A close reading of chapter 1 provides which of the following

lessons for investors:

a. be aware of market cycles.

b. do not diversify across asset

classes.

c. investing in Australia ensures

immunity

Answers

A close reading of chapter 1 provides the following lesson for investors:

a. Be aware of market cycles.

Market cycles refer to the regular patterns of ups and downs in financial markets. Understanding market cycles is crucial for investors because it helps them recognize when markets are in a bullish (upward) or bearish (downward) phase. By being aware of market cycles, investors can make more informed decisions about when to enter or exit investments, adjust their risk tolerance, and effectively manage their portfolios. Being aware of market cycles allows investors to align their investment strategies with the prevailing market conditions, potentially enhancing their returns and minimizing risks.

Diversification across asset classes is generally considered a recommended strategy in investing. It helps spread the risk by investing in a variety of assets, such as stocks, bonds, real estate, and commodities. This diversification helps mitigate the impact of any single asset's performance on the overall portfolio. Therefore, option b is not supported as a lesson from chapter 1.

Investing in a specific country, such as Australia, does not ensure immunity or guarantee protection from market risks. Investing in any particular country carries its own set of risks and uncertainties, including economic, political, and regulatory factors. It is important for investors to conduct thorough research and analysis before making any investment decisions, considering factors such as the country's economic stability, market conditions, and investment opportunities. Therefore, option c is not supported as a lesson from chapter 1.

Learn more about investors ,visit:

https://brainly.com/question/30130634

#SPJ11

Related Questions

how might emotional factors in decision making influence the potential purchase of a business franchise, such as dunkin' donuts among hundreds of others?

Answers

Emotional factors can significantly influence decision-making when purchasing a commercial franchise, such as Dunkin' Donuts.

These factors may include the feelings of security, control, satisfaction or excitement that the buyer/investor experiences when considering a particular brand or franchise.

For example, if the buyer feels secure with the Dunkin' Donuts brand and business model, the buyer may feel it is a safe investment and choose it over other franchises. If the buyer feels they have control over the brand and business, they may be more inclined to choose Dunkin' Donuts over other brands. If the buyer feels satisfaction and happiness at the thought of the Dunkin' Donuts brand and business model, they may choose that franchise for their investment.

Or if the buyer is excited about the prospect of working with a brand as well-known as Dunkin' Donuts, they might be more inclined to choose that franchise over others. Ultimately, emotional factors can significantly influence decision-making when purchasing a retail franchise, such as Dunkin' Donuts, among hundreds of others.

Lear More About Commercial franchise

https://brainly.com/question/3687222

#SPJ11

If the demand for a product decreases, what is likely to happen?

A.

The supply is likely to increase.

B.

The demand is likely to be inelastic.

C.

The price is likely to increase.

D.

The price is likely to decrease.

Answers

Nuns: For our last order of business, some nun fashion! On a traditional full Benedictine habit, the headdress is made up of several parts: the coif; the veil; and this (modeled here by Sister Mary Clarence), a cloth worn around the cheeks, neck, and chin that was also popular among medieval Christian women as a means of modesty?

Answers

The cloth worn around the cheeks, neck, and chin that was also popular among medieval Christian women as a means of modesty is called a wimple.

It was traditionally worn as part of the headdress of nuns and other religious women. The wimple covered the neck and chin and sometimes the forehead, leaving only the face visible. It was worn to symbolize the woman's religious devotion and to signify her renunciation of worldly vanity and fashion.

The wimple is an important part of the traditional Benedictine habit, which is worn by nuns of the Benedictine order. The Benedictine habit is a full-length black or dark brown robe worn with a scapular and a white wimple. The habit is a symbol of the nun's commitment to a life of prayer, simplicity, and service to God and the community.

To learn more about medieval Christian women, here

https://brainly.com/question/31406359

#SPJ4

Think of an item you’ve purchased in the past week. What was the final cost with the sales tax added? show your math with the original amount, sales tax where you live, and total.

Answers

The final cost of the shoes I purchased in Montpelier, after sales tax was added, was $ 42. 40

How to find the final cost with sales tax?Last week, I purchased a pair of shoes at a mall in Montpelier and the price was $40. However, the sales tax rate in Vermont of 6 % had not yet been accounted for.

