Answers

A balance sheet that divides the various assets and liabilities into groups, such as current assets and current liabilities, is called a classified balance sheet.

The asset, liability, and equity totals on a classified balance sheet are the same as those on an unclassified balance sheet, but they are presented in more detail and are divided into different categories rather than being listed in the conventional balance sheet style. A balance sheet that divides assets, liabilities, and equity into discrete categories can be a valuable tool for your company. Use this guide to learn how to make one.

A balance sheet is a type of financial statement that shows your company's total assets, liabilities, and equity at a specific point in time.

Unclassified balance sheets are frequently used by smaller organizations, but if you're searching for a report that presents the same information in a more thorough manner, you should generate a classified balance sheet.

Know more about balance sheet here:

https://brainly.com/question/26323001

#SPJ4

Related Questions

Need to know the words of the corresponding definitions:

When a mark up is added to the cost of producing a good or service to calculate the selling price

Involves setting a low initial price for a new product in order to get a foothold in the market and gain market share

Answers

Answer:

the first one is Markup and the second one is marketing

Explanation:

i hope this is what u mean i hope i helped 229 999 0523

c) “Shadow price is the increase in value created by having one additional unit of a limiting resource at original cost”. Provide a comprehensive real world example of where a shadow price can be calculated with multiple limiting factors and with more than one product. Your answer should be in a form of a short case study roughly 4 or 5 sentences. (5 marks)

Answers

A real world example of shadow pricing would be in a case where a manufacturer produces two product A and B with 2 input such as raw materials and labor.

How is this so?Two products (A & B) are produced through the use of two primary resources: labor & raw materials. To produce one unit of product A, we require roughly an hour's worth (60 minutes) of work time from our available pool.

Also, approximately two pounds worth of our current stockpile must be incorporated into each instance as well. Comparatively speaking, producing one unit from group B takes almost three times that much effort (3 hours' time), but only requires about half as much by weight (a single pound).

Our maximum allowance stands at exactly 60 work-hours across all levels plus another hundred pounds maximum in terms concerning these earthly elements - with that established pricing amounts to a flat rate where five dollars buys us one metric pound whereas ten dollars goes towards hourly wages; so what is their shadow price?

When dealing with limited input availability, the optimal allocation of resources and production process optimization can be achieved using shadow prices. In this regard, it has been determined that labor's shadow price stands at $10 per hour while the shadow price for raw materials is set at $5 per pound.

Learn more about Shadow pricing:

https://brainly.com/question/30695369

#SPJ1

A detailed description of the money your business makes and expends every month

for the first year is called a(n)

cash-flow statement.

income statement.

balance statement.

bank statement

Answers

Difference between administrative management theory and beuracratic management theory

Answers

Answer:

Difference between administrative theory and bureaucracy

Explanation:

The Scientific Theory is based on using data and human strengths to increase output, while the Bureaucratic management style focuses on hierarchies and tight job roles. Regardless of the organization, the goals remain the same across the board. Every organization strives to minimize costs, while maximizing output.

Amber works as an insurance claims agent in charge of assisting policyholders when an accident has occurred. What task might Amber perform as part of her job?

A. buying and selling stocks for her clients

B. running an analysis of a small business's spendings

C. recording items damaged in a house fire

Answers

Answer:

the answer would be B

Explanation:

please tell me if im wrong or right

Answer:

B

Explanation:

When you create a shape, additional

options will become

available when you select that shape in your document. *

a. layout

b. saving

c. editing

d. formatting

Answers

Answer:

formatting or editing because that is where you can change how something is placed or appears in the document.

Two years from now, your mother will receive the first of three annual payments of $20,000 from a small business project. If she can earn 9 percent annually on her investments and plans to retire six years after the last payment, how much will the three business project payments be worth at the time of her retirement?

Answers

Answer:

i think FV(10) is 110,000.

