is the rate of change in production? a. 29.8% b. 32.8% c. 40.4% d. 60%

Answers

Answer: C. 40.4%

Explanation:

To find the rate of change in production, we can use the following formula:

Rate of change = (New value - Old value) / Old value * 100

Where,

Old value = Production of last month = 900

New value = Production of this month = 1264

Substituting the values in the formula,

Rate of change = (1264 - 900) / 900 * 100= 364 / 900 * 100= 0.404 * 100= 40.4%

Therefore, the rate of change in production is 40.4%, which is an option (c). I hope that this answer has helped you!

Answer:

The correct answer is C.

Explanation:

The rate of change in production is: (1264 - 900) / 900 = 0.404 or 40.4%. So, the correct answer is c. 40.4%

Zisk Co. purchases raw materials on account Budgeted purchase amounts are April, $80,000, May, $110,000, and June, $120,000. Payments are made as follows: 70% in the month of purchase and 30% in the month after purchase. The March 31 balance of accounts payable is $22,000. Prepare a schedule of budgeted cash payments for April, May, and June. (I need ending accounts payable)

Answers

Answer:

A schedule of cash payments for April, May, and June is prepared.

Explanation:

The following image shows the calculation and explanation of the cash payment schedule.

1. When talking about personal finances, always remember that you will either manage

your money or the lack of it will

Answers

It is correct to say that when talking about personal finance, always remember that you will manage your money or the lack of it, this being an essential topic for better control of your expenses and income.

How to increase control over your income and expenses?You can develop a personal budget, which is a simple and easy-to-do technique, where all your personal accounts for a period are exposed, whose objective is to increase understanding about your finances, your needs and allocation of resources for your goals.

Therefore, financial education is a topic that should be more instituted in schools and social institutions, to provide greater subsidies for individuals to understand how to balance their finances to increase their quality of life and avoid indebtedness.

Find out more about personal budget here:

https://brainly.com/question/1943261

#SPJ1

Asteria earned a $27,000 salary as an employee in 2020. How much should her employer have withheld from her paycheck for FICA taxes

Answers

Answer:

$2,070

Explanation:

Calculation to determine How much should her employer have withheld from her paycheck for FICA taxes

Social security tax 6.2%

Medicare tax which is 1.45%

Social security tax = $27,000 x 6.2%

Social security tax = $1,674

Medicare tax = $27,000 x 1.45%

Medicare tax =$391.5

FICA taxes Paycheck withheld= - $1,674 + $391.5

FICA taxes Paycheck withheld=$2,065.5

FICA taxes Paycheck withheld=$2,070 (Approximately)

Therefore How much should her employer have withheld from her paycheck for FICA taxes will be $2,070

C. Imagine you Deposit K10, 000 every six months for the next five years at an interest rate of 10% per annum. You would want to know what this value will be at the end of the period.

Required:

i. Using simple interest (5 Marks)

ii. Using compounded interest (5 Marks)

iii. If the deposits were made at the beginning of every six months (5 Marks)

iv. If the deposits were made at the end of every six months (5 Marks

Answers

i) Using simple interest, if the deposits were made at the beginning of every six months, the ending (future value) would be K127,500.

ii) Using simple interest, if the deposits were made at the end of every six months, the ending (future value) would be K122,500.

iii) Using compounded interest, if the deposits were made at the beginning of every six months, the ending (future value) would be K132,067.87.

iv) Using compounded interest, if the deposits were made at the end of every six months, the ending (future value) would be K125,778.93.

What differentiates simple interest from compound interest?The difference between simple interest and compound interest is that simple interest is only based on the principal.

On the other hand, compound interest computes interest on both the principal and accumulated interest.