The sales tax on the shoes I bought was therefore:

= 40 x 6 %

= $2. 40

The final cost with sales tax was:

= 40 + 2.40

= $ 42. 40

Find out more on sales tax at https://brainly.com/question/11694340

#SPJ1

Thinking about your office or college, what types of

information are conveyed through the grapevine? How

often is the information accurate?

Answers

Answer: I would experience a lot of cluster chains speaking on if someone was in trouble. An employee would be called to the back office if they were either in trouble or getting a promotion.

Explanation:

PLEASE ANSWER AS ASKED

How does the cost of goods sold (COGS) change from month to month?

How does the profit change over time?

How has the profit as a percentage of the COGS changed over time?

What factors are responsible for changes in revenue and profit?

Has your company been able to meet its goal of a profit equal to 25 percent of the COGS?

How have the costs of goods sold (COGS) changed over the course of the year?

How has the profit percentage changed over the course of the year?

Answers

The cost of goods sold (COGS) can change from month to month depending on factors such as changes in the price of materials, labor costs, and production volumes.

1. The cost of goods sold (COGS) can change from month to month depending on various factors such as the cost of raw materials, transportation costs, labor costs, production volume, and overhead expenses. For example, if the price of raw materials goes up, the COGS would increase, and if the production volume goes up, the COGS would decrease.

2. The profit can change over time based on various factors such as changes in revenue, expenses, and COGS. If the revenue increases and the expenses remain constant, the profit would increase, and if the COGS increase while the revenue remains the same, the profit would decrease.

3. The profit as a percentage of the COGS can change over time based on changes in revenue and expenses. If the revenue increases and the expenses remain the same, the profit percentage would increase, and if the COGS increase, the profit percentage would decrease.

4. Factors responsible for changes in revenue and profit include changes in market demand, competition, pricing strategy, production efficiency, and cost control measures.

5. It's not clear whether the company has been able to meet its goal of a profit equal to 25 percent of the COGS. This would depend on the specific financial goals of the company and its performance in meeting those goals.

6. The costs of goods sold (COGS) can change over the course of the year based on factors such as changes in the price of materials, transportation costs, labor costs, production volumes, and overhead expenses.

7. The profit percentage can change over the course of the year based on changes in revenue, expenses, and COGS. If the revenue increases and the expenses remain constant, the profit percentage would increase, and if the COGS increase while the revenue remains the same, the profit percentage would decrease.

Learn more about cost of goods sold (COGS): https://brainly.com/question/31553576

#SPJ11

What is the basic economic problem that societies must solve?(1 point)

A)How to allocate resources in order to best satisfy the needs and wants of people.

B)Who will consume the goods and services?

C)What goods and services should be produced?

D)How will the goods and services be produced?

Answers

Answer:

A) How to allocate resources in order to best satisfy the needs and wants of people.

Explanation:

None of the other answers matter if that isn't the starting question.

Answer:

How to allocate resources in order to best satisfy the needs and wants of people.

Explanation:

seedbed preparation

activities

1.cleared the area

Answers

There are four steps in solving one’s personal financial challenges: 1. considering opportunity costs 2. assessing risks and returns 3. setting short- and long-term goals 4. assessing needs and wants Which of these is the correct order of these steps? 2, 1, 3, 4 1, 2, 3, 4 4, 1, 2, 3 4, 2, 3, 1 Mark this

Answers

The correct order of the steps in solving one's personal financial challenges is 4, 2, 3, 1.

Assessing needs and wants: The first step involves evaluating your financial needs and wants. It is essential to differentiate between essential expenses (needs) and non-essential expenses (wants). This step helps in gaining clarity about your priorities and understanding where your money should be allocated.

Assessing risks and returns: Once you have identified your needs and wants, the next step is to assess the risks and returns associated with different financial decisions.

This involves evaluating potential investments, analyzing their risk levels, and considering the potential returns they can generate. Understanding the risk-return trade-off helps in making informed decisions and managing financial challenges effectively.

Setting short- and long-term goals: After assessing risks and returns, it is crucial to establish both short-term and long-term financial goals. Short-term goals may include creating an emergency fund, paying off debts, or saving for a specific purchase.