Explanation:

Suppose today is 1/1/2000, two years from now, ur mom will get the first payment in 2002, and then the second is 2003, and the last is in 2004. U can calculate those number to bring it back to 2000, so u can calculate PV= 46,446 .Then, from 2004, ur mom plans to retire six years later from 2004, which means,2010 (she will begin retire in 2010, last day of 2009, 31/12/2009). Then u will calculate the FV= PV.(1+9%)^10= 110,000

Accounting for Financial Management: Free Cash Flow

The focus on traditional financial statements is market data rather than cash flow. However, cash flow is important to investors, managers, and stock analysts. Therefore, decision makers and security analysts need to modify financial statement data provided to them. An important modification is the concept of free cash flow (FCF). Many analysts regard FCF as being the single and most important number that can be developed from the income statements, even more important than net income. The equation for free cash flow is: FCF = = (EBIT(1 - T) + Depreciation and amortization) - [Capital expenditures + delta Net operating working capital]

Free cash flow is the cash flow actually available for payments to all investors (stockholders and debtholders) after the company has made investments in fixed assets, new products, and operating working capital. A negative FCF means that the company does not have sufficient internal funds to finance its investments in fixed assets and working capital, and that it will have to raise new money in the capital markets to pay for these investments. Negative FCF is not always bad. If FCF is negative because after- tax operating income is negative this is bad, because the company is probably experiencing operating problems. Exceptions to this might be startup companies, companies incurring significant expenses to launch a new product line, and high-growth companies-with large capital investments.

Quantitative Problem: Rosnan Industries' 2018 and 2017 balance sheets and income statements are shown below.

Balance Sheets

Assets 2018 2017

Cash and equivalents $100 $85

Accounts receivable 275 300

Inventories 375 250

Total current assets $750 $635

Net plant and equipment 2,300 1,490

Total assets $3,050 $2,125

Liabilities and Equity

Accounts payable $150 85

Accruals 75 50

Notes payable 150 75

Total current liabilities $375 210

Long-term debt 450 290

Total liabilities 825 500

Common stock 1,225 1,225

Retained earnings 1,000 400

Common equity 2,225 1,625

Total liabilities and equity $3,050 $2,125

Income Statements

2018 2017

Sales $3,100 $1,600

Operating costs excluding

depreciation and amortization 1,250 1,000

EBITDA $1,850 $600

Depreciation and amortization 100 75

EBIT $1,750 525

Interest 62 45

EBT $1,688 $480

Taxes (40%) 675 192

Net income $1,013 $288

Dividends paid $53 48

Addition to retained earnings $600 $240

Shares outstanding 100 100

Price $25.00 $22.50

WACC 10.00%

The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess" cash. Using the financial statements given above, what is Rosnan's 2018 free cash flow (FCF)?

Answers

Rosnan's 2018 free cash flow (FCF) is $765

ROSNAN'S 2018 FREE CASH FLOW

First step is to calculate Net operating working capital for 2017

Using this formula

Net operating working capital = Current assets - (Current liabilities - Notes payable)

Let plug in the formula

Net operating working capital 2017 = $635 - ($210 - $75)

Net operating working capital = $635 - $135

Net operating working capital= $500

Second step is to calculate Net operating working capital for 2018

Net operating working capital 2018 = $750 - ($375 - $150)

Net operating working capital 2018= $750 - $225

Net operating working capital 2018= $525

Third step is to calculate the Change in net operating working capital

Change in net operating working capital =$525 -$500

Change in net operating working capital=$25

Fourth step is to calculate Capital expenditure

Using this formula

Capital expenditure = Net fixed assets in 2018 + Depreciation for 2018 - Net fixed assets in 2017

Let plug in the formula

Capital expenditure= $2,300 + $100 - $1,490

Capital expenditure = $910

Now let determine the Free cash flow using this formula

Free cash flow = EBIT * (1-Tax rate) + Depreciation - Capital expenditure - Change in net operating working capital

Let plug in the formula

Free cash flow = $1,750 ×(1 - 0.40) + $100 - $910 - $25

Free cash flow =($1,750×0.60) +$100-$910-$25

Free cash flow =$1,050+600-$910+$25

Free cash flow =$765

Inconclusion Rosnan's 2018 free cash flow (FCF) is $765

Learn more about Free Cash Flow here:

https://brainly.com/question/17406590

Mr. D is the manager of a local walgreens. His biggest concern is to make sure that his store is always making the most profit possible. He cuts costs by focusing on certain logistical decisions. Every other day walgreens receives shipments from pepsi, evian, hershey, and numerous other manufacturers. Walgreens insists on small shipments every two days, which helps to keep their inventory costs low. What system is mr. D using at walgreens to reduce his costs?.

