A company should consider political and legal factors such as monetary regulations, political stability, the country's attitudes toward international buying, and ________ when determining whether to enter a specific country.

A) size of population

B) government bureaucracy

C) natural resources

D) income distribution

E) cultural norms

Answers

B) Government bureaucracy, When a company is deciding whether or not to enter a specific country, they need to consider various political and legal factors that can affect their business operations. One such factor is the level of government bureaucracy in the country.

This refers to the complexity and efficiency of the government's administrative processes, such as obtaining permits and licenses, registering a business, and complying with regulations.

A high level of bureaucracy can make it difficult and time-consuming for a company to operate in the country, while a low level can make it easier and more efficient. Other factors to consider include monetary regulations, political stability, the country's attitudes toward international buying, and cultural norms.

By analyzing these factors, a company can make an informed decision about whether to enter a particular country and how to adapt its business operations to the local market.

To know more about Government bureaucracy visit:

https://brainly.com/question/30775796

#SPJ11

Related Questions

You work in a company that has snacks in the kitchen. You realize that a coworker never brings their own food or eats out, but instead eats 5-6 snacks each day. You’re aware that other employees help themselves to snacks, but limit themselves to 1 snack per day.

Answers

In case you worry about your colleague's frequent munching tendencies, try initiating a cordial and objective dialogue without any hint of criticism. Voice your concern regarding their welfare and enquire on how to assist them in choosing healthier snacks.

How should you treat this situation?Additionally, it may be plausible that this coworker has an underlying medical condition or dietary limitation prompting he requires more snack breaks than what is perceived as normal practice. In such cases, supportive understanding will go a long way in the person's psychology boosting.

Furthermore, for workers who only snack once each day, disparities impact different dietary necessities and lifestyle preferences aside from health aspects. Hence, gauging an individual in line with someone else proves futile due to numerous factors at play.

Read more about work ethics here:

https://brainly.com/question/12156293

#SPJ1

What is one way that technology can improve the production of goods? Websites can allow consumers to purchase goods online. Container ships can transport a number of goods at once. Automation can create goods more cheaply and easily. Airlines can send goods from one place to another. WILL MARK BRAINLIEST

Answers

One way that technology can improve the production of goods is : ( C ) Automation can create goods more cheaply and easily

What is AutomationAutomation is the creation and application of technologies to the process of production and distribution of goods and services with minimal or no human intervention. Automation makes the creation of goods easier and with less cost.

Hence we can conclude that One way that technology can improve the production of goods is Automation can create goods more cheaply and easily.

Learn more about Automation : https://brainly.com/question/11211656

#SPJ2

Chin needs more money in his net pay each month so he plans to reduce his federal income tax deduction from 12% to only 11% his monthly gross pay is $3500 in his deductions before they change a list in the table what will be his new monthly net pay round your answer to the nearest dollar

Answers

Answer:

$2891

From online search: The table and multiple-choice answers to this questions are as below

The table

Deduction Dollar Amount

Federal Income Tax $420

State Income Tax $95

Social Security $89

Medicare $40

multiple-choice answers

$2821

$2857

$2860

$2891

Explanation:

Chin wants to reduce the federal income tax deduction from 12% to only 11% .

The new federal income tax will be

=11% of $3500

=11/100 x 3500

=0.11 x 3500

=385.

Total deductions will be as follows

Federal Income Tax $385

State Income Tax $95

Social Security $89

Medicare $40

Total= $609

The new net income

= $3500 - $609

=$2,891

Answer:

so D thx

Explanation:

Lenter LLC placed in service on April 29, 2019, machinery and equipment (seven-year property) with a basis of $1,600,000. Assume that Lenter has sufficient income to avoid any limitations. Calculate the maximum depreciation deduction including §179 expensing (but ignoring bonus expensing)

Answers

The maximum depreciation deduction including §179 expensing for Lenter LLC's machinery and equipment (seven-year property) with a basis of $1,600,000 placed in service on April 29, 2019, would be $1,102,807.

The maximum depreciation deduction including §179 expensing for Lenter LLC's machinery and equipment (seven-year property) with a basis of $1,600,000 placed in service on April 29, 2019, would be:

First, apply §179 expensing to the basis of the property. For 2019, the maximum §179 deduction was $1,020,000, and the phase-out threshold began at $2,550,000. Since Lenter's basis of $1,600,000 is less than the phase-out threshold, it can take the full §179 deduction. Therefore, the adjusted basis of the property for depreciation purposes is

$580,000 ($1,600,000 - $1,020,000).