Long-term goals may involve retirement planning, saving for education, or building wealth. Setting clear and measurable goals provides a roadmap for managing personal finances and allows for tracking progress over time.

Considering opportunity costs: The final step is considering opportunity costs, which refers to the trade-offs associated with financial decisions. Every financial choice involves sacrificing one option in favor of another.

It is important to evaluate the potential benefits and drawbacks of each decision and consider the opportunity cost of choosing one option over another. This helps in making informed choices that align with your financial goals and priorities.

For more such question on financial. visit :

https://brainly.com/question/30246516

#SPJ8

The lactose Operon is turned on in:

a. The presence of lactose only

b. The presence of lactose and glucose

c. The presence of glucose and tryptophan

d. The presence of glucose only

Answers

The lactose Operon is turned on in the presence of lactose only.

The lactose Operon is a regulatory system found in bacteria that controls the expression of genes involved in lactose metabolism. It consists of a promoter, an operator, and three structural genes: lacZ, lacY, and lacA. The operator region acts as a switch, determining whether the structural genes are turned on or off.

In the presence of lactose only, the lac repressor protein, which normally binds to the operator and prevents transcription of the structural genes, is rendered inactive. Lactose acts as an inducer by binding to the lac repressor, causing it to detach from the operator. This allows RNA polymerase to bind to the promoter and initiate transcription of the structural genes.

Consequently, the enzymes encoded by these genes are produced, enabling the bacterium to metabolize lactose.

The presence of glucose or tryptophan does not directly affect the lactose Operon. Glucose metabolism is regulated by a separate system involving the catabolite activator protein (CAP) and cyclic AMP (cAMP). When glucose is present, the levels of cAMP decrease, inhibiting the activity of CAP and reducing the transcription of the lactose Operon. Tryptophan, an amino acid, is unrelated to lactose metabolism and does not influence the operon's activation.

Learn more about Lactose

brainly.com/question/13061505

#SPJ11

In 1931, President Herbert Hoover was paid a salary of $75,000. Government statistics show a consumer price index of 15.2 for 1931 and 237 for 2015. President Hoover’s 1931 salary was equivalent to a 2015 salary of about: a) $1,057,894. b) $16,080,001. c) $1,169,408. d) $4,965.

Answers

Answer: c) $1,169,408.

Explanation:

Given the following:

Consumer price index(CPI) :

Year 1 = 1931 = 15.2

Year 2 = 2015 = 237

Salary in 1931 = $75,000

Equivalent salary in 2015 Given the details above:

Salary in 1931 × (CPI for year 2(2015)/ CPI for year 1(1931))

$75,000 × ( 237 / 15.2)

= $75,000 × 15.592105

= $1,169,407.8

= $1,169,408

The best reason to record income at the top of a budget is

a. to easily add expenses to it.

b. to know how much money is available.

c. to avoid spending too much money.

d. to see that is is more important than expenses.

Answers

B) To know how much money is available.

You can clearly see how much money you have available to spend or save by listing revenue at the top of a budget.

Making judgments on how to divide your money and prioritize your expenses requires knowledge of this information.

You may see how much money is available to cover your bills, pay off debts, and save for the future by putting revenue at the top of your budget.

To learn more refer here:

https://brainly.com/question/8348861?referrer=searchResults

A coffee company decides to add some new flavors to its current house blend. How did this company change their product mix? Developing a new product Line extension Deleting a product Product modification

Answers

Product development focuses on bringing new products to a market that already exists. Entering a new market with entirely new products is known as diversification.

What is the main objective of diversification?By distributing investments among different financial instruments, industries, and other categories, diversification is a technique for lowering risk. It aims to maximize return by investing in various sectors that ought to respond to changes in market conditions differently.

Product diversification is a strategy used by a company to boost profitability and achieve higher sales volume from new products. Diversification can take place at the corporate level or at the business level. When a company enters a new industry that bears significant similarities to one or more of its current industries, related diversification takes place. Disney's acquisition of ABC illustrates related diversification because movies and television are both forms of entertainment.