Answers

The system is mr. D using at walgreens to reduce his costs is just in time inventory.

What is just in time inventory?JIT, or just-in-time inventory management, involves only ordering products from vendors when they are actually needed. This approach's primary goals are to lower the cost of keeping inventory and boost inventory turnover.With a just-in-time (JIT) inventory system, a business receives products as close as feasible to the moment they are actually required. As a result, if an auto assembly facility wants to install airbags, it doesn't maintain a supply on hand; instead, it gets them as the cars are put together.In conclusion. When used properly, JIT inventory can be a terrific method to reduce costs and boost productivity.

To learn more about just in time inventory refer to:

https://brainly.com/question/8842151

#SPJ4

Most modern workers _________.

a.

Will change their careers, but not their jobs

b.

Will change their jobs, but not their careers.

c.

Will change both their jobs and careers

d.

Will change neither their jobs nor their careers

Answers

Answer:

B. Will change both their jobs and careers

Explanation:

Internet made it really easy for people to access information , including new educations. Due to the abundant of information that the people can use, acquiring new skills and connections that required to change jobs became much Easier.

According to the data that recorded by the government, around 51% of modern workers change their jobs within 1-5 years period and around 30% workers change their careers every 12 months.

Answer:

c.

Will change both their jobs and careers

Explanation:

got it right on edge

Reggie, who is 55, had AGI of $35,200 in 2022. During the year, he paid the following medical expenses:

Drugs (prescribed by physicians)

Marijuana (prescribed by physicians)

Health insurance premiums-after taxes

Doctors' fees

Eyeglasses

Over-the-counter drugs

$ 570

1,470

1,280

1,320

445

270

Required:

Reggie received $570 in 2022 for a portion of the doctors' fees from his insurance. What is Reggie's medical expense deduction?

Answers

Reggie's medical expense deduction is $7,276.

AGI, or adjusted gross income, is a person's total income minus certain deductions and is used to calculate taxable income.

Reggie, who is 55 years old, had an AGI of $35,200 in 2022. During the year, he incurred the following medical expenses:

Drugs (prescribed by physicians): $5,701

Marijuana (prescribed by physicians): $1,470

Health insurance premiums-after taxes: $1,280

Doctors' fees: $1,320

Eyeglasses: $445

Over-the-counter drugs: $270

Reggie was reimbursed $570 by his insurance company for a portion of the doctors' fees. To calculate his medical expense deduction, we first need to subtract any reimbursements from his total medical expenses.

Total medical expenses: $5,701 + $1,470 + $1,280 + $1,320 + $445 + $270 = $10,486

Reimbursements: $570

Medical expenses after reimbursements: $10,486 - $570 = $9,916

To claim a medical expense deduction, the expenses must exceed a certain percentage of AGI, which varies depending on the taxpayer's age. For taxpayers who are 65 or younger, the threshold is 7.5% of AGI. For taxpayers who are over 65, the threshold is 7%.

Since Reggie is 55 years old, the threshold is 7.5% of his AGI or $35,200 x 0.075 = $2,640.

Therefore, Reggie can deduct the portion of his medical expenses that exceed $2,640.

Amount of medical expenses that exceed the threshold: $9,916 - $2,640 = $7,276

Therefore, Reggie's medical expense deduction is $7,276.

Know more about Adjusted gross income here:

https://brainly.com/question/31249839

#SPJ8

Use the following information to compute profit margin for each separate company a through e. (Round your answers to 1 decimal place.)

Company Net income Net sales Profit Margin

a. $5,253 $44,140

b. 86,033 392,846

c. 90,324 251,598

d. 63,120 1,434,550

e. 72,787 428,158

Required:

Which of the five companies is the most profitable according to the profit margin ratio?