Next, calculate the maximum depreciation deduction using the Modified Accelerated Cost Recovery System (MACRS) seven-year property depreciation table. For property placed in service in 2019, the first-year depreciation rate for seven-year property is 14.29%. Therefore, the maximum depreciation deduction for Lenter would be

$82,807 ($580,000 x 14.29%).

So, the maximum depreciation deduction for Lenter LLC, including §179 expensing, would be $1,102,807 ($1,020,000 + $82,807).

To know more about maximum depreciation deduction:

https://brainly.com/question/11511214

#SPJ4

Eric, after listening to you talk about surpluses, investing and being smart with money, is thinking about how much he would save in interest on his car loan if he paid $50 dollars extra each time he paid his car note. To get this information, eric would need what type of schedule to show him the impact of his extra payments?.

Answers

Eric needs an amortization schedule to show him the impact of his extra payments.

Explain amortization schedule.A table that displays a mortgage's regular payments over time is called an amortization schedule. You can keep track of how much is still owed on your mortgage and determine how much goes to interest by using a mortgage amortization plan.

Amortization is the process of repaying debt in a series of regular payments. Each payment has a principal portion that goes toward the loan balance and an interest portion. The amount put toward the principal increases progressively month after month as the debt amortizes. You can see how much money you pay in principal and interest over time in an amortization schedule.

To learn more about amortization schedule, visit:

https://brainly.com/question/19755003

#SPJ4

st. peter's in rome was paid for in part by selling indulgences. indulgences are:

Answers

The given statement is "st. peter's in rome was paid for in part by selling indulgences. indulgences are" is True.

St. Peter's in Rome was partially financed through the sale of indulgences, which were a form of forgiveness for sins granted by the Catholic Church. During the Middle Ages and Renaissance, the sale of indulgences became a controversial practice, as critics argued that it allowed wealthy individuals to essentially purchase forgiveness for their sins, while others were left without access to such pardons.

The sale of indulgences was one of the factors that contributed to the Protestant Reformation in the 16th century.

To know more about indulgences , refer here :

https://brainly.com/question/28889737#

#SPJ11

What is pre instruction assessment?.

Answers

Pre-assessment gives instructors a means to gain crucial details about what students know and can perform before teaching, as well as about their interests and learning preferences. Pre-assessments may consist of activities to be completed using paper and pencil or maybe performance-based.

Before starting a learning activity, diagnostic tests, often called pre-assessments, give teachers insight into students' prior knowledge and beliefs. They also offer a starting point for determining how much learning has occurred when the learning activity is over.

To know more about Pre- Assessment here

https://brainly.com/question/29548855

#SPJ4

Which of these groups of workers is not a part of Handy's Shamrock organization?

#1 Outsourced workers

#2 Flexible workers

#3 Senior management

#4 Core staff

Answers

Answer:

#1 Outsourced workers

Explanation:

Outsourced workers are not employees of Handy's Shamrock organization. They are workers who have been contracted by Handy Shamrock to carry out specific functions.

In most cases, outsources workers are employed by a company that specializes in certain tasks. For example, Handy Shamrock may need cleaning workers. Instead of hiring cleaners, they may contract a cleaning company to do the job for them. The cleaning company workers that will be cleaning at Handy Shamrock will be outsourced workers.

WILL GIVE BRANEST PLZ ANSWER FAST

According to the video, what are some qualities needed by Computer Support Specialists? Check all that apply.

physical strength and fitness

graphic design skills

patience and understanding

knowledge of computers and software

verbal and written communication skills

marketing and sales skills

Answers

Answer:

patience and understanding

knowledge of computers and software

verbal and written communication skills

Explanation:

Just answered it on edge

Some qualities needed by Computer Support Specialists are as follows:

patience and understandingknowledge of computers and softwareverbal and written communication skillsSo, the correct options are C, D and E.

Who are Computer Support Specialists?A computer support specialist is also commonly known as an IT specialist, network technician, tech support specialist, or network specialist. Computer support specialists refer to those providing assistance and guidance to individuals or organizations that are using computer software or equipment are new-age professionals also known as computer network support specialists.