Learn more about Product diversification here:

https://brainly.com/question/15259776

#SPJ2

martin files a suit against nichelle in a state court over an employment contract. the case proceeds to trial, after which the court renders a verdict. the case is appealed to the state's highest court. after that court's review of martin v. nichelle, a party can appeal the decision to the united states supreme court only if:

Answers

In Martin v. Nichelle, the only way for a party to appeal the decision to the United States Supreme Court is if the case involves a question of federal law or if the highest state court has made a decision that is in conflict with a decision of the Supreme Court.

After the state's highest court reviews the case of Martin v. Nichelle, a party can appeal the decision to the United States Supreme Court only if the case involves a federal question or constitutional issue. This means that the case must involve a question about the interpretation or application of federal law or the U.S. Constitution. If the case only involves a question of state law, then the decision of the state's highest court is final and cannot be appealed to the U.S. Supreme Court.

Here you can learn more about Supreme Court https://brainly.com/question/12848156

#SPJ11

How can I unclog the toilet the potatoes got stuck in there? (I hope this not a inapropriate question)

Answers

Answer:

Just get something like a brush and it will get off

Explanation:

Just do it

For you to understand the lesson well, do the following activities. Have fun and good luck! Activity 1. TRUE/ FALSE. Directions: Read each statement below carefully. Write "T" if the statements are true, and "F" if the statements are false. Write your answers in a separate sheet of paper. 1. If an employee only receives a percentage of the sales made with no additional compensation given then, he is receiving a straight commission. 2. If an employee receives a guaranteed base salary amount and earn an undefined amount of commission based on the amount of sales he makes, then he is receiving a graduated commission. 3. Salary plus commission is earned as a percentage of sales that as volume of sales increases, the amount of commission also increases. 4. The price of a house for sale is P5,000,000. The bank requires 15% down payment. If a buyer wants to buy the house, then he needs to pay P1,125,000 as down payment. 5. A car is valued at P2,000,000 and the required down payment is P500,000. The down payment in percentage form is 25%. 6. A salesperson is receiving a commission of 12% on all of his sales. If he was able sell goods amounting to P50,000, his total commission is P6,000? 7. A salesperson is paid in installment basis. Assuming that he was able to sell a total cost of P320,000 which will be paid in installments of P5,000 monthly with a commission of 5%. At the end of the payment term, he will be able to receive a total commission of P14,000. 8. Charlie is a sales engineer receiving a basic monthly compensation of P13,500 and 1% commission on all sales. He will receive P14,745.8 gross earnings for the month if he will be able to sell P124,580. 9. A golden bejeweled necklace was sold at P650,000 and will be paid in monthly installments of P65,000. If the salesperson gets a 3% monthly commission, then he will receive P1,950.

Answers

In a situation where an employee only receives a percentage of the sales made with no additional compensation given then, he is receiving a straight commission. This is true.

If an employee receives a guaranteed base salary amount and earn an undefined amount of commission based on the amount of sales he makes, then he is receiving a graduated commission. This is true.

Salary plus commission is earned as a percentage of sales that as volume of sales increases, the amount of commission also increases. This is true.

The price of a house for sale is P5,000,000. The bank requires 15% down payment. If a buyer wants to buy the house, then he needs to pay P1,125,000 as down payment is false. The amount needed to be paid will be 15% × P5,000,000 = P750,000.

A car is valued at P2,000,000 and the required down payment is P500,000. The down payment in percentage form is 25%. This is true.

A salesperson is receiving a commission of 12% on all of his sales. If he was able sell goods amounting to P50,000, his total commission is P6,000. This is true.

A salesperson is paid in installment basis. Assuming that he was able to sell a total cost of P320,000 which will be paid in installments of P5,000 monthly with a commission of 5%. At the end of the payment term, he will be able to receive a total commission of P14,000. This is false. The total commission will be:

= 5% × P5000 × (320000/5000) = P16000

Charlie is a sales engineer receiving a basic monthly compensation of P13,500 and 1% commission on all sales. He will receive P14,745.8 gross earnings for the month if he will be able to sell P124,580. This is true.

A golden bejeweled necklace was sold at P650,000 and will be paid in monthly installments of P65,000. If the salesperson gets a 3% monthly commission, then he will receive P1,950. This is true.

Read related link on:

https://brainly.com/question/25709436

Are imports to Russia subject to VAT?