Answers

Answer:

the Company C is the most profitable

Explanation:

The computation of the profit margin for the following companies is

We know that

Profit margin = Net income ÷ Net sales

Now

Company Net income Net sales Profit margin

a $5,253 $44,140 11.9%

b $86,033 $392,846 21.9%

c $90,324 $251,598 35.9%

d $63,120 $1,434,550 4.4%

e $72,787 $428,158 17.0%

Based on the calculation above, the Company C is the most profitable

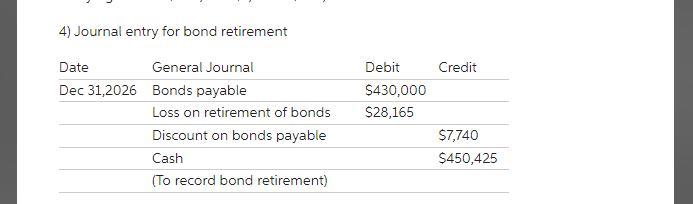

On January 1, 2021, Shay Company issues $430,000 of 8%, 15-year bonds. The bonds sell for $417,100. Six years later, on January 1,

2027, Shay retires these bonds by buying them on the open market for $450,425. All interest is accounted for and paid through

December 31, 2026, the day before the purchase. The straight-line method is used to amortize any bond discount.

1. What is the amount of the discount on the bonds at issuance?

2. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 31,

2026?

3. What is the carrying (book) value of the bonds as of the close of business on December 31, 2026?

4. Prepare the journal entry to record the bond retirement.

Answers

(1). The amount of the discount on the bonds at issuance are at issuance = Par value of bonds-Issue price of bonds = $430,000-$417,100 = $12,900.

What is the amount?The size or quantity of non-count substantives is indicated by the language unit "amount." You can count the magnitude of air in a bottle or the volume of water in a cup, for instance.

(2). As amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 31, 2026, was December 31, 2026 = $12,900/15*6 = $5,160

(3). The carrying (book) value of the bonds as of the close of business on December 31, 2026

Carrying value = Par value-Unamortized discountUnamortized discount = Total discount-Amortized discount = $12,900-$5,160 = $7,740Carrying value = $430,000-$7,740 = $422,260Therefore, As a result, above are the straight-line method is used to amortize any bond discount.

Learn more about the amount here:

https://brainly.com/question/13024617

#SPJ9

ABC Testing Prep provides tests preparation courses for the Certified Public Account (CPA) examination. It offers three different prep courses- One-week review, One-month program and Three-month course. The results of a recent CPA exam are provided in an Excel document (Section A). There are also the results of the last three CPA exams (Section B). Use a 0.05 significant level and state the null and alternate hypotheses in each case.

a. Is there a difference between the means of the three courses for the time spent after graduation before taking the CPA Exam?

b. Test whether there is a difference in the population means for the time spent after graduation before taking the CPA exam.

c. Does it matter which course you take depending on the time you take the exam after graduation?

Answers

a. Null Hypothesis: No variance in the means of all three courses is present when evaluating the time period taken after graduation to complete the CPA Exam.

Thde testing of hypothesisAlternate Hypothesis: Notable disparities exist between the means of all three courses concerning the time frame taken after graduation for taking the CPA Exam.

b. Null Hypothesis: There are no disparities observed among population means regarding the amount of time spent after college graduation prior to taking the CPA Exam.

Alternate Hypothesis: Unevenness can be noticed and distinguished amongst population means concerning the period taken after graduating before tackling the CPA Exam.

c. Null Hypothesis: The course chosen has no effect on the amount of time required to finish the CPA Exam following one's education.

Alternate Hypothesis: The course elected considerably impacts the duration taken to accomplish the CPA Exam after graduating school.

Read more on hypothesis testing here:https://brainly.com/question/15980493

#SPJ1

why does the united states operate under a dual banking system?

Answers

Answer: Under the dual banking system in the United States, banks are afforded a choice in primary regulator and under which laws they will be chartered: state or federal. The coexistence of these two parallel systems allows for healthy market competition.

As a result of the country's dual banking system, banks have the option of choosing either a state or federal legislation as their principal regulator and the laws under which they would be chartered.