Their job is to support the information technology employees working in their organization. Computer support specialists are assigned a variety of responsibilities that differ depending on whether they provide network or direct user support.

Therefore, the correct options are C, D and E.

Learn more about Computer Support Specialists, here:

https://brainly.com/question/30129889

#SPJ6

Banks do not hold a lot of their assets in the form of cash mainly because of:

a. regulation.

b. the fear of being robbed.

c. the opportunity cost of holding cash, cash does not earn interest.

d. it can encourage employee theft.

Answers

Banks do not hold a lot of their assets in the form of cash mainly because of the opportunity cost of holding cash, cash does not earn interest. The correct option is C.

Opportunity costs are the possible advantages that a person, investor, or company forgoes while deciding between two options. It is necessary to weigh the advantages and disadvantages of each choice offered in order to correctly assess opportunity costs.

The interest that could have been made if the cash had been used to buy bonds instead is the opportunity cost of keeping any money balance.

Therefore, due to the opportunity cost of holding cash and cash does not earn interest banks does nor prefer to hold a lot of their assets in the form of cash .

To learn more on opportunity cost, here:

https://brainly.com/question/13036997

#SPJ4

sented below are fwo independent situations: a) Hilman Corporation redeemed $150,000 of its bonds on june 30, 2021, at 102 . The amorized cost of the bonds on the retirement date was $137,700. The bonds pay sem -arnuad interest and the interest payment due on June 30,2021 , has been made and fecorded b) Dalion inc. fedeemed $200,000 of its bonds at 96 on June 30,2021 . The armortized cost of the bonds on the rebremint date was $196,500. The bonds pay. semi-annual inserest and the interest paymem due on June $0.2021. has been made and recorded.

Answers

Amortized cost refers to the value at which an asset or liability is carried on the books of a company over time. t takes into account any premiums or discounts applied to the original cost of the asset or liability.

a) For Hilman Corporation:

Redemption amount: $150,000

Amortized cost on retirement date: $137,700

The difference between the redemption amount and the amortized cost represents the gain or loss on bond redemption.

Gain/Loss = Redemption amount - Amortized cost

= $150,000 - $137,700

= $12,300 (Gain)

Since there is a gain on bond redemption, we need to record the journal entry to reflect this transaction:Date: June 30, 2021

Debit: Bonds Payable - $150,000

Credit: Loss on Bond Redemption - $12,300

Credit: Cash - $150,000b) For Dalion Inc.:Redemption amount: $200,000

Amortized cost on redemption date: $196,500

The difference between the redemption amount and the amortized cost represents the gain or loss on bond redemption.

Gain/Loss = Redemption amount - Amortized cost

= $200,000 - $196,500

= $3,500 (Gain)

Since there is a gain on bond redemption, we need to record the journal entry to reflect this transaction:Date: June 30, 2021

Debit: Bonds Payable - $200,000

Credit: Loss on Bond Redemption - $3,500

Credit: Cash - $200,000

To know more about Amortized Cost visit:

https://brainly.com/question/32596859

#SPJ11

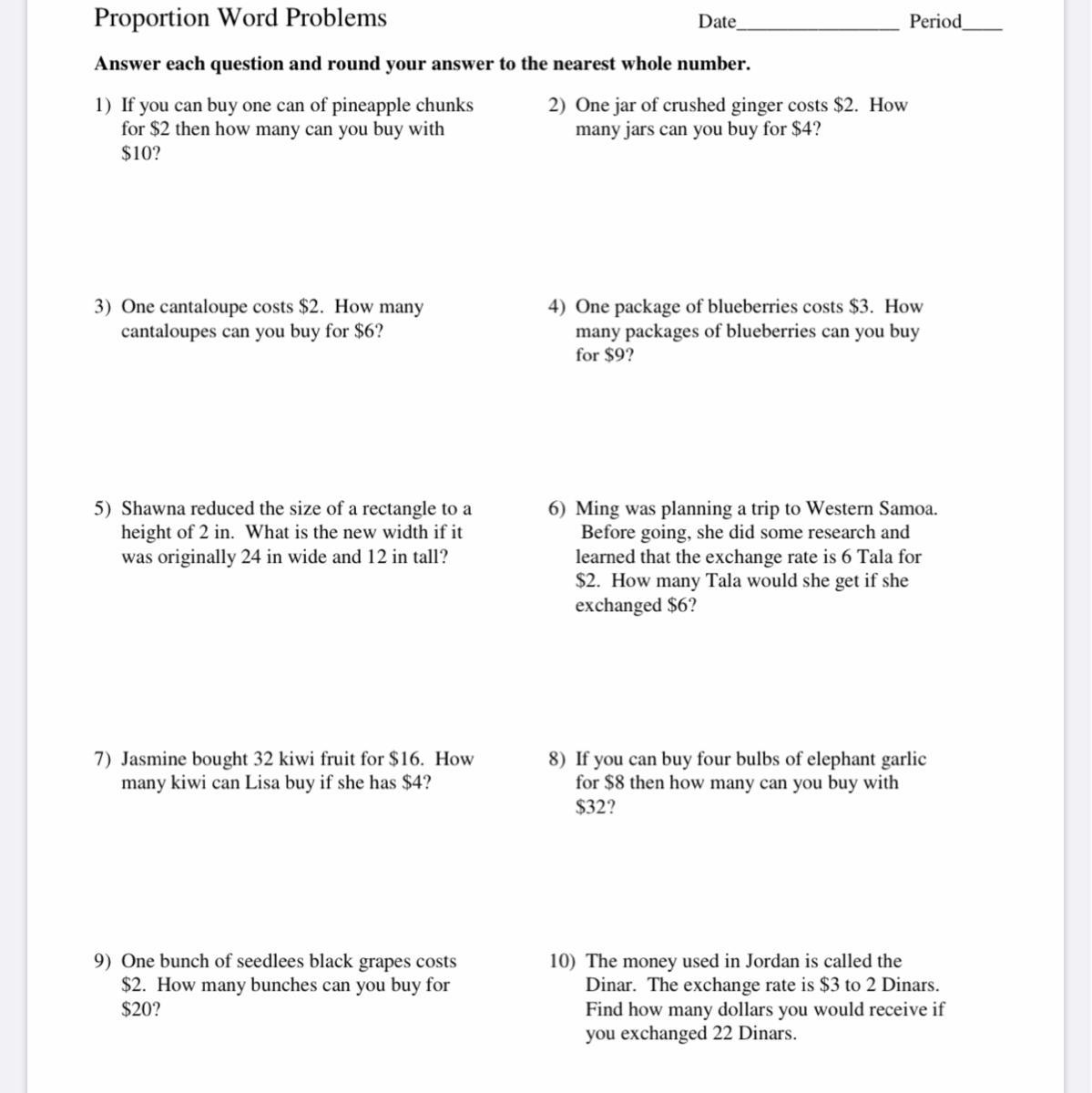

Can someone answer this question please please I don’t know how to do it and it’s to tonight please

And please show the work please

Answers

Answer:

1) 5

2) 2

3) 3

4) 3

5) 4

6) 18

7) 8

8) 16

9) 10

10) 33

Explanation:

1) 10/2 = 5

2) 4/2 = 2

3) 6/2 = 3

4) 9/3 = 3

5) 12/2 = 6, 24/6 = 4

6) 6/2 = 3, 6*3 = 18

7) 16/4 = 4, 32/4 = 8

8) 32/8 = 4, 4*4 = 16

9) 20/2 = 10, 1*10 = 10

10) 22/2 = 11, 11*3 = 33

HOPE THIS HELPS! CAN I GET BRAINLIEST PLEASE? THANKS!In this method of entering a foreign market, the company makes agreements with manufacturers in the foreign market to produce its product or provide its service. O a. licensing O b. contract manufacturing O c joint ownership O d. management contracting

Answers

In this method of entering a foreign market, the company makes agreements with manufacturers in the foreign market to produce its product or provide its service. The correct option is B. contract manufacturing.

In contract manufacturing, the company or the contracting firm provides the manufacturer in the foreign market with all the specifications required to produce the product or provide the service.

Contract manufacturing is a type of outsourcing that enables a company to have its product or service manufactured by a third-party supplier. The manufacturer is responsible for the production process, and the final product is branded with the company's name, indicating that it is produced by that company.

This method of entering a foreign market has several advantages. One of the main advantages is that the company can minimize its risks and costs. By outsourcing the production process to a third-party supplier, the company does not have to make a significant investment in building a manufacturing facility.