Answers

Answer:

yes

Explanation:

they pay 20 percent and is paid directly to Russia

Answer:

The Russian import VAT 20% has to be paid. The tax has to be paid directly to the Russian customs .The customs is one of the contributaries of development.In and out of goods may charged at the same VAT of 20%.

By Sk.

Do you get more money married filing jointly or separately.

Answers

When comparing the two tax filing statuses, married filing jointly generally results in a lower tax bill and a higher tax refund than married filing separately. The main advantage of filing jointly is that you get to combine your incomes, which often leads to a lower tax bill because of the higher tax brackets that are available for couples who file together. On the other hand, if both spouses earn similar incomes and file separately, they may fall into higher tax brackets and pay more in taxes.

In addition, couples who file jointly are eligible for a variety of deductions and credits that aren't available to those who file separately. The standard deduction is typically higher for married couples filing jointly, and they may be eligible for additional tax credits like the Earned Income Tax Credit and the Child and Dependent Care Credit.

Married couples filing separately have some tax benefits, but they are less advantageous than filing jointly. In some cases, filing separately can be beneficial, such as when one spouse has a significant amount of medical expenses or other itemized deductions that are limited by adjusted gross income.

However, couples who file separately are not eligible for some tax credits, and they are subject to lower income thresholds for many deductions. Furthermore, if one spouse itemizes deductions, the other spouse must also itemize instead of taking the standard deduction, which can be a disadvantage in some cases. In conclusion, it's generally more advantageous for married couples to file jointly than separately, but there may be cases where filing separately is the better option.

to know more about money here:

brainly.com/question/2696748

SPJ11

under the gatt framework, nations met periodically to negotiate lower trade restrictions. these negotiations are known as:

Answers

Under the GATT framework, nations met periodically to negotiate lower trade restrictions. These negotiations are known as: sesqui-sessions.

What kind of organization is GATT?The GATT is a global trade pact with the following goals: (a) to raise living standards; (b) to attain full employment; (c) to develop the world's resources; (d) to increase production and exchange of products; and (e) to encourage economic development.

What was the intention behind the creation of GATT?The General Agreement on Tariffs and Trade (GATT) was created to reduce trade barriers, such as high import tariffs and limitations on the quantity and categories of imported commodities, which impeded the free movement of goods across borders.

To know more about GATT visit:

https://brainly.com/question/1446090

#SPJ4

Swifty Corporation was organized on January 1. During the first year of operations, the following plant asset expenditures and recepts were recorded in random order Debit 1. Cost of filing and grading the land 5. 4,000 . 2. Full payment to building contractor 696,000 3. Real estate taxes on land paid for the current year 6,000 4. Cost of real estate purchased as a plant site (and $100,000 and building $49,500) 149,500 5. Excavation costs for new building 38,000 6. Architect's fees on building plans 10,500 7. Accrued real estate taxes paid at time of purchase of real estate 2.000 8. Cost of parking lots and driveways 9. Cost of demolishing building to make and suitable for construction of new building 26.000 5947,000 Credit

10. Proceeds from salvage of demolished building 3,000 Analyze the foregoing transactions using the following column Headings Insert the amounts in the appropriate columns For amounts entered in the Other Accounts column, also indicate the account titles ir an amount reduces the account balance then enter with a negative in preceding the number eg.-18.000 parenthesis, eg (15.000)) Item Land Building Other Accounts

Answers

The amount is $3,000, which increases the account balance.

Here is the analysis of the transactions using the given column headings:

Item Land Building Other Accounts

Cost of filing and grading the land $5,000

Full payment to building contractor $696,000

Real estate taxes on land paid for the current year $6,000

Cost of real estate purchased as a plant site (land $100,000, building $49,500) $100,000 $49,500

Excavation costs for new building $38,000

Architect's fees on building plans $10,500

Accrued real estate taxes paid at time of purchase of real estate $2,000

Cost of parking lots and driveways $9,000

Cost of demolishing building to make it suitable for construction of new building $26,000

Proceeds from salvage of demolished building ($3,000)

Note: The "Other Accounts" column is left blank for the transactions where it is not specified.

For proceeds from salvage of demolished building, the account title is Other Accounts. The amount is $3,000, which increases the account balance.

Learn more about account balance.

https://brainly.com/question/22633732

#SPJ4

so how do i unblock spotify the school Ashby public school and i do not know how to unblock it help me pls for 53 points and it has to work or i will not get you the points!