What is the system?A system is a group of moving or interrelated elements that act according to a set of rules to form a unified whole. A system, surrounded and influenced by its situation, is described by its boundaries, structure, and function and shown in its functioning. Systems are the subjects of study of systems theory and other schemes sciences.

These two parallel systems coexisting promote healthy market competitiveness.When banks under federal and state supervision coexist, the system is referred to as a dual banking system.

Because banks frequently failed in the past owing to a lack of controls and capital under a central banking system, the United States now runs on this structure.

Therefore, system, banks have the option of choosing either a state or federal legislation

Learn more about the system here:

https://brainly.com/question/19843453

#SPJ12

For Wildhorse Company, variable costs are 68% of sales, and fixed costs are $199,000. Management’s net income goal is $77,800. Compute the required sales in dollars needed to achieve management’s target net income of $77,800. (Use the contribution margin approach.)

Answers

Answer: $865000

Explanation:

Contribution margin ratio would be gotten as:

= 100% - 68%

= 32%

= 0.32

Then, the desired sales would be:

= (Fixed cost + desired profit) / CM ratio

= (199,000 + 77800) / 0.32

= 276800 / 0.32

= $865000

Leia just read that the national debt owed by the federal government is at an all-time high. (Explain any possible impact on the federal government from unexpected inflation.)

Answers

Answer:

If the government of the country where Leia is from has a national debt at an all-time high, and at the same time, unexpected high inflation hits, the situation for the government can become extremely dire.

This is because high inflation will lower the value of the domestic currency, which is probably not the currency in which most of of the debt is owed. The proportion of the national debt that is owed in foreign currency will then become more expensive, because more units of domestic currency will be needed to exchange for the foreign currency, rendering the cost of the national debt a lot higher.

Now that we have covered market structures and the role of the government, I want you to write a 200-300 word response explaining about what the government could have done differently in at least two of the following crises. What could they have done differently and how could they have either averted or lessened the fall out of these major economic events in the past century? Make sure each topic is its own paragraph.

Answers

The government could have either averted or lessened the fallout of these major economic events in the past century in the following crises if they have taken the following measures-

The Great Depression: During the Great Depression, the federal government could have done more to help stimulate the economy. For example, they could have provided more public works projects to help create jobs and boost incomes. They also could have increased government spending on infrastructure and transportation projects to help stimulate economic growth. They also could have increased government funding for social services that would have helped those who were most affected by the depression.

The Great Recession of 2008: The federal government could have done more to prevent the Great Recession from happening. They could have regulated the housing and financial markets more closely and monitored financial institutions more closely to prevent risky investments. They also could have provided more oversight and regulation to the banking industry, which would have prevented them from taking on so much risk. Additionally, the government could have provided more assistance to those who were most affected by the recession, such as those who lost their jobs or their homes.

The OPEC Embargo of 1983: The federal government could have taken a more active role in dealing with the OPEC embargo. They could have encouraged the development of alternative sources of energy, such as solar and wind power, to reduce the reliance on oil and other forms of non-renewable energy sources. They also could have implemented policies that would have encouraged the conservation of energy and reduced the oil demand.

1987 - Black Monday: The federal government could have done more to prevent the stock market crash of 1987. They could have increased oversight and regulation of the stock market to prevent large and risky investments. Additionally, they could have provided more access to financial education and advice so that individuals would be more informed when making investments.

The Early 80 Recession: During the early's 80s recession, the federal government could have done more to stimulate the economy. They could have provided more public works projects to help create jobs and boost incomes. They also could have increased government spending on infrastructure and transportation projects to help stimulate economic growth. They also could have increased government funding for social services that would have helped those who were most affected by the recession.

To know more about the great depression, the great recession of 2008, the OPC embargo 1983, 1987 - black Monday, and the Early's 80 recession visit:

brainly.com/question/30796666

brainly.com/question

A value proposition represents the value that _____

A. A seller will realize when it sells the product or service.

B. A customer will realize when he purchases the product or service.

C. A product or service has to offer.

D. Is the ratio of seller’s value to customer’s value.

Answers

Answer:

a customer will realize when he purchases the product or service

A value proposition represents the value that a customer will realize when they purchase the product or service. The correct option is B.