It also does not have to worry about the risks associated with manufacturing in a foreign market, such as changes in regulations, tariffs, and taxes. Contract manufacturing also enables companies to focus on their core competencies. By outsourcing the production process, the company can focus on developing new products, marketing, and distribution.

It also enables the company to enter new markets quickly and efficiently without having to set up a manufacturing facility or distribution network.

However, there are also some disadvantages to this method. The company has less control over the manufacturing process and the quality of the product, which can lead to issues with customer satisfaction and product quality.

To know more about contract manufacturing here

https://brainly.com/question/8438974

#SPJ11

What is Postage(in accounts)

Answers

To recognize a transaction on an account. For example, if one writes a check for $100 and $100 is deducted from that account three days later, the transaction is set to post on the third day.

Management at Reilly Company is considering the purchase of a machine that would cost $240,000 and would last for 10 years. At the end of 10 years, the machine would have a salvage value of $21,500. By reducing labor and other operating costs, the machine would provide annual cost savings of $37,000. The company requires a minimum pretax return of 10% on all investment projects. (Ignore income taxes. ) Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the proposed project is closest to:

Answers

The NPV -$18,033.44 is negative, the investment in the machine is not a good one for the company, as it would result in a loss. The company should not proceed with the purchase of the machine.

To determine whether the purchase of the machine is a good investment for the company, we need to calculate the net present value (NPV) of the project. The formula for calculating NPV is:

NPV = PV of cash inflows - PV of cash outflows

Where PV is the present value of the cash flows.

To calculate the PV of the cash inflows, we need to determine the annual cash savings that the machine will provide over the 10-year period. The annual savings are $37,000, so the total savings over 10 years are:

Total savings = Annual savings x Number of years = $37,000 x 10 = $370,000

To calculate the PV of these cash inflows, we need to use the present value formula, which takes into account the time value of money:

PV = FV / (1 + r)ⁿ

Where FV is the future value, r is the discount rate, and n is the number of periods.

Using a discount rate of 10%, we can calculate the PV of the cash inflows as follows:

PV of cash inflows = $370,000 / (1 + 0.1)¹⁰ = $145,226.36

To calculate the PV of the cash outflows, we need to consider the initial cost of the machine, as well as its salvage value at the end of 10 years. The initial cost is $240,000, and the salvage value is $21,500. To calculate the PV of these cash outflows, we can use the same formula as above:

PV of cash outflows = ($240,000 - $21,500) / (1 + 0.1)¹⁰ = $163,259.80

Therefore, the net present value of the project can be calculated as follows:

NPV = PV of cash inflows - PV of cash outflows

NPV = $145,226.36 - $163,259.80 = -$18,033.44

Since the NPV is negative, the investment in the machine is not a good one for the company, as it will result in a loss. The company should not proceed with the purchase of the machine.

To know more about investment

https://brainly.com/question/13077630

#SPJ4

For Accounts Payable denominated in a foreign currency, an decrease in the direct exchange rate (dollar has strengthened) results in an exchange loss.

Answers

False

What is exchange loss?

A change in the exchange rate between the time an invoice was issued and the time it was paid results in an exchange gain or loss.

An exchange gain or loss results when an invoice is entered at one rate and paid at another.

Losses from foreign exchange are accounted for in other operating expenditures.

Even though you will have accurately converted your prices, the exchange rate when the consumer pays for this invoice will necessarily differ from the rate at which you recorded the invoice in your accounting system. As a result, the payment you receive will be significantly less than what you originally invoiced.

Depending on which direction the exchange rate has moved, i.e., whether the currencies involved have gained or dropped in value, this difference is referred to as an exchange gain or loss (a gain or loss).

Learn more about exchange loss with the help of given link:-

https://brainly.com/question/28192071

#SPJ4

The city council made an appropriation to the police department of $190,000 for the purchase of supplies and equipment. the following transactions and events occurred regarding this appropriation. 1. the department placed purchase order (po) 1 for 5 motorcycles, estimated to cost $20,000 each. 2. the department placed po 2 for crime prevention supplies at an estimated cost of $60,000. 3. the motorcycles ordered in po 1 arrived in good condition. the invoice of $100,000 was approved for payment. 4. po 3 was placed for radio equipment at an estimated cost of $20,000 . 5. the supplies ordered in po 2 arrived, along with an invoice for $64,000. the invoice was approved for payment. 6. the department obtained a check from the finance director for $500, made out to a local supplier, to purchase a new firearm for $500 on an emergency basis; no purchase order had been placed. a) prepare journal entries to record the transactions and events. charge all expenditures to supplies and equipment. (assume the approved budget has already been recorded.)