Answers

Answer:

you need a vpn,

If you have a computer, find a vpn. It helps you change your IP address to where ever. Select a random country and your good to go

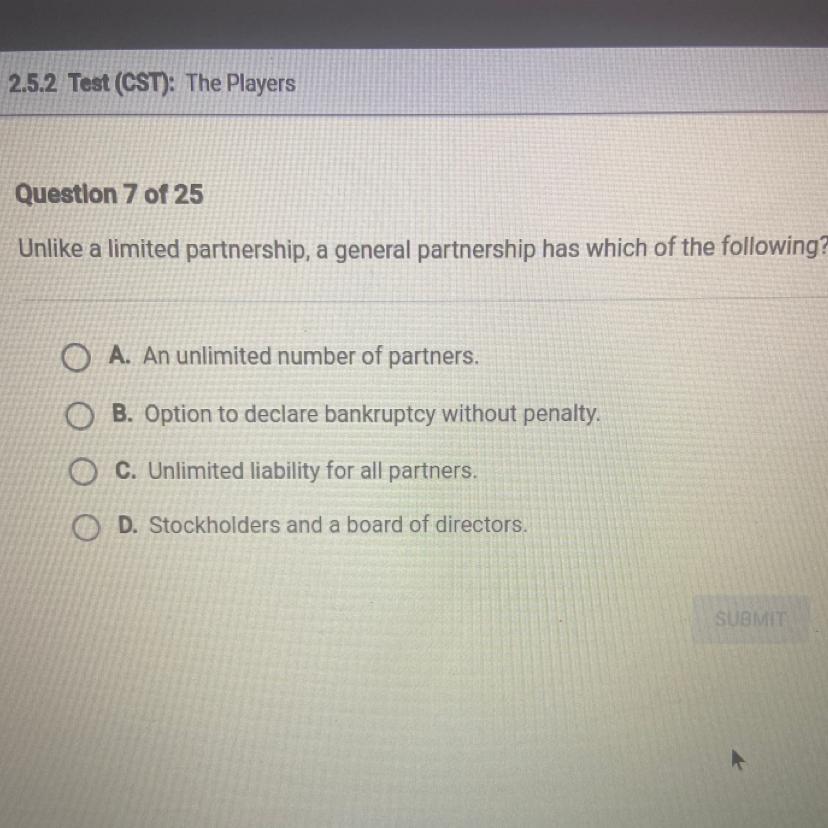

Unlike a limited partnership, a general partnership has which of the following?

O A. An unlimited number of partners.

B. Option to declare bankruptcy without penalty.

C. Unlimited liability for all partners.

D. Stockholders and a board of directors.

Answers

Answer:

C. Unlimited liability for all partners.

Explanation:

A general partner has unlimited liability to the debts of the business. It follows that in a general partnership business, all partners will have unlimited liability to business debts.

A general partnership is not a separate entity from its owners. Assets and liabilities of the business will be treated as those of the partners. Should the business fail in paying its debts, the partners' personal properties may be sold to clear the debts.

what is the relationship between beginning cash balance and ending cash balance for the current year

Answers

Answer:

While the cash flow statement shows cash coming in and going out, the balance sheet shows the assets and liabilities that result, in part, from the activities on the cash flow statement.

Explanation:

Please give the brainliest.

Identify the economic goal of sales management.

Every nation aims for economic growth and

employment _________ for all its citizens.

Answers

The correct economic goal of sales management is: “Every nation aims for economic growth and employment Rights for all its citizens.”

What does economic goal mean?Economic stability is the most crucial objective. This is because maintaining economic stability makes it possible to accomplish other macroeconomic goals.

Price fluctuations due to an unstable economy may cause inflation or deflation, which will affect the currency effect. Economic goals are not always compatible with one another.

The cost of achieving any one goal or set of goals is having fewer resources available to devote to the other goals. Every country strives for economic development and equal job opportunities for all of its residents.