What is the value proposition of a product or service?A value proposition is a concise statement that encapsulates the reasons why a customer would select your good or service. It expresses the value that clients take away most clearly from doing business with you.

A value proposition is a statement or promise that communicates the unique benefits or advantages that a product or service offers to its customers. It is a way of answering the question, "why should I buy this?" and it helps to differentiate a product or service from its competitors. A value proposition should focus on the customer's needs and desires, and communicate how the product or service can meet those needs or solve their problems. While a seller may also realize value when they sell the product or service, the focus of the value proposition is on the customer and the value they will receive.

Learn more about the value proposition here:

https://brainly.com/question/3130122

#SPJ2

describe three purposes of foreign exchange reserves in a country like Kenya. What effects do such foreign exchange reserves have in a country? (10marks)

Answers

1. To Provide Stability: Foreign exchange reserves are an important tool for a country like Kenya to provide greater stability to the economy.

What is economy?Economy is the large scale management of resources, goods, and services to meet the needs of society.

This means that when the value of the local currency fluctuates due to global events, the country can use its foreign exchange reserves to support the exchange rate. This can help to maintain the purchasing power of the local currency and keep the exchange rate from becoming too volatile.

2. To Protect from Speculation: Foreign exchange reserves can also be used as a buffer against speculation. Speculation can create rapid changes in the foreign exchange markets, which can have a destabilizing effect on a country’s economy. By having foreign exchange reserves, a country can protect itself from the effects of speculation.

3. To Support Growth: Foreign exchange reserves can be used to support economic growth. By having foreign exchange reserves, a country can make sure it has access to the foreign currency it needs to finance its imports. This can help to promote economic growth by allowing a country to access the materials and resources it needs to produce goods and services.

The effects of having foreign exchange reserves in a country can be significant. Having reserves can help to maintain the stability of the exchange rate, protect the economy from speculation, and support economic growth.

To learn more about economy

https://brainly.com/question/28210218

#SPJ1

Alfred E. Old and Beulah A. Crane, each age 42, married on September 7,2017. Alfred and Beulah will file a joint return for 2019. Alfred's Social Security number is 111-11-1109. Beulah's Social Security number is 123-45-6780, and she adopted "Old" as her married name. They live at 211 Brickstone Drive, Atlanta, GA 30304. Alfred was divorce from Sarah Old in March 2016. Under the divorce agreement, Alfred is to pay Sarah $1,250 per month for the next 10 years or until Sarah's death, whichever occurs first. Alfred pays Sarah $15,000 in 2019. In addition, in January 2019, Alfred pays Sarah $50,000, which is designated as being for her share of the marital property. Also, Alfred is responsible for all prior years' income taxes. Sarah's Social Security number is 123-45-6788. Alfred's salary for 2019 is $150,000. He is an executive working for Cherry.Inc. (Federal I.D. No. 98-7654321). As part of his compensation package, Cherry provides him with group term life insurance equal to twice his annual salary. His employer withheld $24,900 for Federal income taxes and $8,000 for state income taxes. The proper amounts were withheld for FICA taxes. Beulah recently graduated from law school and is employed by Legal Aid Society.Inc. (Federal I.D. No. 11-1111111), as a public defender. She receives salary of $42,000 in 2019. Her employer withheld $7,500 for Federal income taxes and $2,400 for state income taxes. The proper amounts were withheld for FICA taxes. Alfred and Beulah had interest income of $500. They received $1,900 refund on their 2018 state income taxes. They claimed the standard deduction on their 2018 Federal income tax return. Alfred and Beulah pay $4,500 interest and $1,450 property taxes on their personal residence in 2019. Their charitable contributions total $2,400 (all to their church). They paid sales taxes of $1,400, for which they maintain the receipts. Alfred and Beulah have never owned or used any virtual currency, and they do not want to contribute to the Presidential Election Campaign. Compute the Old's net tax payable (or refund due) for 2019. Suggested software: ProConnect Tax Online

Answers

To compute the Olds' net tax payable (or refund due) for 2019, we need to gather all the relevant information and calculate their taxable income, apply the appropriate tax rates, deductions, and credits. Since the tax calculation involves various factors and tax laws, it would be best to use tax software such as ProConnect Tax Online or consult with a tax professional. The software will streamline the process and ensure accurate calculations based on the specific tax laws and regulations applicable to the Olds' situation.

identify the types of south African businesses/market share

Answers

A company may be incorporated in South Africa under one of five legal categories: a private company, a personal liability company, a public company, a non-profit organisation, or a state-owned corporation.