Simple Interest (Deposits at Beginning):Period Principal Interest Balance

1 K10,000 K500 K10,500 (K10,000 + K500)

2 20,000 1,000 21,500 (K10,500 + K10,000 + K1,000)

3 30,000 1,500 33,000

4 40,000 2,000 45,000

5 50,000 2,500 57,500

6 60,000 3,000 70,500

7 70,000 3,500 84,000

8 80,000 4,000 98,000

9 90,000 4,500 112,500

10 100,000 5,000 127,500

Simple Interest (Deposits at Ending):Period Principal Interest Balance

1 K10,000 K0 K10,000

2 20,000 500 20,500 (K10,000 + K10,000 + K500)

3 30,000 1,000 31,500

4 40,000 1,500 43,000

5 50,000 2,000 55,000

6 60,000 2,500 67,500

7 70,000 3,000 80,500

8 80,000 3,500 94,000

9 90,000 4,000 108,000

10 100,000 4,500 122,500

Compound Interest at Ending:N (# of periods) = 10 (5 x 2)

I/Y (Interest per year) = 10%

PV (Present Value) = K0

PMT (Periodic Payment) = K10,000

Results:

FV = K125,778.93

Sum of all periodic deposits = K100,000 (K10,000 x 2 x 5)

Total Interest = K25,778.93

Compound Interest at Beginning:N (# of periods) = 10 (5 x 2)

I/Y (Interest per year) = 10%

PV (Present Value) = K0

PMT (Periodic Payment) = K10,000

Results:

FV = $132,067.87

Sum of all periodic deposits = K100,000 (K10,000 x 2 x 5)

Total Interest = K32,067.87

Learn more about simple interest and compound interest at brainly.com/question/3402162

#SPJ1

The following account appears in the ledger prior to recognizing the jobs completed in January:Work in ProcessBalance, January 1 $17,890 Direct materials 145,450 Direct labor 156,900 Factory overhead 82,470 Jobs finished during January are summarized as follows:Job 210 $72,490Job 216 44,300Job 224 84,570Job 230 149,000a. Journalize the entry to record the jobs completed.Finished Goods Work in Process Feedbackb. Determine the cost of the unfinished jobs at January 31.______________ $

Answers

Answer:

The unfinished jobs are "$52,350".

Explanation:

The given values are:

Work in process balance,

= $17,890

Direct material,

= $145,450

Direct labor,

= $156,900

Factory overhead,

= $82,470

The four finished jobs are:

Job 210,

= $72,490

Job 216,

= 44,300

Job 224,

= 84,570

Job 230,

= 149,000

Now,

According to the total of all four finished jobs:

The Journal entry will be:

Debit Credit

(a) Finished goods $350,360

Work in progress $

(b)

The unfinished jobs on January 31st will be:

= Work in progress opening balance + Direct material + Direct labor + Factory overhead - finished goods

On substituting the values, we get

= \(17,890+ 145,450+156,900+82,470-350,360\)

= \(52,350\) ($)

If a company is using a cost-focused pricing strategy, it will set prices for products based on __________________

A. what they think costumers will like.

B. how much money they want to make.

C. how much it costs to make them.

D. the current economy.

Answers

If a company is using a cost-focused pricing strategy, it will price products based on C. how much it costs to make them.

What is a cost-focused pricing strategy?It corresponds to a set of tactics and actions that a company will develop based on the manufacturing cost of its product line, that is, one of the objectives is to reduce the unit cost of production through economies of scale to price the product in a way that obtain significant profitable advantages for the positioning of the business.

Economies of scale are achieved when a company is able to use its structure to increase the quantity of manufactured products, thus being able to reduce the average cost of producing each product.

Therefore, a pricing strategy focused on cost can be a relevant competitive differentiator for a company to attract consumers and be well positioned in the market in which it operates.

Find out more about pricing strategy here:

https://brainly.com/question/20927491

#SPJ1

lidge points from all the parts i

Part A

1) What is the idea behind frequency distribution?

2) Which is the common sampling method?

3) What is the measure of central tendency called?

4) What observation basically describes a sample size?

5) What is the measure of dispersion from a mean called?

6) Sample mean or the population mean: which varies the most?

7) Sample mean or individual observation: which varies the most?

8) What is the benefit of increasing the sample size?

9) Numerically characterize a Standard Normal Distribution

Answers

Answer:

a frequency distribution is an overview of all different values in some variable and the number of times they occur that is frequency distribution tells how frequencies are distributed over values frequency distributions are mostly used for summarizing categorical variables.

in non probability sampling the sample is selected based on the random criteria and not every member of the population has a chance of being included, non probability sampling methods include convenience sampling voluntary response sampling purposive sampling snowball sampling and quota sampling.

in statistics a central tendency (or measure of central tendency) is a central or typical value for a probability distribution. ... Colloquially measures of central tendency are often called averages the term central tendency dates from the late 1920s