Learn more about economic goal from here:

https://brainly.com/question/2387455

#SPJ1

Which of the following describes a food retailer?

uses products from farmers and ranchers, commodity processors, and food manufacturers to offer food to their customers

supports the farmers and ranchers with feed and seed

transports the farmers’ and ranchers’ products and the processed and manufactured food products throughout the system

buys the processors’ products to make prepared food

Answers

Answer:

transports the farmers and ranchers

Answer:

B

Explanation:

a trade discount is multiple choice question. a rebate from the manufacturer. a percentage reduction of the amount due for early payment. a reduction from list price. an increase in the account receivable.

Answers

Option (c), A percentage off the list price is what is known as a trade discount.

What alternative names are there for trading discounts?Trade discounts are often referred to as functional discounts. Simply explained, a trade discount is a discount offered by the seller to the buyer while goods are being purchased. It is taken into account by lowering the list price or retail price for the quantity sold.

What sets a trade discount apart from a monetary one?Trade discount is put into effect after a buyer submits a buy order. A cash discount is put into effect when the customer begins the payment process. The trade discount is not recorded since it is taken out of the total amount owed after subtracting it from the invoice.

Learn more about trade discount: https://brainly.com/question/29067322

#SPJ4

Why would a nation "dollarize"—that is, adopt another country’s currency instead of having its own?

Answers

Answer:

When a country dollarizes or accepts the currencies of some other country, it gains the following benefits: Dollarization improves economic stability by almost eliminating currency risk. It safeguards against inflationary pressures. It provides a consistent accounting unit throughout borders. It lowers the likelihood of capital flight.

A nation may choose to dollarize, or adopt another country's currency instead of having its own, for various reasons.

1. Economic Stability: If a country has a history of unstable currency, it may choose to adopt a stronger and more stable currency, such as the US dollar, to provide more stability for its economy. 2. International Trade: Dollarization can simplify international trade by eliminating currency exchange risks and costs, making it easier for businesses to conduct transactions with foreign partners.

3. Inflation Control: Adopting a more stable currency can help a country control inflation, which can occur when a country prints too much money, leading to a decrease in the value of its currency. 4. Foreign Investment: Dollarization can make a country more attractive to foreign investors, as they may feel more confident investing in a country with a more stable currency.5. Political Stability: In some cases, dollarization can be a political decision made by a country's leaders to promote stability and strengthen ties with the country whose currency is being adopted.

To know more about dollarize visit:

https://brainly.com/question/17218184

#SPJ11

caleb is not a professional gambler, but he does like to play slot machines and purchase lottery tickets from time to time. during the year, he won $2,000 while playing slots at lucky casino. caleb kept good records of his gambling winnings and losses, and he has documentation showing that, while he did have some winnings, his losses at the casino totaled $2,350. he also has records showing he spent an additional $200 for lottery tickets without winning anything. if caleb itemizes his deductions, how much can he claim for gambling losses on schedule a, itemized deductions?

Answers

If he won $2,000 while playing slots at lucky casino and kept good records of his gambling winnings and losses, and he has documentation showing that, while he did have some winnings. The amount he can claim for gambling losses on schedule a, itemized deductions is: $2,000.

Itemized deductionA person can tend to deduct their gambling losses when they itemize their deductions on Schedule A and as well kept a record of their winnings and losses.

Since caleb kept all record of his winnings and losses which in turn means that the amount of losses that can be deducted should not be higher than the amount of gambling winning he reported.

This means that caleb yearly losses will be deductible only up to the amount of his winnings which is $2,000.

Therefore If he won $2,000 while playing slots at lucky casino and kept good records of his gambling winnings and losses, and he has documentation showing that, while he did have some winnings. The amount he can claim for gambling losses on schedule a, itemized deductions is: $2,000.

Learn more about itemized deduction here:https://brainly.com/question/8167631

https://brainly.com/question/10657452

#SPJ1

Some employers offer forms of employer compensation in addition to pay these are usually things like healthcare retirement and paid vacation

Answers

Answer:

True

Explanation:

Often called employee welfare package, is a term that refers to all other forms of employer compensation in addition to their pay that is given by employers, sorely because they want to motivate them towards effective work performance.

Healthcare retirement benefits and paid vacation benefits are good examples of employee welfare package.

Which of the following best defines goal?

a. aim or purpose

b. disregard or disrespect

c. freedom from doubt

d. influence

Answers

Because a goal is a target that your trying to accomplish