Answers

The journal entry is below.

Events Accounts Debit Credit

1. Encumbrances 50000

Budgetary fund balance 50000

reserved for encumbrances

To record PO 1

2. Encumbrances 30000

Budgetary fund balance 30000

reserved for encumbrances

To record PO 2.

3. Budgetary fund balance 50000

reserved for encumbrances

Encumbrances 50000

To reverse encumbrance for PO 1.

4. Encumbrances 10000

Budgetary fund balance 10000

reserved for encumbrances

To record PO 3.

5. Budgetary fund balance

reserved for encumbrances 30000

Encumbrances 30000

To reverse encumbrance

for PO 2.

Expenditures 32000

supplies and equipment

Vouchers payable 32000

To record approved voucher

6. Expenditures 250

supplies and equipment

Cash 250

Record emergency cash purchases.

Learn more about The accounts here:-https://brainly.com/question/26181559

#SPJ4

on january 8, cargo co. issued a $80,000, 6%, 120-day note payable to roadside co. using a 360-day year, what is the maturity value of the note? a.$86,800 b.$81,600 c.$84,800 d.$80,000

Answers

The maturity value of the note issued by Cargo Co. to Roadside Co. is $86,800.

This is calculated by taking the original principal amount of $80,000 and multiplying it by the interest rate of 6% for the period of 120 days. The total interest for the 120-day period is $6,800, which when added to the principal gives the maturity value of $86,800.

To calculate the maturity value of the note, use the following formula: Maturity Value = Principal x (1 + Interest Rate x Number of Days/360). In this case, the Maturity Value = $80,000 x (1 + 0.06 x 120/360) = $86,800.

To know more about maturity value click on below link:

https://brainly.com/question/2496341#

#SPJ11

Question 3 of 10

Which of the following is a hard skill that a marketing manager might use on

a regular basis?

A. Using listening skills to understand employee concerns

B. Using spreadsheets to plan budgets

C. Using leadership skills to motivate a project team

D. Using coding skills to create websites for clients

SUBMIT

Answers

Answer: B. Using spreadsheets to plan budgets

Explanation: yes

Question #4

Multiple Choice

Values are principles that typically guide or influence an individual's decision-making process. Two

areas of life most often affected or influenced by values include

emotions and reactions

decisions and responses

physical health and feelings

attitudes and behaviors

Answers

The two spheres of life that are most frequently impacted or altered by values are attitudes and behaviors. The correct response is option (4).

Define attitudes and behaviors.An individual's attitude is defined as their mental perspective, or how they feel or think about someone or something. Behavior describes the actions, motions, conduct, or behaviors of an individual or a group toward other individuals. built upon. Experience and observation.

When people put more focus on their own attitudes and feelings, they tend to act more in line with those feelings, therefore there is a link between attitude and behavior. Additionally, when people feel greater responsibility for their individual actions rather than the actions of a collective, their opinions are more consistent with their behavior.

To know more about attitudes and behaviors, visit:

https://brainly.com/question/29486334

#SPJ1

Does anyone want to be saved and acceot the lord jesus christ to come into your heart if you do please say these words out loud.

Lord I admit to you that I am a sinner, but i ask you to please forguve me from all of my sins. Lord god I repent and I turn away from them and never go back. Lord gold fill me with you Holy Spirit. Amen

Now from this day on read your bible and pray and talk to the Lord.

If you have done these things write back Remeber Jesus Loves You And I do To

Answers

Answer:

nah im goood

Explanation:

i dont feel like asking him to "forguve me from all of my sins"

very proud of u for sharing the good news and ik our Lord is too! don’t let those ppl discourage u! have a blessed day

You see a shirt you really like but it costs $50.00 and you cannot afford it right now. You see one on eBay that is exactly the same for $19.99 plus $1.50 in shipping. What percent are you saving off of the original in-store price if you buy the shirt on eBay? Please show your work. PLEASE HELP ASAP

Answers

Total cost of the shirt from

eBay is the price of the shirt plus the shipping:

19.99 + 1.50 = $21.49

Find the cost difference:

50 - 21.49 = $28.51

Divide the cost difference by original price:

28.51/50 = 0.5702

Multiply by 100 to get percent:

0.5702 x 100 = 57.02%

Answer: 57.02% ( you can probably round the answer to 57%)

Fiscal policy is the government’s use of government spending and taxes to influence the economy. For this task, you will choose one tool of fiscal policy—either government spending or taxes—and complete the activities below.