What percentage of the market?South Africa is a newly industrialised nation with an upper-middle-income economy, according to the World Bank. It is ranked 34th in the world and has the second-largest economy in Africa. South Africa has the 7th per economic status in Africa in the context of purchasing power parity. Nevertheless poverty and inequality continue to be widespread, with almost 25% of the population unemployed and surviving on less than US$1.25 per day. Yet, South Africa continues to have a significant regional impact and is regarded as a middle power in international affairs.

To know about South Africa visit:

https://brainly.com/question/16248215

#SPJ1

Why is it important to include a person's title when developing a reference sheet?

Answers

Answer with Explanation:

It is important to include a person's job title when developing a reference sheet because it shows the person's position and level of experience in his field. Reference sheets are meant to help you get connections that will boost your probability of getting hired. The better the job titles of the people you've listed on your reference list, the more confidence you'll have in the hiring process. The Human Resource wants to talk to people who have the credibility to attest to your past performances and credentials.

It is important to list those people whom you have worked with in a similar context. For example, listing your supervisor on your reference sheet rather than listing someone who is not related to you at work.

Reference sheets are documents that specify the people who can vouch for our character. It is important to include a person's title when developing a reference sheet because it tells the hiring manager that we have relationships with people who are outstanding in a field.

If they can attest to our suitability, then we are likely trustworthy.

Hiring managers might want us to present reference sheets that indicate our referees.It is important to attach titles to the names of these referees because it tells the hirer that responsible members of society are willing to attest to our conduct. This will make the employer more confident in us.Learn more here:

https://brainly.com/question/17706833

A patron of a sporting arena can purchase alcohol inside and take it out to the Parking lot true or false

Answers

If a patron of a sporting arena purchases alcohol inside, they can take it out to the parking lot so this is TRUE.

What are patrons of sporting arenas able to do?Alcohol consumption rules state that a person who purchases alcohol from a licensed venue is allowed to take that drink anywhere within the premises.

The parking lot of a sporting arena still counts as the premises of the sporting arena so the patron can take the alcohol there.

In conclusion, it is true that a patron of a sporting arena can purchase alcohol inside and take it out to the parking lot.

Find out more on the rights of a patron at https://brainly.com/question/26023428

#SPJ1

Give an example of one good or service produced in the United States using the market model. Justify your example using content from the poster.

Answers

Answer:

Oil is the good produced in the United States of America by using the command economic model.

A command economy is an economic system where the government decides the quantity of goods produced as well as the price of the goods. In his type of economy, the prices of goods are fixed and does not depend on the demand and supply. The United States of America produced oil according to the demand of the country's needs of oil so that's why we can conclude that oil is the good that follows the model of command economy.

The Rational Rule for Buyers O compares the benefit of buying an additional unit of the item to the cost of that item. O compares the total benefit of all units to the total price of all units purchased. O only applies to buyers who are buying necessities as opposed to luxury items. O compares the cost of production of an item to the price of the item.

Answers

The correct option is A. The Rational Rule for Buyers compares the benefit of buying an additional unit of the item to the cost of that item.

Rational rules argue that at least a few significant additives of our ethical structures are indeed ecologically rational: they are proper at assisting us to reap not unusual goals. Nichols argues that the account might be prolonged to seize moral motivation as a unique case of a much extra-preferred phenomenon of normative motivation.

Rational conduct is the cornerstone of rational preference theory, a principle of economics that assumes that individuals always make choices that offer them the very best amount of personal software. those decisions provide human beings with the greatest advantage or pleasure given the alternatives to be had. The monetary rationality precept is primarily based on the concept that humans behave in rational methods and keep in mind alternatives and choices inside logical structures of ideas, in preference to concerning emotional, moral, or psychological elements.

To learn more about Rational Rule visit here

brainly.com/question/17611379

#SPJ4

Complete Question:

The Rational Rule for Buyers

A). compares the benefit of buying an additional unit of the item to the cost of that item.

B). compares the total benefit of all units to the total price of all units purchased.

C). only applies to buyers who are buying necessities as opposed to luxury items.

D). compares the cost of production of an item to the price of the item.

The areas of academic study are called

Answers

Answer:

Academic Focus Areas are related majors that are grouped together because they share a foundation of common course requirements and recommendations. At most institutions, every program of study will fit into one of a limited number (five to seven, generally) of Academic Focus Areas.

An academic discipline or field of study is known as a branch of knowledge.

Explanation:

Answer: Branches of knowledge

Happy to help; have a great day! :)

Mrs. Slayman slays all day. She slays 17 times a second. Approximately how much Slaying does Mrs. Slayman do in a day?

Answers

Mrs. Slayman slays approximately 1,468,800 times in a day.

How to calculate much Slaying does Mrs. Slayman do in a dayIf Mrs. Slayman slays 17 times every second, then in one minute (60 seconds), she slays:

17 times/second * 60 seconds = 1020 times/minute

In one hour (60 minutes), she slays:

1020 times/minute * 60 minutes = 61,200 times/hour

And in one day (24 hours), she slays:

61,200 times/hour * 24 hours = 1,468,800 times/day

Therefore, Mrs. Slayman slays approximately 1,468,800 times in a day.

Learn more about word problems at:https://brainly.com/question/21405634

#SPJ1

Consider that the market demand function For IBM Computer represented as a. Calculate Price elasticity of demand when d=20,000-0.5P, Ceteris paribus the price per unit is Birt 10,000. b. It the demand for IBM Computer aces elsarric, inelastic or Unitary elastic? C. Interpret the result

Answers

A. The price elasticity of demand is PED ≈ -0.67.

B. The demand for IBM computers is inelastic because the absolute value of the price elasticity of demand (PED) is less than 1.

C. The negative value of the price elasticity of demand (-0.67) indicates an inverse relationship between price and quantity demanded.

To calculate the price elasticity of demand (PED), we need to use the formula:

PED = (% change in quantity demanded) / (% change in price)

a. Given the demand function d = 20,000 - 0.5P and the price per unit is $10,000, we can calculate the quantity demanded at this price by substituting P = $10,000 into the demand function:

d = 20,000 - 0.5 * 10,000

d = 20,000 - 5,000

d = 15,000

Now, let's consider a small change in price. Let's say the price decreases to $9,500, and the quantity demanded changes to 15,500. We can calculate the percentage changes:

% change in quantity demanded = (15,500 - 15,000) / 15,000 * 100 = 3.33%

% change in price = (9,500 - 10,000) / 10,000 * 100 = -5%

Now we can calculate the price elasticity of demand:

PED = (% change in quantity demanded) / (% change in price)

PED = 3.33% / -5%

PED ≈ -0.67

b. The demand for IBM Computer is inelastic because the absolute value of the price elasticity of demand (PED) is less than 1. In this case, the PED is approximately -0.67, indicating that a 1% change in price will lead to a smaller percentage change in quantity demanded.

c. The negative value of the price elasticity of demand (-0.67) indicates an inverse relationship between price and quantity demanded. In other words, as the price of IBM Computers increases, the quantity demanded decreases, and vice versa. However, since the demand is inelastic, the change in quantity demanded is proportionately smaller than the change in price. This suggests that consumers are not highly responsive to price changes, and IBM Computers are relatively price-insensitive.

Know more about Price elasticity of demand (PED) here:

https://brainly.com/question/32931966

#SPJ8

Most social assistance workers are employed by what type of organization? local government state government federal government private businesses

Answers

Answer:

D. Private business

Explanation: correct on e2020

Answer:

d : private businesses

Explanation:

got it right