Part A

Which tool did you choose?

Part B

Do you think this tool should be increased or decreased to help the economy?

Answers

Explanation:

Fiscal policy is based on the theories of British economist John Maynard Keynes, which hold that increasing or decreasing revenue (taxes) and expenditures (spending) levels influence inflation, employment, and the flow of money through the economic system. Fiscal policy is often used in combination with monetary policy, which, in the United States, is set by the Federal Reserve to influence the direction of the economy and meet economic goals.

.

After the French were unable to complete the canal, the US took charge of its completion in 1904, and US President Theodore Roosevelt concluded that the US should receive all of the advantages.

He forbade other Panamanian merchants from establishing enterprises in the canal, and US military personnel were employed to complete the project.

Fiscal policy is termed as the policy that is wholly based on the increase and decrease of the revenue or the taxes of the different aspects of the economy like employment level, inflation, money flow in the economy, and the various others that are prevailing in the economic system.

It is used with the intuition to combine with the other monetary policy of the economy and then set the federal reserve for the economy to set its goals and acquire the economic goals of the economy.

To know more about the fiscal policy and the monetary policy, refer to the link below:

https://brainly.com/question/6915561

What is it called when managers look at the size of the variances between actual results and budgeted amounts in order to determine which variances should be investigated

Answers

how many tines in earth does the sun intersect equartor

Answers

Answer:

два

Explanation:

Which of the following factors are important considerations when evaluating a business idea? (Check all of the boxes that apply)

Your personality

Location of business

Your finances

Your competition

Number of employees

The number of hours you will work weekly

Answers

Answer:

location of business

your finances

verification of employment income source of funds and payment history must not be older than 90 days before the note rate

Answers

Typically, loan applications request for verification of employment, income, source of funds, and payment history.

It is customary to ask for recent copies of these documents, typically no more than 90 days prior to the note rate, in order to guarantee the reliability and completeness of this information. The 90-day deadline makes sure the information accurately represents the borrower's present financial circumstances, work status, and capacity to make payments. To evaluate the borrower's creditworthiness and make wise lending decisions, lenders rely on current documentation. Lenders can have better trust in the integrity of the data provided and lower the risk of doing so by limiting the time period reasonably short. This also lowers the likelihood that they will rely on out-of-date or potentially incorrect income and payment history data.

learn more about income here:

https://brainly.com/question/14732695

#SPJ11

The goal of any exchange is that the parties to the transaction be?

Answers

The goal of a marketing exchange is to obtain something that is more desired than what is given up to obtain it. In other words, the gain exceeds the expenditures.

Fourth, the trade participants must be able to communicate with one another in order to make their valuable items available. For an exchange to take place, four conditions must be met: (1) Two or more individuals, groups, or organizations must participate, and each must own something of value that the other party desires; (2) the exchange must benefit or satisfy both parties involved in the transaction; (3) each participant must participate.

Learn more about goal

https://brainly.com/question/1512442

#SPJ4

State one financial objective for LEGO.

3 Marker

Answers

Answer: Building, un-building, rebuilding, thereby creating new things and developing new ways of thinking about ourselves, and the world.

Explanation: looked at Lego. com.

I hope it’s right, sorry if it’s not. Best of luck :)

4. Tim moves to a different state and buys a house in his new city. His new house is bigger than the apartment he lived in before, so he also buys new furniture. His property taxes are higher for his new house, but sales tax he pays on his new furniture is lower. Which of these taxes is progressive, and which are regressive? What is the difference between a progressive and a regressive tax? (8 points)

Answers

Answer:

Property tax is progressive

Sales Tax is regressive

A progressive tax is one that takes a higher proportion of revenue from high-income people than it does from low-income people. A regressive tax is one that takes a higher percentage of low-income people's income than it does from high-income people.

Explanation: